Market Overview

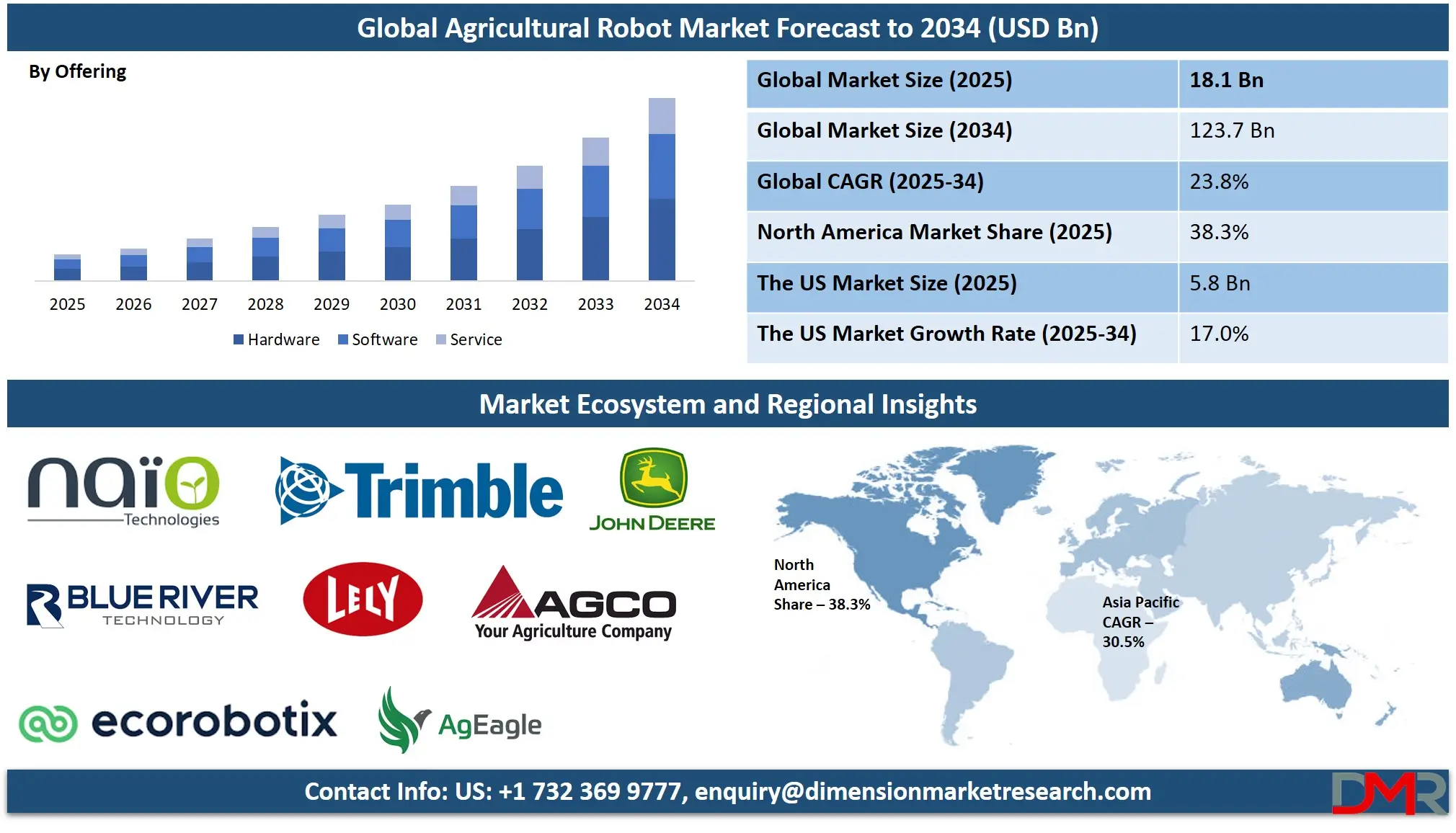

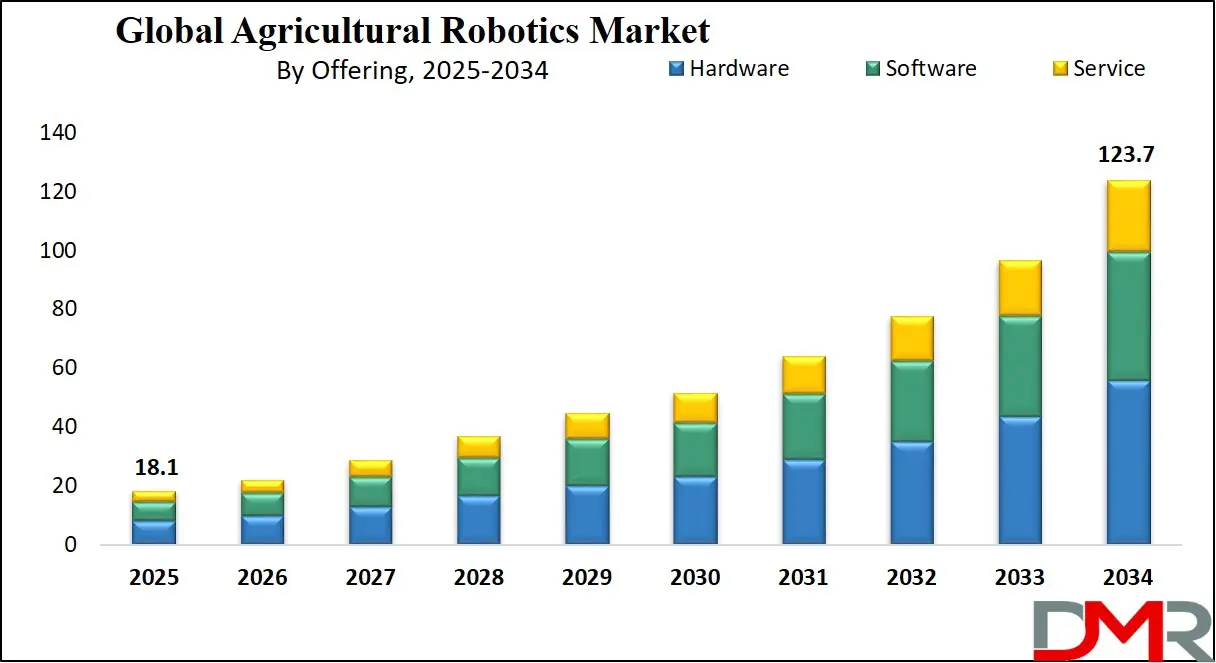

The Global Agricultural Robotics Market is predicted to be valued at

USD 18.1 billion in 2025 and is expected to grow to

USD 123.7 billion by 2034, registering a compound annual growth rate

(CAGR) of 23.8% from 2025 to 2034.

Agricultural robotics refers to the use of automated machines and technologies to perform farming tasks with minimal human intervention. These robots are designed for various agricultural functions such as planting, harvesting, weeding, spraying, and crop monitoring. By incorporating technologies like AI, machine learning, GPS, and computer vision, agricultural robots enhance efficiency, precision, and productivity in farming operations. They help reduce labor costs, improve crop quality, and promote sustainable farming practices. With challenges such as labor shortages, climate change, and rising food demand, robotics offers innovative solutions to modernize traditional farming methods.

The Agricultural robotics market is primarily driven by the need for automation due to labor shortages, increasing food demand, and the pressure to improve productivity while reducing operational costs. Unpredictable weather patterns and climate change have further emphasized the need for more precise, data-driven farming techniques, which agricultural robots can provide. Governments and private companies are investing heavily in agri-tech innovations, including autonomous tractors, drones, robotic harvesters, and AI-driven monitoring systems. These technologies help optimize resources like water, fertilizers, and pesticides while also improving crop quality and minimizing environmental impact.

Rapid advancements in artificial intelligence, sensor technologies, and machine learning are creating new opportunities for the integration of robotics in agriculture. Startups and established agritech companies are collaborating to develop cost-effective, scalable robotic solutions suitable for farms of all sizes. The rise of precision agriculture,

vertical farming, and smart greenhouses presents further potential for robotics in farming. Additionally, government policies and incentives supporting sustainable farming practices are helping accelerate the adoption of these technologies.

The demand for agricultural robotics is growing, particularly in regions like North America, Europe, and Asia-Pacific, where large-scale farming and technological infrastructure are more advanced. Increasing consumer preferences for organic and high-quality produce also drive the need for more precise and efficient farming operations powered by robotics.

The US Agricultural Robotics Market

The US Agricultural Robotics market is projected to be valued at USD 5.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 23.9 billion in 2034 at a CAGR of 17.0%.

The U.S. Agricultural robotics market is driven by the increasing demand for automation in farming due to labor shortages, the need to increase crop yields, and rising operational costs. Technological advancements in AI, robotics, and sensor systems are revolutionizing farming practices, helping farmers reduce resource wastage, enhance productivity, and address sustainability challenges. Additionally, government incentives and investments in agritech innovations contribute significantly to the adoption of robotics, enabling farmers to tackle issues like unpredictable weather, labor shortages, and the need for more efficient farming methods.

The U.S. Agricultural robotics market is seeing trends like the rise of autonomous tractors, drones, and robotic harvesters designed to increase operational efficiency and precision. Integration of AI and machine learning for predictive analytics and real-time monitoring is gaining traction. Precision agriculture, which uses data to optimize resources and crop management, is becoming a key trend. The increased use of robotic weeding, seeding, and spraying systems is reducing the need for labor while improving yield quality. Additionally, vertical farming and

indoor farming are driving the demand for robotic automation in controlled environments.

The Japan Agricultural Robotics Market

The Japan Agricultural Robot market is projected to be valued at

USD 430.0 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds

USD 1,730.0 million in 2034 at a CAGR of

15.5%. Japan's Agricultural robotics market is primarily driven by the aging population of farmers and a declining rural workforce. Automation provides an efficient solution to labor shortages while addressing the need for increased food production.

Technological advancements in robotics and AI are helping Japanese farmers manage crops more efficiently and sustainably. Japan’s government actively supports the integration of automation in agriculture through policies, grants, and investments aimed at modernizing the agricultural sector to overcome the challenges of an aging workforce and limited farmland.

Japan is witnessing the growing use of autonomous robots in various agricultural processes, including planting, harvesting, and crop monitoring. Drones and AI-powered robots are being integrated for precision agriculture, focusing on resource optimization and reducing environmental impact. Robot solutions for rice farming, such as autonomous harvesters, are becoming more popular. Furthermore, innovations like smart greenhouses and vertical farming are gaining attention, and robotics is playing a crucial role in these modern farming techniques. The increasing demand for high-quality, locally produced food is also contributing to the adoption of robotics.

The Europe Agricultural Robotics Market

The Europe Agricultural Robotics market is projected to be valued at USD 3.2 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 8.9 million in 2034 at a CAGR of 12.4%.

Europe’s Agricultural robotics market is driven by the need to improve productivity and sustainability in farming, along with rising labor costs and shortages. The push for environmentally friendly farming practices is increasing the demand for robotic solutions that can minimize pesticide use and optimize water and fertilizer consumption. The European Union's focus on green agriculture, supported by subsidies for sustainable farming technologies, is accelerating the adoption of robotics. Innovations in AI and IoT are also boosting the market, enabling farmers to efficiently manage large-scale agricultural operations and improve crop yields.

In Europe, there is a growing trend toward the adoption of autonomous machinery such as drones, robotic harvesters, and precision sprayers to improve operational efficiency. The integration of artificial intelligence and machine learning into agricultural robotics is leading to more accurate predictions and data-driven decision-making. Vertical farming and the use of robots in controlled environments like greenhouses are on the rise.

Additionally, sustainability trends are promoting robotic solutions for reducing environmental impact, such as robotic weeding systems and precision irrigation technologies. The use of agricultural robots for organic farming is also growing in response to consumer demand for chemical-free produce.

Agricultural Robot Market: Key Takeaways

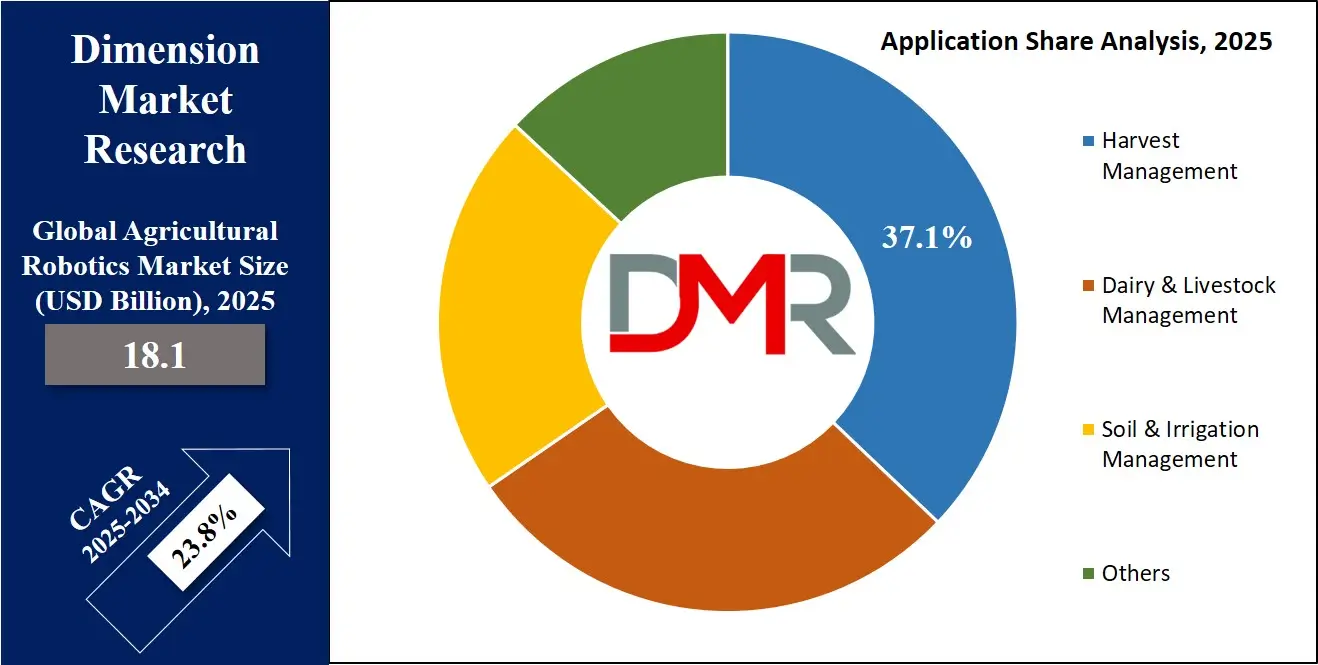

- Market Overview: The global agricultural robotics market is forecasted to reach a valuation of USD 18.1 billion in 2025, with expectations to surge to USD 123.7 billion by 2034, reflecting a robust compound annual growth rate (CAGR) of 23.8% during the forecast period.

- U.S. Agricultural Robotics Market: The agricultural robot market in the United States is estimated to be worth USD 5.8 billion in 2025, growing significantly to reach USD 23.9 billion by 2034, at a CAGR of 17.0%.

- Japan Agricultural obotics Market: Japan's agricultural robot sector is projected to stand at USD 430.0 million in 2025 and is expected to expand to USD 1,730.0 million by 2034, registering a CAGR of 15.5%.

- Europe Agricultural obotics Market: Europe’s agricultural robotics market is expected to be valued at USD 3.2 million in 2025, growing to USD 8.9 million by 2034, with a CAGR of 12.4%.

- Market Analysis by Type: Autonomous tractors are anticipated to lead the market by type, accounting for 27.0% of the total revenue share in 2025.

- Market Analysis by Offering: Within the hardware category, robotic arms are expected to dominate the market with a 35.0% share in 2025.

- Market Analysis by Farming Environment: The outdoor farming segment is forecasted to hold the majority share, capturing 70.0% of the agricultural robotics market by 2025.

- Market Analysis by Application: In terms of application, harvest management is projected to lead with an estimated 40.0% market share in 2025.

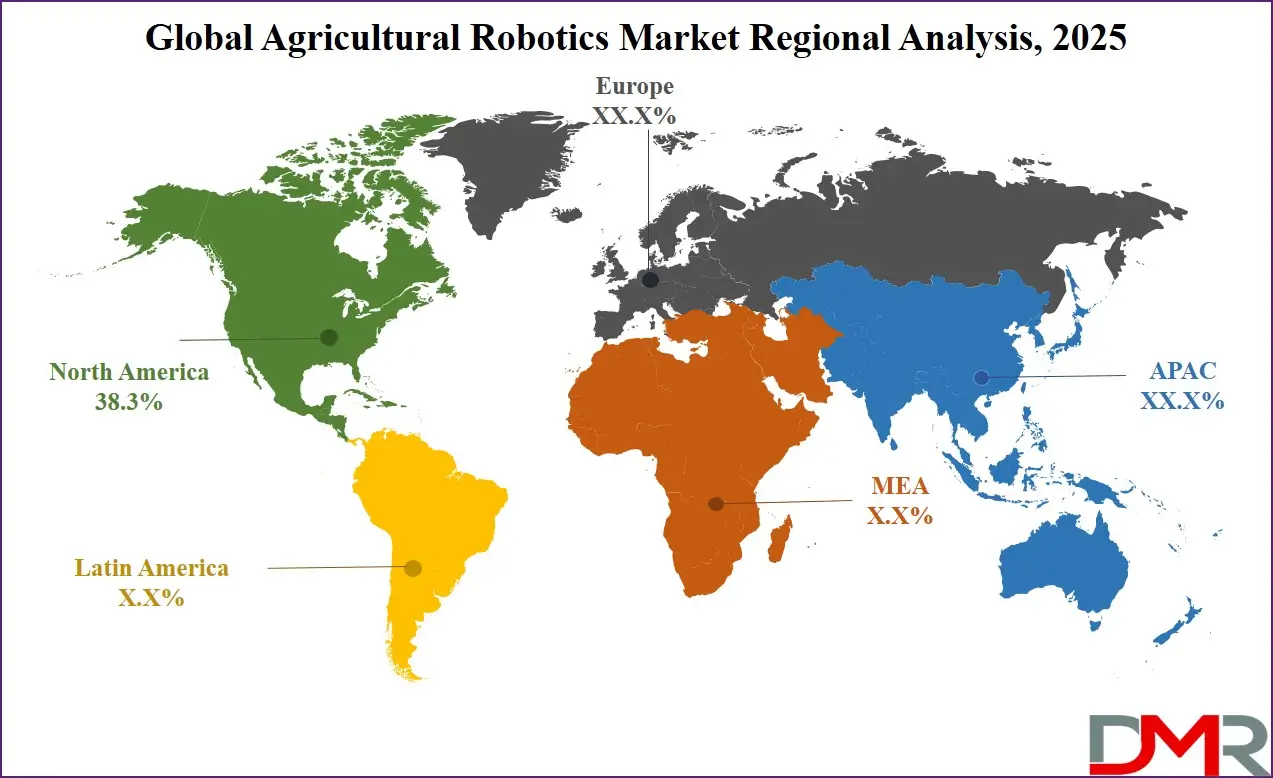

- Leading Region: North America is set to be the leading region in the agricultural robotics market by the end of 2025, commanding a 38.3% market share, driven by the region’s early adoption of advanced agricultural technologies.

Agricultural Robotics Market: Use Cases

- Autonomous Tractors and Machinery: Autonomous tractors and farm machinery can perform tasks like plowing, planting, and harvesting without human intervention. These robots are equipped with GPS, sensors, and AI to navigate fields, optimize routes, and reduce labor costs. They help farmers increase operational efficiency, reduce soil compaction, and improve overall crop yield.

- Precision Spraying and Fertilization: Robots designed for precision spraying apply fertilizers and pesticides more accurately, reducing waste and minimizing environmental impact. These robots use sensors to detect areas that need attention, such as nutrient deficiencies or pest outbreaks, and apply the right amount of chemicals only where necessary, improving crop health while reducing costs and chemical runoff.

- Harvesting Robots: Harvesting robots are particularly useful in fruit and vegetable farming. These robots can identify ripe crops, pluck them delicately, and transport them for processing. They are especially valuable in large-scale agriculture, where labor shortages are common, as they help improve efficiency and reduce food waste by harvesting at the optimal time.

- Weeding Robots: Weeding robots are equipped with advanced sensors and AI to detect weeds and remove them without disturbing the crops. By using mechanical, thermal, or electrical methods to target weeds, these robots reduce the need for chemical herbicides, making farming more sustainable and cost-effective. They are particularly useful in organic farming, where chemical use is minimal.

Agricultural Robot Market: Stats & Facts

- United States Department of Agriculture (USDA): The USDA reports that labor shortages in agriculture have accelerated the demand for robotic solutions, particularly in tasks like fruit picking and weeding.

- University of California, Davis: A study from UC Davis found that robotic harvesters can reduce post-harvest crop losses by up to 10% by increasing efficiency and consistency during peak harvest periods.

- BBC News: According to a 2023 BBC feature, autonomous tractors and robotic weeders are increasingly being adopted in the UK, with some farms reducing pesticide usage by 90% due to precision targeting.

- MIT Technology Review: MIT reported that agricultural robots powered by AI and computer vision are now capable of identifying ripeness in fruits with up to 95% accuracy, drastically reducing reliance on manual labor.

- European Commission: The European Commission noted that the use of drones and field robots in precision farming has helped reduce water usage by 20% on average across EU-funded smart farming pilot projects.

- National Aeronautics and Space Administration (NASA): NASA has partnered with ag-tech researchers to adapt space robotics for use in agriculture, particularly in extreme conditions such as indoor vertical farms.

- Reuters: A 2024 Reuters article highlights that Japanese farms are increasingly turning to rice-planting robots, especially in regions facing aging farmer populations and rural depopulation.

Agricultural Robotics Market: Market Dynamics

Driving Factors in the Agricultural Robotics Market

Labor Shortages and the Push for Automation

Agriculture worldwide is experiencing a growing shortage of skilled labor, caused by factors such as aging populations in rural areas and a general decline in interest among younger generations to pursue farming careers. As a result, farmers are struggling to maintain productivity using traditional labor-intensive methods. Agricultural robotics has emerged as a promising solution to this issue. These robots can carry out repetitive, strenuous, and time-consuming tasks like planting, harvesting, spraying, and weeding with high precision and reliability.

They can operate continuously without fatigue, even in difficult environmental conditions, ensuring stable and predictable output. The use of autonomous systems also reduces the risk of human error, enhancing quality and consistency. For commercial farms, automation offers the ability to scale operations without a proportional increase in labor costs. In summary, agricultural robots address critical labor gaps, enabling farmers to sustain operations and increase productivity despite ongoing workforce constraints.

Technological Innovations in Precision Agriculture

The integration of advanced technologies into agricultural robotics is transforming the way food is grown, monitored, and harvested. Precision agriculture leverages

artificial intelligence (AI), the Internet of Things (IoT), and

machine learning to enable real-time data analysis and decision-making. These systems allow robots to collect information on crop health, soil moisture, nutrient levels, and pest presence. AI algorithms analyze this data to identify patterns and predict outcomes, allowing farmers to make informed interventions.

For instance, AI-equipped robots can detect early signs of disease or pest infestation, enabling targeted treatment that minimizes chemical use. IoT devices enhance this capability by linking sensors across a farm, offering continuous monitoring and automation of irrigation or fertilization. Machine learning improves robots' performance over time as they adapt to changing field conditions. Overall, these innovations optimize resource use, reduce environmental impact, and significantly improve crop yield and quality, helping meet global food security demands.

Restraints in the Agricultural Robotics Market

High Costs of Implementation and Maintenance

Despite their many benefits, agricultural robots often come with high costs that limit their widespread adoption, particularly among small and mid-sized farms. The upfront investment required for purchasing advanced robotics systems, such as autonomous tractors, drones, or automated harvesters, is substantial. These costs are compounded by the need for supplementary technology like sensors, software platforms, and communication infrastructure.

Additionally, ongoing maintenance expenses, periodic software updates, and system repairs can further strain a farm’s operating budget. In many developing countries, the absence of accessible financing options or government subsidies makes it even more challenging for farmers to afford these technologies. Moreover, the return on investment may take several seasons to materialize, making farmers hesitant to adopt these tools without guaranteed long-term benefits. Without scalable, cost-effective models and financial support systems, the adoption of agricultural robotics may remain confined to large-scale farms, limiting its overall impact on global agricultural productivity and sustainability.

Complexity and Lack of Technical Skills

The deployment and maintenance of agricultural robots require a level of technical knowledge that many farmers do not currently possess. These systems often involve sophisticated hardware and software components, including AI algorithms, GPS navigation, machine learning models, and cloud-based data analytics. Operating such systems effectively demands a solid understanding of digital tools and continuous learning to adapt to updates and troubleshooting needs.

Many farmers, especially in rural or underdeveloped regions, lack access to the technical education or training necessary to use these machines efficiently. The complexity of user interfaces, integration challenges with existing machinery, and limited availability of on-site technical support further hinder adoption.

In addition, language barriers and unfamiliarity with digital platforms can exacerbate these challenges. To ensure broader uptake of agricultural robotics, there is a pressing need for training programs, simplified interfaces, and localized technical support that make these systems more accessible and user-friendly for everyday farmers.

Opportunities in the Agricultural Robotics Market

Growth Potential in Developing Regions

Developing regions offer a significant opportunity for the expansion of agricultural robotics. Countries in Africa, Asia, and Latin America are witnessing rising food demand due to rapid population growth and urbanization. However, many of these regions continue to struggle with outdated farming methods, poor yield efficiency, and severe labor shortages. Agricultural robots have the potential to transform these farming systems by automating key tasks and improving productivity. Lightweight, modular, and cost-effective robotic solutions can be tailored to suit smallholder farms in diverse environments. Governments and international development organizations can play a critical role by offering subsidies, pilot programs, and technical support to encourage adoption.

Additionally, public-private partnerships can facilitate access to finance and training, especially in remote areas. By addressing local challenges through affordable innovation, agricultural robotics can support food security, enhance rural incomes, and contribute to sustainable economic development in emerging agricultural economies.

Focus on Eco-Friendly Robotic Systems

As sustainability becomes a central concern in global agriculture, there is increasing interest in the development of environmentally friendly robotic systems. Electrically powered agricultural robots, unlike traditional diesel-powered equipment, produce lower greenhouse gas emissions and help reduce the carbon footprint of farming operations. Recent advances in battery technology have improved the energy efficiency and operational duration of electric robots, making them more viable for long-term field use.

These systems can be powered using renewable sources such as solar energy, further enhancing their sustainability. Eco-friendly robots are also designed to apply fertilizers, pesticides, and water more precisely, reducing environmental waste and minimizing soil and water pollution. As consumers, regulators, and agricultural stakeholders push for greener practices, manufacturers have a growing incentive to invest in sustainable innovations. These environmentally responsible technologies not only benefit the planet but also help farmers meet stricter environmental regulations and gain access to eco-conscious markets.

Trends in the Agricultural Robotics Market

Integration of AI and Machine Learning

Artificial intelligence (AI) and machine learning are increasingly central to the evolution of agricultural robotics. These technologies enable robots to move beyond basic automation into adaptive and intelligent decision-making. Machine learning allows robots to improve performance over time by analyzing data from previous seasons and adjusting to new patterns. For example, a robot can learn to recognize the difference between weeds and crops, enabling precise weeding without damaging plants. AI also powers advanced image recognition systems, enabling drones and ground robots to detect diseases, nutrient deficiencies, and pest activity with high accuracy.

By continuously collecting and analyzing data, these systems allow for smarter, timely interventions, ultimately enhancing yields and reducing input costs. Furthermore, AI integration enables seamless connectivity between various farm systems, facilitating coordinated operations. As these capabilities grow, AI-driven robotics is transforming farms into interconnected, self-optimizing ecosystems that respond dynamically to changing conditions.

Rise of Drone Use for Agricultural Monitoring

Drones, also known as unmanned aerial vehicles (UAVs), are playing a rapidly expanding role in modern agriculture. Equipped with high-resolution cameras, multispectral sensors, and GPS systems, drones provide a bird’s-eye view of fields, enabling detailed monitoring of crop health, soil conditions, and pest activity. Farmers can use this real-time imagery to make informed decisions on irrigation, fertilization, and disease control. Drones can also be used for tasks like aerial spraying, planting seeds, and mapping field boundaries with greater speed and efficiency than manual methods.

Their mobility and ease of deployment make them particularly useful for monitoring large or hard-to-reach areas. The affordability of consumer-grade drone technology has made it accessible to farms of various sizes. As regulations evolve to support commercial drone use in agriculture, we can expect further integration of UAVs into precision farming strategies, enabling data-driven and resource-efficient cultivation practices across the globe.

Agricultural Robot Market: Research Scope and Analysis

By Type Analysis

Autonomous Tractors are predicted to dominate with a 27.0% revenue share in the Agricultural Robotics Market by 2025. The agricultural industry depends on autonomous tractors because modern farming operations require efficient, large-scale practices. Automation in tractor operations results in lower expenses while simultaneously providing enhanced fieldwork accuracy and productive fuel management.

Modern farms find these tractors attractive because the combination of AI and GPS technology features allows for improved efficiency, together with scalability in operations. Autonomous tractors will continue to lead the agricultural robotics market because large farms utilize their capability for labor reduction and productivity enhancement to deal with manpower shortages.

The UAV (drone) industry segment will demonstrate the fastest compound annual growth rate throughout the upcoming years. The growing significance of drones in precision agriculture stems from their crop surveillance capabilities and both fertilizer delivery functions and time-sensitive data analysis features. Farming experts find drones useful because they offer fieldwide benefits at lower costs than conventional equipment and fast operational speeds. Rapid expansion of drone technology applications in agriculture will occur due to ongoing advancements in battery life capabilities and AI functions, and sensor precision that drive rapid business expansion in this agricultural segment.

By Offering Analysis

Robotic Arms from the Hardware segment are likely to lead with a 35.0% market leadership position in the Agricultural Robotics Market in 2025. The wide-scale farm applications depend on robotic arms to execute vital operations, including harvesting, combined with packaging, as well as material handling. These machines perform their tasks fast and precisely, which makes them necessary tools on large agricultural operations. The market demand for robotic arms rises because farmers need automation tools to manage labor shortages alongside increased productivity goals. Robotic arms will sustain their position as the dominant segment because the advancing technology produces better products at lower prices.

AI & Machine Learning Algorithms within the software segment are projected to achieve the fastest Compound Annual Growth Rate (CAGR) over the upcoming few years. Agriculture experiences a transformation through AI and machine learning because these technologies produce predictive insights to optimize resources while enabling better decisions. Accurate agricultural data analysis becomes feasible through these technologies because they help farmers study soil health together with weather patterns.

The market demand for AI-powered software solutions in precision agriculture will surge as AI technology evolves and becomes more accessible. The market expansion results from improved automation systems alongside better data processing capacity and a rising emphasis on smart agricultural solutions.

By Farming Environment Analysis

Outdoor farming environment segment is expected to dominate in the Agricultural Robotics Market, with a 70.0% market share by 2025. Large-scale crop production in outdoor environments functions as the fundamental support of worldwide farming, which stimulates the requirement for agricultural robots. Autonomous tractors, together with drones and harvesting robots, operate in extensive areas by automating processes while boosting productivity and minimizing manual work requirements.

Industrial outdoor farming is adopting agricultural robotics due to increasing requirements for optimized planting and monitoring, and harvesting operations as its operations expand and become more sophisticated. The market dominance of outdoor robots becomes stronger through the application of GPS technology, together with AI systems and sensor technology, which increases their operational efficiency.

Over the upcoming years, the Indoor farming environment segment will demonstrate a 30.0% annual CAGR. Vertical farming and controlled-environment agriculture (CEA) represent the quickly developing indoor farming sector because consumers want locally produced foods while seeking more efficient agricultural methods.

The integration of automated harvesting equipment and planting robots with monitoring systems becomes crucial in indoor agriculture because they maximize space utilization and minimize irrigation, and increase agricultural productivity. The segment's high growth rate will increase due to expanding indoor farming systems supported by advancements in technology, which have driven up the adoption of robotics.

By Offering Analysis

Robotic Arms from the Hardware segment are predicted to have the largest market presence at 35.0% within the Agricultural Robotics Market in 2025. The agricultural industry depends on robotic arms for crucial activities, which include harvesting and packaging as well as material handling, due to their widespread use in many farming operations. The farming industry relies heavily on robotic arms because they execute repetitive work with precision and speed at every large-scale farm operation.

The acceleration of robotic arms demand comes from two factors: labor shortages and productivity requirements. Robotic arms will maintain their position as the dominant segment because technological progress combines with lower prices to drive their adoption rate upward.

AI & Machine Learning Algorithms from the Software segment are forecasted to achieve the highest annual Compound Annual Growth Rate throughout the upcoming years. AI machines learn new techniques that transform Agricultural through machine-generated predictions combined with optimized resource allocation and better decision capabilities.

Through data analysis, these technologies give farmers access to extensive ecological and soil health records, which simplifies efficient crop management. AI will expand quickly as a result of its developing sophistication and accessibility, which will especially benefit precision agriculture through its advanced software solutions. Benefits from automation, along with enhanced data processing methods, together with rising requirements for intelligent agricultural technologies, will drive this expansion.

By Application Analysis

Harvest Management is likely to lead with nearly 40.0% market share in the Agricultural Robotics industry market share in 2025. The number of harvesting robots increases because they provide efficiency gains while lowering operational costs, while ensuring better harvest precision. The ongoing agricultural labor shortage creates an ideal environment for robotic harvest management solutions, which result in significant financial benefits for big operations because they achieve crop monitoring with weed detection and plant scouting responsibilities.

Harvesting robots possess the capability to shift between various agricultural settings and crop types because of their adaptive technology. Recent technological breakthroughs in AI and machine learning make these robots increasingly affordable and dependable, thus establishing their market leadership position within agricultural robotics.

The Dairy & Livestock Management segment demonstrates a prediction of achieving the highest Compound Annual Growth Rate by 2025. Increased worries about animal welfare and dwindling labor resources, and greater farming efficiency requirements make dairy farm robots essential for livestock and dairy farm management.

Automated milking systems on dairy farms and other dairy farm management robots help dairymen obtain steady milk yields and monitor their livestock's health. The integration of electronic systems that monitor animals for tracking their health behaviors and movement locations helps decrease expenses while enhancing operational outputs.

The Agricultural Robotics Market Report is segmented on the basis of the following:

By Type

- Autonomous Tractors (Driverless Tractors)

- Unmanned Aerial Vehicles (UAVs/Drones)

- Dairy Robots

- Harvesting Robots

- Weeding Robots

- Material Management

By Farming Environment

By Offering

- Hardware

- Robotic Arms

- Sensors & Cameras

- GPS & Navigation Systems

- Drone Components

- Software

- Data Analytics Platforms

- AI & Machine Learning Algorithms

- Farm Management Software

- Service

- System Integration & Deployment

- Maintenance & Support

- Consulting & Training

By Application

- Harvest Management

- Field Farming

- Plowing & Seeding

- Crop Monitoring & Weed Detection

- Plant Scouting

- Crop Protection and Scouting

- Weather Tracking & Monitoring

- Dairy & Livestock Management

- Dairy Farm Management

- Livestock Monitoring

- Precision Fish Farming

- Soil & Irrigation Management

- Others

Regional Analysis

Region with the largest Share

North America is predicted to dominate the Agricultural robotics market with a

38.3% market share by the end of 2025, driven by early adoption of advanced farming technologies, large-scale commercial farms, and ongoing labor shortages. The U.S. leads in integrating AI, autonomous machinery, and precision Agricultural systems. High investment in agricultural R&D and favorable government policies supporting agri-tech innovation further strengthen the region’s leadership.

Additionally, companies such as Deere & Company and AGCO Corporation are headquartered in North America, promoting widespread deployment of robotic solutions. The region's technological maturity and focus on sustainable, high-yield farming methods position it as the largest contributor to the agricultural robotics market globally.

Region with Highest CAGR

Asia Pacific is predicted to experience the highest CAGR in the Agricultural robotics market due to rapid population growth, rising food demand, and increasing pressure on agricultural productivity. Countries like China, India, and Japan are investing heavily in agricultural automation to modernize traditional farming and counteract labor shortages. Government support, such as subsidies for smart farming equipment and favorable policy frameworks, is accelerating technology adoption.

In addition, the rise of agritech startups and innovations tailored to small and medium-sized farms is making robotics more accessible. Japan is leading in dairy and rice automation, while China is pushing for widespread drone use. As rural digitization grows and economic development continues, the Asia Pacific region is poised for rapid growth in this market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Companies running in the global Agricultural robotics market compete fiercely while developing advanced technology systems to overcome labor shortages and improve crop cultivation and operational efficiency simultaneously. Deere & Company together with AGCO Corporation and Trimble Inc. dominate the market because of their relentless pursuit of autonomous tractors and precision Agricultural solutions including integrated farm management platforms. The market sees Lely and DJI and Naïo Technologies among specialized players who push innovation in dairy robotics as well as UAVs and weeding solutions.

The market faces disruption from emerging startup companies Small Robot Company, Agrobot and Iron Ox which present AI-driven sustainable robotic solutions. The smart farming technology market depends on strategic partnerships together with acquisitions and heavy R&D investments for staying competitive while Asia-Pacific and European companies gain strength from increasing regional smart farming technology demand. Companies that started as startups or have mid-level locations now add significant competition to the industry through specialized high-tech agricultural products made for harvesting fruits and the automation of indoor cultivation and precise weed control.

The market recognizes SwarmFarm Robot along with Harvest CROO Robot and Vision Robot Corp. for their development of application-specific robots which boost production levels even as they lower chemical inputs. Robot-as-a-service (RaaS) models are increasing market presence to provide small and medium-sized farms better access to advanced robotics through subscription-based payments.

Regional competition aligns with drone-based solution development in the Asia-Pacific region, while European manufacturers take leading positions in sustainable robotics markets. The market will expand through its next phase because businesses presenting seamless AI-powered integrated systems will gain leadership positions during the climate-resilient data-driven farming demand increase.

Some of the prominent players in the Global Agricultural Robotics Market are:

- Deere & Company

- AGCO Corporation

- Trimble Inc.

- Lely Holding S.à.r.l.

- Naïo Technologies

- Blue River Technology

- AgEagle Aerial Systems

- EcoRobotix

- Octinion

- Yamaha Motor Co., Ltd.

- Autonomous Solutions Inc.

- Kubota Corporation

- Harvest CROO Robot

- Iron Ox

- Agrobot

- Small Robot Company

- Ecorobotix

- SwarmFarm Robot

- Vision Robot Corp.

- Other Key Players

Recent Developments

- In February 2024, CNH Industrial N.V. announced an investment in Bem Agro, a Brazilian startup specializing in AI-powered agronomic mapping. This strategic move aims to bolster CNH Industrial's precision Agricultural capabilities by leveraging Bem Agro’s aerial imaging technologies to enhance crop monitoring, reduce herbicide usage, and optimize resource deployment.

- In January 2024, DeLaval unveiled the VMS Batch Milking system, a new approach designed to boost efficiency and reduce labor demands in robotic milking. Notably, Rancho Pepper Dairy had already installed 22 DeLaval VMS V300 units in 2022 to manage its herd of 2,000 cows.

- In April 2023, GEA Group Aktiengesellschaft deepened its partnership with Kerbl, a provider of livestock farming products. Through the GEA Exclusive Program, this collaboration is intended to expand GEA’s presence in new international markets. By tapping into Kerbl’s industry knowledge and distribution network, GEA aims to deliver advanced agricultural solutions and better support livestock farmers.

- In August 2023, Fullwood JOZ introduced FULLSENSE, an upgraded milking robot software. This innovation simplifies the interpretation of complex data, empowering dairy farmers with actionable insights. The software provides valuable information on input variations, milk production trends, and irregular animal behavior.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 18.1 Bn |

| Forecast Value (2034) |

USD 123.7 Bn |

| CAGR (2025–2034) |

23.8% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 5.8 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Autonomous Tractors (Driverless Tractors, Unmanned Aerial Vehicles (UAVs/Drones), Dairy Robots, Harvesting Robots, Weeding Robots, and Material Management), By Farming Environment (Indoor, and Outdoor), By Offering (Hardware, Software, and Service), By Application (Harvest Management, Dairy & Livestock Management, Soil & Irrigation Management, and Others) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Deere & Company, AGCO Corporation, Trimble Inc., Lely Holding S.à.r.l., Naïo Technologies, Blue River Technology, AgEagle Aerial Systems, EcoRobotix, Octinion, Yamaha Motor Co., Ltd., Autonomous Solutions Inc., Kubota Corporation, Harvest CROO Robotics, Iron Ox, Agrobot, Small Robot Company, Ecorobotix, SwarmFarm Robotics, Vision Robotics Corp., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

The Global Agricultural Robot Market size is estimated to have a value of USD 18.1 billion in 2025 and is expected to reach USD 123.7 billion by the end of 2034.

North America is expected to be the largest market share for the Global Agricultural Robot Market, with a share of about 38.3% in 2025.

Some of the major key players in the Global Agricultural Robotics Market are Deere & Company, Trimble Inc., Kubota Corporation, and many others.

The market is growing at a CAGR of 23.8 percent over the forecasted period.

The US Agricultural Robotics Market size is estimated to have a value of USD 5.8 billion in 2025 and is expected to reach USD 23.9 billion by the end of 2034.