Market Overview

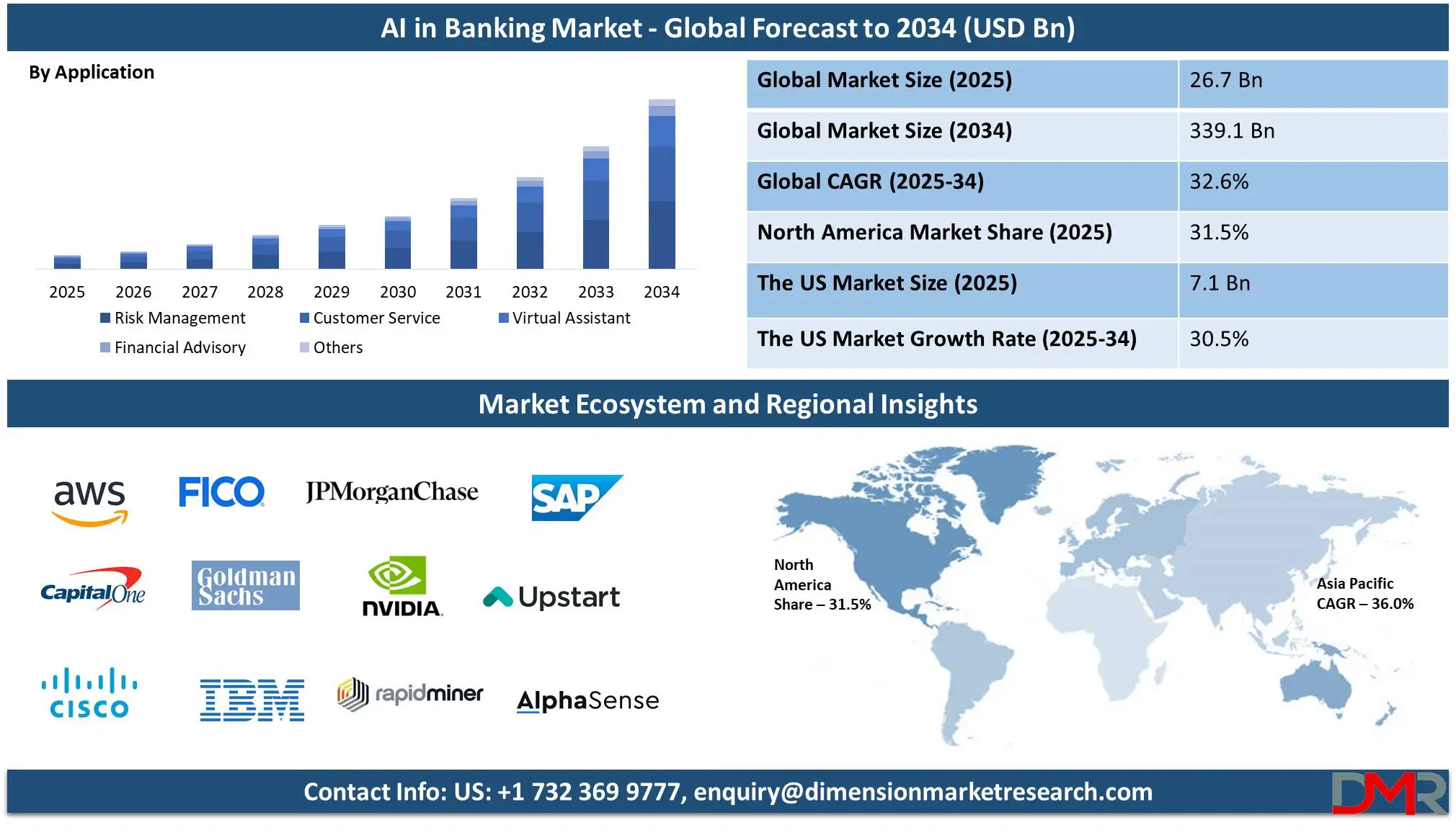

The Artificial Intelligence (AI) in Banking Market is expected to be valued at

USD 26.7 billion in 2025, and is further anticipated to reach

USD 339.1 billion by 2034 at a

CAGR of 32.6%.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global AI in banking market is driven by increasing adoption of artificial intelligence to enhance operational efficiencies, customer experiences, and risk management within financial institutions. AI-enabled solutions such as machine learning, natural language processing, and robotic process automation are revolutionizing bank processes by automating repetitive tasks, providing real-time data analysis capabilities, and improving decision making processes.

Banks and financial service providers are turning to artificial intelligence (AI)-powered banking solutions to offer financial products, enhance fraud detection mechanisms, and simplify regulatory compliance requirements. AI banking solutions have seen an upsurge of interest due to digital banking innovations requiring advanced analytics for competitive edge in an ever-evolving market landscape.

One of the key applications of AI in banking is risk assessment and fraud detection. AI algorithms analyze vast volumes of transactional data in real time to identify unusual patterns and anomalies that may indicate fraudulent activities. Traditional rule-based fraud detection systems often struggle to keep pace with the sophisticated techniques used by cybercriminals, but AI-driven models continuously learn from emerging threats, improving accuracy and reducing false positives. This trend is not only relevant to banking but also strongly aligned with developments in the

AI in Cybersecurity Market, where advanced AI models are being deployed to proactively detect and neutralize digital threats.

Moreover, AI enables predictive analytics for credit risk assessment, allowing banks to evaluate borrowers' creditworthiness more efficiently and make data-driven lending decisions. This has significantly improved loan underwriting, reducing default rates and enhancing financial stability. AI-powered chatbots and virtual assistants have revolutionized customer service in banking by providing immediate, round-the-clock support.

These AI-driven interfaces use natural language processing to understand customer inquiries and provide relevant responses, eliminating the need for human intervention in routine queries. Banks are also implementing AI-driven recommendation engines that analyze customers' spending habits and financial behavior to suggest suitable products, such as credit cards, loans, or investment opportunities. This level of hyper-personalization enhances customer engagement and loyalty while also increasing cross-selling and up-selling opportunities for financial institutions.

AI is also playing a pivotal role in regulatory compliance and risk management within the banking sector. Financial institutions must adhere to stringent regulations imposed by authorities such as the Financial Action Task Force (FATF) and the Basel Committee on Banking Supervision. AI-driven compliance solutions help banks automate the monitoring and reporting of transactions to detect money laundering, insider trading, and other illicit activities.

The US AI in Banking Market

The US Artificial Intelligence (AI) in Banking Market is projected to be valued at USD 7.1 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 77.8 billion in 2034 at a CAGR of 30.5%.

AI in banking in the US is experiencing rapid expansion due to rising customer demands for automation, improved customer experiences, and advanced risk management solutions. Financial institutions across the U.S., including JPMorgan Chase, Bank of America, Citibank, and Wells Fargo are investing heavily in AI technologies to streamline operations, reduce costs, and provide personalized banking services. With the presence of tech giants such as Google, Microsoft, IBM, and Amazon Web Services (AWS) offering AI-based financial solutions, the U.S. banking sector is at the forefront of AI innovation, setting global benchmarks in digital transformation. The growth of AI technologies is also spurring parallel advances in related industries, such as the

AI in Education Market, which leverages similar intelligent systems to transform learning environments.

One of the most significant areas where AI is reshaping the U.S. banking industry is fraud detection and cybersecurity. With the rise in digital transactions, cyber threats and financial fraud have become a major concern for banks and regulatory authorities. AI-powered fraud detection systems use machine learning and real-time data analysis to identify suspicious activities and prevent fraudulent transactions before they occur.

The U.S. banking sector has also embraced AI-driven biometric authentication solutions, such as facial recognition, voice recognition, and behavioral biometrics, to enhance security and prevent identity theft. Financial regulators, including the Federal Reserve, the Office of the Comptroller of the Currency (OCC), and the Consumer Financial Protection Bureau (CFPB), are closely monitoring AI applications in banking to ensure compliance with cybersecurity standards and consumer protection laws.

Customer service and experience have been significantly improved through AI-powered chatbots and virtual assistants in the U.S. banking sector. Major banks have integrated AI chatbots into their mobile apps and websites to provide instant support for routine inquiries, such as balance checks, transaction details, and loan eligibility. For example, Bank of America's AI-powered assistant, Erica, has gained widespread popularity for assisting customers with financial management tasks.

Global AI in Banking Market: Key Takeaways

- Market Value: The global AI in banking market size is expected to reach a value of USD 339.1 billion by 2034 from a base value of USD 26.7 billion in 2025 at a CAGR of 32.6%.

- By Component Type Segment Analysis: Solution type components are anticipated to lead in the component type segment, capturing 59.0% of the market share in 2025.

- By Technology Type Segment Analysis: Natural Language Processing (NLP) technologies are poised to consolidate their market position in the technology type segment capturing 43.0% of the total market share in 2025.

- By Application Type Segment Analysis: Risk Management applications are expected to maintain their dominance in the application type segment capturing 40.0% of the total market share in 2025.

- By Enterprise Type Segment Analysis: Large Enterprises are anticipated to consolidate their dominance in the enterprise type segment capturing 75.0% of the total market share in 2025.

- Regional Analysis: North America is anticipated to lead the global AI in banking market landscape with 31.5% of total global market revenue in 2025.

- Key Players: Some key players in the global AI in banking market are Amazon Web Services, Inc., Capital One, Cisco Systems, Inc., FAIR ISAAC CORPORATION (FICO), Goldman Sachs, International Business Machines Corporation, and Other Key Players.

Global AI in Banking Market: Use Cases

- AI-Driven Predictive Analytics for Credit Scoring: Traditional credit assessment methods rely on static financial history and fixed parameters, often excluding potential borrowers with limited credit records. AI-powered models analyze alternative data sources such as transaction history, spending patterns, employment records, and even social behavior to assess creditworthiness more accurately.

- AI-Powered Robo-Advisors for Wealth Management: Robo-advisors have transformed wealth management by offering automated, AI-driven investment advice tailored to individual financial goals and risk tolerance. These platforms use machine learning algorithms to analyze market trends, economic indicators, and client profiles to recommend optimal investment strategies. Unlike human advisors, AI-powered robo-advisors provide 24/7 portfolio management, real-time rebalancing, and lower-cost investment solutions, making wealth management more accessible to a wider audience.

- AI-Based Loan and Mortgage Processing Automation: The loan and mortgage approval process is traditionally time-consuming, requiring extensive documentation and manual underwriting. AI-driven automation is revolutionizing this sector by streamlining document verification, risk assessment, and approval workflows. Optical Character Recognition (OCR) and Natural Language Processing (NLP) technologies extract and validate data from submitted documents, reducing processing time from weeks to days.

- AI-Enhanced Hyper-Personalization in Digital Banking: AI is enabling hyper-personalized banking experiences by analyzing vast amounts of customer data to deliver tailored financial products, services, and recommendations. Machine learning algorithms track user behavior, spending patterns, and preferences to suggest personalized budgeting tips, customized credit card offers, and relevant investment opportunities.

Global AI in Banking Market: Stats & Facts

- According to Eurostat, in 2024, 13.5% of EU enterprises with 10 or more employees utilized AI technologies, up from 8.0% in 2023. Denmark led with 27.6% adoption, followed by Sweden (25.1%) and Belgium (24.7%). Additionally, in 2024, 27.11% of enterprises in the EU’s manufacturing sector used AI for marketing and sales, while 26.23% applied AI in production processes.

- According to the European Parliament, the global AI market was valued at over USD 141.7 billion in 2023 and is projected to reach nearly USD 2.07 trillion by 2030. Additionally, in 2023, the United States led private AI investment with USD 68.1 billion, followed by China with USD 7.9 billion.

- According to the World Bank, the information technology services sector grew twice as fast as the global economy, creating jobs at six times the global rate.

- According to the European Commission, USD 21.8 billion is planned to be raised to build four AI gigafactories in Europe. Additionally, the InvestAI initiative aims to mobilize USD 218 billion in AI investments. According to the ECB, digital transformation and AI-related risks are among the supervisory priorities for 2023-2025. Also private investors have pledged nearly USD 119.9 billion in France's AI sector.

- According to the IMF, AI adoption is boosting productivity but also exacerbating wage inequality.

- According to the World Bank, AI-driven growth has accelerated the expansion of the IT services sector which will further anticipated to boost the growth of this market.

Global AI in Banking Market: Market Dynamic

Global AI in Banking Market: Driving Factors

Rising Adoption of Digital Banking and Fintech InnovationsAs consumers increasingly prefer online and mobile banking solutions over traditional branch-based services, financial institutions are investing heavily in AI-driven technologies to enhance digital experiences, automate processes, and improve security. AI enables banks to offer seamless, 24/7 customer support through virtual assistants, personalize financial services based on real-time data, and streamline complex operations such as fraud detection and risk assessment. The growing competition from fintech startups is also pushing traditional banks to accelerate their AI adoption to remain competitive, improve operational efficiency, and meet evolving customer expectations. Additionally, the rise of contactless payments, blockchain-based transactions, and embedded finance is further driving AI integration in banking services.

Increasing Focus on Fraud Detection and Risk Management

With the rapid rise in digital transactions, cyber threats, identity theft, and financial fraud have become major concerns for banks and regulatory bodies. AI-powered fraud detection systems use machine learning algorithms and real-time data analytics to identify suspicious activities, unusual transaction patterns, and potential security breaches. Unlike traditional rule-based fraud detection methods, AI continuously learns from new data, improving accuracy and reducing false positives.

Moreover, AI enhances risk assessment by analyzing vast datasets to predict credit defaults, market fluctuations, and compliance risks. Banks are also leveraging AI-driven biometric authentication and behavioral analytics to strengthen security measures and prevent unauthorized access. As financial crimes become more sophisticated, AI plays a crucial role in ensuring proactive threat detection, regulatory compliance, and overall financial stability in the banking sector.

Global AI in Banking Market: Restraints

Data Privacy and Security Concerns

AI-powered banking solutions rely on vast amounts of sensitive customer data, including financial transactions, personal identities, and behavioral insights. However, the increasing use of AI raises risks related to data breaches, cyberattacks, and unauthorized access, which can compromise customer trust and regulatory compliance. Strict data protection laws, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the U.S., impose stringent requirements on banks regarding data collection, storage, and usage.

Additionally, the potential for AI bias and unethical data usage further complicates its adoption, as financial institutions must ensure transparency and accountability in AI-driven decision-making. Addressing these privacy concerns requires robust cybersecurity measures, AI governance frameworks, and regulatory alignment, which can slow down AI implementation in the banking sector.

High Implementation Costs and Integration Challenges

Deploying AI-driven solutions requires substantial investment in advanced technologies, skilled personnel, and cloud computing infrastructure. Many traditional banks operate on legacy systems that are not easily compatible with modern AI applications, leading to complex and costly integration processes. Additionally, maintaining AI models requires continuous updates, training on new data, and compliance with evolving regulations, further increasing operational expenses.

Smaller banks and financial institutions often struggle with these financial and technical barriers, limiting their ability to fully leverage AI capabilities. The lack of standardized AI frameworks across the banking industry also creates inconsistencies in deployment and scalability. As a result, while AI offers immense benefits, its widespread adoption is hindered by the significant resources and expertise required for successful implementation.

Global AI in Banking Market: Opportunities

Expansion of AI-Driven Financial Inclusion

In many developing regions, a large portion of the population remains unbanked or underbanked due to limited access to traditional banking infrastructure and credit history. AI-powered alternative credit scoring models, which analyze non-traditional data such as mobile phone usage, transaction behavior, and social patterns, enable banks and fintech companies to assess creditworthiness more accurately.

This allows financial institutions to offer loans, insurance, and banking services to previously underserved individuals and small businesses. Additionally, AI-driven chatbots and digital banking platforms reduce the need for physical bank branches, making financial services more accessible through mobile applications. As AI continues to evolve, banks can leverage it to bridge the financial gap, drive economic growth, and create new revenue streams by tapping into emerging markets with untapped customer potential.

Growth of AI-Powered Personalized Banking Services

Consumers expect well-customized financial services that cater to their individual needs, spending habits, and financial goals. AI-powered recommendation engines analyze real-time customer data, transaction history, and behavioral patterns to offer customized financial products such as investment portfolios, savings plans, and credit options. Additionally, AI-driven virtual financial advisors provide personalized insights, budgeting tips, and automated portfolio management, enhancing customer engagement and satisfaction.

Banks leveraging AI for hyper-personalization can improve customer retention, boost cross-selling and up-selling opportunities, and differentiate themselves in a competitive market. As AI technologies continue to advance, integrating predictive analytics and real-time personalization into digital banking platforms will allow financial institutions to create more intuitive and customer-centric banking experiences, driving long-term growth and profitability.

Global AI in Banking Market: Trends

Adoption of Generative AI for Enhanced Banking Operations

Banks are leveraging generative AI models, such as ChatGPT and other advanced language models, to automate customer service, generate personalized financial reports, and assist in complex data analysis. These AI-driven systems can create human-like responses, draft legal and compliance documents, and even generate predictive financial insights based on historical data.

Additionally, generative AI is being used to streamline internal workflows, such as risk assessment, fraud detection, and regulatory reporting, by automating repetitive and time-consuming tasks. The use of

Generative AI in Analytics Market is also contributing to major innovations across sectors, including banking, as it helps institutions make data-backed strategic decisions with greater accuracy and speed.

As banks continue integrating generative AI into their digital platforms, they can improve operational efficiency, reduce costs, and enhance overall customer engagement. With advancements in AI ethics and governance, this trend is expected to drive significant transformation in banking services while ensuring transparency and compliance.

Rise of AI-Powered Autonomous Finance

Autonomous finance leverages machine learning and predictive analytics to automate tasks such as budgeting, bill payments, savings allocation, and investment management. Banks and fintech companies are integrating AI into mobile banking apps and digital platforms to offer self-adjusting financial plans that optimize spending, debt repayment, and wealth accumulation based on real-time user behavior.

AI-powered robo-advisors are also evolving to provide fully automated portfolio management, adjusting asset allocations dynamically in response to market changes. As consumers seek smarter and more convenient financial solutions, autonomous finance is becoming a key differentiator, helping banks enhance customer experience, improve financial literacy, and create seamless, AI-driven financial ecosystems.

Global AI in Banking Market: Research Scope and Analysis

By Component Analysis

The solution-type components are projected to dominate the component type segment, accounting for 59.0% of the market share in 2025. The growing demand for AI-driven solutions in fraud detection, risk assessment, automated decision-making, and customer engagement is a key factor driving this dominance. Banks and financial institutions are increasingly investing in AI software to optimize operations, enhance security, and improve customer service through chatbots, predictive analytics, and algorithmic trading.

Additionally, AI-powered credit scoring models, personalized recommendation engines, and automated loan processing systems are gaining traction, further contributing to the rapid adoption of AI solutions in the banking sector. AI solutions benefit from rapid advances in machine learning, natural language processing, and computer vision technology, enabling financial institutions to develop more sophisticated AI models. Cloud-based AI platforms have seen widespread adoption due to their scalability, cost effectiveness, and capacity for processing vast quantities of financial data in real time.

The services component also remains essential for the successful implementation, integration, and maintenance of AI technologies in the banking sector. AI services comprise consulting, deployment, training, and support services designed to help financial institutions successfully adopt AI-powered systems. Consulting services help banks identify suitable AI apps for their specific needs while seamlessly integrating them with existing IT infrastructure.

While deployment services include setting up AI models on real-time banking data, before customizing solutions in accordance with business objectives and regulatory standards. Financial institutions rely heavily on AI training and support services as part of their operations, as AI systems must remain accurate and efficient to remain profitable. Training services help banking professionals understand AI-driven workflows to leverage insights effectively.

By Technology Type Analysis

Natural Language Processing (NLP) technologies are set to strengthen their market position in the technology type segment, capturing 43.0% of the total market share in 2025. NLP plays an indispensable role in improving customer interactions, automating communication processes, and extracting valuable insights from unstructured financial data. Banks and financial institutions are turning to NLP-powered chatbots and virtual assistants for customer inquiries, transactions, and providing real-time financial advice.

AI-powered tools enhance service efficiency by decreasing wait times, simultaneously handling multiple requests, and creating a personalized customer experience. Furthermore, Natural Language Processing (NLP) technology enables banks to process large volumes of text-based data such as loan agreements, compliance documents, and regulatory reports with greater accuracy and speed. An additional factor driving its adoption is sentiment analysis and risk management applications of NLP. By analyzing customer feedback, online reviews, and social media discussions, banks can accurately gauge market sentiment and customize services accordingly.

Alongside Natural Language Processing (NLP), Machine Learning (ML) and Deep Learning technologies constitute a crucial subsegment of the AI in banking market, enabling advanced analytics, predictive modeling, and automated decision-making. Machine learning algorithms analyze vast datasets to detect trends, assess credit risks, and enhance fraud detection mechanisms. Financial institutions utilizing these models continuously learn from historical data, improving their accuracy over time and using these models to make data-driven lending decisions, optimize investment strategies, and enhance risk assessment frameworks.

Automation underwriting and AI portfolio management are key areas where Machine Learning (ML) technology has transformed traditional banking processes, making them faster, more accurate, and cost-effective than before. Deep learning, a subset of machine learning, takes AI-driven banking applications one step further by processing complex financial data via neural networks. This technology can be especially helpful in detecting financial fraud, as it is capable of recognizing subtle patterns within transaction data that traditional rule-based systems might overlook.

By Application Analysis

Risk Management applications are projected to retain their dominance in the application type segment, accounting for 40.0% of the total market share in 2025. The increasing complexity of financial risks, integrated with the growing threat of fraud, cybersecurity breaches, and regulatory compliance challenges, has fueled the demand for AI-driven risk management solutions. Banks and financial institutions are leveraging artificial intelligence to enhance real-time risk assessment, detect anomalies in financial transactions, and prevent potential threats before they escalate.

AI-powered predictive analytics enable institutions to assess credit risks more accurately by analyzing vast datasets, including historical financial behavior, transaction patterns, and even external economic indicators. This allows lenders to make data-driven decisions, reduce defaults, and optimize loan approvals while ensuring compliance with evolving regulations.

While Risk Management remains the leading application segment, AI-driven customer service solutions are also revolutionizing the banking sector. This subsegment is experiencing rapid expansion as banks are adopting AI-powered chatbots, virtual assistants, and sentiment analysis tools to enhance customer interactions. AI-powered chatbots offer 24/7 assistance for inquiries relating to account balances, transaction history, and loan applications without human interaction.

These intelligent systems improve response times, reduce operational costs, and enhance customer satisfaction by quickly providing instant answers to common inquiries. AI-powered virtual assistants are capable of performing complex tasks such as guiding users through banking processes, automating bill payments, and offering financial planning advice based on user behavior.

By Enterprise Size Analysis

Large enterprises are expected to strengthen their dominance in the enterprise type segment, capturing 75.0% of the total market share in 2025. Financial institutions, including multinational banks, investment firms, and large-scale lending organizations, are at the forefront of AI adoption due to their significant financial resources, advanced digital infrastructure, and stringent regulatory compliance structures. With rising demands for automation, real-time decision-making, and enhanced cybersecurity among large enterprises, they have invested significantly in Artificial Intelligence-powered solutions such as risk assessment models or trading platforms powered by AI.

One of the key factors contributing to the widespread AI adoption in large enterprises is the sheer volume of data they manage. With millions of transactions processed daily, AI-powered analytics tools help these institutions identify market trends, predict financial risks, and enhance customer engagement strategies. Additionally, AI-driven automation streamlines back-office operations, such as loan approvals, fraud detection, and compliance monitoring, allowing large banks to enhance service delivery while maintaining regulatory standards.

While large enterprises lead in AI adoption, small and medium-sized enterprises (SMEs) in the banking sector are also increasingly embracing AI-driven solutions to enhance their competitiveness. Unlike their larger counterparts, SMEs often face resource constraints that limit their ability to invest in expensive AI infrastructure. However, the emergence of cloud-based AI solutions and AI-as-a-Service (AIaaS) has made it more accessible for smaller financial institutions to integrate AI into their operations.

These solutions enable SMEs to leverage AI-powered chatbots for customer service, automate compliance checks, and improve risk management without requiring large-scale infrastructure investments. AI is also transforming the way SMEs offer financial products and services. Many smaller banks and fintech startups use AI-driven alternative credit scoring models to assess loan applicants based on behavioral data, transaction history, and even non-traditional financial indicators. This allows them to provide more inclusive financial services to individuals and small businesses that may not have a traditional credit history.

The AI in Banking Market Report is segmented on the basis of the following

By Component

By Technology

- Natural Language Processing (NLP)

- Machine Learning & Deep Learning

- Computer Vision

- Others

By Enterprise Size

By Application

- Risk Management

- Customer Service

- Virtual Assistant

- Financial Advisory

- Others

Global AI in Banking Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate the global AI in banking market, accounting for

31.5% of total market revenue in 2025. The region's dominance can be attributed to technologically advanced financial institutions, early adoption of AI solutions, and robust regulatory frameworks that encourage innovation while upholding security and compliance standards. Major banks and financial service providers in the US and Canada have been at the forefront of adopting Artificial Intelligence into their operations, taking advantage of machine learning, natural language processing, predictive analytics, and personalized financial services to increase decision-making, customer service, and fraud prevention.

The increasing shift toward digital banking, coupled with the rising demand for personalized financial services, has further accelerated AI adoption across the banking sector. North America's dominance in AI-powered banking lies primarily with its developed fintech ecosystem. The region is home to some of the world's leading financial technology and Artificial Intelligence startups that partner with traditional banks to implement cutting-edge AI solutions.

Region with the Highest CAGR

The Asia-Pacific region is projected to experience the highest compound annual growth rate (CAGR) in the AI in banking market, driven by rapid digital transformation, increasing fintech adoption, and government-led initiatives promoting AI integration in financial services. The region’s banking sector is undergoing a significant shift as financial institutions accelerate AI adoption to enhance customer experience, optimize risk management, and improve operational efficiency.

Countries such as China, India, Japan, and Singapore are at the forefront of AI-driven banking innovations, leveraging advancements in machine learning, natural language processing, and automation to streamline processes and offer personalized financial services.

One of the primary factors fueling the rapid growth of AI in banking across Asia-Pacific is the region’s expanding digital banking ecosystem. The growing penetration of mobile banking applications and the widespread use of digital payment solutions have created a strong demand for AI-powered services. Banks are integrating AI-based chatbots, robo-advisors, and automated credit risk assessment tools to cater to the region’s diverse and tech-savvy population.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global AI in Banking Market: Competitive Landscape

The global competitive landscape of AI in banking is characterized by the presence of major financial institutions, technology giants, and fintech startups striving to integrate artificial intelligence into banking operations. As AI adoption accelerates, competition within the market is intensifying, with companies focusing on innovation, strategic partnerships, and acquisitions to strengthen their position. Leading banks, including JPMorgan Chase, Bank of America, and HSBC, are heavily investing in AI-powered automation, predictive analytics, and fraud detection to enhance efficiency and customer experience.

These institutions leverage AI-driven chatbots, machine learning algorithms, and advanced data analytics to optimize decision-making and reduce operational costs. IBM, Microsoft, Google and Amazon Web Services (AWS) play an instrumental role in shaping the AI-powered banking sector.

These firms provide cloud-based AI solutions, cognitive computing capabilities, and AIaaS platforms that help banks integrate AI without significant infrastructure investments. IBM Watson offers AI-powered risk management and financial advisory solutions, while Google Cloud's AI tools assist banks with real-time fraud detection and automated compliance monitoring.

Microsoft Azure and AWS both offer AI-powered financial services solutions designed to strengthen data security, customer insights, and operational automation. As banks expand their AI capabilities, partnering with these tech titans remains a crucial growth strategy. Fintech startups and AI-driven financial service providers are also reshaping the competitive dynamics of the banking industry. Companies such as Upstart, Zest AI, and Kabbage use AI-powered lending platforms to assess credit risk and provide personalized loan offerings, challenging traditional banking models.

Some of the prominent players in the Global AI in Banking are

- Amazon Web Services, Inc.

- Capital One

- Cisco Systems, Inc.

- FAIR ISAAC CORPORATION (FICO)

- Goldman Sachs

- International Business Machines Corporation

- JPMorgan Chase & Co.

- NVIDIA Corporation

- RapidMiner

- SAP SE

- Upstart

- AlphaSense

- Enova International

- Kreditech

- Zest AI

- Temenos

- Kasisto

- DataRobot

- Ayasdi

- Feedzai

- Other Key Players

Global AI in Banking Market: Recent Developments

- January 2025: Bank of America acquired Zest AI, a leading provider of AI-powered credit underwriting solutions. This acquisition enables the bank to enhance its lending decision-making by leveraging AI-driven risk assessment models. With Zest AI’s expertise, Bank of America aims to improve loan approval accuracy, reduce bias in lending, and provide more personalized credit offerings.

- November 2024: Citigroup acquired Feedzai, a prominent AI-based risk management platform specializing in fraud detection and prevention. The acquisition strengthens Citigroup’s ability to combat financial crimes, ensuring real-time transaction monitoring with AI-driven analytics. By integrating Feedzai’s machine learning algorithms, Citigroup enhances its cybersecurity framework, protecting customers from evolving fraud threats.

- May 2024: HSBC acquired AION, an AI-powered wealth management platform, to expand its digital financial advisory services. AION’s AI-driven investment insights and automated portfolio management tools allow HSBC to provide more customized financial solutions. The acquisition aligns with HSBC’s strategy of enhancing its AI-based banking ecosystem for high-net-worth clients.

- March 2024: Goldman Sachs acquired GreenSky, a fintech company known for its AI-driven consumer lending solutions. The acquisition strengthens Goldman Sachs’ consumer finance segment by integrating AI-based credit risk assessment and loan origination automation. This move helps the bank streamline its lending process while expanding its digital banking services.

- July 2024: Barclays acquired Simudyne, an AI-based simulation platform specializing in risk modeling and financial scenario analysis. This acquisition enables Barclays to use AI-driven simulations for stress testing, fraud detection, and market analysis. By leveraging Simudyne’s advanced technology, Barclays enhances its decision-making capabilities in volatile financial environments.

- October 2023: Mastercard acquired Aiia, a European open banking technology provider, to boost its AI-driven payment processing solutions. Aiia’s data connectivity platform allows Mastercard to facilitate seamless financial transactions and improve payment security. The acquisition aligns with Mastercard’s vision of expanding AI-powered financial services and enhancing digital banking efficiency.

- August 2023: Wells Fargo acquired Kasisto, an AI conversational banking platform, to enhance its virtual assistant and chatbot services. This acquisition helps the bank improve customer engagement by offering AI-driven, real-time support for banking inquiries. By leveraging Kasisto’s natural language processing (NLP) technology, Wells Fargo aims to automate customer service while ensuring personalized banking experiences.

- September 2023: JPMorgan Chase acquired Frank, a financial planning platform, to strengthen its AI-driven student banking services. The acquisition allows JPMorgan to provide better digital tools for student loans, financial aid, and personalized banking experiences for young consumers. By integrating Frank’s AI-powered financial planning tools, JPMorgan enhances its education-focused banking segment.

- July 2023: Visa acquired Tink, an open banking platform, to strengthen its AI capabilities in financial data aggregation and payment processing. Tink’s AI-powered analytics tools enable Visa to offer smarter financial services and improved transaction security. This acquisition supports Visa’s broader strategy of using AI to optimize digital payment experiences and financial insights.

- April 2023: Morgan Stanley acquired Selerity, an AI-powered financial news and data analytics firm, to enhance its market intelligence capabilities. Selerity’s AI-driven real-time news analysis helps Morgan Stanley optimize investment strategies and decision-making. This acquisition enables the bank to leverage AI for deeper financial insights and improved risk assessment.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 26.7 Bn |

| Forecast Value (2034) |

USD 339.1 Bn |

| CAGR (2025-2034) |

32.6% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 7.1 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Solutions and Services), By Technology (Natural Language Processing (NLP), Machine Learning & Deep Learning, Computer Vision, and Others), By Application (Risk Management, Customer Service, Virtual Assistant, and Others), By Enterprise Size (Large Enterprises, and SMEs) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Amazon Web Services, Inc., Capital One, Cisco Systems, Inc., FAIR ISAAC CORPORATION (FICO), Goldman Sachs, International Business Machines Corporation, JPMorgan Chase & Co., NVIDIA Corporation, RapidMiner, SAP SE, Upstart, AlphaSense, Enova International, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global AI in banking market?

▾ The global AI in banking market size is estimated to have a value of USD 26.7 billion in 2025 and is expected to reach USD 339.1 billion by the end of 2034.

What is the size of the US AI in banking market?

▾ The US AI in banking market is projected to be valued at USD 7.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 77.8 billion in 2034 at a CAGR of 30.5%.

Which region accounted for the largest global AI in banking market?

▾ North America is expected to have the largest market share in the global AI in banking market with a share of about 31.5% in 2025.

Who are the key players in the global AI in banking market?

▾ Some of the major key players in the global AI in banking market are Amazon Web Services, Inc., Capital One, Cisco Systems, Inc., FAIR ISAAC CORPORATION (FICO), Goldman Sachs, International Business Machines Corporation, and many others.

What is the growth rate in the global AI in banking market?

▾ The market is growing at a CAGR of 32.6 percent over the forecasted period.