Biopharmaceuticals, also called biologics, are

medical products sourced from living organisms, cells, or proteins through biotechnology processes. They are important in modern healthcare, supporting the advancement of customized medicine. These drugs can be customized to address specific molecular aspects of an individual's disease, facilitating personalized treatment strategies based on the patient's unique genetic profile or disease subtype.

Key Takeaways

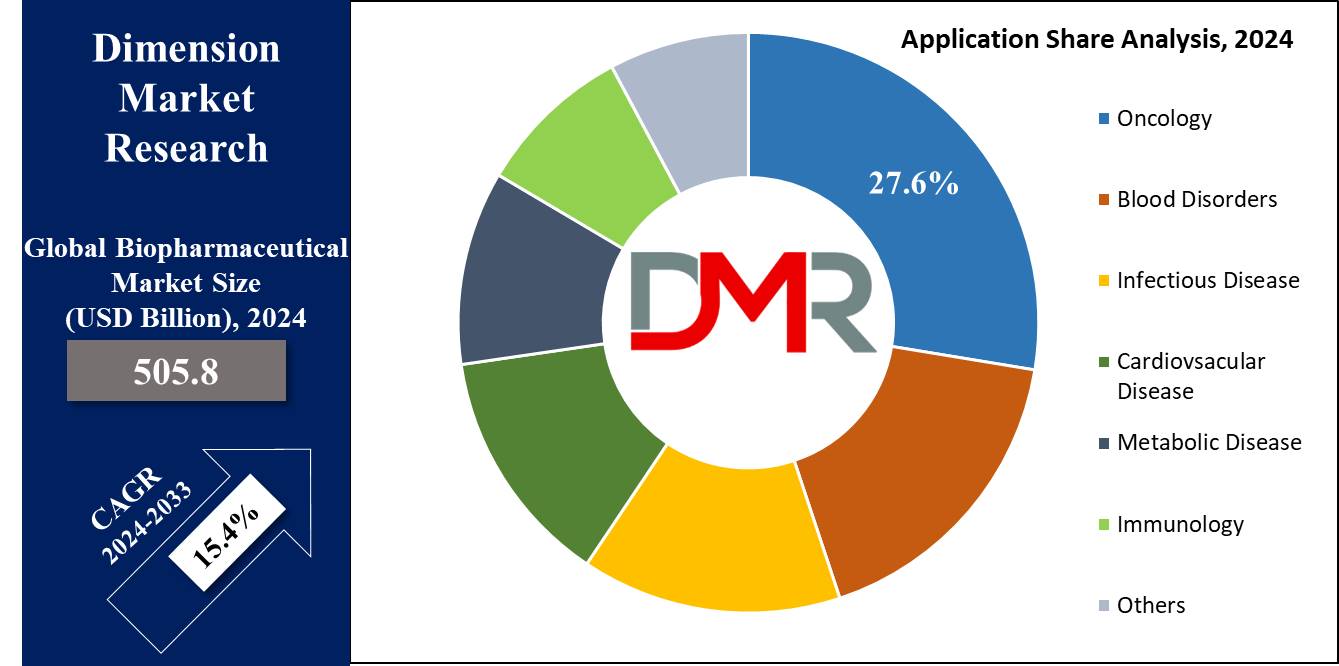

- Market Growth: The Biopharmaceutical Market size is expected to grow by 1,253.7 billion, at a CAGR of 15.4% during the forecasted period.

- By Type: The Monoclonal antibodies as a type is expected to lead in 2024 with a major & is anticipated to dominate throughout the forecasted period.

- By Application: Oncology is expected to get the largest revenue share in 2024 in the Biopharmaceutical market.

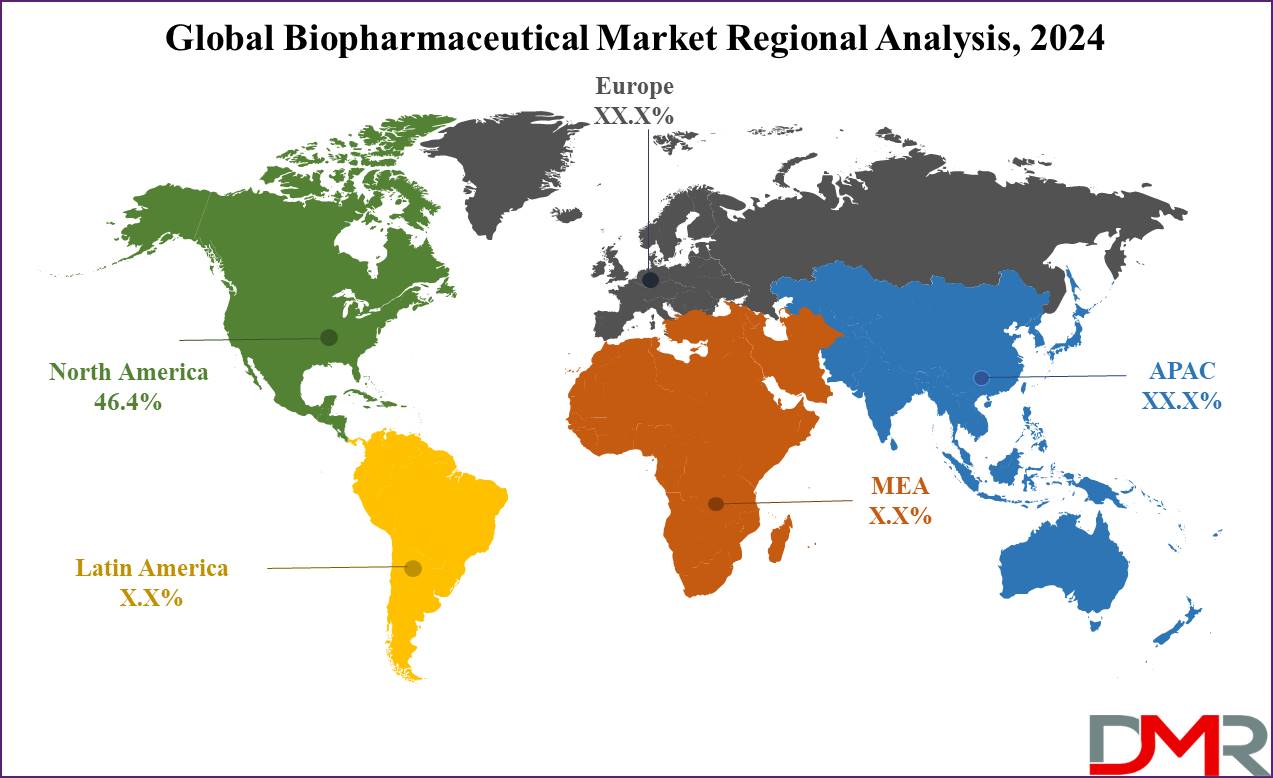

- Regional Insight: North America is expected to hold a 46.4% share of revenue in the Global Biopharmaceutical Market in 2024.

- Use Cases: Some of the use cases of Biopharmaceutical include advanced therapies, vaccines, and more.

Use Cases

- Drug Development and Innovation: Biopharmaceuticals are important in developing new, innovative drugs that target specific diseases, and provide treatments for conditions such as cancer, autoimmune diseases, and rare genetic disorders.

- Personalized Medicine: By using biotechnology, biopharmaceuticals allow personalized medicine approaches, and customized treatments to individual patients based on their genetic profiles, enhancing efficacy and reducing side effects.

- Advanced Therapies: The biopharmaceutical industry is at the lead of advanced therapies, like gene therapy, cell therapy, and regenerative medicine, which provide groundbreaking treatments for earlier untreatable conditions.

- Vaccines: Biopharmaceuticals play a vital role in the development and production of vaccines, like those for infectious diseases like COVID-19, contributing to global public health and disease prevention efforts.

Market Dynamic

Driving Factors

Increasing Investment in R&D

Major investments in research and development by biopharmaceutical companies are driving innovation and the discovery of new biological drugs, which is leading to a strong pipeline of novel therapies and expanding the market.

Favorable Regulatory Environment

Streamlined regulatory processes and supportive policies from agencies like the FDA and EMA are accelerating the approval and market entry of biopharmaceutical products, which encourages companies to develop and launch new biologics, driving market growth.

Restraints

High Development Costs

The biopharmaceutical market experiences major challenges due to the high costs associated with the research, development, and manufacturing of biological drugs. These expenses can restrict the ability of smaller companies to compete and can impact pricing and accessibility for patients.

Stringent Regulatory Requirements

Biopharmaceuticals must adhere to strong regulatory standards to ensure safety and efficacy. The lengthy and complex approval processes can hold up product launches, increase development costs, and create significant barriers to market entry.

Opportunities

Expansion into Emerging Markets

Biopharmaceutical companies have many growth opportunities in emerging markets, where growth in the healthcare infrastructure, rising income levels, and greater access to

healthcare services are driving the need for advanced therapies and biologic drugs.

Advancements in Biotechnology

Constant developments in biotechnology, like personalized medicine, gene therapy, and advanced biologics, provide opportunities for developing new treatments and addressing unmet medical needs. These developments can lead to the creation of breakthrough therapies and expand the therapeutic potential of biopharmaceuticals.

Trends

Adoption of Artificial Intelligence and Machine Learning

The integration of AI and ML in biopharmaceutical research and development is a major trend. These technologies are being utilized to streamline drug discovery, optimize clinical trial design, predict patient responses, and expand the development of new therapies, enhancing efficiency and minimizing costs.

Growth of Biosimilars

The biopharmaceutical market is experiencing significant growth in the development and acceptance of biosimilars. These are near-identical copies of original biological drugs that have lost patent protection. Biosimilars provide affordable alternatives to expensive biologics, increasing access to treatments and promoting competitive pricing in the market.

Research Scope and Analysis

By Type

The global biopharmaceuticals market is categorized by type, into erythropoietin, hormones, interferon, insulin, vaccines, monoclonal antibodies, and others. Among these monoclonal antibodies is set to account for a large share of the biopharmaceutical market revenue in 2024, due to their therapeutic efficiency in addressing various chronic conditions like cardiovascular disorders, cancer, rheumatoid arthritis, multiple sclerosis, & more. Their targeted approach minimizes the impact on healthy cells, developing fewer side effects. Monoclonal antibodies, mainly, have gained popularity due to their precise cell-targeting nature, which has expanded their adoption globally, as patients highly recognize their benefits in treating diverse disorders.

Further, during the forecast period, the vaccines segment is expected to grow significantly in the global biopharmaceutical market, as the anticipation can be taken into consideration as a rising number of disorders & increased investments by vaccine developers, highlight a concerted effort to advance therapeutic solutions & contribute to the overall expansion of the biopharmaceutical market.

By Application

The global biopharmaceuticals market is segmented by application into infectious disease, oncology, metabolic disease, immunology, cardiovascular disease, blood disorders, & other applications. Among these, the oncology segment is projected to hold the largest market share in 2024 & is predicted to maintain its dominance throughout the forecast period, which is due to the significant use of biopharmaceuticals in treating several diseases, like prostate cancer, lung cancer, breast cancer, & colorectal cancer. Such an alarming increase in cancer cases globally further contributes to oncology's sustained prominence.

Also, high growth prospects, are anticipated in cardiovascular disorders, which are driven by the increase in the number of cardiovascular diseases globally & the higher investment by biopharmaceutical manufacturers in the development of new medications for cardiovascular conditions. As a result, the market is anticipated to experience major expansion in addressing the increase in healthcare challenges related to cardiovascular disorders.

The Biopharmaceutical Market Report is segmented on the basis of the following

By Type

- Monoclonal Antibodies

- Insulin

- Vaccine

- Hormone

- Interferon

- Erythropoietin

- Others

By Application

- Blood Disorder

- Oncology

- Infectious Disease

- Cardiovascular Disease

- Metabolic Disease

- Immunology

- Others

Regional Analysis

North America is set to dominate the global biopharmaceutical market in 2024 by

holding a major 46.4% market share in revenue, which is driven by higher investments from market players & supportive government policies, mainly in the large US market, which also holds the intellectual property rights for the majority of newly developed medicines. Also, factors like major healthcare expenditure, a rise in awareness of biopharmaceutical availability, & a growth in the number of severe diseases further contribute to North America's leading position.

Also, the Asia Pacific region is set to come out as a highly promising market during the forecast period. Home to more than half of the global population, Asia Pacific benefits from an increase in healthcare expenditure, a rise in the prevalence of chronic diseases, and major government investments in development healthcare infrastructure. Moreover, the presence of top Contract Manufacturing Organizations (CMOs) in the region plays an vital role in driving the biopharmaceutical market's growth.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The biopharmaceuticals market is moderately fragmented as many companies operate within it involves the examination of both international & local companies that have a significant market share. Further industry is characterized by diverse players contributing to its dynamics, with well-known entities vying for prominence alongside regional players, shaping a competitive & varied market environment.

Some of the prominent players in the Global Biopharmaceutical Market are

- Abbott

- Sanofi

- Novo Nordisk

- Merck & Co

- Pfizer

- Amgen

- Biogen

- AbbVie

- Johnson & Johnson

- Eli Lilly & Company

- Other Key Players

Recent Developments

- In May 2024, Sentynl Therapeutics and Eiger BioPharmaceuticals, Inc. announced the completion of the sale of Eiger's Zokinvy (lonafarnib) program to Sentynl. Zokinvy is the first and only treatment approved by the U.S. FDA to target the cause and symptoms of progeria, also known as Hutchinson-Gilford progeria syndrome (HGPS) & processing-deficient progeroid laminopathies (PDPL).

- In April 2024, Biocon announced the signing of an exclusive licensing and supply agreement with Biomm S.A., a specialty pharmaceutical company in Brazil, for the commercialization of its vertically integrated drug product, Semaglutide (gOzempic), which is utilized to enhance glycemic control in adults with type-2 diabetes. Further, Biocon will also undertake the development, manufacturing, and supply of the drug product.

- In January 2024, AbbVie and Umoja Biopharma announced two exclusive options and license agreements to create multiple in-situ generated CAR-T cell therapy candidates in oncology using Umoja's proprietary VivoVecTM platform, which includes UB-VV111, Umoja's prominent clinical program for hematologic malignancies currently at the IND-enabling phase.

- In May 2022, Eli Lilly & Company unveiled its plans to invest USD 2.1 billion for the expansion of its manufacturing facilities in Indiana, USA, which highlights the company's commitment to improving its production capabilities, likely contributing to increased pharmaceutical manufacturing capacity & supporting its role in the pharmaceutical industry within the United States.

- In May 2022, LOTTE acquired Bristol Myers Squibb's manufacturing facility in East Syracuse, New York, intending to change it into the LOTTE Center for North America Operations, which positions the site as a hub for LOTTE's new biologics Contract Development & Manufacturing Organization (CDMO) business in the United States, marking a significant development in their expansion & presence in the biopharmaceutical industry.