Market Overview

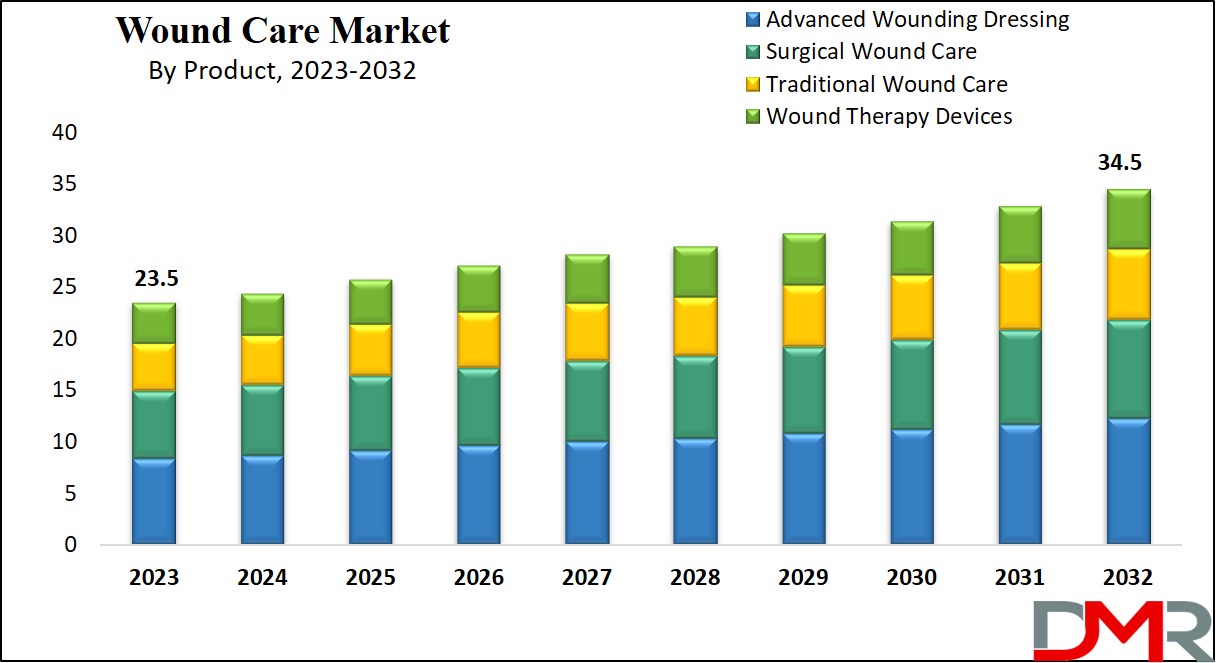

The Global Wound Care Market is expected to reach a value of USD 23.5 billion in 2023, and it is further anticipated to reach a market value of USD 34.5 billion by 2032 at a CAGR of 4.4%.

Wound care includes products designed for the management of both acute & chronic wounds, like burns, ulcers, and post-operative wounds. Advanced wound care solutions, including dressings like films, foams, hydrogels, alginates, & hydrocolloids, maintain a moist environment that fosters wound healing without hindering the process, which caters to patients with chronic wounds, offering convenient & cost-effective options that can be used at their convenience to support their healing journey.

As per PMC, the Wound Care Market is driven by a growing burden of chronic wounds, affecting approximately 1.5–2 million people in Europe and 6.5 million in the USA. In Europe, 64% of wounds treated in home care are chronic, with 24% lasting over six months and 16% persisting for a year or more.

Hospital audits reveal 50% of inpatients have wounds, with 22% showing pressure damage. Pressure ulcer prevalence in U.S. critical care stands at 22%. Wound care accounts for 3% of healthcare costs—£5 billion annually in the UK and $25 billion in the U.S.—highlighting the sector’s financial impact.

The wound care industry is experiencing rapid growth, with numerous events and conferences highlighting advancements in treatment technologies, such as the use of bioactive dressings and digital wound monitoring. Key opportunities include partnerships between healthcare providers and med-tech firms to enhance patient outcomes. The convergence of innovation in this space mirrors developments seen in other fast-growing healthcare markets, including the

Oral Care Market, where technology and patient-centered solutions are similarly reshaping consumer and clinical approaches.

Recent deals focus on expanding market reach, like mergers and acquisitions among wound care product manufacturers. Surveys reveal increasing demand for advanced wound management solutions due to aging populations and rising chronic wound cases. Stay updated through specialized conferences and industry news to capitalize on emerging trends and innovations in this dynamic sector.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Key Takeaways

- Market Growth: The global wound care market is expected to reach USD 34.5 billion by 2032, growing at a CAGR of 4.4% from 2023.

- Segment Leadership: Advanced wound dressings represent the largest product segment, accounting for 45.2% of the total market in 2023 due to rising chronic wounds.

- Chronic Wound Impact: Chronic wounds dominated the application segment, making up 53% of the market in 2023, driven by aging populations and diabetes prevalence.

- End User Focus: Hospitals were the leading end user, contributing 56% of the market in 2023, owing to frequent surgical procedures and longer-term care needs.

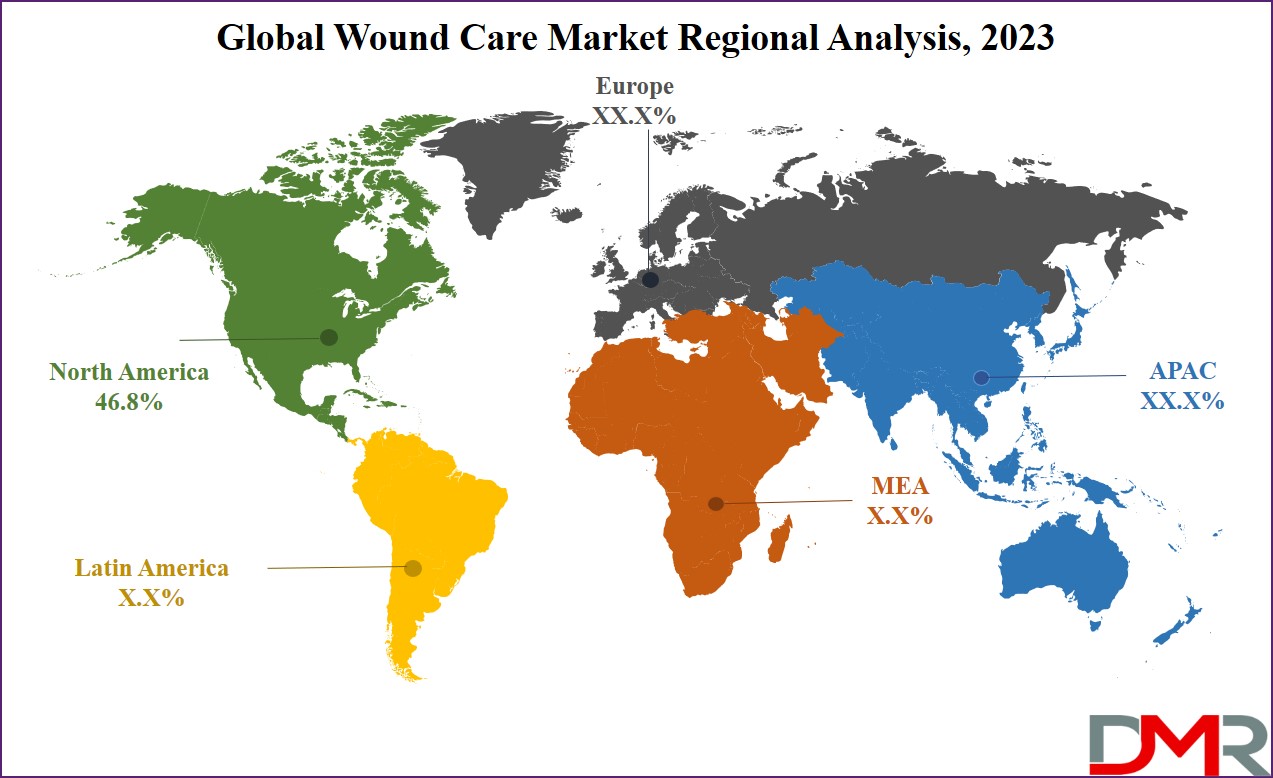

- Regional Insights: North America led the market with a 46.8% share in 2023, supported by high healthcare spending, aging population, and demand for advanced wound care products.

- Innovation Drivers: Technological advancements such as bioactive dressings and digital wound monitoring are significantly improving wound care management and patient outcomes.

- Competitive Dynamics: Market competition is intensifying, with major players investing in partnerships, product launches, and M&A activities to enhance their market presence.

Use Cases

- Hospital Wound Management: Advanced wound care products can significantly improve healing and infection control in hospitals, especially for surgical and chronic wound patients, enhancing recovery rates and reducing hospital stays.

- Home Care Solutions: Portable and single-use wound therapy devices make at-home wound management feasible for elderly and post-surgical patients, reducing hospital visits and healthcare costs.

- Chronic Disease Care: Specialized dressings and therapies target diabetic and venous ulcers, supporting regular treatment for chronic wound patients and lowering the risk of complications.

- Emergency Treatment Kits: Acute wound care solutions, such as specialized dressings and infection prevention products, are valuable for emergency response and trauma care in both hospital and field settings.

- Remote Monitoring Services: Telemedicine and digital wound monitoring platforms allow professionals to track healing progress remotely, ensuring timely interventions and improving patient outcomes.

- Innovation Partnerships: Collaboration between med-tech firms and healthcare providers drives the development and adoption of next-generation wound care solutions with greater efficacy and business value.

Market Dynamic

Over the past decade, factors like a growing global aging population, a rise in surgical procedures, increased incidents of traumatic injuries, & the growth in the number of conditions like diabetes & obesity have led to a notable growth in acute, chronic, & surgical wounds.

These conditions often result in infections, ulcers, & chronic wounds that require advanced wound management, contributing to higher healthcare costs. The synergy between wound management and chronic disease care parallels the increasing integration seen in sectors such as the

Respiratory Care Devices Market, where comorbidities often necessitate comprehensive treatment approaches.

The growing number of hospital visits for wound treatment is anticipated to further boost the demand for advanced wound care products, mainly in hospital settings, driven by a rise in healthcare spending, a multitude of therapeutic surgeries, & the number of hospital-acquired pressure ulcers.

In addition, government initiatives focused on raising awareness among the public & technological advancements are major growth catalysts for the advanced wound care market, alongside enhanced

healthcare infrastructure & rising healthcare budgets. Further, the high costs associated with advanced wound care products pose a challenge to market expansion. Furthermore, the valued risks & a lack of awareness regarding the use of these products present significant challenges impeding the market's growth during the forecast period.

Research Scope and Analysis

By Product

The wound care market is categorized by product into surgical wound care, advanced wound dressings, traditional wound care, & wound therapy devices. Among these, the advanced wound dressing segment claims the largest market share in 2023 & is expected to exhibit the highest growth throughout the forecast period.

Advanced wound dressings are mainly used in the treatment of chronic & non-healing wounds. With the rise in the number of chronic wounds like diabetic foot ulcers, the need for advanced wound dressings is set to grow, driving significant growth in the wound care industry.

Further, the surgical wound care segment is projected to experience significant growth during the forecast period, which can be attributed to the global rise in surgical procedures & subsequent surgical site infections. As surgical cases continue to grow globally, the need for products in the surgical wound care category is expected to grow, contributing to the segment's considerable expansion.

By Application

In 2023, the chronic wounds segment takes the lead in the wound care market, holding the largest share, and it's anticipated significant growth throughout the forecast period, which is primarily attributed to the growth in the elderly population & the rising number of chronic wounds like diabetic foot ulcers & venous pressure ulcers.

Further, according to the Journal of the American Heart Association, the United States is experiencing a steady rise in cases of varicose vein ailments, with about 23% of the population getting affected. This growth in varicose vein patients can potentially lead to the development of venous leg ulcers, further driving the market's expansion.

Further, the acute wound segment is anticipated to experience the fastest growth during the forecast period, with the increasing incidence of traumatic wounds & burns serving as a major driver for this segment.

Acute wound care products provide several advantages, including minimal surgical site infections, enhanced patient outcomes, & shorter hospital stays.

In addition, the global prevalence of burn wounds is on the rise. As acute wound products are mainly used to treat traumatic wounds, the use of wound care products is anticipated to

fuel the growth of this segment.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By End User

The hospital segment commands the largest share in the wound care market in 2023, which is primarily driven by a global increase in surgical procedures, a consequence of sedentary lifestyles, & a rise in number of bariatric surgeries, which necessitate the use of wound care products to prevent surgical site infections.

Surgical wound care dressings and Negative Pressure Wound Therapy (NPWT) are mainly suitable for hospital settings & are not typically used in home care.

Hospitals, as major buyers of wound care products, often have long-term contracts with suppliers, further contributing to the segment's growth. In addition, the growth in hospital admissions post-surgery, where patients require wound care products for postoperative wound healing, fuels the segment's significant growth.

Also, the home care segment is anticipated to experience fast growth during the forecast period, as the demand for home healthcare wound care products increased during the pandemic, with single-use NPWT systems playing an important role. These devices are lightweight, portable, and affordable, making them a preferred choice for treating wounds at home.

The higher elderly population, which often prefers home care or nursing home facilities, further drives this segment's growth. In regions like North America & Europe, the presence of many organizations offering home care services promotes the adoption of home care settings. With these combined factors, the home care segment is anticipated to see significant growth in the coming future.

The Wound Care Market Report is segmented on the basis of the following:

By Product

- Advanced Wound Dressing

- Surgical Wound Care

- Traditional Wound Care

- Wound Therapy Devices

By Application

- Chronic Wounds

- Acute Wounds

By End User

- Hospitals

- Home Care

- Outpatient Facilities

- Research & Manufacturing

Regional Analysis

North America maintains its dominance in the wound care industry, holding a significant market share of

46.8% in 2023, which is expected to continue experiencing notable growth during the forecast period. Factors contributing to this growth include an increase in the population base & a growth in the number of patients, particularly in the United States. In addition, the aging population in North America is at a higher risk of developing wounds, further increasing the demand for wound care products.

Also, the Asia Pacific region is expected to show a high growth in the wound care market over the forecasted period, which can be attributed to changes in lifestyle habits, resulting in a growth in the number of chronic diseases in the region.

For instance, India has seen a huge growth in diabetic patients, with numbers predicted to grow more in the coming future. Moreover, the rise in medical tourism has led to a growth in the number of surgeries, contributing to the region's quick expansion in the wound care market, as all these key factors are anticipated to experience the fastest growth in this market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The wound care industry is characterized by many small & large manufacturers, leading to intense competition, which is expected to grow even stronger in the coming years due to the many players of market players.

In addition, prominent companies are highly engaging in partnerships, building new products, & pursuing mergers & acquisitions to enhance their range of wound care solutions, as such strategic moves focus on solidifying their positions in the market, resulting in a growing competitive landscape within the industry.

In August 2023, Medela unveiled its expansion plans for the negative pressure wound therapy (NPWT) category by introducing the Invia Integrated Dressing, ideal for all types of wounds, including post-surgical incisions, as this sterile dressing is versatile, designed for both home & hospital use, with an application duration of up to 7 days.

It contains a three-layer fluid-handling pad with a skin-friendly silicone adhesive border & incorporates a Quick-connector, a standard feature in Medela's NPWT products for seamless pump-to-dressing connections. The dressing is compatible with Medela's Liberty & Motion NPWT pumps, improving its usability and compatibility.

Some of the prominent players in the global Wound Care Market are:

- 3M

- Coloplast

- Smith & Nephew

- Medtronic

- Advancis Medical

- Medline Industries

- URGO Medical

- Baxter International

- Cardinal Health Inc

- Centaur Pharma

- Other Key Players

Recent Developments

- In January 2025, Fesarius Therapeutics received FDA 510(k) clearance for DermiSphere hDRT, a collagen-based regenerative wound care product designed to enhance tissue integration and healing.

- In November 2024, Imbed Biosciences gained FDA clearance for Microlyte Ag/Lidocaine, an antimicrobial wound dressing with pain management properties targeting ulcers, burns, and surgical wounds.

- In April 2024, Vomaris launched PowerHeal, an FDA-approved bioelectric bandage for over-the-counter wound management, increasing accessibility for minor abrasions and blisters.

- In April 2024, Mölnlycke Health Care signed an agreement to acquire P.G.F. Industry Solutions GmbH, manufacturer of Granudacyn wound cleansing solutions, expanding its wound care portfolio globally.

- In 2024, Coloplast announced the acquisition of Kerecis, marking a significant expansion in its advanced wound care portfolio and driving innovation in biologics-based wound management.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 23.5 Bn |

| Forecast Value (2032) |

USD 34.5 Bn |

| CAGR (2023-2032) |

4.4% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Advanced Wound Dressing, Surgical Wound Care, Traditional Wound Care, and Wound Therapy Devices), By Application (Chronic Wounds, and Acute Wounds), By End User (Hospitals, Home Care, Outpatient Facilities, and Research & Manufacturing) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

3M, Coloplast, Smith & Nephew, Medtronic, Advancis Medical, Medline Industries, URGO Medical, Baxter International, Cardinal Health Inc, Centaur Pharma, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Wound Care Market?

▾ The Global Wound Care Market size is estimated to have a value of USD 23.5 billion in 2023 and is

expected to reach USD 34.5 billion by the end of 2032.

Which region accounted for the largest Global Wound Care Market?

▾ North America has the largest market share for the Global Wound Care Market with a share of about 46.8% in 2023.

Who are the key players in the Global Wound Care Market?

▾ Some of the major key players in the Global Wound Care Market are 3M, Coloplast, Medtronic, and many others.

What is the growth rate in the Global Wound Care Market?

▾ The market is growing at a CAGR of 4.4 % over the forecasted period.