Market Overview

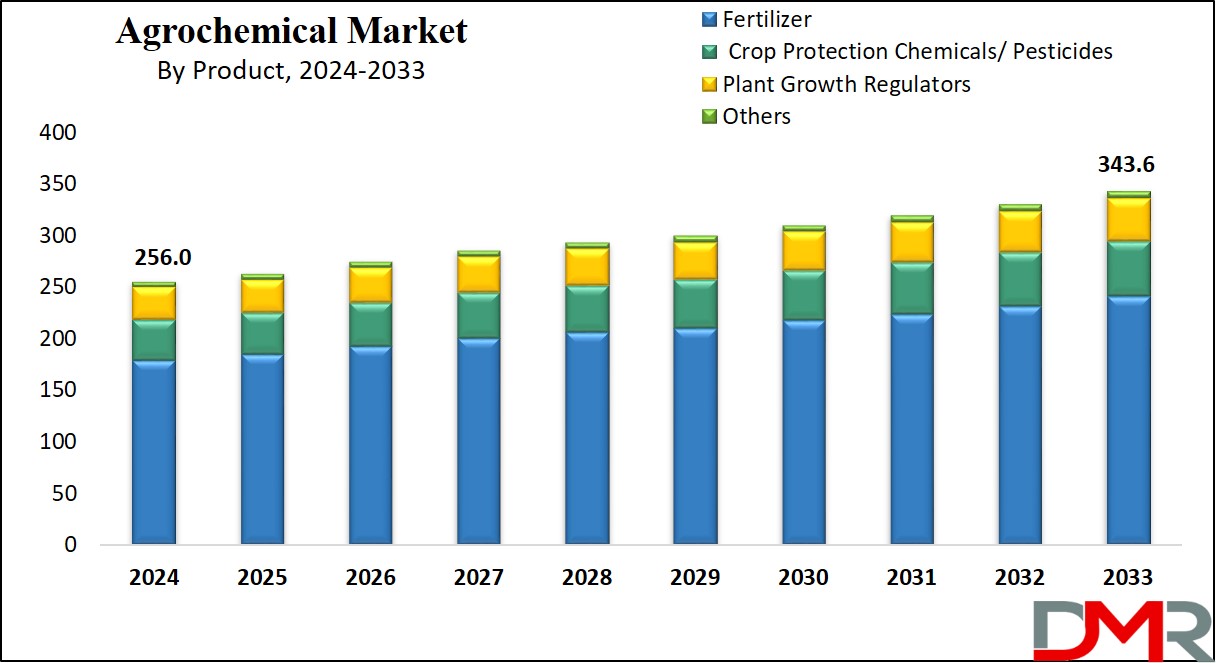

The Global Agrochemical Market is expected to reach a value of USD 256.0 billion by the end of 2024, and it is further anticipated to reach a market value of USD 343.6 billion by 2033 at a CAGR of 3.3%.

Agrochemicals, consisting of chemical & biological formulations, are important tools to enhance crop quality & productivity. The categories include pesticides, protecting crops from pests & weeds, and fertilizers, enriching crop & soil quality. The global narrative to enhance agricultural output on existing land underscores the pivotal role of agrochemicals in helping farmers boost both the quality & quantity of their yields.

The varying application of agrochemicals within agriculture emphasizes their significance in leading to productivity. The growing demand for food grains & the elevating global population further show the importance. Increasing urbanization & rising industrialization have limited cultivable land, amplifying the requirement for enhanced agricultural productivity.

The increasing demand for fertilizers is a significant driver of growth in the agrochemical market. Currently, synthetic fertilizers sustain nearly 50% of the global population by boosting agricultural output. Fertilizers, whether organic or inorganic, play a vital role in enhancing soil fertility and promoting crop growth.

Organic fertilizers include manure, fish meal, granite meal, and seaweed, while inorganic options comprise nitrogen, phosphorus, potassium, and other compounds. Inorganic fertilizers are favored for their quick and effective results compared to organic alternatives. In India, urea consumption reached 35.73 million MT and DAP 10.53 million MT in 2022-23, reflecting respective growths of 4.5% and 13.6% over 2021-22.

Key Takeaways

- The global agrochemical market is expected to grow by 87.6 billion, at a CAGR of 3.3% during the forecasted period.

- By Application, cereals & grains category is expected to lead in 2024 & is anticipated to dominate throughout the forecasted period.

- In addition, fruits & vegetables are expected to have steady growth over the forecasted period.

- By Product, the Fertilizer segment is expected to take the lead & drive the market in 2024.

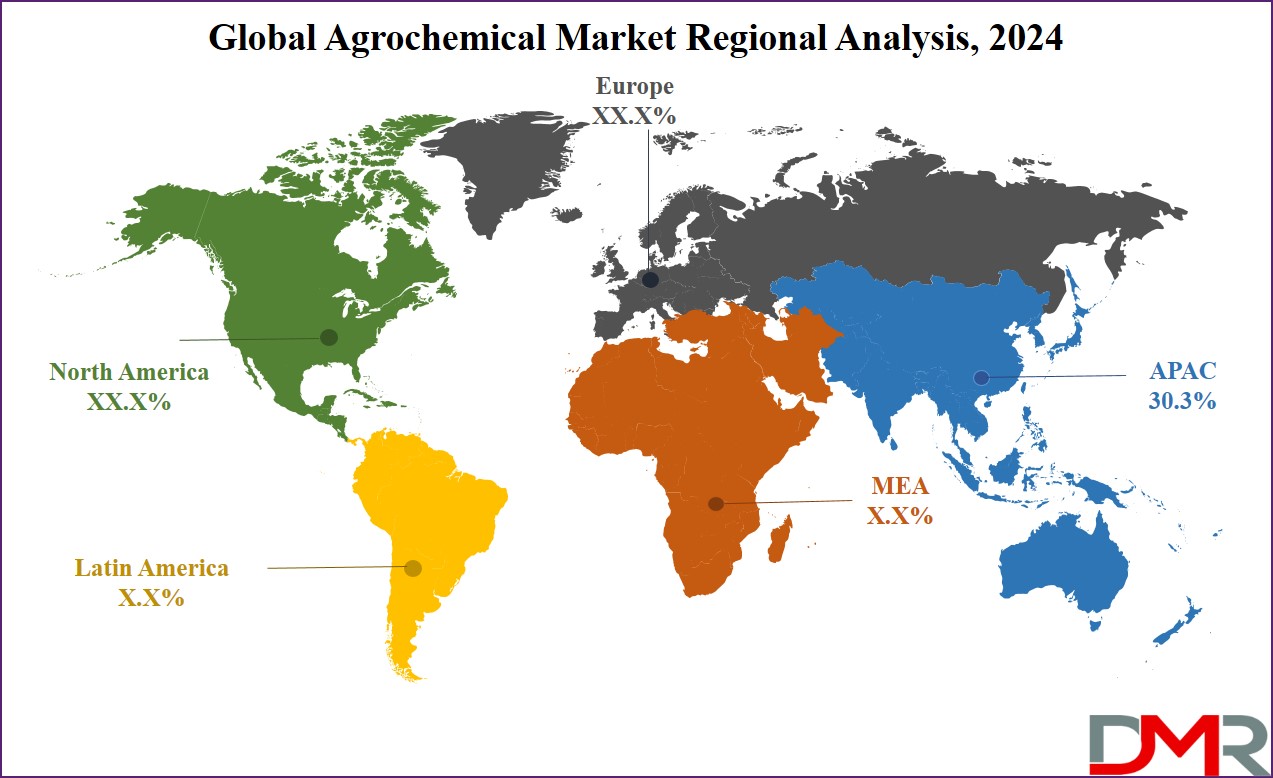

- Asia Pacific is expected to hold a 30.3% share of revenue in the Global Agrochemical Market in 2024.

- Some of the use cases of agrochemical include pest & disease management, crop protection & yield improvement, and more.

Use Cases

- Pest and Disease Management: Agrochemicals like insecticides & herbicides help control & manage pest infection & weed growth. In addition, fungal diseases can highly impact crop health & yield, where fungicides are used to protect & control fungal infections, supporting crop health & protecting against diseases that can lead to crop loss.

- Crop Nutrition Enhancement: Agrochemicals like fertilizers provide essential nutrients to crops, improving soil fertility & promoting better plant growth. Nitrogen, phosphorus, & potassium are common ingredients in fertilizers that support optimal crop development & better yield.

- Crop Protection and Yield Improvement: As plant growth regulators, agrochemicals can influence many physiological processes in plants, like growth, flowering, & fruiting. Proper use of these chemicals can lead to better crop yields, enhanced quality.

- Post-Harvest Management: Agrochemicals are used in post-harvest scenarios to protect stored crops from degrading, pests, and diseases. Preservatives help maintain the quality of harvested crops during storage, transportation, transportation services, and processing. Further, certain agrochemicals are used to control the ripening process of fruits post-harvest, which allows fruits to reach consumers in best condition and extends their shelf life.

Market Dynamic

The growth in the use of agrochemicals is driven by factors like development in agricultural technology, growth in demand for food & the necessity for better plant management, where the Asia Pacific region, particularly nations like China & India, plays a major role in driving this demand. Further China, a major global manufacturer, exporter, & consumer, of fertilizers & insecticides, leads the way with about one-third of the world's pesticides & fertilizers consumption.

Moreover, the market for crop protection chemicals, like fungicides & herbicides, is all set to witness higher adoption because of the growing incidences of pest & rodent attacks on crops, which is driven by the necessity to protect crop yields. The growth trends highlight the importance of agrochemicals in ensuring global food security,

food safety testing & sustaining agricultural productivity.

However, growing concerns over environmental impact, regulatory scrutiny, & a growing emphasis on sustainable agriculture pose restraints for the global agrochemicals market. Further, stricter regulations & consumer demand for eco-friendly alternatives challenge traditional agrochemical practices.

Driving Factors

A growing global population and increased food security needs are two primary drivers of the agrochemical market. Rising agricultural demand necessitates higher crop yields, driving farmers toward advanced agrochemical solutions like fertilizers, herbicides and pesticides for better crop productivity. Due to urbanization and over cultivation, arable land has decreased, leading to overuse of chemicals to boost productivity and increase yields.

Technological advancements and the creation of bio based alternatives play a significant role in driving market expansion. Furthermore, government support for modern farming practices, subsidies, and initiatives designed to boost agricultural output further increase adoption rates especially among emerging economies ensuring sustained demand over the long term.

Trending Factors

A key trend in the agrochemical market is the shift towards bio based and sustainable products, driven by consumer and government demand for more eco friendly practices. Manufacturers have invested in organic fertilizers and biopesticides in order to reduce ecological impact. Precision farming and integrated pest management (IPM) have rapidly gained prominence, providing farmers with tools for optimizing agrochemical use with minimum waste.

Digital farming &

vertical farming solutions such as drones and AI powered systems are also improving product application efficiencies. Increased climate awareness and commitment to carbon neutral practices have driven an explosion of innovative low toxicity, eco friendly agrochemical formulations setting off a wave of sustainability focused market transformation.

Restraining Factors

The agrochemical market faces considerable restraints due to environmental regulations and health concerns. Governments around the world impose stringent policies regulating synthetic fertilizers and pesticides in order to mitigate their harmful impacts on ecosystems and human health. Conformance with these regulations often increases production costs for manufacturers, making their products unaffordable for smaller farmers.

Overuse of agrochemicals has the potential to degrade soil quality, pollute water supplies and strengthen pest resistance, prompting advocacy groups to call for less chemical solutions in agriculture. Consumer preference for organic and chemical free produce also challenges markets by necessitating an infusion of alternative agricultural practices which reduce growth of conventional agrochemical solutions.

Opportunity

The agrochemical market presents numerous opportunities with advancements in

biotechnology and increased adoption of sustainable agriculture practices. Innovations like genetically modified crops designed to resist pests and diseases reduce dependence on traditional chemicals while creating demand for complementary agrochemical solutions.

Emerging markets across Asia Pacific, Africa and Latin America represent growth opportunities due to an influx of agricultural investments as well as modernizing farming methods. Climate resilient agriculture encourages drought tolerant products and ecologically sound agrochemicals. Furthermore, partnerships between governments and agrochemical companies to improve food security open new avenues of growth; expanding markets in previously under served regions.

Research Scope and Analysis

By Product

Under the segmentation by product, the fertilizer sector is expected to hold a substantial revenue share in 2024, which is fueled by the significant use of fertilizers to enhance crop production, driving growth in the agrochemicals sector. Fertilizers find application in numerous ways for cereals & grains, like mixing with other fertilizers for seedlings, top-dressing separately, or spraying. Proper amounts and effective applications are crucial for boosting cereal & grain yields.

Further, the crop protection chemicals market is anticipated to exhibit remarkable growth in coming years, majorly led by herbicides, fungicides, insecticides, & other products such as bactericides & rodenticides.

By Application

The cereal & grains category is expected to stand out with a remarkable market share in 2024, largely because of the growing consumption in the Asia-Pacific region. This sector's growth is supported by a broader global cultivation & the need for fertilizers.

Further, agrochemicals are critical for optimizing yields of crops like wheat, rice, & other cereals. They're equally vital for cultivating fruits & vegetables, ensuring the safety & better quality of the produce, as insufficient soil nutrients can hinder yields, especially for produce such as wheat & rice.

In addition, the fruits and vegetables category is projected to experience steady growth, driven by rising global demand, especially from health-conscious consumers.

The Agrochemical Market Report is segmented on the basis of the following:

By Product

- Fertilizer

- Nitrogenous

- Urea

- Ammonia

- Ammonium Nitrate

- Ammonium Sulfate

- Calcium Ammonium Nitrate

- Others

- Phosphatic

- Diammonium Phosphate

- Monoammonium Phosphate

- Triple Superphosphate

- Others

- Potassic

- Potassium Chloride

- Potassium Sulfate

- Others

- Secondary Fertilizers

- Calcium

- Magnesium

- Sulfur Fertilizers

- Others

- Crop Protection Chemicals/ Pesticides

- Insecticides

- Herbicides

- Fungicides

- Others

- Plant Growth Regulators

- Others

By Application

- Cereal & Grains

- Oilseed & Pulses

- Fruits & Vegetables

- Others

Regional Analysis

The Asia Pacific region is expected to claim a substantial

30.3% market share in 2024, driven by key agricultural players like China, India, & Japan, as China's distinction as the world's leading pesticide manufacturer & exporter as per ITC & Food and Agricultural Organization, & India's position as the fourth-largest agrochemical producer worldwide according to OECD (Organization for Economic Co-operation and Development) & Food and Agricultural Organization (FAO) played key roles in the growth of this region, which also significantly influences regional per capita income & enhances consumer spending.

Moreover, in North America, the US is expected the lead in the agrochemical sector, driven by its dominance in products such as soy, blueberries, sorghum, & maize, as the growth is attributed to favorable weather patterns, reduced trade tensions, better produce pricing, & contributing to the expansion of the United States agrochemical market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Manufacturers in the market have come up with a range of products, including potent fertilizers & several pesticides such as herbicides, insecticides, fungicides, and various other crop protection chemicals. Competing manufacturers look for supremacy, considering factors like product excellence, pricing, and services, along with innovation, sustainability, and corporate image.

Further, key strategies included by enterprises to enhance their market presence consist of partnerships, mergers, and acquisitions, expanding distribution channels and geographical reach, as well as launching new product lines.

Some of the prominent players in the global Agrochemical Market are

- BASF SE

- Bayer AG

- The DOW Chemical Company

- Solvay

- Clariant AG

- Nufarm

- Evonik Industries AG

- Helena Agri-Enterprises, LLC

- FMC Corp.

- ADAMA Ltd.

- Other Key Players

Recent Developments

- In December 2023, Sumitomo Chemical announced its plans to develop its new agrochemical plant in the western part of Gujarat, as the company would obtain about 50 acres of land in the part and will aim to complete construction around 2027. In addition, the starting investment is expected to be over USD 35 million. Further, the new plant would be its third Indian facility for active ingredients in agrochemicals.

- In November 2023, Insecticides Limited announced its four new products, namely Nakshatra, Supremo SP, Opaque, and Million in the middle of sowing of Rabi crops. Through the introduction of these crop protection products, the company focuses on the well-being of individual farmers along with the holistic progress & sustainability of the entire agricultural sector.

- In September 2023, The China Ministry of Agriculture & Rural Affairs announced plans to approve 12 new pesticide products, like Cyclobutrifluram & Flusulfinam. The announcement was made by the ICAMA & Rural Affairs, after the deliberation & approval of the 12 new pesticide products by the First Committee Meeting of the Tenth National Pesticide Registration Review Committee.

- In July 2023, UPL Sustainable Agri Solutions (SAS), an integrated AgTech platform of UPL Ltd., launched the new insecticide Argyle, an affordable, sustainable, and innovative solution, mainly designed for soybean & cotton crops. Argyle contains Acetamiprid 25% and Bifenthrin 25% wetable granules (WG), using an eco-friendly WG formulation that quickly dissolves in water, using canopy coverage & efficacy.

- In June 2023, Best Agrolife Limited (BAL), one of the major players in the Indian agrochemical industry, announced that the company has attained the registration for the indigenous manufacturing of the product Trifloxystrobin 10%+ Difenoconazole 12.5% + Sulphur 3% Sc under section 9 (3) FIM. With this the company will become the first Indian agrochemical company to manufacture Trifloxystrobin 10% + Difenoconazole 12.5% + Sulphur 3% Sc in India.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 256.0 BN |

| Forecast Value (2032) |

USD 343.6 BN |

| CAGR (2023-2032) |

3.3% |

| Historical Data |

2018 - 2023 |

| Forecast Data |

2024 - 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Fertilizer, Crop Protection Chemical/Pesticides, Plant Growth Regulators, and Others), By Application (Cereal & Grains, Oilseed & Pulses, Fruits & Vegetables, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

BASF SE, Bayer AG, The DOW Chemical Company, Solvay, Clariant AG, Nufarm, Evonik Industries AG, Helena Agri-Enterprises LLC, FMC Corp, ADAMA Ltd, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Agrochemical Market size is estimated to have a value of USD 256.0 billion in 2024 and is

expected to reach USD 343.6 billion by the end of 2033.

Asia Pacific is expected to have the largest market share for the Global Agrochemical Market with a

share of about 30.3% in 2024.

Some of the major key players in the Global Agrochemical Market are BASF SE, Bayer AG, The DOW

Chemical Company, and many others.

The Agrochemical market is growing at a CAGR of 3.3% over the forecasted period.