Advanced IC Substrates Market Overview

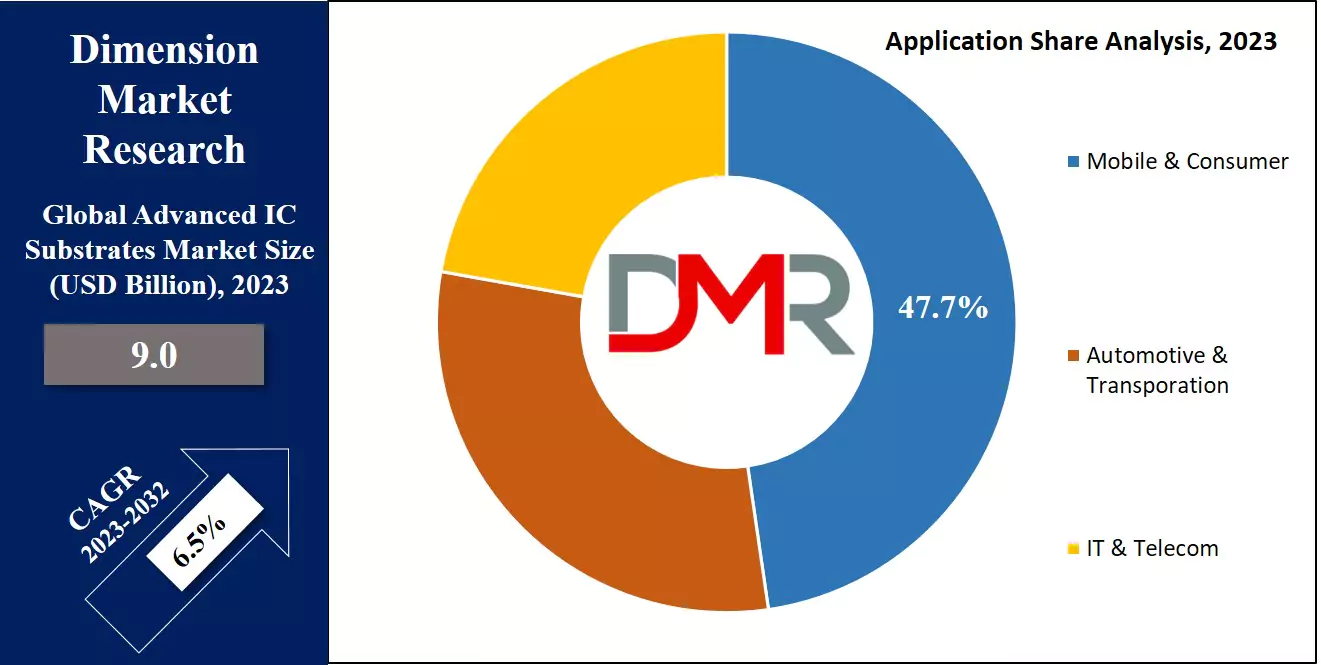

The Global Advanced IC Substrates Market is expected to reach a value of USD 9.0 billion in 2023, and it is further anticipated to reach a market value of USD 15.9 billion by 2032 at a CAGR of 6.5%.

The IC substrates, capable of bending & stretching, allow compact and power-efficient designs by including passive components directly. Ensuring the reliability of IC substrates is crucial, driving the development of advanced testing & inspection technologies. Integrating photonics with conventional electronic components on a single substrate enhances bandwidth & data transfer rates.

Through-silicon vias (TSVs) connect integrated circuits, using performance in a space-efficient manner. Material science development contributes to substrates with enhanced heat conductivity, minimal signal loss, & heightened reliability for high-performance applications. Increasing adoption of high-density interconnects and chip integration technology enhances functionality for devices supporting

5G Services and edge computing, while also enabling efficient designs in

Healthcare Cloud Computing solutions.

Advanced IC Substrates Market Key Takeaways

- By Application, Mobile & Consumer segment leads in 2023 & is anticipated to dominate throughout the forecasted period.

- In addition, IT & Telcom is expected to have significant growth over the forecasted period.

- By Type, FC BGA takes the lead & drives the market in 2023.

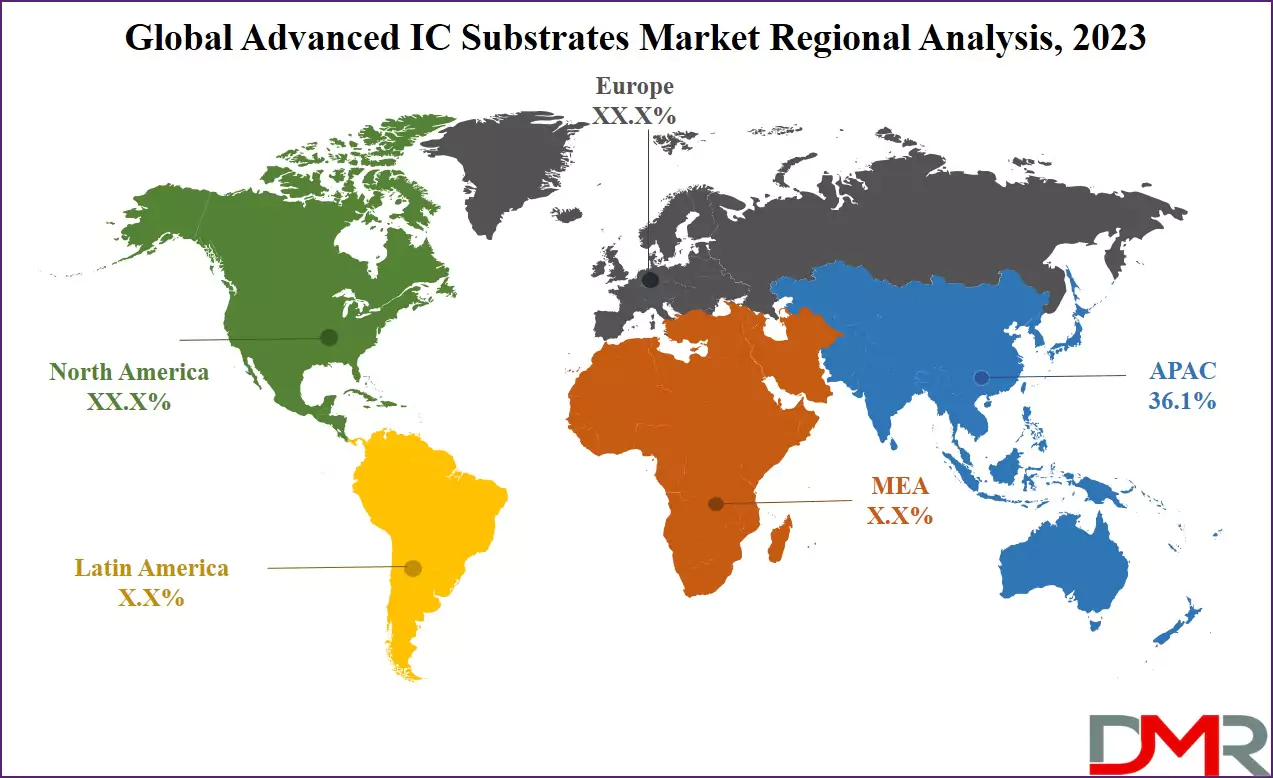

- Asia Pacific has a 36.1% share of revenue in the Global Advanced IC Substrates Market in 2023.

Advanced IC Substrates Market Use Cases

- High-Performance Computing (HPC): Used in data centers, AI processors, and supercomputers to enhance computing power and efficiency.

- Smartphones & Consumer Electronics: Enables compact, high-density chip packaging for smartphones, tablets, and wearable devices.

- 5G & Telecommunications: Supports high-frequency, low-latency applications in 5G base stations, network infrastructure, and RF modules.

- Automotive Electronics: Critical for ADAS (Advanced Driver Assistance Systems), electric vehicles (EVs), and in-vehicle infotainment systems.

- IoT & Edge Computing: Enhances the performance of IoT devices, smart sensors, and edge computing systems for real-time processing.

- Medical Devices & Imaging Systems: Used in advanced medical imaging, diagnostics, and wearable health monitoring devices for high-reliability applications.

Advanced IC Substrates Market Dynamic

Advancements in IC technology drive the need for more powerful electronic gadgets like IoT devices, wearables, tablets, laptops, smartphones, and auto electronics, which need enhanced ICs to meet evolving customer & industry needs, mainly with the rising demand for fast data transmission in applications like streaming, gaming, & cloud computing. Advanced IC substrates play a vital role in supporting high-frequency & high-speed signal processing, ensuring efficient data flow within electronic devices.

The need for specialized ICs is driven by innovations in technologies like AI, 5G, AR, and VR, requiring substrates capable of handling high performance & complexity. In addition, the growth of green energy technologies & the broad use of IoT gadgets drive the need for energy-efficient electronics, achievable with power-efficient ICs facilitated by advanced IC substrates.

However, the current supply chain faces challenges owing to globalization, with components sourced globally, making it vulnerable to disruptions from natural disasters, geopolitical unrest, or unforeseen events like pandemics.

Also, many electronics firms, adopt a just-in-time inventory approach to minimize storage costs and maintain lesser buffer stocks, leaving little room for error during disruptions. To minimize supply chain risks, businesses may consider longer lead times and increased stocks, which with higher storage costs & an increased risk of obsolescence.

Driver

Rising Demand for High-Performance Electronics The advanced IC substrates market is driven by an increasing demand for high-performance electronics in consumer devices, automotive electronics, and data centers. With the surge in adoption of 5G technology,

5G technology ROI , AI, and IoT there has been an ever-increasing demand for substrates which support high density interconnections and efficient signal transmission.

Advanced IC substrates such as flip-chip and fan-out wafer-level packaging enable miniaturization and improved performance in semiconducto

r devices. Furthermore, electric vehicles and autonomous driving systems have increased demand for robust yet reliable IC substrates, fuelling further market growth.

Trend

Heterogeneous Integration Heterogeneous integration is becoming an important trend in the advanced IC substrates market, uniting multiple semiconductor technologies such as logic, memory and RF components onto a single substrate. Packaging solutions with 2.5D and 3D architectures have gained increasing traction to meet demand for higher bandwidth, reduced latency and enhanced functionality within compact designs.

This trend is being led by industries like telecom, automotive and healthcare where multifunctional and power efficient systems are of vital importance; driving innovation and competition through miniaturization efforts which drive miniaturization and integration techniques and advances this market landscape further than ever before.

Restraint

High Manufacturing Costs mes One major hurdle facing the advanced IC substrates market is the high manufacturing costs associated with developing and producing these complex materials. Processes like multilayering, precise alignment, fine pitch interconnections and stringent quality controls increase production costs considerably.

Further compounded by advanced facilities with stringent quality controls required for their manufacture and stringent quality controls that must be in place before adopting advanced substrates by smaller manufacturers or cost-sensitive sectors. Supply chain disruptions due to material shortages exacerbate this challenge, particularly within emerging economies where markets expansion poses real obstacles compared with established economies.

Opportunity

Emerging Technologies Offer Growth Potential for Advanced IC Substrates in 2019 Emerging technologies present significant growth potential for the advanced IC substrates market. Innovations in

artificial intelligence (AI), augmented and virtual reality (AR/VR), and edge computing require advanced packaging solutions with superior performance and reliability.

Adopting 5G infrastructure and developing next-generation processors for cloud computing and data centers further expands market potential. As wearable devices and medical equipment become more mainstream, manufacturers who focus on cost-efficient production techniques and eco-friendly materials can take advantage of the expanding applications to drive growth in previously untapped markets.

Advanced IC Substrates Market Research Scope and Analysis

By Type

The Advanced IC Substrates market segment based on type distinguishes between FC BGA & FC CSP, with FC BGA coming out as the leading category in 2023. FC BGA, a packaging technology, exceeds in connecting ICs directly to the substrate, significantly boosting performance.

In this technology, the IC undergoes a flipping process, & its active side creates a connection with the substrate through small solder balls acting as conductive links, which brings out several benefits, like shorter signal paths, increased electrical efficiency, & improved thermal dissipation due to direct substrate contact.

Particularly advantageous in space-constrained, high-density applications like smartphones, tablets, and high-performance computing systems, FC BGA technology proves its efficacy in meeting the demands of modern electronics.

By Application

The advanced IC substrates market is led by the mobile and consumer segment in 2023, driven by the significant impetus from the mobile sector. The growing demand for smartphones, tablets, & wearable technology has led to significant growth in the production of advanced IC substrates, important for smoothly integrating sophisticated semiconductor components into small, portable devices.

Beyond mobile devices, the consumer electronics domain includes a variety of computers, gaming consoles, smart TVs, and digital cameras depending on advanced IC substrates for optimal functionality. Effective cooperation & integration within the semiconductor supply chain play a major role, with substrate producers closely collaborating with semiconductor foundries & packaging businesses to ensure smooth compatibility and performance.

Further, the IT & telecom segment emerged as the fastest-growing in the advanced IC substrates market. As integral components, integrated circuits (ICs) & substrates align with the continuous innovations in the IT &telecom industries.

These substrates, serving as the foundation for semiconductor devices, facilitate increased densities, expanded functionality, & superior performance. The rise of data centers & the growing demand for cloud services have intensified the requirement for sophisticated IC substrates, which are critical for processing & storing large data.

The Advanced IC Substrates Market Report is segmented on the basis of the following:

By Type

By Application

- Mobile & Consumer

- Automotive & Transportation

- IT & Telecom

How Does Artificial Intelligence Contribute To Improve Advanced IC Substrates Market ?

- Optimized Design & Simulation: AI-driven design tools enhance IC substrate layouts, improving signal integrity, thermal management, and miniaturization.

- Manufacturing Process Automation: AI-powered robotics and predictive analytics streamline substrate fabrication, reducing defects and production costs.

- Quality Control & Defect Detection: Machine learning algorithms analyze high-resolution imaging data to detect microscopic defects in substrates, ensuring reliability.

- Supply Chain Optimization: AI enhances demand forecasting, material procurement, and inventory management, minimizing disruptions in the IC substrate supply chain.

- Enhanced Performance Prediction: AI-driven simulations predict substrate performance under various conditions, reducing the need for extensive physical testing.

- Yield Improvement & Waste Reduction: AI identifies inefficiencies in manufacturing, optimizing processes to increase yield and minimize material waste.

- Thermal & Power Management: AI optimizes the thermal dissipation properties of substrates, improving the performance and longevity of semiconductor devices.

Advanced IC Substrates Market Regional Analysis

The Asia Pacific region asserts its dominance in the advanced IC substrate market in 2023, capturing the largest share at

36.1%, which is due to well-established manufacturing units, along with a growing demand for innovative electronic devices, mainly in the context of electric vehicles (EVs). The region benefits from assistance from government initiatives that further fuel market expansion.

Moreover, North America is set to experience significant market growth, driven by its lead in semiconductor innovation. Hosting many semiconductor players and research centers, the region sees significant investments in advanced IC substrates.

Also, government programs & financial incentives contribute to the sector's expansion, mainly as high-performance electronics, like game consoles, smartphones, tablets, and automotive electronics, continue to drive demand for sophisticated IC substrates.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Advanced IC Substrates Market Competitive Landscape

The global advanced IC substrates market is largely consolidated and characterized by different players competing for market share. Intense competition creates innovation & technological advancements in IC substrate solutions. Companies focus on enhancing performance, reliability, and energy efficiency to meet changing industry demands.

Further, strategic collaborations, mergers, and acquisitions are common, reflecting the dynamic nature of the market as players aim to solidify their positions and capture emerging opportunities.

In February 2023, Samsung Electro-Mechanics launched a specialized automotive semiconductor package with an FC BGA substrate customized for driving assistance systems, broadening the scope of chip applications in vehicles, which is designed to meet the technical challenges of Advanced Driver Assistance Systems (ADAS). While Samsung's existing FCBGAs found use in PCs & smartphones, the new variant is optimized for high-performance autonomous driving applications.

Some of the prominent players in the global Advanced IC Substrates Market are

- Fujitsu

- Unimicron Corp

- JCET Group

- Ibiden Co Ltd

- TTM Technologies

- ASE Kaohsiung

- Kyocera Corp

- Panasonic Corp

- Siliconware Precision Industries Co. Ltd

- AT&S Austria Technologies & Systemtechnik AG

- Other Key Players

Advanced IC Substrates Market Recent Developments

- In February 2023, Matrix Electronics and Advanced Engineering (AE) plans to launch an advanced automated robot handling and peeler system for crafting printed circuit boards (PCBs) and integrated circuit substrates. AE's dedicated engineering teams focus on expediting accurate & reliable production in their specialized shop. Also known for high-end PCB & IC substrate automation solutions, they provide clients with comprehensive automation equipment and software solutions to enhance manufacturing efficiency.

- In July 2023, a semiconductor start-up Silicon Box built a new semiconductor facility valued at USD 2 billion, reflecting the company's commitment to advancing semiconductor technology, which is expected to play a critical role in the production & packaging of semiconductors, contributing to the growth & innovation of the industry.

- In March 2023, Thinktrans, a Chinese IC substrate manufacturer, aimed to secure Series A funding in the range of USD 72.45 million to USD 144.9 million. Specializing in in-house design and production of IC substrates, further, the company directly caters to three key client groups: IDMs, OSATs, and design houses, aligning with its strategic business model.

Advanced IC Substrates Market Report Details

| Report Characteristics |

| Market Size (2023) |

USD 9.0 Bn |

| Forecast Value (2032) |

USD 15.9 Bn |

| CAGR (2023-2032) |

6.5% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (FC BGA & FC CSP), By Application (Mobile & Consumer, Automotive & Transportation, and IT & Telecom) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Fujitsu, Unimicron Corp, JCET Group, Ibiden Co Ltd, TTM Technologies, ASE Kaohsiung, Kyocera Corp, Panasonic Corp, Siliconware Precision Industries Co. Ltd, AT&S Austria Technologies & Systemtechnik AG, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Advanced IC Substrates Market size is estimated to have a value of USD 9.0 billion in 2023

and is expected to reach USD 15.9 billion by the end of 2032.

Asia Pacific has the largest market share for the Global Advanced IC Substrates Market with a share of

about 36.1% in 2023.

Some of the major key players in the Global Advanced IC Substrates Market are Fujitsu, Unimicron Corp,

JCET Group, and many others.

The market is growing at a CAGR of 6.5 percent over the forecasted period