Market Overview

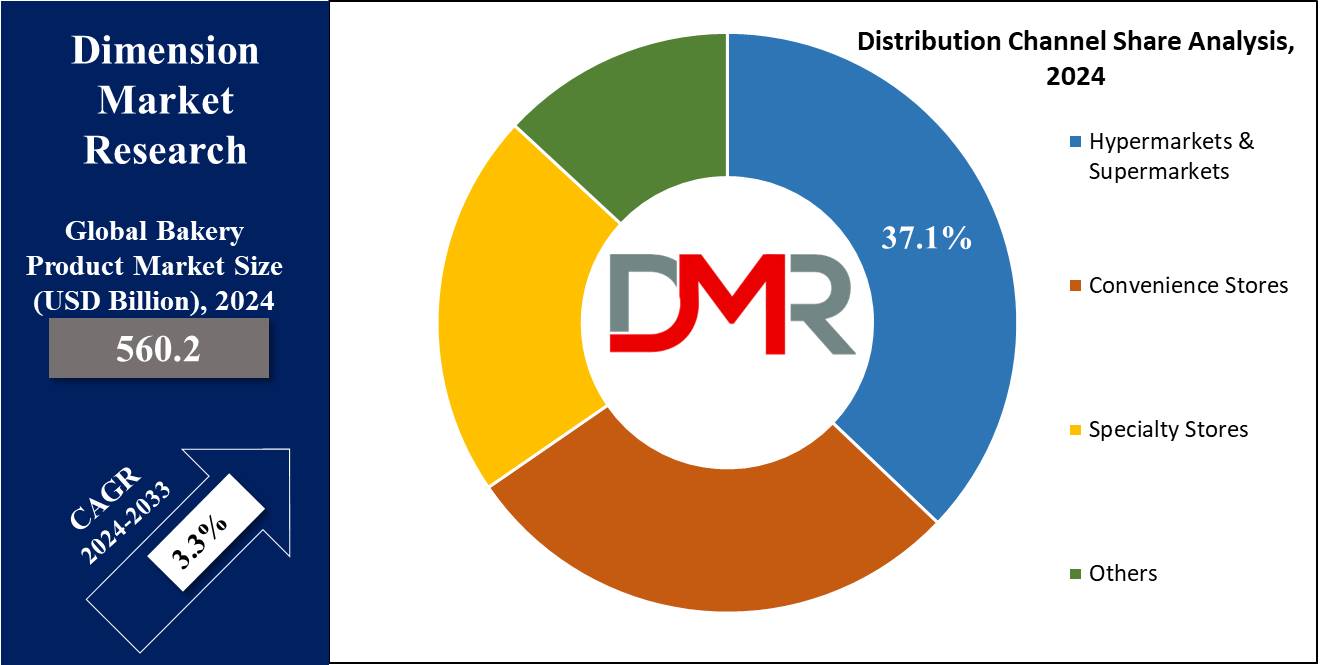

The Global Bakery Product Market is anticipated to be valued at USD 560.2 billion in 2024 and is further expected to reach USD 753.0 billion by 2033, at a CAGR of 3.3%.

Bakery products are foods normally made in a bakery, offering bread, cakes, pastries, cookies, muffins, pies, and many more. These products are made from materials like flour, sugar, eggs, butter, yeast, and many more, often incorporating essential

Dairy Products like butter and milk. These are popular across many cultures globally and are frequently consumed as snacks, desserts, or side dishes. They are distributed directly to bakeries, in bulk to supermarkets and other shops, online, through catering companies, and specialty food stores, with a growing segment distributed as part of the

Frozen Food category for longer shelf life.

As per LLCBuddy, the bakery product market exhibits a highly fragmented structure, with 15% of income generated by the top 50 firms. Over 6,000 retail bakeries contribute $3 billion in sales, with 75% of this revenue stemming from the 50 largest companies. Notably, 65% of bakeries employ fewer than 10 workers, and 44% operate with one to four staff. Ingredient prices, driven by wheat and vegetable oil costs, can fluctuate by up to 40% annually. The U.S. bread industry recorded a 7.2% export growth, surpassing $1 billion, with 80% shipped to Canada, 10% to Japan, and 6% to Mexico.

The bakery product market is experiencing dynamic activity, driven by mergers, acquisitions, and collaborations aimed at market expansion and innovation. Recent deals include leading bakery brands acquiring artisanal companies to tap into the premium segment. Opportunities abound in gluten-free, plant-based, and low-sugar bakery products, catering to rising health-conscious consumer demand.

Technological advancements in production and supply chain optimization are reshaping the industry. The latest news highlights strategic partnerships between manufacturers and retail giants to boost market reach. Sustainability and eco-friendly packaging are also emerging as key focus areas, creating new opportunities for growth and differentiation in this competitive market.

Key Takeaways

- The Global Bakery Product Market is expected to reach USD 560.2 billion in 2024 and is projected to grow to USD 753.0 billion by 2033, at a CAGR of 3.3%, driven by rising consumer demand for convenient, nutritious, and specialty bakery products.

- By Product, the Bread & Rolls segment is expected to dominate the market in 2024, due to high consumption across age groups, nutritional value, and affordability.

- By Specialty Type, the Gluten-free segment is anticipated to lead with a high CAGR in 2024, reflecting growing awareness of gluten intolerance and health-conscious consumer preferences.

- By Distribution Channel, Hypermarkets & Supermarkets are expected to emerge as the leading channel with the largest revenue share in 2024, providing convenience, product variety, and accessibility.

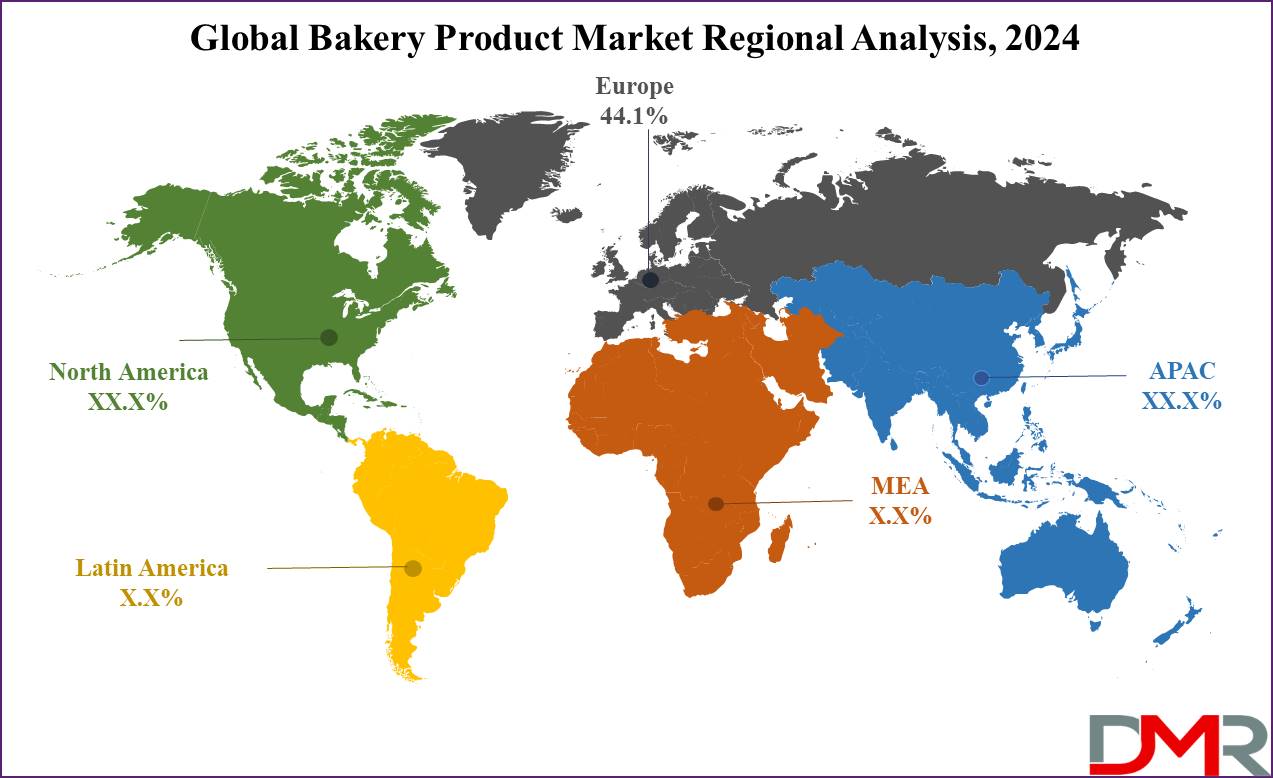

- Europe is projected to dominate the bakery product market with a 44.1% revenue share in 2024, driven by ethnic baking traditions, demand for high-fiber and gluten-free products, and a preference for premium baked goods.

Use Cases

- Breakfast & Morning Meals: Bread, croissants, muffins, bagels, and pastries are commonly consumed with coffee or tea to start the day.

- Snacks & Sweet Treats: Cookies, brownies, and cakes are enjoyed for leisure, social gatherings, and tea-time indulgence.

- Celebrations & Special Occasions: Cakes, pastries, and decorative baked goods are popular for birthdays, weddings, and holidays.

- Gifting & Corporate Use: Bakery items serve as thoughtful presents for loved ones, coworkers, or clients.

- Health-Conscious & Specialty Diets: Gluten-free, sugar-free, and organic bakery products cater to consumers seeking healthier alternatives while maintaining taste and texture.

Market Dynamic

The bakery product market is experiencing growth due to the higher consumption of convenient foods and the rapid adoption of bread & biscuits in the morning breakfast. The rising interest of consumers in nutrition, health-conscious living, and organic choices has mainly been driven by the demand for whole wheat, additive-free bakery products, reflecting a broader consumer scrutiny of Food Additives.

The market is growing due to the popularity of gluten and sugar-free items, driven by claims that these foods can avoid issues like bloating, indigestion, obesity, diabetes, and related health conditions. Thus, bakery products offering alternatives free from these ingredients are gaining popularity and driving the growth of the market.

Furthermore, innovative bakery goods such as biscuits and cakes made from healthy ingredients are attracting consumers who are cautious of their diets, further contributing to market growth. However, these foods often contain high calories which could cause serious health effects on the human body, restraining the growth of this market.

Research Scope and Analysis

By Product

The bread and rolls segment is expected to lead the bakery product market with a large revenue share in 2024 driven by factors like flavors, texture, and sweetness. The dominance of this segment is due to its high consumption among various age groups.

Some other main factors for increasing the demand for bread and rolls segment are high nutritional value, affordable price, and convenient option. Also, bread is available in many forms like whole grain, gluten-free, and brown bread which are known for their nutritional value as they contain fiber, vitamins, and minerals, boosting the growth of this market.

The main factor that drives the market is the affordable price of bread and rolls compared to other bakery products makes it more accessible to a large base of customers. Manufacturers are focused on product innovation and the introduction of healthier variants which plays a vital role in the demand for these bakery products. The cake & Pastries segment is expected to have high growth in 2024 due to the launch of new flavors and increasing consumers’ disposable income.

By Specialty Type

The gluten-free segment is expected to dominate the bakery product market based on specialty type with a high revenue share in 2024 due to growing awareness of gluten intolerance and, sensitivity among consumers. It is proven that gluten-free is healthier for the human body which influences manufacturers to produce high-quality products containing these ingredients which attract a vast consumer.

Organic foods are expected to lead the market due to customer choice for organic, clean-labeled, and environment-friendly products. Further, these foods are free from synthetic chemicals, driving the need. Low-calorie and sugar-free products are also gaining popularity due to consumer's choice for a balanced diet.

By Distribution Channel

Hypermarkets & Supermarkets are expected to emerge as the leading distribution channel in the bakery product market with the largest revenue share in 2024 which is attributed to the presence and convenience of a wide range of products in one place. These retail stores are becoming convenient options for consumers due to their variety and availability.

Specialty stores are anticipated to dominate the market due to their ability to offer creative bakery goods. These stores are helpful to those customers who look for certain types of bakeries, like organic, gluten-free, and sugar-free varieties as they are famous for offering quality and authenticity in their products. They often use high-quality ingredients and traditional recipes for bakery items with exceptional taste and texture.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Global Bakery Product Market Report is segmented based on the following:

By Product

- Bread and Rolls

- Biscuits

- Cakes & Pastries

- Others

By Specialty Type

- Gluten-free

- Fortified

- Organic

- Low-calorie

- Sugar-free

By Distribution Channel

- Hypermarkets & Supermarkets

- Convenience Stores

- Specialty Stores

- Others

Regional Analysis

Europe is expected to dominate the bakery product market with the largest revenue share of 44.1% in 2024 due to demand for baked goods including gluten-free, high-fiber, and trans-fat products. The market's growth in this region is mainly shaped by the mixed range of European ethnicities with deeply rooted baking customs. Additionally, the demand for bakery items and the high delicacies associated with many European countries, which is an important factor fueling the growth of the market in this region.

Asia-Pacific is anticipated to be the second fastest-growing region in the coming year due to the presence of major companies in developing countries, like China, India, Singapore, and Japan. Moreover, the rising population, per capita income level, and growing demand for breakfast grains and cereals in this region contribute to the growth of the market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Bakery product Market is fragmented in nature due to the presence of a large number of domestic as well as foreign players. Major companies are using diverse marketing strategies, including launching new products, innovating existing ones, conducting marketing campaigns, and securing celebrity endorsements to improve their visibility among potential customers.

Startup companies are introducing gluten-free and sugar-free products with nutritional benefits to increase their consumer reach. Businesses are heavily investing in R&D to expand their product ranges, which is expected to encourage further growth in the market for bakery goods. One of the main business strategies used by manufacturers in the bakery products industry to benefit customers and increase market share is producing locally to lower operational costs.

Some of the prominent players in the global bakery product market are

- Nestle SA

- Associated British Foods plc

- Mondelez International, Inc

- Finsbury Food Group Plc

- Bimbo Bakeries USA

- Britannia Industries

- Gruma, S.A.B. de C.V.

- Bakers Delight Holdings

- Grupo Bimbo S.A.B de C.V.

- Yamazaki Baking Co., Ltd.

- JAB Holding Company

- ARYZTA AG

- General Mills, Inc.

- Others

Recent Development

- In June 2023, Entenmann’s introduced a rebranding initiative for Entenmann Minis to incorporate NaviLens Technology on retail packaging, allowing visually impaired individuals to access product information such as name, nutrition facts, and allergen details.

- In January 2023, Sara Lee Bread announced the addition of a new white bread, an 18-oz loaf, made with veggies that offers a delicious taste, one cup of veggies, vitamins A, D, and E, smooth texture, nutrition, and no added colors, flavors, or high fructose corn syrup perfect for lunchboxes or breakfast.

- In July 2022, Britannia launched Biscafe, its latest coffee-flavored cracker, with a focus on appealing to a youthful demographic of caffeine enthusiasts seeking a unique snacking experience.

- In April 2022, Walker’s Shortbread collaborated with retailer Dufry to introduce a new selection called the Global Travel Retailer range, available at over 55 travel destinations globally. The range encompasses various types of shortbreads and additional products.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 560.2 Bn |

| Forecast Value (2033) |

USD 753.0 Bn |

| CAGR (2023-2032) |

3.3% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Bread and Rolls, Biscuits, Cakes & Pastries, Others), By Specialty Type (Gluten-free, Fortified, Organic, Low-calorie, Sugar-free), By Distribution Channel (Hypermarkets & Supermarkets, Convenience Stores, Specialty Stores, Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Nestle SA, Associated British Foods plc, Mondelez International, Inc, Finsbury Food Group Plc, Bimbo Bakeries USA, Britannia Industries, Gruma, S.A.B. de C.V., Bakers Delight Holdings, Grupo Bimbo S.A.B de C.V., Yamazaki Baking Co., Ltd., JAB Holding Company, ARYZTA AG, General Mills, Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Bakery Product Market?

▾ The Global Bakery Product Market size is estimated to have a value of USD 560.2 billion in 2024 and is

expected to reach USD 753.0 billion by the end of 2033.

Which region accounted for the largest Global Bakery Product Market?

▾ Europe has the largest market share for the Global Bakery Product Market with a share of about 44.1%

in 2024.

Who are the key players in the Global Bakery Product Market?

▾ Some of the major key players in the Global Bakery Product Market are Kraft Food Group Inc., Nestle

S.A., Bimbo Bakeries USA, and many others.

What is the growth rate in the Global Bakery Product Market?

▾ The market is growing at a CAGR of 3.3 percent over the forecasted period.