The automobile chips are important parts that make it possible to use features like safety, entertainment, and autonomous driving. The need for sensors, processors, and other semiconductor components has expanded due to the growing popularity of Advanced Driver Assistance Systems (ADAS).

Power electronics and Battery management systems are now important due to the rise of EVs. As a result, the growth of the automobile industry is closely related to the growth of the market for automotive chips.

The global automotive chip market continues to experience supply chain issues. Although initial recovery from pandemic-induced chip shortage has occurred, disruptions caused by geopolitical tensions and shifts in demand has caused fluctuating production schedules at automakers around the world - these challenges continue to affect vehicle production globally.

Demand for automotive chips has been driven by the increase in electric vehicle (EV) ownership and advanced driver assistance systems (ADAS). Both require more sophisticated semiconductor components that, in turn, necessitate high-performance chips. Furthermore, connectivity and infotainment systems have expanded chip usage within modern vehicles.

Opportunities in the automotive chip market are rapidly emerging in sectors like autonomous driving, where chips play a critical role in sensor fusion, machine learning, and real-time data processing. Furthermore, sustainability initiatives present an opportunity for chips that enhance energy efficiency or vehicle-to-grid (V2G) technologies to play their part. Innovation in chip design also seems essential in meeting increasing automotive demands.

As per IDC, Automotive chip sales are projected to experience significant expansion, with logic chip revenues projected to surpass US$8 billion by 2027 due to increasing autonomous driving and advanced driver assistance systems (ADAS), driving an increased need for high-performance computing chips such as HPCs. Memory chip revenue should surpass $7 billion by 2027 as vehicles need additional storage for maps, media files, and logs.

As per IDC Microprocessors Market is projected to garner revenue exceeding

US$15 billion by 2027, thanks to the increasing complexity of vehicle functionalities. Microcontroller units (MCUs) and

microprocessor units (MPUs) are becoming more powerful computing units to handle vast data and complex algorithms; at the same time, analog chips will surpass US$17 billion, providing advanced features such as noise suppression, higher accuracy levels, and faster response times.

The US Automotive Chip Market

The US Automotive Chip Market is projected to reach USD 23.6 billion in 2024 at a compound annual growth rate of 10.4% over its forecast period.

The automotive chip market in the US has growth opportunities driven by the growing electric vehicle (EV) sector, development in autonomous driving technologies, and rising demand for connected vehicles. Also, government incentives for EV adoption and investment in smart infrastructure create a favorable environment. In addition, the U.S. semiconductor industry's innovation and R&D capabilities position the country for leadership in automotive chip development.

Further, the increase in electric vehicles, the development of autonomous driving technologies, and strong government support for innovation and infrastructure drive the market. However, challenges like semiconductor supply chain disruptions and high development costs, can impact production timelines and increase market uncertainties. Balancing these factors will be crucial for sustained growth.

Key Takeaways

- Market Growth: The Automotive Chip Market size is expected to grow by 87.8 billion, at a CAGR of 11.1% during the forecasted period of 2025 to 2033.

- By Product: The microcontroller segment is expected to lead in 2024 with a major & is anticipated to dominate throughout the forecasted period.

- By Vehicle Type: The passenger vehicle segment is expected to lead the Automotive Chip market in 2024.

- By Application: The safety segment is expected to get the largest revenue share in 2024 in the Automotive Chip market.

- Regional Insight: North America is expected to hold a 46.4% share of revenue in the Global Automotive Chip Market in 2024.

- Use Cases: Some of the use cases of Automotive Chip include powertrain control, ADAS, and more.

Use Cases

- ADAS (Advanced Driver Assistance Systems): Automotive chips power ADAS features such as lane-keeping assist, adaptive cruise control, and collision avoidance systems, improving vehicle safety & driver convenience.

- Infotainment Systems: Chips allow specialized infotainment systems, providing smooth connectivity, navigation, multimedia, and voice recognition features within vehicles.

- Powertrain Control: Automotive chips optimize engine and transmission performance, enhancing fuel efficiency, reducing emissions, and supporting hybrid/electric vehicle power management.

- Autonomous Driving: These chips are crucial for processing data from sensors, cameras, and LIDAR in real time, allowing autonomous vehicle navigation and decision-making.

Market Dynamic

Driving Factors

Rise of Electric Vehicles (EVs)

The growing adoption of electric vehicles drives the need for advanced semiconductor components to manage battery systems, power electronics, and charging infrastructure. As EV adoption grows globally, the demand for efficient, high-performance chips becomes more important, boosting the automotive chip market.

Advancements in Autonomous Driving Technology

The push toward completely

autonomous vehicles needs specialized chips to process large volumes of data in real-time from sensors, cameras, and AI algorithms. As automakers & tech companies expand the development of autonomous driving systems, the need for powerful, reliable automotive chips is expected to grow.

Restraints

Supply chain disruptions

The current global supply chain issues, like semiconductor shortages, can severely impact the availability of automotive chips. These disruptions can impact vehicle production, increase costs, and develop uncertainty in the market, hindering its growth.

High R&D Costs

Developing advanced automotive chips demands significant investment in R&D. The high costs associated with developing new technologies, meeting safety standards, and ensuring chip reliability can limit market entry for smaller players and slow overall industry growth.

Opportunities

Growth in Connected Vehicles

The growth of the Internet of Things (IoT) in the automotive sector provides a major opportunity for automotive chips. As vehicles become highly connected, integrating features like vehicle-to-everything (V2X) communication, advanced infotainment, and over-the-air updates, the need for specialized chips developed to handle these tasks will increase.

The Emergence of AI and Machine Learning in Vehicles

The integration of AI and

machine learning in vehicles, mainly in areas like predictive maintenance, driver behavior analysis, and personalized in-car experiences, opens new opportunities for automotive chip innovation. Companies that can design chips capable of supporting these advanced AI functions will have a competitive advantage in the fast-evolving automotive market.

Trends

Shift Towards 7nm and Smaller Nodes

There is a major trend in the automotive chip market toward the adoption of advanced semiconductor manufacturing processes, like 7nm and smaller nodes. These smaller, more effective chips allow higher performance and lower power consumption, which are important for supporting the demands of modern vehicles, including EVs and autonomous systems.

Increased Focus on Cybersecurity

As vehicles become more connected and dependent on software, the automotive chip market is experiencing an increased focus on cybersecurity. Manufacturers are designing chips with built-in security features to protect against hacking, data breaches, and other cyber threats, ensuring the safety & integrity of vehicle systems.

Research Scope and Analysis

By Product

The global automotive chip market is categorized into various product types like analog, logic, microcontrollers, sensors, and others. In 2024, microcontrollers are expected to dominate, driven by their use in power management, audio systems, and driver assistance technologies. The growing need for advanced power management in electric and hybrid vehicles, combined with the trend of integrating multiple functions into single chips, is fueling the expansion of microcontrollers in the market.

Further logic ICs, essential for storing and retrieving data in infotainment systems, navigation, and engine control units, are anticipated to see significant growth due to the growing demand for specialized automotive guidance and entertainment systems.

Moreover, the sensors segment is projected to grow significantly, driven by the rising demand for advanced safety and driver assistance features such as parking aids and collision avoidance. Overall, the automotive chip market is expected to experience strong growth, with key players focusing on innovative, high-performance, and cost-effective solutions to meet evolving industry needs.

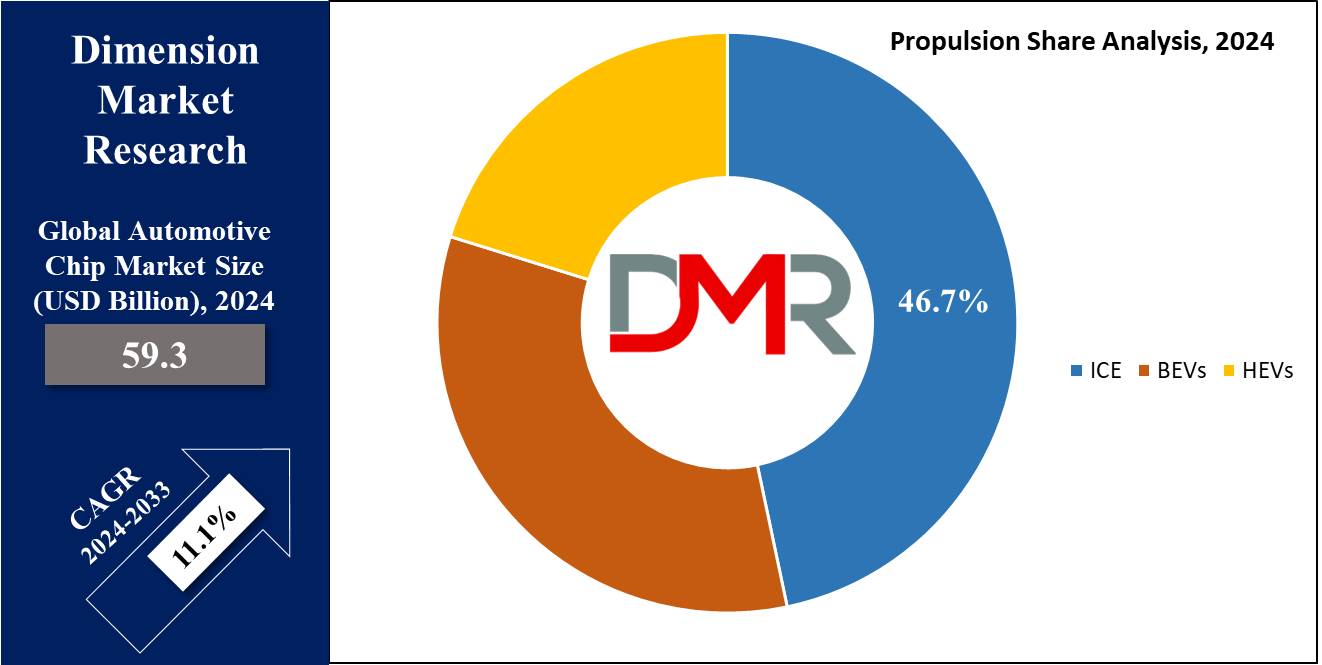

By Propulsion

The automotive chip market is segmented based on propulsion types, including Internal Combustion Engines (ICE), Battery Electric Vehicles (BEVs), and Hybrid Electric Vehicles (HEVs). Among these, the ICE segment is set to be the dominant, mainly due to its established infrastructure and broad adoption.

However, the rise of high-efficiency power modules has majorly enhanced the performance of BEVs, offering greater driving range and faster recharge times, which makes them show a higher growth rate over the forecasted period.

As a result, while ICE vehicles continue to hold a major share, the market for BEVs and HEVs is also growing rapidly due to advancements in technology and increasing consumer preference for more sustainable and efficient transportation options.

By Vehicle Type

The passenger vehicle segment is expected to hold a substantial share of the global automotive chip market in 2024. Rising per capita income has boosted the global sale of passenger vehicles to meet growing transportation needs.

Further, post-COVID, these vehicles have also increased consumer concern for safety, driving the preference for personal vehicles, which is expected to persist, creating an increased demand for passenger vehicles and consequently strengthening the segment’s share in the global automotive chip market.

Further, commercial vehicles play an important role in the growth of the automotive chip market due to their growing dependency on advanced technologies for efficiency and safety. The demand for commercial vehicles is driven by the need for better logistics, fleet management, and advanced driver assistance systems.

Chips are vital for integrating features like telematics, real-time data analytics, and autonomous driving capabilities, enhancing operational efficiency and safety. As the commercial vehicle sector grows and incorporates more advanced technology, the need for specialized automotive chips grows, thereby driving market growth and innovation in this segment.

By Application

The safety segment is expected to hold a significant share of the global automotive chip market in 2024, driven by the integration of essential safety technologies like anti-lock braking systems (ABS), airbags, and electronic brake force distribution (EBD).

The growing focus on in-car digital connectivity and content, mainly in developed countries where consumers prioritize entertainment and connectivity features, is also contributing to the growth of this segment. In addition, the major trend towards electrification of vehicle powertrains, which focuses on meeting stringent emission standards, is improving the demand for automotive chips in safety systems.

Further, the growth of the telematics & infotainment and powertrain segments is expected to be substantial in the forecast period. High-efficiency

silicon carbide (SiC) based power modules are enhancing the driving range and recharge speed of modern electric vehicles, further driving growth in these areas. As electric and connected vehicles become more prevalent, the demand for advanced chips in telematics, infotainment, and powertrain systems is anticipated to rise significantly.

The Automotive Chip Market Report is segmented based on the following

By Product

- Microcontrollers

- Logic ICs

- Sensor

- Analog ICs

- Others

By Propulsion

By Vehicle Type

By Application

- Safety

- Powertrain

- Chassis

- Telematics & Infotainment

- Body Electronics

- Others

Regional Analysis

The North American automotive chip market is predicted to lead in 2024 with a share of 46.4%, due to its strong automotive and semiconductor industries. The region's early adoption of technologies like electric vehicles (EVs) and autonomous driving has significantly boosted the demand for automotive chips. Further government initiatives supporting electric mobility & strict safety regulations further contribute to the market's growth in North America.

Moreover, in Europe, the automotive chip market holds the second-largest share, driven by the region's commitment to sustainable mobility and strict emission standards like Euro 6. Also, investments in EV infrastructure have expanded the adoption of electric vehicles, growing the need for automotive chips.

Within Europe, Germany leads in market share, while the UK is experiencing rapid growth in this sector. In addition, the Asia-Pacific region is expected to experience rapid expansion in the automotive chip market, assisted by urbanization, growing incomes, and a large consumer base, as China dominates in market share, with India showing the fastest growth in the region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the automotive chip market is characterized by a mixture of established semiconductor giants & innovative startups. Leading players in the market dominate with advanced technologies &large-scale production capabilities, driving progress in areas like electric vehicles, autonomous driving, and connectivity.

Further, emerging players aim at niche markets and specialized applications, often using cutting-edge development in AI and IoT. Also, intense competition fosters rapid technological evolution and innovation, while companies also contend with supply chain challenges and regulatory demands. Further, strategic partnerships, mergers, and acquisitions are common as firms look to enhance their market position and expand their product offerings.

Some of the prominent players in the Global Automotive Chip market are:

- NXP Semiconductors

- Infineon Technologies AG

- Robert Bosch

- NVIDIA Corp

- Texas Instruments

- Renesas Electronics Corporation

- STMicroelectronics

- Toshiba Corporation

- Analog Devices

- Other Key Players

Recent Developments

- In March 2024, Arm Holdings Ltd. launched its new, safety-enabled Arm Automotive Enhanced range, based on Armv9, which is expected to deliver server-class performance for artificial intelligence in vehicles and is being launched ahead of a new Compute Subsystems ecosystem developed mainly for the automotive industry, which allows automakers to reduce their development times drastically and deliver new, AI-powered experiences for vehicles up to two years earlier than was previously possible.

- In March 2024, Hyundai Motor is expected to be in the process of designing automotive semiconductors with a 5nm process, focusing on ensuring a stable supply of advanced chips in the Software Driven Vehicle (SDV) era. Further, the move also draws attention to relevant wafer foundries & other supplier partners and plans to use the advanced 5nm process to develop chips for Advanced Driver Assistance Systems (ADAS).

- In January 2024, Intel announced that the company will launch automotive versions of its latest AI-enabled chips, marking its entry into the market for semiconductors that power the brains of future cars, which puts Intel in direct competition with Qualcomm and NVIDIA. Also, the company announced its plans to acquire Silicon Mobility, a French startup known for designing system-on-a-chip technology and software for controlling electric vehicle motors and onboard charging systems.

- In January 2024, Texas Instruments (TI) launched new semiconductors developed to improve automotive safety and intelligence. The AWR2544 77GHz millimeter-wave radar sensor chip is the industry's first for satellite radar architectures, allowing higher levels of autonomy by improving sensor fusion and decision-making in ADAS. TI's new software-programmable driver chips, the DRV3946-Q1 integrated contactor driver and DRV3901-Q1 integrated squib driver for pyro fuses, provide built-in diagnostics and support functional safety for battery management and powertrain systems.

- In June 2023, Stellantis N.V. & Hon Hai Technology Group announced the creation of SiliconAuto, a half-and-half joint venture dedicated to developing and selling a family of advanced semiconductors to supply the automotive industry, like Stellantis, starting in 2026. Further, the joint venture combines Foxconn’s development capabilities and domain expertise in the ICT industry with Stellantis’ deep understanding of diverse mobility needs worldwide.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 59.3 Bn |

| Forecast Value (2033) |

USD 153.8 Bn |

| CAGR (2024-2033) |

11.1% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 23.6 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Microcontrollers, Logic ICs, Sensor, Analog ICs, and Others), By Propulsion (ICE, BEVs, and HEVs), By Vehicle Type (Passenger, and Commercial), By Application (Safety, Powertrain, Chassis, Telematics & Infotainment, Body Electronics, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

NXP Semiconductors, Infineon Technologies AG, Robert Bosch, NVIDIA Corp, Texas Instruments, Renesas Electronics Corporation, STMicroelectronics, Toshiba Corporation, Analog Devices, and Other Key Players |

| Purchase Options |

HVMN Inc., Thync Global Inc., Apple Inc., Fitbit Inc., TrackmyStack, OsteoStrong, The ODIN, Thriveport LLC, Muse, Moodmetric, and Other Key Players |