FDA's recent approval of RNA interference (RNAi) treatments for liver diseases has given market momentum an additional boost. In April 2023, they granted approval of an innovative RNAi drug designed to treat familial amyloid polyneuropathy (FAP), underscoring RNAi technologies' expansive potential in neurological conditions and liver-related ailments, expanding the toolkit beyond traditional biologics like Monoclonal Antibodies.

Antisense and RNA interference therapies share the common goal of controlling gene expression to treat genetic disorders. Synthetic short DNA or RNA molecules that enhance particular RNA sequences within cells are attached to their target RNA and form a double-stranded structure that prevents the target RNA from functioning normally.

By investing more into genetic research, companies are turning their attention towards new RNAi-based therapies designed to combat cancer, cardiovascular diseases, and autoimmune disorders. Strategic partnerships between biopharma companies and academic institutions create additional opportunities for RNA-targeted treatments - fuelling further market expansion.

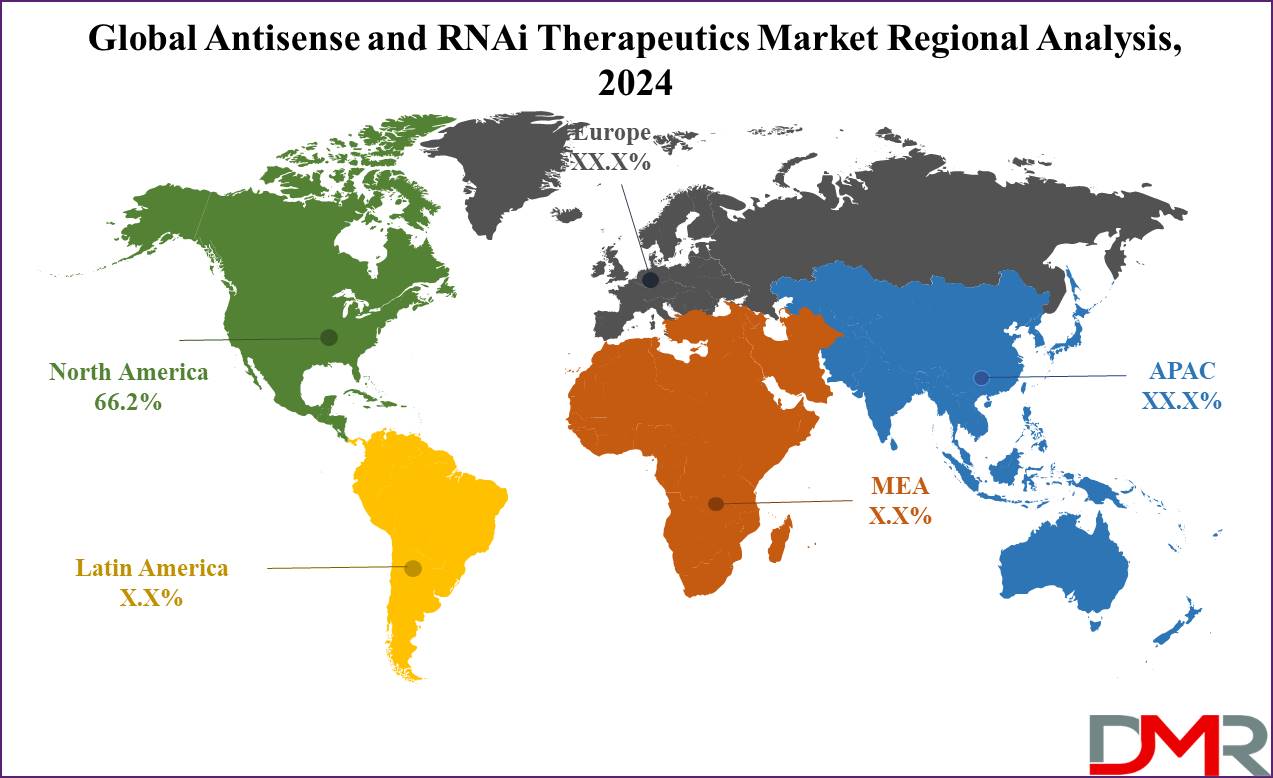

In terms of regional distribution, North America holds the largest market share at 48%, largely due to advancements in RNAi drug development and FDA approvals. The European market follows with 30%, while the Asia-Pacific region has seen 12% growth in RNAi therapeutic research, especially in China and India, where demand is increasing for innovative treatments.

Genetic therapies present great growth prospects for rare diseases and chronic conditions. Prosperous research efforts into RNA interference and antisense technologies for oncology and metabolic conditions could open new treatment avenues in coming years, representing substantial growth opportunities in this market segment.

Key Takeaways

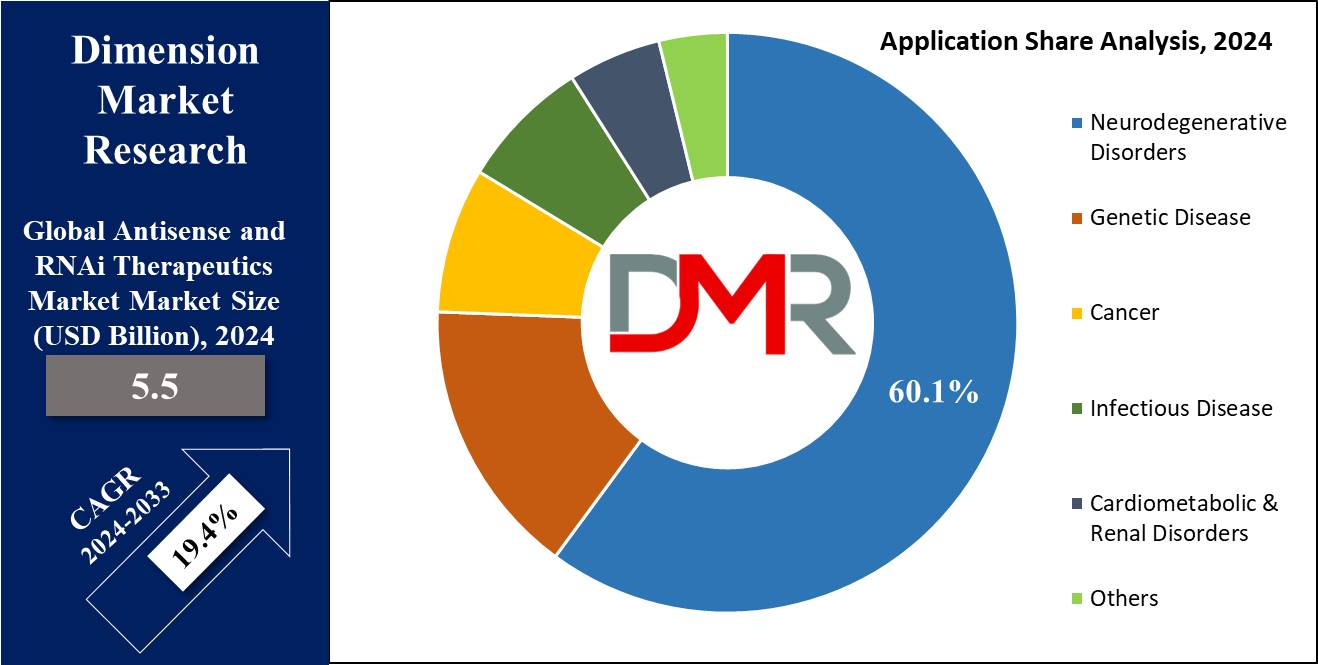

- At USD 5.5 billion in 2024, the global antisense and RNAi therapeutics market is predicted to grow and is projected to rise at a CAGR of 19.4% to USD 27.2 billion by 2033.

- The antisense RNA segment is expected to hold the largest market share based on technology in 2024.

- The intrathecal injections segment is expected to dominate the market in terms of route of administration with a share of 44.3% in 2024.

- The neurodegenerative disorders sector is expected to dominate the market with a 60.1% revenue share in 2024.

- North America is expected to lead the market with a 66.2% share of the global market in 2024.

Use Cases

- Antisense and RNAi therapies have shown the ability to target specific genes involved in cancer development and progression as these can obstruct cancer cell growth and induce programmed cell death by preventing the expression of oncogenes or genes critical for tumor survival.

- These therapies are used for treating neurological disorders by changing the expression of disease-causing genes as antisense oligonucleotides can target and reduce the expression of the mutant huntingtin protein responsible for neuronal toxicity.

- These methods can stop viruses from multiplying by aiming at important viral genes or control regions.

- These treatments are used in managing metabolic disorders by adjusting the activity of genes related to metabolic processes, such as targeting genes linked to cholesterol or glucose metabolism to address conditions like high cholesterol or diabetes.

Market Dynamic

In various medical disorders, whether they are genetic or hereditary, antisense technology is efficient in gene expression transformation which identifies the targeted sequence. The market is expanding due to the adoption of 3D printing technologies in their products. Antisense oligonucleotide and RNAi therapies are two different therapeutic ways that use oligonucleotides to deal with rare diseases and they have shown better therapeutic outcomes at the same time. Another factor is that there are particular no treatment options for rare diseases on the global level.

As a result, there is a progressive rise in financing and research initiatives aimed at creating innovative treatments for rare diseases. Also, major progress made by key players in the development of siRNA-based therapies for several diseases is anticipated to fuel the industry's expansion in the upcoming years. Furthermore, many studies have explored antisense and RNAi therapy as promising treatments for COVID-19. These papers and studies support scientists working on RNA interference and antisense technology which is expected to fuel the market expansion. However, the higher cost of RNA interference-based drugs hampering the growth of this market.

Research Scope and Analysis

By Technology

The antisense RNA segment is expected to hold the largest market share based on technology in 2024, primarily due to its revenue generation dominance and common testing for controlling many conditions. Further, this technology regulates both protein and gene expression, finding applications in cardiovascular, respiratory, neurodegenerative, and genetic disorders, expected to fuel segment growth.

Studies show the potential of antisense oligonucleotide therapies in treating various disorders, including infectious diseases, further increasing the demand for antisense RNA technology. Furthermore, the RNA interference technology segment is anticipated to witness a higher CAGR over the forecast period.

This technology is used to investigate gene functions in model organisms and cell cultures, and it is also used to target specific gene sequences associated with cancer. Moreover, this technology finds its application in treating bacterial diseases, viruses, and parasites, as well as providing pain relief.

By Route of Administration

The intrathecal injections segment is expected to dominate the market with a share of 44.3% in 2024. It is a method of delivering medicines that involves injecting them into the spinal canal or subarachnoid space to reach the cerebral spinal fluid.

This method is applied in pain management, spinal anesthetic, chemotherapy, and the introduction of medications to fight particular infections, particularly following neurosurgery procedures. Also, every genetically modified molecule is to consider the route of medication delivery as one of its most important components.

Furthermore, the subcutaneous segment is anticipated to witness the highest CAGR over the forecast period as this injection is delivered in fatty tissue directly beneath the epidermis. The infusion site can be freely chosen with this kind of delivery, possible locations include the thighs, belly, and backs of the arms. This facilitates smaller needle sizes, potentially reducing discomfort during the infusion process.

By Application

The neurodegenerative disorders sector is expected to dominate the market with a 60.1% revenue share in 2024, acting industry player to enhance RNAi and antisense therapies for treating such conditions. Government efforts, along with initiatives by other major firms, are anticipated to drive growth in this segment. Besides that, the genetic disorders segment shows the highest CAGR in 2024 among the others since the amount of investigation devoted to nucleotide drugs is growing very fast.

One more scenario, where mutations in some genetic disorders promote abnormal splicing of pre-mRNA is essential for the formation of diseased or not at all functional proteins. Controlling a normal splicing process by using antisense and RNAi tools gives rise to correct mRNA processing, thereby leading to the abrogation of mutated proteins.

The Antisense and RNAi Therapeutics Market Report is segmented based on the following

By Technology

- RNA Interference

- Antisense RNA

By Route of Administration

- Intrathecal Injections

- Intravenous Injections

- Subcutaneous Injections

- Others

By Application

- Neurodegenerative Disorders

- Genetic Disease

- Cancer

- Infectious Disease

- Cardiometabolic & Renal Disorders

- Others

Regional Analysis

North America is expected to lead the

market with a 66.2% share of the global market in 2024, due to several RNAi treatments being developed in this region. Moreover, many biopharma companies have spent heavy amounts of capital developing therapeutic RNAi treatments. Several sectors that help these sectors work in the region are being developed, the big companies in healthcare and pharmaceuticals being the major players in the area.

This market has seen significant gains as the technologies that use RNA have improved and they have shown effective results in different fields. Europe; in second position, is projected to be a fast-developing area within the market. There are companies in Europe that are working on antisense and RNAi therapeutics, higher the regional market growth for the predicted period.

North America

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The key players in this market are looking to progress in these therapies for the treatment of many conditions as antisense oligonucleotide therapies show significance in addressing several disorders, such as infectious diseases. Major players in the market are engaging in strategic actions like partnerships, launching new products, and acquisitions to enhance their market standing and expand their market positioning. Businesses are introducing innovative treatments to diversify their product portfolios and extend their market reach.

Some of the key players in the global antisense and RNAi therapeutics market are

- GSK plc

- Olix Pharmaceuticals, Inc.

- Sanofi

- Alnylam Pharmaceuticals, Inc.

- Arbutus Biopharma

- Benitec Biopharma Inc.

- Silence Therapeutics

- Ionis Pharmaceuticals, Inc

- Sarepta Therapeutics

- Percheron Therapeutics Limited

- Others

Recent Development

- In August 2023, Sirnaomics Ltd completed phase I clinical trials for STP707, an RNAi therapy targeting multiple solid tumors.

- In July 2023, Alnylam Pharmaceuticals, Inc. partnered with Roche to develop and commercialize zilebesiran, an RNAi therapy for hypertension.

- In July 2023, Ionis Pharmaceuticals, Inc. expanded its collaboration with AstraZeneca, granting rights for AstraZeneca to market eplontersen in countries outside the U.S.

- In June 2023, Alloy Therapeutics introduced the AntiClastic Antisense Oligonucleotide platform for genetic medicine development.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 5.5 Bn |

| Forecast Value (2033) |

USD 27.2 Bn |

| CAGR (2023-2032) |

19.4% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Technology (RNA Interference, Antisense RNA), By Route of Administration (Intrathecal Injections, Intravenous Injections, Subcutaneous Injections, Others), By Application (Neurodegenerative Disorders, Genetic Disease, Cancer, Infectious Disease, Cardiometabolic & Renal Disorders, Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

GSK plc, Olix Pharmaceuticals, Inc., Sanofi, Alnylam Pharmaceuticals, Inc., Arbutus Biopharma, Benitec Biopharma Inc., Silence Therapeutics, Ionis Pharmaceuticals, Inc, Sarepta Therapeutics, Percheron Therapeutics Limited, Others |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |