The global aquaponics and hydroponics systems and equipment market has seen massive growth due to increased demand for sustainable agriculture. The method merges aquaculture with

hydroponics, which holds that plants and fish are synergistically produced in the controlled environment of water use to attain high productivity.

The market is characterized by a wide range of equipment variants, which include HVAC, LED grow lights, irrigation systems, and aeration systems, all of these are quite critical for the maintenance of optimal growing conditions.

The adoption rate of these systems is high in areas where arable land and water resources are less compared to other areas; this will further strengthen the market in regions like Asia-Pacific and North America. Additionally, increasing awareness with respect to

food security and demand for organic produce has also been boosting the market growth.

Innovations in automation and IoT-enabled smart systems drive the adoption of aquaponic and hydroponic systems across the world. Key players operating in the market are striving to develop product portfolios and invest in R&D to improve system efficiency and sustainability.

The demand for farming practices like urban farming and sustainable agriculture is rising, and this trend is expected to further fuel growth in the global aquaponics and hydroponics systems and equipment market during the forecast period.

Aquaponics and hydroponics offer exciting new opportunities in both developed and emerging markets, particularly urban areas with limited space for traditional farming that lack sufficient sunlight for fruit trees to produce food locally. Furthermore, with growing attention being paid to sustainability and organic farming techniques like aquaponics/hydroponics as a viable means to meeting global food demands while decreasing environmental impact.

As per hydrobloomers Aquaponic systems offer significantly higher yields compared to traditional soil-based agriculture, producing up to 10 times more food per unit area. Plants grown in these systems also benefit from faster growth rates, with some crops growing up to 25% faster than in conventional soil. This results in more frequent harvests, typically every 28 days.

Space efficiency is another key advantage of aquaponics. Vertical aquaponic setups can generate up to 20 times more food per square foot than traditional farming, making them ideal for urban environments. This space-saving technique contributes to urban farming by providing fresh, local produce in densely populated areas, benefiting food security.

Aquaponic systems also excel in nutrient and energy efficiency. By recycling fish waste to nourish plants, these systems eliminate the need for synthetic fertilizers. Additionally, aquaponics can reduce energy consumption by incorporating renewable energy sources like solar and wind, leading to lower operational costs and higher returns, with some gardens seeing a 600% ROI.

The US Aquaponics and Hydroponics Systems and Equipment Market

The US Aquaponics and Hydroponics Systems and Equipment market is projected to be valued at USD 1,059.3 million in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 4,071.0 million in 2033 at a CAGR of 16.1%.

The future growth of the U.S. aquaponic and hydroponic equipment market looks optimistic, propelled by the increasing consumer demand for locally grown and produced sustainable foods. Urban agriculture and vertical gardening have taken a wave across densely populated cities, where land space is highly costly and consumers are seeking access to fresh and organic products. These systems enable all-year-round productions and are therefore highly awaited in areas with harsh climates.

Key U.S. trends are examples of integrating smart technology and automation in hydroponic or aquaponic systems through resource use, plant health, and general workmanship in order to increase efficiency while keeping labor costs down.

In summary, the trend of farm-to-table movements has pushed these systems to the forefront of commercial adoption in restaurants and grocery stores. Some of the critical opportunities in the U.S. market mostly entail developing small home-based systems for use by individuals. More so, the increasing awareness of sustainable approaches creates a market, and there are larger potential for market expansion.

Finally are the government incentives and policies in place that are focused on promoting sustainable agriculture to enhance market growth. Recent developments have seen collaborative work between tech companies, and agricultural companies in developing processes towards more sophisticated, consumer-oriented systems, and the rise of urban farms in New York, Chicago, and Los Angeles, among others push the growth of this market in this region.

Key Takeaways

- Global Value: The global aquaponics and hydroponics systems and equipment market size is estimated to have a value of USD 4.482.4 million in 2024 and is further expected to reach USD 18,724.7 million by the end of 2033.

- Global Growth Rate: The market is growing at a CAGR of 17.2 percent over the forecasted period.

- The US Market Value: The US aquaponics and hydroponics systems and equipment market is projected to be valued at USD 1,059.3 million in 2024 which is further forecasted to reach USD 4,071.0 million in 2033 at a CAGR of 16.1%.

- By Equipment Segment Analysis: Heating, ventilation, and air conditioning (HVAC) are projected to dominate this market in the equipment segment with 32.5% of the market share in 2024.

- By Technique Segment Analysis: Nutrient film technique is projected to dominate the global aquaponics and hydroponic system and equipment market in the technique segment as it holds 33.2% of the market share in 2024.

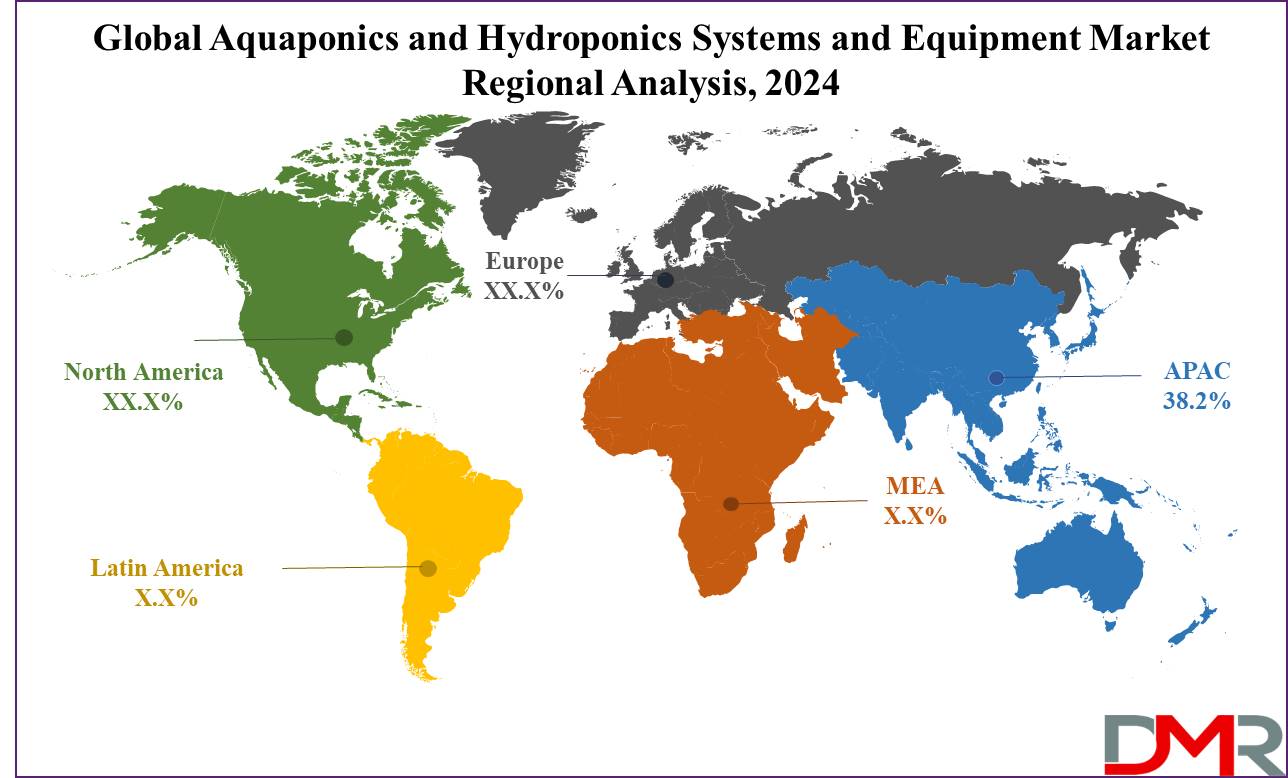

- Regional Analysis: Asia Pacific is expected to have the largest market share in the Global Aquaponics and Hydroponics Systems and Equipment Market with a share of about 38.2% in 2024.

Use Cases

- Urban Farming: Due to their compact nature, aquaponics is very conducive for farming in urban areas. It can raise fresh produce and fish within small spaces to minimize the cost of transportation and promote food security.

- Educational Programs: Schools and universities use hydroponic and aquaponics systems for educational purposes, teaching students about sustainable agriculture, water conservation, and the integration of biology with technology.

- Commercial Agriculture: Large-scale farms employ these systems to achieve maximum crop yields and fish production with a minimum water supply. Thus, it becomes very vital, especially in areas prone to water shortage conditions.

- Home Gardening: These home-based hydroponic systems help people grow fresh vegetables and herbs within their homes. In turn, this can help them get healthy pesticide-free produce all throughout the year.

Market Dynamic

Trends

Smart Farming IntegrationIoT-enabled smart systems in hydroponic and aquaponic setups have revolutionized agriculture. By providing real-time monitoring and automated control over environmental factors like light levels, temperatures, nutrient levels, and labor costs - real-time monitoring allows real-time control over environmental elements while greatly increasing crop growth and decreasing labor costs significantly. As this trend grows, demand grows for equipment compatible with smart technology enabling precision farming techniques.

Vertical Farming Expansion

Vertical farming has emerged as an emerging trend within aquaponics and hydroponics systems and equipment markets, particularly among urban environments where space utilization can be maximized for producing fresh produce in high-density spaces. Particularly notable in Asia-Pacific and North American urbanized regions with limited arable land are driving a greater need for innovative agricultural solutions like vertical farming.

Sustainability and Circular Economy

A growing emphasis on sustainability and circular economy principles has a major effect through to aquaponics and hydroponics systems. Such systems abide by circular economy principles by recycling water and nutrients while minimizing environmental impact. This trend is gathering steam as consumers, businesses, and governments prioritize more eco-friendly practices, increasing demand for closed-loop agricultural systems.

Growth Drivers

Sustainable Agriculture Demand

Aquaponics and hydroponics markets have seen steady momentum driven by a global shift toward environmentally responsible farming methods such as aquaponics. Aquaponics systems use significantly less water than traditional methods while eliminating the need for chemical fertilizers, and meeting consumer desires for organic, eco-friendly produce - helping drive market expansion across regions facing water scarcity issues as well as environmental obstacles. This demand propels these markets even further forward, especially those facing severe water scarcity issues or ecological hardship.

Food Security Concerns

Increased food insecurity concerns in urban and arid regions are driving the growth of aquaponic and hydroponic systems. The aquaponic and hydroponic systems allow year-round production of high-quality, nutritious food without regard for external weather patterns that is why the market expansion for aquaponic and hydroponic is therefore increasing at an unprecedented pace. As populations increase alongside climate change-exacerbated agriculture practices, market expansion becomes ever more rapid in the upcoming period.

Government Support and Incentives

Increased government support via subsidies, grants, and favorable policies is driving more organizations towards adopting aquaponics and hydroponics systems as an approach for food security and environmental challenges, leading to investments being made and new agricultural initiatives being created in many regions across the world.

Technological Innovations in Equipment

Continuous advances in equipment technologies, particularly LED lighting, nutrient delivery systems, and automation solutions are driving market expansion. These advancements improve aquaponic and hydroponic system scalability and accessibility to both residential and commercial users alike, as well as creating cost-efficient energy-saving systems that increase the adoption rate of these systems.

Growth Opportunities

Technological Advancements

Advances in automation, IoT, and AI are creating exciting opportunities in aquaponics and hydroponics systems and equipment markets. These advancements increase system efficiencies while decreasing operational costs while simultaneously increasing crop yields - making these investments appealing to both residential and commercial users alike. Companies investing in R&D to incorporate such cutting-edge technologies will likely secure significant market shares over time.

Expansion in Emerging Markets

Emerging markets offer tremendous unrealized potential in Asia-Pacific and Latin America, creating tremendous expansionary potential. As awareness of sustainable farming practices rises and governments in these regions support agricultural innovation, the adoption of aquaponic and hydroponic systems should increase significantly; companies that can adapt their offerings specifically for each emerging market should experience exponential growth opportunities.

Customized Solutions for Urban Agriculture

As urbanization continues to rise, there is a growing demand for customized aquaponic and hydroponic systems designed for urban settings, such as rooftop gardens, vertical farms, and indoor farming units. Companies that develop compact systems tailored specifically for densely populated cities offer significant growth potential through these niche solutions.

Collaboration with Educational Institutions

Cooperating with educational institutions presents market players with an exceptional growth opportunity. Partnering with schools, universities, and research centers allows companies to promote aquaponics and hydroponics systems as educational tools within educational systems thereby driving innovation within markets as a whole and expanding markets even further. Furthermore, collaboration helps raise awareness among younger generations regarding sustainable farming practices while expanding markets further.

Restraints

High Initial CostsThe high initial investment required for setting up aquaponic and hydroponic systems is a major restraint for market growth. The costs associated with purchasing and installing advanced equipment, such as

HVAC systems, LED grow lights, and automated controllers, can be prohibitive for small-scale farmers and hobbyists. This financial barrier limits the adoption of these systems, particularly in developing regions.

Technical Complexity

Aquaponic and hydroponic system management presents unique technical difficulties when applied on a larger scale. Proper functioning requires knowledge of water chemistry, plant nutrition, and system maintenance - something unfamiliar users might be intimidated by at first. Furthermore, their dependence upon specialists for maintenance poses additional threats of system failure in smaller facilities that lack staff to oversee operations effectively.

Limited Awareness and Adoption

Although aquaponics and hydroponics offer many advantages, awareness, and adoption remain low across many parts of the globe. Many potential users, particularly in rural or developing regions, lack familiarity with these systems or access to appropriate resources and training necessary for implementation, as a result, market growth remains restricted.

Research Scope and Analysis

By Equipment

Heating, ventilation, and air conditioning (HVAC) are projected to dominate this market in the equipment segment with 32.5% of the market share in 2024. HVAC has a dominating share in the global aquaponics and hydroponics systems and equipment market because of its importance in maintaining optimal growing conditions.

HVAC in controlled environment agriculture is applied to maintain the temperature, humidity, and air quality so that plants and fish face no external factors relating to the weather. Climate control is essential in aquaponics and hydroponics to safeguard aquatic species and protect crops.

Using HVAC systems can maintain conditions in and around the ideal sweet spot range that is necessary for areas that experience extreme climates or where seasonal variations would otherwise adversely affect production. In such a stable environment, year-round farming becomes possible, substantially enhancing overall productivity and profitability. Next, HVAC technology is only getting better as improvements in energy use and complexity with smart controls increase.

In fact, it is lower operational costs and improved performance, respectively, that these innovations bring. This, therefore, makes HVAC systems an indisputable part of any modern aquaponic or hydroponic operation. However, it is expected that the advent of more sustainable controlled agriculture systems will keep making HVAC systems splendid in their leadership.

By Technique

Nutrient film technique is projected to dominate the global aquaponics and hydroponic system and equipment market in the technique segment as it holds 33.2% of the market share in 2024. The nutrient film technique segment dominates this global market, counting on its efficiency and scalability.

In the NFT technique, a very thin film of water enriched with nutrients continuously flows over the roots of plants, providing them with a constant supply of oxygen and other nutrients. This is highly efficient for maximum plant growth with minimum use of water and nutrients, thus being preferred by commercial growers.

Most users, however, find NFT systems pretty basic and user-friendly. It does not involve any complex setting up processes as would be the case with other techniques. Furthermore, setting up and maintaining an NFT system involves pretty fundamental processes; hence, the technique can be used by large commercial farmers and even small-scale hobby farmers. Another additional advantage of an NFT system is that it's modular; hence, it is very easy to upscale to meet both small- and large-scale needs.

NFT works particularly well for leafy greens and herbs because of the relatively superficial roots and the fact that the plants are continuously bathed in nutrient solution. High yields obtained in such a small area add to the charm of the NFT system, especially in the case of urban agriculture, where space is an expensive commodity. As such, NFT continues to lead in terms of technique segment growth, driven by efficiency, versatility, and easy scalability.

By Application

Fish is anticipated to dominate this market in the application segment as it hold the highest market share in 2024. Fish, however, dominate the applications segment because fish are considered to be the hub of activity in the aquaponic cycle. In a system of aquaponics, it is the fish that provide the bulk of the plant nutrients through their wastes, which get converted into necessary nutrients through bacterial activity. This relationship enables the simultaneous production of fish and plants, hence it is an efficient and very viable method of farming.

Having fish in such aquaponic systems gives an important edge to sustainability and resource efficiency. In other words, wastes from fish act as natural fertilizers, hence eliminating any chemical input into the environment to reduce environmental impact. Additionally, the ability to harvest both fish and plants from the same system increases overall productivity and profitability, making it an attractive option for commercial farmers.

Also, there is a rising market demand for fresh and sustainably farmed fish in areas that wild-caught or traditionally farmed fish cannot reach. The aquaponic systems offer an accurate supply of quality fish, such as tilapia, catfish, and barramundi that feed well in such environments. This creates a dual-output ability that makes fish, in terms of applicability, a key driver of their dominance in the market.

By End User

Aquaponics farms are projected to dominate the aquaponic and hydroponic systems and equipment market as they hold the highest market in 2024. The aquaponics farm segment occupies the biggest share of the end-user segment in the global aquaponics and hydroponics systems and equipment market, as it fully leverages the potential use of integrated farming systems. The farms are fully specialized in producing fish and plants within one closed-loop system that enhances resource efficiency and sustainability.

Because it capitalizes on this symbiosis between fish and plants, an aquaponics farm can produce high yields while creating minimal negative impacts on the environment. One of the major reasons setting aquaponics farms ahead is their potential for scaling and commercialization. They may be as small or as large as commercial enterprises that can adapt to varying market demand. Year-round fish and crop production independent of seasonal fluctuations facilitates a fresh supply of produce and seafood every time and caters to fast-rising local and sustainable food demands.

This also involves the rising demands of customers for organically and sustainably farmed produce. With growing awareness about food security and the environment, it rightly positions aquaponics farms to cater to these demands for a reliable alternative over traditional farming methods. Besides this, technology and system design have evolved to provide accessibility, and cost-effectiveness which effectively contribute to the dominance of aquaponics farms in this segment.

The Global Aquaponics and Hydroponics Systems and Equipment Market Report is segmented on the basis of the following

By Equipment

- Heating, Ventilation, and Air Conditioning (HVAC)

- Temperature Control Systems

- Humidity Control Systems

- Air Filtration Systems

- Irrigation System

- Drip Irrigation

- Spray Irrigation

- Subsurface Irrigation

- Automated Irrigation Controllers

- LED Grow Light

- Full Spectrum LED Grow Lights

- Supplemental Lighting Systems

- High-Intensity Discharge (HID) Lamps

- Smart Grow Lights (with IoT integration)

- Aeration System

- Air Pumps

- Oxygenation Systems

- Other Equipment

By Technique

- Nutrient-Film Technique

- Vertical NFT Systems

- Horizontal NFT Systems

- Commercial-Scale NFT Systems

- Media-Filled Grow Bed

- Expanded Clay Pellets

- Perlite/Vermiculite Mix

- Coco Coir Substrate

- Deep-Water Culture Technique

- Raft Systems

- Floating Platforms

- Bubbler Systems

- Ebb and Flow System

- Flood and Drain Tables

- Automatic Timers for Flood Cycles

- Overflow and Drain Systems

- Dutch-Bucket Systems

- Multi-Plant Dutch-Bucket Systems

- Single-plant Dutch-Bucket Systems

- Automated Nutrient Delivery Systems

By Applications

- Vegetables

- Leafy Greens

- Lettuce

- Spinach

- Kale

- Arugula

- Root Vegetables

- Fruiting Vegetables

- Tomatoes

- Peppers

- Eggplant

- Fruits

- Berries

- Strawberries

- Blueberries

- Raspberries

- Citrus Fruits

- Exotic Fruits

- Dragon Fruit

- Passion Fruit

- Herbs

- Culinary Herbs

- Medicinal Herbs

- Aromatic Herbs

- Fish

- Freshwater Fish

- Saltwater Fish

- Crustaceans

- Other Applications

By End User

- Aquaponics Farms

- Homes

- Micro Farms

- Other End Users

Regional Analysis

Asia Pacific is projected to dominate the global aquaponics and hydroponics system and equipment market as this region

holds 38.8% of the total market share in 2024. The largest share of the global aquaponics and hydroponics systems and equipment market lies in the Asia-Pacific region, driven by various factors like favorable climatic conditions, rapid urbanization, and rising demand for sustainable agriculture.

Countries like China, Japan, and South Korea are getting on board with the innovation in farming techniques since they have been able to produce high output in narrow spaces with minimum water consumption. Countries like China, Japan, and Australia are getting on board with the innovation in farming techniques since they have been able to produce high output in narrow spaces with minimum water consumption.

In the densely inhabited areas, for example, urban cities of China and Japan, traditional farming is quickly becoming impossible to practice due to a lack of arable land and adequate water supply. This problem can be averted by means of aquaponic and hydroponic systems since they have the capacity to grow fresh produce in a controlled environment; hence most appropriate for urban farming. This growth momentum was further supported by the development of vertical farming and rooftop gardens in these cities.

Moreover, government initiatives and support towards sustainable agriculture have been the key reason for dominance in this region. For instance, policies regarding food security and eco-friendly farming promoted aquaponics and hydroponic systems in countries like Australia and Singapore.

Advanced technologies and expertise available in these nations also supported the market towards growth at a fast pace. With the trend of increasing urbanization in the Asia-Pacific region and more impetus being given to sustainable food production, its lead in the global aquaponics and hydroponics systems and equipment market can only get further strengthened.

By Region

North America

Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global aquaponics and hydroponics systems and equipment market has become highly competitive among major players focused on innovation, product development, and strategic partnerships. In such a scenario, top companies like Argus Control Systems, General Hydroponics, and Endless Food Systems lead technological innovation in this market.

These companies also want to broaden their product offerings with respect to commercial farms, urban growers, and hobbyists. For example, Argus Control Systems is recognized for its sophisticated management of the climate, while General Hydroponics has a wide span of nutrient solutions and growing mediums developed specifically for hydroponic systems.

This market also comprises strategic collaborations and mergers that further help these companies get better market shares and increase their existence at a global level. For example, strategic alliances or partnerships between technology companies and agricultural companies give rise to more sophisticated, user-friendly systems that can attract a larger audience.

The competitive landscape is further shaped by the entry of new players and startups, particularly in emerging markets, which are driving innovation and increasing the availability of affordable systems and equipment. As the market continues to grow, competition is expected to intensify, leading to more innovations and improved product offerings.

Some of the prominent players in the Global Aquaponics and Hydroponics Systems and Equipment Market are

- Nelson & Pade

- Perth Aquaponics

- UrbanFarmers

- M Hydro

- Aquaponic Lynx

- Argus Controls System

- Backyard Aquaponics

- Better Grow Hydro

- Colorado Aquaponics

- ECF Farmsystems

- GreenTech Agro

- Hydrofarm

- General Hydroponics

- Hydrodynamics International

- LivinGreen

- My Aquaponics

- Other Key Players

Recent Developments

- August 2024: General Hydroponics introduced a new line of IoT-integrated smart grow lights, designed to optimize light spectra for different plant growth stages. These lights allow precise control over the light environment, improving crop yields and energy efficiency. The introduction of these smart grow lights reflects the growing trend toward automation and precision farming in hydroponic systems.

- July 2024: Argus Control Systems announced a strategic partnership with Agri-Tech Solutions, a leading agricultural technology firm. Together, they are developing advanced climate control systems equipped with AI-driven predictive analytics for large-scale hydroponic farms.

- June 2024: Endless Food Systems expanded its product offerings by launching modular aquaponics systems tailored for urban farming. These compact, space-efficient designs are specifically designed for use in urban environments, such as rooftop gardens and indoor farming operations.

- May 2024: The Australian Government introduced a new subsidy program aimed at promoting the adoption of hydroponics and aquaponics systems in both rural and urban areas. This initiative is part of the government's broader strategy to enhance food security and promote sustainable agricultural practices across the country.

- April 2024: Sky Greens, a leading vertical farming company in Singapore, implemented advanced hydroponic systems in its latest project. The systems, which integrate LED grow lights and automated irrigation systems, are designed to maximize production in limited spaces, making them ideal for Singapore's urban environment.

- March 2024: Aquaponic Solutions Europe secured significant investment from Green Innovations Capital to scale its operations and expand into new markets. The company plans to use the funds to enhance its product offerings and improve its closed-loop aquaponic systems, which are known for their efficiency and sustainability.

- February 2024: Hydrofarm Holdings Group, a leading provider of hydroponic equipment and supplies, published research findings that demonstrated the increased efficiency of using smart irrigation systems in hydroponic setups. These findings have led to a surge in demand for the company's automated irrigation controllers, which are designed to optimize water usage and nutrient delivery in hydroponic farms.

- January 2024: Nelson and Pade, Inc., a prominent aquaponics company, launched a new education initiative aimed at promoting aquaponics as a sustainable farming method. The initiative includes the development of curriculum materials and hands-on training programs for schools and universities.

- December 2023: Freight Farms, a company specializing in containerized farming systems, announced the release of its latest product, the "Greenery S," an advanced hydroponic system designed for container farms. This system features enhanced climate control, energy-efficient LED lighting, and automated nutrient management, making it ideal for urban and remote farming locations.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 4,482.4 Mn |

| Forecast Value (2033) |

USD 18,724.7 Mn |

| CAGR (2024-2033) |

17.2% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 1,059.3 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Equipment (Heating, Ventilation, and Air Conditioning, Irrigation System, LED Grow Light, Aeration System, and Other Equipment), By Technique (Nutrient-Film Technique, Media-Filled Grow Bed, Deep-Water Culture Technique, Ebb and Flow System, and Dutch-Bucket System), By Applications (Vegetables, Fruits, Herbs, Fish, Other Applications), By End User (Aquaponics Farms, Homes, Micro Farms, and Other End Users) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Nelson & Pade, Perth Aquaponics, UrbanFarmers, M Hydro, Aquaponic Lynx, Argus Controls System, Backyard Aquaponics, Better Grow Hydro, Colorado Aquaponics, ECF Farmsystems, GreenTech Agro, Hydrofarm, General Hydroponics, Hydrodynamics International, LivinGreen, My Aquaponics, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |