An Airport Information System (AIS) includes diverse technological solutions mainly designed for providing flight information to passengers at airports. It uses electronic & mechanical screens throughout the terminal, complemented by virtual versions on airport websites.

Its key components include the Airport Operation Control Center (AOCC), which manages cargo, flight dispatch, maintenance, and crew, and the Departure Control System (DCS), which oversees passenger check-in, boarding, weather monitoring, & flight information display.

The Airport Information Systems Market is experiencing strong growth, driven by increasing air traffic & a growth in demand for real-time passenger data sharing. Airport expansion projects & infrastructure modernization further contribute to the expansion driven by the International Air Transport Association's projection of a potential doubling of passengers to 8.19 billion by 2035.

In addition, the growing number of air travelers corresponds to a growing demand for Airport Information Systems, enabling major airports to invest in business intelligence solutions and mobile services for passengers &staff, as mobile applications play a major role in evolving airport passenger communications strategies, improving customer relationships with real-time information & exploring successful commercial opportunities, positively impacting the market.

However, the market faces challenges like high modernization costs & information-sharing regulations. Further, facial recognition algorithms, with varying error rates based on race or gender, create concerns about unequal screenings. The associated high costs of biometric devices & the complexity of interconnecting multiple IT systems create more obstacles to the market's overall growth.

Airport Information Systems Markets are experiencing unprecedented growth due to their increasing need for innovative solutions that improve passenger experiences, streamline airport operations, and guarantee safety. Given the rising number of air travelers and complex airport operations, these systems play a pivotal role in improving efficiency and communication within airports.

Recent advances in digital technologies, such as Artificial Intelligence (AI), Internet of Things (IoT), and cloud-based platforms, are revolutionizing airport information systems. These innovations enable real-time data processing, predictive maintenance, personalized services for travelers and smoother airport operations for improved customer satisfaction.

As per aci.aero The 2024 Annual World Airport Traffic Dataset provides an extensive compilation of data, covering 2,700 airports in over 185 countries and territories. It serves as the most thorough resource for airport statistics, delivering crucial information on global air traffic and the performance of airports worldwide.

Airports worldwide are investing heavily in infrastructure upgrades such as smart terminals and automation to accommodate rising passenger traffic, spurring further market growth by driving demand for integrated information systems that manage everything from flight schedules and baggage handling through

security checks and beyond.

Key Takeaways

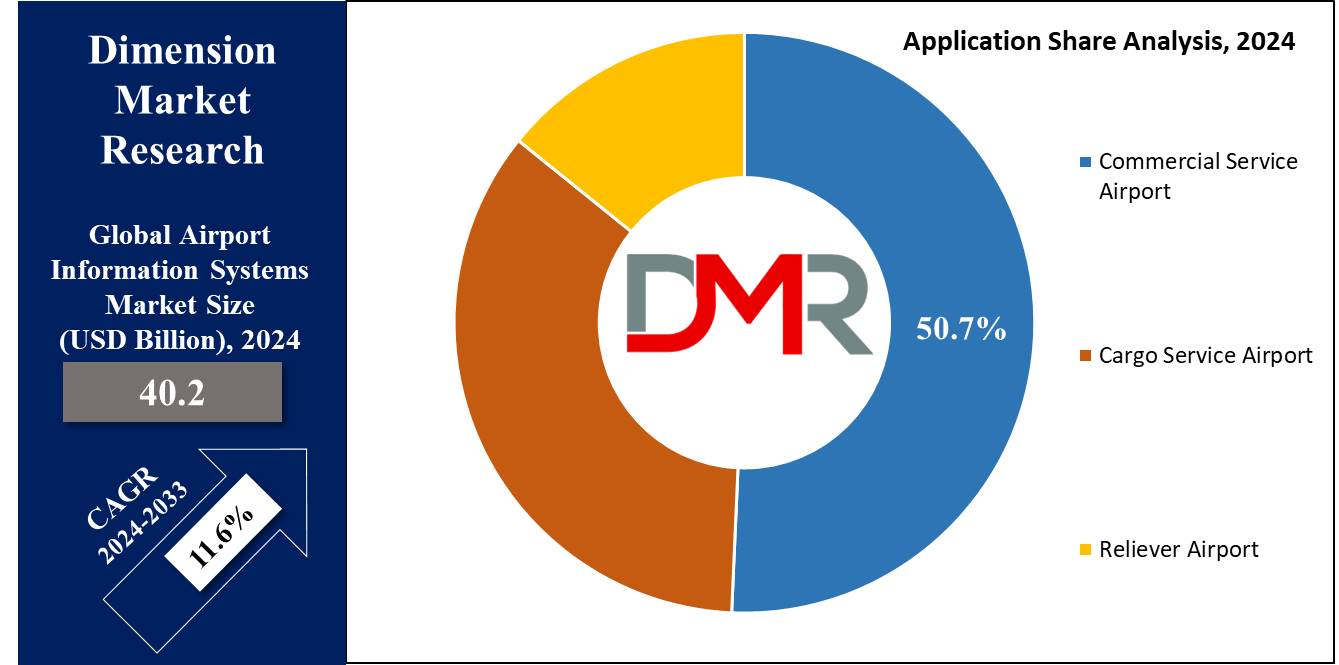

- Market Size: The Global Airport Information System Market is expected to grow by USD 93.5 billion by 2032, at a CAGR of 11.2% during the forecasted period.

- Market Definition: Airport Information Systems deals with the technology and software program used to manage airport operations, inclusive of flight scheduling, passenger processing, baggage management, and safety, ensuring efficient and secure travel experiences.

- By Type Segment Analysis: By type, the resource management system leads this segment with 31.0% of market share in 2023 and is anticipated to show such dominance in the upcoming period as well.

- By Application Segment Analysis: By application, the commercial service airport takes the lead in this segment with 50.7% of the market share in 2023.

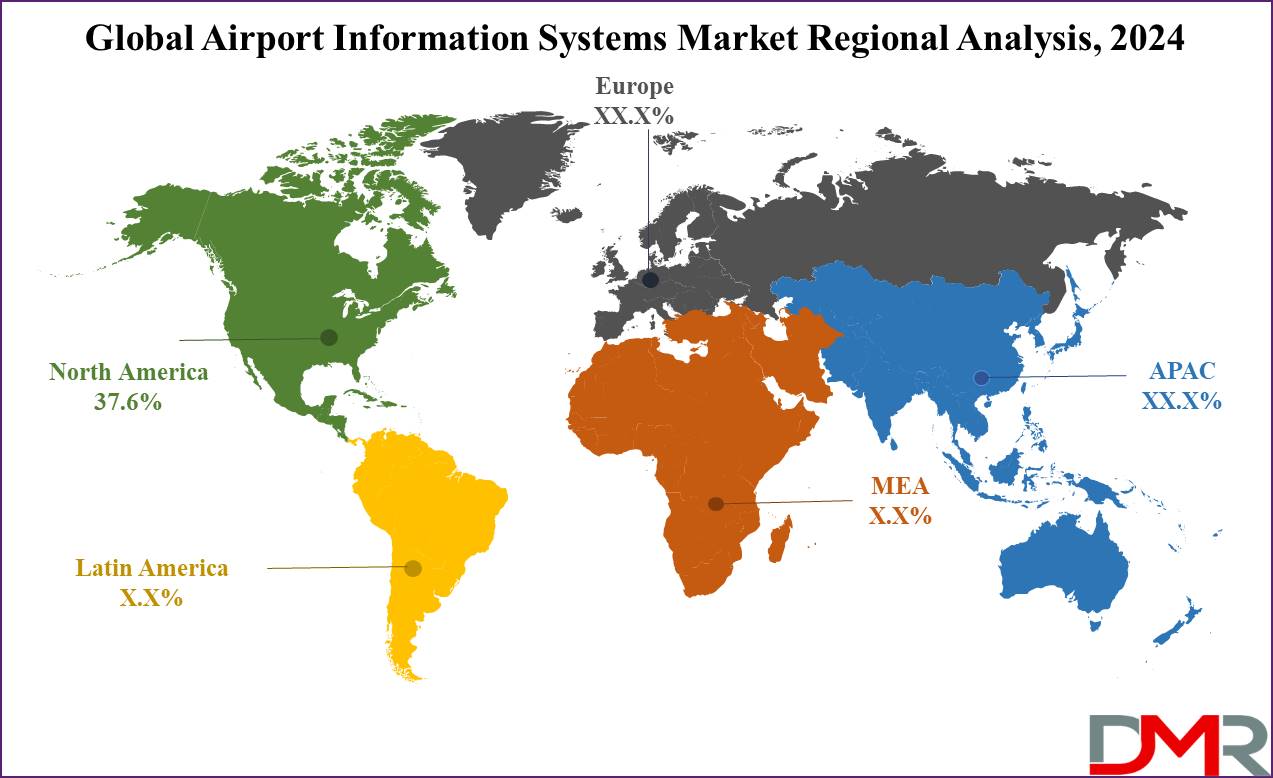

- Regional Analysis: North America dominates the global airport information system market as they hold a 37.6% share of revenue share in 2024.

- Growth Drivers: Growth drivers for the airport information systems marketplace include of growing air traffic, demand for superior passenger experience, technological advancements, security needs, and investments in airport infrastructure development and modernization.

Use Cases

- Flight Information Display Systems (FIDS): Provide real-time flight status updates to passengers, inclusive of departure and arrival time, gate information, and delays, enhancing operational efficiency.

- Baggage Handling Systems (BHS): Track and manage bags in the entire journey, lowering misplaced luggage incidents and improving average baggage processing efficiency and passenger satisfaction.

- Passenger Processing Systems: Automate check-in, security screening, and boarding procedures, decrease wait time, and enhance passenger throughput while ensuring compliance with security protocols.

- Resource Management Systems: Optimize allocation of airport resources which includes gates, runways, and staff, improving operational efficiency and operational charges.

- Security Systems: Integrate surveillance, access control, and biometric identification to enhance airport safety, streamline passenger movement, and observe regulatory requirements for safety and protection.

Market Dynamic

Trends

Technological AdvancementsThe integration of

artificial intelligence (AI), Internet of Things (IoT), and blockchain in airport records systems is revolutionizing airport management by way of enhancing operational efficiency, protection, and passenger experience. Advanced technologies permit real-time data sharing and predictive analytics, improving decision-making processes.

Passenger Experience Enhancement

Airports are increasingly more specialized in imparting seamless travel experiences. Implementations of self-service kiosks, biometric identification, and cell applications for real-time flight updates and personalized offerings have become commonplace, notably enhancing passenger pleasure and operational performance.

Growth Drivers

Increasing Air Traffic

The growing number of worldwide air tourists and expanding airline networks necessitate efficient airport information systems. This surge in air traffic needs strong systems for handling passenger flow, flight schedules, and safety processes driving the growth of this market.

Airport Infrastructure Development

Governments and private sectors are closely investing in the expansion and modernization of airport infrastructure. These investments consist of upgrading present centers and building new airports, which require advanced information systems to manage operations effectively and enhance passenger services.

Growth Opportunities

Emerging Markets

Rapid monetary growth and growing disposable income in emerging markets, mainly in Asia-Pacific and the Middle East, are taking the lead in the construction of new airports and upgrading existing ones. These regions present considerable possibilities for the adoption of advanced airport information systems.

Sustainable Airport Operations

The rising emphasis on sustainability and eco-friendly operations offers opportunities for implementing efficient technology in airport information systems. Solutions that optimize energy usage, reduce carbon footprints, and enhance operational efficiency are gaining traction, aligning with global sustainability needs.

Restraints

High Implementation Costs

The initial investment required for deploying advanced airport information systems can be substantial. Costs associated with purchasing, installing, and maintaining these systems can be prohibitive for smaller airports, limiting market growth.

Cybersecurity ConcernsIncreasing reliance on

digital and interconnected systems raises significant cybersecurity risks. Airports must invest in robust cybersecurity measures to protect sensitive data and ensure system integrity, which can be a complex and costly endeavor, potentially restraining market growth.

Research Scope and Analysis

By Type

In terms of type, the global airport information system market is categorized into Flight information display systems (FIDS), resource management systems, airport operations systems, passenger processing systems,

baggage processing systems, public address systems, and others.

among these, the resource management systems segment emerges as the dominant force with 31.0% market share in 2023, holding the highest market share & is expected to have substantial growth to lead the global market throughout the forecasted period, which is attributed to the critical role played by resource management systems in optimizing various airport operations.

As airports highly prioritize efficiency & seamless coordination, the need for these systems is expected to rise. The forecasted substantial growth of the resource management systems segment highlights its vital contribution to shaping the future landscape of airport technology, reflecting the industry's ongoing commitment to enhanced resource utilization & operational effectiveness.

By Application

The global market is categorized by application into three segments: commercial service airport, cargo service airport, & reliever airport. among these, the commercial service airport segment stands out by securing a 50.7% market share in 2023 & is expected to demonstrate robust growth throughout the forecast period on a global scale, which is attributed to the segment's important role in catering to the growing demands for passenger services.

As air travel continues to evolve, the commercial service airport component plays a major role in meeting the growing expectations of global travelers. Its dominance showcases its current market strength & the anticipation of sustained growth, following its significance in shaping the overall landscape of airport services & operations during the forecasted period.

The Airport Information Systems Market Report is segmented on the basis of the following

By Type

- Resource Management Systems

- FIDS

- Passenger Processing Systems

- Public Addressing Systems

- Airport Operations Systems

- Baggage Processing Systems

- Others

By Application

- Commercial Service Airport

- Cargo Service Airport

- Reliever Airport

Regional Analysis

North America exhibits a clear dominance, accounting for the major Airport Information Systems market

share of 37.6% in 2023, as the region has an advanced ecosystem of technology companies, research institutions, & startups that add up to the advancement & implementation of airport information systems. Further, the region has some of the world's biggest & most developed economies, giving the financial resources necessary to invest in & install these technologies.

Moreover, the increase in demand for this technology due to the presence of several international airports in North America, which handle substantial air traffic, is fueling the market growth. Moreover, the imposition of several rules & policies by regional governments to support the adaptation of advanced technologies to enhance aviation safety & security is also influencing the market growth. Furthermore, the growing expectations of regional passengers are facilitating the integration of smart technologies to streamline processes, minimize wait times, & enhance convenience.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The airport information systems market shows moderate consolidation, with software providers collaborating with hardware manufacturers to develop comprehensive solutions that meet airports' changing capacity needs at competitive prices.

Further increases in investments in digital technology & smart solutions are driving efficiency enhancement in airport procedures. As a result, there is a growth in the trend of airports awarding new contracts to enhance & streamline their operational segments via implementing advanced information systems.

In October 2022, SITA, a company specializing in air transport communications & IT, unveiled a collaboration with Versa Networks, as both companies are set to introduce SITA Connect Go, a secure SD-WAN (Software-Defined Wide Area Network) designed for the air transport sector, which aims to provide a multi-tenant edge solution, addressing the distinctive communication & technology needs of the air transport industry.

Some of the prominent players in the global Airport Information Systems Market are

- IBM Corp

- SITA

- Thales Group

- NEC Corp

- Siemens AG

- Honeywell Inc.

- Airport Information Systems Ltd

- Indra Sistemas

- INFORM

- VELATIA

- Other Key Players

Recent Developments

- In November 2023, The Innovative Contractors for Advanced Dimensions announced their selection of Collins Aerospace, a part of RTX Corporation, to deliver, deploy, and provide support services for airport operational and passenger processing systems at NEOM Bay Airport in NEOM City, Saudi Arabia.

- In June 2023, Indra Australia provided the Royal Australian Air Force (RAAF) with three Defence Deployable Air Traffic Management and Control Systems (DDATMCS). These systems enhance global airspace management for defense, humanitarian, and disaster operations, featuring deployable 3D radar integrated into mobile Area Control Centers. The collaboration with Daronmont Technologies ensures high local content, bolstering RAAF’s capabilities and Indra’s commitment to modernizing armed forces.

- In May 2023, Indra launched its new subsidiary, Indra Air Traffic Inc., in Overland Park, Kansas, to strengthen its position in the US air traffic management (ATM) sector. This move follows the acquisition of Selex ES's air traffic business and aims to support US air infrastructure renewal. The subsidiary will serve clients like the FAA, US Air Force, and US Navy, featuring a center of excellence for air navigation systems. Indra seeks to expand its global leadership in ATM technology.

- In October 2022, SITA, a leader in air transport communications and information technology, partnered with Versa Networks to launch SITA Connect Go. This multi-tenant edge secure SD-WAN (Software-Defined Wide Area Network), developed collaboratively, aims to enhance connectivity and security for the air transport industry.

- In June 2022, Finavia chose Amadeus' cloud-based Airport Operational Database (AODB) for deployment at Helsinki Airport and 19 regional airports in Finland. This initiative is part of Finavia’s modernization plans for its airports, aiming to improve ground handling operations. Successful implementations of such projects are expected to help these companies attract more customers in the future.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 40.2 Bn |

| Forecast Value (2033) |

USD 108.2 Bn |

| CAGR (2024-2033) |

11.6% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Resource Management Systems, FIDS, Passenger Processing System, Public Addressing System, Airport Operations Systems, Baggage Processing Systems, and Others), By Application (Commercial Service Airport, Cargo Service Airport, and Reliever Airport) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

IBM Corp, SITA, Thales Group, NEC Corp, Siemens AG, Honeywell Inc., Airport Information Systems Ltd, Indra Sistemas, INFORM, VELATIA, and Other Key Players |

| Purchase Options |

HVMN Inc., Thync Global Inc., Apple Inc., Fitbit Inc., TrackmyStack, OsteoStrong, The ODIN, Thriveport LLC, Muse, Moodmetric, and Other Key Players |