Market Overview

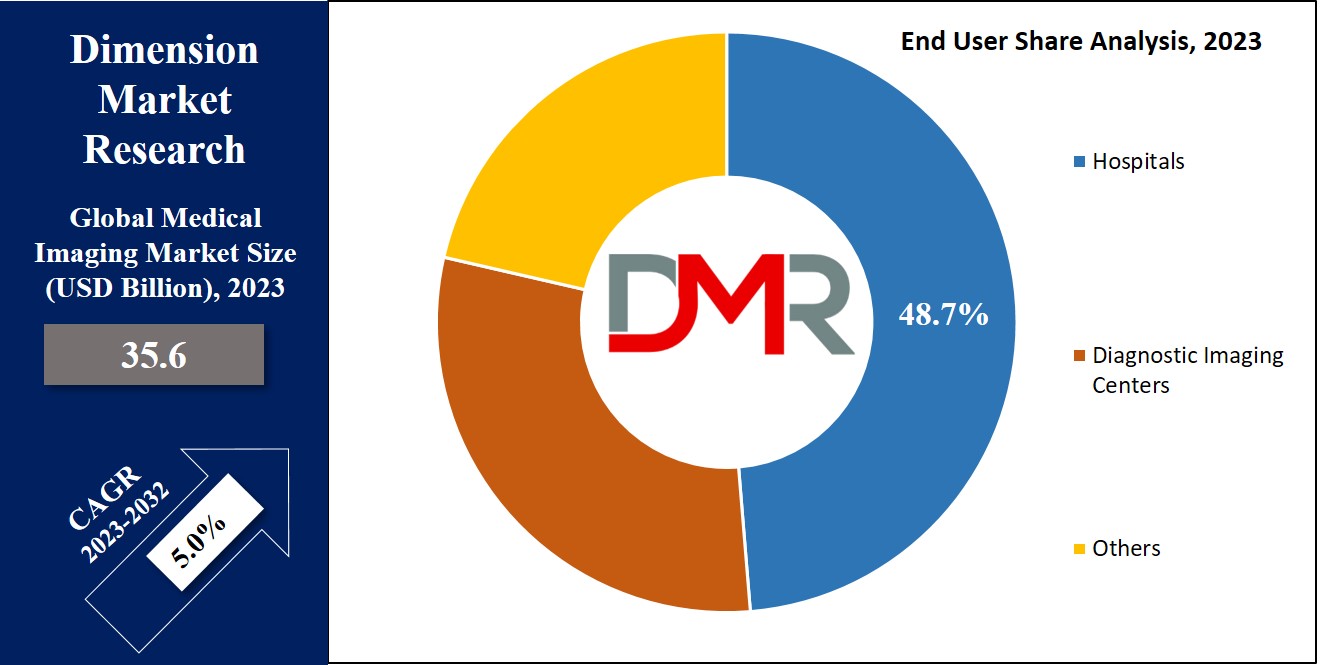

The Global Medical Imaging Market is expected to reach a value of

USD 35.6 billion in 2023, and it is further anticipated to reach a market value of

USD 55.2 billion by 2032 at a CAGR of 5.0%.

Medical imaging includes diverse technologies used to observe, diagnose, or treat medical conditions by delivering detailed views of the human body. Each technology provides unique insights into potential illnesses, damage to specific body parts, or the efficiency of medical interventions. By visually representing tissues & organs, medical imaging serves the important purpose of assisting clinical diagnoses &guiding medical interventions.

Key Takeaways

- By Product, the Ultrasound segment takes the lead in 2023 & is anticipated to dominate throughout the forecasted period.

- In addition, the Computed Tomography (CT) segment is expected to have significant growth over the forecasted period.

- By End User, Hospitals take the lead & drive the market in 2023

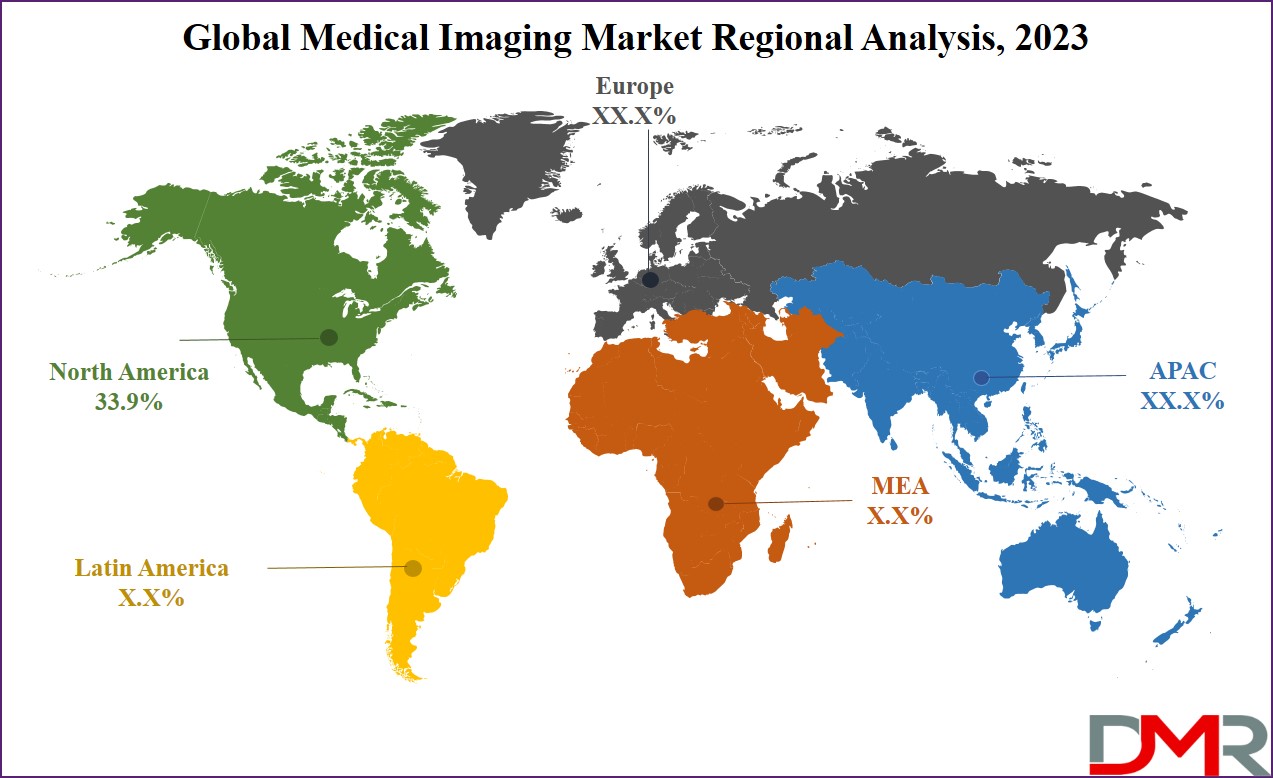

- North America has a 33.9% share of revenue in the global medical imaging market in 2023

Market Dynamic

The growth in the prevalence of specific medical conditions has driven a growth in demand for diagnostic imaging procedures, as issues related to head & neck in individuals across different age groups, including adults, young, & the aging population, have led to an increase in preference for diagnostic imaging tests like CT-scans, MRI scans, ultrasonography, nuclear imaging, & digital volume tomography, which is anticipated to drive the medical imaging market. Further, the growing incidence of chronic disorders, like heart conditions, is expected to boost the diagnostic imaging market, with the launch of equipment featuring new abilities contributing to industry expansion.

The integration of AI-driven medical imaging devices & the advent of IoT has also played a major role in creating a strong presence for the

diagnostic imaging industry in healthcare, strengthening progress & revenue growth.

However, many factors have restrained market growth, like low imaging volumes, economic challenges leading to minimal adoption of advanced imaging technology, staff reductions in radiology centers & hospitals, and a rise in teleradiology services. Further, even after technical advancements & increased utilization of the latest imaging tools, the market faced a decline, as the high cost of medical imaging devices & an unfavorable reimbursement environment for advanced imaging equipment further constrain market expansion.

Research Scope and Analysis

By Product

In 2023, ultrasound commands the largest share in the medical imaging market & is predicted to maintain its lead throughout the forecast period, which is fueled by the growth in applications of ultrasound, with current developments in ultrasound transducers opening new limits in biomedical & cardiovascular imaging, as the market is experiencing a major focus on developing portable ultrasound devices, expanding their use in ambulatory &emergency care settings. Further, the integration of AI into streamlining image quantification ultrasound systems, and selection processes, is anticipated to contribute to the sustained growth of this segment.

Further, the Computed Tomography (CT) segment is anticipated to experience the fastest growth in the coming years, which is driven by the growth in demand for point-of-care CT devices & the introduction of high-precision CT scanners that incorporate AI, ML, & advanced visualization systems. These technological developments position the CT segment at the lead of innovation in the medical imaging landscape.

By End User

The hospital sector has the largest market share in 2023 and has experienced rapid growth in the diagnostic imaging market in recent years, primarily due to the convenience of obtaining multiple facilities within a single location, providing patients with a hassle-free experience. Hospitals, as main

healthcare centers, provide a diverse range of services & house-trained medical staff, making them a major driver for this segment. The large vast space available in a hospital setting allows the provision of advanced imaging techniques & facilities.

Moreover, diagnostic imaging centers also play a vital role by offering necessary facilities for imaging processes and are expected to witness high revenue growth in the coming future, mainly benefiting general clinics & smaller healthcare setups that may face financial constraints in maintaining such equipment. However, the challenge depends on the limited availability of several other medical facilities within these diagnostic imaging centers.

The Medical Imaging Market Report is segmented on the basis of the following:

By Product

- X-Ray Devices

- Ultrasound

- Computed Tomography

- Magnetic Resonance Imaging

- Nuclear Imaging

By End User

- Hospitals

- Diagnostic Imaging Centers

- Others

Regional Analysis

North America dominates the medical imaging market with a substantial 33.9% share in 2023, which is attributed to the region's abundance of industry players & the frequent introduction of new products. Further, the high adoption of advanced medical imaging equipment in North America is driven by favorable reimbursement scenarios & large funding from market players. The US contributes significantly to North America's position, as it leads the charts in healthcare spending as a percentage of GDP. These factors, all together with a growing aging population, increased occurrence of chronic diseases, & a rising trend in preventive diagnostic practices, are anticipated to fuel the medical imaging industry in the region.

Further, the Asia Pacific diagnostic imaging market is expected for quickly growth due to the increase in the incidence of chronic diseases & a strong requirement for advanced imaging devices. The region's market is further supported by growth in local manufacturing units, expected to offer competitively priced diagnostic units, thus meeting the needs of this price-sensitive & underpenetrated market space.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The medical imaging systems market experiences strong competition, dominated by big & mid-sized players that together generate most of the market revenue. To expand their market share, these key players are utilizing diverse strategies like acquisitions, mergers, strategic agreements, & product innovation, by focusing on developing & introducing more effective products, highlighting a dynamic landscape driven by constant efforts to stay ahead in the industry.

In March 2022, Philips launched advanced cloud-based enterprise imaging informatics & analytics solutions. The Philips Health Suite Interoperability showcases a complete integrated Health IT platform in the cloud, catering to different workflow needed within the imaging enterprise, which aims to improve connectivity & efficiency in healthcare operations by delivering a comprehensive solution for managing & analyzing medical imaging data.

Some of the prominent players in the global Medical Imaging Market are:

- Siemens Healthcare

- GE Healthcare

- Fujifilm VisualSonics

- Cubresa

- Esaote

- Hologic

- Canon Medical International

- Samsung Medison

- PerkinElmer Inc

- Koning Corp

- Other Key Players

COVID-19 Pandemic & Recession: Impact on the Global Medical Imaging Market:

The COVID-19 pandemic & the following economic downturn have highly impacted the global medical imaging market. The healthcare sector experienced unprecedented challenges as resources were redirected to pandemic response. Elective procedures, mostly driving the need for medical imaging, saw a reduction, affecting the market growth. Supply chain disturbances & financial constraints hampered the adoption of advanced imaging technologies. However, the pandemic highlighted the importance of diagnostic imaging in managing & understanding infectious diseases, leading to growth in focus on innovation & technology integration in the medical imaging sector. As economies recover, the medical imaging market is anticipated to rebound, driven by rising demand, technological development, and a growing awareness of the vital role imaging plays in modern healthcare. Adaptations made during the crisis also catalyzed long-term enhancement in the industry's resilience & efficiency.

Recent Developments

- In April 2022, Royal Philips & Prisma Health, one of South Carolina's major non-profit healthcare systems, announced a multi-year partnership, which focuses on attaining enterprise interoperability, standardizing patient monitoring, & supporting innovation in enterprise imaging solutions. The agreement focuses to improve patient care & grow clinical performance by innovating healthcare practices throughout the enterprise & using the potential of patient data.

- In April 2022, Sectra engaged in a deal with North York General Hospital (NYGH) in Canada that enterprises imaging solution, using its radiology & breast imaging modules, along with a vendor-neutral archive (VNA), for image review & storage., which focuses on to enhance radiology reading efficiency & streamline workflows, allowing NYGH to enhance patient care without adding to the workload of its staff.

- In March 2022, Intelerad Medical Systems introduced its advanced Enterprise Imaging & Informatics Suite during the 2022 HIMSS Global Health Conference & Exhibition, which allows hospitals & health systems to dismantle data silos, creating a cohesive, vendor-neutral information hub. It also allows the integration of vital patient data throughout the entire healthcare ecosystem, encouraging seamless collaboration & accessibility across different healthcare entities.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 35.6 Bn |

| Forecast Value (2032) |

USD 55.2 Bn |

| CAGR (2023-2032) |

5.0% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (X-Ray Devices, Ultra Sound, Computed

Tomography, Magnetic Resonance Imaging, and

Nuclear Imaging), By End User (Hospitals, Diagnostic

Imaging Centers, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Siemens Healthcare, GE Healthcare, Fujifilm

VisualSonics, Cubresa, Esaote, Hologic, Canon

Medical International, Samsung Medison,

PerkinElmer Inc, Koning Corp, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Medical Imaging Market size is estimated to have a value of USD 35.6 billion in 2023 and is

expected to reach USD 55.2 billion by the end of 2032.

North America has the largest market share for the Global Medical Imaging Market with a share of

about 33.9% in 2023.

Some of the major key players in the Global Medical Imaging Market are Siemens Healthcare, GE

Healthcare, Fujifilm VisualSonics, and many others.

The market is growing at a CAGR of 5.0 percent over the forecasted period.