Market Overview

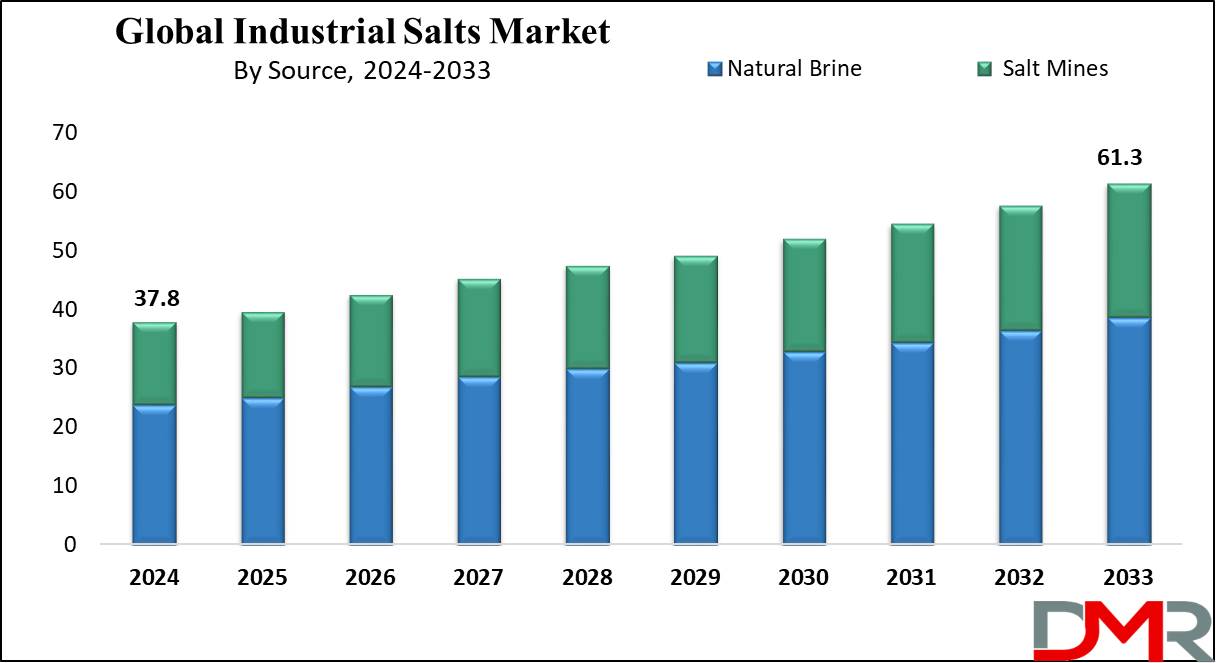

The Global Industrial Salt Market size is expected to reach USD 37.8 billion in 2024 and is further anticipated to value USD 61.3 billion by 2033, at a CAGR of 5.5%.

Industrial salts, also known as sodium chloride, constitute a white crystalline solid produced from seawater & rock salt deposits through conventional methods like vacuum evaporation, mining, & solar evaporation. The industry is expected to show significant expansion due to increasing demand across key sectors such as oil & gas, highway deicing, agriculture, water treatment, & chemical processing, particularly for caustic soda, chlorine, & soda ash production.

The chlor-alkali segment in the chemical industry is a major consumer due to the absence of economically viable alternatives. Anticipated growth factors include rising demand for direct applications like agriculture & deicing and indirect utilization in chemical processing.

Innovations in technologies, especially in high-purity salt production using methods like vacuum pan method, are expected to fuel market growth. Despite the availability of various production capacities globally, landlocked countries mostly rely on imports, while certain African nations possess domestic rock salt deposits.

Key Takeaways

- Market size: The global Industrial Salt market is anticipated to grow by 21.6 billion, at a CAGR of 5.5 % during the forecasted period of 2025 to 2033.

- Market Definition: Industrial salt is a type of salt that is produced for industrial applications obtained through the mining of underground salt deposits or the evaporation of saltwater.

- Source Analysis: Natural brine is forecasted to hold the largest market share of 63.1% and dominate the industrial salt market based on source in 2024.

- Manufacturing Process Analysis: Conventional mining is projected to be the dominant force in the market based on manufacturing process capturing the largest revenue share of 52.6% in 2024.

- Product Analysis: Salt in brine is forecasted to hold the largest market share and dominate the market based on product in 2024.

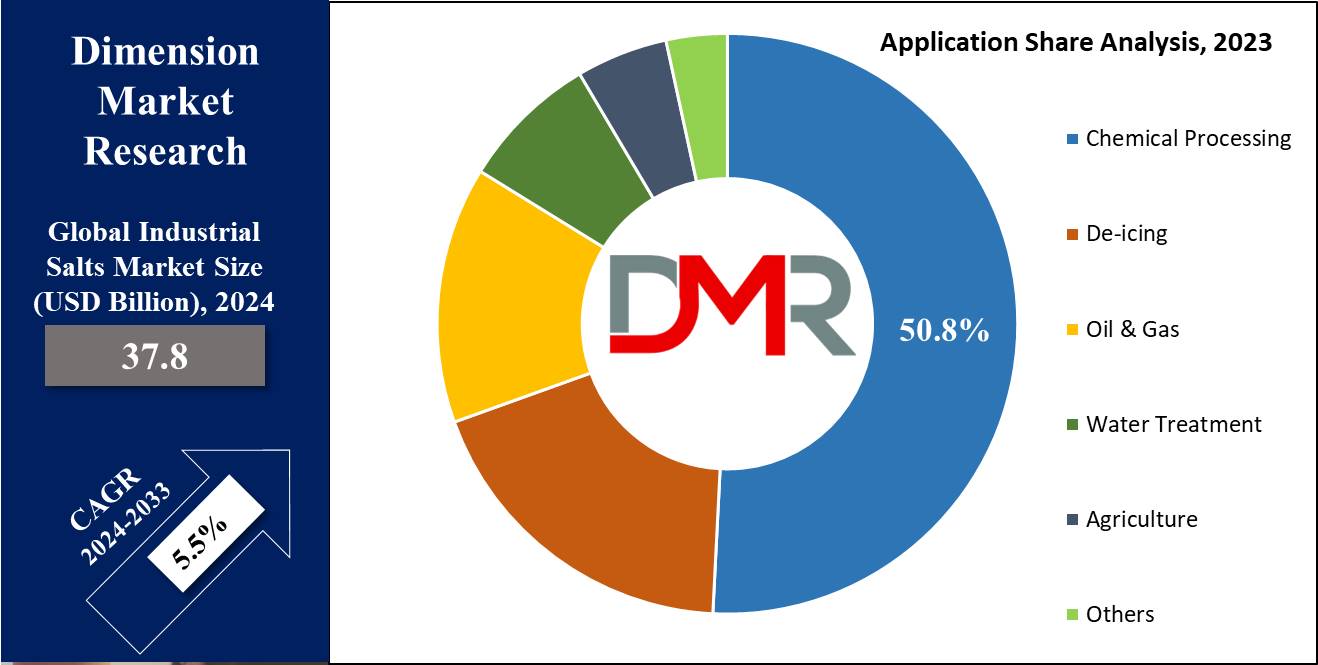

- Application Analysis: Chemical Processing as an application is expected to witness significant growth with the highest revenue share of 50.8% throughout the forecast period.

- Regional Analysis: Asia-Pacific is anticipated to dominate the global industrial salt market, capturing a revenue share of 34.1 % in 2024.

Use Cases

- Food processing: Industrial salt acts as a preservative, extending the shelf life of various food products such as meats, fish, and pickles by inhibiting the growth of bacteria. It helps regulate yeast activity to strengthen gluten structure in the dough, enhances flavor, and balances sweetness.

- Agriculture: Industrial salts are actively used in the agriculture sector as a fertilizer to replenish soil with essential nutrients like sodium and chloride. It is also required in livestock as a dietary supplement to maintain electrolyte balance and promote healthy growth and development.

- Water Treatment: Industrial salts are widely used in the water treatment process as they help remove impurities like calcium and magnesium ions from water which is important for producing clean and potable water for drinking purposes.

- Chemical Industry: Industrial salts in the chemical industry a raw materials in the production of chlorine and sodium hydroxide through the electrolysis of brine. They are used in the manufacturing of plastics, paper, textiles, and numerous other products.

Market Dynamic

Drivers

Abundant Reserves and Cost-Effective Solutions

Global Industrial Salt Market experiences robust growth due to the abundance of salt reserves. The abundant supply of industrial salts & straightforward engineering methods leads companies to a reduction in cost, stimulating the demand for the industrial salt across diverse applications. Key sectors such as oil & gas benefit significantly from industrial salt, enabling thorough drilling for natural gas & crude oil.

Diverse Applications and Key Industry Impacts

Pharmaceutical industry relies on industrial salts for capsule production & saline solutions. Industrial salts find versatile applications across cosmetics, food, & several sectors. The chlor-alkali sector incorporates salt in detergents & solvents due to its affordability and efficiency.

Restrains

Health and Environmental Concerns Surrounding Industrial Salt Usage

The utilization of industrial salts in various sectors can pose health risks, including potential brain damage, and can be harmful to the environment. For instance, the use of mercury salts can adversely affect kidney function and, in certain instances, result in fatalities.

Moreover, governmental restrictions concerning the widespread use of industrial salt in chemical processes constitute another factor affecting the market's advancement. Consequently, these factors limit market expansion, limiting growth in the foreseeable future.

Opportunities

Growing use in water treatment plant

Water treatment projects, particularly in water softening and purification, provide additional market opportunities. The limited availability of affordable alternatives further propels the market. Consequently, the market is poised for significant expansion in the upcoming years.

Dominance of Industrial Salts Due to Lack of Cost-Effective Alternatives

The absence of affordable alternatives necessitates the use of industrial salts for manufacturing products like ethylene dichloride, making it the most cost-effective option available. This situation presents significant growth opportunities for the market in the projected timeframe. Approximately half of the global demand for industrial salts stems from chemical processes.

Impact of Rapid Industrialization on Industrial Salt Demand

The rapid pace of industrialization and urban development has led to increased demand for various chemical products in recent years, subsequently driving the need for industrial salts.

Trend

Technological Advancements

Industrial salt companies are using advanced technology for better extraction methods, purification processes, and overall efficiency. Automation and digitalization are becoming more prevalently adopted by major market players.

Demand in Chemical Industry

Industrial salt are demanded in chemical industry for applications like chlorine production, which is used extensively in

water treatment, plastics, and other chemical processes. It is also used in chlor-alkali industry for manufacturing sodium hydroxide (caustic soda) and hydrogen gas through the electrolysis of saltwater.

Research Scope and Analysis

By Product

Salt in brine is anticipated to dominate the industrial salt market during the forecast year due to its ease of dissolution, handling, & consistent salinity, which is mostly utilized in several applications, especially in the food sector. Being sold in liquid form eases the process of adding salt to foods during manufacturing. In the food sector, salt dissolved in water forms a salt solution, majorly used for pickling & brining, methods employed for protecting & flavoring food.

By inhibiting the growth of harmful microorganisms, salt extends the shelf life of food products while enhancing their taste & texture. Brine (a high-concentration saline solution) is derived from large water bodies & mine deposits via solution mining and is extensively utilized by chemical companies operating in the industrial for the production of chlorine & caustic soda.

Solar salt is anticipated to experience rapid growth due to its rising demand in agricultural and water treatment sectors. Nevertheless, factors linked to the product, such as production expenses, duration, level of purity, and harvest timing based on climatic conditions, are anticipated to hinder the expansion of the market.

By Source

Natural brine is expected to dominate the industrial salt market with a 63.1% revenue share in 2024. It serves as a significant source of industrial salts, obtained from vast saline water bodies or via solution mining methods. The increasing limitations on the activities of mining are anticipated to positively affect the application sectors' utilization of brine. Chemical processing, a major industry, extensively relies on brine, leading to a substantial demand.

However, the processing cost associated with brine to produce crystals is high due to the heightened energy consumption required for vaporization. Moreover, the boiling operations in the vacuum pan method utilize substantial energy, contributing to increased prices. Consequently, this technology finds usage majorly in specific high-purity contexts.

Salt mines are anticipated to experience notable growth due to the rising consumption of rock salt in application industries. It involves the excavation of salt deposits from underground mines, followed by crushing, washing, and refining to produce high-quality industrial salt. In addition, these mines have extensive reserves, ensuring a stable and sustainable supply of industrial salt, which further contributes to their growth and prominence in the market.

By Manufacturing Process

Conventional mining is expected to dominate the global industrial salt market with the largest revenue share of 52.6% in 2024, as it is the most traditional method of extracting salt from underground deposits. It is a straightforward and relatively inexpensive method that includes an evaporation process used for extraction. This segment is driven by its higher quality and quantity of salt deposits.

The efficiency and cost-effectiveness of conventional mining are improved due to technological advancements in mining equipment, which drive the growth of this market. Automated drilling machines and advanced geological surveying tools help optimize the mining processes and reduce production costs, thereby fueling market growth.

Solar evaporation is expected to show notable growth after conventional mining due to the abundance of suitable geographical locations for solar evaporation as it is a natural process of evaporating water from saltwater ponds, leaving behind concentrated salt.

This segment is driven by the presence of regions with high solar irradiance and access to seawater or brine sources which are suitable for setting up solar evaporation facilities. These are natural, sustainable, and environmentally friendly salt production methods. It does not require energy inputs or chemicals which makes it an attractive option for environmentally conscious consumers and industries.

By Application

Chemical processing is expected to dominate the industrial salt demand based on application, constituting a market share of 50.8% in 2024. Industrial salts find widespread utilization in the manufacturing of soda ash chlorine, & caustic soda because of their economical nature & abundant availability.

The rising demand for industrial salts in chemical processing & chlor alkali applications, especially in India & China, is set to drive the market growth. The absence of economically viable alternatives has led to the active usage of industrial salts in the chloralkali process for producing products like ethylene dichloride, boosting the demand further. Several grades, such as brine, rock, & high-purity grades, are utilized by chemical manufacturers.

Notably, key chemical players opt for producing high-purity artificial brine for internal consumption using the solution mining method. The application segment that stood second is the de-icing sub-segment, driven by its abundant supply, affordability, & effective ice control characteristics. Rock salt is mainly employed for this purpose due to its inherent lack of requirement for purification.

The Global Industrial Salts Market Report is segmented based on the following:

By Product

- Salt in Brine

- Solar Salt

- Rock Salt

- Vacuum Pan Salt

By Source

By Manufacturing Process

- Conventional Mining

- Solar Evaporation

- Vacuum Pan Evaporation

By Application

- Water Treatment

- Oil & Gas

- De-Icing

- Chemical Processing

- Caustic Soda

- Soda ash

- Chlorine

- Agriculture

- Others

Impact of Artificial Intelligence on Industrial Salts Market

- Optimized Extraction & Processing: AI-powered mining and refining algorithms enhance salt extraction efficiency, reducing impurities and maximizing yield.

- Automated Quality Control & Purity Enhancement: AI-driven spectroscopy and sensor technology ensure precise grading of industrial salts, maintaining consistency across applications like chemicals, food, and water treatment.

- Predictive Maintenance for Equipment: Machine learning models monitor production equipment, predicting failures and optimizing maintenance schedules to minimize downtime and operational costs.

- Supply Chain & Logistics Optimization: AI forecasts demand trends, transportation needs, and inventory levels, improving distribution efficiency and reducing waste in supply chains.

- Sustainable Production & Waste Reduction: AI-driven process automation helps minimize energy use, reduce brine waste, and improve resource utilization, making industrial salt production more eco-friendly.

Regional Analysis

Asia-Pacific is anticipated to dominate the global industrial salts market both in terms of production & consumption,

with a 34.1 % share in global revenue in 2024. The rising emphasis on healthy & clean environments and

healthcare has enhanced the demand for a variety of products serving as cleansing agents. The surge in demand for disinfection products and laundry detergents has been substantial.

Given the increasing populations in countries such as India & China, the escalating demand for several food items is set to further propel market expansion in the foreseeable future. Moreover, China has ramped up its production in response to growing demand. The increasing industrialization in the Asia Pacific region & the increasing desire for the chemical sector’s products are anticipated to boost consumption in the foreseeable future.

Furthermore, the anticipated growth in the North American market is accredited to its wide usage in de-icing during severe weather conditions, driven majorly by increased demand for products in chemical processing & highway de-icing sectors.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Major players in the market like K+S Group leverage the strategic advantage of geographically convenient production sites across North America, South America & Europe. Equipped with an extensive network of production facilities, global players show superior flexibility in responding to weather-driven fluctuations in de-icing demand, ensuring consistent supply to consumers.

Key players in the market include Cargill Inc., Tata Chemicals Limited, and China National Salt Industry Corporation. Within the industry, businesses face intense competition, majorly centered on product quality & regional growth initiatives. Established entities like Compass Mineral and Morton Salt engage in competitive regional expansion efforts, focusing on high-margin sectors like food processing & pharmaceuticals.

Some of the prominent players in the Global Industrial Salts Market are

- Cargill Inc.

- Tata Chemicals Limited

- China National Salt Industry Corporation (CNSIC)

- Delmon Salt Factory Co. Ltd

- Compass Minerals Limited

- INEOS Enterprises

- Morton Salt

- Mitsui & Co. Ltd.

- European Salt Company

- K+S Group

- Others

Recent Development

- In January 2024, Saltworks Technologies doubled its production capability to upgrade its main manufacturing facility which is built upon its standardized and replicable modular designs, along with cell-based production and adherence to ISO Quality Assurance standards.

- In May 2023, Cargill’s salt business signed an agreement with CIECH Group, a leading supplier of evaporated salt products to extend its range of specialty and evaporated food salt solutions to food manufacturers in Europe.

- In March 2023, Minerals Income and Investment Fund (MIIF) announced plans to boost Ghana's salt industry, prioritizing the Ada Songhor Lagoon which aims to develop it into Sub-Saharan Africa's largest salt-producing area, aligning with Ghana's industrialization agenda.

- In February 2023, Invest International announced a loan facility of USD 13.6 million for the Egyptian Salt Industry Company (ESIC) which is designated for the development of a salt refining industrial plant in Egypt, leveraging technology and equipment provided by a Dutch company Titan Salt B.V.

- In December 2022, CIECH Soda Polska signed a supply agreement with Inowroclaw Salt Mines “Solino” to provide brine to its production plant up until 2035.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 37.8 Bn |

| Forecast Value (2033) |

USD 61.3 Bn |

| CAGR (2024–2033) |

5.5% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Source (Salt Mines, and Natural Brine), By Manufacturing Process (Conventional Mining, Solar Evaporation, and Vacuum Pan Evaporation), By Product (Rock Salt, Salt in Brine, Solar Salt, and Vacuum Pan Salt), By Application (Water Treatment, Oil & Gas, De-Icing, Chemical Processing, Agriculture, and Others). |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Cargill Inc., Tata Chemicals Limited, China National Salt Industry Corporation, Delmon Salt Factory Co. Ltd, Compass Minerals Limited, INEOS Enterprises, Morton Salt, Mitsui & Co. Ltd., European Salt Company, K+S Group, and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Industrial Salts Market size is estimated to have a value of USD 37.8 billion in 2024 and is expected to reach USD 61.3 billion by the end of 2033.

Asia Pacific is expected to be the largest market share for the Global Industrial Salts Market with a share of about 34.1 % in 2024.

Some of the major key players in the Global Industrial salt market are Cargill Inc., Tata Chemicals Limited, China National Salt Industry Corporation, Delmon Salt Factory Co. Ltd, and many others.

The market is growing at a CAGR of 5.5 percent over the forecasted period.