Market Overview

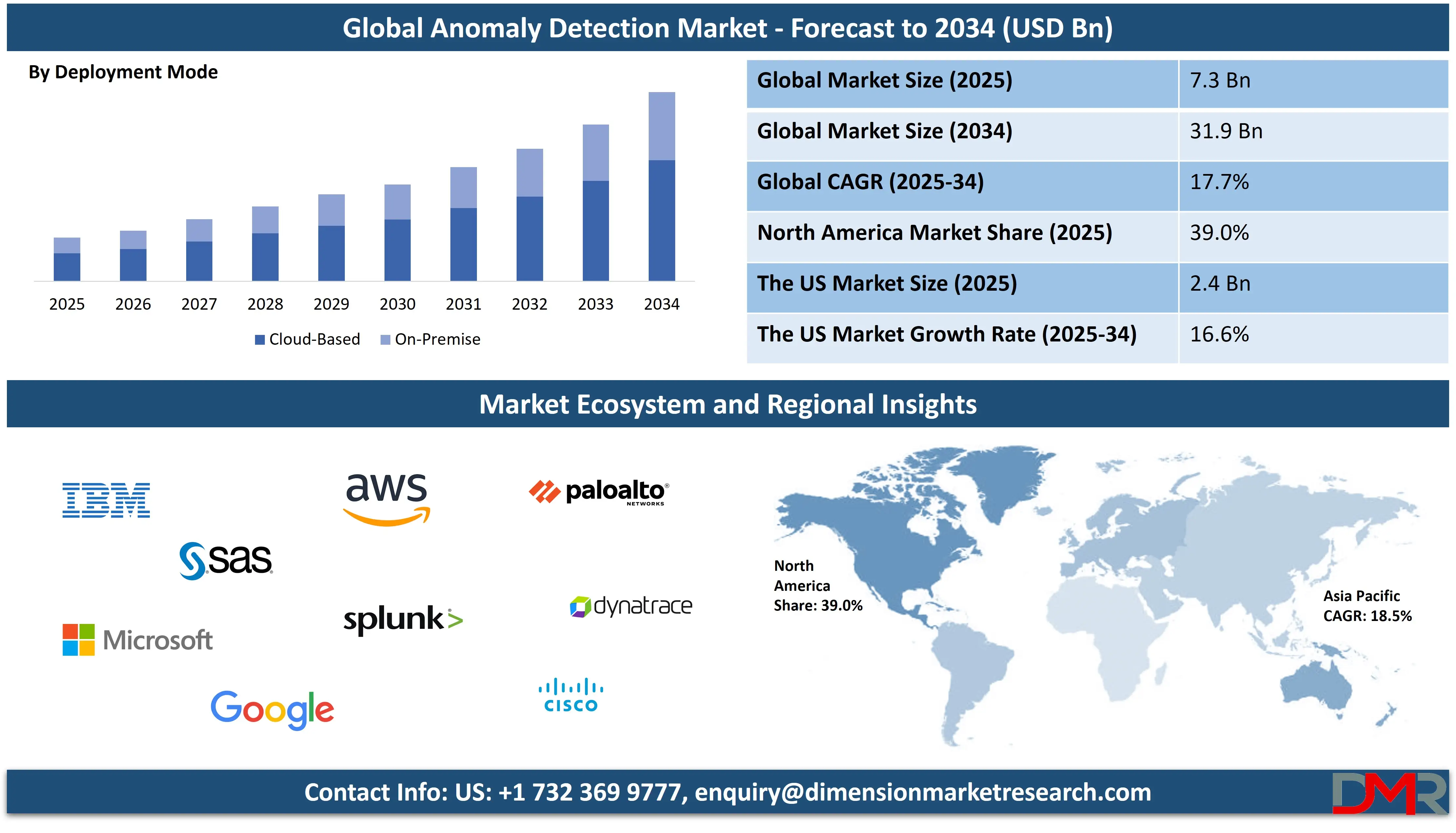

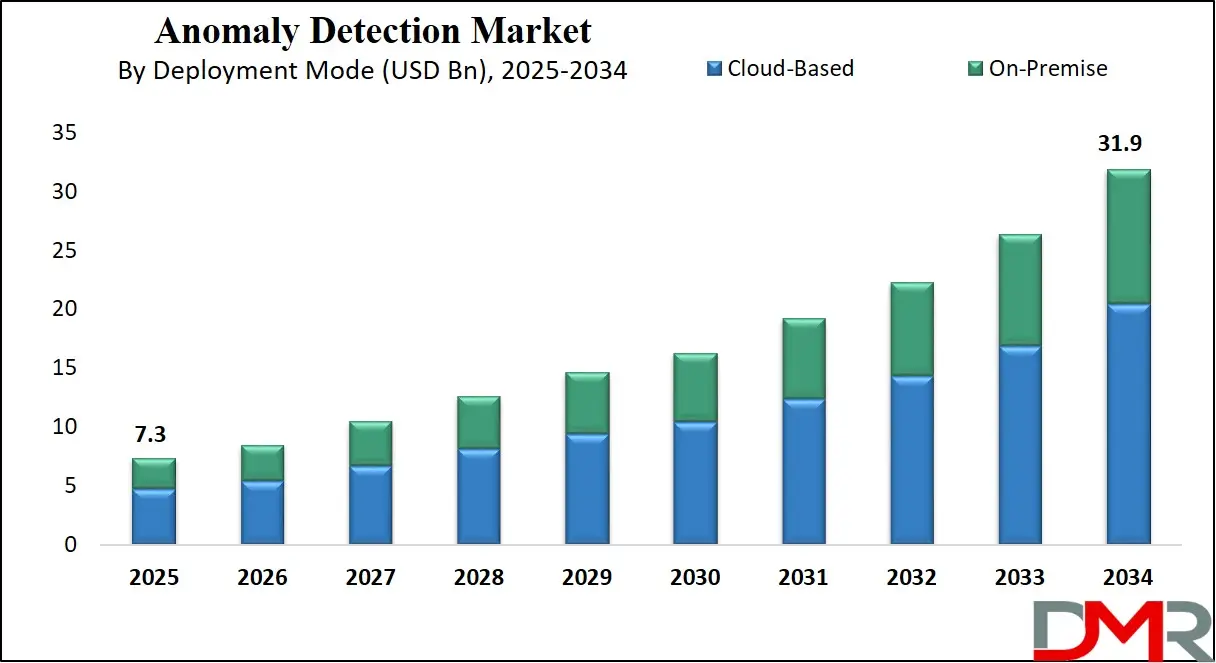

The Global Anomaly Detection Market is projected to grow from USD 7.3 billion in 2025 to USD 31.9 billion by 2034, expanding at a CAGR of 17.7%. This growth is driven by the rising adoption of AI-powered anomaly detection solutions, growing demand for real-time data monitoring, and the surge in cybersecurity threats across sectors such as BFSI, healthcare, IT, telecom, and manufacturing.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Anomaly detection refers to the process of identifying patterns in data that do not conform to expected behavior. It plays a crucial role in uncovering unusual occurrences that could signal critical incidents, such as fraud, cyber intrusions, equipment malfunctions, or system failures. Leveraging statistical models, machine learning algorithms, and artificial intelligence, anomaly detection helps organizations continuously monitor complex datasets and systems in real-time. Its use spans a wide array of domains, from banking and healthcare to industrial IoT and e-commerce, offering proactive measures for risk mitigation, operational efficiency, and decision-making enhancement.

The global anomaly detection market encompasses a diverse landscape of technologies and solutions aimed at identifying deviations within massive datasets. This market is fueled by the rising demand for advanced cybersecurity tools, the proliferation of connected devices, and the growing reliance on predictive analytics across industries. Enterprises are integrating AI-based anomaly detection systems into their infrastructure to safeguard digital assets, ensure process optimization, and support compliance initiatives. Cloud-native deployment models and real-time monitoring capabilities have further elevated the value proposition of these systems in high-risk environments.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Across sectors such as finance, telecommunications, manufacturing, and healthcare, detecting real-time anomalies has become imperative. As cyber threats evolve and data volumes surge, organizations seek scalable solutions that offer deep insights and timely alerts. The anomaly detection market is thus shaped by the intersection of big data analytics, automation, and AI, with vendors constantly innovating to deliver context-aware and domain-specific solutions. Regional markets are witnessing varying levels of adoption, with North America and Asia-Pacific leading the transformation due to their tech maturity and growing focus on digital resilience.

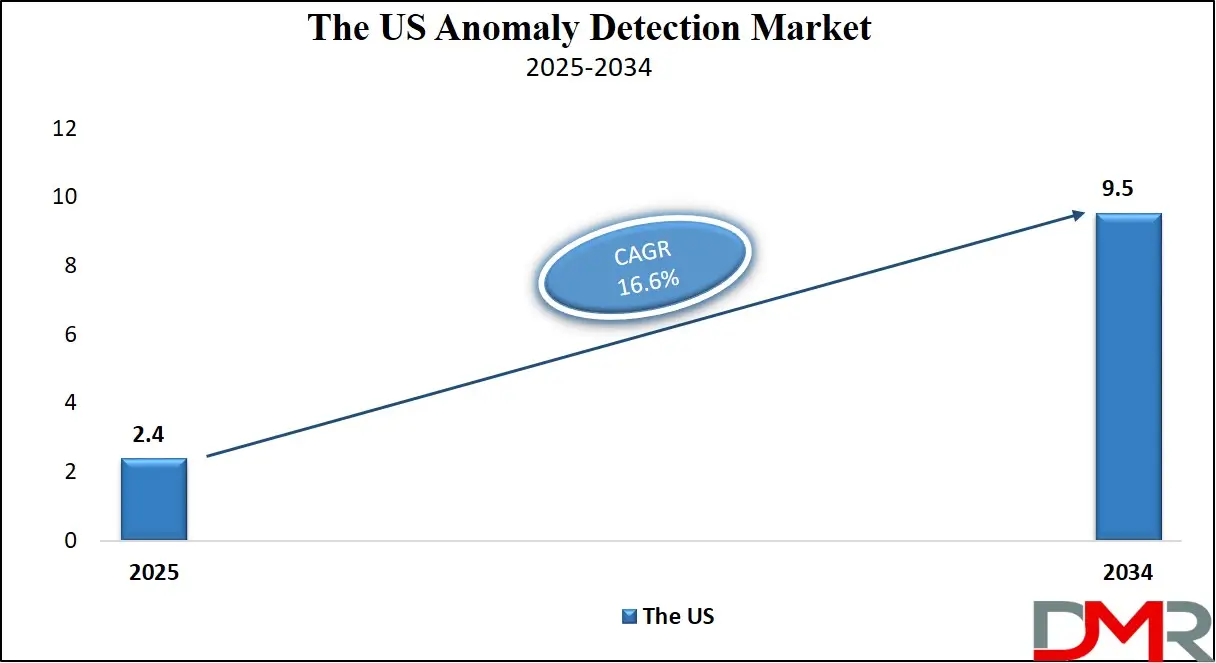

The US Anomaly Detection Market

The U.S. Anomaly Detection Market size is projected to be valued at USD 2.4 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 9.5 billion in 2034 at a CAGR of 16.6%.

The United States anomaly detection market is witnessing accelerated growth, driven by the country’s strong digital infrastructure, high cyber threat exposure, and early adoption of AI and machine learning technologies.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Enterprises across financial services, government agencies, and critical infrastructure sectors are investing heavily in real-time anomaly detection tools to monitor system behavior, detect fraud, and prevent data breaches. The rapid rise in cloud computing, IoT deployment, and high-frequency data generation has further elevated the importance of anomaly detection systems in managing operational risks and ensuring compliance with stringent regulatory standards such as HIPAA, SOX, and PCI DSS.

A growing emphasis on predictive analytics and behavioral pattern recognition is reshaping how US organizations approach network security, system health monitoring, and IT operations management. Major tech giants and cybersecurity firms in the U.S. are continuously innovating to deliver context-aware anomaly detection platforms integrated with AI, edge computing, and big data analytics.

The proliferation of advanced persistent threats, along with increased investments in smart manufacturing and digital healthcare, is contributing to the expansion of anomaly detection applications beyond traditional IT security. As businesses pursue digital transformation, the demand for scalable, cloud-native, and autonomous anomaly detection systems is expected to remain a key growth catalyst in the U.S. market landscape.

Europe Anomaly Detection Market

In 2025, Europe is expected to account for approximately USD 1.7 billion of the global anomaly detection market share. This strong position is attributed to the region’s proactive stance on data security, regulatory compliance, and technological innovation. European countries have been early adopters of anomaly detection solutions across various sectors, including BFSI, healthcare, manufacturing, and government.

The implementation of stringent regulations such as the General Data Protection Regulation (GDPR) has intensified the need for intelligent monitoring and detection systems to ensure data integrity, detect insider threats, and manage compliance risks. Additionally, sectors like smart manufacturing and critical infrastructure in countries such as Germany, France, and the Nordics are investing in predictive analytics and real-time anomaly detection to prevent system failures and improve operational efficiency.

With a projected CAGR of 16.2% from 2025 to 2034, the European anomaly detection market is poised for robust growth, fueled by the rising complexity of IT environments, rapid digitization of services, and growing cyber threats. Organizations across the continent are adopting AI- and machine learning-based solutions to address both operational anomalies and security threats in real-time. The region also benefits from a strong ecosystem of technology vendors, research institutions, and digital transformation initiatives backed by the European Union.

As cloud adoption continues to rise and edge computing gains traction, European enterprises are expected to increase their investments in scalable and adaptive anomaly detection systems, making the region one of the most dynamic and strategically important markets in the global landscape.

Japan Anomaly Detection Market

Japan’s anomaly detection market is estimated to reach USD 400 million in 2025, reflecting its growing investment in digital transformation, smart infrastructure, and cybersecurity resilience. As one of Asia’s most technologically advanced nations, Japan is leveraging anomaly detection tools to monitor system health, detect fraudulent behavior, and support predictive maintenance across sectors such as manufacturing, finance, and public services.

The country’s strong industrial base, especially in automotive and electronics, relies on data-driven monitoring solutions to ensure equipment reliability and reduce downtime. Additionally, financial institutions in Japan are integrating real-time anomaly detection to combat digital fraud and comply with regulatory requirements related to transaction monitoring and customer data protection.

With a projected CAGR of 14.1% from 2025 to 2034, Japan’s market is expected to grow steadily, driven by the adoption of AI, machine learning, and edge computing technologies. As IoT devices proliferate across smart factories, cities, and transportation networks, there is a growing demand for advanced detection systems that can analyze large-scale data in real time and detect subtle deviations. Furthermore, the government’s push for digital modernization and cybersecurity enhancement in critical sectors provides a favorable environment for the expansion of anomaly detection solutions. Japanese enterprises are also seeking localized, language-adapted platforms that integrate seamlessly with existing legacy systems, creating opportunities for both domestic and international vendors to serve this high-potential, innovation-focused market.

Global Anomaly Detection Market: Key Takeaways

- Market Value: The global anomaly detection market size is expected to reach a value of USD 31.9 billion by 2034 from a base value of USD 7.3 billion in 2025 at a CAGR of 17.7%.

- By Component Segment Analysis: Solutions are anticipated to dominate the component segment, capturing 72.0% of the total market share in 2025.

- By Deployment Mode Segment Analysis: Cloud-based deployment mode is expected to maintain its dominance in the deployment mode segment, capturing 64.0% of the total market share in 2025.

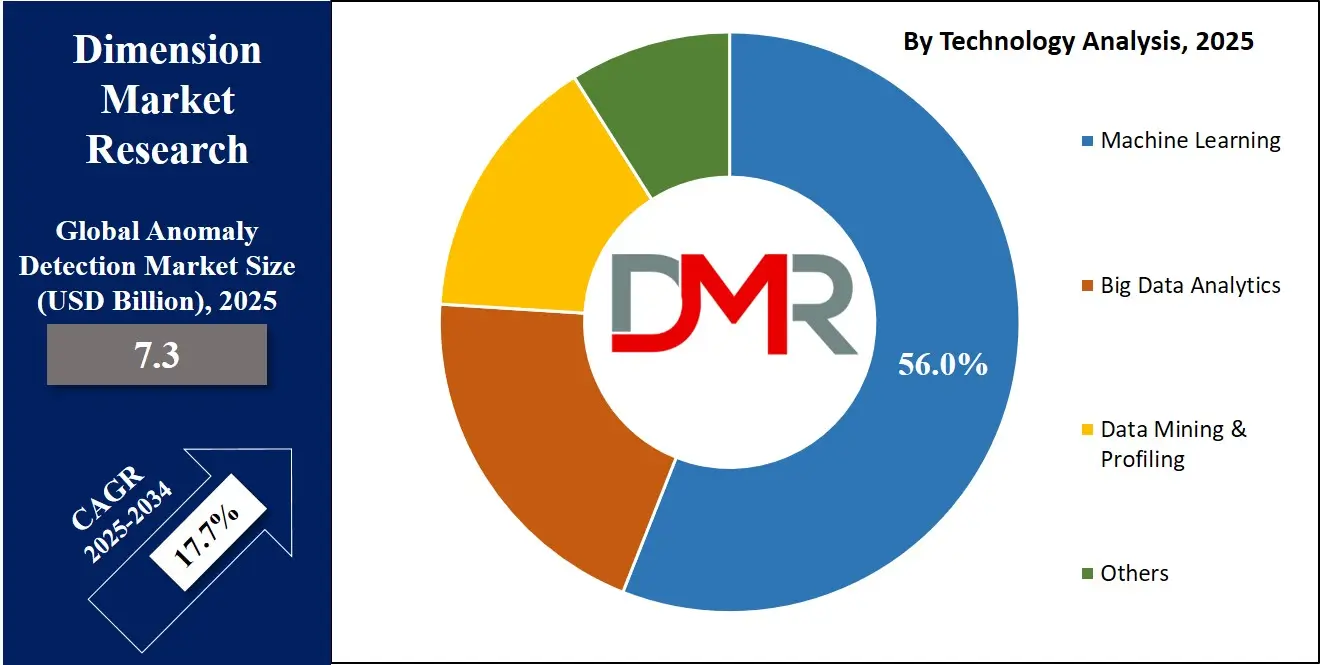

- By Technology Segment Analysis: Machine Learning will dominate the technology segment, capturing 56.0% of the market share in 2025.

- By Organization Size Segment Analysis: Large Enterprises are poised to consolidate their dominance in the organization size segment, capturing 67.0% of the total market share in 2025.

- By Application Area Segment Analysis: Fraud Detection will lead in the application area segment, capturing 22.0% of the market share in 2025.

- By Industry Vertical Segment Analysis: The BFSI industry will lead the industry vertical segment, capturing 24.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global anomaly detection market landscape with 39.0% of total global market revenue in 2025.

- Key Players: Some key players in the global anomaly detection market are IBM, SAS Institute, Microsoft, Google (Alphabet), Amazon Web Services (AWS), Splunk, Cisco Systems, Palo Alto Networks, Dynatrace, Sumo Logic, Rapid7, Darktrace, Anodot, HPE (Hewlett Packard Enterprise), Trend Micro, LogRhythm, and Other Key Players.

Global Anomaly Detection Market: Use Cases

- Fraud Detection in Financial Services: Anomaly detection plays a critical role in combating fraud across banking, insurance, and fintech platforms. By analyzing transactional behavior in real time, anomaly detection systems can flag irregular activities such as unauthorized withdrawals, account takeovers, and unusual payment patterns. Financial institutions deploy AI-based anomaly detection models trained on historical transaction data and user behavior analytics to detect subtle deviations that rule-based systems often miss. With digital payments, online lending, and mobile banking on the rise, these systems help reduce false positives, automate alerting, and enhance risk mitigation. Integration with anti-money laundering (AML) and compliance frameworks further improves security posture and regulatory adherence.

- Cyber Threat Detection in IT and Telecom: In IT infrastructure and telecom networks, anomaly detection is used extensively to uncover hidden cyber threats, including zero-day attacks, lateral movement, and insider threats. These solutions monitor massive volumes of network traffic, system logs, and endpoint behavior to detect outliers that may indicate potential breaches or system compromise. Leveraging machine learning, behavior profiling, and real-time data analytics, organizations can proactively identify anomalies before they escalate into serious threats. As telecom providers deploy 5G and cloud-native architectures, anomaly detection supports threat intelligence, intrusion detection, and network resilience in complex digital ecosystems.

- Predictive Maintenance in Industrial IoT: Manufacturers and energy companies use anomaly detection to enable predictive maintenance and reduce equipment downtime. By continuously monitoring sensor data from machinery, turbines, or pipelines, these systems can detect early signs of wear, malfunction, or system degradation. AI-driven anomaly detection models identify deviations in temperature, vibration, or pressure that fall outside the expected operational thresholds. This proactive approach minimizes unplanned outages, extends equipment lifespan, and optimizes resource utilization. In sectors like oil & gas, automotive, and power generation, anomaly detection is a cornerstone of Industry 4.0 and smart factory initiatives.

- Patient Monitoring in Healthcare: Anomaly detection supports advanced patient monitoring and clinical decision-making by analyzing physiological signals and health records in real time. Hospitals and healthcare providers use these systems to detect anomalies in heart rate, oxygen levels, or glucose readings that may indicate deteriorating patient conditions. With the rise of remote patient monitoring, wearables, and telehealth, AI-based detection models help in early diagnosis, emergency response, and personalized treatment. Additionally, anomaly detection is used in medical imaging display, lab diagnostics, and hospital operations to ensure quality care, reduce diagnostic errors, and improve patient outcomes.

Impact of Artificial Intelligence on the Anomaly Detection Market

- Driving Real-Time Detection across Industries: Artificial Intelligence has significantly transformed anomaly detection by enabling real-time identification of abnormal patterns across massive and dynamic datasets. Traditional rule-based systems often struggle with detecting subtle or evolving anomalies, especially in high-volume environments like cybersecurity, financial transactions, and industrial IoT. AI models, particularly machine learning and deep learning algorithms, learn from complex behavioral patterns and can flag deviations that would otherwise go unnoticed. This has led to enhanced responsiveness and security across sectors.

- Improving Accuracy and Reducing False Positives: One of the core benefits AI brings to the anomaly detection market is its ability to minimize false alarms. Conventional systems frequently generate false positives due to static thresholds. In contrast, AI systems adapt over time, learning from historical and contextual data to distinguish between genuine threats and benign outliers. This results in more accurate alerts, reducing alert fatigue for human analysts and allowing teams to focus on real anomalies with higher precision.

- Enabling Predictive and Preventive Maintenance: In manufacturing, energy, and transportation sectors, AI-driven anomaly detection plays a crucial role in predictive maintenance. By monitoring equipment behavior and detecting early signs of degradation or failure, AI helps organizations take preventive action before costly breakdowns occur. This shift from reactive to proactive maintenance not only saves operational costs but also extends asset lifecycles and enhances safety.

- Accelerating Automation and Scalability: AI-powered anomaly detection systems are inherently scalable and can handle large, unstructured datasets across distributed environments. Cloud-based AI models can be deployed across networks, applications, and devices, enabling centralized anomaly monitoring without manual intervention. This automation is essential for businesses dealing with rapid data growth, such as e-commerce platforms, telecom providers, and financial institutions.

Global Anomaly Detection Market: Stats & Facts

-

National Renewable Energy Laboratory (NREL)

- Power system anomalous data in SCADA and OT networks include both physical-event anomalies (e.g., load switching, faults) and IT-based anomalies like sensor malfunctions and cyber intrusions.

-

U.S. Department of the Treasury (Financial Services Sector)

- Financial institutions sharing anonymized cybersecurity data can reduce fraud by approximately 50%, while smaller firms that lack data-sharing practices face higher vulnerability to digital threats.

-

U.S. White House (2024 National Cybersecurity Posture)

- Emerging AI-powered cyber defense tools significantly enhance the detection of anomalous network traffic, supporting the defense of critical infrastructure systems across federal and commercial sectors.

-

Cybersecurity and Infrastructure Security Agency (CISA)

- CISA operational use cases include:

- Network anomaly detection within Security Operations Centers (SOCs), analyzing terabytes of daily traffic

- Identification of anomalies in industrial control and operational technology networks using unsupervised machine learning models

-

National Institute of Standards and Technology (NIST) & NREL (Energy Sector)

- AI systems deployed in energy networks detect both malicious and non-malicious anomalies such as equipment failures, sensor errors, and abnormal oscillations, using real-time data event diagnostics

-

U.S. Government Accountability Office (GAO)

- Network routers and perimeter devices provide flow data and audit logs that help identify anomalous activity linked to malware campaigns, lateral movement, or sensitive data exfiltration attempts.

-

Defense Advanced Research Projects Agency (DARPA)

- The ADAMS project (2011–2014) invested USD 35 million to develop machine learning algorithms capable of detecting insider threats and irregular behavior patterns within secure networks.

- The PRODIGAL program (2011–2013) was funded with USD 9 million to build graph-based anomaly detection systems for identifying compromised users and behavioral outliers within large organizations.

Global Anomaly Detection Market: Market Dynamics

Global Anomaly Detection Market: Driving Factors

Rising Cybersecurity Threats and Data Breaches

The growing volume and sophistication of cyberattacks are driving demand for anomaly detection systems across sectors. From ransomware and insider threats to advanced persistent threats (APTs), organizations require intelligent solutions that can detect irregular behavior patterns in real-time.

As enterprises migrate to hybrid and multi-cloud environments, anomaly detection becomes essential for securing endpoints, networks, and applications. The integration of behavioral analytics and real-time alert systems ensures a proactive approach to threat detection and response, reducing the risk of data loss and compliance violations.

Surge in IoT and Connected Devices

The exponential growth of IoT devices across smart cities, manufacturing plants, and healthcare facilities has created a complex ecosystem that generates massive volumes of real-time data. Anomaly detection is crucial for identifying irregularities in device communication, system operations, and environmental readings.

Whether monitoring industrial sensors, connected vehicles, or medical wearables, anomaly detection systems enhance operational efficiency and mitigate risks associated with hardware failure, cyber threats, or human error. This has made AI-driven anomaly detection a core element of intelligent automation and edge computing frameworks.

Global Anomaly Detection Market: Restraints

High Implementation and Integration Costs

Despite their growing importance, anomaly detection solutions often require significant upfront investments in infrastructure, skilled personnel, and system integration. Smaller enterprises may find it difficult to deploy and scale such systems, especially when real-time analytics and machine learning capabilities are involved.

The complexity of integrating anomaly detection with legacy IT systems and diverse data sources further delays implementation, making ROI uncertain in some cases. These challenges hinder widespread adoption, particularly among cost-sensitive and resource-constrained businesses.

Lack of Standardization and Skilled Workforce

The absence of industry-wide standards for anomaly detection, especially in emerging domains like edge AI and behavioral monitoring, creates interoperability challenges. Moreover, a shortage of data scientists and AI engineers skilled in anomaly detection algorithms, statistical modeling, and domain-specific pattern recognition affects deployment quality and system accuracy.

Organizations often struggle to train models with insufficient labeled data, leading to high false positives or missed detections. This talent gap and data scarcity limit market scalability and consistency in performance.

Global Anomaly Detection Market: Opportunities

Integration with AIOps and Observability Platforms

Anomaly detection is being embedded within AIOps platforms to support automated IT operations, root cause analysis, and system optimization. By combining observability tools with AI-driven anomaly insights, enterprises can predict incidents, prioritize alerts, and automate remediation workflows. This opens new opportunities in DevOps, cloud-native monitoring, and enterprise performance management. The demand for unified visibility across complex digital infrastructures makes anomaly detection a key enabler of proactive system resilience.

Growing Demand in Healthcare and Life Sciences

The healthcare sector presents a growing opportunity for anomaly detection technologies. From remote patient monitoring and clinical diagnostics to operational intelligence and fraud detection, the application potential is vast. AI-powered systems can detect anomalies in patient vitals, radiology scans, or hospital workflows to prevent adverse events and improve care outcomes. The growing use of telehealth, electronic health records (EHR), and wearable devices has created a rich data environment, where anomaly detection supports early disease diagnosis and clinical decision support.

Global Anomaly Detection Market: Trends

Shift Toward Self-Learning and Adaptive AI Models

A prominent trend in the anomaly detection market is the evolution toward self-learning, context-aware models that adapt continuously to new data patterns. These systems reduce manual intervention by learning normal behavior over time and updating detection thresholds dynamically. They are especially useful in environments with evolving data baselines, such as e-commerce traffic, manufacturing operations, or customer behavior analytics. This trend aligns with broader advancements in unsupervised and semi-supervised machine learning for real-time data intelligence.

Expansion of Edge-Based Anomaly Detection

As edge computing becomes more prevalent, organizations are deploying anomaly detection at the edge to enable faster decision-making and reduced latency. This trend is particularly significant in sectors like industrial automation, energy, and transportation, where real-time insights are critical. Edge-based anomaly detection processes data locally on devices or gateways, minimizing cloud dependency and supporting decentralized data architectures. This enhances privacy, speed, and scalability while enabling real-time operational awareness across distributed environments.

Global Anomaly Detection Market: Research Scope and Analysis

By Component Analysis

In the component segment of the anomaly detection market, solutions are expected to maintain a dominant position, accounting for approximately 72.0% of the total market share in 2025. This dominance is largely attributed to the growing adoption of advanced software platforms and tools that utilize artificial intelligence, machine learning, and big data analytics to detect anomalies across diverse data environments.

These solutions are integrated into enterprise systems for use cases such as cybersecurity threat detection, fraud monitoring, system performance analysis, and operational intelligence. Organizations are prioritizing scalable, automated, and customizable anomaly detection platforms that can process real-time data streams and generate actionable insights without extensive human oversight. The demand is especially strong in industries like finance, healthcare, telecom, and manufacturing, where early detection of irregularities is critical to maintaining service quality and minimizing risk.

On the other hand, services in the anomaly detection market play a supportive but essential role in ensuring the successful deployment and performance of these solutions. Services include consulting, system integration, training, support & and maintenance. As the technology landscape grows more complex, organizations often require expert assistance to tailor anomaly detection solutions to their specific business needs, integrate them with legacy systems, and ensure regulatory compliance.

Additionally, ongoing technical support and updates are vital to keeping the systems effective against evolving threats and data patterns. While services command a smaller share compared to solutions, their contribution to long-term customer retention and optimized system functionality makes them a crucial component of the overall market ecosystem.

By Deployment Mode Analysis

In the deployment mode segment of the anomaly detection market, cloud-based solutions are projected to dominate with a 64.0% market share in 2025. This preference for cloud deployment is driven by several factors, including scalability, cost efficiency, ease of integration, and accessibility from multiple locations. Organizations across sectors are adopting cloud-native anomaly detection platforms to monitor vast and distributed data sources in real time.

The flexibility of cloud infrastructure allows businesses to scale up their analytics capabilities without heavy upfront investments in hardware or IT resources. Moreover, the integration of anomaly detection with other cloud services such as data lakes, AI engines, and cybersecurity tools enables seamless and intelligent monitoring. The rise of remote work, SaaS adoption, and digital transformation initiatives further reinforces the demand for cloud-based anomaly detection, especially among SMEs and enterprises with multi-location operations.

While cloud deployment leads the market, on-premise solutions continue to play a vital role, particularly in industries with stringent data privacy, compliance, or latency requirements. Organizations in sectors like defense, banking, and healthcare may prefer on-premise anomaly detection systems to retain full control over sensitive data and system configurations. These deployments often offer enhanced customization, direct oversight, and tighter security protocols.

Although more resource-intensive in terms of infrastructure and maintenance, on-premise solutions provide critical value where data sovereignty and offline operation capabilities are necessary. As a result, while the market is shifting toward cloud, on-premise deployment remains relevant for organizations with specialized operational or regulatory needs.

By Technology Analysis

Within the technology segment of the anomaly detection market, machine learning is expected to lead by a significant margin, capturing 56.0% of the total market share in 2025. The growing dominance of machine learning is fueled by its ability to automatically learn from vast and complex datasets, detect hidden patterns, and adapt to evolving data trends without explicit programming. These capabilities are crucial for identifying anomalies in dynamic environments such as financial transactions, network traffic, user behavior, and industrial equipment performance.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Supervised, unsupervised, and semi-supervised machine learning models are widely deployed across sectors to enhance detection accuracy, reduce false positives, and support proactive decision-making. As data volumes grow exponentially, the efficiency and intelligence offered by machine learning-driven anomaly detection systems are becoming indispensable for real-time monitoring and predictive analysis across industries like cybersecurity, fintech, healthcare, and logistics.

In parallel, big data analytics represents another vital technology in the anomaly detection landscape. As organizations accumulate massive volumes of structured and unstructured data from various sources, big data tools provide the computational power and infrastructure needed to process, store, and analyze this data at scale. In the context of anomaly detection, big data analytics enables organizations to examine data across distributed systems, identify outliers in historical or real-time streams, and visualize trends over time.

It plays a particularly important role in supporting machine learning algorithms by providing high-quality, high-volume datasets for training and inference. Big data frameworks also facilitate anomaly detection in domains like e-commerce, telecom, and manufacturing, where the ability to manage high-frequency data inputs and deliver fast, data-driven insights is critical for operational efficiency and strategic planning.

By Organization Size Analysis

In the organization size segment of the anomaly detection market, large enterprises are expected to consolidate their dominance, accounting for 67.0% of the total market share in 2025. This trend is largely driven by the complex IT infrastructures, vast customer databases, and heightened security requirements of large organizations across sectors such as finance, healthcare, telecom, and manufacturing.

These enterprises often face a wide range of threats and operational anomalies that require advanced, scalable, and real-time detection capabilities. With greater budgets and access to technical expertise, large companies are more likely to invest in comprehensive anomaly detection platforms powered by AI and machine learning, which can be integrated with existing cybersecurity, compliance, and performance monitoring systems. Furthermore, the demand for automated analytics, predictive maintenance, and behavioral risk modeling continues to grow within large enterprises as part of their broader digital transformation and governance strategies.

Small and medium-sized enterprises (SMEs), while capturing a smaller portion of the market, represent a rapidly growing segment for anomaly detection solutions. As digital adoption accelerates among SMEs, their exposure to cybersecurity threats, data integrity issues, and IT performance challenges also increases. However, due to limited financial and human resources, SMEs often seek lightweight, cost-effective anomaly detection tools that are easy to deploy and maintain.

The availability of cloud-based and subscription-based solutions has made it more feasible for SMEs to adopt anomaly detection technologies without heavy capital investment. In addition to cybersecurity, SMEs are using anomaly detection for fraud prevention, customer behavior analysis, and IT system health monitoring. As awareness of data-driven operations expands among smaller firms, their participation in the anomaly detection market is expected to rise steadily in the coming years.

By Application Area Analysis

In the application area segment of the anomaly detection market, fraud detection is projected to hold the largest share at 22.0% in 2025. This leading position is primarily driven by the escalating threat of financial crimes, including identity theft, payment fraud, and account takeovers, across banking, insurance, fintech, and e-commerce sectors. Organizations are deploying anomaly detection tools to monitor transactional behavior in real-time, identify deviations from user profiles, and flag suspicious activities before they escalate into major financial losses.

The use of AI and machine learning in fraud detection enables these systems to evolve with emerging fraud patterns, reduce false positives, and enhance decision-making speed. Additionally, regulatory compliance requirements and growing consumer expectations for secure digital experiences are reinforcing the demand for advanced fraud detection systems powered by anomaly detection.

Intrusion and threat detection also forms a critical segment in the anomaly detection market, especially in the face of sophisticated cyberattacks targeting enterprises, governments, and cloud-based infrastructures. Anomaly detection technologies are extensively used to identify unusual network behavior, unauthorized access attempts, and potentially malicious insider activity. These systems continuously analyze logs, traffic patterns, and user actions to detect signs of compromise that traditional signature-based tools might miss.

In a time when ransomware, phishing, and zero-day exploits are on the rise, intrusion and threat detection solutions enable organizations to respond proactively and protect their digital assets. The growing complexity of hybrid IT environments and remote work models has further accelerated the adoption of anomaly-based threat detection as a core component of modern cybersecurity strategies.

By Industry Vertical Analysis

In the industry vertical segment of the anomaly detection market, the BFSI (Banking, Financial Services, and Insurance) sector is expected to lead with a 24.0% market share in 2025. This dominance is driven by the sector’s high vulnerability to fraud, cyberattacks, regulatory breaches, and data anomalies.

Financial institutions are under constant pressure to safeguard vast volumes of sensitive data while ensuring smooth and secure transaction processing. Anomaly detection plays a pivotal role in identifying unauthorized account activities, unusual transaction patterns, and potential money laundering attempts in real time. Advanced AI and machine learning models help these organizations enhance fraud prevention, meet compliance requirements such as KYC and AML, and ensure uninterrupted service delivery. As digital banking, mobile payments, and automated lending continue to expand, the demand for robust anomaly detection capabilities within the BFSI sector will only intensify.

The IT and telecom industry is also a major contributor to the anomaly detection market, utilizing these technologies to ensure network security, maintain system uptime, and optimize operational performance. Telecom providers and IT service companies handle enormous volumes of data across highly distributed infrastructures, making them susceptible to service disruptions, cyber intrusions, and performance bottlenecks. Anomaly detection is used to monitor network traffic, server logs, and user activity to identify abnormal behavior that could indicate security breaches, system failures, or fraudulent usage.

These insights enable proactive threat mitigation and help providers deliver consistent service quality in a competitive and highly dynamic environment. With the rollout of 5G, increased cloud adoption, and the rise of software-defined networks, IT and telecom firms are integrating anomaly detection into their operational and security frameworks to enhance agility and resilience.

The Anomaly Detection Market Report is segmented on the basis of the following

By Component

By Deployment Mode

By Technology

- Machine Learning

- Big Data Analytics

- Data Mining & Profiling

- Others

By Organization Size

By Application Area

- Fraud Detection

- Intrusion & Threat Detection

- Malware Detection

- Log & File Monitoring

- Network Traffic Monitoring

- Cloud Monitoring

- Payment Fraud Detection

- Others

By Industry Vertical

- BFSI

- IT & Telecom

- Healthcare & Life Sciences

- Retail & eCommerce

- Government & Defense

- Manufacturing

- Energy & Utilities

- Transportation & Logistics

- Others

Global Anomaly Detection Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to lead the global anomaly detection market in 2025, accounting for 39.0% of the total market revenue. This regional dominance is fueled by the early adoption of advanced technologies, a mature cybersecurity ecosystem, and significant investments in AI-driven analytics across key sectors such as banking, healthcare, defense, and technology.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The presence of leading technology vendors, robust digital infrastructure, and growing regulatory pressure for data protection further supports the widespread implementation of anomaly detection solutions. As enterprises in the U.S. and Canada continue to embrace cloud computing, IoT, and real-time monitoring, the demand for scalable and intelligent anomaly detection tools is expected to remain strong throughout the forecast period.

Region with significant growth

The Asia-Pacific region is expected to register the highest CAGR in the global anomaly detection market during the forecast period, driven by rapid digital transformation, growing cyber threats, and the expanding adoption of AI and big data analytics across emerging economies such as China, India, and Southeast Asia.

As organizations in this region modernize their IT infrastructures and shift toward cloud-native environments, the need for real-time anomaly detection solutions to monitor financial transactions, network activity, and operational systems is accelerating. Government initiatives promoting smart city development, digital banking, and Industry 4.0 are further boosting demand, making Asia-Pacific the fastest-growing regional market for anomaly detection technologies.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Anomaly Detection Market: Competitive Landscape

The global competitive landscape of the anomaly detection market is characterized by a mix of established technology giants and agile, innovation-driven startups, all vying to expand their market presence through advanced, AI-powered solutions. Key players such as IBM, Microsoft, Google (Alphabet), Amazon Web Services, and Cisco Systems are leveraging their broad portfolios and global reach to deliver scalable anomaly detection platforms integrated with machine learning, cloud analytics, and cybersecurity tools.

At the same time, companies like Darktrace, Anodot, and Sumo Logic are gaining traction with specialized offerings focused on behavioral analytics, real-time monitoring, and industry-specific applications.

Strategic partnerships, product innovations, and acquisitions are frequent as vendors aim to strengthen their capabilities across diverse sectors, including BFSI, IT and telecom, healthcare, and manufacturing. With growing demand for proactive threat detection and predictive insights, the competition is intensifying, pushing players to differentiate through automation, interoperability, and verticalized solutions.

Some of the prominent players in the global anomaly detection market are:

- IBM

- SAS Institute

- Microsoft

- Google (Alphabet)

- Amazon Web Services (AWS)

- Splunk

- Cisco Systems

- Palo Alto Networks

- Dynatrace

- Sumo Logic

- Rapid7

- Darktrace

- Anodot

- HPE (Hewlett-Packard Enterprise)

- Trend Micro

- LogRhythm

- Fortinet

- AIOpsgroup

- Broadcom (Symantec)

- DataDog

- Other Key Players

Global Anomaly Detection Market: Recent Developments

- June 2025: Acceldata introduced its new Adaptive AI Anomaly Detection feature, enabling proactive detection of complex, multidimensional data irregularities before they impact business-critical applications.

- April 2025: HITEK AI launched a Predictive Maintenance and Anomaly Detection System within its CAFMTEK platform, enhancing fault prediction and operational continuity in facility management.

- June 2025: Sagtec finalized the acquisition of Smart Bridge, expanding its AI suite to include behavioural anomaly detection and real‑time fraud prevention modules.

- April 2025: Datadog acquired Metaplane, a data observability startup whose anomaly detection models strengthen its lineage tracking and alerting capabilities.

- May 2025: Una Software secured USD 4.4 million in seed funding to develop its AI-powered FP&A platform with built-in anomaly detection and conversational forecasting capabilities.

- April 2025: Exaforce, an AI-driven SOC platform focused on reducing false-positive security alerts, raised USD 75 million in Series A funding led by Khosla Ventures and Mayfield Fund.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 7.3 Bn |

| Forecast Value (2034) |

USD 31.9 Bn |

| CAGR (2025–2034) |

17.7% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 2.4 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Solutions and Services), By Deployment Mode (Cloud-Based and On-Premise), By Technology (Machine Learning, Big Data Analytics, Data Mining & Profiling, and Others), By Organization Size (Large Enterprises and SMEs), By Application Area (Fraud Detection, Intrusion & Threat Detection, Malware Detection, Log & File Monitoring, Network Traffic Monitoring, Cloud Monitoring, Payment Fraud Detection, and Others), and By Industry Vertical (BFSI, IT & Telecom, Healthcare & Life Sciences, Retail & eCommerce, Government & Defense, Manufacturing, Energy & Utilities, Transportation & Logistics, and Others). |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

IBM, SAS Institute, Microsoft, Google (Alphabet), Amazon Web Services (AWS), Splunk, Cisco Systems, Palo Alto Networks, Dynatrace, Sumo Logic, Rapid7, Darktrace, Anodot, HPE (Hewlett-Packard Enterprise), Trend Micro, LogRhythm, and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global anomaly detection market?

▾ The global anomaly detection market size is estimated to have a value of USD 7.3 billion in 2025 and is expected to reach USD 31.9 billion by the end of 2034.

What is the size of the US anomaly detection market?

▾ The US anomaly detection market is projected to be valued at USD 2.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 9.5 billion in 2034 at a CAGR of 16.6%.

Which region accounted for the largest global anomaly detection market?

▾ North America is expected to have the largest market share in the global anomaly detection market, with a share of about 39.0% in 2025.

Who are the key players in the global anomaly detection market?

▾ Some of the major key players in the global anomaly detection market are IBM, SAS Institute, Microsoft, Google (Alphabet), Amazon Web Services (AWS), Splunk, Cisco Systems, Palo Alto Networks, Dynatrace, Sumo Logic, Rapid7, Darktrace, Anodot, HPE (Hewlett-Packard Enterprise), Trend Micro, LogRhythm, and Other Key Players.

What is the growth rate of the global anomaly detection market?

▾ The market is growing at a CAGR of 17.7 percent over the forecasted period.