Market Overview

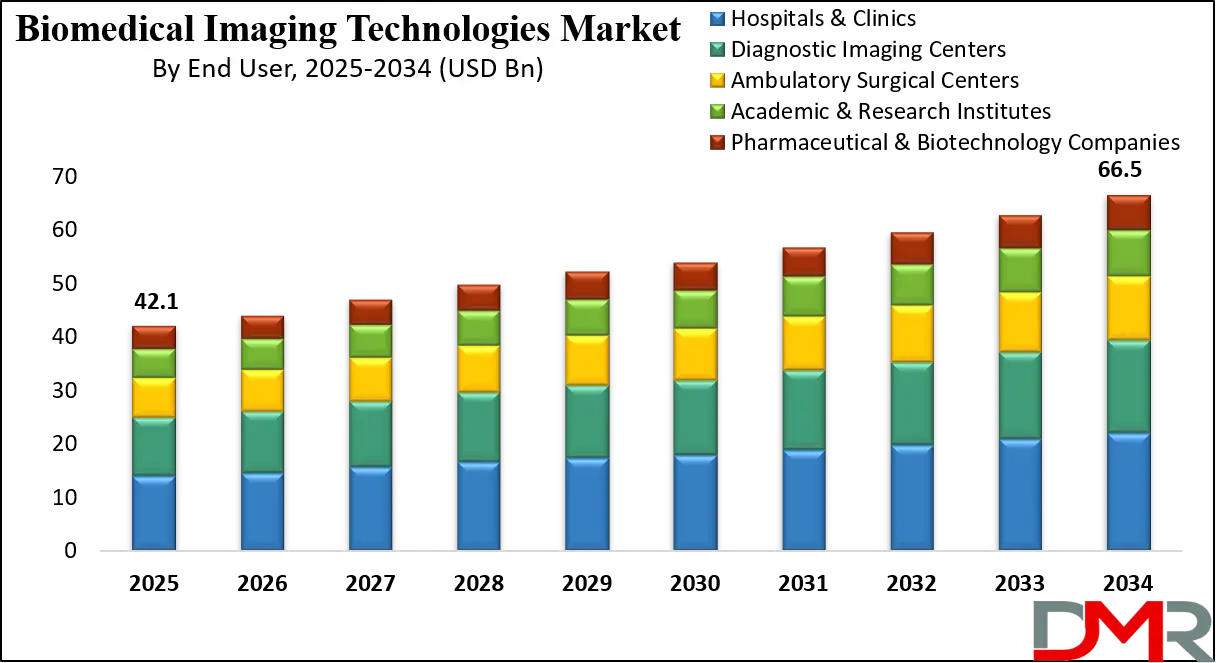

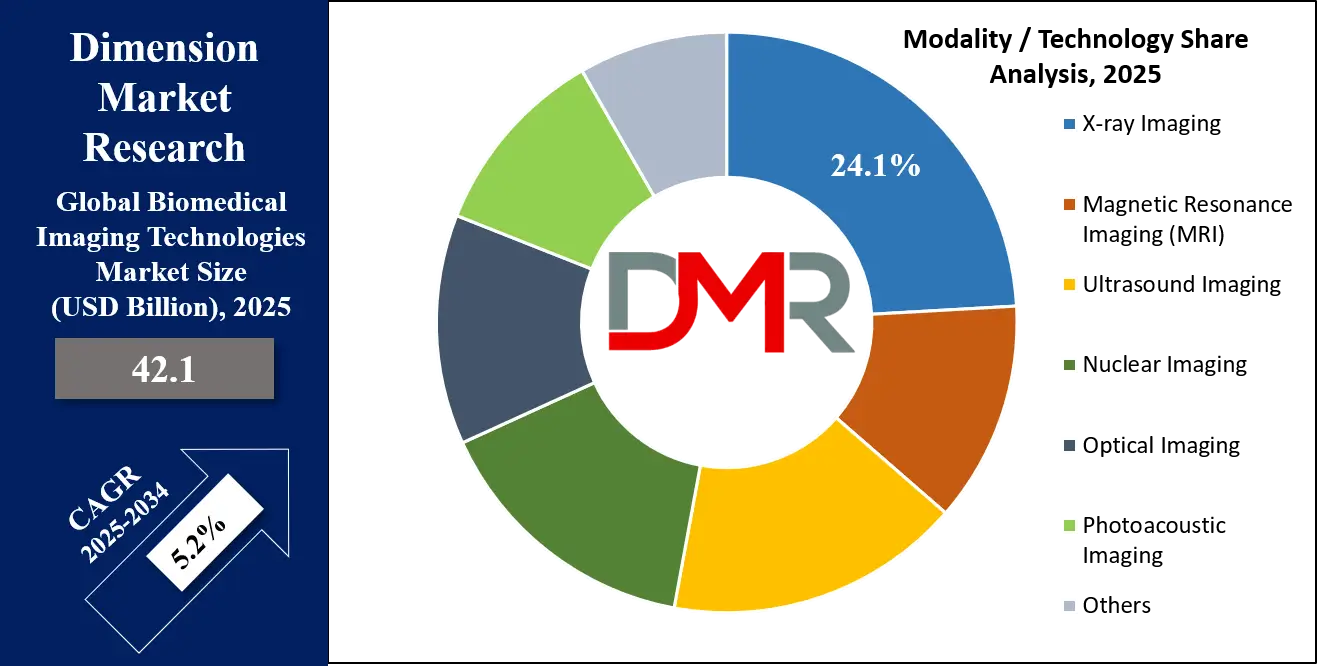

The Global Biomedical Imaging Technologies Market is expected to be valued at USD 42.1 billion in 2025 and is anticipated to expand at a CAGR of 5.2%, reaching approximately USD 66.5 billion by the end of 2034.

The Global Biomedical Imaging Technologies Market is on a strong growth trajectory, supported by rising demand for advanced diagnostic solutions that are non-invasive, highly accurate, and integral to early disease detection. The market is being propelled by technological advancements such as hybrid modalities like PET/CT and PET/MRI, portable imaging solutions, and point-of-care ultrasound, which are expanding accessibility and versatility. Artificial intelligence integration is reshaping radiology by automating image analysis, enhancing workflow efficiency, and improving diagnostic accuracy, while cloud-based PACS and radiology information systems are streamlining interoperability across healthcare networks.

Opportunities are flourishing in areas like AI-enabled diagnostic software, tele-radiology services, and outpatient imaging centers that extend advanced diagnostics to underserved populations. The growing burden of chronic diseases such as cancer, cardiovascular conditions, and neurological disorders is also fueling sustained demand for innovative imaging technologies, especially as personalized medicine and image-guided therapies gain traction. Challenges include reimbursement constraints, long capital equipment replacement cycles, stringent regulatory frameworks, and cybersecurity risks associated with medical data sharing.

Skilled radiologist shortages further strain adoption in some regions, but manufacturers are responding with workflow-optimizing solutions and service-based models. The global biomedical imaging technologies are set to remain central to preventive healthcare, early detection, and precision medicine, offering significant growth prospects across both developed and emerging economies.

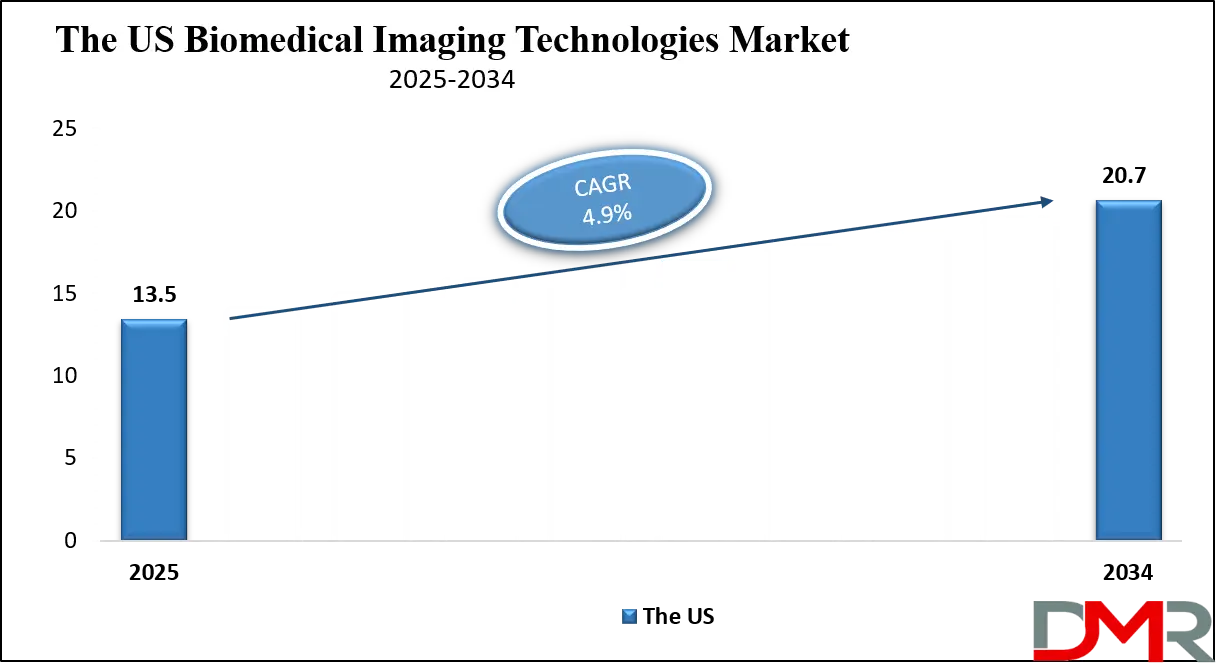

The US Biomedical Imaging Technologies Market

The US Biomedical Imaging Technologies Market is projected to reach USD 13.5 billion in 2025 at a compound annual growth rate of 4.9% over its forecast period.

The U.S. Biomedical Imaging Technologies Market benefits from a combination of high healthcare expenditure, a rapidly aging population, and an advanced medical infrastructure that supports both innovation and widespread adoption. The United States Census Bureau reports steady growth in the population aged 65 and older, a demographic group that requires frequent diagnostic evaluations for conditions such as cancer, cardiovascular disease, and neurodegenerative disorders.

Medicare reimbursement for a wide range of imaging services ensures steady patient access, while overall healthcare spending among the highest globally continues to drive investment in cutting-edge MRI, CT, ultrasound, and nuclear imaging modalities. Hospitals, outpatient imaging centers, and academic research institutions play complementary roles in ensuring rapid diffusion of new technologies, with leading medical universities spearheading clinical trials for next-generation imaging systems and AI-based diagnostic platforms.

The country’s demographic advantage lies in its large elderly population and high prevalence of chronic illnesses, which together create sustained demand for diagnostic imaging. Government priorities emphasizing value-based care and interoperability further shape vendor strategies, encouraging the development of cost-effective, outcome-oriented imaging technologies that can seamlessly integrate with electronic health records. This ecosystem of strong reimbursement, advanced infrastructure, and large patient demand ensures that the U.S. remains a leader in adoption and innovation within biomedical imaging technologies.

The Europe Biomedical Imaging Technologies Market

The Europe Biomedical Imaging Technologies Market is estimated to be valued at USD 6.3 billion in 2025 and is further anticipated to reach USD 9.8 billion by 2034 at a CAGR of 5.0%.

The European Biomedical Imaging Technologies Market is characterized by a steadily aging population and a healthcare system that prioritizes early detection, chronic disease management, and population-wide screening programs. Eurostat data highlights that the proportion of people aged 65 and older continues to rise across the European Union, creating significant demand for imaging services in cardiology, oncology, and musculoskeletal care.

Many European countries operate within centralized healthcare systems or national health services, which allows for large-scale investmenats in imaging technologies but also creates pressure to ensure cost-efficiency, durability, and clinical value. Regulatory harmonization under EU medical device frameworks influences product development, particularly in areas such as AI-driven diagnostics, cross-border tele-radiology, and data-sharing under GDPR.

Western Europe, with its high-income nations, tends to adopt the most advanced imaging technologies more rapidly, while Central and Eastern Europe demonstrate faster relative growth as healthcare infrastructure expands. Workforce shortages, particularly among radiologists and imaging technicians, pose challenges, but this is prompting increased interest in workflow automation and AI solutions that can support clinical efficiency.

Preventive healthcare initiatives and emphasis on radiation dose reduction are further shaping demand, encouraging adoption of advanced ultrasound, low-dose CT, and hybrid molecular imaging systems. With strong public health priorities and aging demographics, Europe continues to be a key market with both stable demand and opportunities for innovation.

The Japan Biomedical Imaging Technologies Market

The Japan Biomedical Imaging Technologies Market is projected to be valued at USD 2.5 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 3.9 billion in 2034 at a CAGR of 4.8%.

The Japanese Biomedical Imaging Technologies Market is shaped by one of the world’s most aged populations, with nearly one-third of citizens over the age of 65. This demographic profile drives extensive use of diagnostic imaging across geriatrics, oncology, cardiology, and neurology. Japan’s universal healthcare coverage provides consistent reimbursement for imaging services, ensuring high accessibility across urban and rural regions.

Hospitals and community health centers invest heavily in modalities such as high-definition CT, PET/CT, MRI, and ultrasound, reflecting a commitment to both early detection and ongoing management of chronic diseases. The Ministry of Health, Labour and Welfare places emphasis on preventive healthcare and routine screenings, creating steady imaging volumes that underpin market stability.

Japanese innovation in imaging is notable, with domestic companies focusing on miniaturization, dose efficiency, and integration with digital health platforms. This focus aligns with government initiatives promoting quality assurance and interoperability in medical technologies. The demographic advantage for Japan lies in its high longevity and large elderly population, which necessitate sustained diagnostic imaging use, while the healthcare infrastructure ensures equitable access across the population. Technological advancements, preventive care culture, and investment in advanced modalities keep Japan at the forefront of imaging technology adoption, even as workforce shortages and healthcare cost containment create challenges for future growth.

Global Biomedical Imaging Technologies Market: Key Takeaways

- Global Market Size Insights: The Global Biomedical Imaging Technologies Market size is estimated to have a value of USD 42.1 billion in 2025 and is expected to reach USD 66.5 billion by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 5.2 percent over the forecasted period of 2025.

- The US Market Size Insights: The US Biomedical Imaging Technologies Market is projected to be valued at USD 13.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 20.7 billion in 2034 at a CAGR of 4.9%.

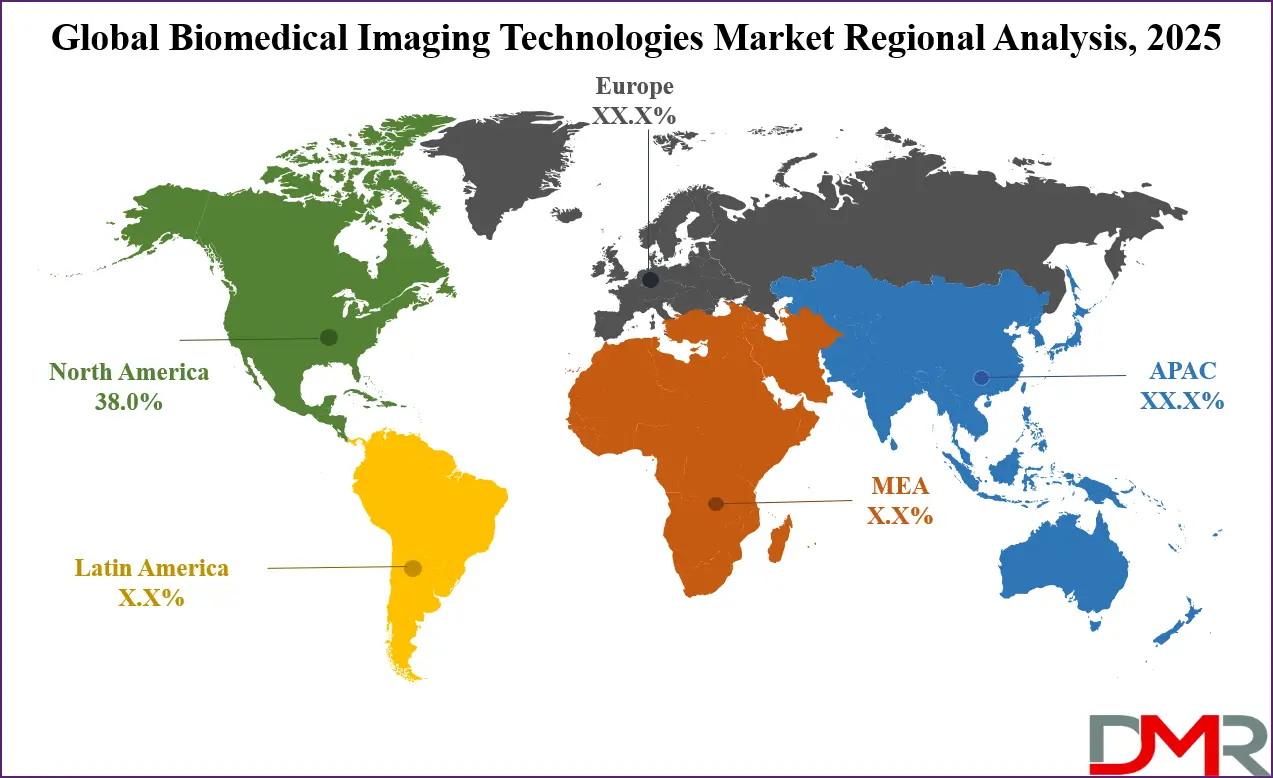

- Regional Insights: North America is expected to have the largest market share in the Global Biomedical Imaging Technologies Market with a share of about 38.0% in 2025.

- Key Players: Some of the major key players in the Global Biomedical Imaging Technologies Market are Siemens Healthineers, GE HealthCare, Philips Healthcare, Canon Medical Systems, Fujifilm Holdings, Hologic, and many others.

Global Biomedical Imaging Technologies Market: Use Cases

- Oncology Diagnostics: Biomedical imaging technologies such as PET-CT and MRI enable early detection, staging, and monitoring of cancers. They support precision oncology by guiding biopsies, planning radiation therapy, and tracking tumor response to treatments, thereby improving survival outcomes and patient management.

- Cardiovascular Disease Management: CT angiography, echocardiography, and cardiac MRI provide detailed visualization of heart structures, blood flow, and vessel blockages. These tools aid in diagnosing coronary artery disease, assessing heart failure, and guiding minimally invasive interventions, ensuring timely treatment and better cardiovascular health outcomes.

- Neurological Imaging: Advanced MRI and PET imaging support the diagnosis and monitoring of neurological disorders like Alzheimer’s, Parkinson’s, and epilepsy. These modalities help evaluate brain structure, connectivity, and metabolic activity, allowing clinicians to track disease progression and optimize therapeutic interventions.

- Obstetrics and Gynecology: Ultrasound and MRI are widely used for prenatal care, fetal monitoring, and identifying gynecological conditions. Real-time imaging improves maternal and fetal safety, supports early detection of abnormalities, and assists in planning safe deliveries and gynecological surgical procedures with minimal complications.

- Musculoskeletal Disorders: X-ray, MRI, and ultrasound imaging are essential in diagnosing fractures, arthritis, ligament injuries, and degenerative diseases. These technologies help physicians accurately evaluate bone density, joint health, and soft-tissue conditions, guiding effective treatment strategies and rehabilitation plans for musculoskeletal patients.

Global Biomedical Imaging Technologies Market: Stats & Facts

National Institutes of Health (NIH)

- The NIH invests over USD 1 billion annually in extramural funding for research and development in biomedical imaging and bioengineering.

- The National Institute of Biomedical Imaging and Bioengineering (NIBIB) supports over 1,200 research grants and contracts at institutions across the United States.

- NIH-supported research led to a 40% reduction in radiation dose for standard pediatric CT scans without loss of diagnostic quality.

Centers for Disease Control and Prevention (CDC)

- In the United States, the percentage of hospitals with MRI services increased from 59% in 2008 to over 70% in 2021.

- The rate of CT scans performed in U.S. emergency departments for injury-related visits is approximately 25 million per year.

- The CDC's National Breast and Cervical Cancer Early Detection Program has provided more than 6.3 million breast and cervical cancer screening exams to low-income, uninsured women since its inception.

Food and Drug Administration (FDA)

- The FDA clears or approves over 100 new or modified medical imaging devices each year through the 510(k), PMA, and De Novo pathways.

- As part of the Mammography Quality Standards Act (MQSA), the FDA certifies and annually inspects over 8,700 mammography facilities in the U.S.

- The FDA's Sentinel Initiative has monitored the safety of over 200 million medical imaging procedures involving contrast agents.

World Health Organization (WHO)

- Two-thirds of the world's population has no access to medical imaging, with low-income countries having access to less than 10% of the world's imaging equipment.

- The WHO estimates that over 3.6 billion diagnostic radiology examinations are performed globally each year.

- The WHO List of Essential Diagnostic Instruments includes ultrasound and X-ray equipment as critical for basic healthcare facilities.

- The WHO's IAEA-supported imPACT reviews have helped over 90 countries assess their medical imaging radiation safety and needs.

Organisation for Economic Co-operation and Development (OECD)

- The average number of MRI units per million population in OECD countries is 18.1, with Japan having the highest density at 55.2 per million.

- The average number of CT scanners per million population across OECD countries is 28.5.

- There has been an average annual growth rate of over 5% in the number of MRI and CT exams performed in OECD countries over the past decade.

International Atomic Energy Agency (IAEA)

- The IAEA's Directory of Radiotherapy Centres (DIRAC) indicates that over 40 member states have no radiation therapy or advanced diagnostic imaging capabilities at all.

- The IAEA has provided over USD 300 million in assistance to more than 125 countries for improving their radiology and nuclear medicine infrastructure.

- Through its quality assurance programs, the IAEA has helped reduce incorrect radiation doses in medical imaging by up to 15% in participating hospitals.

Medicare (Centers for Medicare & Medicaid Services - CMS)

- Medicare spending for advanced medical imaging services (MRI, CT, PET) was approximately USD 7 billion annually.

- CMS data shows a shift from hospital outpatient settings to freestanding imaging centers, which now perform over 40% of non-invasive diagnostic imaging procedures paid for by Medicare.

- The utilization rate of MRI scans among Medicare beneficiaries is over 120 exams per 1,000 enrollees annually.

Canadian Institute for Health Information (CIHI)

- In Canada, there was an average of 13.5 MRI exams and 50.9 CT exams performed per 1,000 people annually.

- The median wait time for a computed tomography (CT) scan in Canada is 4 weeks.

- The median wait time for a magnetic resonance imaging (MRI) scan in Canada is 10.7 weeks.

Office of the National Coordinator for Health Information Technology (ONC)

- Over 90% of U.S. non-federal acute care hospitals have adopted certified health IT with advanced capabilities for image storage and access.

- The integration of Picture Archiving and Communication Systems (PACS) with Electronic Health Records (EHRs) is present in over 80% of U.S. hospitals.

National Cancer Institute (NCI)

- NCI's National Lung Screening Trial found that screening with low-dose helical CT reduced lung cancer mortality by 20% among heavy smokers.

- The use of PET-CT scans in cancer staging increased by over 400% in the decade following its introduction into oncology guidelines.

- NCI's Surveillance, Epidemiology, and End Results (SEER) program utilizes imaging data for over 8 million cancer patients to track trends in diagnosis and treatment.

U.S. Veterans Health Administration (VHA)

- The VHA operates one of the largest integrated imaging networks in the U.S., performing over 5 million radiology procedures annually for veterans.

- The VHA has implemented teleradiology across its system, allowing for over 15% of all radiological images to be interpreted by a radiologist at a different location.

American College of Radiology (ACR) - National Radiology Data Registry

- Data from the ACR's Dose Index Registry, which contains information on over 200 million medical imaging procedures, shows a 20% reduction in average radiation dose for routine CT abdomen/pelvis scans over the last 10 years.

- The ACR's National Mammography Database has compiled data from over 50 million mammography exams to track and improve quality and accuracy. (Note: While the ACR is a professional body, its National Radiology Data Registry is a widely cited source of aggregated, real-world imaging data used by government agencies for policy making.)

Global Biomedical Imaging Technologies Market: Market Dynamics

Driving Factors in the Global Biomedical Imaging Technologies Market

Rising Prevalence of Chronic Diseases and Aging Population

The increasing global prevalence of cancer, cardiovascular conditions, musculoskeletal disorders, and neurological diseases is driving demand for advanced biomedical imaging technologies. According to the World Health Organization, non-communicable diseases account for nearly three-quarters of all global deaths, with imaging playing a central role in early detection, treatment planning, and monitoring. Parallel to disease prevalence, aging populations in regions such as North America, Europe, and Japan significantly increase the volume of diagnostic imaging procedures, as older adults are more likely to undergo regular scans for chronic disease management.

This demographic shift, combined with preventive healthcare initiatives, is compelling healthcare providers to expand imaging infrastructure. Consequently, hospitals, clinics, and diagnostic centers are investing heavily in high-resolution CT, MRI, and PET systems, creating long-term growth momentum for the biomedical imaging technologies market globally.

Government Initiatives and Healthcare Infrastructure Expansion

Governments worldwide are prioritizing early disease detection and advanced diagnostics, leading to direct funding, subsidies, and public-private partnerships in biomedical imaging. National health services across Europe emphasize population-wide screening for cancer and cardiovascular diseases, while the U.S. Medicare program ensures coverage for a wide range of imaging procedures. In the Asia-Pacific region, rising healthcare expenditure in countries like China and India is facilitating the establishment of new hospitals and diagnostic imaging centers. Additionally, policy frameworks supporting digital healthcare integration, telemedicine, and AI-based diagnostics are accelerating adoption.

Investments in training radiologists and upgrading imaging infrastructure further drive demand, particularly in regions addressing workforce shortages. These initiatives not only expand access to imaging but also stimulate continuous innovation in modality development, positioning biomedical imaging as a central pillar of healthcare modernization and improved patient outcomes.

Restraints in the Global Biomedical Imaging Technologies Market

High Capital Investment and Maintenance Costs

One of the major barriers to the adoption of biomedical imaging technologies is the substantial upfront investment required for advanced imaging systems such as MRI, PET, and CT scanners. Beyond acquisition costs, expenses related to installation, facility modifications, maintenance, and ongoing service contracts place significant financial pressure on hospitals and diagnostic centers. Smaller healthcare providers, particularly in emerging markets, often face challenges in securing adequate funding or reimbursement to justify such investments.

Additionally, the rapid pace of technological advancement shortens replacement cycles, compelling providers to update systems more frequently to stay clinically competitive. These cost barriers restrict adoption in low- and middle-income countries, widening the global diagnostic gap. Vendors are exploring leasing models, pay-per-use structures, and bundled service agreements, but financial constraints remain a persistent restraint on global market penetration.

Regulatory Complexity and Workforce Shortages

The biomedical imaging technologies market faces challenges due to stringent and evolving regulatory frameworks governing safety, efficacy, and data security. In regions like the European Union, compliance with the Medical Device Regulation (MDR) and adherence to data protection requirements under GDPR complicate product approvals and cross-border imaging data sharing. In the U.S., the Food and Drug Administration (FDA) requires extensive clinical validation for AI-driven imaging tools, delaying time-to-market.

Alongside regulatory hurdles, global shortages of radiologists and trained imaging technicians limit effective utilization of existing infrastructure. This workforce gap leads to increased reporting backlogs, diagnostic delays, and uneven access to care. Training programs and AI-assisted workflow solutions are attempting to mitigate these issues, but regulatory and human resource challenges remain significant obstacles to market expansion.

Opportunities in the Global Biomedical Imaging Technologies Market

AI-Powered Imaging Software and Data Analytics

Opportunities are rapidly emerging in the convergence of imaging hardware with AI-driven software platforms and advanced data analytics. Startups and established vendors alike are developing cloud-based solutions that enable automated image segmentation, anomaly detection, and predictive analytics to assist radiologists and clinicians. Such platforms support precision medicine by integrating imaging findings with genomic, proteomic, and clinical datasets, enabling personalized treatment planning.

Moreover, AI-driven decision support systems are expanding into teleradiology, facilitating remote diagnosis and reducing the impact of radiologist shortages. As reimbursement pathways evolve to include AI-assisted reporting and regulators approve machine learning models for clinical use, demand for integrated software-hardware ecosystems will rise. Vendors capable of offering comprehensive imaging solutions that combine devices, analytics, and secure data management will unlock significant long-term growth and recurring revenue streams in global healthcare systems.

Expansion in Emerging Markets and Decentralized Care

Rapid economic development and healthcare reforms in Asia-Pacific, Latin America, and parts of the Middle East are creating substantial growth opportunities for Biomedical Imaging Technologies. Expanding healthcare infrastructure, rising insurance coverage, and growing awareness of preventive care are driving investments in imaging facilities across these regions. At the same time, decentralized healthcare delivery models emphasize the role of portable and point-of-care imaging solutions in rural and underserved communities.

For example, handheld ultrasound devices are increasingly used in primary care and maternal health services in resource-limited settings. These markets represent high growth potential due to their relatively low imaging penetration rates compared with developed economies. Vendors who provide cost-effective, durable, and easily maintainable solutions alongside training and support can capture significant market share while advancing global health equity through accessible diagnostic imaging.

Trends in the Global Biomedical Imaging Technologies Market

Integration of Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are rapidly transforming biomedical imaging technologies by enabling automated image interpretation, enhancing diagnostic precision, and reducing reporting turnaround times. AI-driven radiology tools can detect anomalies earlier than human observation, assisting radiologists in identifying cancers, cardiovascular risks, and neurological disorders with improved accuracy. Furthermore, AI supports workflow optimization by triaging urgent cases, minimizing reporting errors, and integrating seamlessly with picture archiving and communication systems (PACS).

Beyond diagnostics, AI-based imaging biomarker discovery is paving the way for personalized medicine by correlating imaging phenotypes with genetic and clinical data. Hospitals and research centers are increasingly adopting these solutions to manage growing imaging volumes while addressing radiologist shortages. This trend is expected to deepen as regulators establish frameworks for AI-driven medical devices and as reimbursement structures evolve to include AI-assisted interpretations.

Growth of Hybrid and Portable Imaging Modalities

Hybrid imaging systems such as PET/CT, PET/MRI, and SPECT/CT have become critical in oncology, cardiology, and neurology for providing both structural and functional insights in a single scan. Their adoption is accelerating as clinical guidelines increasingly recommend hybrid imaging for staging cancers, evaluating cardiac perfusion, and managing neurodegenerative diseases. Simultaneously, there is a rising demand for portable and point-of-care imaging devices, particularly handheld ultrasound and compact MRI units.

These technologies enhance accessibility in outpatient clinics, emergency departments, and rural settings, supporting faster decision-making while reducing patient transfers to centralized facilities. Advances in miniaturization, cloud integration, and wireless connectivity are expanding the role of portable imaging, aligning with healthcare systems’ broader push toward decentralized diagnostics and patient-centric care delivery models.

Global Biomedical Imaging Technologies Market: Research Scope and Analysis

By Modality / Technology Analysis

Magnetic Resonance Imaging (MRI) is projected to lead the modality and technology segment in the biomedical imaging technologies market owing to its unparalleled precision and versatility in soft tissue visualization. Unlike X-ray or CT imaging, which rely on ionizing radiation, MRI provides high-resolution, radiation-free images, making it particularly valuable for repeat examinations and sensitive populations such as children or pregnant women.

It is widely applied in neurology for detecting brain tumors, multiple sclerosis, and stroke; in orthopedics for joint, ligament, and spinal conditions; and in oncology for tumor detection, staging, and therapy monitoring. Its dominance is further reinforced by advancements like 3T and 7T scanners, which allow deeper tissue penetration and higher spatial resolution, and the development of functional MRI (fMRI) that maps brain activity in real time.

AI-driven enhancements in image reconstruction and workflow automation have also streamlined diagnostics, improving speed and accuracy. Hospitals and advanced diagnostic centers continue to prefer MRI for complex clinical cases, especially as health systems worldwide push toward precision medicine and value-based care models.

Additionally, expanding applications in cardiac imaging, diffusion tensor imaging for neurological disorders, and whole-body MRI for cancer metastasis screening further enhance its market leadership. With continuous investment in innovation and growing clinical reliance, MRI remains the most widely adopted and high-value imaging modality globally.

By Application Analysis

Oncology is poised to be the leading application area in the biomedical imaging technologies market, driven by the critical role of imaging in the entire cancer care continuum from prevention and detection to treatment planning and monitoring. Imaging modalities such as MRI, PET-CT, CT scans, and molecular imaging techniques are indispensable for identifying tumors at early stages, accurately staging cancer progression, and evaluating treatment effectiveness.

The global burden of cancer, with increasing incidence rates reported by organizations such as the World Health Organization and the International Agency for Research on Cancer, has significantly strengthened demand for biomedical imaging. Oncology imaging is further reinforced by technological innovations like hybrid imaging (PET-MRI and PET-CT), which combine anatomical and functional data, offering clinicians a more comprehensive view of tumor biology.

Governments and health organizations are also prioritizing cancer control programs, including population-wide screening for breast, colorectal, and lung cancers, which rely heavily on imaging technologies. Precision medicine trends, where therapies are tailored to individual patients, also rely on advanced imaging biomarkers to identify molecular targets and measure therapeutic response.

Furthermore, as cancer survival rates improve, follow-up imaging for survivors has become a growing area of need. With healthcare systems investing heavily in cancer infrastructure and pharmaceutical companies conducting imaging-based clinical trials, oncology is expected to continue dominating applications, making it the cornerstone of biomedical imaging technologies for years ahead.

By End User Analysis

Hospitals and clinics are projected to represent the dominant end-user segment in the biomedical imaging technologies market, largely due to their ability to integrate advanced imaging into comprehensive patient care pathways. Hospitals have the necessary infrastructure, financial resources, and skilled workforce to procure, operate, and maintain high-cost imaging equipment such as MRI, CT, PET, and advanced ultrasound systems.

Imaging is central to most hospital-based services, spanning emergency care, oncology, cardiology, neurology, orthopedics, and obstetrics, where timely diagnosis directly influences patient outcomes. In contrast to diagnostic imaging centers and ambulatory surgical centers, hospitals offer multidisciplinary collaboration, where imaging results are immediately linked to clinical decisions and treatment plans. Academic hospitals also serve as innovation hubs, adopting next-generation imaging tools and leveraging AI-based diagnostics and interventional radiology.

Clinics, particularly large specialty networks, contribute by delivering outpatient imaging services, often integrated with hospital networks for continuity of care. The dominance of hospitals and clinics is further supported by global healthcare reforms that emphasize integrated care delivery, where imaging is not seen in isolation but as part of a broader diagnostic and therapeutic workflow.

Reimbursement frameworks often favor hospital-based imaging, especially for advanced modalities like MRI and PET-CT, reinforcing this trend. Moreover, hospitals are expanding investments in hybrid operating rooms, where imaging technologies guide minimally invasive surgeries in real time. With rising patient volumes, complex case requirements, and the growing emphasis on precision medicine, hospitals and clinics will remain the most critical end-users driving demand for biomedical imaging technologies globally.

The Global Biomedical Imaging Technologies Market Report is segmented on the basis of the following:

By Modality / Technology

- X-ray Imaging

- Conventional X-ray

- Digital X-ray

- Computed Tomography (CT)

- Magnetic Resonance Imaging (MRI)

- Low-field MRI

- Mid-field MRI

- High-field MRI (3T and above)

- Ultrasound Imaging

- 2D Ultrasound

- 3D & 4D Ultrasound

- Doppler Ultrasound

- Nuclear Imaging

- Positron Emission Tomography (PET)

- Single Photon Emission Computed Tomography (SPECT)

- Optical Imaging

- Near-Infrared Imaging

- Fluorescence Imaging

- Photoacoustic Imaging

- Other

By Application

- Cardiology

- Oncology

- Neurology

- Orthopedics & Musculoskeletal

- Gynecology & Obstetrics

- Gastroenterology

- Pulmonology

- Urology & Nephrology

- Others

By End User

- Hospitals & Clinics

- Diagnostic Imaging Centers

- Ambulatory Surgical Centers

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

Impact of Artificial Intelligence in the Global Biomedical Imaging Technologies Market

- Enhanced Diagnostic Accuracy: AI-powered algorithms analyze imaging data with greater speed and precision, reducing human errors. They assist radiologists in detecting subtle anomalies early, improving diagnostic accuracy across oncology, cardiology, neurology, and musculoskeletal disorders.

- Workflow Optimization: AI streamlines image acquisition, processing, and reporting. Automated segmentation, annotation, and prioritization tools save radiologists’ time, reduce patient wait periods, and enhance throughput, supporting hospitals and diagnostic centers under rising imaging demand.

- Personalized Medicine Support: By analyzing imaging biomarkers, AI tailors diagnosis and treatment plans to individual patient profiles. It enables early disease prediction, therapy response assessment, and precision oncology, strengthening outcomes within value-based healthcare models.

- Advanced Imaging Reconstruction: AI improves image quality through denoising, resolution enhancement, and faster reconstruction times, even with lower radiation doses. This enables safer, high-quality imaging, particularly in pediatric, oncology, and emergency cases requiring rapid evaluations.

- Integration with Emerging Modalities: AI enhances novel imaging techniques such as photoacoustic and molecular imaging by providing real-time interpretation. This supports research, drug development, and clinical adoption, accelerating biomedical imaging’s evolution into more dynamic and predictive applications.

Global Biomedical Imaging Technologies Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate the biomedical imaging technologies market with 38.0% of the total revenue by the end of 2025, due to its advanced healthcare infrastructure, high adoption of cutting-edge technologies, and strong investment in research and development. The United States leads the region, driven by the widespread availability of MRI, CT, PET, and hybrid modalities across hospitals, clinics, and specialized imaging centers.

Favorable reimbursement policies for diagnostic procedures under Medicare and Medicaid significantly boost accessibility, allowing patients to undergo high-cost imaging scans with reduced financial barriers. The region also benefits from a dense concentration of leading manufacturers, including GE HealthCare, Philips, and Siemens Healthineers, who maintain strong operational bases and innovation hubs.

Furthermore, high disease prevalence, particularly cancer and cardiovascular conditions, creates consistent demand for advanced imaging technologies. Data from the U.S. National Cancer Institute highlights millions of annual diagnostic imaging procedures performed for cancer detection and monitoring, reinforcing oncology as a major application driver.

North America also leads in integrating artificial intelligence into imaging systems, enhancing diagnostic accuracy and workflow efficiency. With strong regulatory oversight from the FDA ensuring product safety and innovation approval, the region continues to maintain its leadership. The presence of world-class academic institutions and research hospitals further accelerates clinical adoption of next-generation imaging technologies, strengthening North America’s dominant market position.

Region with the Highest CAGR

Asia Pacific is expected to register the highest CAGR in the biomedical imaging technologies market, fueled by rapid healthcare infrastructure development, large patient pools, and rising investment in advanced medical technologies. Countries like China, India, and Japan are witnessing increased demand for diagnostic imaging, driven by growing incidences of cancer, neurological disorders, and cardiovascular diseases.

Government healthcare reforms and investments are expanding imaging access in both urban and rural regions, making advanced technologies more widely available. For example, China’s Healthy China 2030 initiative emphasizes early diagnosis, preventive healthcare, and modernization of diagnostic facilities, which directly accelerates imaging adoption. Rising medical tourism in countries like India, Thailand, and Singapore is also boosting demand for state-of-the-art imaging services, as international patients seek affordable yet advanced diagnostics.

Japan, already technologically advanced, continues to expand AI-assisted imaging applications and innovative modalities such as photoacoustic imaging. Additionally, rising disposable incomes and growing insurance penetration make high-cost scans like MRI and PET-CT more accessible to middle-class populations. The region is also attracting global imaging companies that are setting up manufacturing hubs, partnerships, and research collaborations to meet rising local demand at affordable prices. With expanding healthcare budgets, rapid urbanization, and growing clinical research investments, the Asia Pacific is positioned to be the fastest-growing market, outpacing other regions in biomedical imaging adoption and technological advancement.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Biomedical Imaging Technologies Market: Competitive Landscape

The biomedical imaging technologies market is highly competitive, with a mix of multinational giants and regional players competing through innovation, partnerships, and product diversification. Siemens Healthineers, GE HealthCare, and Philips Healthcare dominate with strong portfolios across MRI, CT, PET, and hybrid modalities, supported by global service networks. Canon Medical Systems and Fujifilm Holdings strengthen their position through innovation in MRI, ultrasound, and digital X-ray imaging, while Hologic specializes in women’s health imaging solutions.

United Imaging Healthcare and Mindray are gaining ground with cost-effective solutions and rapid growth in Asia. Smaller innovators like Hyperfine are introducing portable and low-cost MRI systems, broadening accessibility. Partnerships with hospitals, AI firms, and research institutes are central strategies, enabling the integration of artificial intelligence, cloud platforms, and advanced reconstruction techniques. Companies are also focusing on regulatory approvals, clinical trials, and reimbursement alignment to expand adoption. The landscape reflects a balance of established market leaders leveraging R&D investments and new entrants offering disruptive technologies, ensuring dynamic competition and continuous technological evolution.

Some of the prominent players in the Global Biomedical Imaging Technologies Market are:

- Siemens Healthineers

- GE HealthCare

- Philips Healthcare

- Canon Medical Systems Corporation

- Fujifilm Holdings Corporation

- Hologic, Inc.

- Carestream Health

- Esaote SpA

- Hitachi Medical Systems

- Samsung Medison Co., Ltd.

- Agfa-Gevaert Group

- Bruker Corporation

- Mindray Medical International Limited

- Neusoft Medical Systems Co., Ltd.

- PerkinElmer, Inc.

- Shimadzu Corporation

- Analogic Corporation

- CurveBeam LLC

- Hyperfine, Inc.

- United Imaging Healthcare

- Other Key Players

Recent Developments in the Global Biomedical Imaging Technologies Market

June 2024

- Collaboration: Siemens Healthineers and Tempus announced a strategic collaboration to integrate AI-powered imaging analytics with clinical data to advance precision medicine in oncology. The focus is on connecting radiology and pathology data.

- Investment: The U.S. National Institutes of Health (NIH) announced over USD 50 million in funding through the Bridge2AI program to accelerate the development of AI-ready medical imaging datasets, focusing on ethical creation and standardization.

May 2024

- Conference: The Society of Nuclear Medicine and Molecular Imaging (SNMMI) Annual Meeting took place in Toronto, Canada. Major highlights included new clinical data for PSMA-targeted PET radiopharmaceuticals and the presentation of novel PET tracers for neurology and oncology.

- Collaboration: GE HealthCare and Medis Medical Imaging announced a collaboration to integrate Medis's cardiovascular image analysis software into GE's cardiac ultrasound and CT systems to improve workflow for clinicians.

April 2024

- Investment: The U.K. Government announced an investment of USD 15 million to install AI-enabled MRI scanners across the National Health Service (NHS) to significantly cut scan times and reduce waiting lists.

- Collaboration: Philips and PathAI announced a multi-year partnership to develop AI-powered digital pathology solutions integrated with Philips' digital pathology platform, aiming to enhance diagnostic efficiency and standardize workflows.

March 2024

- Conference: The European Congress of Radiology (ECR 2024) was held in Vienna, Austria. A key theme was the clinical integration of AI, with sessions on federated learning, low-field MRI, and sustainability in radiology.

- Development: Canon Medical Systems received U.S. FDA 510(k) clearance for its Aquilion Serve SP CT system, designed for streamlined imaging in sterile environments like operating and interventional rooms.

February 2024

- Collaboration: FUJIFILM Sonosite and Global Medical Response (GMR) announced a large-scale agreement to provide point-of-care ultrasound (POCUS) systems and education across GMR's mobile healthcare fleet in the U.S.

- Investment: The Australian Government unveiled a USD 50 million grant through the Medical Research Future Fund (MRFF) to establish a national network of cutting-edge imaging and mass spectrometry facilities for research.

January 2024

- Merger/Acquisition: Samsung Medison, a subsidiary of Samsung Electronics, completed its acquisition of Sonio, a French AI startup specializing in fetal ultrasound analysis software, for approximately USD 65 million.

- Development: Hyperfine, Inc. received CE Mark approval for its next-generation Swoop® 2.0 portable MRI system, which features enhanced image quality and new clinical applications.

November 2023

- Conference: The Radiological Society of North America (RSNA) Annual Meeting took place in Chicago, USA. The expo floor featured heavy emphasis on generative AI, cloud-native platforms, and vendor-neutral analytics.

- Collaboration: Hologic, Inc. and Samsung Electronics Co., Ltd. announced a multi-year partnership to co-develop and commercialize a new 3D mammography system, combining Hologic's imaging tech with Samsung's digital design.

Report Details

| Report Characteristics |

| Market Size (2025) |

UUSD 42.1 Bn |

| Forecast Value (2034) |

USD 66.5 Bn |

| CAGR (2025–2034) |

5.2% |

| The US Market Size (2025) |

USD 13.5 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Modality / Technology (X-ray Imaging, MRI, Ultrasound Imaging, Nuclear Imaging, Optical Imaging, Photoacoustic Imaging, and Other), By Application (Cardiology, Oncology, Neurology, Orthopedics & Musculoskeletal, Gynecology & Obstetrics, Gastroenterology, Pulmonology, Urology & Nephrology, Others), and By End User (Hospitals & Clinics, Diagnostic Imaging Centers, Ambulatory Surgical Centers, Academic & Research Institutes, Pharmaceutical & Biotechnology Companies) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Siemens Healthineers, GE HealthCare, Philips Healthcare, Canon Medical Systems, Fujifilm Holdings, Hologic, Carestream Health, Esaote, Hitachi Medical Systems, Samsung Medison, Agfa-Gevaert, Bruker, Mindray Medical, Neusoft Medical Systems, PerkinElmer, Shimadzu, Analogic, CurveBeam, Hyperfine, United Imaging Healthcare, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Biomedical Imaging Technologies Market size is estimated to have a value of USD 42.1 billion in 2025 and is expected to reach USD 66.5 billion by the end of 2034.

The market is growing at a CAGR of 5.2 percent over the forecasted period of 2025.

The US Biomedical Imaging Technologies Market is projected to be valued at USD 13.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 20.7 billion in 2034 at a CAGR of 4.9%.

Which region accounted for the largest Global Biomedical Imaging Technologies Market?

Some of the major key players in the Global Biomedical Imaging Technologies Market are Siemens Healthineers, GE HealthCare, Philips Healthcare, Canon Medical Systems, Fujifilm Holdings, Hologic, and many others.