Laboratory informatics solutions market growth is being propelled by several factors. One key contributor is increased investment in pharmaceutical and biotechnology research & development activities these industries require advanced, customized solutions to efficiently manage complex data and speed research processes.

Life sciences and food & beverage sectors also experience an increasing demand for real-time data access which requires centralized platforms that can handle the diverse data generated by laboratories together with stringent regulatory requirements this trend only further propels market expansion.

As laboratories prioritize accuracy, compliance and efficiency,

laboratory informatics solutions have seen increased demand. This has fostered innovation and technological advancements within this market and encouraged further competition between companies within it; cloud-based solutions have become more popular due to their scalability, accessibility and flexibility as they enable reduction of manual work while decreasing labor costs, decreasing error rates while simultaneously improving data traceability, security and sharing capabilities.

Laboratory informatics helps streamline processes, enhance quality management and comply with regulatory standards more efficiently, while supporting decision-making by optimizing business processes. Technologies like Laboratory Information Systems (LIS) and LIMS are widely utilized by clinics and laboratories alike to reduce diagnostic errors while improving services; they simplify data management while increasing accuracy thus increasing operational efficiencies of laboratories.

Key Takeaways

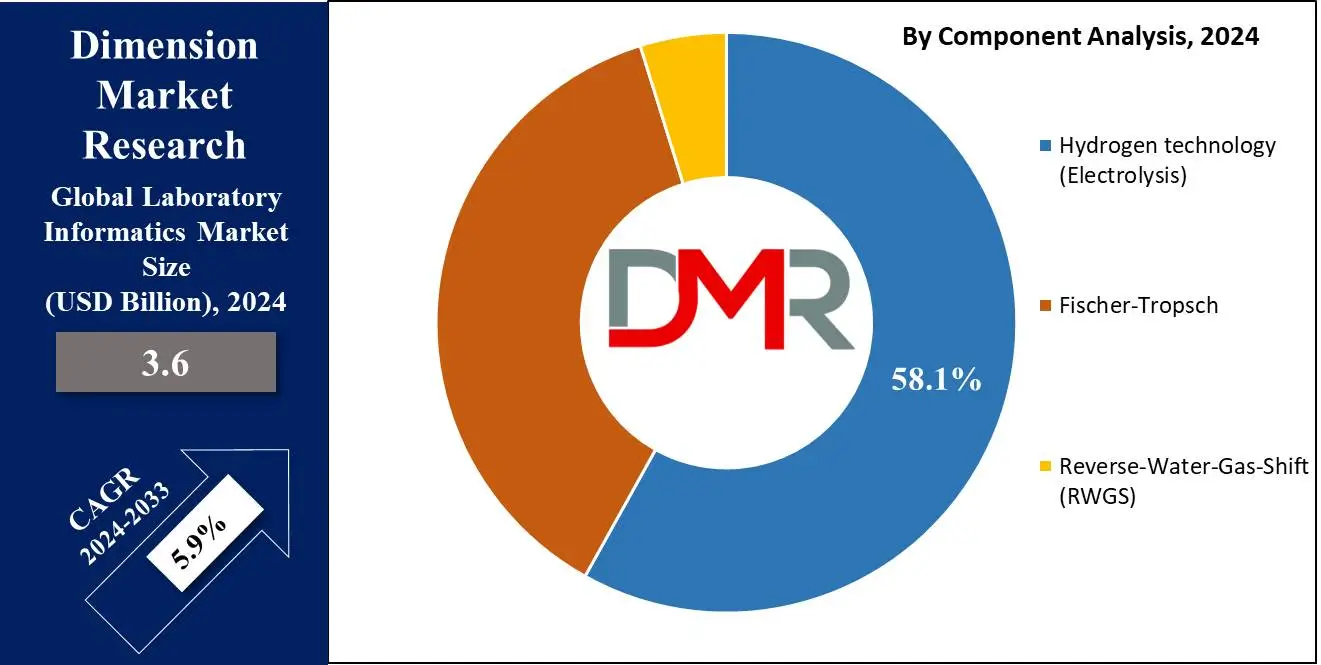

- Market Size & Share: Laboratory Informatics Market size is estimated to reach USD 3.6 Billion in 2024 and is further anticipated to value USD 6.1 Billion by 2033, at a CAGR of 5.9%.

- Solution Analysis: In 2023, LIMS taking approximately 40% of the market share.

- Component Analysis: The saw services dominate the market with roughly 55% market share in 2023.

- Deployment Model Analysis: By 2023, cloud models had taken an estimated 60% share of the market.

- Industry Analysis: Life sciences currently account for roughly 45% of laboratory informatics market revenue in 2023.

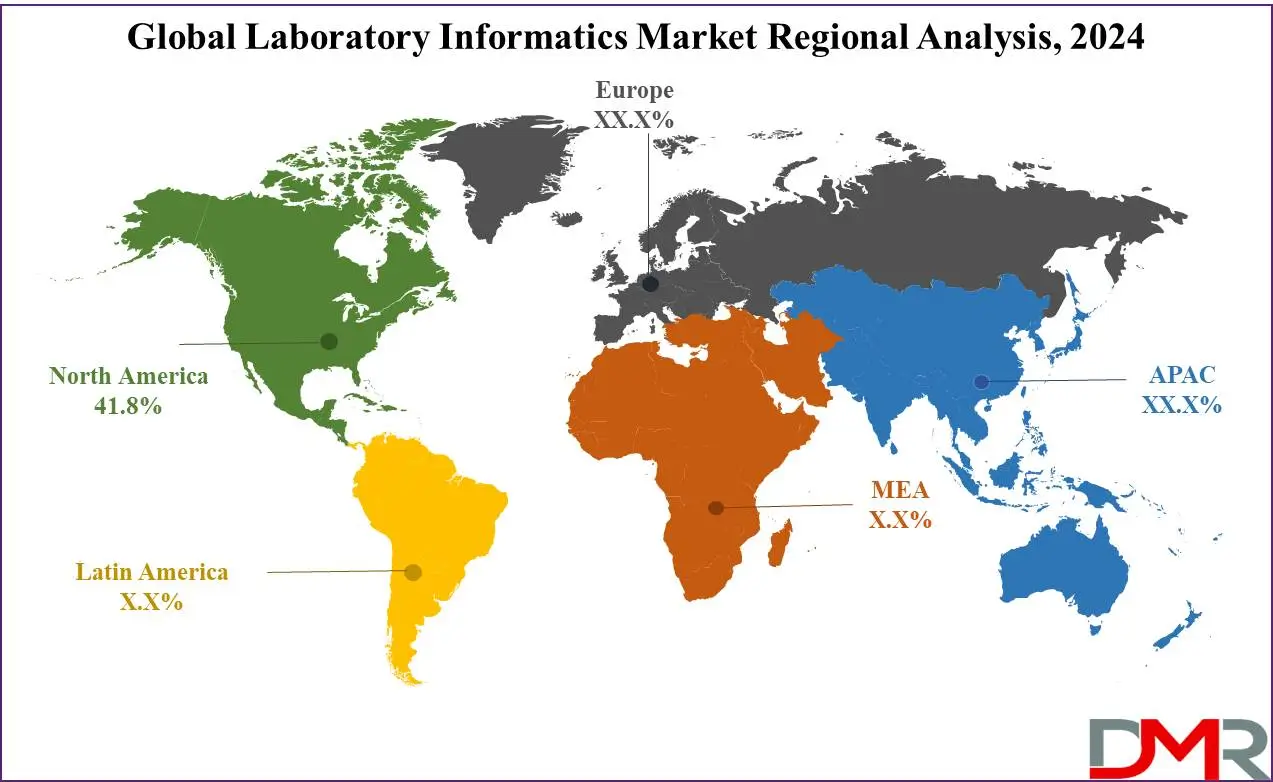

- Regional Analysis: In 2023, North America dominated the laboratory informatics market, accounting for approximately 41.8% of the global market share.

Use Cases

- Data Management: Organizes and integrates large volumes of lab data, especially in pharmaceuticals and life sciences.

- Regulatory Compliance: Ensures labs adhere to strict standards (FDA, ISO) by maintaining accurate records and quality control.

- Quality Control: Automates processes to track samples, analyze test results, and ensure reliable data accuracy.

- R&D Efficiency: Speeds up research by managing workflows, providing real-time data access, and enhancing collaboration.

- Clinical Diagnostics: Automates diagnostic workflows, reducing errors and improving lab efficiency and patient outcomes.

Laboratory Informatics Market Dynamics

Driver of Laboratory Informatics Market

The primary driver for laboratory informatics market growth is increasing investment in research and development (R&D), particularly within

pharmaceuticals and

biotechnology sectors. These industries rely heavily on advanced informatics solutions to manage vast amounts of complex data generated during drug discovery, clinical trials and other forms of scientific research.

Laboratory informatics solutions help optimize data management while increasing accuracy and speeding research processes. As demand for new drugs and therapies increases, so too does the need for customizable and integrated solutions that drive market expansion. R&D activity must remain high to develop personalized medicine, vaccines and novel treatments that address global health challenges.

Trend Adoption of Cloud-Based Solutions

A key trend in laboratory informatics market is the rise in adoption of cloud-based solutions, offering increased scalability, flexibility, and accessibility - allowing laboratories to manage large datasets more efficiently. Cloud platforms enable real-time data access and seamless integration with other systems, making them integral tools for global team collaboration.

This trend is especially strong within sectors such as life sciences, healthcare and food safety where interoperability of data sharing and interoperability is of the utmost importance. Furthermore, their adoption helps reduce infrastructure costs while improving data security, making cloud informatics an attractive solution.

Restriction: High Implementation Costs

One of the chief restraints to laboratory informatics market growth is its high implementation costs, such as initial setup, software licensing, customization and ongoing maintenance costs. These costs may be prohibitively expensive for small to mid-sized laboratories that need advanced informatics solutions.

Additionally integrating new informatics platforms with existing systems requires skilled IT personnel and training employees on new systems adds further operational burden; all this leads to slower adoption rates among smaller organizations in developing regions with limited financial and technical resources.

Opportunity: Growing Demand for Personalized Medicine

The rising interest in personalized medicine presents laboratory informatics companies with a key opportunity. As healthcare becomes more individualized through genetic and molecular profiles, laboratories require advanced informatics solutions to efficiently manage and analyze large datasets.

Laboratory informatics is a key component of genomics, proteomics, and other areas of precision medicine by providing data-driven insights and assuring regulatory compliance.

Due to increased demand, companies are responding by creating more specialized solutions tailored specifically for personalized

healthcare - creating significant growth potential in this market segment.

Laboratory Informatics Market Research Scope and Analysis

By Solution Analysis

Laboratory Informatics Market Solutions such as Laboratory Information Management Systems (LIMS), Electronic Lab Notebooks (ELN), Chromatography Data Systems (CDS), and Scientific Data Management Systems (SDMS) address different laboratory needs.

LIMS systems dominate this sector due to their comprehensive features for data management, sample tracking, workflow automation and regulatory compliance - essential in industries like pharmaceuticals, biotechnology and life sciences, which need to handle large amounts of data for research and diagnostics purposes.

2023 will see LIMS taking approximately 40% of the market share, due to its ability to centralize laboratory operations, streamline data handling, and increase overall lab efficiency. ELNs and CDS are becoming more prevalent for data recording and analysis in research settings but trail LIMS in market share terms. Other solutions such as Electronic Data Capture Systems or Laboratory Execution Systems might be essential solutions in specific industries or processes.

By Component Analysis

At the core of laboratory informatics is software, services and support - each play an essential part in providing solutions. Software serves as the backbone of these solutions with platforms like Laboratory Information Management Systems (LIMS), Electronic Lab Notebooks (ELN) and Chromatography Data Systems (CDS) providing platforms for managing laboratory data and automating workflows. However, customizing integration consulting as well as training validation and ongoing maintenance services also play a crucial role.

2023 saw services dominate the market with roughly 55% market share. This can be explained by labs' demand for tailored solutions, seamless integration into existing systems, and regulatory compliance support services; demand has surged since labs prioritize personalized, cloud-based informatics solutions with consulting, implementation, and technical support services as labs favor personalized cloud solutions over traditional approaches.

Software still plays a central role, but services provide organizations with an effective means to maximize investment while optimizing long-term system usability and optimizing long-term system optimization strategies and guarantee long-term system usability and usability over time.

By Deployment Model Analysis

Laboratory informatics market deployment models encompass two options for software installation and hosting: on-premise and cloud. By 2023, cloud models had taken an estimated 60% share of the market. This shift can be explained by an increasing need for real-time data access, improved storage capacities and seamless integration with other systems.

As organizations adopt cloud platforms more extensively - especially those working within biotechnology, healthcare and life sciences sectors - cloud dominance should increase further and offer significant operational advantages over traditional on-premise solutions.

An on-premise model involves installing software locally in an organization's infrastructure for greater control and security it has traditionally been preferred by laboratories handling sensitive or confidential information like pharmaceutical and government sectors. Meanwhile, cloud solutions provide more scalability, flexibility and cost efficiency, making them appealing to laboratories looking to streamline operations.

By Industry Analysis

Life sciences currently account for roughly 45% of laboratory informatics market revenue in 2023. This market dominance can be attributed to increasing demand for advanced data management solutions within pharmaceutical, biotechnology, and healthcare industries - such as Pharmaceutical Information Management Systems (LIMS) and Electronic Lab Notebooks (ELN) used by laboratories utilizing personalized medicine solutions; strict regulatory requirements; accurate traceable data management solutions are all contributing to its increase in use within life sciences laboratories.

Food & Beverage and Agriculture industries also benefit greatly from laboratory informatics as it ensures compliance with safety standards and quality control; Petrochemical, Oil & Gas industries also utilize laboratory informatics solutions for process optimization and environmental safety, while Chemicals, Environmental Testing & Forensics sectors take advantage of laboratory informatics to increase operational efficiencies, meet regulatory standards, enhance data accuracy in analytical processes as well as meet environmental safety regulations.

The Global Laboratory Informatics Market Report is segmented based on the following

By Solution

- Laboratory Information Management Systems

- Broad-Based LIMS

- Industry-Specific LIMS

- Electronic Lab Notebooks

- Chromatography Data Systems

- Electronic Data Capture & Clinical Data Management Systems

- Laboratory Execution Systems

- Enterprise Content Management & Document Management Systems

- Scientific Data Management Systems

By Component

- Services

- Software

- Support

By Deployment Model

- On-premise model

- Cloud model

- Software-as-a-service

- Infrastructure-as-a-service

- Platform-as-a-service

By Industry

- Life science

- Pharmaceutical & biotechnology companies

- Biobanks & biorepositories

- Contract service organizations

- Academic research institutes

- Molecular diagnostics & clinical research laboratories

- Toxicology laboratories

- NGS laboratories

- Food & beverage and agriculture

- Petrochemical and oil & gas

- Chemicals

- Environmental testing

- Forensics

- Other industries

Laboratory Informatics Market Regional Analysis

In 2023, North America dominated the laboratory informatics market, accounting for approximately

41.8% of the global market share. This leadership is primarily driven by the region's advanced healthcare and pharmaceutical industries, along with significant investments in research and development. Strict regulatory requirements from agencies like the FDA, along with the growing adoption of laboratory information management systems (LIMS), have further fueled the demand for informatics solutions.

Additionally, the rising use of cloud-based platforms and technological advancements in data analytics contribute to the region’s dominance. The strong presence of key industry players and research institutes also bolsters North America's market leadership.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Laboratory Informatics Market Competitive Landscape

Key players in the laboratory informatics market are investing heavily in innovation, expanding their product lines, and broadening technological offerings in order to remain competitive.

Companies investing in advanced solutions such as cloud-based platforms, AI integration and data analytics to enhance laboratory efficiency and compliance as well as strengthening their global presence through mergers or acquisitions; continuous advancements of laboratory information management systems (LIMS), electronic lab notebooks (ELN) and other informatics tools are helping these market leaders meet growing demands for efficient data management systems.

Some of the prominent players in the global Laboratory Informatics Market are

Recent Development

- Agilent Technologies: Agilent bolstered their collaborations, with particular attention being paid to integration within chromatography systems and data management through cloud-based laboratory informatics platforms.

- Abbott Informatics expanded their STARLIMS LIMS platform, emphasizing cloud solutions for managing lab data and increasing regulatory compliance.

- McKesson Corporation made efforts to enhance healthcare data solutions while improving patient record management.

- PerkinElmer, Inc.: PerkinElmer introduced AI-driven solutions for workflow optimization and regulatory compliance across various industries.

- Thermo Fisher Scientific, Inc.: Thermo Fisher grew through acquisitions and collaborations, expanding their LIMS offerings and emphasizing workflow automation.

- LabVantage Solutions, Inc.: LabVantage enhanced its LIMS capabilities for pharmaceutical labs by emphasizing cloud functionality and automation through automation solutions such as LabVantage Control Center.

- ID Business Solutions Ltd: IDBS upgraded their E-WorkBook platform to enable enhanced R&D lab management and collaboration capabilities.

Laboratory Informatics Market Report Details

| Report Characteristics |

| Market Size (2024) |

USD 3.6 Bn |

| Forecast Value (2033) |

USD 6.1 Bn |

| CAGR (2024-2033) |

5.9% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Solution(Laboratory Information Management Systems (Broad-Based LIMS, Industry-Specific LIMS) Electronic Lab Notebooks, Chromatography Data Systems, Electronic Data Capture & Clinical Data Management Systems, Laboratory Execution Systems, Enterprise Content Management & Document Management Systems, Scientific Data Management Systems) By Component (Services, Software, Support) By Deployment Model (On-premise model, Cloud model(Software-as-a-service, Infrastructure-as-a-service, Platform-as-a-service) By Industry (Life science (Pharmaceutical & biotechnology companies, Biobanks & biorepositories, Contract service organizations, Academic research institutes, Molecular diagnostics & clinical research laboratories, Toxicology laboratories, NGS laboratories) Food & beverage and agriculture, Petrochemical and oil & gas, Chemicals, Environmental testing, Forensics, Other industries) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Agilent Technologies, Abbott Informatics, McKesson Corporation, PerkinElmer, Inc., Thermo Fisher Scientific, Inc., LabVantage Solutions, Inc., ID Business Solutions Ltd., LabLynx, Inc., Waters Corporation, LabWare, Core Informatics |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |