Market Overview

The global adventure sports and activities market is projected to reach

USD 954.2 billion in 2025 and is expected to grow to

USD 3,592.5 billion by 2034, registering a

CAGR of 15.9%. This growth is driven by rising demand for experiential travel, outdoor recreation, eco-adventure sports and activities, and extreme sports across key regions.

Adventure sports and activities encompass a diverse range of physically demanding and thrill-inducing outdoor experiences that often involve elements of risk, exploration, and skill. These activities typically take place in natural environments such as mountains, forests, rivers, oceans, and deserts, providing participants with unique encounters that challenge both their physical endurance and mental resilience. Examples include rock climbing, white-water rafting, snowboarding, scuba diving, zip-lining, paragliding, and wilderness trekking. In recent years, adventure travel has evolved to include both extreme sports and soft adventure experiences, making it accessible to a broader audience. The appeal lies in its ability to offer authentic, adrenaline-driven moments that promote personal growth, environmental awareness, and cultural immersion.

The global adventure sports and activities market has grown rapidly, driven by shifting consumer preferences toward experiential and outdoor-based leisure. With a growing emphasis on health, fitness, and wellness tourism, travelers are seeking meaningful journeys that combine physical activity with nature-based exploration. The rise of digital nomads and conscious travelers has further expanded the demand for unique experiences such as glacier hiking, caving, jungle safaris, and undersea diving.

This expansion is also supported by social media trends that showcase offbeat adventures, encouraging others to pursue similar high-energy travel pursuits. As a result, traditional tourism models are being reshaped by customized itineraries, multi-sport vacations, and cross-cultural adventure programs.

Fueling this market growth is a strong investment in adventure infrastructure, safety innovations, and supportive government policies that position adventure sports and activities as a major contributor to national economies. Adventure travel hotspots in regions like Asia Pacific, Europe, and Latin America are witnessing the rise of sustainable practices, certified training programs, and inclusive tourism development that cater to a wide demographic.

Strategic partnerships among local operators, eco-lodges, and global travel platforms have enabled smoother logistics, personalized adventure planning, and responsible tourism. As climate-conscious consumers gravitate toward nature-based travel, the global adventure sports sector is poised to become an integral part of the future leisure landscape, combining recreation with resilience, education, and environmental stewardship.

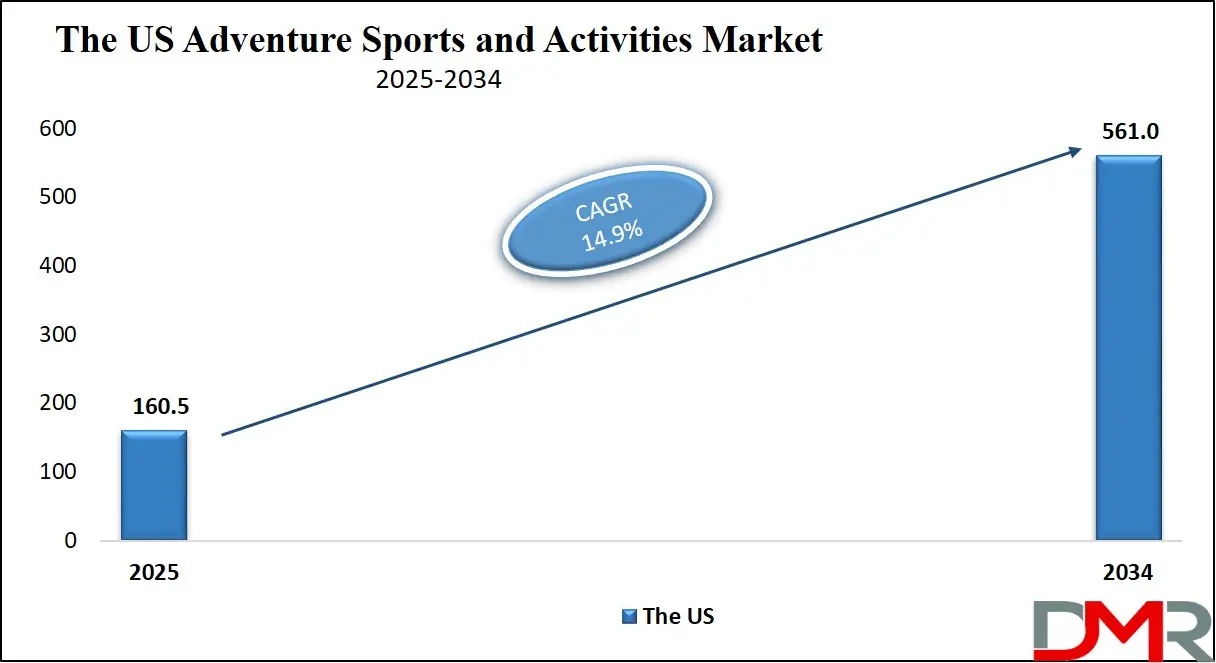

The US Adventure Sports and Activities Market

The U.S. Adventure Sports and Activities Market size is projected to be valued at USD 160.5 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 561.0 billion in 2034 at a CAGR of 14.9%.

The U.S. adventure sports and activities market is a mature yet dynamic segment within the broader outdoor recreation industry, characterized by a strong appetite for nature-based experiences and adrenaline-fueled escapades. With its vast and varied geography ranging from rugged mountain ranges and expansive deserts to dense forests and coastal shorelines, the United States offers a diverse playground for adventure seekers.

Popular activities such as rock climbing in Colorado, white-water rafting in the Grand Canyon, snowboarding in the Rockies, and surfing in California have long attracted both domestic and international travelers. The presence of well-established national parks, robust adventure infrastructure, and certified training programs contributes to the safety, accessibility, and appeal of outdoor sports across all skill levels.

In recent years, shifting consumer behavior towards wellness travel, digital detox experiences, and sustainable tourism has further energized the adventure segment in the U.S. Younger travelers, especially millennials and Gen Z, are actively seeking off-grid experiences like backpacking, canyoneering, zip-lining, and paddleboarding as a way to connect with nature and escape urban routines. The growth of weekend adventure trips, guided eco-tours, and solo expeditions reflects a cultural shift where experiences are valued over material possessions.

Additionally, adventure travel companies in the U.S. are focusing on inclusivity, offering adaptive adventure programs for differently-abled individuals and family-friendly packages that blend education with exploration. This evolving landscape signals a continued rise in demand for customized, low-impact, and transformational adventure travel across the country.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The European Sports and Activities Market

Europe’s adventure sports and activities market is projected to be valued at USD 362.5 billion in 2025, accounting for approximately

37.5% of the global market share. This significant contribution is driven by the region’s unparalleled mix of natural diversity, historic travel culture, and well-established adventure tourism infrastructure. From snowboarding in the French Alps and paragliding in Austria to coastal kayaking in Croatia and cycling tours across the Netherlands, Europe offers a vast array of experiences for various skill levels and interests. High safety standards, widespread availability of certified operators, and a growing preference for sustainable and active tourism among European travelers are further cementing the region’s global leadership in this space.

With an anticipated CAGR of 13.4% from 2025 to 2034, Europe’s market is set for steady and robust growth. Key growth drivers include rising demand for wellness-infused outdoor experiences, eco-conscious travel choices, and the integration of digital platforms for adventure booking and customization.

Additionally, initiatives from the European Union to promote sustainable tourism, along with investments in preserving protected areas and enhancing regional accessibility, are creating favorable conditions for long-term expansion. The growing interest from non-European adventure tourists, especially from Asia and North America, is also contributing to increased inbound travel, making Europe a dynamic and evolving hub for the global adventure economy.

The Japanese Adventure Sports and Activities Market

Japan’s adventure sports and activities market is expected to reach a valuation of USD 38.1 billion in 2025, accounting for an estimated 4.0% of the global market share. While relatively smaller compared to regions like Europe or North America, Japan’s share is driven by its unique combination of cultural heritage, natural landscapes, and a growing domestic interest in experiential travel.

The country offers a wide range of adventure opportunities, from skiing and snowboarding in Hokkaido to hiking in the Japanese Alps and diving in Okinawa. With a highly developed infrastructure, efficient transportation networks, and a reputation for safety and cleanliness, Japan appeals to both domestic and international adventure tourists seeking high-quality, immersive outdoor experiences.

With a projected CAGR of 11.2% between 2025 and 2034, Japan’s adventure tourism market is poised for healthy growth. This expansion is fueled by a younger generation showing strong interest in outdoor recreation, government initiatives to boost regional tourism, and increased investment in eco-tourism and rural revitalization. Japan's emphasis on wellness tourism, forest bathing (shinrin-yoku), and nature retreats aligns well with global trends favoring mindfulness and sustainable travel. Furthermore, the integration of traditional cultural elements into outdoor experiences, such as temple trails, samurai hiking paths, and nature-based Zen retreats, continues to attract a growing niche of culturally curious, experience-driven travelers from across the globe.

Global Adventure Sports and Activities Market: Key Takeaways

- Market Value: The global adventure sports and activities market size is expected to reach a value of USD 3,592.5 billion by 2034 from a base value of USD 954.2 billion in 2025 at a CAGR of 15.9%.

- By Business Model Segment Analysis: Adventure Tour Operators are poised to consolidate their dominance in the business model segment, capturing 40.0% of the total market share in 2025.

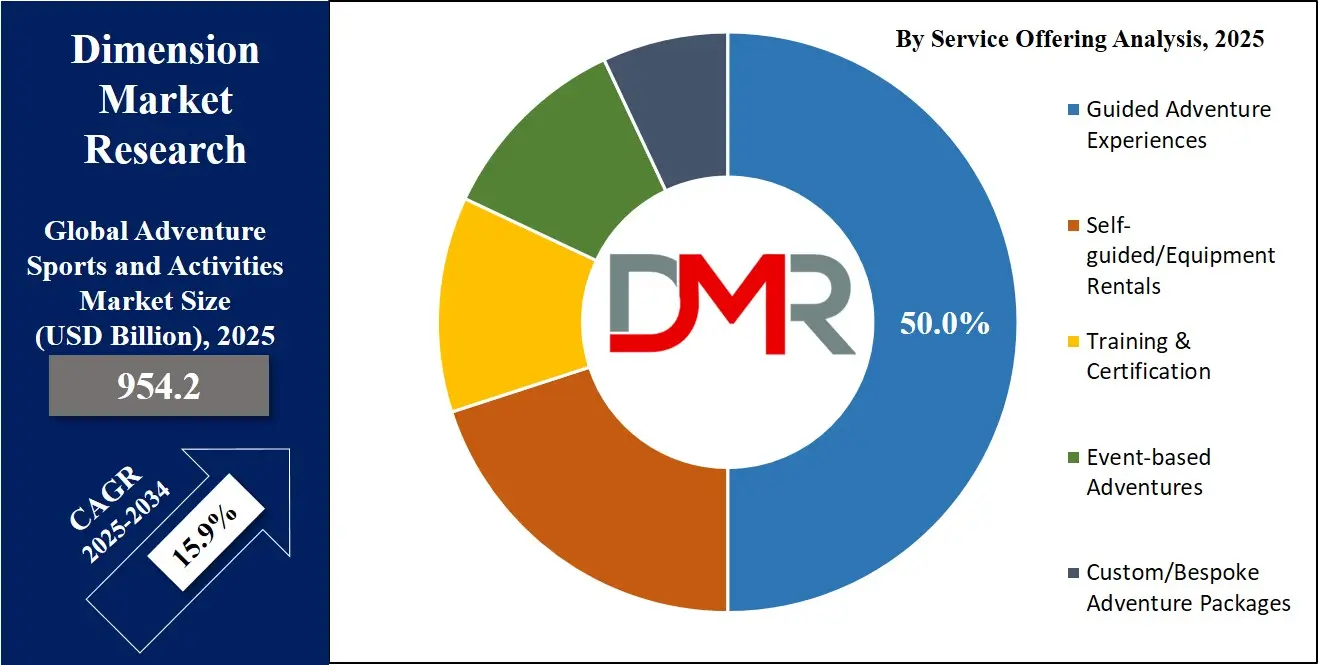

- By Service Offering Segment Analysis: Guided Adventure Experiences are expected to dominate the service offering segment, capturing 50.0% of the total market share in 2025.

- By Provider Type Segment Analysis: SMEs (Small/Local Operators) will lead the provider type segment, capturing 57.0% of the market share in 2025.

- By Safety & Compliance Level Segment Analysis: Certified/Regulated Operators are anticipated to maintain their dominance in the safety & compliance level segment, capturing 60.0% of the total market share in 2025.

- By Industry Vertical Segment Analysis: Eco & Wildlife Adventures are projected to lead the industry vertical segment, capturing 25.0% of the total market share in 2025.

- Regional Analysis: Europe is anticipated to lead the global adventure sports and activities market landscape with 37.5% of total global market revenue in 2025.

- Key Players: Some key players in the global adventure sports and activities market are G Adventures, Intrepid Travel, REI Adventures, Exodus Travels, Abercrombie & Kent, The Travel Corporation, TUI Group, Austin Adventures, and other key players.

Global Adventure Sports and Activities Market: Use Cases

- Eco-Tourism and Sustainable Adventure Travel: The rising global consciousness around environmental conservation has propelled eco-tourism as a significant use case within the adventure sports and activities market. Travelers seek experiences that allow them to explore pristine natural environments while minimizing their ecological footprint. This includes activities such as guided jungle treks, wildlife safaris, coral reef snorkeling, and mountain biking through protected trails. Adventure operators are adopting sustainable practices like low-impact camping, waste reduction initiatives, and community-based tourism to preserve biodiversity and support local livelihoods. The integration of eco-friendly accommodations and carbon offset programs enhances the appeal for environmentally aware tourists who prioritize ethical travel. This trend also opens opportunities for certification bodies and green travel platforms that validate sustainable adventure offerings, helping shape a responsible tourism economy.

- Corporate Wellness and Team-Building Programs: Corporate clients represent a growing segment within the adventure sports market by leveraging outdoor activities for employee wellness, leadership development, and team cohesion. Adventure experiences such as rock climbing, white-water rafting, obstacle course racing, and wilderness survival training are used to foster resilience, communication skills, and problem-solving abilities among teams. These activities offer immersive environments away from traditional office settings, promoting mental health and stress relief. Many companies partner with specialized adventure tour operators to design bespoke programs tailored to organizational goals and group dynamics. This use case not only supports corporate social responsibility initiatives but also taps into the expanding wellness tourism market, which emphasizes physical activity, mindfulness, and nature connection as pathways to productivity and job satisfaction.

- Adventure Travel for Millennials and Gen Z: Younger generations, particularly millennials and Gen Z, are redefining travel preferences by prioritizing authentic, experience-driven adventures over conventional sightseeing. This demographic gravitates towards off-the-beaten-path destinations and adrenaline-pumping activities such as paragliding, scuba diving, mountaineering, and desert safaris. Social media platforms amplify this trend by showcasing visually captivating adventure moments that inspire peer engagement and brand discovery. Adventure travel companies are responding with curated itineraries that emphasize cultural immersion, sustainability, and personalized challenges. The demand for digital convenience has accelerated the adoption of mobile booking apps, virtual reality previews, and real-time safety tracking, enhancing the overall customer journey. This use case drives innovation in experiential marketing, community-based tourism, and multi-activity packages that appeal to tech-savvy, socially conscious travelers.

- Adaptive and Inclusive Adventure Sports: The adventure sports and activities market is witnessing increased efforts to make outdoor recreation accessible to individuals with disabilities and diverse physical abilities. Adaptive adventure programs include wheelchair-accessible hiking trails, guided scuba diving with specialized equipment, adaptive skiing, and inclusive mountaineering expeditions. Organizations and tour operators collaborate with rehabilitation centers, advocacy groups, and certified trainers to develop safe, supportive environments that encourage participation regardless of physical limitations. This inclusivity movement not only broadens the customer base but also promotes social equity and empowerment through adventure. Enhanced training, tailored gear, and assistive technology play critical roles in delivering these experiences. The growth of adaptive adventure sports aligns with broader trends in accessible tourism and universal design, reinforcing the sector’s commitment to diversity and inclusion.

Global Adventure Sports and Activities Market: Stats & Facts

United Nations World Tourism Organization (UNWTO)

- Adventure tourism accounts for approximately 20% of all global tourism arrivals.

- The number of international adventure tourists grew at an average rate of 5% annually over the past decade.

- Ecotourism, a key segment of adventure travel, represents over 7% of global tourism receipts.

- Developing countries receive nearly 60% of adventure tourism arrivals, promoting sustainable development.

- Adventure tourism supports the livelihoods of 70 million people worldwide, especially in rural areas.

United States National Park Service (NPS)

- Over 300 million visitors annually participate in adventure-related activities such as hiking, backpacking, and climbing in US national parks.

- Hiking participation in US national parks increased by 12% between 2015 and 2022.

- More than 60% of US national park visitors engage in some form of adventure or outdoor recreation activity.

- Adventure tourism contributes over USD 18 billion annually to local economies surrounding US national parks.

• European Environment Agency (EEA)

- Over 80% of Europeans participate in some form of outdoor recreational activity annually, including adventure sports.

- Mountain and trekking tourism generate approximately 10% of total tourism revenue in Alpine regions.

- Protected natural areas in Europe attract over 120 million visits yearly for adventure and eco-tourism activities.

- Adventure tourism in Europe supports around 2.5 million jobs across rural and mountain regions.

Japan Tourism Agency (JTA)

- Domestic adventure tourism participation in Japan grew by 9% annually between 2017 and 2023.

- Nature-based tourism, including hiking and skiing, contributes approximately 15% of Japan’s total tourism revenue.

- Japan has over 250 designated adventure tourism sites, including national parks and coastal areas.

- The government has invested over USD 200 million since 2020 to promote rural adventure tourism development.

Canadian Parks and Wilderness Society (CPAWS)

- Canada’s national and provincial parks attract over 100 million visits annually, with 65% engaging in adventure sports such as canoeing, hiking, and wildlife watching.

- Adventure tourism in Canada generates more than CAD 20 billion in annual economic impact.

- Over 30% of Canada’s adventure tourists are international visitors, primarily from the US and Europe.

Australian Government – Department of Agriculture, Water and the Environment

- Adventure tourism contributed AUD 11 billion to the Australian economy in 2023.

- Approximately 40% of Australian domestic travelers participated in outdoor adventure activities in 2022.

- Australia has over 500 certified adventure tourism operators complying with national safety and sustainability standards.

- Coastal and marine-based adventure tourism activities, such as scuba diving and surfing, accounted for 35% of the total market share in 2023.

New Zealand Ministry of Business, Innovation & Employment (MBIE)

- New Zealand attracts 15% of its international visitors specifically for adventure tourism, contributing NZD 5 billion annually.

- Adventure tourism supports over 20,000 jobs, especially in rural and mountainous regions.

- Trekking and hiking are the top adventure activities for international tourists, accounting for 45% of all adventure-related participation.

South African Tourism

- Adventure tourism in South Africa grew by 8% annually from 2018 to 2023.

- Over 70% of adventure tourists in South Africa participate in activities such as safari trekking, bungee jumping, and white-water rafting.

- The government has allocated USD 50 million toward infrastructure development to boost adventure tourism in rural areas since 2020.

Global Adventure Sports and Activities Market: Market Dynamics

Global Adventure Sports and Activities Market: Driving Factors

Growing Demand for Experiential and Outdoor Tourism

The growing preference for experiential travel and nature-based tourism is a major driver of the adventure sports market. Modern travelers, especially millennials and Gen Z, seek immersive and adrenaline-filled experiences such as trekking, paragliding, and scuba diving that allow them to connect with the natural environment. This shift toward active and personalized vacations fuels the growth of adventure travel segments, supported by social media platforms that amplify the appeal of unique outdoor experiences. Additionally, rising awareness of health and wellness benefits associated with outdoor physical activities motivates more people to participate in adventure sports and recreational tourism.

Advancements in Safety and Adventure Infrastructure

Enhanced safety measures and improved adventure infrastructure have significantly lowered barriers to entry, encouraging broader participation in adventure activities. The development of certified training programs, advanced safety gear, GPS tracking, and rescue operations ensures a secure environment for extreme sports like rock climbing and white-water rafting. Investment in adventure parks, eco-friendly resorts, and well-marked trails improves accessibility and comfort for tourists. These improvements not only attract seasoned adventure enthusiasts but also novices, expanding the overall market base.

Global Adventure Sports and Activities Market: Restraints

High Risk and Perceived Safety Concerns

Despite advances in safety, adventure sports inherently involve physical risks, which can deter a significant portion of potential participants. The possibility of injury, accidents, or medical emergencies in remote locations remains a key challenge. Insurance complexities and liability issues also affect participation rates. Many travelers prefer safer, low-risk alternatives, limiting the market growth for high-intensity adventure sports. Regulatory hurdles and stringent compliance requirements can further restrict operations in sensitive or protected natural areas.

Seasonal and Climatic Limitations

Adventure activities often depend on favorable weather and specific seasons, which restrict their availability throughout the year. For example, skiing and snowboarding are limited to winter months, while activities like river rafting depend on monsoon or snowmelt seasons. Climatic unpredictability and natural disasters such as floods, wildfires, or storms can disrupt adventure tourism operations, affecting overall market stability. This seasonality also complicates revenue forecasting and resource allocation for adventure tour operators.

Global Adventure Sports and Activities Market: Opportunities

Expansion of Eco-Adventures and Sustainable Travel

There is growing consumer interest in eco-adventures that combine outdoor sports with environmental stewardship. This trend offers opportunities to develop low-impact tourism products such as guided wildlife safaris, sustainable trekking routes, and marine conservation diving tours. Adventure operators can partner with local communities and conservation organizations to promote responsible travel while creating authentic experiences. Integrating green certifications and carbon offset programs can further attract eco-conscious travelers and differentiate market offerings.

Technology Integration and Digital Transformation

The adoption of technology is transforming how adventure sports are marketed, booked, and experienced. Mobile applications with virtual reality previews, AI-powered personalized itineraries, and real-time safety monitoring enhance customer engagement and operational efficiency. Drone footage and 360-degree videos serve as immersive marketing tools that inspire travelers. Furthermore, online platforms facilitate global reach for small adventure providers, while wearable devices and IoT sensors improve participant safety and performance tracking, creating a seamless adventure travel experience.

Global Adventure Sports and Activities Market: Trends

Rise of Multi-Activity and Hybrid Adventure Packages

Travelers seek comprehensive adventure experiences that combine multiple activities such as hiking, kayaking, mountain biking, and cultural exploration within a single trip. This trend toward multi-activity itineraries allows tourists to maximize their engagement and value while exploring diverse landscapes and local heritage. Adventure companies are designing integrated packages that cater to varying skill levels and interests, creating more flexible and personalized travel options.

Growing Focus on Inclusive and Adaptive Adventure Sports

The market is witnessing a growing emphasis on inclusivity by developing adaptive adventure sports programs that cater to individuals with disabilities or limited mobility. This trend promotes accessible tourism, ensuring that adventure experiences are available to a wider audience. Innovations in adaptive equipment, specialized training for guides, and accessible infrastructure are key enablers. By embracing diversity, the adventure sector not only expands its customer base but also fosters social responsibility and equity within outdoor recreation.

Global Adventure Sports and Activities Market: Research Scope and Analysis

By Business Model Segment Analysis

Adventure Tour Operators have long been the backbone of the adventure sports and activities market, and they are expected to maintain their dominant position with an estimated 40.0% market share in 2025. These operators specialize in designing, organizing, and managing comprehensive adventure travel experiences, often bundling transportation, accommodation, guides, permits, and activity equipment into all-inclusive packages. Their expertise lies in curating authentic, safe, and seamless journeys that cater to various traveler profiles, from hardcore thrill-seekers to casual adventure enthusiasts.

Adventure Tour Operators benefit from strong local networks and deep destination knowledge, enabling them to offer specialized itineraries such as mountain expeditions, jungle safaris, or diving adventures that are difficult for individual travelers to arrange independently. Their role also extends to providing certified guides, safety assurances, and cultural interpretation, which collectively enhance customer confidence and satisfaction. As a result, these operators command substantial loyalty and trust, especially among first-time adventure tourists or those seeking hassle-free, professionally managed trips.

On the other hand, Online Travel Agencies (OTAs) have rapidly emerged as critical players, reshaping the distribution landscape within the adventure sports and activities market. OTAs act as digital intermediaries that connect travelers with a broad array of adventure service providers, including tour operators, activity suppliers, and accommodation partners, through user-friendly online platforms. Their value proposition lies in offering convenience, transparency, and competitive pricing by aggregating diverse adventure options in one place.

Customers can easily compare packages, read reviews, customize itineraries, and make instant bookings, often supported by secure payment systems and mobile accessibility. OTAs also leverage advanced technologies such as AI-driven recommendations and dynamic pricing models to tailor offerings and enhance user experience.

While OTAs may lack the in-depth local expertise of traditional tour operators, their scale and reach enable them to target tech-savvy and independent travelers who prefer self-directed adventure planning. This segment is witnessing robust growth as digital penetration and smartphone adoption increase globally, making OTAs an indispensable channel for expanding market access and driving consumer engagement in adventure tourism.

By Service Offering Segment Analysis

Guided Adventure Experiences are projected to dominate the service offering segment of the adventure sports and activities market, expected to capture around 50.0% of the total market share in 2025. These experiences are characterized by professionally led activities where trained guides accompany participants, ensuring safety, expert navigation, and enriched storytelling throughout the journey. Guided adventures cater to a wide range of activities such as trekking, kayaking, mountaineering, scuba diving, and wildlife safaris.

The appeal lies in the comprehensive support provided, which includes route planning, equipment handling, risk management, and cultural interpretation. Participants benefit from the guides’ local knowledge, technical skills, and emergency response capabilities, which enhance both the safety and overall experience. This service offering is particularly attractive to novice or less-experienced adventure travelers who prefer structured itineraries and professional oversight.

Additionally, guided experiences often integrate educational elements about the environment, wildlife, and local communities, making the journey more immersive and meaningful. The demand for these services continues to rise as travelers seek authentic and secure adventure opportunities with minimal logistical hassle.

In contrast, the Self-guided/Equipment Rentals segment caters to independent adventure enthusiasts who prefer flexibility and autonomy during their outdoor activities. This segment includes rentals of essential adventure gear such as bicycles, kayaks, climbing equipment, camping supplies, and diving apparatus, allowing travelers to plan and execute their trips without a professional guide. Self-guided adventures appeal to experienced participants who value freedom of movement, personalized pacing, and the thrill of exploration on their terms.

The growing popularity of digital maps, GPS devices, and mobile apps has further empowered travelers to confidently undertake self-guided tours while maintaining safety and navigation accuracy. This segment is especially prominent in locations with well-marked trails, accessible terrain, and rental facilities that support equipment availability and maintenance.

Self-guided options also tend to attract budget-conscious travelers and those seeking shorter, customizable experiences. The expansion of this segment reflects a broader trend towards personalized and tech-enabled adventure travel, providing a complementary alternative to guided services.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Provider Type Segment Analysis

Small and Medium-sized Enterprises (SMEs), often represented by local and regional adventure tour operators, are expected to lead the provider type segment, capturing approximately

57.0% of the market share in 2025. These operators play a vital role in delivering authentic, culturally immersive, and region-specific adventure experiences. SMEs benefit from their deep-rooted knowledge of local terrain, traditions, and ecosystems, allowing them to create highly customized and niche offerings such as guided mountain treks, river rafting excursions, or wildlife safaris tailored to the unique characteristics of their area.

Their smaller scale fosters close relationships with local communities and stakeholders, which supports sustainable tourism practices and economic empowerment at the grassroots level. Moreover, SMEs are often more agile and innovative, quickly adapting to emerging traveler trends such as eco-tourism, adventure wellness, or adaptive sports. Despite their limited geographic reach compared to large corporations, these operators dominate due to their ability to provide personalized services, flexibility in itinerary design, and cost-effective options that appeal to budget-conscious and experience-driven travelers.

In contrast, Large Multinational Operators represent global players with extensive resources, brand recognition, and wide-reaching distribution networks that span multiple countries and continents. These operators offer standardized adventure packages with professional marketing, strong safety protocols, and comprehensive customer service, often targeting premium segments of the market. They can invest in advanced technology, international certifications, and partnerships with global travel agencies, enabling them to attract high-value travelers seeking well-established and reliable brands.

Large operators typically provide large-scale adventure tours, luxury expedition cruises, and multi-country itineraries, benefiting from economies of scale and operational efficiencies. However, their standardized approach can sometimes limit customization and local authenticity compared to SMEs. Nevertheless, these multinational companies are critical for driving the commercialization and globalization of adventure tourism, expanding the market by making adventure sports accessible to a broader, international audience.

By Safety & Compliance Level Segment Analysis

Certified and regulated operators are expected to maintain a dominant position in the safety and compliance level segment, capturing approximately 60.0% of the total market share in 2025. These operators adhere to stringent industry standards, local and international safety regulations, and certification requirements designed to minimize risks associated with adventure sports. Compliance with protocols such as guide certifications, equipment safety inspections, emergency preparedness, and environmental protection guidelines builds traveler confidence and trust, especially for high-risk activities like mountaineering, white-water rafting, or scuba diving.

Certified operators typically invest in staff training, licensed medical support, and insurance coverage, ensuring comprehensive risk management throughout the adventure experience. This focus on safety is particularly crucial for attracting families, senior travelers, and international tourists who prioritize well-managed and legally compliant adventures. Moreover, regulatory compliance helps these operators gain access to protected areas and permits, further enhancing their market credibility. As adventure tourism grows, the emphasis on professional standards and responsible practices positions certified operators as leaders in delivering secure, reliable, and sustainable adventure travel.

On the other hand, the non-certified or informal market consists of smaller, often local providers who may operate without formal licensing, certification, or adherence to comprehensive safety regulations. This segment is typically characterized by more flexible, low-cost adventure options that appeal to budget travelers and those seeking spontaneous or less-structured experiences.

Non-certified operators often serve remote or emerging adventure destinations where regulatory oversight is limited or still developing. While this segment can offer authentic and grassroots-level adventure experiences, it carries higher safety risks due to inconsistent training, unverified equipment quality, and a lack of standardized emergency protocols. Travelers engaging with informal providers may face challenges related to liability, insurance coverage, and quality assurance. However, the informal market remains significant in many regions, driven by local entrepreneurship and community-based tourism initiatives. Efforts to formalize this segment through awareness programs and gradual regulatory frameworks represent opportunities for growth and safer participation.

By Industry Vertical Segment Analysis

Eco & Wildlife Adventures are projected to lead the industry vertical segment, accounting for approximately 25.0% of the global market share in 2025. This segment has gained strong momentum due to the rising global emphasis on environmental awareness, biodiversity conservation, and sustainable tourism. Eco-adventures typically involve low-impact outdoor experiences such as guided wildlife safaris, birdwatching tours, rainforest explorations, and marine eco-expeditions. These activities attract eco-conscious travelers who seek meaningful interactions with nature while contributing to conservation efforts and local communities.

Protected national parks, biosphere reserves, and UNESCO heritage sites serve as popular destinations for this vertical. The appeal of spotting rare species, engaging in citizen science programs, and learning about indigenous ecosystems under expert guidance enhances the educational and ethical value of such experiences. As governments and NGOs support ecotourism as a tool for conservation financing and sustainable development, the eco and wildlife segment is positioned for long-term growth and continued dominance in the market.

Mountain & Trekking Tourism represents another key vertical in the adventure sports and activities market, catering to travelers who seek physically challenging and scenic outdoor journeys. This segment includes a wide range of experiences from light hiking trails to high-altitude expeditions such as those in the Himalayas, Andes, Rockies, and Alps. Trekking tourism appeals to a diverse demographic, from solo backpackers to organized group trekkers, who are drawn to the mental and physical rewards of exploring remote mountain landscapes.

The segment’s growth is fueled by growing health and wellness awareness, a global surge in fitness-oriented lifestyles, and a desire for digital detox and personal transformation through nature immersion. Well-known routes like the Inca Trail, Everest Base Camp, and Kilimanjaro attract international adventurers year-round. Infrastructure improvements, such as better trail markings, eco-lodges, and safety services, have made these destinations more accessible. Additionally, the integration of cultural experiences with local tribes, highland villages, and mountaineering heritage enhances the storytelling appeal and depth of the experience, solidifying the relevance of mountain and trekking tourism in the adventure economy.

The Adventure Sports and Activities Market Report is segmented on the basis of the following:

By Business Model

- Adventure Tour Operators

- Online Travel Agencies (OTAs)

- Destination Management Companies (DMCs)

- Freelance/Local Guides

- Resort/Hotel-based Offerings

- Club/Association-based Models

By Service Offering

- Guided Adventure Experiences

- Self-guided/Equipment Rentals

- Training & Certification

- Event-based Adventures

- Custom/Bespoke Adventure Packages

By Provider Type

- SMEs (Small/Local Operators)

- Large Multinational Operators

- Public/NGO/Community-run Initiatives

- Government/State Tourism Boards

By Safety & Compliance Level

- Certified/Regulated Operators

- Non-certified/Informal Market

By Industry Vertical

- Eco & Wildlife Adventure

- Mountain & Trekking Tourism

- Water-based Adventure Tourism

- Extreme/Thrill Adventure

- Desert & Off-road Tourism

- Snow & Ice Adventure

Global Adventure Sports and Activities Market: Regional Analysis

Region with the Largest Revenue Share

Europe is anticipated to dominate the global adventure sports and activities market in 2025, contributing approximately 37.5% of total global market revenue. This leadership position is driven by the region's rich diversity of natural landscapes, well-developed infrastructure, and long-standing culture of outdoor recreation. From alpine skiing in the Swiss and French Alps to hiking in the Scottish Highlands and kayaking along the Norwegian fjords, Europe offers a wide spectrum of adventure experiences catering to both domestic and international tourists.

The region's strong regulatory standards, emphasis on sustainable tourism, and high traveler safety benchmarks have further enhanced its reputation as a premier destination for adventure seekers. Additionally, the popularity of multi-country itineraries, facilitated by seamless cross-border travel, and the presence of numerous certified adventure operators position Europe at the forefront of the market, attracting a wide range of thrill-seekers, eco-tourists, and cultural explorers.

Region with significant growth

The Asia-Pacific region is projected to register the highest CAGR in the global adventure sports and activities market through the forecast period, driven by rapid economic development, rising disposable incomes, and a growing appetite for experiential travel among younger demographics. Countries such as India, China, Thailand, Indonesia, and Vietnam are witnessing a surge in domestic and international adventure tourism, supported by improved infrastructure, government-backed tourism campaigns, and increased digital accessibility to travel planning.

The region’s vast geographic diversity, from Himalayan trekking routes to tropical diving destinations, offers a wide range of adventure opportunities that appeal to both novice and experienced travelers. Additionally, the rise of social media influence, wellness-focused experiences, and eco-conscious tourism is accelerating market growth, positioning Asia-Pacific as the fastest-expanding hub for adventure tourism globally.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Adventure Sports and Activities Market: Competitive Landscape

The global competitive landscape of the adventure sports and activities market is highly fragmented yet intensifying, characterized by a mix of established multinational operators, niche local providers, and rapidly growing digital travel platforms. Key players compete on parameters such as experience customization, safety standards, destination diversity, and sustainability practices. Companies like G Adventures, Intrepid Travel, and REI Adventures lead with curated, small-group experiences, while larger conglomerates such as TUI Group and The Travel Corporation leverage their global reach and resource depth to attract a broad traveler base.

Meanwhile, the rise of Online Travel Agencies (OTAs) and adventure-focused startups has intensified competition by democratizing access and enabling direct-to-consumer bookings. Innovation in digital interfaces, mobile-first travel solutions, and AI-based itinerary planning is reshaping how companies engage with adventure tourists. Additionally, firms are focusing on sustainability certifications, community engagement, and eco-tourism credentials to differentiate themselves in a market that values responsible and immersive travel experiences.

Some of the prominent players in the global adventure sports and activities market are:

- G Adventures

- Intrepid Travel

- REI Adventures

- Exodus Travels

- Abercrombie & Kent

- The Travel Corporation (TTC)

- TUI Group

- Austin Adventures

- MT Sobek

- World Expeditions

- Adventure Life

- Backroads

- Wild Frontiers Adventure Travel

- Kensington Tours

- Butterfield & Robinson

- Explore Worldwide

- KE Adventure Travel

- Boundless Journeys

- Trek Travel

- Natural Habitat Adventures

- Other Key Players

Global Adventure Sports and Activities Market: Recent Developments

Product Launches

- February 2024: Arc, an electric boat manufacturer, unveiled the Arc Sport, a mass-market electric sport boat priced at USD 258,000. This launch signifies Arc's expansion into the watersports segment, offering high-performance, all-electric watercraft designed for adventure enthusiasts.

- June 2024: Kuna Sportswear introduced a new collection of long-sleeve UPF 50+ shirts featuring bold and innovative designs. These shirts are tailored for outdoor activities like fishing and hiking, blending style with high-performance functionality.

Mergers and Acquisitions

- January 2025: Dolphin Capital acquired Zip World, a Welsh adventure park operator known for the world's fastest zipline, in a £100 million deal. This acquisition expands Dolphin Capital's portfolio in the adventure tourism sector.

- December 2024: Clarus Corporation's Rhino-Rack division acquired assets of RockyMounts, a Colorado-based bicycle transport product company. This move aims to enhance Clarus's adventure gear offerings, particularly in the bike rack and hitch-based products segment.

Funding Events

- December 2024: Much Better Adventures, a traveltech company offering exclusive, solo-friendly active outdoor adventure holidays, raised £5 million. The funding will support the company's mission to deliver socially responsible and sustainable travel experiences.

- January 2024: Varlo Sports, a sports apparel company, secured seed funding with participation from REI Co-op Path Ahead Ventures. This investment is intended to fuel Varlo's growth and innovation in the athletic performance apparel space.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 954.2 Bn |

| Forecast Value (2034) |

USD 3,592.5 Bn |

| CAGR (2025–2034) |

15.9% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 160.5 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Business Model (Adventure Tour Operators, OTAs, DMCs, Freelance/Local Guides, Resort/Hotel-based, Club/Association-based), By Service Offering (Guided Experiences, Self-guided/Equipment Rentals, Training & Certification, Event-based, Custom Packages), By Provider Type (SMEs, Large Multinationals, Public/NGO Initiatives, Government Boards), By Safety & Compliance (Certified/Regulated, Non-certified/Informal), and By Industry Vertical (Eco & Wildlife, Mountain & Trekking, Water-based, Extreme/Thrill, Desert & Off-road, Snow & Ice) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

G Adventures, Intrepid Travel, REI Adventures, Exodus Travels, Abercrombie & Kent, The Travel Corporation, TUI Group, Austin Adventures, and other key players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

How big is the global adventure sports and activities market?

▾ The global adventure sports and activities market size is estimated to have a value of USD 954.2 billion in 2025 and is expected to reach USD 3,592.5 billion by the end of 2034.

What is the size of the US adventure sports and activities market?

▾ The US adventure sports and activities market is projected to be valued at USD 160.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 561.0 billion in 2034 at a CAGR of 14.9%.

Which region accounted for the largest global adventure sports and activities market?

▾ Europe is expected to have the largest market share in the global adventure sports and activities market, with a share of about 37.5% in 2025.

Who are the key players in the global adventure sports and activities market?

▾ Some of the major key players in the global adventure sports and activities market are G Adventures, Intrepid Travel, REI Adventures, Exodus Travels, Abercrombie & Kent, The Travel Corporation, TUI Group, Austin Adventures, and other key players.

What is the growth rate of the global adventure sports and activities market?

▾ The market is growing at a CAGR of 15.9 percent over the forecasted period.