Market Overview

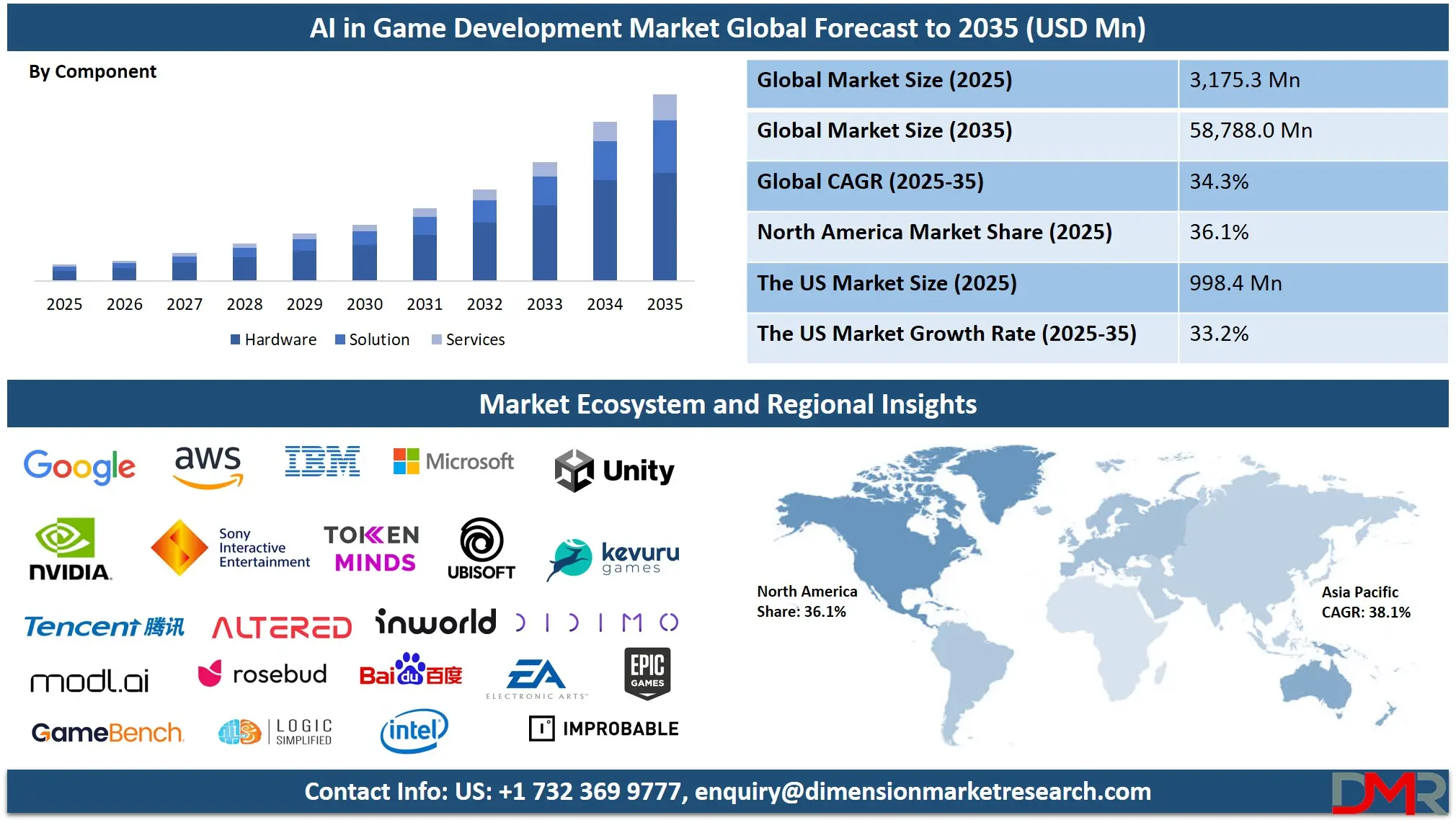

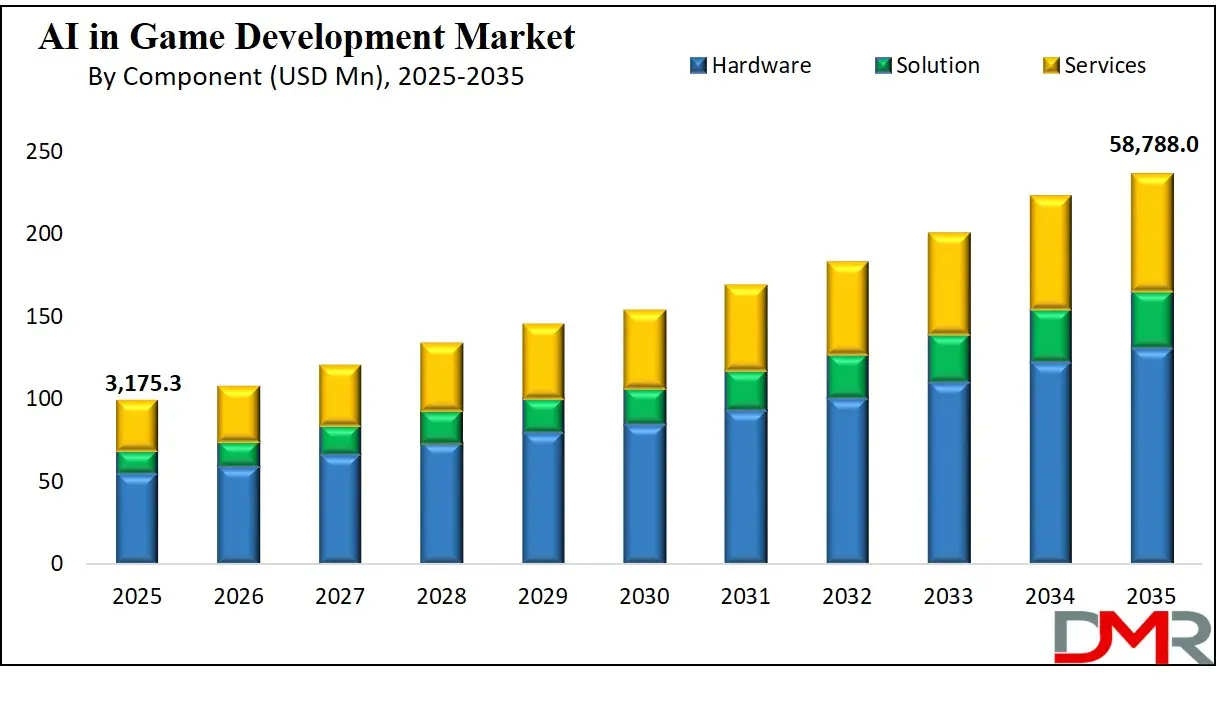

The Global AI in Game Development Market is estimated to be valued at USD 3,175.3 million in 2025 and is further anticipated to reach USD 58,788.0 million by 2035 at a CAGR of 34.3%.

AI is reshaping game production pipelines: machine learning and deep learning accelerate procedural content generation, realistic NPC behavior, voice-to-speech and speech-to-voice systems, automated QA, and intelligent matchmaking, enabling studios to shorten iteration cycles and deliver personalization at scale. This transformation is supported by rising internet penetration and mobile access, with nearly two-thirds of the global population now online, expanding the player base for AI-driven experiences.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Key trends include on-device inference for latency-sensitive gameplay, cloud AI integration for large-scale models and live game operations, synthetic data creation, generative assets for art and dialogue, and advanced animation systems. These trends are fueling new monetization models such as dynamic content updates, adaptive downloadable content, and AI-powered live operations.

Opportunities are evident in procedural storytelling, NPCs that learn from player behavior, real-time voice cloning and localization for global launches, personalized difficulty balancing, and AI democratization tools for indie developers. Growth is amplified by global digital adoption and younger demographics who demand immersive and interactive entertainment experiences.

Restraints remain in the form of high computing and data costs, ethical issues linked to deepfakes and voice cloning, concerns around online safety and moderation for AI-driven agents, and a shortage of hybrid ML-game design talent. Regulatory and IP-related questions regarding AI-generated content also present hurdles.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Looking ahead, AI adoption in game development is poised to grow rapidly, driven by expanded digital infrastructure, rising developer tool availability, and global investment in artificial intelligence research. Regions with strong broadband, cloud infrastructure, and youthful populations are expected to see the fastest adoption, with game studios worldwide integrating AI as a core driver of innovation and competitiveness.

The US AI in Game Development Market

The US AI in Game Development Market is projected to be valued at USD 998.4 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 17,090.9 million in 2035 at a CAGR of 33.2%.

The U.S. market benefits from a dense concentration of developer talent, advanced cloud infrastructure, and a highly engaged digital population. The workforce in computer and information technology fields continues to expand, supplying the engineers, data scientists, and technical artists required for AI integration in gaming. Employment projections indicate strong demand for software and AI-related roles, ensuring a steady pipeline of talent for the industry.

Broadband penetration and nationwide internet initiatives are reducing digital divides, expanding the domestic player base, and enabling low-latency cloud gaming. This creates fertile ground for studios to implement AI systems in live service games, adaptive matchmaking, and procedural content generation.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Demographically, the U.S. combines scale with diversity. Metropolitan hubs such as the West Coast, Seattle, Austin, and New York house clusters of AI and gaming expertise. A growing STEM graduate population, supported by federal education programs and workforce development initiatives, ensures ongoing availability of skilled professionals. This unique mix of digital adoption and talent development supports innovation in game AI.

Public programs that expand internet access, STEM education, and digital literacy provide institutional support that strengthens the domestic AI ecosystem. Federal initiatives also encourage innovation through research funding, tax incentives, and partnerships between universities and the private sector. Combined, these factors position the U.S. as a leading hub for AI in game development, with unmatched scale, talent, and infrastructure to sustain long-term market growth.

The Europe AI in Game Development Market

The Europe AI in Game Development Market is estimated to be valued at USD 905.9 million in 2025 and is further anticipated to reach USD 21,458.5 million by 2035 at a CAGR of 35.1%.

Europe’s AI in gaming market is underpinned by strong digital infrastructure, high household broadband penetration, and a digitally literate population with high levels of online engagement. With widespread internet adoption, European game studios have access to a broad and connected player base, ideal for scaling AI-driven live services and interactive experiences.

Europe also benefits from robust institutional frameworks. EU digital strategies, public innovation funds, and national R&D incentives support AI tool development for content generation, localization, and analytics. This collaborative environment encourages partnerships between universities, research institutes, and private studios, helping accelerate technology transfer into practical applications like procedural environments, NPC behavior models, and real-time language processing.

Talent availability is reinforced by Europe’s strong university system and specialized programs in computer science, artificial intelligence, and digital arts. This creates a diverse labor pool that can support both large-scale publishers and indie developers in adopting AI-enhanced production pipelines.

Policy and regulation play a defining role in Europe’s trajectory. The region’s strong data protection frameworks and AI governance discussions ensure that AI adoption aligns with privacy and safety standards. This encourages on-device AI processing and compliance-first design choices, fostering new niches for middleware companies specializing in secure and ethical AI tools.

Overall, Europe’s mix of digital readiness, regulatory clarity, and institutional support creates an environment conducive to steady growth in AI in game development. Studios are leveraging these advantages to expand global reach and bring advanced AI-powered features to increasingly sophisticated European audiences.

The Japan AI in Game Development Market

The Japan AI in Game Development Market is projected to be valued at USD 121.7 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 2,963.5 million in 2035 at a CAGR of 37.8%.

Japan’s gaming industry combines strong cultural IP, established global franchises, and a robust console and mobile market, making it a fertile ground for AI adoption. High internet penetration and nearly universal smartphone usage ensure that AI-enhanced features can reach players seamlessly across platforms. Urban centers like Tokyo and Osaka concentrate tech talent and gaming communities, creating powerful innovation clusters.

Demographically, Japan faces an ageing population but maintains high per-capita game consumption and deep engagement with digital entertainment. These dynamics push studios to innovate with AI-driven localization, real-time voice translation, and procedural storytelling, enabling Japanese content to reach wider international audiences. Government emphasis on promoting digital content exports further incentivizes the integration of AI into production pipelines.

Japan’s ecosystem benefits from strong institutional support through national policies that encourage research and development in digital technologies. University-industry collaborations and government-funded initiatives strengthen the middleware and tool ecosystem, enabling developers to access advanced AI frameworks for testing and deployment.

Challenges such as a shrinking domestic workforce and competition for AI talent are offset by robust infrastructure, cultural demand for innovative games, and government-backed strategies to expand overseas content distribution. These conditions encourage studios to adopt AI solutions that lower production costs, streamline localization, and enhance user experiences for both domestic and global audiences.

Japan is therefore positioned as a key regional player in AI in game development, with its legacy of game innovation, strong consumer market, and strategic push for global digital content exports fueling adoption over the next decade.

Global AI in Game Development Market: Key Takeaways

- Market Value: The global AI in Game Development market size is expected to reach a value of USD 58,788.0 million by 2035 from a base value of USD 3,175.3 million in 2025 at a CAGR of 34.3%.

- By Game Genre Type Segment Analysis: The Action and Adventure game genre type is poised to consolidate its dominance in the game genre type segment, capturing 25.5% of the total market share in 2025.

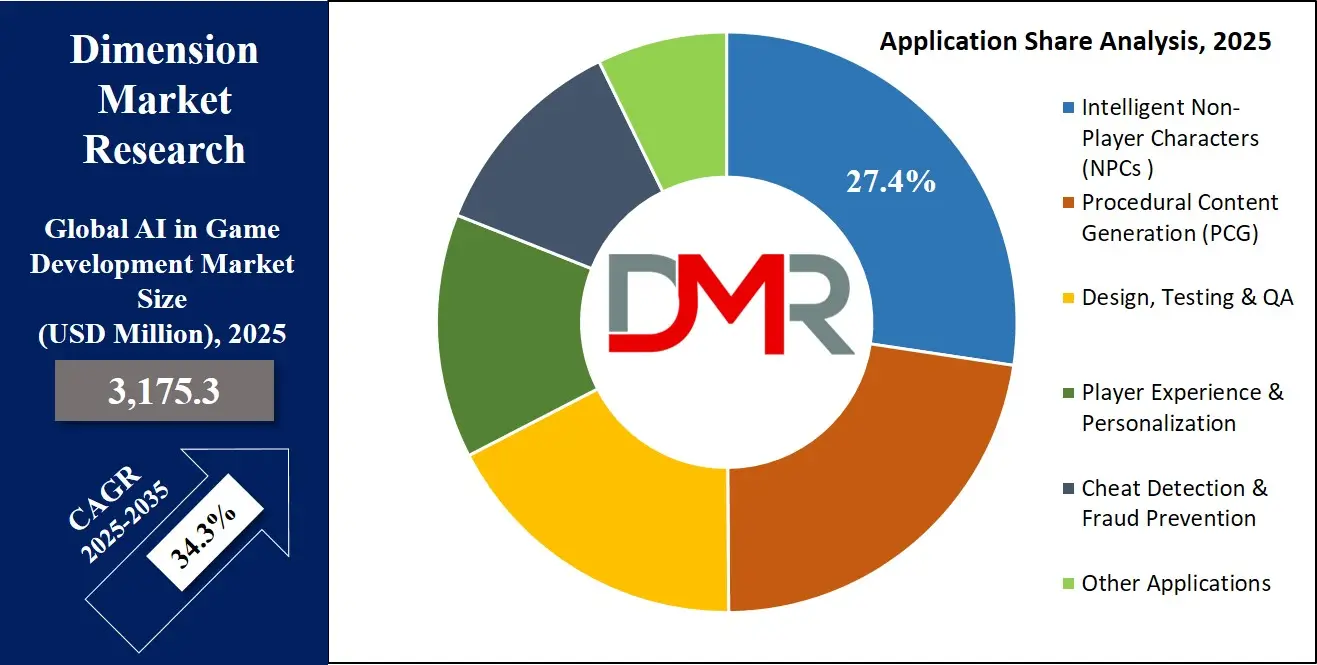

- By Application Type Segment Analysis: Intelligent Non-Player Characters (NPCs ) applications are anticipated to maintain their dominance in the application type segment, capturing 27.4% of the total market share in 2025.

- By Platform Type Segment Analysis: Mobile platforms are poised to consolidate their market position in the platform type segment, capturing 33.6% of the total market share in 2025.

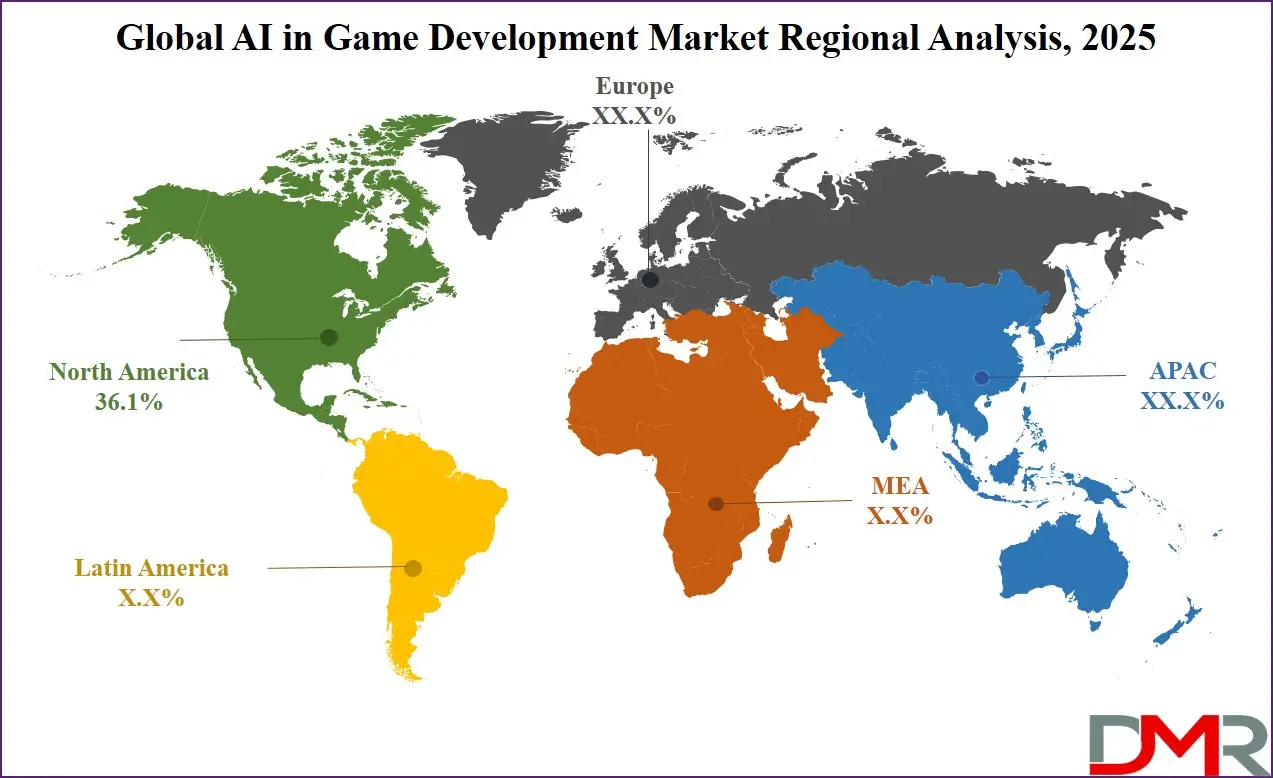

- Regional Analysis: North America is anticipated to lead the global AI in Game Development market landscape with 36.1% of total global market revenue in 2025.

- Key Players: Some key players in the global AI in game development market are Microsoft Corporation, Activision Blizzard, Inc., IBM Corporation, NetEase, Inc., Google LLC, Baidu, Inc., Intel Corporation, Ubisoft Entertainment SA, Amazon Web Services, Inc., NVIDIA Corporation, Epic Games, Inc., Tencent Holdings Limited, and Other Key Players

Global AI in Game Development Market: Use Cases

- AI-Driven Procedural Content Generation: Game studios use AI algorithms to generate vast, dynamic game environments without manual design. AI-powered tools like GANs (Generative Adversarial Networks) and procedural algorithms help create landscapes, cities, dungeons, and missions in open-world and role-playing games. For example, No Man’s Sky utilizes procedural generation to create unique planets, flora, and creatures, providing an infinite, ever-changing universe for players.

- Smart NPCs and Adaptive Enemy AI: AI enhances the behavior of non-player characters (NPCs) by making them more reactive and realistic. In modern games, AI-powered enemies adapt to player actions, learning from past interactions to improve combat strategies. For instance, The Last of Us Part II uses AI to make enemies communicate, strategize, and dynamically react to changing scenarios, offering a more immersive and challenging experience.

- AI-Powered Game Testing and Bug Detection: Automated AI testing tools streamline game development by identifying bugs, glitches, and balancing issues in real-time. Machine learning models analyze gameplay patterns to detect anomalies, reducing the need for extensive human playtesting. Ubisoft’s Commit Assistant is an AI tool that predicts and prevents coding errors, helping developers fix issues before they impact the final game release.

- Personalized Gaming Experiences: AI-driven analytics help developers customize gaming experiences based on player behavior. Machine learning models analyze in-game actions, preferences, and skill levels to dynamically adjust difficulty, recommend content, or offer tailored challenges. EA’s FIFA series uses AI to personalize difficulty settings, adjusting gameplay mechanics based on a player’s performance to ensure a balanced and engaging experience.

Global AI in Game Development Market: Stats & Facts

International Telecommunication Union (ITU)

- 67% of the world’s population (about 5.4 billion people) were using the Internet in 2023.

- ITU estimates about 5.5 billion people (≈68% of global population) were using the Internet in 2024.

World Bank (World Development Indicators / Data)

- The World Bank’s “Individuals using the Internet (% of population)” is maintained as an official global indicator used to track digital reach across countries (time-series coverage for 1960–present).

- World Bank indicators show R&D expenditure (% of GDP) is tracked for all countries and is used to compare national R&D intensity (official dataset used by analysts and governments for policy).

Eurostat (European Commission statistical office)

- In 2023, 93.1% of EU households had internet access.

- In 2023, 95% of households in EU cities had internet access, compared with 93% in towns/suburbs and 91% in rural areas.

- 45.2% of EU enterprises purchased cloud computing services in 2023 (an increase of ~4.2 percentage points vs. 2021).

U.S. Census Bureau / American Community Survey (ACS)

- Latest ACS figures show approximately 89.7% of U.S. households report a broadband internet subscription (ACS broadband/computer & internet use tables).

- ACS-derived estimates indicate very high computer and internet use among U.S. households, supporting large domestic online user bases for games and live services.

U.S. Bureau of Labor Statistics (BLS)

- The median annual wage for computer and information technology occupations was USD 105,990 (May 2024).

- BLS occupational data provide employment counts and projections for computing occupations that feed talent-supply forecasts used by studios and tool vendors.

National Science Foundation (NSF) — National Center for Science and Engineering Statistics (NCSES)

- The U.S. STEM workforce comprised about 36.8 million people in 2021 (about 24% of total U.S. employment), a core talent pool for AI and game development.

- NSF reports global total R&D expenditures reached roughly USD 3.1 trillion (PPP) in 2022, indicating the large public/private investment base that underpins AI capability.

- NSF/NSB notes ~190,000 AI-related patents were granted worldwide between 2000 and 2022, with about 40,000 AI patents granted to inventors in China and about 9,000 to inventors in the United States in 2022 (patent distribution detail).

Organisation for Economic Co-operation and Development (OECD)

- OECD statistics show aggregate R&D intensity across OECD members is regularly tracked and reported (used to benchmark national competitiveness); recent OECD reporting places OECD-wide GERD around ~2.7% of GDP (latest consolidated reporting).

- OECD data and country tables are an authoritative source on research personnel and R&D spending that inform national AI and digital policy planning.

World Intellectual Property Organization (WIPO)

- WIPO reports ~54,000 “GenAI-related” patent families filed globally (2014–2023) and notes a rapid rise in generative-AI filings in recent years.

- WIPO notes that cumulative scholarly output tied to AI/GenAI exceeds 1.6 million scientific publications and hundreds of thousands of patent filings (a broad measure of research intensity).

United States Patent and Trademark Office (USPTO)

- The USPTO’s Artificial Intelligence Patent Dataset (AIPD) extension identifies AI content across 15.4 million U.S. patent documents published through 2023 (official dataset used by policymakers).

- USPTO calendar summaries show approximately 312,000–348,000 patent publications/grants in recent single-year tallies (official yearly patent totals used to gauge innovation activity).

United Nations — Population Division (World Population Prospects)

- UN population projections are the official baseline for demographic structure; the World Population Prospects provides country-level age and working-age population series used to estimate youth cohorts (key gamer age groups) for all countries.

- UN projections indicate which countries will have expanding or contracting working-age and youth populations, affecting long-run demand patterns for games and digital entertainment.

Japan — Ministry of Internal Affairs & Communications (MIC) / METI (Ministry of Economy, Trade & Industry)

- Official Japan telecom/communications datasets report mobile cellular subscriptions well above 100 per 100 people (Japan reported ~167 mobile subscriptions per 100 people in 2022), indicating very high mobile reach.

- METI and national digital content whitepapers document high broadband and mobile adoption and government programs supporting digital content exports — institutional context that supports AI-enabled localization and distribution.

Eurostat / EU Digital Policy (combined institutional facts)

- EU public funding and digital strategies (Horizon/EU innovation programmes) are explicitly targeted toward AI, cloud, and digital content R&D, providing grant and testbed resources for studios and middleware providers.

- EU data-protection and AI governance initiatives create regulatory constraints and compliance requirements that influence how AI features for games are engineered (e.g., privacy-preserving design and on-device processing).

Global AI in Game Development Market: Market Dynamics

Global AI in Game Development Market: Driving Factors

Rising Demand for Realistic and Immersive Gaming Experiences

Modern gamers expect high levels of realism in graphics, character interactions, and game physics, pushing developers to integrate advanced AI-driven technologies. AI-powered procedural animation enhances character movements, ensuring they react naturally to in-game physics, terrain, and environmental changes. Additionally, AI-driven behavioral modeling allows NPCs to exhibit human-like decision-making, making interactions more authentic. This factor is particularly evident in story-driven and open-world games, where AI generates unique player-driven narratives. Games like Red Dead Redemption 2 and Cyberpunk 2077 use AI to create dynamic, evolving worlds where NPCs respond to the player’s choices in real time, increasing overall engagement.

Growth of AI-Powered Cloud Gaming and Game Streaming

Platforms like Xbox Cloud Gaming (xCloud), NVIDIA GeForce Now, and PlayStation Now are leveraging AI to enhance streaming efficiency, reduce latency, and dynamically adjust game resolution based on network conditions. AI-based upscaling technologies, such as NVIDIA’s DLSS (Deep Learning Super Sampling), use machine learning to render high-quality images with lower processing power, enabling smooth gameplay even on less powerful devices. Additionally, AI-driven predictive analytics helps optimize server load distribution, ensuring seamless multiplayer gaming experiences with minimal lag. As cloud gaming continues to gain popularity, AI integration is becoming essential for delivering high-performance, on-demand gaming experiences to a global audience.

Global AI in Game Development Market: Restraints

High Implementation Costs and Complex Integration

Developing AI-driven features requires specialized expertise, advanced computing power, and extensive data training, all of which add significant costs to the development process. Small and mid-sized game studios often struggle to afford AI-powered tools like procedural content generation, deep learning-based animation, and real-time NPC behavior modeling. Additionally, integrating AI into established game engines like Unreal Engine or Unity requires custom-built solutions, which further fuels development time and resource allocation. These challenges can slow down AI adoption, particularly among independent developers and smaller gaming companies.

Ethical Concerns and Data Privacy Regulations

AI-driven personalization and behavior tracking in gaming raise ethical concerns and data privacy challenges, particularly in markets like the U.S. and Europe, where strict regulations such as the CCPA (California Consumer Privacy Act) and GDPR (General Data Protection Regulation) apply. AI systems collect and analyze large amounts of player data, including gameplay behavior, preferences, and in-game decisions, to enhance user experiences. However, concerns over data misuse, unauthorized tracking, and potential AI biases have sparked debates about the ethical implications of AI in gaming. Stricter data privacy laws are forcing companies to implement transparent data collection practices, encryption methods, and opt-in consent models, which can slow down AI innovation and uplift compliance costs for game developers.

Global AI in Game Development Market: Opportunities

Expansion of AI-Driven Metaverse and VR/AR Gaming

AI can enhance real-time interactions, create intelligent virtual NPCs, and dynamically adapt virtual worlds based on player actions. In metaverse gaming, AI-driven avatars can learn and evolve, providing a more personalized and interactive experience. Companies like Meta (Horizon Worlds), Epic Games (Fortnite Metaverse), and Roblox are investing in AI to build expansive, user-driven virtual environments. Additionally, AI-powered gesture recognition, voice processing, and real-time spatial mapping are revolutionizing AR/VR gaming by making interactions more intuitive and lifelike.

Growth of AI-Powered Game Development Tools for Indie Developers

AI-powered platforms like GPT-4 for scriptwriting, NVIDIA Omniverse for real-time collaboration, and Unity’s AI-assisted game design tools are lowering the barriers to entry for smaller teams. AI can automate asset creation, game testing, and procedural environment generation, enabling indie developers to produce high-quality games with fewer resources. As AI technology becomes more accessible through cloud-based services and open-source frameworks, indie game developers can compete with larger studios, fostering innovation and creativity in the industry.

Global AI in Game Development Market: Trends

AI-Powered Hyper-Personalization in Gaming

Machine learning models analyze real-time data to adjust difficulty levels, recommend in-game content, and create personalized storylines. Games like FIFA and Call of Duty already implement AI-driven adaptive difficulty to ensure a balanced experience for players. Additionally, AI-powered voice recognition and emotion detection are being integrated into games to modify NPC responses and in-game environments based on a player’s emotional state, making gaming more immersive and interactive.

Generative AI for Content Creation

The use of generative AI in game development is gaining momentum, allowing developers to automate content creation, from textures and animations to entire game levels and dialogues. AI models like OpenAI’s DALL·E and DeepMind’s GATO are being explored to generate unique artwork, assets, and storytelling elements dynamically. This trend significantly reduces development time and costs while enabling the creation of more diverse and expansive game worlds. Studios are also experimenting with AI-driven procedural storytelling, where AI dynamically generates plot twists and character interactions based on player choices, offering a unique narrative experience for every player.

Global AI in Game Development Market: Research Scope and Analysis

By Component Analysis

Within the AI in-game development market, the Solution segment is anticipated to hold dominance over hardware and services. Solutions encompass AI-powered engines, middleware, development kits, and specialized software frameworks that directly influence how games are designed, tested, and delivered. Game developers increasingly depend on AI-based solutions for intelligent NPC behavior, procedural content generation, speech synthesis, and adaptive difficulty balancing. Unlike hardware, which is capital-intensive and often commoditized, or services, which are tailored and limited in scalability, solutions are reusable, customizable, and highly adaptable across genres and platforms.

The rapid growth of generative AI frameworks and APIs further accelerates the demand for AI solutions, enabling developers to integrate natural language dialogue systems, real-time localization, and automated content pipelines without building systems from scratch. In particular, tools like Unity ML-Agents, Unreal Engine AI toolsets, and startup-driven middleware solutions dominate the workflows of both AAA studios and indie developers.

The appeal of the solution segment is also tied to its ability to reduce time-to-market and development costs, providing automated QA, bug detection, and AI-assisted design that streamlines production. Additionally, with the rise of cloud-based platforms and AI-as-a-service models, adoption barriers are lowered for smaller studios. The cumulative effect is that solutions become the backbone of AI integration across the industry, consistently outpacing hardware adoption and service reliance. This dominance is expected to strengthen further as cloud deployment and generative design APIs expand globally, fueling scalable AI-driven innovation in gaming.

By Game Genre Analysis

The Action and Adventure game genre is projected to dominate the AI in game development market, projected to hold 25.5% of the total market share in 2025. The Action and Adventure genre dominates the AI in-game development market due to its broad audience appeal, dynamic gameplay mechanics, and heavy reliance on AI systems to enhance immersion. Unlike niche genres, action, and adventure titles attract diverse demographics across mobile, console, and PC platforms, providing the largest addressable market for AI integration. These games typically require intelligent NPCs, adaptive combat systems, and procedural environments, which are all powered by AI-driven systems.

Titles in this category often prioritize storytelling interwoven with real-time gameplay, making AI crucial for procedural narrative adjustments, context-aware NPC interactions, and environment generation. Major franchises such as Assassin’s Creed, The Legend of Zelda, and Uncharted exemplify how adaptive AI keeps players engaged by responding dynamically to player choices and playstyles. The genre’s commercial success also encourages heavy investment in AI innovations, as publishers aim to differentiate with lifelike characters, immersive worlds, and evolving missions.

Another driver of dominance is the genre’s suitability for AI-driven personalization. Action-adventure games frequently incorporate scalable difficulty adjustment and mission branching, features enhanced by machine learning models analyzing player behavior. Combined with high engagement and replayability, AI integration becomes a competitive necessity rather than an optional feature.

While RPGs and shooters also leverage AI heavily, their audiences are more segmented. Action and adventure games, however, occupy a universal sweet spot where AI-enhanced immersion drives both narrative depth and mass-market appeal, ensuring the segment maintains dominance within the AI-driven gaming landscape.

By Platform Analysis

Mobile gaming is anticipated to dominate the AI in-game development market, capturing 33.6% of the total market share in 2025. In terms of platforms, Mobile gaming dominates the AI in-game development market, surpassing PC, console, AR/VR, and cloud. The reason lies in accessibility, affordability, and global reach. Mobile devices account for the majority of the gaming population worldwide, particularly in Asia-Pacific and emerging markets, where smartphones are the primary means of digital entertainment.

AI plays a crucial role in mobile gaming by powering personalized recommendations, adaptive difficulty scaling, and player behavior analytics, which directly enhance user retention and monetization. Free-to-play models, which dominate mobile, rely heavily on AI algorithms to optimize in-game economies, manage ads, and predict user spending patterns. AI-driven analytics enable developers to maximize engagement through tailored content, dynamic challenges, and event-based updates.

Moreover, mobile games often incorporate lightweight AI models optimized for on-device performance, minimizing latency while enhancing real-time decision-making. Advances in edge AI and 5G connectivity further strengthen mobile’s dominance, enabling richer NPC interactions and cloud-assisted features even in resource-constrained devices.

Unlike console and PC markets, where adoption may be limited by hardware cost and geographic concentration, mobile platforms reach billions of users. AR/VR and cloud gaming are promising but remain niche due to infrastructure and affordability challenges. Mobile AI ecosystems benefit from seamless integration with app stores, advertising networks, and cloud analytics services, reinforcing their scale advantage.

Thus, mobile’s sheer user base, monetization potential, and reliance on AI-driven personalization make it the undisputed leader in platform dominance for AI in game development.

By Application Analysis

The Intelligent Non-Player Characters (NPCs ) application is expected to maintain its dominance in the AI in-game development market, securing 27.4% of the total market share in 2025. Within applications, Intelligent Non-Player Characters (NPCs) dominate the AI in-game development market. NPCs represent the most direct and visible use of AI in gaming, shaping player engagement, immersion, and narrative flow. From simple enemies with pathfinding to advanced characters with adaptive decision-making and natural language dialogue, NPCs are central to gameplay mechanics across nearly all genres.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Developers prioritize NPC intelligence because it directly impacts the player’s perception of realism and challenge. Machine learning models and reinforcement learning systems now allow NPCs to adapt strategies based on player actions, creating dynamic encounters that maintain replayability. Generative AI further enhances NPCs with unscripted dialogue, lifelike voice synthesis, and emotional responsiveness, expanding beyond combat roles into storytelling, companionship, and co-op experiences.

The dominance of NPC applications is reinforced by their cross-genre necessity. Whether in action, RPG, shooter, or simulation titles, NPCs function as allies, adversaries, or world inhabitants. Studios increasingly market AI-driven NPCs as a competitive differentiator, as players demand deeper immersion and more meaningful interactions.

While procedural content generation, testing/QA automation, and personalization are growing rapidly, they remain less visible to the end-user compared to NPCs. Fraud prevention tools also play an important role, but function in the background. By contrast, NPC intelligence is front-facing and player-centric, making it the application where AI delivers maximum value perception. This ensures Intelligent NPCs maintain their dominance in the AI in game development market, driving both consumer engagement and industry investment.

The AI in Game Development Market Report is segmented on the basis of the following:

By Component

- Hardware

- Solution

- Services

By Game Genre

- Action and Adventure

- Role-Playing Games (RPGs)

- Shooter (FPS/TPS)

- Simulation and Strategy

- Sports and Racing

- Other Games

By Platform

- Mobile

- PC

- Console

- AR/VR

- Cloud and Streaming Gaming

By Application

- Intelligent Non-Player Characters (NPCs)

- Procedural Content Generation (PCG)

- Design, Testing & QA

- Player Experience & Personalization

- Cheat Detection & Fraud Prevention

- Other Applications

Global AI in Game Development Market: Regional Analysis

Region with the Largest Revenue Share

The North America region is projected to dominate the AI in game development market, accounting for 36.1% of the total global market revenue in 2025. North America dominates the AI in game development market due to its strong technological ecosystem, mature gaming industry, and leadership in AI research and development. The U.S. and Canada are home to some of the world’s largest gaming companies, including Microsoft, Electronic Arts, Activision Blizzard, and Take-Two Interactive, which heavily invest in integrating AI for design, NPC intelligence, and player personalization. Silicon Valley’s AI ecosystem, combined with access to world-class research institutions and venture capital, enables game studios to adopt advanced machine learning, natural language processing, and generative AI technologies faster than other regions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The widespread adoption of high-performance gaming consoles and PCs further reinforces North America’s dominance, as developers leverage AI to create highly immersive and competitive experiences tailored for this advanced user base. Additionally, the region is a leader in cloud gaming services and streaming platforms such as Xbox Cloud Gaming and NVIDIA GeForce Now, both of which rely on AI-driven optimization for rendering, latency reduction, and personalized content delivery.

Strong partnerships between gaming studios and AI-focused startups also accelerate innovation, with companies developing middleware solutions that enhance procedural content generation and real-time testing. The robust esports ecosystem in the U.S. amplifies demand for AI-driven cheat detection and fraud prevention solutions.

Overall, North America’s combination of financial strength, technical expertise, and consumer readiness creates an environment where AI in gaming thrives, securing the region’s dominance in market share.

Region with the Highest CAGR

Asia-Pacific is anticipated to exhibit the highest CAGR in the AI in game development market due to its massive gamer population, rapid mobile adoption, and increasing investments in advanced gaming ecosystems. China, Japan, South Korea, and India represent the region’s core growth engines, with billions of active players driving unprecedented demand for AI-driven personalization, adaptive difficulty, and intelligent NPCs.

Mobile gaming, which dominates the APAC gaming landscape, is particularly conducive to AI adoption. Developers in China and Southeast Asia use AI extensively for real-time analytics, in-game personalization, and monetization strategies, boosting both player engagement and revenue models. The rising popularity of cloud gaming platforms in the region, supported by 5G infrastructure rollouts, further accelerates AI integration by enabling low-latency, cloud-assisted AI features even on mid-tier devices.

Japan and South Korea lead in AR/VR and immersive gaming, where AI enhances lifelike environments, NPC realism, and narrative interactivity. Meanwhile, India’s fast-growing developer ecosystem benefits from AI-as-a-service platforms and open-source AI tools, democratizing access for indie studios and smaller developers. Regional giants such as Tencent, NetEase, and Sony are spearheading AI innovations, from procedural content generation to AI-powered anti-cheat systems, and expanding their influence globally.

Government-backed initiatives, such as China’s AI development strategy and South Korea’s smart gaming investments, create a policy-driven boost for adoption. With its large consumer base, strong mobile-first ecosystem, and aggressive AI adoption strategies, Asia-Pacific continues to register the fastest growth, establishing itself as the most dynamic and rapidly expanding market for AI in game development.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global AI in Game Development Market: Competitive Landscape

The AI in game development market is highly competitive, with a mix of global tech giants, established gaming studios, and innovative AI startups. Leading companies such as Microsoft, Google, Tencent, Sony, Ubisoft, and NetEase are investing heavily in integrating AI to differentiate their game offerings and expand immersive experiences. Microsoft leverages its Azure AI cloud ecosystem to support game studios, while Google enhances game design and analytics through AI-powered solutions in Stadia and DeepMind research projects. Tencent and NetEase, dominant in Asia, integrate AI into large-scale multiplayer games to improve NPC intelligence, combat fraud, and boost in-game personalization.

Gaming engine providers like Unity Technologies and Epic Games (Unreal Engine) play a crucial role, offering AI-driven development toolkits that power NPC behavior, procedural content generation, and automated testing. Startups such as Inworld AI, Latitude, and Modl.ai are also disrupting the market with niche innovations like generative AI dialogue systems, adaptive storytelling, and automated QA testing, gaining traction among indie developers and mid-sized studios.

Strategic collaborations and acquisitions shape the competitive landscape. Large gaming companies increasingly partner with AI-focused firms to accelerate integration, while cloud providers like Amazon Web Services (AWS) and NVIDIA strengthen their foothold through AI-enhanced cloud gaming and GPU-based AI platforms.

Overall, the competitive landscape reflects a balance between scale and specialization, where global leaders dominate infrastructure and platform support, while agile startups pioneer creative AI applications. This dynamic ensures rapid evolution, with competition driving innovation in every layer of the AI gaming value chain.

Some of the prominent players in the global AI in Game Development are:

- Google LLC (Alphabet Inc.)

- Amazon

- IBM Corp

- Microsoft Corporation

- NVIDIA Corporation

- Unity Technologies

- Epic Games, Inc.

- Tencent Holding Limited

- Sony Interactive Entertainment

- Ubisoft Entertainment S.A.

- Altered AI

- Inworld AI

- DIDIMO

- Modl.AI

- Kevuru Games

- Rosebud AI

- TokenMinds

- Baidu, Inc.

- Electronic Arts Inc. (EA)

- GameBench

- Logic Simplified

- BR Softtech

- Improbable

- Intel Corp

- Other Key Players

Global AI in Game Development Market: Recent Developments

- March 2025: Scopely, a Saudi-owned game developer, acquired Niantic’s games division, including Pokémon Go, for USD 3.5 million, strengthening its mobile gaming portfolio and expanding its global footprint in location-based AR experiences.

- March 2025: Elon Musk’s AI company, xAI, acquired Hotshot, a startup specializing in AI-powered video generation, to compete with OpenAI’s Sora and accelerate development of creative AI tools for gaming and immersive storytelling applications.

- February 2025: Google resumed acquisition talks with Wiz, a leading cloud security startup, at a higher valuation, signaling Google’s continued strategy to integrate AI-powered cloud protection into its gaming and enterprise ecosystems.

- January 2025: Microsoft acquired AI startup OpenAI for USD 10 million, aiming to integrate advanced generative AI capabilities into its gaming, productivity, and enterprise offerings, while strengthening Azure AI infrastructure for global developers and creators.

- December 2024: NVIDIA acquired AI chipmaker Graphcore for USD 1.2 million to expand its leadership in AI hardware, ensuring stronger support for gaming developers leveraging high-performance GPUs for AI-driven game development and cloud rendering.

- November 2024: Ubisoft acquired Spirit AI, an AI narrative startup, to integrate advanced conversational systems into its games, enhancing NPC dialogue, immersive storytelling, and player-driven narrative experiences across its blockbuster gaming franchises worldwide.

- October 2024: Sony Interactive Entertainment acquired Promethean AI, an AI-driven animation company, to boost its game design and development capabilities, enabling faster creation of lifelike virtual environments and adaptive AI-powered animation workflows.

- September 2024: Electronic Arts (EA) acquired Modl.ai, an AI analytics firm, to enhance game testing, automate quality assurance, and analyze player behavior, improving personalization and efficiency across its global portfolio of interactive entertainment.

- August 2024: Tencent acquired Inworld AI, an AI startup focused on intelligent virtual characters, to develop lifelike NPCs, conversational agents, and adaptive in-game companions for its growing portfolio of multiplayer and mobile gaming platforms.

- July 2024: Take-Two Interactive acquired GameBench, an AI-powered game testing company, to strengthen its quality assurance processes, automate testing workflows, and optimize game performance, ensuring better player experiences across its major gaming titles.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 3,175.3 Mn |

| Forecast Value (2035) |

USD 58,788.0 Mn |

| CAGR (2025–2035) |

34.3% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 998.4 Mn |

| Forecast Data |

2026 – 2035 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Hardware, Solution, and Services), By Game Genre (Action and Adventure, Role-playing games (RPGs), Shooter(FPS/TPS), Simulation and Strategy, Sports and Racing, and Other Games), By Platform (Mobile, PC, Console, AR/VR, and Cloud and Streaming Gaming), and By Application (Intelligent Non-Player Characters (NPCs), Procedural Content Generation (PCG), Design, Testing & QA, Player Experience & Personalization, Cheat Detection & Fraud Prevention, and Other Application) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Google LLC (Alphabet Inc.), Amazon, IBM Corp, Microsoft Corporation, NVIDIA Corporation, Unity Technologies, Epic Games, Inc., Tencent Holding Limited, Sony Interactive Entertainment, Ubisoft Entertainment S.A., Altered AI, Inworld AI, DIDIMO, Modl.AI, Kevuru Games, Rosebud AI, TokenMinds, Baidu, Inc., Electronic Arts Inc. (EA), GameBench, Logic Simplified, BR Softtech, Improbable, Intel Corp., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global AI in Game Development market?

▾ The global AI in Game Development market size is estimated to have a value of USD 3,175.3 million in 2025 and is expected to reach USD 58,788.0 million by the end of 2035.

What is the size of the US AI in the Game Development market?

▾ The US AI in Game Development market is projected to be valued at USD 964.0 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 11,823.2 million in 2035 at a CAGR of 32.1%.

Which region accounted for the largest global AI in the Game Development market?

▾ North America is expected to have the largest market share in the global AI in Game Development market, with a share of about 36.1% in 2025.

Who are the key players in the global AI in Game Development market?

▾ Some of the major key players in the global AI in Game Development market are Google LLC (Alphabet Inc.), Amazon, IBM Corp, Microsoft Corporation, NVIDIA Corporation, Unity Technologies, Epic Games, Inc., Tencent Holding Limited, Sony Interactive Entertainment, Ubisoft Entertainment S.A., and many others.

What is the growth rate of the global AI in the Game Development market?

▾ The market is growing at a CAGR of 34.3 percent over the forecasted period.