Elastomeric materials refer to substances displaying rubbery characteristics. An elastomer constitutes a polymer wherein the molecular connections rely on weak intermolecular forces. These materials find necessity in high-precision applications, like dental crowns or implants, where accuracy is paramount.

The market's growth is driven by the increasing acceptance of medical elastomers in the production of single-use medical devices such as syringes, valves, & tubing on a global scale. Additionally, the growing need for several implants, like artificial heart valves, is further fueling the demand for medical elastomers.

These elastomers possess desirable properties, such as biocompatibility, durability, & resistance to chemicals & high temperatures and, making them ideal for the production of various

medical equipment like syringes, tubes, catheters, bags, & gloves.

The United States comes out to be medical elastomers’ one of the largest consumers with significant growth anticipated over the forecast period. One of the major factors of the growth includes enhanced access to medical facilities & services for the people, aided by several initiatives of government for example, the ACA (Affordable Care Act) & Medicaid, etc.

The global medical elastomers market is witnessing tremendous expansion due to the rising demand for advanced medical devices and healthcare solutions. Elastomers play an integral part in manufacturing components that ensure patient safety and device functionality - seals, gaskets and tubing being primary examples. Minimally invasive surgeries and diagnostic devices have increased adoption of high-performance elastomers thereby creating further growth within this sector.

Due to advances in material science, the market is witnessing the introduction of innovative elastomers that provide enhanced performance such as biocompatibility and increased durability. Furthermore, medical industry is shifting toward eco-friendly alternatives by developing bio-based and recyclable elastomeric materials - this trend aligns with global efforts toward eco-friendly solutions.

As the medical industry expands in North America and Asia-Pacific regions, demand for elastomers in drug delivery systems, surgical instruments and wound care products increases rapidly. Furthermore, regulatory bodies continue to place emphasis on assuring safety and reliability of medical-grade materials; creating further opportunities for market expansion. With technological advancements driving high-quality medical product requirements and technological breakthroughs opening new avenues, market growth remains robust.

TPE materials have witnessed increasing usage across non-invasive applications, particularly wound care products and sealing applications. TPE has seen exponential increases across wound care products, sealing applications and prosthetics. Medical device manufacturing industries relying heavily on premium-grade elastomeric materials has spurred investments in research and development activities to ensure manufacturing standards and regulatory compliance are upheld.

Market Dynamic

Silicone, in particular, is anticipated to observe significant demand globally for the forecast period. Thanks to its extensive usage in producing medical elastomers. One such example can be applications in the encapsulation of medical items.

Continuous advancements & developments in silicone-based advanced substances production are also expected to drive the growth of the market. The American

Cancer Society stated that breast cancer stands as the predominant cancer impacting women in the United States, excluding skin cancer. It is frequently detected in women, particularly those in their middle and later stages of life.

The hormonal treatment for symptoms of menopause results in increased levels of estrogen, which is affecting women with cancer formation in the breast. Breast cancer treatment has led to a rise in the demand for silicone breast implants which is further fueling growth in the United States medical elastomer market in the coming years. The market in the United States is driven by major key players like Dow Inc., Eastman Chemical Co., & DuPont. Dominant players’ expertise & their presence in the field contribute to the further development of the market in the nation.

Moreover, the enhanced occurrence of the variants of COVID-19 variants has led to an increased number of patients, leading to a rise in demand for several healthcare parts such as syringes, gloves, catheters, masks, etc. thus boosting its demand for medical elastomers.

Driving Factors

The medical elastomers market is driven by rising demand for advanced medical devices in emerging markets, specifically. Elastomers, known for their flexibility, biocompatibility, and durability are integral parts of manufacturing products such as catheters, syringes, and surgical instruments. Rising healthcare expenditure and chronic diseases necessitating frequent use of medical devices have only fueled this demand further.

Furthermore, advances in elastomer technology are improving performance in key applications like drug delivery systems; as healthcare infrastructure increases globally and develops in developing regions alike, the need for high performance materials such as medical elastomers will only increase significantly.

Trending Factors

A notable trend in the medical elastomers market is a move toward more eco friendly materials. As environmental concerns increase, manufacturers are turning towards eco friendly elastomers made of renewable materials or designed to break down easily after use aligning themselves with global efforts to limit medical waste's environmental footprint.

Advances in polymer chemistry have resulted in eco friendly elastomers with superior performance and biocompatibility that also offer environmental advantages. Their use is especially prevalent in developed markets where regulatory bodies and healthcare providers emphasize sustainability alongside functionality for medical devices and packaging materials.

Restraining Factors

Stringent regulatory frameworks represent one of the main barriers for growth in the medical elastomers market. Making elastomers that comply with stringent safety, biocompatibility and performance requirements set by agencies like the FDA or EMA requires substantial investments in research, testing and compliance activities.

The approval process can be complex and time consuming, discouraging smaller players from entering the market. Any delays or rejections during approval could seriously compromise product launches and revenue streams, while regional regulations often necessitate manufacturers to adjust products to comply with different compliance standards, further increasing costs and time to market.

Opportunity

Wearable medical devices offer medical elastomers market players an exciting prospect for growth. Wearable devices like fitness trackers, glucose monitors and portable ECG devices require lightweight yet flexible and durable materials for user comfort and functionality. Medical grade elastomers are ideal for these applications, offering excellent biocompatibility and adaptability to complex designs.

As wearable devices increasingly incorporate sensors and advanced technologies into wearable designs, high performance elastomers will become ever more necessary. With personalized healthcare becoming the trend worldwide, this demand for wearable device specific elastomers should continue its steady increase globally.

Research Scope and Analysis

By Type

The segment of thermoplastic elastomer dominates the medical elastomer market, accounting for a maximum share of the market in 2023. The type segment includes both thermoset elastomers & thermoplastic elastomers. This dominance of thermoplastic elastomers can be accredited to the rising spending on

healthcare facilities & on medical devices, such as plastic syringes, surgical gloves, instruments, & other items of plastic required in industrial applications.

The growing desire for plastics that are less weighted, for example, thermoplastic elastomer, has been driven by these factors, especially in the medical sector. Additionally, the investment in R&D for coronavirus studies & vaccine development has led to a rise in the need for pharmaceutical lab & lab equipment.

However, it is crucial to consider that most plastic polymers are derived from crude oil, making their costs susceptible to fluctuations in global crude oil prices. Seasonal variations, supply & demand dynamics, natural disasters, & several other factors can lead to changes in the prices of crude oil, which can affect the overall thermoplastic elastomers’ cost.

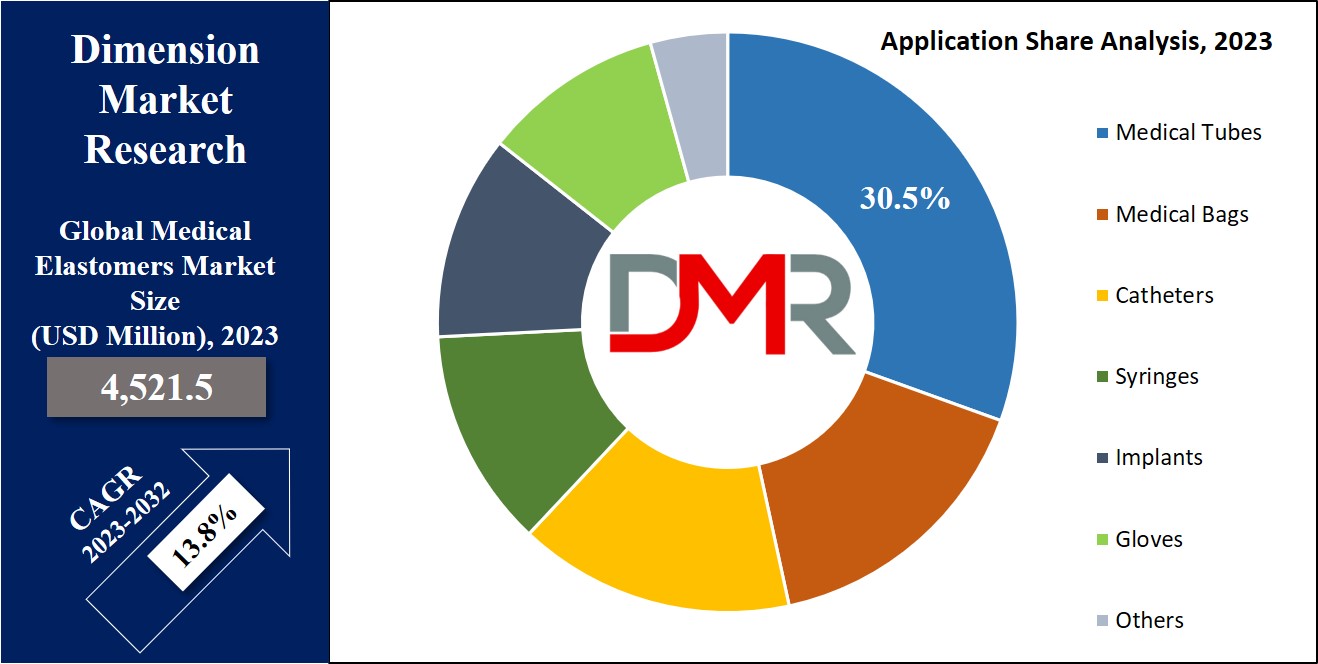

By Application

The segment of medical tubes dominates the market, capturing the maximum share of the total revenue. The rising demand for such tubes in increasing patients suffering from a number of diseases such as lung cancer, pulmonary fibrosis, & asthma, is further propelling the elastomers’ requirements in the medical & healthcare sector.

The ongoing innovations in the systems of drug delivery by the producers of healthcare equipment are driving the need for medical tubes that are customized. Moreover, the rising number of mergers & acquisitions among key players in the pharmaceutical device sector is anticipated to increase the demand for global single-use healthcare or medical equipment or devices, significantly fostering the growth of the market.

Another factor working behind the expansion of market size is the old age population and the rising prevalence of chronic diseases among them. Furthermore, the growing demand for less intrusive medical processes & single-use tube-based pharmaceutical devices is also driving the market’s growth.

The Medical Elastomers Market Report is segmented on the basis of the following

By Type

- Thermoset Elastomer

- Thermoplastic Elastomer

By Application

- Medical Bags

- Syringes

- Catheters

- Medical Tubes

- Implants

- Gloves

- Others

Regional Analysis

North America dominates the market for medical elastomers among other regions, capturing over maximum share of the total revenue. A major factor affecting this regional market’s growth is the rising investment in medical equipment in the United States especially in health insurance form. This growth in spending is significantly propelling the growth in the market in North America. Several uses of medical elastomers in this region encompass medical bags, medical tubing, syringes & implants.

Furthermore, Asia Pacific is anticipated to observe growth in the upcoming years. The medical sector in several nations like Australia, India & China is witnessing a higher desire for high-quality healthcare components & devices, driven by enhanced spending & investment in the medical sector. Moreover, the ongoing efforts to improve safety norms in medical centers are expected to further propel the demand for medical elastomers in Asia Pacific by 2032.

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The manufacturers are actively involved in expanding their portfolio of medical elastomers and exploring their applications. In addition to innovation, they are focusing on streamlining the pre- and post-production processes to keep up with the rapid advancements in technology.

Additionally, the economic downturn and financial uncertainties led to deferred investments and cautious spending in the healthcare sector, affecting the overall demand for medical elastomers. As the world gradually recovers from the pandemic and economies stabilize, the medical elastomers market is expected to regain momentum, driven by resuming healthcare activities, increased focus on medical research and development, and the rising need for advanced medical devices and equipment.