Market Overview

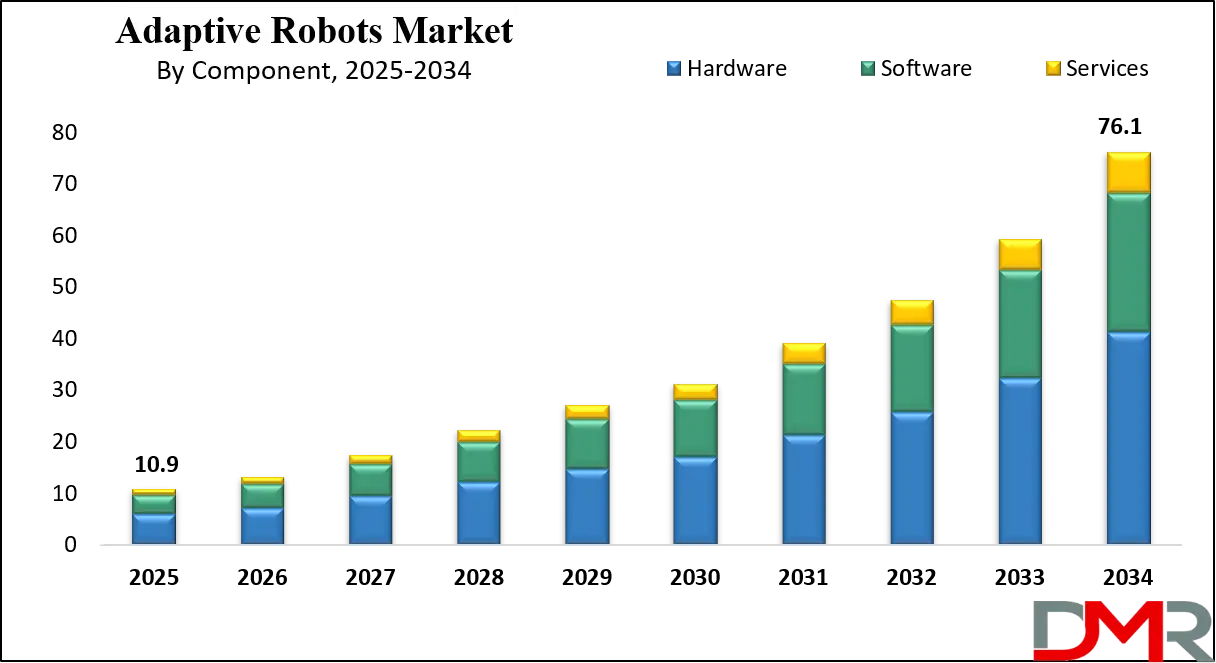

The Global Adaptive Robots Market size is projected to reach USD 10.9 billion in 2025 and grow at a compound annual growth rate of 24.1% from there until 2034 to reach a value of USD 76.1 billion.

Adaptive robots are intelligent machines that can adjust their behavior and decisions based on changing environments or tasks. Unlike traditional robots that follow strict programming, adaptive robots use technologies like artificial intelligence (AI), sensors, and machine learning to make real-time adjustments. This allows them to respond to unexpected situations, work more safely alongside humans, and handle complex or unpredictable tasks more efficiently. Their flexibility is what sets them apart and makes them useful in various industries.

In recent years, demand for adaptive robots has risen in fields like manufacturing, healthcare, agriculture, and logistics. In factories, they can manage shifting assembly lines or handle parts of different shapes and sizes. In hospitals, they support surgeries and help patients with rehabilitation, adjusting their actions based on a patient’s progress. On farms, they can respond to soil conditions or crop maturity levels. The same ability to learn and adapt makes them helpful in warehouses where product types and locations change often.

A key trend in adaptive robotics is the move toward more collaborative and decentralized systems. One emerging area is swarm robotics, where groups of simple robots work together to achieve complex goals. Instead of being controlled by a central unit, each robot in the group follows simple rules, reacts to its surroundings, and communicates with nearby robots. This approach enhances adaptability since the group can reconfigure or change behavior if one unit fails or the task shifts. Swarm-like behavior adds a layer of intelligence to adaptive robots, especially in situations that require flexibility, like search and rescue or warehouse coordination.

Recent developments show that companies are investing in research and design to make adaptive robots even more responsive and efficient. Improvements in vision systems, natural language processing, and predictive analytics have helped robots better understand human instructions and environmental changes. Many of these upgrades aim to make robots safer and more useful in shared workspaces, especially in industries where flexibility and fast changes are the norm.

Events over the past few years, such as disruptions in global supply chains, have also pushed businesses to adopt more flexible robotic systems. Adaptive robots can be quickly repurposed for different tasks without needing major reprogramming, helping companies stay resilient during market shifts or labor shortages. Their role became especially important during the pandemic, where adaptability was critical in healthcare and manufacturing.

Overall, adaptive robots are helping businesses become more responsive and efficient. The integration of ideas like swarm robotics within adaptive systems allows for even more dynamic solutions. These developments are not just about making robots smarter—they’re about making them more useful in everyday, changing environments where fast learning and flexible action matter most.

The US Adaptive Robots Market

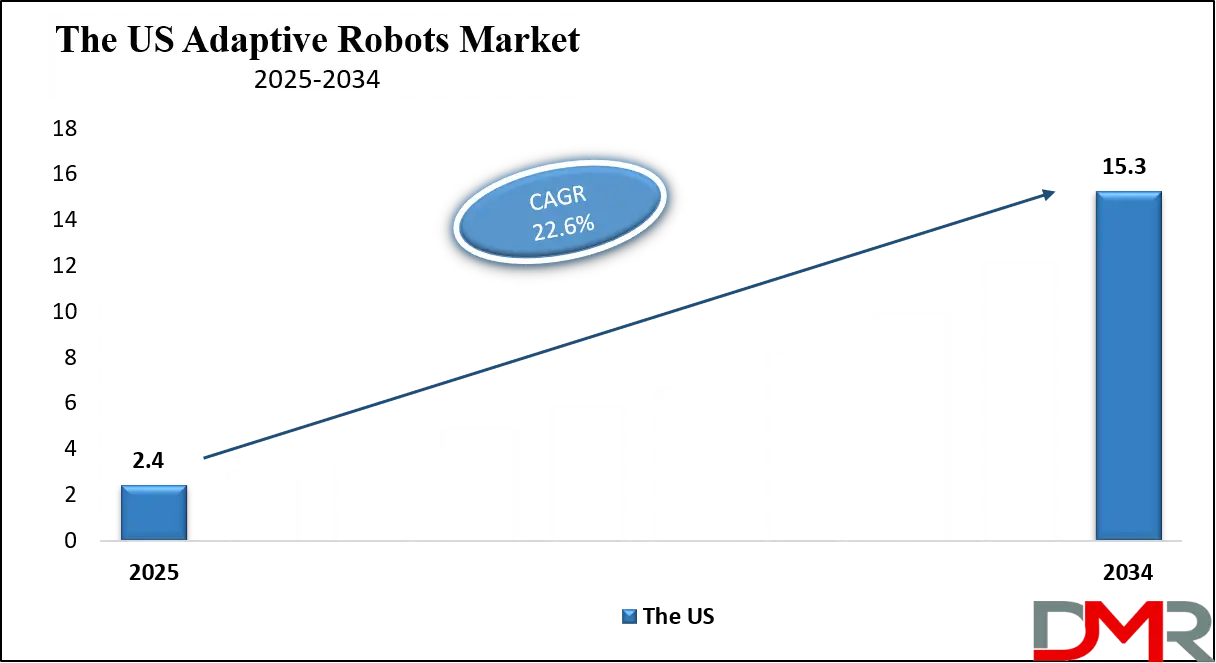

The US Adaptive Robots Market size is projected to reach USD 2.4 billion in 2025 at a compound annual growth rate of 22.6% over its forecast period.

The US plays a significant role in the adaptive robots market due to its strong focus on innovation, research, and development in robotics and artificial intelligence. Many leading technology companies and research institutions are based in the US, driving advancements in adaptive robot capabilities. The country’s diverse industries, including manufacturing, healthcare, and logistics, actively adopt adaptive robots to improve efficiency and flexibility.

Additionally, the US government supports robotics development through funding and policy initiatives that encourage automation and smart manufacturing. The growing demand for collaborative robots that can safely work alongside humans further boosts the US market. Overall, the US remains a key player, contributing to technology breakthroughs and widespread adoption of adaptive robots across various sectors.

Europe Adaptive Robots Market

Europe Adaptive Robots Market size is projected to reach USD 2.2 billion in 2025 at a compound annual growth rate of 23.7% over its forecast period.

Europe plays a vital role in the adaptive robots market, driven by strong manufacturing industries and a focus on advanced automation. Countries like Germany, Italy, and France lead in deploying adaptive robots, especially in automotive, machinery, and electronics production. European companies emphasize safe human-robot collaboration and are pioneers in developing robots that can adapt to changing environments and tasks. The European Union supports robotics innovation through funding programs and regulatory frameworks that promote research and cross-border collaboration.

Additionally, Europe’s push for Industry 4.0 and smart factories has accelerated the integration of adaptive robots across sectors. With a focus on sustainability, precision, and workforce safety, Europe continues to shape the development and responsible adoption of adaptive robotics technologies.

Japan Adaptive Robots Market

Japan Adaptive Robots Market size is projected to reach USD 0.9 billion in 2025 at a compound annual growth rate of 23.1% over its forecast period.

Japan holds a prominent position in the adaptive robots market, known for its advanced robotics technology and strong industrial base. The country has a long history of integrating robotics into manufacturing, particularly in the automotive and electronics sectors, where adaptive robots help improve precision and flexibility. Japanese companies invest heavily in research and development, focusing on making robots smarter, safer, and more efficient.

Japan is also a leader in developing robots that work alongside humans in healthcare and service industries, enhancing patient care and daily life support. The government actively promotes robotics through supportive policies and funding, encouraging innovation and adoption. Japan’s expertise and commitment make it a vital contributor to the growth and evolution of adaptive robotics worldwide.

Adaptive Robots Market: Key Takeaways

- Market Growth: The Adaptive Robots Market size is expected to grow by USD 62.9 billion, at a CAGR of 24.1%, during the forecasted period of 2026 to 2034.

- By Component: The hardware segment is anticipated to get the majority share of the Adaptive Robots Market in 2025.

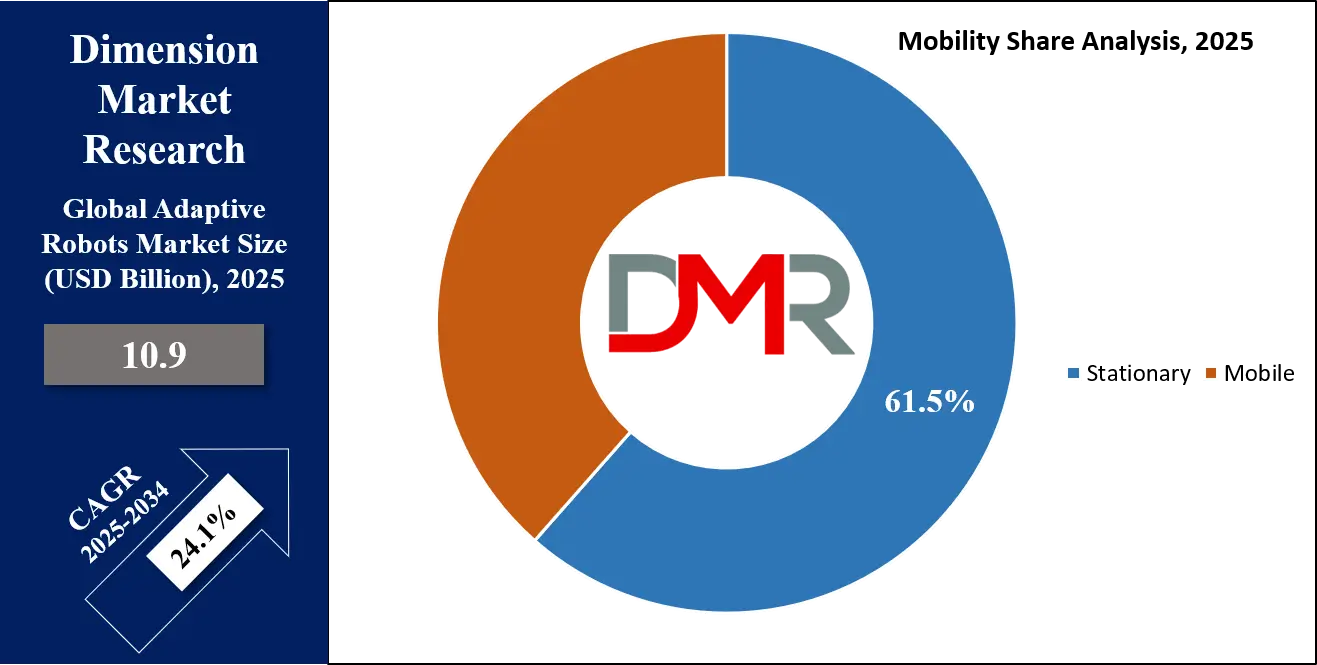

- By Mobility: The stationary segment is expected to get the largest revenue share in 2025 in the Adaptive Robots Market.

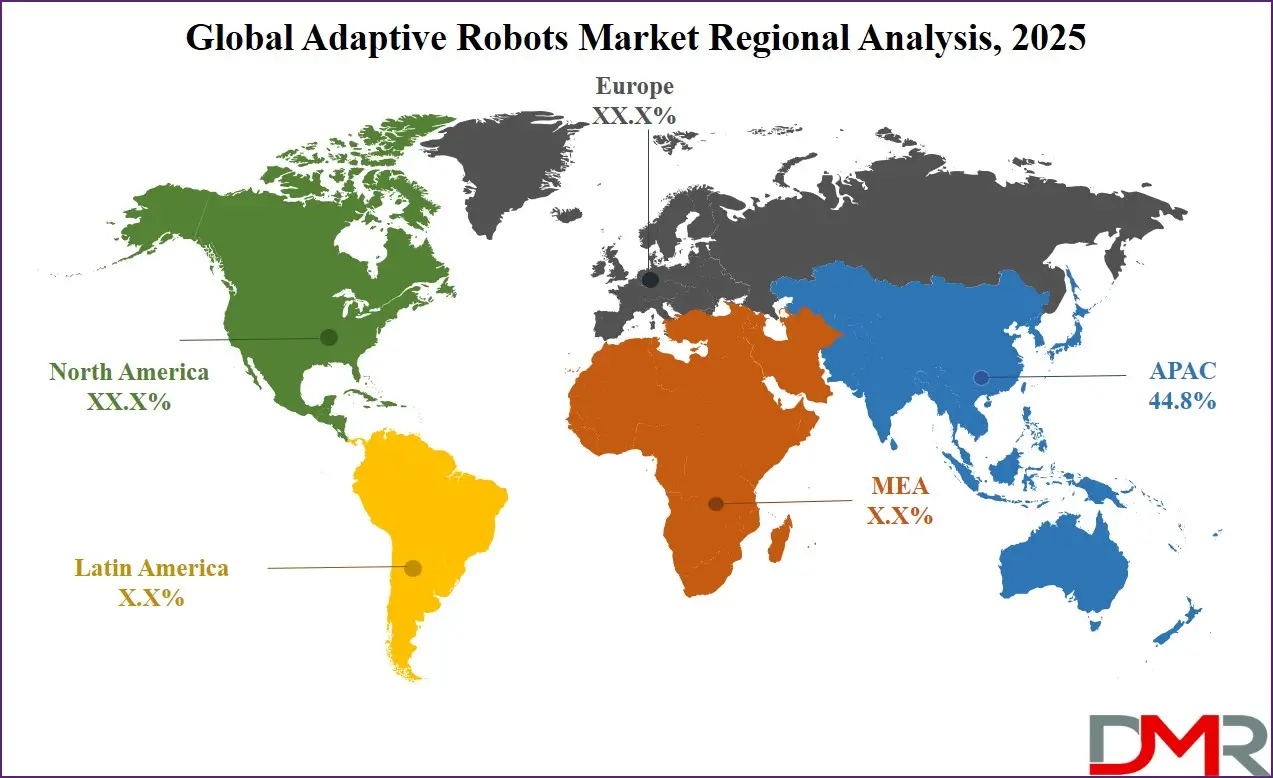

- Regional Insight: Asia Pacific is expected to hold a 44.8% share of revenue in the Global Adaptive Robots Market in 2025.

- Use Cases: Some of the use cases of Adaptive Robots include smart manufacturing, warehouse automation, and more.

Adaptive Robots Market: Use Cases

- Smart Manufacturing: Adaptive robots are used on dynamic production lines where they adjust in real-time to product variations, tool changes, or different assembly tasks. Their ability to self-correct helps reduce downtime and ensures consistent output quality, even in high-mix, low-volume environments.

- Healthcare Assistance: In hospitals and rehabilitation centers, adaptive robots support patients by adjusting therapy routines based on individual progress. They can also assist surgeons with precision tasks, adapting to the movement of soft tissues or unexpected changes during procedures.

- Warehouse Automation: Adaptive robots in logistics can recognize different types of packages, adjust their handling techniques, and navigate changing layouts. They work efficiently alongside human workers, reacting to real-time demands and order priorities.

- Agricultural Support: On farms, adaptive robots perform tasks like picking fruits or detecting pests by sensing crop conditions. Their ability to respond to weather, plant growth stages, and field layout changes makes them valuable for improving yield and efficiency.

Stats & Facts

- According to the International Federation of Robotics, China installed 276,288 industrial robots in 2023, accounting for 51% of global installations and bringing its operational stock to nearly 1.8 million units, making it the only country with such a vast robotic presence on the factory floor.

- As per the World Intellectual Property Organization (WIPO), industrial robot installations globally grew at an average annual rate of 13.3% between 2012 and 2022, effectively doubling since 2015, with forecasts estimating up to 700,000 new installations annually by 2026.

- According to the International Federation of Robotics, India recorded the fastest global growth in industrial robot installations in 2023, with a 59% year-on-year increase reaching 8,510 units; the automotive sector alone saw a 139% surge to 3,551 units.

- As stated by the International Federation of Robotics, Japan remained the second-largest global robot market in 2023, though installations fell by 9% to 46,106 units following strong years in 2021 and 2022, with medium- to high-single-digit growth expected from 2025 onwards.

- According to the International Federation of Robotics, Europe reached an all-time high of 92,393 industrial robot installations in 2023—up 9% from the previous year—largely due to demand from the automotive sector, nearshoring trends, and the clearing of project backlogs.

- As reported by Visual Capitalist, the UK saw a 51% increase in robot installations in 2023, reaching 3,830 units; this surge was primarily driven by a massive 297% increase in automotive sector installations, with notable contributions from the food and metal industries.

- According to the World Intellectual Property Organization, global sales of professional service robots jumped 48% in 2022 to nearly 158,000 units, with the Robotics as a Service (RaaS) segment growing by 50% to surpass 21,000 units.

- As per the International Federation of Robotics, Germany, Europe’s largest industrial robot market and the only one in the global top five, increased its installations by 7% in 2023 to 28,355 units, while Italy and France experienced respective declines of 9% and 13%.

- According to the International Federation of Robotics and the World Intellectual Property Organization, the Republic of Korea installed 31,444 industrial robots in 2023 (down just 1%) and remains the global leader in robots relative to GDP.

- As per the World Intellectual Property Organization, hospitality robots saw a 125% spike in global sales in 2022, making them one of the fastest-growing segments of the service robot market, whereas medical robot sales declined by 4% during the same year.

- According to Visual Capitalist, the global stock of operational industrial robots reached nearly 4.3 million units in 2023, with China accounting for over 276,000 new units that year, maintaining its position as the dominant market.

- As reported by the International Federation of Robotics, EU countries accounted for 80% of Europe’s total 92,393 industrial robot installations in 2023, with robust growth in countries like Spain (+31%), Slovakia (+48%), and Hungary (+31%).

Market Dynamic

Driving Factors in the Adaptive Robots Market

Rising Need for Flexible Automation in Dynamic Industries

One of the key growth drivers of the adaptive robots market is the increasing demand for flexible automation across industries such as manufacturing, healthcare, logistics, and agriculture. Traditional fixed-function robots are often too rigid for modern production environments that require rapid changes, customization, and high variability in tasks. Adaptive robots, with their ability to learn from surroundings, make real-time decisions, and switch between operations, offer a perfect solution.

As industries face fluctuating market conditions, labor shortages, and increasing product complexity, the need for smart, responsive automation becomes more critical. This has pushed companies to invest in adaptive robotics to stay competitive and reduce downtime. The ability of these robots to work safely alongside humans also supports their growing presence in shared workspaces.

Advancements in AI, Machine Learning, and Sensor Technologies

Technological innovation is a major force driving the growth of the adaptive robots market. Advances in artificial intelligence, machine learning, and sensor systems have significantly improved how robots understand and interact with their environment. Modern adaptive robots can process large sets of data, detect subtle changes, and respond with precise actions.

This makes them ideal for tasks requiring real-time adjustment, such as handling fragile items, reacting to human input, or navigating unstructured spaces. Enhanced computing power and lower costs of components like vision systems and force sensors have also made adaptive robots more accessible to a wider range of businesses. As research continues and software capabilities expand, adaptive robots are expected to become even more intelligent, efficient, and versatile.

Restraints in the Adaptive Robots Market

High Initial Costs and Integration Challenges

One major restraint in the adaptive robots market is the high initial investment required for purchasing, programming, and integrating these systems. Adaptive robots are more advanced than traditional robots, and this complexity often translates to higher costs for hardware, software, and training. For small and medium-sized enterprises, these expenses can be a significant barrier.

Additionally, integrating adaptive robots into existing workflows may require changes in infrastructure, process redesign, and skilled technicians. This can lead to extended implementation timelines and disruptions in operations. The return on investment may not be immediate, especially in industries with tight budgets, making decision-makers hesitant to adopt such advanced automation despite its long-term benefits.

Lack of Skilled Workforce and Technical Awareness

Another key challenge facing the adaptive robots market is the shortage of skilled professionals who can develop, manage, and maintain these advanced systems. Adaptive robots rely on complex technologies such as AI, machine learning, and data analytics, which require specialized knowledge to operate effectively. In many regions, there is still a limited talent pool trained in robotics and automation, slowing down deployment and innovation.

Additionally, some industries or businesses may lack awareness of what adaptive robots can offer, leading to underutilization or reluctance to invest. Without sufficient technical support and education, companies may struggle to make full use of adaptive robots’ capabilities, hindering broader market growth.

Opportunities in the Adaptive Robots Market

Expansion into Emerging Markets and New Industries

The adaptive robots market has a significant opportunity to grow by expanding into emerging economies and industries that are only beginning to adopt automation. Countries with rapidly developing manufacturing sectors, such as those in Southeast Asia, Latin America, and Africa, present untapped markets where adaptive robots can improve productivity and address labor shortages.

Additionally, sectors like agriculture, construction, and small-scale healthcare facilities are increasingly recognizing the benefits of flexible robotics. By tailoring adaptive robot solutions to the specific needs of these markets and industries, companies can capture new customers and create customized applications. This geographic and sector diversification can drive substantial market growth as automation becomes more accessible worldwide.

Integration with IoT and Advanced Data Analytics

Another major opportunity for the adaptive robots market lies in combining robotics with the Internet of Things (IoT) and advanced data analytics. By connecting robots to smart sensors and cloud-based platforms, companies can enable continuous monitoring, predictive maintenance, and real-time decision-making. This integration allows adaptive robots to perform more efficiently by learning from a larger data set and adjusting their behavior dynamically. It also supports better coordination between multiple robots and other automated systems within a facility. As industries move toward smarter factories and digital transformation, adaptive robots equipped with IoT capabilities will play a crucial role in driving automation’s next phase, opening new possibilities for innovation and productivity.

Trends in the Adaptive Robots Market

Integration of Generative AI for Intuitive Robot Programming

A significant trend in the adaptive robotics market is the incorporation of generative AI to simplify robot programming. This advancement allows operators to instruct robots using natural language or visual prompts, reducing the need for specialized coding expertise. Such user-friendly interfaces make adaptive robots more accessible to a broader range of industries and applications. By enabling robots to understand and execute tasks based on intuitive inputs, businesses can achieve faster deployment and greater flexibility in operations. This trend is particularly impactful in sectors like manufacturing and logistics, where rapid adaptation to changing tasks is essential for maintaining efficiency.

Expansion of Adaptive Robots into Non-Traditional Industries

Adaptive robots are increasingly being deployed beyond traditional manufacturing settings, entering sectors such as healthcare, agriculture, and logistics. In healthcare, robots assist in surgeries and patient rehabilitation, adapting to individual patient needs. In agriculture, they perform tasks like harvesting and pest control, responding to varying crop conditions. This diversification is driven by the robots' ability to learn from their environment and adjust their actions accordingly, making them valuable assets in dynamic and complex industries. The expansion into these non-traditional industries reflects the growing recognition of adaptive robots' versatility and potential to enhance productivity across various fields.

Research Scope and Analysis

By Component Analysis

Hardware are set to dominate in 2025 with a share of 54.3%, playing a key role in the growth of the adaptive robots market by providing the physical foundation that enables precision, movement, and real-time responsiveness. This segment includes robotic arms, sensors, actuators, and control units, all essential for allowing robots to perform tasks in changing environments.

The demand for more durable, lightweight, and efficient hardware is rising as industries look for robots that can adapt to different roles without major reprogramming. With advancements in sensor technologies and flexible joint systems, hardware is becoming smarter and more responsive. Industries like automotive, electronics, and logistics rely heavily on this segment to support automation and enhance productivity. As demand for collaborative and multifunctional robots increases, the importance of reliable and high-performance hardware continues to grow in the adaptive robotics space.

Software is having significant growth over the forecast period, driven by the rising need for intelligent decision-making and task flexibility in adaptive robots. It enables robots to learn from data, adjust to new conditions, and respond to their environment in real time. Software platforms support machine learning, vision processing, and movement control, making robots smarter and more efficient. The demand for easy-to-use interfaces and cloud-based systems is also growing, helping industries adopt adaptive robots with minimal technical hurdles.

Through continuous updates and data-driven learning, software allows robots to evolve with tasks, improving accuracy and performance. As industries shift towards automation with flexibility and intelligence, the software segment is becoming crucial in shaping how adaptive robots perform, interact, and integrate across different environments and applications.

By Type Analysis

In terms of type, cobots will be leading in 2025 with a share of 68.8%, expected to be a major force in driving the growth of the adaptive robots market due to their ability to safely work alongside humans without the need for safety cages. These collaborative robots are built to assist in tasks that require flexibility, precision, and frequent changes, making them ideal for dynamic environments like small-scale manufacturing, packaging, and assembly lines.

Their ease of use, fast deployment, and space-saving design make them popular among businesses looking for automation without heavy infrastructure changes. Cobots can learn from human actions, adjust to new tasks, and improve productivity without replacing workers, promoting a human-robot partnership. As industries seek smarter and more adaptable automation solutions, the demand for cobots is set to grow strongly across sectors, aiming for higher efficiency and lower operational stress.

Further, the service robot segment is having significant growth over the forecast period, supported by its ability to perform a wide range of non-industrial tasks in real-world settings. These robots are used in healthcare, logistics, agriculture, and customer service, where adaptability and mobility are key. Autonomous service robots, a vital part of this segment, can operate independently in complex environments, using sensors and AI to navigate, detect objects, and respond to their surroundings.

Their growing use in hospitals, warehouses, and public spaces shows their potential to ease human workload and improve efficiency. The service robot segment benefits from rising interest in automation outside factory settings, offering smart assistance in daily tasks and services. With increasing focus on safety, convenience, and real-time response, service robots are becoming an essential part of adaptive robotics across different industries.

By Payload Analysis

Up to 5kg payload segment is set to lead the Adaptive Robots Market in 2025 with a 44.7% share, mainly due to the rising demand for lightweight, compact, and cost-effective robots across various industries. These adaptive robots are especially useful in small-scale manufacturing, electronics assembly, and delicate part handling, where precision and flexibility are critical. Their smaller size and lighter build make them easier to deploy, operate, and integrate into existing workflows.

They also reduce the risk of workplace accidents, making them ideal for collaborative tasks with human workers. As industries increasingly turn to automation to address labor shortages and improve productivity, the up to 5kg segment continues to gain traction. The growing presence of these robots in smart factories, retail, and logistics also adds to their appeal, further solidifying their leadership in the adaptive robotics space.

Also, 5–15kg payload robots segment is expected to see significant growth over the forecast period, driven by their ideal balance between strength and precision. These robots are highly suited for handling medium-weight tasks such as machine tending, packaging, palletizing, and component assembly. Many autonomous service robots also fall under this category, especially those used in healthcare, hospitality, and logistics. Their ability to perform repetitive but critical functions with consistency and flexibility is increasing their adoption.

Additionally, these robots provide a cost-effective alternative to larger, high-payload machines, especially in mid-sized operations. As more industries seek adaptive robots that can multitask without sacrificing performance, the demand for 5–15kg payload robots is set to rise steadily.

By Technology Analysis

Machine learning is expected to be leading in 2025 with a share of 68.8%, playing a powerful role in the growth of the adaptive robots market by helping robots learn from experience and make smarter decisions over time. This technology allows robots to analyze data from their sensors, identify patterns, and adjust their actions without needing to be reprogrammed. It gives robots the ability to improve task accuracy, work in changing environments, and adapt to unexpected situations. From picking and placing items to navigating complex spaces, machine learning supports a wide range of real-world applications.

As industries move toward intelligent automation, machine learning helps adaptive robots become more independent, efficient, and responsive. This boosts their performance across different sectors and makes them suitable for both structured and unstructured tasks, driving long-term adoption and development of smart robotic systems.

Natural language processing is experiencing significant growth over the forecast period, helping adaptive robots interact more naturally with humans. NLP allows robots to understand spoken or written commands, interpret user intentions, and respond in a way that makes sense in the context of the task. This technology is especially useful in service, healthcare, and customer-facing roles where communication is important.

It enables robots to provide instructions, answer questions, or follow complex requests in simple language. By making human-robot interaction smoother, NLP increases user comfort and widens the use of adaptive robots beyond industrial settings. It also supports real-time learning and adjustment through feedback, improving overall performance. As communication becomes a key feature of automation, NLP will keep advancing adaptive robotics across various industries.

By Mobility Analysis

In 2025, stationary robots are expected to be leading with a share of 61.5%, playing a strong role in the growth of the adaptive robots market due to their stability, precision, and suitability for repetitive industrial tasks. These robots are fixed in one place and are commonly used in sectors like manufacturing, electronics, and automotive, where high-speed and accurate operations are critical.

Their ability to handle heavy loads, perform tasks with exact movements, and operate continuously makes them reliable for large-scale production. With growing demand for automation in structured environments, stationary adaptive robots offer the benefit of efficiency without the need for frequent repositioning. They are also easier to integrate with existing systems and are cost-effective over time. Their dependability and consistent performance support the steady expansion of adaptive robotics, particularly in high-volume and high-precision applications.

Mobile robots are experiencing significant growth over the forecast period, supported by their flexibility and ability to navigate dynamic environments. These robots can move independently, making them ideal for industries like logistics, healthcare, and agriculture, where tasks often occur across large or changing spaces. Mobile adaptive robots use sensors, cameras, and navigation systems to detect obstacles, plan routes, and adjust actions in real time.

This mobility enables them to deliver goods, inspect areas, or assist in operations where human access is limited or time-sensitive. Their rising use in warehouses, hospitals, and farms shows their value in increasing productivity and reducing manual effort. As industries push for more intelligent and responsive solutions, mobile robots are becoming a vital part of adaptive robotics, offering smart, efficient, and scalable automation across various real-world applications.

By Application Analysis

Based on application, handling is expected to be leading in 2025 with a share of 24.6%, playing an important role in the growth of the adaptive robots market by supporting repetitive, labor-intensive tasks such as picking, placing, loading, and unloading. Adaptive robots used in handling applications are designed to adjust to different product sizes, weights, and shapes without needing major reprogramming or mechanical changes.

This makes them ideal for industries like manufacturing, logistics, and electronics, where speed, accuracy, and flexibility are key. These robots help reduce physical strain on human workers and ensure consistent output, even in high-volume settings. As businesses aim to boost productivity and adapt quickly to changing product lines, handling robots offer a smart solution. Their ability to work in varied environments and respond to dynamic requirements is driving their strong demand across multiple sectors.

On the other hand, packaging is having significant growth and is expected to maintain it over the forecast period, driven by rising demand for automation in industries like food, pharmaceuticals, and consumer goods. Adaptive robots used in packaging can manage tasks such as sorting, sealing, labeling, and wrapping, adjusting to different product types and sizes.

Their flexibility helps businesses reduce waste, improve efficiency, and maintain consistency even during high-speed operations. With increased product variation and frequent changeovers, traditional systems often fall short, but adaptive robots fill the gap by learning and adapting on the go. These robots also support hygienic and safety standards, which are critical in sectors like food and medicine. As companies push for smarter packaging lines and greater operational agility, the use of adaptive robots in this space continues to expand, offering cost-effective, fast, and reliable automation solutions.

By End User Industry Analysis

Automotive is expected to be leading in 2025 with a share of 25.7%, playing a central role in the growth of the adaptive robots market as the industry increasingly embraces automation for better efficiency and precision. Adaptive robots are widely used in vehicle assembly, welding, painting, and quality inspection—tasks that demand accuracy, repeatability, and safety.

These robots can quickly adjust to new models and design changes, making them suitable for fast-paced production lines and custom vehicle manufacturing. With rising demand for electric vehicles and shorter development cycles, carmakers are turning to flexible automation to stay competitive. Adaptive robots help reduce human error, lower production time, and improve workplace safety. Their ability to respond to complex and shifting production needs makes them a valuable tool in automotive manufacturing, supporting smarter and more agile operations across the sector.

Healthcare & medical is anticipated to have significant growth over the forecast period, driven by the increasing need for automation in patient care, diagnostics, and surgery. Adaptive robots in this field are designed to work in sensitive environments, supporting tasks such as rehabilitation, patient assistance, drug delivery, and even complex surgeries. Their ability to adjust to human interaction, environmental changes, and diverse medical conditions makes them reliable partners in hospitals and clinics.

These robots not only reduce the strain on healthcare workers but also enhance precision in delicate procedures. As the population ages and demand for healthcare services rises, adaptive robots offer scalable, safe, and efficient solutions. With continued innovation in sensor technology and AI, their role in improving patient outcomes and operational flow is expected to grow steadily across the healthcare landscape.

The Adaptive Robots Market Report is segmented on the basis of the following:

By Component

- Hardware

- Software

- Services

By Type

- Collaborative Robots (Cobots)

- Industrial Robots

- Service Robots

- Mobile Robots

By Payload

- Up to 5 kg

- 5–15 kg

- More than 15 kg

By Technology

- Machine Learning

- Computer Vision

- Natural Language Processing

- Motion Control

- Sensors & Perception Systems

By Mobility

By Application

- Handling

- Assembly

- Welding

- Painting

- Inspection & Quality Control (QC)

- Packaging

- Logistics

- Others

By End Use Industry

- Automotive

- Electronics & Semiconductors

- Healthcare & Medical

- Food & Beverage

- Aerospace & Defense

- Metals & Machinery

- Logistics & Warehousing

- Consumer Goods

- Others

Regional Analysis

Leading Region in the Adaptive Robots Market

Asia Pacific is expected to be leading in 2025 with a share of 44.8%, playing a strong role in the growth of the adaptive robots market due to rapid industrial expansion, strong manufacturing bases, and rising adoption of automation across major economies. Countries like China, Japan, South Korea, and India are investing heavily in robotics for sectors such as automotive, electronics, healthcare, and logistics. Adaptive robots are becoming more important in this region as industries aim for flexible production systems that can respond quickly to shifting demands and market trends.

The rise in local robot manufacturers and favorable government initiatives supporting smart factories and advanced manufacturing further boost regional development. In addition, high labor costs in developed Asia Pacific countries and labor shortages in emerging ones are pushing businesses to adopt intelligent robotic systems. With a growing focus on AI-driven technology and industrial upgrades, Asia Pacific continues to create strong opportunities for the expansion of adaptive robotics across different sectors.

Fastest Growing Region in the Adaptive Robots Market

Europe is set to show significant growth over the forecast period in the adaptive robots market, supported by strong industrial automation, rising demand for flexible robotics, and a focus on sustainable production. With countries investing in smart manufacturing and Industry 4.0 technologies, adaptive robots are becoming vital tools for improving efficiency and maintaining competitiveness.

The region’s established automotive, electronics, and food processing sectors are increasingly adopting collaborative and AI-powered robots to manage complex tasks. Government support for digital transformation and labor efficiency is also encouraging wider use of intelligent robotics. As industries shift toward more responsive and adaptive systems, Europe continues to create favorable conditions for the expansion of advanced robotic solutions.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The adaptive robots market is becoming increasingly competitive as more players enter the field to meet rising global demand. This growth is driven by industries needing flexible, intelligent machines that can adjust to changing tasks and environments. Companies are focusing on developing robots that are easy to train, safe to work alongside humans, and quick to adapt. Innovation in artificial intelligence, machine learning, and advanced sensors has become a key area of focus.

Smaller startups are also pushing boundaries with creative designs and niche applications, while established players are expanding into new sectors. The competition is not just about hardware but also software that makes robots smarter and more useful. Partnerships, research investments, and regional expansions are common strategies in this evolving landscape.

Some of the prominent players in the global Adaptive Robots are:

- ABB

- Omron

- Kuka AG

- Mitsubishi Electric

- Epson Robots

- Doosan Robotics

- Flexiv

- Boston Dynamics

- Robotics Inc

- PAL Robotics

- RightHand Robotics

- AUBO Robotics

- Delta Electronics

- Neura Robotics

- Comau

- Kawasaki Heavy Industries

- Universal Robots

- Fanuc Corporation

- Other Key Players

Recent Developments

- In April 2025, Universal Robots (UR) and Mobile Industrial Robots (MiR) are set to showcase a wide range of automation solutions at Automate 2025, taking place from May 12-15 in Detroit. Occupying the largest exhibition space at booths #4023 and #3623, both companies aim to highlight their shared mission to boost customer productivity through advanced robotics. Ujjwal Kumar, Group President of Teradyne Robotics, emphasized that their unified presence demonstrates Teradyne Robotics’ ability to meet automation demands across various industries.

- In March 2025, Siemens presented its latest automation and digital solutions for intralogistics, addressing labor shortages, sustainability, and demographic shifts. A key innovation is the Simatic Robot Pick AI Pro, an AI vision software that enhances adaptive picking by enabling robots to handle diverse objects. Siemens also highlights how data-driven, software-defined automation boosts warehouse flexibility. The Siemens Xcelerator ecosystem further supports seamless integration and innovation, helping industries move toward smarter, more digitalized operations in logistics and warehousing.

- In February 2025, eBots Inc announced that its eBots-IDO-02 robot has completed the factory acceptance test (FAT) by Foxconn (Hon Hai Technology Group), which marks a major step toward advancing automation in electronics production. The successful FAT highlights the robot’s readiness for deployment and supports the industry’s transition from labor-heavy operations to fully automated manufacturing, reinforcing eBots Inc.’s role in shaping the future of intelligent and efficient production systems.

- In January 2025, Flexiv Robotics Inc. announced a partnership with Kurabo Industries Ltd. to co-develop the KURAVIZON adaptive robot by combining Flexiv’s force-control technology with Kurabo’s KURASENSE 3D vision sensing system. Based in Santa Clara, Flexiv aims to strengthen its global reach through advanced automation solutions. Owen Wu, Flexiv’s Asia-Pacific business development manager, emphasized that this collaboration reflects the company’s mission to innovate in robotic automation by uniting complementary technologies and expanding the possibilities in adaptive robotics.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 10.9 Bn |

| Forecast Value (2034) |

USD 76.1 Bn |

| CAGR (2025–2034) |

24.1% |

| The US Market Size (2025) |

USD 2.4 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Hardware, Software, and Services), By Type (Collaborative Robots (Cobots), Industrial Robots, Service Robots, and Mobile Robots), By Payload (Up to 5 kg, 5–15 kg, and More than 15 kg), By Technology (Machine Learning, Computer Vision, Natural Language Processing, Motion Control, and Sensors & Perception Systems), By Mobility (Stationary and Mobile), By Application (Handling, Assembly, Welding, Painting, Inspection & Quality Control (QC), Packaging, Logistics, and Others), By End Use Industry (Automotive, Electronics & Semiconductors, Healthcare & Medical, Food & Beverage, Aerospace & Defense, Metals & Machinery, Logistics & Warehousing, Consumer Goods, and Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

ABB, Omron, Kuka AG, Mitsubishi Electric, Epson Robots, Doosan Robotics, Flexiv, Boston Dynamics, Robotics Inc, PAL Robotics, RightHand Robotics, AUBO Robotics, Delta Electronics, Neura Robotics, Comau, Kawasaki Heavy Industries, Universal Robots, and Fanuc Corporation, and Other Key Players

|

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Adaptive Robots Market size is expected to reach a value of USD 10.9 billion in 2025 and is expected to reach USD 76.1 billion by the end of 2034.

Asia Pacific is expected to have the largest market share in the Global Adaptive Robots Market, with a share of about 44.8% in 2025.

The Adaptive Robots Market in the US is expected to reach USD 10.0 billion in 2025.

Some of the major key players in the Global Adaptive Robots Market are ABB, Omron, Kuka AG, and others

The market is growing at a CAGR of 24.1 percent over the forecasted period.