Market Overview

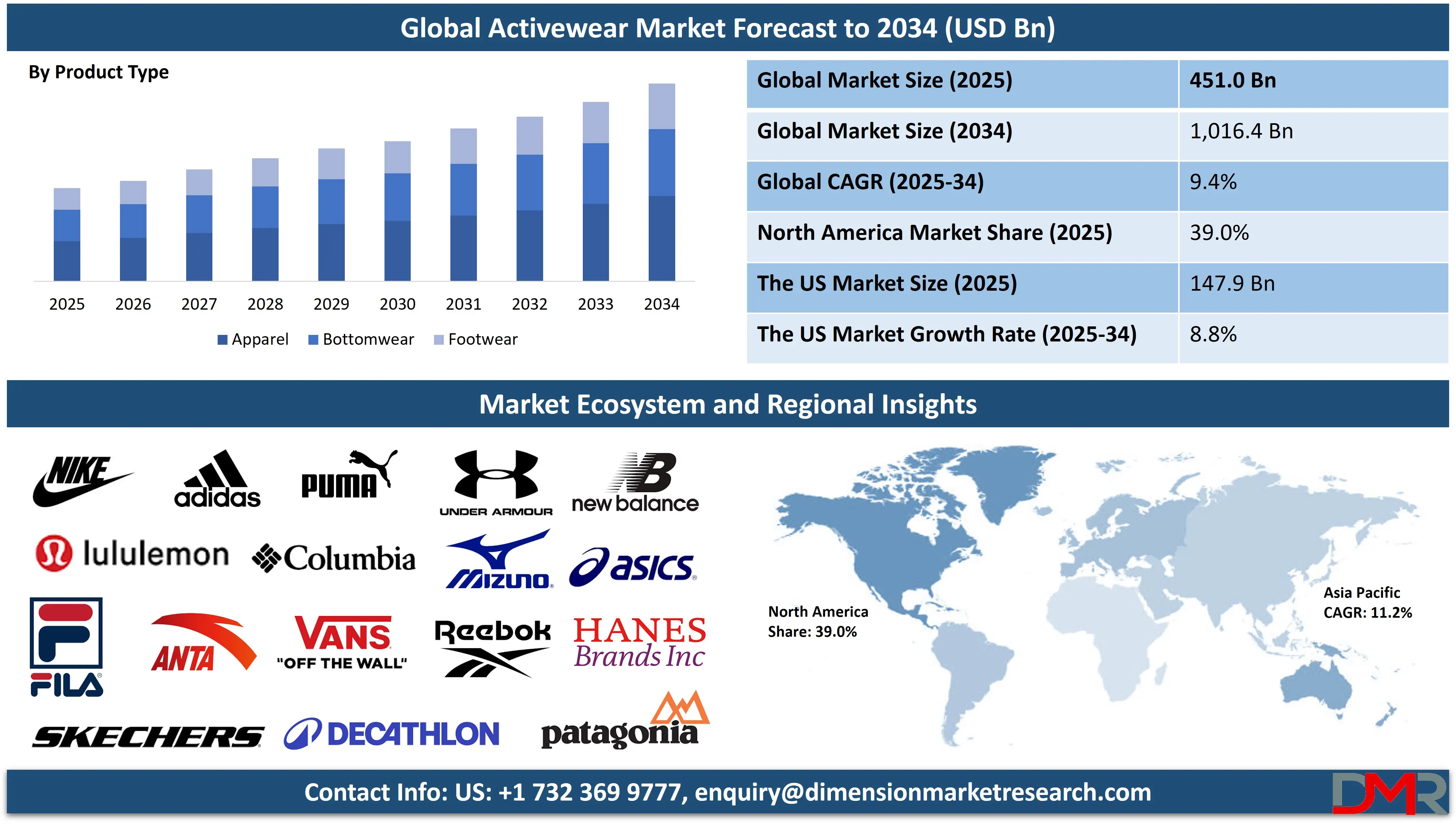

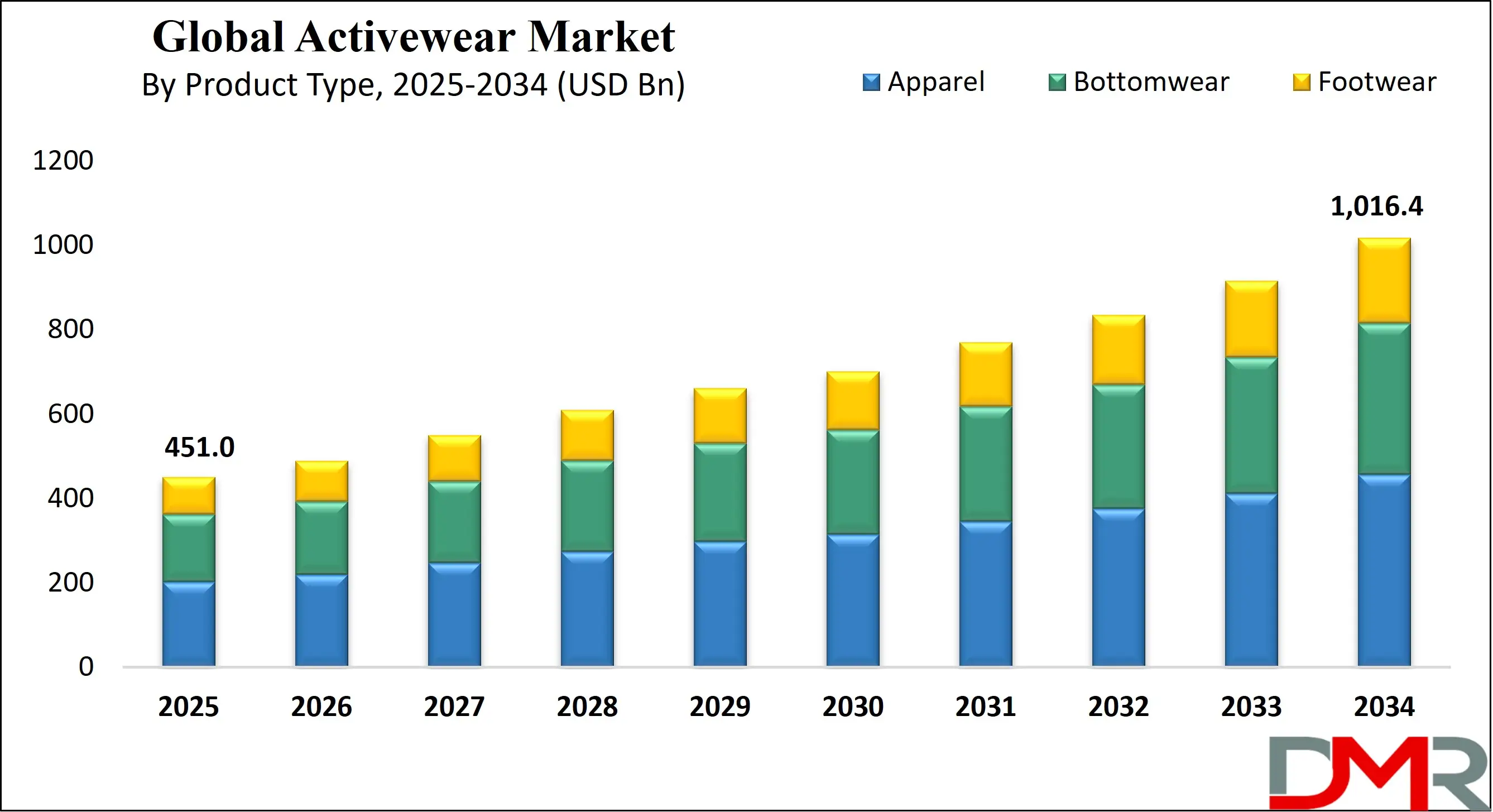

The Global Activewear Market is projected to reach USD 451.0 billion in 2025 and grow at a compound annual growth rate of 9.4% from there until 2034 to reach a value of USD 1,016.4 billion.

The global activewear market is experiencing robust growth, fueled by lifestyle changes, performance-driven innovation, and rising sustainability consciousness. Athleisure continues to dominate as consumers increasingly choose versatile, comfort-first designs that transition seamlessly from exercise to casual and work settings. Technological advancements such as moisture-wicking, anti-microbial treatments, and breathable yet durable fabrics are enabling broader adoption across different climates and activities. At the same time, participation in recreational and structured physical activities is expanding, with rising interest in running, yoga, gym training, outdoor pursuits, and hybrid fitness classes.

Sustainability is emerging as a key opportunity, with recycled polyester, organic cotton, and biodegradable materials gaining traction, alongside circular business models such as apparel recycling and brand-led resale initiatives. Digital-first strategies are reshaping distribution as brands rely heavily on e-commerce, social commerce, and direct-to-consumer platforms, driving stronger consumer engagement and loyalty. However, the sector also faces significant restraints, including raw material cost volatility, supply chain disruptions, and intense market competition, which compress margins and heighten marketing costs.

Additionally, demand fluctuations linked to economic cycles pose challenges. Despite these pressures, forecasts indicate that the global activewear market will maintain healthy compound annual growth rates through the 2020s, supported by innovation, lifestyle shifts, and expanding adoption in emerging economies. The future growth prospects lie in sustainability-led differentiation, targeting niche activities such as emerging sports, and capturing the growing fitness culture in developing regions.

The US Activewear Market

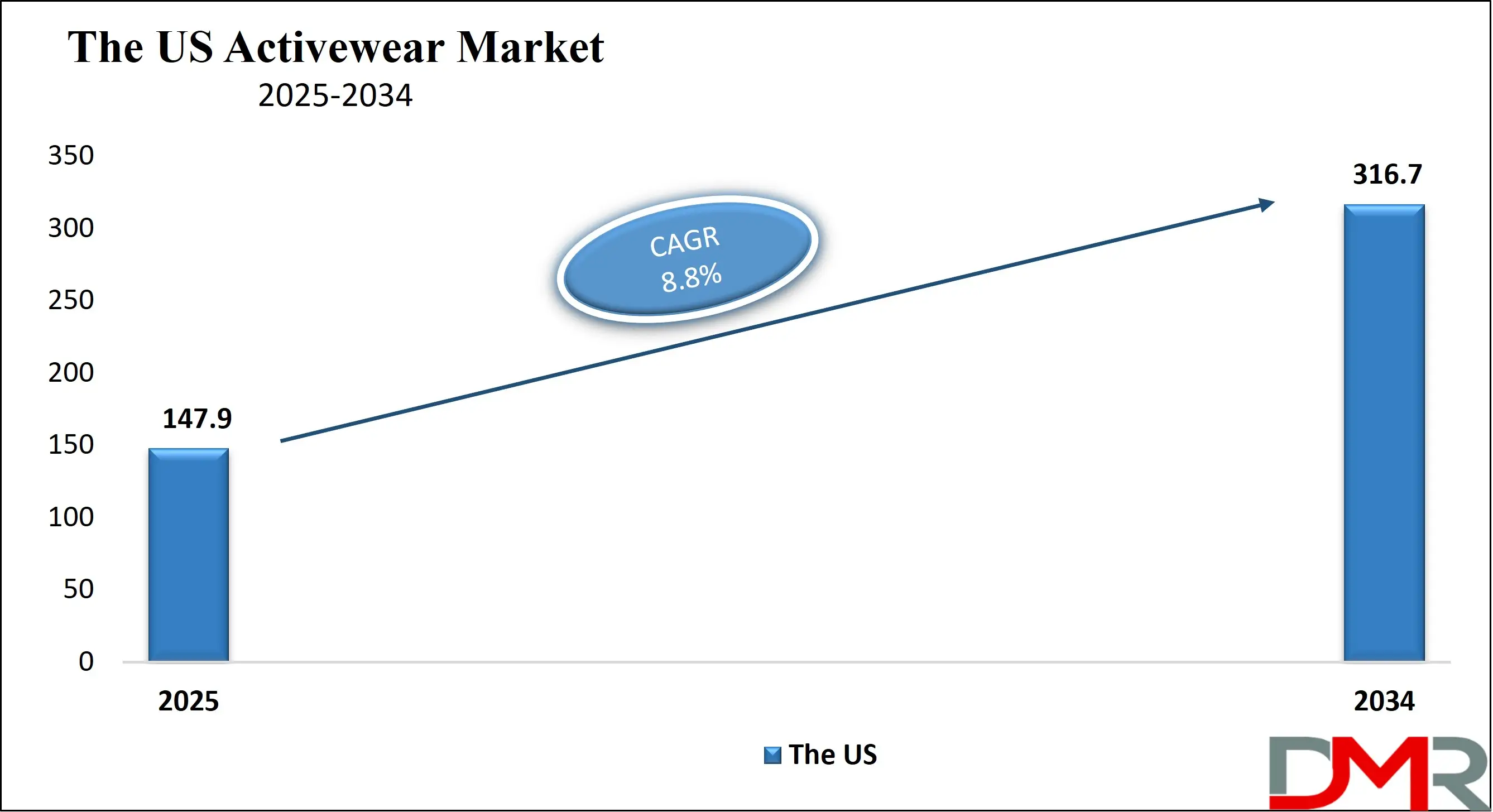

The US Activewear Market is projected to reach USD 147.9 billion in 2025 at a compound annual growth rate of 8.8% over its forecast period.

The United States activewear market benefits from unique demographic strengths, rising health awareness, and widespread adoption of fitness-oriented lifestyles. The U.S. Census Bureau data highlights steady population growth with strong representation in younger age groups, creating a large base of active consumers, while also showing a growing senior demographic that drives demand for functional and wellness-focused apparel. The Centers for Disease Control and Prevention reports that nearly half of U.S. adults meet aerobic activity guidelines, reflecting a broad and consistent culture of physical fitness.

Government initiatives like the Physical Activity Guidelines for Americans promote exercise as a national health priority, further reinforcing apparel consumption across running, gym, outdoor, and leisure activities. The U.S. also benefits from high disposable income levels and a digitally connected consumer base that fuels strong e-commerce growth, especially in direct-to-consumer models where brands like Nike and Lululemon thrive.

Additionally, immigration contributes to demographic diversity and a younger workforce population, sustaining long-term demand. Structural advantages such as well-developed trade networks, advanced retail ecosystems, and widespread participation in school and community sports ensure consistent consumer engagement. Together, these demographic and behavioral strengths position the U.S. as a global leader in activewear adoption and innovation.

The Europe Activewear Market

The Europe Activewear Market is estimated to be valued at USD 67.6 billion in 2025 and is further anticipated to reach USD 135.1 billion by 2034 at a CAGR of 8.0%.

The European activewear market is shaped by a mix of cultural, demographic, and policy-driven dynamics. Public surveys and Eurostat data reveal that around four in ten Europeans engage in physical activity at least weekly, with participation rates highest in Northern and Western Europe and lower in parts of Southern and Eastern Europe. This variation drives localized demand northern markets lean heavily into outdoor gear and high-performance activewear, while southern markets show greater uptake of versatile athleisure and casual wear. The European Union’s strong emphasis on health promotion and sustainability supports growth in this sector, with regulatory frameworks driving eco-labeling, low-impact materials, and circular economy practices.

Cycling and walking programs funded by governments encourage active mobility, which fuels demand for functional apparel suited to both commuting and fitness. Europe’s demographic mix with aging populations in some regions and vibrant younger consumer bases in urban centers ensures demand across diverse product categories.

Younger generations drive athleisure adoption and e-commerce growth, while older demographics prioritize comfort and functionality. The region’s policy-driven sustainability push, combined with a health-conscious population, creates fertile ground for innovation, especially in eco-friendly fabrics and multi-purpose designs. These structural characteristics make Europe a leading hub for sustainable activewear.

The Japan Activewear Market

The Japan Activewear Market is projected to be valued at USD 27.0 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 57.7 billion in 2034 at a CAGR of 8.6%.

Japan’s activewear market is deeply influenced by its demographic profile, cultural habits, and government-led initiatives. The country’s aging population is one of its most defining features, creating strong demand for apparel that prioritizes comfort, ease of movement, and wellness integration. At the same time, school sports programs and widespread community engagement in physical activity ensure steady demand among younger populations for performance-driven apparel and footwear.

Surveys such as Japan’s Sports-Life Survey highlight high participation in walking, running, and light fitness activities, indicating broad adoption of active lifestyles across age groups. Urban density also plays a role, as consumers demand compact, versatile, and durable apparel suitable for commuting, daily routines, and fitness activities.

Public health campaigns in Japan actively promote sports participation and regular exercise as part of national well-being goals, sustaining consistent consumer demand. Retail infrastructure blends efficient specialty sports stores with highly advanced e-commerce channels, giving Japanese consumers access to both premium international brands and local innovators. Seasonal peaks in demand align with school sports seasons, recreational events, and community programs, reinforcing cyclical buying behavior. Overall, Japan’s demographic trends, health-focused culture, and strong retail ecosystem make it a stable and innovation-driven market for activewear.

Global Activewear Market: Key Takeaways

- Global Market Size Insights: The Global Activewear Market size is estimated to have a value of USD 451.0 billion in 2025 and is expected to reach USD 1,016.4 billion by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 9.4 percent over the forecasted period of 2025.

- The US Market Size Insights: The US Activewear Market is projected to be valued at USD 147.9 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 316.7 billion in 2034 at a CAGR of 8.8%.

- Regional Insights: North America is expected to have the largest market share in the Global Activewear Market with a share of about 39.0% in 2025.

- Key Players: Some of the major key players in the Global Activewear Market are Nike, Inc., Adidas AG, Puma SE, Under Armour, Inc., Lululemon Athletica Inc., Columbia Sportswear Company, ASICS Corporation, and many others.

Global Activewear Market: Use Cases

- Athleisure Lifestyle: Activewear is widely used as everyday apparel, blending fashion with comfort. Consumers wear leggings, joggers, and sports tops not only for workouts but also for travel, work-from-home, and casual outings, supporting the booming athleisure trend across urban markets.

- Professional Fitness Training: Gyms, fitness centers, and boutique studios drive demand for durable, sweat-resistant, and flexible activewear. Trainers, athletes, and enthusiasts rely on performance-oriented apparel and footwear designed for endurance, agility, and injury prevention during high-intensity workouts and strength training sessions.

- Outdoor and Adventure Sports: Hiking, cycling, trekking, and running in outdoor environments require technical apparel with weather resistance, UV protection, and moisture management. Activewear designed for outdoor use expands brand opportunities in global markets with rising adventure tourism and wellness travel demand.

- Yoga & Mindful Wellness: Yoga and Pilates participants favor lightweight, stretchable, and breathable fabrics that enable unrestricted movement and comfort. Activewear in this segment often includes eco-friendly fabrics and minimalist designs, appealing to consumers who blend physical exercise with wellness and mindfulness practices.

- Recreational & Community Activities: Activewear extends to casual sports, school athletics, and community fitness events. Families and kids’ participation in recreational games, weekend sports, and school activities creates a steady demand for affordable, durable, and versatile apparel and footwear across genders and age groups.

Global Activewear Market: Stats & Facts

U.S. Census Bureau

- The U.S. population reached 333 million in 2022, with nearly 53 million adults aged 65 and over, a demographic driving comfort-focused apparel demand.

- Approximately 63% of the population is aged 18–64, supporting strong demand for performance and activewear products.

- Over 82% of Americans live in urban areas, where athleisure and e-commerce adoption are strongest.

Centers for Disease Control and Prevention (CDC, USA)

- About 47% of U.S. adults meet aerobic physical activity guidelines.

- 24% of adults meet both aerobic and muscle-strengthening guidelines, indicating high activewear adoption potential.

- 54% of adults aged 18–24 are most likely to meet physical activity guidelines, fueling youth-focused activewear demand.

- The prevalence of obesity among U.S. adults is 41.9%, contributing to demand for fitness and wellness apparel.

U.S. Bureau of Labor Statistics (BLS)

- Average annual household spending on apparel and services in the U.S. was USD 1,754 in 2022.

- U.S. employment in the sporting goods, hobby, and apparel sector exceeded 550,000 workers in 2022, reflecting robust retail activity.

Eurostat (European Union)

- About 40% of Europeans exercise or play sports at least once a week.

- 7% of Europeans engage in physical activity five or more times per week.

- Northern Europe shows higher participation rates: 70% in Finland and 60% in Sweden engage regularly in sports.

- Approximately 75% of EU citizens live in cities, supporting strong demand for athleisure in urban Europe.

European Commission – Eurobarometer on Sport and Physical Activity

- 46% of Europeans never exercise or play sports, highlighting market penetration opportunities.

- 36% of Europeans perform physical activities such as cycling or walking regularly, driving demand for versatile activewear.

World Health Organization (WHO)

- Globally, 28% of adults are insufficiently active.

- Physical inactivity levels are highest in high-income countries, with over 37% not meeting activity recommendations.

- 81% of adolescents aged 11–17 years worldwide are not sufficiently physically active, signaling long-term opportunity for youth-focused apparel.

Statistical Handbook of Japan / Japan Sports Agency

- Japan’s population aged 65 and above reached 29% in 2022, the highest globally, driving demand for wellness-oriented apparel.

- The Sports-Life Survey shows walking is the most popular activity in Japan, with 56% participation among adults.

- Running and jogging participation stands at 11% among Japanese adults.

Australian Bureau of Statistics (ABS)

- 72% of Australians aged 15 and over participated in sport or physical recreation in 2020–21.

- Walking for exercise was most popular, with 45% of adults participating.

- Fitness/gym activities ranked second, with 32% participation.

Sport England (Active Lives Survey)

- In England, 62.3% of adults (16+) are active for more than 150 minutes per week.

- Around 25.8% of adults are inactive, doing less than 30 minutes of weekly activity.

Canada – Statistics Canada / Canadian Fitness and Lifestyle Research Institute

- 68% of Canadians aged 18–79 meet recommended aerobic physical activity guidelines.

- 57% of Canadian children and youth (aged 5–17) achieve recommended physical activity levels daily.

Global Activewear Market: Market Dynamic

Driving Factors in the Global Activewear Market

Rising Global Participation in Fitness and Sports Activities

The increase in physical activity worldwide is a powerful driver of the activewear market. Public health initiatives, gym memberships, recreational clubs, and awareness campaigns are fueling the adoption of sports and fitness as part of daily routines. From running to yoga, people are embracing healthier lifestyles, leading to consistent demand for performance-driven apparel and footwear. School-level sports programs and youth participation further amplify consumption, creating steady market growth across generations. This cultural shift toward fitness is supported by governments promoting physical activity as a preventive healthcare measure, ensuring that demand remains structurally strong. Activewear thus benefits from both wellness-driven consumer priorities and institutional support.

Expansion of E-Commerce and Omnichannel Retail

The rapid growth of digital commerce has transformed the way activewear is marketed, sold, and consumed. Brands now leverage direct-to-consumer platforms, social media marketing, and personalized digital experiences to engage customers. E-commerce enables global accessibility, while omnichannel strategies integrate physical and digital touchpoints to deliver seamless shopping experiences.

Innovations such as virtual try-ons, AI-driven recommendations, and influencer collaborations are further driving online engagement. For consumers, online platforms provide convenience, variety, and price comparison opportunities, boosting brand competition and consumer choice. For companies, direct digital channels enhance margins, collect consumer insights, and build loyalty. This structural retail shift remains a major growth accelerator for the activewear market worldwide.

Restraints in the Global Activewear Market

Volatility in Raw Material Costs and Supply Chain Disruptions

The activewear industry is heavily dependent on raw materials such as polyester, nylon, and cotton, which are subject to significant price volatility due to oil price fluctuations, crop yields, and global demand pressures. Geopolitical uncertainties, trade restrictions, and logistical bottlenecks further strain supply chains, leading to rising costs and production delays. For brands, these challenges reduce profit margins and complicate planning cycles. Smaller players are especially vulnerable, as they lack the financial resilience of larger competitors. While companies are exploring local sourcing, recycling, and vertical integration to mitigate risks, supply chain fragility remains a persistent constraint on the market’s stability.

Intense Market Competition and Counterfeit Products

The activewear sector is one of the most competitive apparel categories, with global giants, regional brands, and numerous startups vying for market share. This leads to heavy promotional spending, frequent product launches, and shrinking margins. Simultaneously, counterfeit activewear products present a significant challenge, particularly in price-sensitive markets. Fake goods undermine brand equity, reduce sales, and create consumer trust issues. Despite efforts such as trademark enforcement and advanced authentication technologies, counterfeit markets continue to thrive, especially online. The combined effects of saturated competition and illicit product sales pressure legitimate players, making differentiation and innovation critical to maintaining long-term growth.

Opportunities in the Global Activewear Market

Penetration in Emerging Economies with Growing Fitness Culture

Emerging markets in Asia-Pacific, Latin America, and Africa represent significant untapped opportunities for activewear. Rising urbanization, expanding middle-class populations, and increasing disposable incomes are fueling demand for fitness apparel. Governments in these regions are actively promoting physical activity through national sports initiatives, infrastructure investments, and wellness programs.

Additionally, younger demographics with strong digital adoption are driving online retail penetration, offering global brands new consumer bases. Local manufacturing and collaborations with regional influencers further strengthen opportunities. Activewear companies that tailor products to cultural preferences and climate-specific needs in these economies are well-positioned to capture high growth over the coming decade.

Product Diversification and Integration with Technology

Activewear innovation is moving beyond traditional performance apparel toward integration with technology and cross-category diversification. Smart fabrics with biometric monitoring, temperature regulation, and compression features are gaining traction among professional athletes and wellness enthusiasts. At the same time, crossover categories like swim-active hybrids, modest activewear, and adaptive apparel for seniors and people with disabilities present strong growth niches. Collaborations between fashion houses and sports brands further enhance brand visibility and market reach. As consumers seek personalized, functional, and stylish solutions, diversified offerings and wearable technology integration offer activewear brands opportunities to capture new audiences and create value-added, premium products.

Trends in the Global Activewear Market

Athleisure as a Dominant Lifestyle Movement

Athleisure has shifted from a fashion fad into a lifestyle norm, reshaping the global apparel industry. Consumers increasingly prioritize versatility, seeking products that transition seamlessly from workouts to social and professional settings. Remote and hybrid work models have intensified this demand, with comfort and performance becoming essential features for everyday wardrobes. Brands are responding by designing multifunctional apparel that blends style, durability, and technical performance. The result is a consumer base that perceives activewear not just as sports apparel but as a universal clothing category. This long-term trend continues to attract investment in innovative fabrics, inclusive sizing, and designs tailored to diverse lifestyles and demographics.

Sustainability and Eco-Conscious Product Innovation

Sustainability has become one of the strongest and most enduring trends in the activewear market. Consumers are increasingly aware of environmental footprints, driving demand for products made from recycled polyester, organic cotton, bamboo-based fabrics, and biodegradable fibers. Brands are adopting circular economy models through recycling initiatives, resale platforms, and take-back programs to enhance brand equity. Transparency in sourcing and ethical manufacturing practices are also growing priorities, supported by eco-certifications and stricter regulations in regions like Europe. As sustainability merges with consumer purchasing decisions, eco-friendly activewear is no longer niche but a mainstream expectation, fundamentally reshaping product portfolios and competitive differentiation strategies.

Global Activewear Market: Research Scope and Analysis

By Product Type Analysis

Apparel is projected to be the undisputed leader in the activewear market, as it covers a broad spectrum of products, including leggings, shorts, T-shirts, jackets, hoodies, sweatshirts, and sports bras. Unlike accessories or footwear, apparel is both a performance necessity and a lifestyle staple, creating a dual consumer pull. The rise of the athleisure trend has made activewear apparel acceptable in offices, schools, social events, and even luxury fashion segments, effectively broadening its consumer base beyond athletes or fitness enthusiasts. Women’s apparel, particularly yoga leggings and sports bras, has been a game-changer, with brands innovating in seamless stitching, breathable fabrics, and inclusive sizing.

Meanwhile, men’s segments such as compression T-shirts, training shorts, and joggers also contribute significantly to demand. Apparel dominates due to its versatility in blending casual wear with sports performance, appealing equally to urban professionals, students, and health-conscious consumers. Seasonal launches, limited-edition collections, and celebrity collaborations have amplified demand, especially among millennials and Gen Z, who prioritize style alongside performance.

Sustainability has added another dimension to this segment, with recycled polyester and organic cotton becoming mainstream in apparel collections. Compared to footwear and accessories, apparel provides more opportunities for design innovation, faster adoption cycles, and higher sales frequency since consumers replace or refresh clothing more often than shoes or accessories. This repeated purchasing cycle, combined with its multifunctional use, makes apparel the core of the activewear market and ensures its continuing dominance.

By Usage Analysis

Gym and fitness training is anticipated to represent the leading usage segment in the activewear industry due to the global rise of structured fitness routines, weight training, and cardio-based workouts. The gym has evolved from being a niche activity to a mainstream lifestyle, with millions of people subscribing to gyms, fitness studios, or personal training programs worldwide.

This shift has fueled consistent demand for high-performance clothing such as compression leggings, breathable tank tops, durable shorts, and supportive sports bras. Fitness apparel must deliver durability, sweat resistance, flexibility, and recovery support, making innovation in fabric technology particularly relevant to this category. The fitness boom is also fueled by corporate wellness initiatives and growing health awareness about obesity, cardiovascular issues, and sedentary lifestyles. At the same time, the role of social media influencers and fitness personalities has reinforced the popularity of gym-based activewear, as consumers emulate the looks and workout styles of their favorite athletes or online trainers.

Gym training appeals to both men and women across age groups, providing a balanced demand base, unlike yoga, which is more popular among women, or outdoor sports, which may be seasonal. The pandemic also created a surge in home gyms, which sustained activewear purchases even outside traditional gyms. With the global fitness industry expanding and younger demographics prioritizing strength and body conditioning, gym and fitness training activewear is expected to continue dominating usage categories.

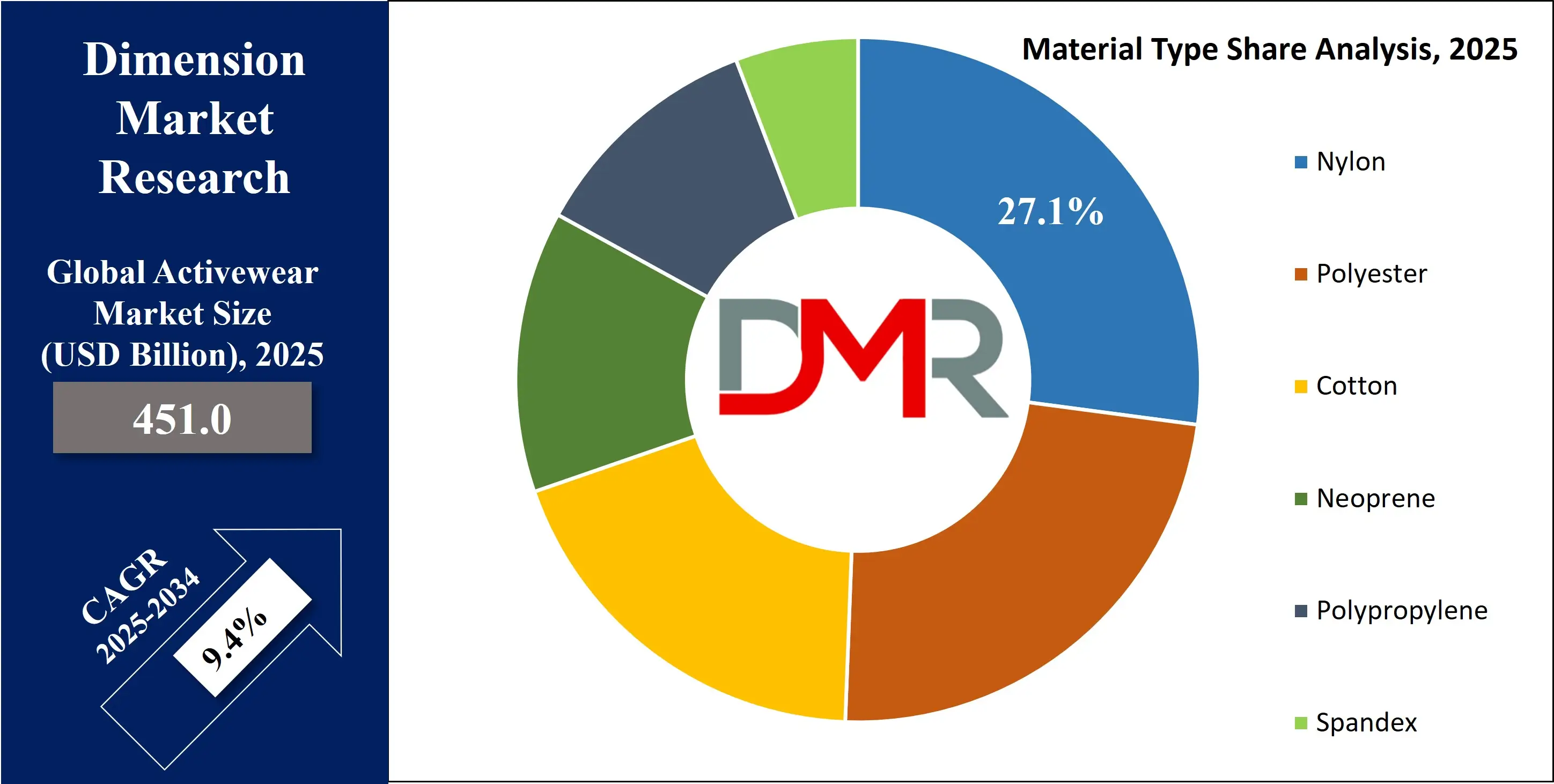

By Material Type Analysis

Polyester is poised to be the dominant material type in the activewear market, thanks to its unmatched combination of durability, versatility, and cost-effectiveness. As a synthetic fiber, polyester is lightweight, wrinkle-resistant, moisture-wicking, and quick-drying, making it ideal for demanding workout environments. It can withstand repeated washing without losing shape or performance, a critical factor for consumers who wear and wash activewear multiple times a week.

Polyester’s dominance is amplified by its compatibility with other fibers such as spandex and cotton, allowing brands to create hybrid fabrics that deliver both stretch and comfort. Its affordability compared to alternatives like neoprene or polypropylene ensures widespread adoption across apparel, footwear, and accessories.

Additionally, sustainability trends have positioned polyester as a modern material of choice. The growing adoption of recycled polyester made from PET bottles or post-consumer waste aligns with eco-conscious consumer demand and corporate responsibility goals. Recycled polyester retains the same qualities as virgin polyester while significantly reducing environmental impact, making it the centerpiece of “green activewear.” Unlike cotton, which absorbs sweat and dries slowly, polyester actively enhances performance by keeping the body cool and dry during intense activity.

This makes it highly favored in gym wear, running apparel, and outdoor activewear. Its adaptability in both mass-market and premium products ensures polyester remains the cornerstone material for global activewear, cementing its leadership over natural and specialty fabrics.

By Price Range Analysis

The medium price range is expected to hold dominance in the activewear market because it caters to the largest and most diverse consumer base by balancing affordability with quality. While premium-priced activewear appeals to niche high-income groups and luxury buyers, and low-priced alternatives attract price-sensitive consumers, the middle range strikes the ideal compromise. This category appeals strongly to millennials and Gen Z, who seek durable, stylish, and high-performing products but are unwilling to consistently pay premium prices. Brands like Nike, Adidas, Puma, and Under Armour have expanded their mid-range offerings, ensuring that consumers have access to products that combine fashionable aesthetics with performance technology.

Online platforms amplify this dominance by offering discounts, subscription models, and seasonal promotions that make medium-priced products even more attractive. Furthermore, most innovations in fabric blends, sustainability, and inclusive sizing are targeted at this segment, ensuring continued consumer loyalty. With athleisure becoming a mainstream lifestyle rather than a niche category, middle-income households form the backbone of consumer demand. Medium price range activewear not only offers functional benefits but also serves as a style statement, reinforcing its dominance over low-cost and premium segments.

By Consumer Group / End User

Women are projected to dominate the activewear market, as they represent the largest and most dynamic consumer group. The rising popularity of yoga, Pilates, dance workouts, and fitness training among women has fueled demand for specialized products such as leggings, sports bras, and yoga pants. Unlike men, women’s purchasing decisions in activewear are shaped not only by performance but also by style, versatility, and fashion appeal.

Athleisure has blurred the line between workout clothing and casual wear, turning women’s activewear into everyday staples that can be worn to the office, brunch, or while traveling. Women are also more responsive to social media-driven trends, with celebrity endorsements and influencer promotions shaping preferences. Brands increasingly cater to this group with inclusive sizing, gender-specific designs, and maternity-friendly lines, further strengthening demand.

Women’s willingness to experiment with new colors, patterns, and sustainable fabrics also drives innovation in the market. While men’s and kids’ segments remain significant, they lag behind in size and variety compared to women’s activewear. With rising disposable income and growing emphasis on fitness and wellness among women, this group is expected to remain the dominant consumer demographic in the activewear market.

By Distribution Channel Analysis

The online segment is projected to dominate the distribution channels for activewear, driven by the convenience, accessibility, and variety it offers to global consumers. E-commerce platforms and company-owned websites allow shoppers to compare products, access wider inventories, and benefit from price discounts unavailable in physical stores. The pandemic accelerated online adoption, and even after restrictions eased, consumer behavior has permanently shifted toward digital-first shopping. Social media platforms and digital marketing have amplified online sales, as influencer collaborations, sponsored posts, and targeted ads directly drive purchase decisions.

Additionally, online platforms offer personalized recommendations, AI-based size guidance, and augmented reality try-ons, enhancing the overall shopping experience. Direct-to-consumer (DTC) activewear brands thrive in this space, cutting out middlemen and engaging customers with competitive pricing and exclusive collections. For consumers in urban and rural regions alike, online channels eliminate geographic barriers and offer door-to-door delivery.

While offline stores such as specialty shops and mega-retail outlets still attract walk-in traffic, especially for trying products physically, their scalability is limited compared to digital platforms. With increasing internet penetration, mobile commerce, and the rising influence of omnichannel strategies, online distribution is expected to sustain its dominance in the activewear industry well into the future.

The Global Activewear Market Report is segmented on the basis of the following

By Product Type

- Apparel

- Topwear

- T-shirts

- Tank tops

- Sports bras

- Jackets

- Sweatshirts

- Others

- Bottomwear

- Leggings

- Shorts

- Sweatpants

- Track pants

- Others

- Footwear

- Running shoes

- Training shoes

- Casual sports shoes

- Others

- Accessories

By Usage

- Running

- Outdoor Sports

- Yoga & Pilates

- Gym & Fitness Training

- Recreational Activities

- Others

By Material Type

- Nylon

- Polyester

- Cotton

- Neoprene

- Polypropylene

- Spandex

By Price Range

By Consumer Group / End User

By Distribution Channel

- Online

- E-commerce websites

- Company-owned websites

- Offline

- Specialty stores

- Mega retail stores

- Others

Impact of Artificial Intelligence in the Global Activewear Market

- Personalized Shopping Experiences: Artificial Intelligence-powered recommendation engines analyze consumer data, including past purchases, browsing patterns, and fitness preferences, to deliver hyper-personalized product suggestions. This helps activewear brands boost customer engagement, improve conversion rates, and enhance brand loyalty by offering exactly what customers are likely to buy.

- Smart Product Development and Design: AI enables brands to analyze consumer feedback, market trends, and performance data to design new products that align with demand. AI-driven simulations also allow companies to test fabric stretchability, breathability, and durability before manufacturing, accelerating product innovation in activewear apparel and Luxury Footwear.

- Enhanced Supply Chain and Inventory Management: AI algorithms optimize production planning, demand forecasting, and inventory management. By predicting seasonal demand for items like leggings or jackets, brands reduce overproduction and stockouts, leading to lower costs, improved sustainability, and timely product availability.

- Virtual Fitting Rooms and Sizing Solutions: AI-powered virtual try-on tools and body-scanning technologies help customers find the perfect fit online. This reduces return rates, increases customer satisfaction, and enhances the digital shopping experience, making e-commerce a more reliable distribution channel for activewear.

- Integration of Smart Activewear: AI is embedded into next-generation smart activewear that tracks biometrics such as heart rate, calories burned, or posture correction. These AI-enabled garments are transforming the market by merging fitness tracking technology with apparel, offering consumers functional and data-driven fitness solutions.

Global Activewear Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate the global activewear market as it holds 39.0% of the market share by the end of 2025, owing to its strong consumer base, well-established fitness culture, and the presence of leading international brands. The U.S. and Canada have some of the world’s highest fitness participation rates, with millions engaged in gym memberships, outdoor sports, running, and yoga. According to U.S. government data, nearly half of American adults meet aerobic physical activity guidelines, reinforcing the consistent demand for performance-driven apparel and footwear.

The athleisure trend is particularly strong in this region, where activewear doubles as everyday fashion, driven by urban lifestyles and shifting consumer preferences toward comfort-oriented clothing. The region is home to top industry players such as Nike, Under Armour, Lululemon, and Columbia Sportswear, all of which are headquartered in North America. Their robust innovation strategies, celebrity endorsements, and marketing influence globally strengthen the region’s market share.

Additionally, high disposable income and consumer willingness to spend on premium products contribute to the leadership position. E-commerce adoption is widespread, with digital-first sales models and direct-to-consumer channels growing rapidly. Sustainability is also an emerging driver, with brands in North America leading the push toward recycled fabrics and eco-friendly collections. The combination of lifestyle integration, innovation leadership, and financial capability ensures that North America remains the dominant force in the activewear market.

Region with the Highest CAGR

Asia Pacific is projected to record the highest CAGR in the activewear market, driven by its massive population base, rising disposable incomes, and increasing focus on fitness and wellness. Countries such as China, India, Japan, South Korea, and Australia are witnessing rapid urbanization and lifestyle shifts, where fitness activities like yoga, gym training, running, and outdoor sports are becoming integral. Governments across the region are promoting health and physical activity, such as India’s “Fit India Movement” and China’s growing emphasis on sports participation. These initiatives, combined with rising obesity concerns and health awareness, are fueling activewear adoption.

The region also benefits from its demographic advantage—Asia Pacific has a large youth population that is highly influenced by global fashion trends, social media, and celebrity endorsements. Affordable mid-range activewear brands, as well as global giants like Adidas and Nike, are expanding aggressively in Asia to capture this fast-growing consumer segment. E-commerce penetration is another key driver, with platforms such as Tmall, Flipkart, and Rakuten enabling easy access to both domestic and international activewear brands. Furthermore, local players are emerging with competitive pricing and innovative product offerings tailored to regional preferences.

The increasing acceptance of athleisure as everyday wear is also fueling demand, as consumers seek versatile apparel suitable for both casual and fitness use. With rising middle-class spending power, evolving fashion consciousness, and growing health priorities, the Asia Pacific is positioned as the fastest-growing region in the global activewear market, outpacing more mature markets like North America and Europe.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Activewear Market: Competitive Landscape

The global activewear market is highly competitive, characterized by the presence of established international giants, regional players, and emerging digital-first brands. Leading companies such as Nike, Adidas, Puma, Under Armour, Lululemon, and Columbia Sportswear dominate the landscape, leveraging strong brand equity, global distribution networks, and continuous product innovation.

These players invest heavily in research and development, focusing on fabric technologies like moisture-wicking, stretchable, and eco-friendly materials to meet evolving consumer demands. Sustainability has become a competitive differentiator, with brands introducing recycled polyester, organic cotton, and carbon-neutral initiatives to appeal to eco-conscious buyers.

Athleisure-focused companies such as Lululemon and Alo Yoga continue to gain traction by blurring the line between fitness wear and casual fashion. Direct-to-consumer (DTC) models and online platforms are reshaping competition, allowing newer entrants like Gymshark and Outdoor Voices to build strong followings through social media-driven strategies. Meanwhile, fast-fashion retailers such as H&M and Zara have launched activewear lines to capture market share in the affordable segment.

In North America and Europe, premium positioning dominates, while in the Asia Pacific, affordability and localization strategies are more prominent. Strategic collaborations with athletes, fitness influencers, and celebrities remain a key marketing tactic, reinforcing brand visibility. Mergers, acquisitions, and expansion into emerging markets are also common strategies for growth. Overall, the activewear market is defined by constant innovation, brand differentiation, and the ability to adapt to rapidly changing consumer lifestyles.

Some of the prominent players in the Global Active Wear Market are

- Nike, Inc.

- Adidas AG

- Puma SE

- Under Armour, Inc.

- Lululemon Athletica Inc.

- Columbia Sportswear Company

- ASICS Corporation

- New Balance Athletics, Inc.

- Reebok International Limited

- Fila Holdings Corp.

- Skechers USA, Inc.

- Patagonia, Inc.

- Hanesbrands Inc.

- VF Corporation (The North Face, Vans)

- Decathlon S.A.

- Anta Sports Products Limited

- Li-Ning Company Limited

- Mizuno Corporation

- Gap Inc. (Athleta)

- Champion

- Other Key Players

Recent Developments in the Global Activewear Market

- August 2025: Nike announced the launch of its fully AI-driven design platform to accelerate the creation of customized activewear, using consumer insights from its digital ecosystem.

- June 2025: Lululemon introduced its first recyclable yoga leggings as part of its “Be Planet” sustainability initiative, targeting eco-conscious consumers.

- April 2025: Adidas expanded its partnership with Allbirds to create low-carbon activewear footwear, focusing on sustainable performance innovation.

- January 2025: Puma launched a new digital-first campaign integrating AR try-on features, allowing consumers to visualize apparel and footwear through mobile devices before purchase.

- October 2024: Under Armour rolled out its smart training shoes equipped with biometric sensors to track workout performance and sync with its fitness app, UA MapMyRun.

- September 2024: Decathlon opened one of the largest experience-driven flagship stores in Singapore, combining retail, indoor sports activities, and digital product displays to enhance consumer engagement.

- July 2024: Columbia Sportswear introduced an AI-powered demand forecasting system to streamline inventory management and reduce waste across its activewear product lines.

- May 2024: Gymshark announced expansion into the U.S. with multiple offline pop-up stores in Los Angeles and New York to strengthen its omnichannel presence.

- February 2024: Alo Yoga collaborated with TikTok influencers to launch a limited-edition athleisure line targeted at Gen Z consumers.

- November 2023: Reebok unveiled its “Sustainable Motion” collection using 100% recycled polyester, marking a major step in its sustainability roadmap.

- August 2023: Lululemon launched its first men ''s-focused activewear collection in Asia, aiming to expand beyond its women’s stronghold in the region.

- March 2023: Adidas partnered with Peloton to release co-branded activewear tailored for indoor cycling enthusiasts.

- January 2023: Nike invested in advanced 3D knitting technology to create seamless activewear, reducing fabric waste during production.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 451.0 Bn |

| Forecast Value (2034) |

USD 1,016.4 Bn |

| CAGR (2025–2034) |

9.4% |

| The US Market Size (2025) |

USD 147.9 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Apparel, Footwear, and Accessories), By Usage (Running, Outdoor Sports, Yoga & Pilates, Gym & Fitness Training, Recreational Activities, and Others), By Material Type (Nylon, Polyester, Cotton, Neoprene, Polypropylene, and Spandex) By Price Range (Low, Medium, and High), By Consumer Group(Men, Women, and Kids), By Distribution Channel (Online, and Offline) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Nike, Inc., Adidas AG, Puma SE, Under Armour, Inc., Lululemon Athletica Inc., Columbia Sportswear Company, ASICS Corporation, New Balance Athletics, Inc., Reebok International Limited, Fila Holdings Corp., Skechers USA, Inc., Patagonia, Inc., Hanesbrands Inc., VF Corporation, Decathlon S.A., Anta Sports Products Limited, Li-Ning Company Limited, Mizuno Corporation, Gap Inc. (Athleta), Champion (Hanesbrands Inc.), and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Activewear Market size is estimated to have a value of USD 451.0 billion in 2025 and is expected to reach USD 1,016.4 billion by the end of 2034.

The market is growing at a CAGR of 9.4 percent over the forecasted period of 2025.

The US Activewear Market is projected to be valued at USD 147.9 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 316.7 billion in 2034 at a CAGR of 8.8%.

North America is expected to have the largest market share in the Global Activewear Market with a share of about 39.0% in 2025.

Some of the major key players in the Global Activewear Market are Nike, Inc., Adidas AG, Puma SE, Under Armour, Inc., Lululemon Athletica Inc., Columbia Sportswear Company, ASICS Corporation, and many others.