Market Overview

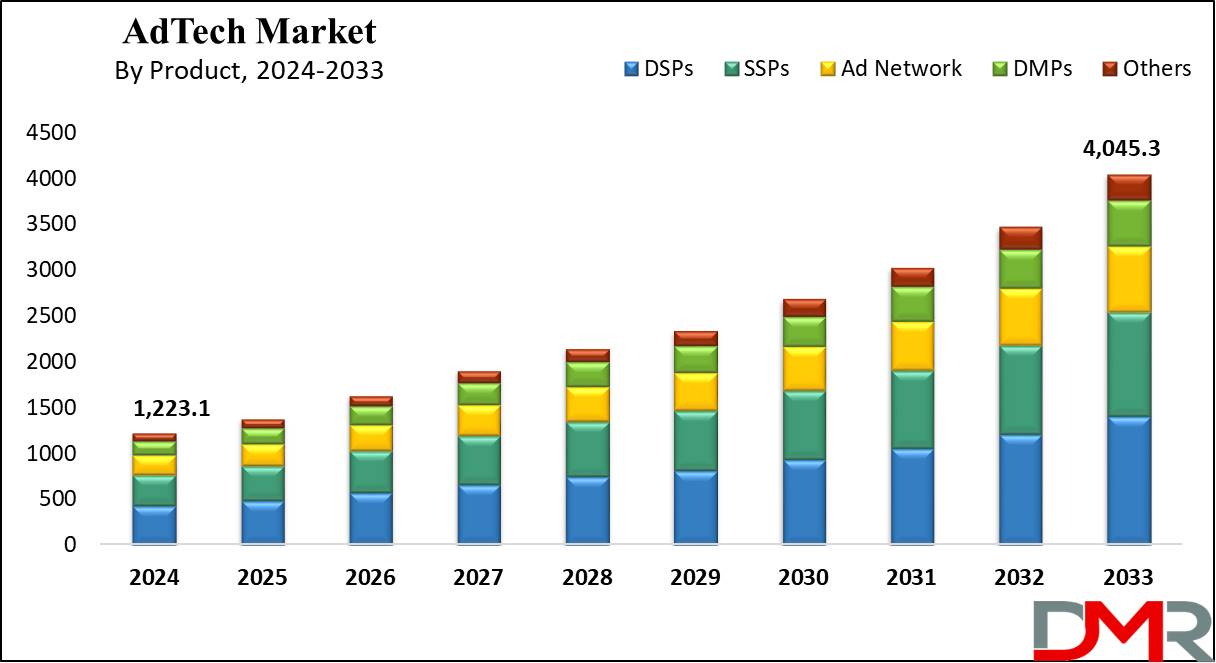

The Global AdTech Market size reached a value of USD 1,223.1 billion in 2024, and it is further anticipated to reach a market value of USD 4,045.3 billion by 2033 at a CAGR of 14.2%.

Advertising Technology, or Ad-tech, includes a suite of software & resources that helps brands & agencies in planning, overseeing, & evaluating their digital advertising efforts, which includes tools for digital banner ads, accurate audience targeting, & different advertising delivery methods. Ad-tech software includes various platforms like Demand-Side Platforms (DSPs), Supply-Side Platforms (SSPs), Ad Exchanges, Ad Networks, Ad Servers, & SEM Platforms.

As per WorldMetrics, 68% of marketers report that programmatic advertising has boosted their ROI. The average viewability rate for display ads sits at just 56.1%, meaning nearly half of these ads go unseen. In fact, around 50% of digital display ads served never actually reach consumers' eyes. With over 25% of the global population using ad blockers, this challenge only intensifies for advertisers.

However, cross-device targeting has proven effective, with a 72% higher likelihood of conversions when brands reach audiences across multiple devices. These metrics underline the key challenges and opportunities shaping today’s AdTech strategies.

AdTech, short for "advertising technology," refers to digital tools and software used to deliver, manage, and analyze advertising campaigns. The AdTech market is expanding rapidly as brands increasingly adopt digital platforms, driving demand for programmatic advertising, data analytics, and personalized ad delivery. Growth is fueled by advancements in

artificial intelligence, machine learning, and data management, allowing marketers to target consumers with precision.

As per Eskimi, monthly Gen Z connected TV (CTV) users in the U.S. are projected to rise from 49.6 million in 2022 to 56.1 million by 2025, marking a 6.5 million increase. Leichtman Research Group indicates that 62% of people aged 18-34 watch video via a CTV daily, compared to 54% of those aged 35-54 and 24% of those aged 55+.

In 2023, 88% of U.S. households owned at least one internet-connected TV device, with over 110 million Gen Z and Millennial users. Additionally, 73% of CTV viewers prefer free ad-supported content. The Trade Desk found 87% of marketers view CTV advertising as effective, emphasizing precise targeting (63%), relevance (51%), and brand awareness (59%).

Opportunities in AdTech include developing privacy-friendly solutions, leveraging data analytics, and tapping into emerging platforms like connected TV and in-game advertising. Major players are also focused on integrating omnichannel marketing to reach users seamlessly across devices. Recent trends include heightened interest in privacy-compliant tech due to regulations like GDPR and CCPA.

The latest industry events, like AdExchanger's Programmatic I/O and CES, spotlight innovations and allow industry leaders to discuss regulatory shifts, consumer data privacy, and evolving technologies shaping the future of digital advertising.

Key Takeaways

- Market Growth: The AdTech Market size is expected to grow by 2,822.2 billion, at a CAGR of 14.2% during the forecasted period of 2025 to 2033.

- By Solution: The Demand-side platforms (DSPs) segment is expected to lead in 2024 with a major & is anticipated to dominate throughout the forecasted period.

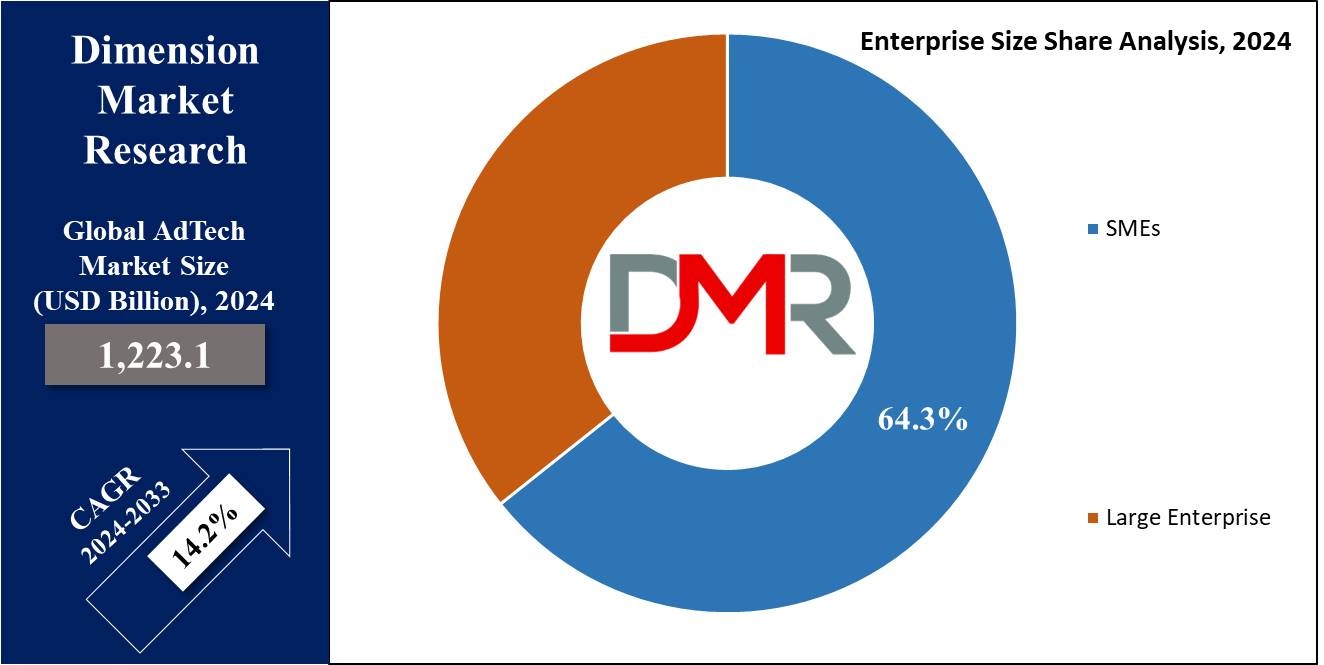

- By Enterprise Size: SMEs are expected to lead the AdTech market in 2024

- By End User: The retail & consumer goods segment is expected to get the largest revenue share in 2024 in the AdTech market.

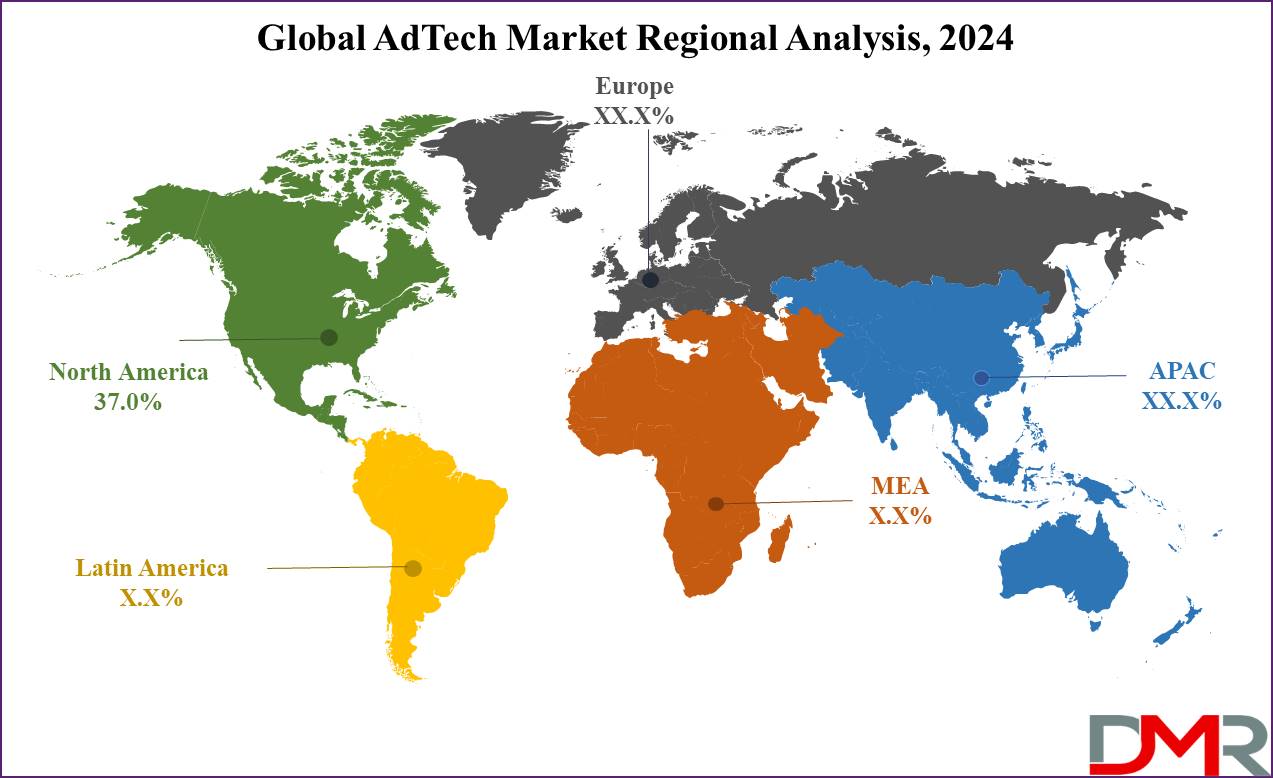

- Regional Insight: North America is expected to hold a 37.0% share of revenue in the Global AdTech Market in 2024.

- Use Cases: Some of the use cases of AdTech include target advertising, attribution modeling, and more.

Use Cases

- Targeted Advertising: Adtech platforms use data analytics to understand consumer behavior &preferences, allowing advertisers to target specific demographics with customized ads, maximizing engagement & conversion rates.

- Real-Time Bidding (RTB): Ad exchanges use RTB algorithms to support the instant buying & selling of ad inventory, making advertisers bid on impressions in real-time based on user data & ad relevance.

- Attribution Modeling: Adtech employs attribution models to analyze the customer journey across many touchpoints, determining the most effective channels and campaigns that lead to conversions, and optimizing ad spend allocation.

- Ad Fraud Detection: Advanced algorithms in ad tech detect and reduce various forms of ad fraud, like click fraud and bot traffic, safeguarding advertisers' investments & ensuring genuine engagement with their ads.

Market Dynamic

Driving Factors

Data-driven Advertising

The higher availability and usage of data analytics tools allow advertisers to develop more targeted and personalized campaigns. By using

big data and AI technologies, ad tech platforms can provide more accurate audience targeting, resulting in higher ROI for advertisers and driving growth in the ad tech sector.

Rise of Programmatic Advertising

Programmatic advertising is constantly gaining traction due to its efficiency & effectiveness in ad buying as well as selling processes. Automation and real-time demand allow advertisers to reach their target audiences more efficiently while publishers can expand their revenue by selling ad inventory programmatically. The scalability & transparency provided by programmatic advertising are driving its adoption globally, driving the growth in the ad tech market.

Opportunities

Emerging Markets

There is higher untapped potential for ad tech companies in emerging markets where internet penetration & digital advertising adoption are on the rise. These markets provide opportunities for ad tech firms to launch innovative solutions customized to local preferences & behaviors, driving growth through better ad spending and market expansion.

Cross-Channel Integration

As consumers largely engage with content across multiple devices & channels, there is a high need for ad tech solutions that provide smooth integration and synchronization across platforms. Ad tech companies have the opportunity to develop complete cross-channel advertising solutions that allow advertisers to reach consumers effectively across many touchpoints, improving campaign performance and driving revenue growth.

Restraints

Privacy Regulations

The growing focus on data privacy regulations, like GDPR in Europe and CCPA in California, creates a major challenge for ad tech companies. Obeying these regulations requires strict data handling practices & may limit the ability to collect and use user data for targeted advertising, potentially impacting ad targeting capabilities and revenue streams.

Ad Blocking

The expansion of ad-blocking software creates a significant challenge for ad tech companies and advertisers alike. As more users deploy ad blockers to improve their online browsing experience and avoid intrusive ads, the effectiveness of traditional digital advertising methods diminishes. Ad tech firms must find innovative ways to deliver non-intrusive and engaging ad experiences to resist ad blocking and maintain revenue streams.

Trends

Contextual Advertising

With the rise in concerns about data privacy & regulations limiting the use of personal data for targeting, contextual advertising has seen a resurgence. Advertisers are aiming more at the context in which ads are displayed, like the content of the webpage or app, to ensure relevancy &effectiveness. Advanced contextual targeting technologies use NLP and

machine learning to understand the content context and deliver ads that align with the user's interests and intent.

First-Party Data Monetization

As advertisers look for alternative sources of data for targeting in response to privacy regulations & changes to third-party cookie policies, there's a rise in focus on first-party data monetization. Ad tech companies are assisting publishers and brands use their first-party data assets to drive advertising effectiveness. By using data collected directly from their audiences, advertisers can develop more personalized and relevant ad experiences while maintaining control over data privacy and compliance.

Research Scope and Analysis

By Solution

Demand-side platforms (DSPs) are expected to have the largest market share in 2024, with is further anticipated to continue growth during the forecast period, as DSPs play a major role in simplifying the process of purchasing advertising inventory, resulting in enhanced efficiency & effectiveness. They hold great appeal for advertisers focusing on reaching specific audiences while aiming & enhancing the overall performance of their marketing endeavors due to their advanced targeting capabilities.

These platforms are aided by advertisers for their ability to fine-tune ad campaigns, making them a preferred choice in the market as they not only streamline the ad buying process but also provide enhanced options for accurate audience targeting, ultimately driving their market dominance.

By Advertising Type

The search advertising segment is set to have a substantial market share of the global AdTech market in 2024 while experiencing major growth throughout the projected period. Search advertising revolves around the practice of displaying ads on SERPs (search engine results pages) when a user enters a specific search query, which is highly favored by marketers because it accurately targets users actively looking for related products or services.

By capitalizing on user intent during their search, search advertising provides a strategic advantage, as it connects advertisers with a motivated & relevant audience, making it a preferred choice in the advertising landscape.

By Enterprise Size

The AdTech market is categorized by the size of enterprises into small & medium enterprises (SMEs), and large enterprises. The SME segment is projected to have a significant share of revenue in the AdTech market in 2024, as it typically includes local businesses, small online retailers, & startups, which often operate with limited financial resources & the aim of looking for affordable & precise advertising solutions.

SMEs commonly prefer utilizing self-service platforms to connect with their target audiences, using channels like search engines, social media, & online marketplaces to efficiently reach their marketing goals.

By Platform

In terms of platform, the AdTech market is segmented into mobile, web, & other, where in 2024, the mobile segment is anticipated to have the largest portion of revenue in the AdTech market, which can be due to the versatility of mobile advertising, offering a wide range of ad formats, including video, display, & in-app ads, which can be accurately customized to specific devices and target audiences.

Further, the expansion of mobile marketing has driven the advancement of advanced technologies that allow businesses to effectively reach consumers based on their geographical location, further solidifying mobile's prominent position in the AdTech landscape.

By End User

The retail & consumer goods category stands as the dominant force in the market, and is expected to retain the largest market share in 2024, with anticipation for further growth in the coming future, as businesses within the retail and consumer goods sector heavily depend on AdTech to market their products & services, expand their brand visibility, & ultimately boost their sales figures.

Through the use of AdTech tools, retail enterprises engage with customers effectively & leverage platforms like social media to promote new products, assisting direct interaction with their target audience, thus solidifying their stronghold in the market.

The AdTech Market Report is segmented on the basis of the following

By Solution

- DSPs

- SSPs

- Ad Network

- DMPs

- Others

By Advertising Type

- Programmatic Advertising

- Search Advertising

- Display Advertising

- Mobile Advertising

- Email Marketing

- Native Advertising

- Others

By Enterprise Size

By Platform

By End User

- Retail & Consumer Goods

- BFSI

- Media & Entertainment

- IT & Telecom

- Healthcare

- Others

Regional Analysis

North America is set to lead the global AdTech market in 2024, with a

major 37.0% share of revenue, & the United States plays a major role in this achievement. The region's growth is mainly driven by the broad adoption of digital advertising, where businesses are utilizing data to optimize their ad investments & gain deeper insights into their target audiences, which has led to a rapid expansion of Data Management Platforms (DMPs) & marketing analytics tools, allowing companies to collect, analyze, & use data for crafting effective ad campaigns.

Further, the US stands as the world's biggest digital advertising hub, mainly due to shifting consumer preferences towards online & mobile platforms. In addition, the presence of tech giants like Google, Facebook, Amazon, and more headquartered in the US, has highly influenced the industry's growth.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The AdTech market experiences intense competition, with major companies operating look for a major portion of the market. As the key players are dedicated to offering ad platforms that assist marketers in selling, purchasing, & delivering digital ads. Adtech firms in this field are ever-changing, mainly influenced by technology advancements, rising gaming industry, shifts in consumer habits, & regulatory updates, making it essential for companies to stay nimble & adapt to these evolving dynamics.

Some of the prominent players in the Global AdTech Market are

- Amazon

- Google

- Microsoft

- Adobe

- Alibaba Group

- Meta Platform

- SpotX

- Verizon

- X Corp

- Criteo

- Other Key Players

Recent Developments

- In December 2023: TripleLift & LiveRamp announced the integration of TripleLift Audiences with RampID, providing marketers with large & scalable first-party audience solutions, which ensures privacy-centric lookalike addressability across the open web without depending on traditional identifiers.

- November 2023: Amazon Ads launched advanced features in campaign planning, activation, and measurement, empowering advertisers with greater audience control & providing faster, actionable insights into ad performance.

- March 2023: Adobe & professional services firm Accenture partnered to harness the potential of the content supply chain for enterprise marketers, which centers on leveraging Adobe's integrated Content Supply Chain technologies to develop innovative services that allow marketers to efficiently produce &distribute content, that focuses on to enable personalized & scalable customer experiences, improving the value & impact of content for businesses in a collaborative effort between the two companies.

- January 2023: Twitter (Now "X") announced its partnership with ad-tech firms DoubleVerify & Integral Ad Science (IAS) to allow advertisers to monitor ad placement around inappropriate content, and to use adjacency control tools to refine campaigns.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 1,223.1 Bn |

| Forecast Value (2033) |

USD 4,045.3 Bn |

| CAGR (2024-2033) |

14.2% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Solution (DSPs, SSPs, Ad Network, DMPs, and Others), By Advertising Type (Programmatic Advertising, Search Advertising, Display Advertising, Mobile Advertising, Email Marketing, Native Advertising, and Others), By Enterprise Size (SMEs and Large Enterprise), By Platform (Mobile, Web, and Others), By End User (Retail & Consumer Goods, BFSI, Media & Entertainment, IT & Telecom, Healthcare, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Amazon, Google, Microsoft, Adobe, Alibaba Group, Meta Platform, SpotX, Verizon, X Corp, Criteo, and Other Key Players |

| Purchase Options |

Physio-Control Inc., Schiller, Medtronic, Abbott, Boston Scientific Corporation, Koninklijke Philips N.V., Zoll Medical Corporation, BIOTRONIK, Progetti Srl, LivaNova Plc, and Other Key Players |

Frequently Asked Questions

The Global AdTech Market size reached a value of USD 1,066.8 billion in 2023 and is expected to reach USD 4,045.3 billion by the end of 2033.

North America will have the largest market share for the Global AdTech Market with a share of about 37.0% in 2024.

Some of the major key players in the Global AdTech Market are Meta Platform, X Corp, Adobe, and many others.

The market is growing at a CAGR of 14.2 percent over the forecasted period.