Market Overview

The Global

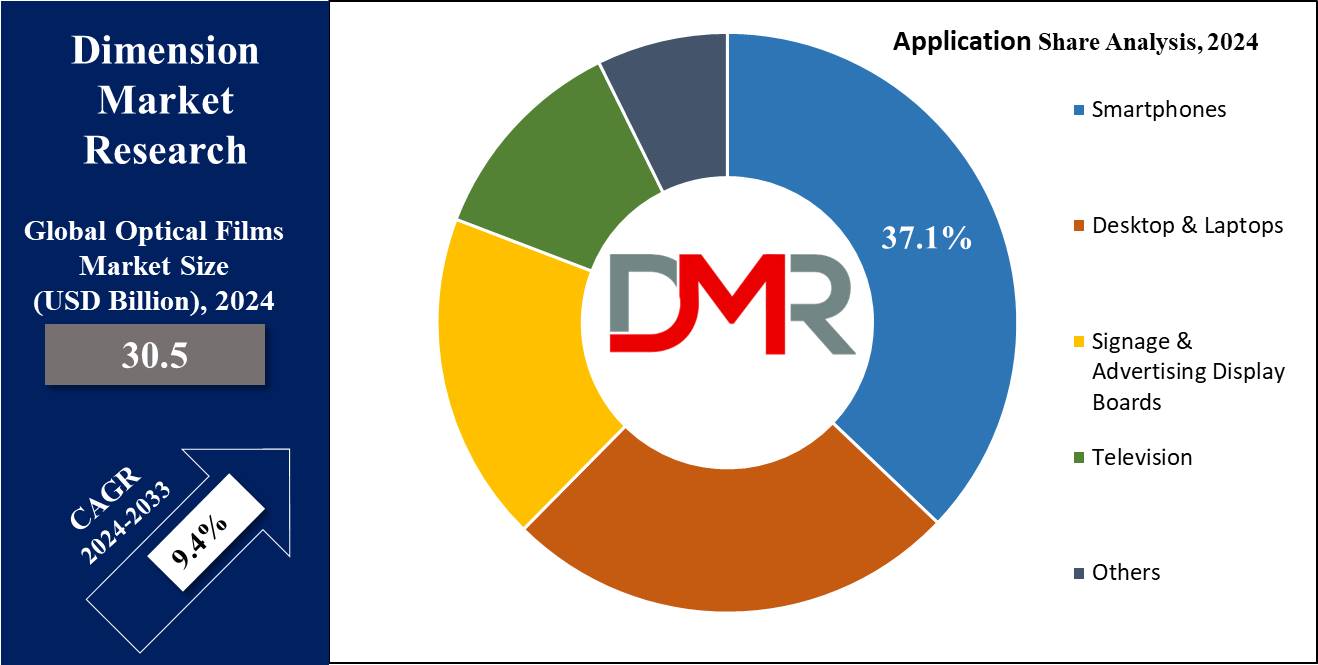

Optical Films Market size was valued at

USD 27.8 billion in 2023 and is anticipated to be

USD 68.7 billion in 2033 by a 9.4% CAGR over the forecast period.

Optical films consist of multiple layers used in various applications like reducing reflections and glare, as well as controlling light. They provide

energy efficiency, heat, & moisture resistance, and excellent flexibility, making them highly durable. By reducing battery consumption, they extend device usage. These films diminish reflections and enhance light transmission. These attributes are now influencing adjacent sectors such as

Automotive Wrap Films, where light control and surface aesthetics are becoming more essential in vehicle customization and safety.

There are different types of optical films, including BEF (brightness enhancement films), DBEF (display surface films, reflective polarizer films), ACLF (light control/privacy films), and ESR (backlight reflector films). These films are mainly used in FCDs (flat control displays) found in TVs, smartphones, industrial display control panels & laptops.

The need for optical films is elevating in sectors like automotive displays, desktops, laptops,

televisions, smartphones, and tablets, where better readability, higher brightness, consistent color, superior contrast, & reduced glare are important characteristics. In addition, innovations are spilling over into areas like

Medical Packaging Films, where clarity, light resistance, and durability are essential for preserving the integrity of pharmaceutical products during storage and transportation.

Recent years have witnessed an explosive increase in television demand, driven by rising disposable income among middle class populations as well as expansion of hotels and other infrastructure facilities. According to ZVEI (German Electrical and Electronic Manufacturers' Association), global electronics production was projected to reach EUR 4.7 trillion by 2020. Asia became the fastest growing region, estimated to experience an estimated compound annual growth rate of approximately 4% in 2020.

America and Europe recorded two to two and one percent respectively over that same timeframe. China, known for being a leading electronics production hub worldwide, played a central role in driving this surge. China plays an essential role in meeting domestic demand for electronic products like TVs one of the fastest growing segments within electronics while also serving as a key exporter of these items into global markets, further cementing China's centrality within global electronics value chains.

Key Takeaways

- Market Growth: The Optical Films Market size is expected to grow by 35.6 billion, at a CAGR of 9.4% during the forecasted period of 2025 to 2033.

- By Type: Polarizing film is expected to lead in 2024 with a major & is anticipated to dominate throughout the forecasted period.

- By Application: The smartphone segment is expected to get the largest revenue share in 2024 in the Optical Films market.

- Regional Insight: Asia Pacific is expected to hold a 54.8% share of revenue in the Global Optical Films Market in 2024.

- Use Cases: Some of the use cases of Optical Films include display technology, lighting systems, and more.

Use Cases

- Display Technology: Optical films are integral components in display technologies like LCDs (Liquid Crystal Displays) and OLEDs (Organic Light Emitting Diodes). They enhance screen brightness, clarity, and contrast by controlling light polarization, reflection, & diffusion.

- Photovoltaics: In solar panels, optical films are used to improve light trapping, increasing the efficiency of energy conversion. These films assist in directing sunlight onto photovoltaic cells, ensuring maximum absorption & electricity generation.

- Lighting Systems: Optical films play an important role in improving the efficiency and aesthetics of lighting systems. They can diffuse light to develop uniform illumination, minimize glare, and improve light transmission, making them ideal for applications ranging from residential lighting to automotive headlights.

- Anti-reflective Coatings: Optical films are used as anti-reflective coatings on lenses, camera filters, and eyeglasses. By minimizing surface reflections, they improve optical clarity, enhance contrast, and minimize glare, resulting in sharper images and better visual comfort.

Market Dynamic

Driving Factors

Consumer Electronics DemandThe rise in the demand for consumer electronics like smartphones, tablets, laptops, and televisions drives the growth of the optical film market. As display technologies advance, there is a growing need for optical films to enhance screen performance, including brightness, clarity, and energy efficiency. Additionally, the proliferation of high-resolution displays and emerging technologies like OLED and flexible displays further drive the need for specialized optical films customized to these applications.

Rising Solar Energy InvestmentsWith the global transformation towards renewable energy sources, there's a major Growth in investments in solar photovoltaic (PV) technology. Optical films play a major role in improving the efficiency of solar panels by improving light absorption and trapping within the PV cells. As governments and industries aim to achieve sustainability goals and reduce carbon footprints, the demand for optical films in solar applications is expected to continue growing.

Opportunities

Emerging Display TechnologiesThe fast development of new display technologies like MicroLED, MiniLED, and

quantum dot displays opens up many opportunities for optical film manufacturers. These advanced display technologies need specialized optical films to optimize light management, color accuracy, & energy efficiency. Companies that can innovate & provide customized solutions for these new technologies stand to capture a significant share of the market.

Increasing Adoption of Automotive Displays

The automotive industry is experiencing a growth in the adoption of in-vehicle display systems for infotainment, navigation, and driver assistance features. As vehicle manufacturers look to deliver improved user experiences and safety features, there's a higher demand for high-performance optical films to enhance display visibility, readability in varying lighting conditions, and durability.

Optical film manufacturers can capitalize on this trend by creating automotive-grade films that meet the strict requirements of the automotive sector, like temperature resistance, impact resistance, and optical clarity.

Restraints

High Manufacturing Costs

One major restraint in the optical film market is the high cost associated with manufacturing specialized films with advanced functionalities. Developing optical films with specific properties like high clarity, durability, and light management often needs specialized manufacturing processes and advanced materials, driving up production costs. These high manufacturing costs can limit market accessibility for smaller players & may develop challenges for broad adoption, mainly in price-sensitive industries.

Intense Competition and Technological Obsolescence

The optical film market is highly competitive, with many players constantly innovating and introducing new products to meet changing customer demands, as it can lead to margin pressures and shorter product life cycles as companies look to stay ahead of competitors.

In addition, rapid development in display and lighting technologies may impact existing optical film solutions obsolete, requiring companies to constantly invest in research & development to maintain relevance in the market, which can development major challenges for companies operating in the optical film market.

Trends

Demand for High-Performance Films in 5G DevicesWith the global rollout of

5G technology, there's a higher demand for high-performance optical films in 5G-enabled devices like smartphones and tablets. These devices need advanced display technologies with better clarity, brightness, and energy efficiency to support high-speed data transmission and improve user experiences. As a result, manufacturers are investing in the development of special optical films optimized for 5G devices, like films that minimize electromagnetic interference (EMI) and improve signal transmission, thereby driving growth of the market.

Shift towards Sustainable and Eco-Friendly Solutions

Sustainability has become a major concern across industries, including the optical film market. In response to growing environmental awareness & regulatory pressures, there's a major trend towards the adoption of sustainable and eco-friendly optical film solutions. Manufacturers are highly focused on developing films that use bio-based or recycled materials, along with implementing eco-friendly manufacturing processes with less carbon footprint and waste generation.

In addition, there's a high demand for optical films that allow energy savings and promote eco-friendly practices in end-use applications such as displays and lighting, reflecting a major industry shift towards sustainability and environmental stewardship.

Research Scope and Analysis

By Type

Based on type, the sub-segment of the polarizing film will lead the global optical film market, contributing maximum shares in the global revenue in 2024, which is also expected to maintain its dominance in the coming future, marking the fastest growth rate. It is widely applicable in both LCD and OLED displays for various uses.

The high desire for polarizing films in several sectors like smartphones, television, display boards, & others, is due to their ability to improve image quality in liquid crystal displays. These films work by transforming non-polarized light into linearly polarized light, allowing specific beams to pass in one direction while absorbing all other beams.

The backlight film serves as a major component providing the illumination for LCDs, as the

LCD panel lacks inherent luminosity. Therefore, having a light source is important to function the display. In addition, the LCD backlight film comprises a backlight, adhesive materials, an optical diaphragm, a plastic frame, insulation products & several other elements.

By Application

In terms of application, smartphones are anticipated to dominate the optical film market with a maximum share of global revenue in 2024. The increase in demand for consumer electronics, mainly in Asia Pacific, is driving the need for optical films.

Factors like fast urbanization, a growing middle class, changing spending habits, & a transformation toward huge spending are boosting the need for consumer electronics like computers, TVs, smartphones, & tablets, which is expected to significantly grow the demand for optical films.

The acceptance of the product in LCD & LED technologies is also contributing to the demand, majorly in the Television sector. Therefore, the sub-segment of Television is also experiencing growth in recent years. Moreover, the desire for larger displays & the increase in popularity of video walls are anticipated to drive the growth of the television segment in the upcoming years.

The Global Optical Films Market Report is segmented on the basis of the following

By Type

- Backlight Unit

- Polarizing Film

- Indium Tin Oxide

By Application

- Smartphones

- Desktops & Laptops

- Television

- Signage & Advertising Display Boards

- Others

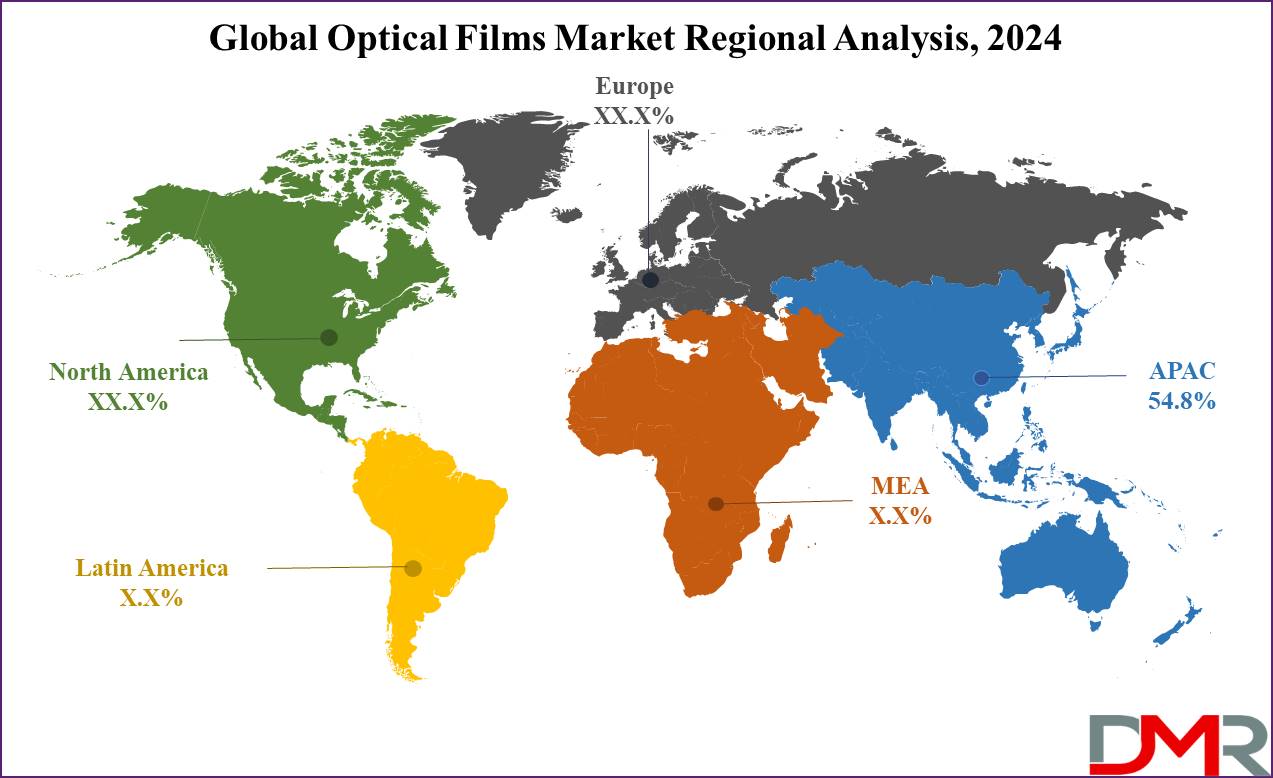

Regional Analysis

The Asia Pacific region is expected to be led by the Global Optical Films Market, with a

maximum share of 54.8% in global revenue in 2024. Over recent years, Asia Pacific has become a hotspot for key international players spending heavily in the production sector. Nations like India, China, & Japan, mainly in Northeast Asia, have focused on boosting their economies by aiming at the extraction of raw materials, manufacturing, & services.

The growing desire for customer electronics in the region has been a major driving force. India's government imposed many national reform strategies, like Digital India, Make in India, & 100% FDI in electronic hardware manufacturing, supporting growth in the electronic manufacturing sector.

Additionally, the region benefits from affordable labor and proximity to raw material suppliers, making it attractive for investors. Indonesia, China, South Korea, Taiwan & India, are poised to continue propelling market growth in the coming years.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

In the Global Optical Films Market, many big companies are trying hard to be the leaders. They use tactics like joining with other companies, creating new products, & improving their technology to stay ahead. These companies compete strongly to sell the best products. They focus on making high-quality films & managing their supply chains effectively.

To win in the market, they invest in R&D to create new & better products. They also work closely with manufacturers and try to understand what customers want. This fierce competition drives them to keep improving & further expanding their reach worldwide.

Some of the prominent players in the Global Optical Films Market are

Recent Developments

- In March 2024, Nikon Corporation announced for complete acquisition of the outstanding membership interests of RED.com, LLC (RED) whereby RED will become a complete subsidiary of Nikon, under a Membership Interest Purchase Agreement.

- In January 2024, FlexEnable, launched optical evaluation kits for AR and VR devices, which include ambient dimming & tunable lens film modules made using FlexEnable’s flexible liquid crystal (LC) technology, which bring game-changing optical performance to AR/VR and allow highly smaller, lighter and curved devices key factors in achieving the visual and physical comfort necessary for all-day wearability and sustained adoption. The evaluation kits are fisrtly available to selected strategic partners who want to evaluate FlexEnable’s breakthrough technology for integration into new products.

- In September 2023, FUJIFILM North America Corporation, Optical Devices Division introduced the FUJINON Duvo 1 HZK24-300mm Portable PL Mount Zoom Lens (“Duvo 24-300mm”), a dual format lens supporting two types of large-image sensors2, specializing in shallow depth-of-field and beautiful bokeh.

- In August 2023, Precision Glass & Optics (PG&O) announced its latest capability, the extended operating wavelength range of finished optics from the mid-ultraviolet (0.2 µm) out to the longwave infrared spectrum (15 µm), which is available on high-precision, polished substrates ranging in size from 0.059” to 30” diameter.

- In April 2023, IDEX Corporation announced it has entered into a definitive agreement to acquire Iridian Spectral Technologies for cash consideration of 150 million CAD (USD 110 million) subject to customary adjustments, which complements existing IDEX optical coating expertise, enabling it to expand its core capabilities to help current and future markets.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 30.5 Bn |

| Forecast Value (2033) |

USD 68.7 Bn |

| CAGR (2024-2033) |

9.4% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Backlight Unit, Polarizing Film, and Indium Tin Oxide), and By Application (Smartphones, Desktops & Laptops, Television, Signage & Advertising Display Boards, and Others). |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Toray Industries, Inc., 3M Company, Nitto Denko Corporation, Samsung SDI Co., Ltd., LG Chem Ltd., PRONAT Industries Ltd., Sumitomo Chemical Co., Ltd., Hyosung Chemical, Zeon Corporation, UFO Digital Solutions Pty Ltd., and Other Key Players. |

| Purchase Options |

HVMN Inc., Thync Global Inc., Apple Inc., Fitbit Inc., TrackmyStack, OsteoStrong, The ODIN, Thriveport LLC, Muse, Moodmetric, and Other Key Players |

Frequently Asked Questions

The Global Optical Films Market was valued USD 27.8 billion in 2023.

The expected CAGR for the Global Optical Films Market is 9.4% for the forecast period.

The Asia Pacific region is set to lead the Global Optical Films Market, with a maximum share of 54.6% in global revenue in 2024.

Some prominent players in the Global Optical Films Market include Toray Industries, Inc., 3M Company, Nitto Denko Corporation, Samsung SDI Co., Ltd., LG Chem Ltd., PRONAT Industries Ltd., Sumitomo Chemical Co., Ltd., Hyosung Chemical, Zeon Corporation, etc.