Market Overview

The

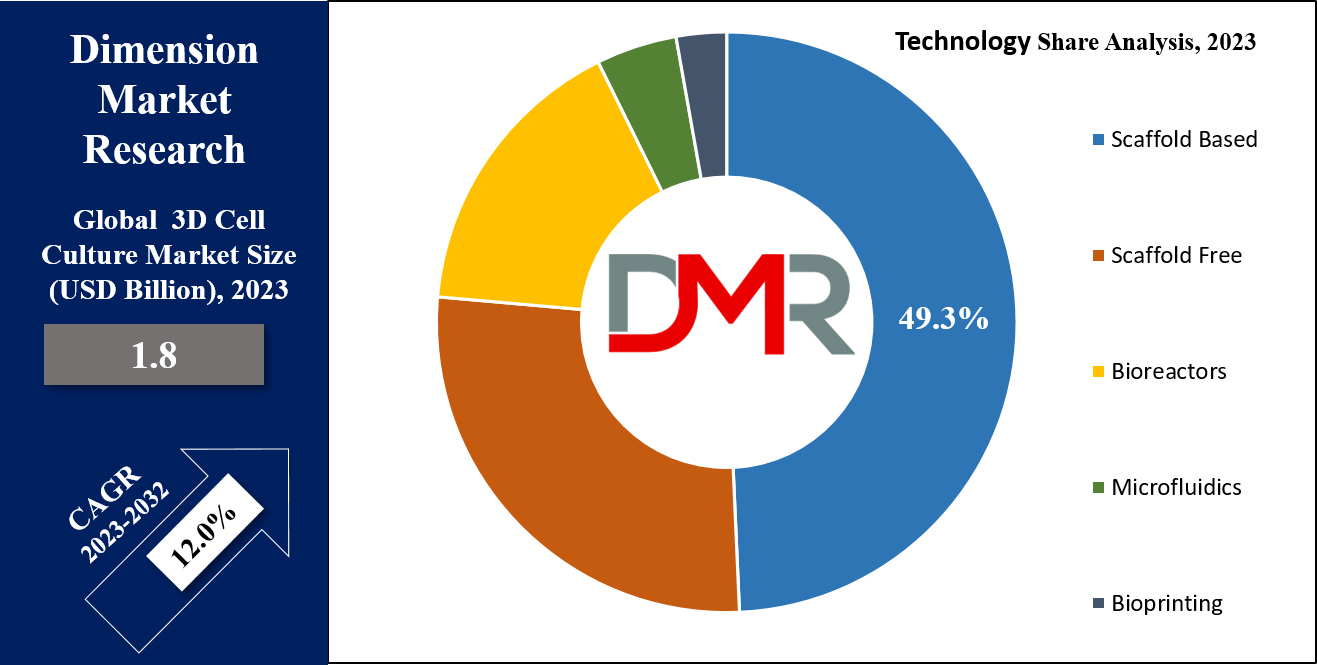

3D cell culture market size is anticipated to be worth

USD 1.8 billion in 2023 and is likely to reach

USD 5.0 billion by 2023 at a

CAGR of 12.0%.

The 3D cell culture market refers to the industry that is involved in the development and manufacturing of services associated with the cultivation of cells in a three-dimensional environment, rather than the traditional flat or two-dimensional culture. This technology is widely used in the

pharmaceutical and biotechnology industries for drug testing, disease epidemiology, and tissue engineering. In the case of scientific research, these cells are preferred as they can mimic the natural cellular environment of cells.

That is why they play a vital role in research on how a cell works as well as their movement, response to signals, growth of blood vessels, drug processing, gene activity, protein production, and breach in the immune system. So, because of the advantages over 2D cell culture, 3D cell culture has become more popular for cancer studies. This market is also engaged in supplying 3D cell culture products, equipment and tissue engineering.

Market Dynamic

Cell culture refers to one of the laboratory techniques that allow prokaryotic and eukaryotic cells to grow and develop under controlled artificially created natural environmental conditions. This technique is used for studying tissue growth, morphology and epidemiology of viruses and bacteria. Cultured cells are widely used in the field of basic cell biology research to replicate disease processes, and to commence clinical trials.

3D cell culture is a technique that involves creating a simulated environment and allowing biological cells to grow and interact with each other in the three dimensions. Several factors such as the increase in the number of oncology patients and rising cases of infectious diseases are driving the growth of the 3D cell culture market. The 3D cell cultured stem cells have a wide range of applications, from treating degenerative diseases to developing

artificial organs. This versatile nature of these cells attracts the attention of researchers and makes it a prominent topic for research.

Moreover, the rising cases of chronic diseases and multiple organ failure have increased the demand for organs for transplants. However, the shortage of organ donors in the

healthcare sector has pushed the healthcare industry to find alternative solutions to this problem. However, 3D cell cultures play a vital role in maintaining organoids and functional tissue constructs for transplantation. For example, recently FaCellitate's BIOFLOAT was launched which offers advanced 3D cell culture, aiming to mimic different metabolic activities of the human body.

Key Takeaways

- Market Growth: The 3D cell culture market is expanding rapidly and it is projected to attain USD 5.0 billion by 2023.

- By Technology: 49.3% of the market employs scaffold-based technology in carrying out 3D-cell culture, with the expectation that this type of technology will continue growing till 2032.

- By Application: The largest share of revenue in 2023 is attributed to stem cell research and tissue engineering when it comes to popular applications of 3D-cell culture.

- By End-User: In the year 2023 biotech and pharmaceutical companies took up 48.0 % of the market share.

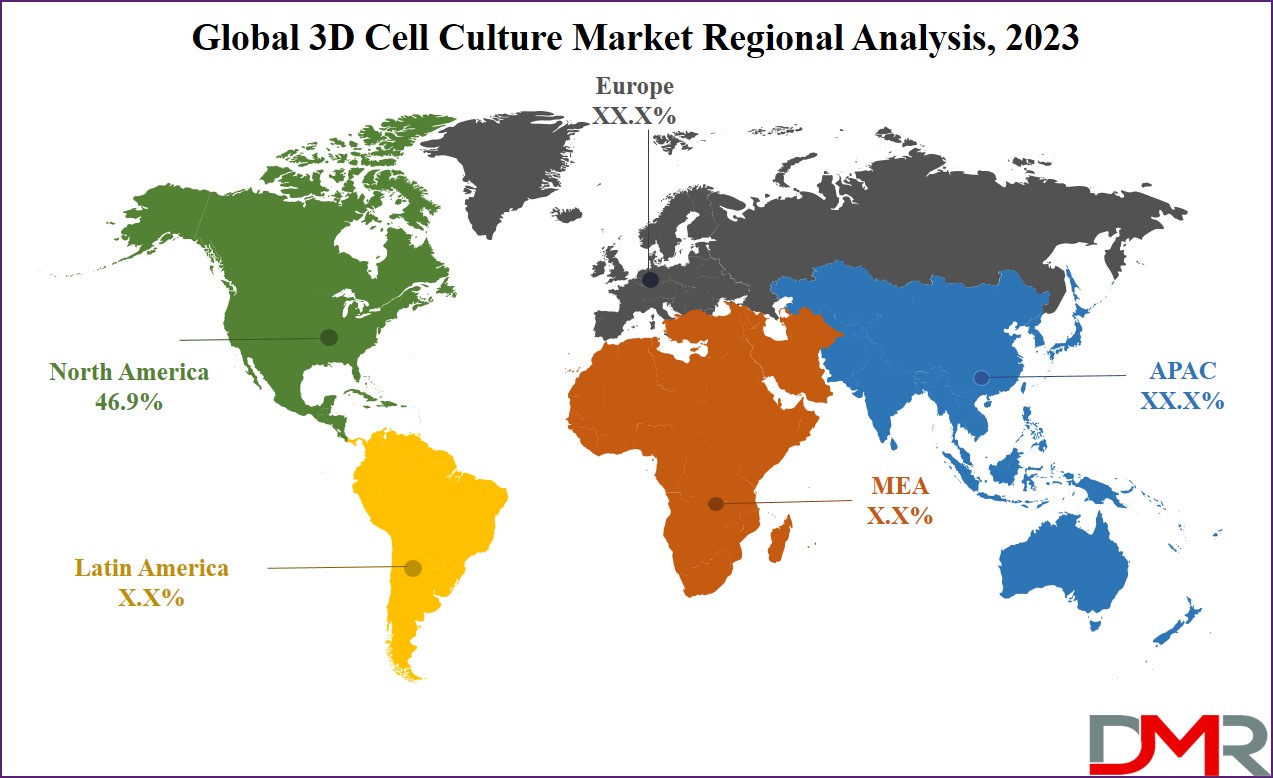

- Regional Insights: Close to half (46.9%) of 2023’s total revenue came from North America as they lead globally in the market.

Use Cases

- Making Tiny Organs: Experts utilize 3D cell culture to create small models of organs (e.g hearts and livers) within a laboratory setting, these “micro-organs” can be used to comprehend the functionality of actual human organs and develop fresh therapies against related diseases.

- Testing New Medicines Safely: Consider replicating sick persons cells in a small quantity then testing various drugs on it to identify the best performing one that doesn’t cause harm to the individual involved. This is what researchers participate in when through 3D cell culture they look for medications that could be more effective in managing diseases such as cancer.

- Growing New Body Parts: By incorporating the principles of 3D cell culture into their work, medical researchers are able to produce specialized cells which can be used in place of damaged tissues – for example, skin cells for burn patients or brand new organs for those requiring transplants. In essence, it is akin to creating extra parts for ourselves! Innovations here are often supported by solutions from the 3D Printing Market, enabling precise biofabrication.

- Understanding How Diseases Spread: By growing cells in a 3D environment, scientists can easly study how diseases spread and also how our bodies fight with them. This helps doctors find better ways to keep us healthy.

- Helping Animals Stay Healthy: Scientists also use 3D cell culture to helping animals. They can grow cells and study them to find ways to protect these animals from diseases and help them survive in the wild.

Research Scope and Analysis

By Technology

In the context of technology used in 3D cell culture, scaffold-based technology holds 49.3% of the market share in 2023 and is anticipated to show subsequent growth in the forthcoming years of 2023 to 2032. The growth of scaffold-based 3D cell culture technology is driven by various factors. It is used in tissue engineering and regenerative medicine where it replicates the target cells' natural extracellular matrix and morphology. Especially in the case of regenerative medicine the scaffold materials expand the options and enhance the efficiency and versatility of scaffold-based cell culture techniques. Scaffold-based 3D cell culture dominates the market due to its ability to mimic the physiological environment of cells and their organization. It also supports multiple cell types to grow in an artificial environment and ensures high reproducibility.

Moreover, the addition of hydrogels with scaffold-based culture allows them to create a more realistic cellular environment of cells, when they are provided with biochemical and mechanical support. A prominent example of this particular process will be Dolomite Bo's hydrogel-focused reagent kits that are used for high-throughput cell encapsulation. Also, the new advances in this market are further pushing the growth of scaffold-based technologies, as some researchers have successfully 3D printed an edible cell culture scaffold by using common plant proteins as an ingredient. This convergence of technologies marks a significant overlap with trends in the

3D Display Market and 3D Printing Market, where advanced modeling and material fabrication techniques are increasingly used in life sciences.

However, it's essential to recognize that other 3D culture methods, such as scaffold-free techniques, bioreactors, microfluidics, and bioprinting, also have their unique benefits and are selected based on specific research requirements. The choice of technology used for the research depends on the research's specific objective.

By Application

Stem cell research and tissue engineering come out to be the dominant player within the application segment, commanding a maximum revenue share in 2023. Within this segment based on application, Stem Cell Research and Tissue Engineering act as the forefront of regenerative medicine. Regenerative medicines involve the use of stem cells to repair, replace, & regenerate damaged tissues and organs. This factor has driven significant interest and investment in the 3D cell culture market as it has the potential to solve various critical medical conditions, such as organ transplantation and tissue engineering.

Furthermore, the 3D cell cultured stem cells have the potential to revolutionize the healthcare sector by offering a new treatment for those patients whose medical conditions were previously considered untreatable. Stem cell research and tissue engineering witness the collaboration between research institutes, healthcare institutions, and the pharmaceutical industry for the development and push adoption of 3D cell culture techniques in stem cell and tissue engineering. These advancements strongly complement the

Cell Therapy Market, offering promising solutions for complex and chronic conditions.

By End-User

Based on the end-users, Biotechnology and pharmaceutical companies dominate the 3D cell culture market as they hold 48.0% of the market share in 2023 and are expected to show significant growth in the forecasted period of 2023 to 2032 as well. The reason these industries dominate this segment is because the biotechnology and pharmaceutical companies heavily rely on 3D cell culture techniques to develop new drugs.

The 3D cell cultured cell provides more accurate information on identifying potential drug candidates, as it can assess their safety & efficiency and helps them to grow in vivo conditions. The growing need for effective and cost-efficient drug screening has led biotechnology and pharmaceutical companies to adopt 3D cell culture technologies, as the 3D cell culture techniques helps in the screening process for drug discovery. The Biotechnology and pharmaceutical companies are at the forefront of the global 3D cell culture market as they heavily invest in research and development, for the creation of cutting-edge techniques to push the growth of this market.

The 3D Cell Culture Market Report is segmented on the basis of the following:

By Technology

- Scaffold Based

- Hydrogels

- Polymeric Scaffolds

- Micropatterned Surface Microplate

- Nanofiber Based Scaffolds

- Scaffold Free

- Hanging Drop Microplates

- Spheroid Microplates with ULA Coating

- Magnetic Levitation

- Bioreactors

- Microfluidics

- Bioprinting

By Application

- Stem Cell Research & Tissue Engineering

- Cancer Research

- Drug Development & Toxicity Testing

- Others

By End-User

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutes

- Hospitals

- Others

Regional Analysis

North America asserts its dominance in the 3D cell culture market, commanding a substantial 46.9% share of the total revenue in 2023. Moreover, looking ahead, North America is all set to maintain its position as the fastest-growing regional market during the projected period. This outstanding growth can be accredited to the region's growing manufacturing sector & the contribution of foreign investments, both of which are expected to be vital drivers of regional market expansion.

Remarkably, this region stands out as a major hub of leading pharmaceutical and biotechnology industries as well as reputed academic and research institutes. The region acts as a center of technological innovation that has a long history of research in biological sciences. This region has various regulatory bodies, such as the FDA that is very responsive to advanced in vitro testing methods like 3D cell culture for drug development and toxicity testing. So, in other words, these factors collectively position North America as a dominant force in the 3D cell culture market, with a highly developed ecosystem that promotes research, innovation, and technological advancement.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the global 3D cell culture market shows a high degree of fragmentation, featuring various global biotechnology and pharmaceutical companies. These companies are making substantial investments in research & development while engaging in mergers to yield innovative products, thus putting themselves in a competitive advantage within the sector. Remarkably, there's a recent trend shift towards the usage of 3D cell culture, led by its growing popularity as it can mimic the natural environment of the target cell.

Leading companies in the global 3D cell culture market include Thermo Fisher Scientific, Corning Incorporated, Merck KGaA, Lonza Group, and InSphero AG. These companies offer a wide range of 3D cell culture products and services, including scaffold-based and scaffold-free systems, bioreactors, and specialized culture media. The major key players of the global 3D cell culture market are Thermo Fisher Scientific Inc., Merck KGaA, PromoCell GmbH, Lonza, Corning Incorporated, Avantor Inc., Tecan Trading AG, REPROCELL Inc., CN Bio Innovations Ltd, Lena Biosciences, BiomimX SRL, InSphero AG, and other key players.

Some of the prominent players in the Global 3D Cell Culture Market are:

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- PromoCell GmbH

- Lonza

- Corning Incorporated

- Avantor, Inc.

- Tecan Trading AG

- REPROCELL Inc.

- CN Bio Innovations Ltd

- Lena Biosciences

- BiomimX SRL

- InSphero AG

- Other Key Players

Recent Developments

- February 2024: The Healey-Driscoll Administration invested in Mansfield Bio-Incubator to boost biomanufacturing, accelerate cell and gene therapy development, and enhance workforce training in Southeastern Massachusetts.

- November 2023: HeartBeat.bio, a Vienna-based biotech startup, raises USD 4.88 million to develop a 3D human tissue-based drug discovery platform for heart disease, aiming to revolutionize cardiac drug development.

- July 2023: Halifax-based startup 3D BioFibR secures USD 3.52 million seed funding for collagen fiber manufacturing, aiming to expand facilities and meet increasing demand.

- November 2022: REPROCELL invests in Histocell S.L., a Spanish CDMO specializing in stem cell therapy, to enhance clinical iPSC service offerings, strengthening their strategic relationship.

- June 2022: GeminiBio, a well-known biological product supplier and leading chemical reagents formed a partnership with Avantor, which was aimed at meeting the rising demand for the bioproduction workflow solution.

- March 2022: CELLINK, under BICO, introduced BIO CELLX, a groundbreaking biodispensing platform automating 3D cell culture, revolutionizing cancer research and drug discovery with pre-validated protocols.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 1.8 Bn |

| Forecast Value (2032) |

USD 5.0 Bn |

| CAGR (2023-2032) |

12.0% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Technology (Scaffold Based, Scaffold Free,

Bioreactors, Microfluidics and Bioprinting), By

Application (Stem Cell Research & Tissue Engineering,

Cancer Research, Drug Development & Toxicity

Testing and Others), By End-User (Biotechnology &

Pharmaceutical Companies, Academic & Research

Institutes, Hospitals and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Thermo Fisher Scientific Inc., Merck KGaA, PromoCell

GmbH, Lonza, Corning Incorporated, Avantor Inc.,

Tecan Trading AG, REPROCELL Inc., CN Bio

Innovations Ltd, Lena Biosciences, BiomimX SRL,

InSphero AG, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The 3D cell culture market size is anticipated to be worth USD 1.8 billion in 2023.

The Global Industrial Lubricants Market is expected to grow at a compound annual growth rate of 12.0%

from 2023 to 2032.

North America dominates the Global 3D Cell Culture Market accounting for 46.9% in 2023.

The major key players of the global 3D cell culture market are Thermo Fisher Scientific Inc., Merck KGaA,

PromoCell GmbH, Lonza, Corning Incorporated, Avantor Inc., Tecan Trading AG, REPROCELL Inc., CN Bio

Innovations Ltd, Lena Biosciences, BiomimX SRL, InSphero AG, and other key players.

Contents

1.1.Objectives of the Study

1.3.Market Definition and Scope

2.3D Cell Culture Market Market Overview

2.1.Global 3D Cell Culture Market Market Overview by Type

2.2.Global 3D Cell Culture Market Market Overview by Application

3.3D Cell Culture Market Market Dynamics, Opportunity, Regulations, and Trends Analysis

3.1.1.3D Cell Culture Market Market Drivers

3.1.2.3D Cell Culture Market Market Opportunities

3.1.3.3D Cell Culture Market Market Restraints

3.1.4.3D Cell Culture Market Market Challenges

3.2.Emerging Trend/Technology

3.4.PORTER'S Five Forces Analysis

3.6.Opportunity Map Analysis

3.11.Supply/Value Chain Analysis

3.12.Covid-19 & Recession Impact Analysis

3.13.Product/Brand Comparison

4.Global 3D Cell Culture Market Market Value ((US$ Mn)), Share (%), and Growth Rate (%) Comparison by By Technology, 2017-2032

4.1.Global 3D Cell Culture Market Market Analysis by By Technology: Introduction

4.2.Market Size and Forecast by Region

5.Global 3D Cell Culture Market Market Value ((US$ Mn)), Share (%), and Growth Rate (%) Comparison by By Application, 2017-2032

5.1.Global 3D Cell Culture Market Market Analysis by By Application: Introduction

5.2.Market Size and Forecast by Region

5.3.Stem Cell Research & Tissue Engineering

5.5.Drug Development & Toxicity Testing

6.Global 3D Cell Culture Market Market Value ((US$ Mn)), Share (%), and Growth Rate (%) Comparison by By End-User, 2017-2032

6.1.Global 3D Cell Culture Market Market Analysis by By End-User: Introduction

6.2.Market Size and Forecast by Region

6.3.Biotechnology & Pharmaceutical Companies

6.4.Academic & Research Institutes

10.Global 3D Cell Culture Market Market Value ((US$ Mn)), Share (%), and Growth Rate (%) Comparison by Region, 2017-2032

10.1.1.North America 3D Cell Culture Market Market: Regional Analysis, 2017-2032

10.2.1.Europe 3D Cell Culture Market Market: Regional Trend Analysis

10.3.1.Asia-Pacific 3D Cell Culture Market Market: Regional Analysis, 2017-2032

10.3.1.7.Rest of Asia-Pacifc

10.4.1.Latin America 3D Cell Culture Market Market: Regional Analysis, 2017-2032

10.4.1.5.Rest of Latin America

10.5.Middle East and Africa

10.5.1.Middle East and Africa 3D Cell Culture Market Market: Regional Analysis, 2017-2032

11.Global 3D Cell Culture Market Market Company Evaluation Matrix, Competitive Landscape, Market Share Analysis, and Company Profiles

11.1.Market Share Analysis

11.3.Thermo Fisher Scientific, Inc.

11.3.2.Financial Highlights

11.3.5.Key Strategies and Developments

11.4.2.Financial Highlights

11.4.5.Key Strategies and Developments

11.5.2.Financial Highlights

11.5.5.Key Strategies and Developments

11.6.2.Financial Highlights

11.6.5.Key Strategies and Developments

11.7.Corning Incorporated

11.7.2.Financial Highlights

11.7.5.Key Strategies and Developments

11.8.2.Financial Highlights

11.8.5.Key Strategies and Developments

11.9.2.Financial Highlights

11.9.5.Key Strategies and Developments

11.10.2.Financial Highlights

11.10.3.Product Portfolio

11.10.5.Key Strategies and Developments

11.11.CN Bio Innovations Ltd

11.11.2.Financial Highlights

11.11.3.Product Portfolio

11.11.5.Key Strategies and Developments

11.12.2.Financial Highlights

11.12.3.Product Portfolio

11.12.5.Key Strategies and Developments

11.13.2.Financial Highlights

11.13.3.Product Portfolio

11.13.5.Key Strategies and Developments

11.14.2.Financial Highlights

11.14.3.Product Portfolio

11.14.5.Key Strategies and Developments

12.Assumptions and Acronyms