Market Overview

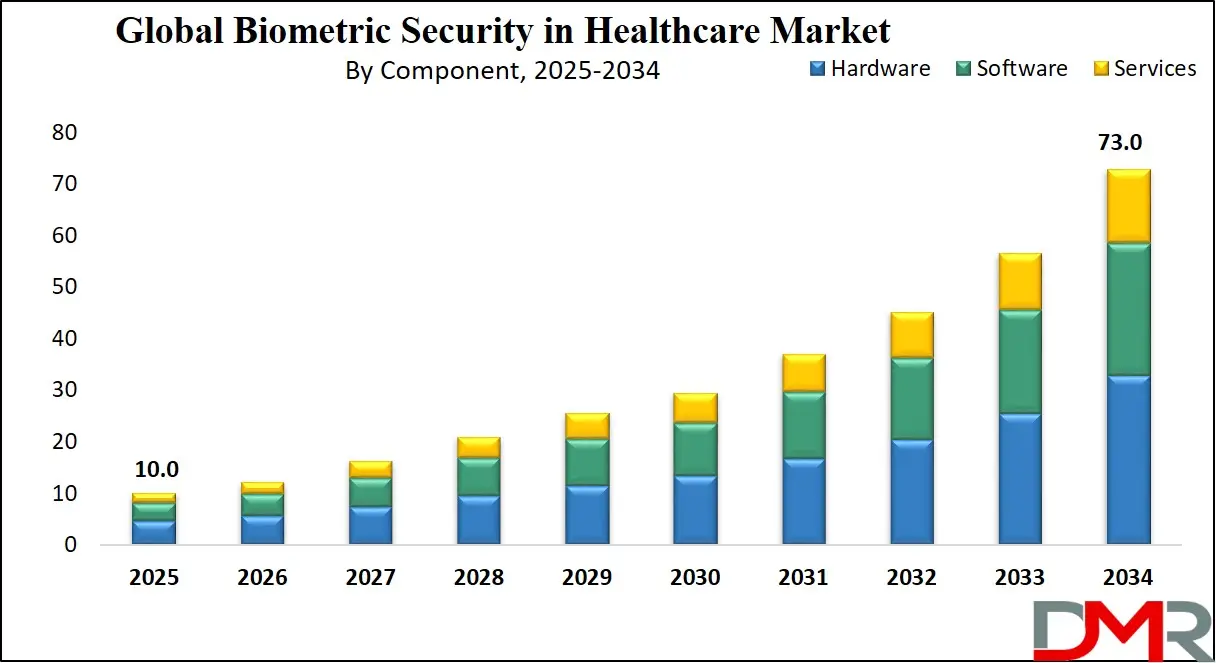

The Global Biometric Security in Healthcare Market is predicted to be valued at

USD 10.0 billion in 2025 and is expected to grow to

USD 73.0 billion by 2034, registering a compound annual growth rate (CAGR) of

24.7% from 2025 to 2034.

The global biometric security in healthcare market is undergoing rapid change, mainly because of increased demand for improved protection of patient data and robust medical identity verification. Biometric tech innovations like fingerprinting, facial recognition, and multimodal identity confirmation are now being integrated within healthcare IT systems to enhance the speed and precision of picking patients out.

The increased adoption of biometric-connected access control in hospitals and diagnostic centers is contributing to reducing medical mistakes and blocking disloyal usage of private health information. Among key trends are the shift to contactless biometric approaches encouraged by increased concern for hygiene, as well as the utilization of artificial intelligence to enhance authentication.

The potential for development is quite vast in terms of the development of telemedicine services and the remote monitoring of patients, which involves secure authentication to preserve the patient’s privacy and comply with the standards of regulations. The growth in the deployment of cloud-based biometric solutions offers scalable and cost-efficient security alternatives to healthcare organizations that easily plug into electronic health records as well as hospital management systems. Furthermore, the growing concerns about personalized and precision medicine also lead to the increasing need for robust biometric authentication to secure individualized health data during digital exchanges.

Despite these opportunities, the market faces challenges such as privacy concerns and the substantial upfront costs involved in deploying sophisticated biometric systems in healthcare settings. Difficulties in integrating with existing legacy systems and meeting stringent data protection regulations may hinder adoption. Additionally, biometric accuracy can be compromised by sensor limitations and user cooperation, which can affect usability in fast-paced clinical environments.

Looking forward, the biometric security sector in healthcare is set for significant expansion, driven by continuous technological advancements and stricter data privacy regulations. The growing burden of chronic illnesses and healthcare infrastructure development in emerging markets will further boost demand. Innovations in multimodal biometrics and AI-powered analytics are expected to improve system dependability, establishing biometric security as a critical element of healthcare operations worldwide.

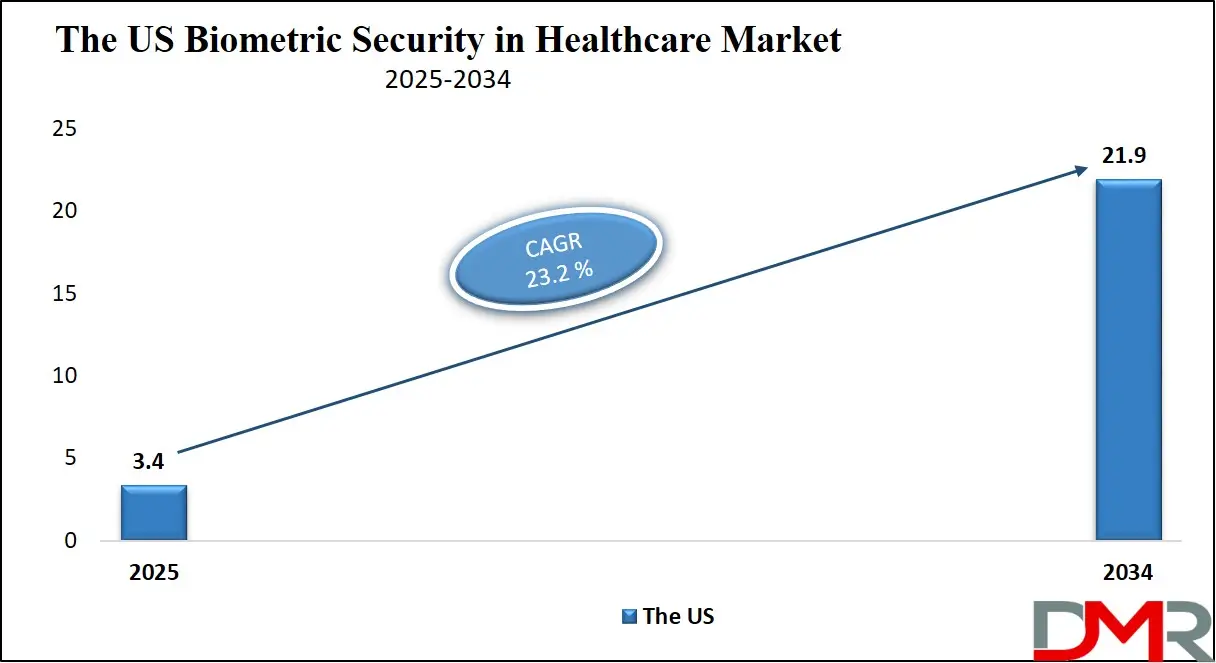

The US Biometric Security in Healthcare Market

The US Biometric Security in Healthcare market is projected to be valued at USD 3.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 21.9 billion in 2034 at a CAGR of 23.2%.

The US healthcare sector increasingly prioritizes patient data security due to rising cyber threats and strict regulatory frameworks like HIPAA. Healthcare providers are adopting biometric technologies such as fingerprint, facial recognition, and iris scanning to ensure secure and accurate patient identification and to prevent medical identity theft. The growing digitization of medical records and need for secure access to electronic health records drive demand for advanced biometric authentication solutions. Additionally, healthcare organizations focus on reducing operational inefficiencies and enhancing patient safety, which further accelerates the deployment of biometric security systems.

In the US, there is a strong shift toward multimodal biometric authentication systems that combine multiple biometric traits for enhanced security and accuracy. Contactless biometric solutions have gained popularity to minimize infection risks, especially in healthcare settings. Mobile biometric devices and AI-powered biometric systems are increasingly integrated to support real-time identification and improve workflow efficiency. The focus on interoperability between biometric systems and healthcare IT infrastructure is another emerging trend, facilitating seamless data sharing and secure access across platforms.

The Japan Biometric Security in Healthcare Market

The Japan Biometric Security in Healthcare market is projected to be valued at

USD 900.0 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds

USD 6,400 billion in 2034 at a

CAGR of 24.5%.

Japan’s aging population and the resulting increase in healthcare demand have propelled the adoption of biometric security to improve patient management and safety. The government’s push for healthcare digitalization and smart hospital initiatives supports the integration of biometric authentication technologies such as fingerprint and iris scanning. High awareness of data privacy and stringent regulations encourage secure access control to electronic health records and medical devices. The need to reduce medical errors and enhance workflow efficiency further drives the use of biometric systems across healthcare facilities.

Japan’s healthcare sector is witnessing a growing adoption of contactless biometric authentication solutions to ensure hygiene and minimize infection risks. There is a notable increase in the use of multimodal biometric systems combining multiple biometric identifiers to strengthen security and accuracy. Integration of AI-powered biometric analytics is emerging, enabling better recognition performance and predictive security management. Mobile biometric devices are increasingly used to support healthcare professionals in decentralized care settings. The trend toward seamless integration of biometric security with healthcare IT infrastructure is accelerating digital transformation in Japan’s healthcare industry.

The Europe Biometric Security in Healthcare Market

The Europe Biometric Security in Healthcare market is projected to be valued at USD 2,100 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 14,700 million in 2034 at a CAGR of 23.9%.

Europe’s biometric security market in healthcare is driven by stringent data privacy laws such as GDPR, which emphasize protecting patient data from unauthorized access. The rising adoption of electronic health records and digital health services compels healthcare providers to implement biometric authentication for enhanced security. Growing awareness about cybersecurity threats and healthcare fraud also propels demand.

The focus on improving patient safety and minimizing medical errors encourages the use of biometric systems for accurate patient identification. Additionally, government initiatives promoting smart healthcare infrastructure and digital transformation support market growth. European healthcare organizations increasingly deploy multimodal biometric systems combining fingerprint, facial, and iris recognition to improve authentication reliability.

Contactless biometric technologies are favored for hygiene and convenience, especially post-pandemic. Integration of AI and machine learning with biometric systems is gaining traction to enhance recognition accuracy and predict security threats. Mobile biometric solutions for remote healthcare and telemedicine are expanding rapidly. There is also an emphasis on compliance-driven solutions that align biometric security with Europe’s strict privacy regulations, fostering trust among patients and providers.

Biometric Security in Healthcare Market: Key Takeaways

- Market Overview: The Global Biometric Security in Healthcare Market is anticipated to reach a valuation of USD 10.0 billion by 2025, with projections indicating significant growth to USD 73.0 billion by 2034, reflecting a compound annual growth rate (CAGR) of 24.7% during the forecast period from 2025 to 2034.

- U.S. Market Outlook: The U.S. Biometric Security in Healthcare Market is estimated at USD 3.4 billion in 2025 and is forecasted to expand to USD 21.9 billion by 2034, growing at a CAGR of 23.2%. This robust growth highlights the country’s strong adoption of advanced biometric technologies in healthcare.

- Japan Market Outlook: Japan’s Biometric Security in Healthcare market is expected to be valued at USD 900.0 million in 2025, with a projected increase to USD 6.4 billion by 2034, achieving a CAGR of 24.5%. The growth is driven by technological advancements and increasing focus on secure patient identification systems.

- Europe Market Outlook: The European Biometric Security in Healthcare Market is set to reach USD 2.1 billion in 2025 and is projected to grow to USD 14.7 billion by 2034, registering a CAGR of 23.9%. The region’s emphasis on privacy, data security, and digital health initiatives supports this growth trajectory.

- Component Analysis: Hardware components are expected to dominate the market, accounting for over 51.3% of the global revenue share in 2025. This includes devices such as biometric scanners, sensors, and cameras used for identity verification.

- Technology Analysis: Fingerprint recognition is projected to lead among the technologies used in biometric healthcare security, representing approximately 34.6% of the global market share in 2025. Its reliability, affordability, and ease of integration contribute to its widespread adoption.

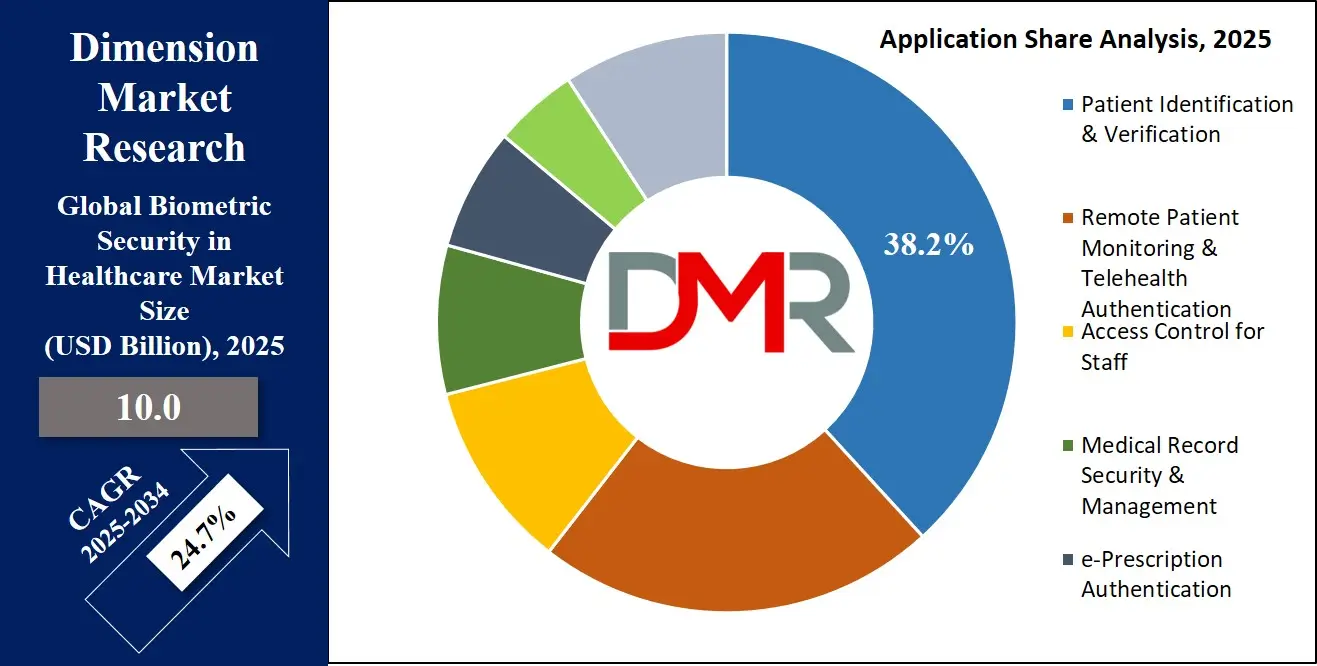

- Application Analysis: Patient identification and verification is forecasted to be the leading application segment, contributing around 38.2% of the global market revenue in 2025. This growth is driven by the increasing need to ensure accurate and secure access to patient information.

- End User Analysis: Hospitals and clinics are expected to be the dominant end users of biometric security solutions, holding a substantial 47.5% share of the global revenue in 2025, due to rising concerns over patient safety, data privacy, and operational efficiency.

- Regional Leadership: North America is set to lead the global market, capturing approximately 40.0% of total market revenue by 2025, driven by advanced healthcare infrastructure and strong regulatory support for biometric security integration.

Biometric Security in Healthcare Market: Use Cases

- Patient Identification: Biometric systems like fingerprint or iris scans ensure accurate patient identification, reducing medical errors and preventing identity fraud. This enhances patient safety by linking medical records precisely to the correct individual, especially in emergencies where quick and reliable verification is critical.

- Access Control to Medical Records: Healthcare providers use biometric authentication to restrict access to sensitive electronic health records (EHR). Only authorized personnel can access patient data, protecting privacy and complying with regulations like HIPAA, thereby preventing unauthorized data breaches and maintaining confidentiality.

- Medication Dispensing Security: Biometric verification controls access to medication cabinets and dispensing machines. By confirming the identity of healthcare staff, it reduces the risk of medication errors, theft, or misuse, ensuring only qualified personnel administer drugs to patients safely and accurately.

- Time and Attendance Monitoring: Biometric time tracking in hospitals ensures accurate logging of healthcare workers’ shifts. This prevents time fraud, optimizes staffing, and supports payroll accuracy. It also helps manage workforce allocation, ensuring enough staff are available for critical patient care needs.

Biometric Security in Healthcare Market: Stats & Facts

- World Health Organization (WHO) reports that over 40% of healthcare data breaches involve unauthorized access, highlighting the critical need for robust biometric security measures in healthcare settings.

- The Journal of Medical Internet Research (JMIR) states that biometric authentication reduces patient identity fraud by up to 70% compared to traditional password-based systems.

- According to a study published in IEEE Access, multimodal biometric systems combining fingerprint and iris recognition achieve accuracy rates exceeding 98% in patient verification.

- Harvard Business Review (HBR) highlights that hospitals implementing biometric security have seen a 30% reduction in administrative errors related to patient misidentification.

- National Institutes of Health (NIH) research shows that voice recognition biometrics can improve remote patient authentication success rates by over 85% in telehealth applications.

- As per The Lancet Digital Health, the integration of palm vein biometrics in clinical environments decreased unauthorized access incidents by nearly 50% within the first year of deployment.

- Health Affairs Journal reveals that healthcare organizations using biometric systems report an average 15-20% decrease in HIPAA compliance violations related to access control.

- MIT Technology Review notes that contactless biometric technologies help reduce infection transmission risks in healthcare facilities, a factor especially critical post-pandemic.

- According to The New England Journal of Medicine (NEJM), biometric security adoption contributes to enhanced patient safety by ensuring 100% accurate patient identification during medication administration.

- Stanford Medicine studies indicate that the implementation of biometric solutions in electronic health records (EHR) systems reduces identity theft-related incidents by up to 60%.

Biometric Security in Healthcare Market: Market Dynamics

Driving Factors in the Biometric Security in Healthcare Market

Increasing Need for Enhanced Patient Data SecurityThe growing digitization of healthcare records has significantly increased the demand for robust biometric security solutions. Healthcare organizations are increasingly adopting biometric authentication technologies such as fingerprint scanning, facial recognition, and iris recognition to protect sensitive patient information from unauthorized access and cyber threats. Compliance with stringent healthcare regulations like HIPAA and GDPR is driving the adoption of biometric access control systems to safeguard electronic health records (EHR). The increasing incidents of healthcare data breaches and identity theft are pushing hospitals and clinics to invest in advanced biometric security systems to ensure the confidentiality, integrity, and availability of patient data.

Growing Adoption of Contactless Biometric Systems

The pandemic accelerated the adoption of contactless biometric security solutions in healthcare settings to minimize physical contact and reduce infection risks. Technologies such as facial recognition, iris scanning, and voice recognition gained traction as they enable secure and hygienic patient and staff identification. Contactless biometric systems also enhance operational efficiency by speeding up patient check-ins and access management. This shift is supported by the rising demand for touchless authentication in hospitals and clinics, which helps maintain social distancing protocols while ensuring high security standards for healthcare facilities.

Restraints in the Biometric Security in Healthcare Market

High Implementation and Maintenance Costs

Despite the benefits, the high initial cost of deploying biometric security systems remains a significant restraint for many healthcare providers, especially smaller clinics and hospitals with limited budgets. Installation of advanced biometric hardware such as iris scanners or facial recognition cameras, coupled with integration into existing healthcare IT infrastructure, requires substantial investment. Additionally, ongoing maintenance, software updates, and training for staff add to the overall expenditure. This financial burden can slow down the widespread adoption of biometric authentication technologies, particularly in developing regions where healthcare funding is constrained.

Privacy Concerns and Data Security RisksThe collection and storage of biometric data raise significant privacy concerns among patients and healthcare professionals. Biometric identifiers are unique and immutable, making unauthorized access or misuse potentially damaging. Concerns about biometric data breaches, identity theft, and misuse by malicious actors can hinder the acceptance of biometric security systems in healthcare. Furthermore, the lack of clear regulations in some regions on biometric data handling and consent can lead to legal challenges and resistance from stakeholders worried about compromising patient confidentiality and violating data protection laws.

Opportunities in the Biometric Security in Healthcare Market

Integration of AI and Machine Learning with Biometric SystemsThe convergence of

artificial intelligence (AI) and machine learning (ML) with biometric security is opening new opportunities in healthcare. AI-powered biometric authentication systems enhance accuracy and speed by learning from large datasets, improving recognition capabilities even under challenging conditions like poor lighting or partial occlusion. Healthcare providers can leverage AI-driven biometric analytics for predictive security measures, real-time anomaly detection, and personalized patient experiences. This integration supports smarter, more adaptive biometric solutions that improve both security and operational efficiency in hospitals and clinics.

Expansion of Biometric Security in Telemedicine and Remote HealthcareThe rise of

telemedicine and remote patient monitoring is creating demand for secure biometric authentication to verify patient identities remotely. Biometric security technologies like voice recognition and facial authentication can help prevent fraud and ensure secure access to telehealth platforms and electronic medical records from any location. As healthcare services increasingly move towards digital channels, biometric systems offer a scalable solution to protect patient data and maintain trust in virtual care environments, presenting significant growth potential for vendors specializing in biometric security solutions for healthcare.

Trends in the Biometric Security in Healthcare Market

Shift Toward Multimodal Biometric Authentication SystemsHealthcare organizations are increasingly adopting multimodal biometric systems that combine multiple biometric traits such as fingerprint, facial recognition, and iris scanning to enhance security and accuracy. Multimodal authentication reduces false acceptance and rejection rates, ensuring reliable patient and staff identification in healthcare environments. This trend aligns with the rising demand for robust access control in hospitals and clinics, addressing vulnerabilities associated with single-mode biometric systems. The integration of multiple biometric modalities improves user convenience and security compliance, making it a preferred choice in healthcare biometric applications.

Increasing Use of Mobile Biometric Devices in Healthcare

The healthcare sector is witnessing growing adoption of mobile biometric devices for secure access and identity verification. Portable fingerprint scanners, facial recognition enabled smartphones, and wearable biometric sensors are being used by healthcare professionals for on-the-go authentication. These mobile biometric solutions facilitate secure patient check-ins, medication dispensing, and staff time tracking, especially in decentralized or remote healthcare settings. The trend toward mobility supports flexible workflows and real-time data access, enhancing both security and operational efficiency in the healthcare industry.

Biometric Security in Healthcare Market: Research Scope and Analysis

By Component Analysis

The hardware segment is expected to hold the majority of shares in the global biometric security in healthcare market, with more than 51.3% shares in 2025. This expansion is mainly informed by the growing installation of biometric scanners and authentication devices in hospitals and diagnostic labs for proper patient’ identification. Increase in demand for mobile biometric systems and fingerprint recognition in clinical environment is also driving adoption. With hospital safety and regulatory compliance being on top of the list, the hospital investments in advanced hardware solutions only increase. Some of the drivers include increasing initiatives of healthcare fraud prevention and the implementation of biometric hardware in electronic health records (EHR) systems, enhancing identity management on heterogeneous healthcare environs.

The segment of the software is expected to register the fastest CAGR in the biometric security in healthcare market by 2025. This has been triggered by the growing dependence on biometric authentication software for access into medical records and telehealth platforms. In the context of expanding cloud-based biometric solutions and instant analytics as the norm in healthcare IT, the need for sturdy data management solutions is skyrocketing.

Lack of frictionless integration with the existing hospital information systems (HIS) and the necessity to allow compliance with data protection legislations are dynamically driving software adoption as well. Additionally,

digital health infrastructure growth and AI-based biometric tools are also allowing accelerated and secure identity verification and access control in both clinical and offsite care settings.

By Technology Analysis

Fingerprint recognition is expected to lead the global biometric security in healthcare market with an approximate share of

34.6% of the total market share in 2025. Its use in hospitals and clinics for patient authentication and workforce management remains the driving force in its uptake. Fingerprint-based systems are low-cost and easy to insert and provide healthcare workflows with robust identity verification. There is further demand for this segment due to the enhanced use of biometric time attendance systems and access control devices in medical facilities.

Along with IP-address verification technology, fingerprint recognition is the most trusted and scalable modality as healthcare providers improve their electronic medical records’ security and reduce identity fraud. Also, its ability to integrate with the existing health information infrastructure helps to significantly enhance operational efficiency as well as satisfy patients’ data privacy standards.

The multimodal biometrics is expected to record the highest CAGR in the biometric security in healthcare market by the end of 2025. This growth is driven by increased demand for greater accuracy in identification via their integration of two or more biometric modes, such as face and voice identification. Healthcare institutions are embracing multimodal solutions to avoid the limitations of a single-mode system, whereby greater security and a reduced number of false matches are experienced.

Given that PMP is becoming more crucial, multimodal systems are being adopted for safe access to EHR and multi-factor authentication in telehealth platforms. Sensory fusion integration and AI-facilitated biometric recognition capabilities are promoting the use, particularly in high-risk settings, including intensive care sections, pharmacies, and controlled substance dispensing systems.

By Application Analysis

The segment of the patient identification & verification is expected to lead the global biometric security in healthcare, accounting for around 38.2% of revenue shares in 2025. The shift in the emphasis on precise patient matching within the electronic health systems and the heightened requirement for getting rid of redundant records are significant factors. Hospitals and healthcare providers are also implementing biometric verification systems in a bid to increase security for the patients, reduce medical errors, and facilitate the admission process.

This part is highly enhanced by biometric-enabled monitoring of the patients in the emergency rooms and outpatient settings. Its integration with the hospital information systems and the increasing adoption of software in outpatient imaging centers contributes its dominant position as biometric identification chinks in as the centerpiece in the protection of patient data and in informing workflow in clinical operations.

Remote patient monitoring & telehealth authentication are expected to record the highest CAGR in the biometric security in healthcare market by the end of 2025. As virtual healthcare is rapidly developing, biometric verification procedures that are both secure and reliable are necessary for verifying the identity of patients during remote consultations. The use of facial recognition and voice biometrics in mobile health platforms for

chronic disease management and elderly care is one of the drivers of this segment.

This feature of real-time identity verification in telehealth sessions and compatibility with remote diagnostics tools drives the adoption. With healthcare systems moving towards a digital-first care delivery model, the use of biometric-based secure logins and automated identity verifications is becoming essential for maintaining patient confidentiality and adherence to remote care rules and regulations.

By End User Analysis

The hospitals & clinics segment is expected to dominate the global biometric security in healthcare market, where it is likely to have a

47.5% share of the revenue in 2025. The rising demand to secure access to patient records and, with that, control physical entry points into medical facilities is a major driver of growth. Hospitals are incorporating biometric authentication systems for the simplification of patient admission, integration into clinical workflow, as well as protection of protected health information.

Fingerprint scanners, facial recognition terminals, and palm vein readers are being massively rolled out in intensive care units and surgical wards. Increasing investments in hospitals’ cybersecurity infrastructure and electronic identity systems are driving segment dominance, driven by the need to enhance operational efficiency and adherence to digital healthcare standards among healthcare administrators.

The homecare settings segment is expected to register the highest CAGR in the biometric security in healthcare market by the year-end 2025. The need for secure biometric identification in non-clinical environments is rising very quickly, along with the increasing spread of remote care delivery and mobile health technologies. Chronic and post-acute care home-based treatment patients need stable verification solutions to access digital therapeutics and teleconsultation services.

Biometric wearables and voice recognition instruments are increasingly adopted into home monitoring systems to ensure data reliability to personalize healthcare services. Furthermore, the increasing aging population and the increase in virtual nursing programs raise the demand for a biometric-supported authentication framework for the secure interaction between patients and caregivers, fulfilling the requirements of personal health data protection laws.

The Biometric Security in Healthcare Market Report is segmented on the basis of the following

By Component

- Hardware

- Biometric Scanners (Fingerprint, Iris, Palm Vein, etc.)

- Biometric Cameras

- Authentication Devices

- Mobile Biometric Devices

- Software

- Biometric Authentication Software

- Biometric Data Management & Analytics

- Services

- Installation & Integration Services

- Support & Maintenance Services

- Consulting Services

By Technology

- Fingerprint Recognition

- Face Recognition

- Iris Recognition

- Voice Recognition

- Palm Vein Recognition

- Behavioral Biometrics

- Multimodal Biometrics

- Other Biometric Technologies

By Application

- Patient Identification & Verification

- Remote Patient Monitoring & Telehealth Authentication

- Access Control for Staff

- Medical Record Security & Management

- e-Prescription Authentication

- Time & Attendance Monitoring

- Insurance & Claims Fraud Prevention

By End User

- Hospitals & Clinics

- Pharmaceutical & Biotech Companies

- Health Insurance Providers

- Diagnostic Laboratories

- Research & Academic Institutes

- Homecare Settings

- Government & Regulatory Bodies

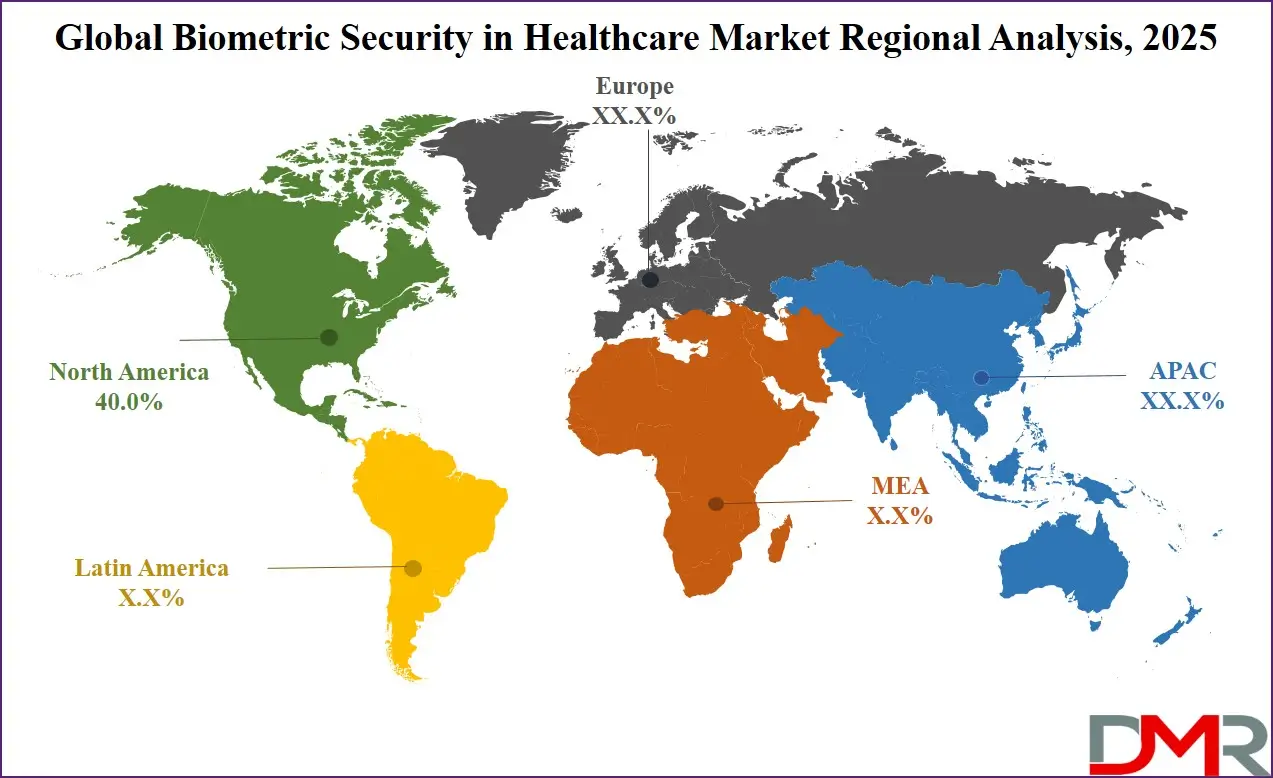

Regional Analysis

Region with the largest Share

North America holds the largest share in the biometric security in healthcare market, accounting for approximately

40.0% of the global market revenue by 2025. The region benefits from advanced healthcare infrastructure, high adoption of digital health technologies, and stringent regulations on patient data privacy, such as HIPAA. The widespread use of biometric authentication in hospitals, clinics, and insurance providers enhances patient identity management and data security. Additionally, significant investments in cybersecurity and the presence of leading biometric technology vendors drive market growth. The growing focus on reducing healthcare fraud and improving operational efficiency through biometric-enabled access control and patient verification also solidifies North America’s dominant position.

Region with Highest CAGR

Asia-Pacific is expected to register the highest CAGR in the biometric security in healthcare market through 2025. Rapid digital transformation in healthcare, increasing government initiatives to modernize healthcare infrastructure, and rising awareness about patient data security contribute to this growth. Expanding telemedicine services and the growing elderly population in countries like China, India, and Japan fuel the demand for secure biometric authentication. Furthermore, the adoption of cloud-based biometric platforms and mobile biometric devices in emerging economies accelerates market penetration. Improving healthcare IT systems and increased investment in health data protection regulations further enhance the regional market’s growth potential.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The biometric security in the healthcare market is characterized by intense competition among global and regional players offering advanced biometric authentication technologies. Key companies are focusing on innovations in contactless biometrics, such as facial recognition, iris scanning, and voice recognition, to meet the growing demand for hygienic and secure patient identification.

Leading players are investing in AI-powered biometric systems that enhance accuracy and reduce false positives, enabling seamless integration with electronic health records (EHR) and hospital information systems (HIS).

Vendors are increasingly developing multimodal biometric solutions, which combine two or more biometric traits for higher reliability in identity verification and access control. The market is witnessing strategic collaborations, partnerships, and acquisitions aimed at expanding portfolios and geographic presence. Cloud-based biometric security and mobile biometric devices are gaining traction, especially in telehealth and remote care applications.

Companies are also focusing on compliance with stringent regulations like HIPAA and GDPR, offering data privacy-centric solutions for healthcare environments. The competitive landscape is further shaped by the emergence of startups and niche technology providers introducing cost-effective and scalable biometric solutions. Continuous technological advancements and the growing emphasis on cybersecurity in healthcare are expected to further intensify competition and drive innovation in this dynamic market

Some of the prominent players in the Global Biometric Security in Healthcare Market are:

- IDEMIA

- NEC Corporation

- Gemalto (Thales Group)

- BioKey International

- Cognitec Systems

- Suprema Inc.

- Fujitsu Limited

- Crossmatch (a HID Global company)

- Aware, Inc.

- SecuGen Corporation

- Dermalog Identification Systems

- Iris ID Systems, Inc.

- ZKTeco

- Neurotechnology

- Hitachi, Ltd.

- Daon

- Princeton Identity

- BioSec Group

- Next Biometrics

- Delta ID

- Other Key Players

Recent Developments

- In May 2025, MedGuard Systems successfully integrated AI-powered facial recognition technology into its patient identity management platforms. This enhancement significantly improves accuracy in identifying patients and staff within busy healthcare facilities, particularly emergency rooms and outpatient centers, where quick and precise identity verification is paramount to avoid medical errors and unauthorized access.

- In April 2025, HealthSafe Inc. expanded the deployment of its palm vein biometric access devices across multiple U.S. hospital networks. This expansion enables healthcare providers to implement more effective touchless security protocols, enhancing both patient safety and compliance with strict infection control measures.

- In March 2025, CareAccess launched a comprehensive multimodal biometric authentication platform combining iris and facial recognition technologies. This solution aims to minimize false positives and negatives by cross-verifying multiple biometric markers, which is especially useful in clinical environments where accurate patient identification directly impacts treatment outcomes.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 10.0 Bn |

| Forecast Value (2034) |

USD 73.0 Bn |

| CAGR (2025–2034) |

24.7% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 3.4 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Hardware, Software, Services), By Technology (Fingerprint Recognition, Face Recognition, Iris Recognition, Voice Recognition, Palm Vein Recognition, Behavioral Biometrics, Multimodal Biometrics, Other Biometric Technologies), By Application (Patient Identification & Verification, Remote Patient Monitoring & Telehealth Authentication, Access Control for Staff, Medical Record Security & Management, e-Prescription Authentication, Time & Attendance Monitoring, Insurance & Claims Fraud Prevention), By End User (Hospitals & Clinics, Pharmaceutical & Biotech Companies, Health Insurance Providers, Diagnostic Laboratories, Research & Academic Institutes, Homecare Settings, Government & Regulatory Bodies) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

IDEMIA, NEC Corporation, Gemalto (Thales Group), BioKey International, Cognitec Systems, Suprema Inc., Fujitsu Limited, Crossmatch (a HID Global company), Aware, Inc., SecuGen Corporation, Dermalog Identification Systems, Iris ID Systems, Inc., ZKTeco, Neurotechnology, Hitachi, Ltd., Daon, Princeton Identity, BioSec Group, Next Biometrics, Delta ID, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

The Global Biometric Security in Healthcare Market size is estimated to have a value of USD 10.0 billion in 2025 and is expected to reach USD 73.0 billion by the end of 2034.

North America is expected to be the largest market share for the Global Biometric Security in Healthcare Market with a share of about 40.0% in 2025.

Some of the major key players in the Global Biometric Security in Healthcare Market are IDEMIA, NEC Corporation, Gemalto, and many others.

The market is growing at a CAGR of 24.7% over the forecasted period.

The US Biometric Security in Healthcare Market size is estimated to have a value of USD 3.4 billion in 2025 and is expected to reach USD 21.9 billion by the end of 2034.