Market Overview

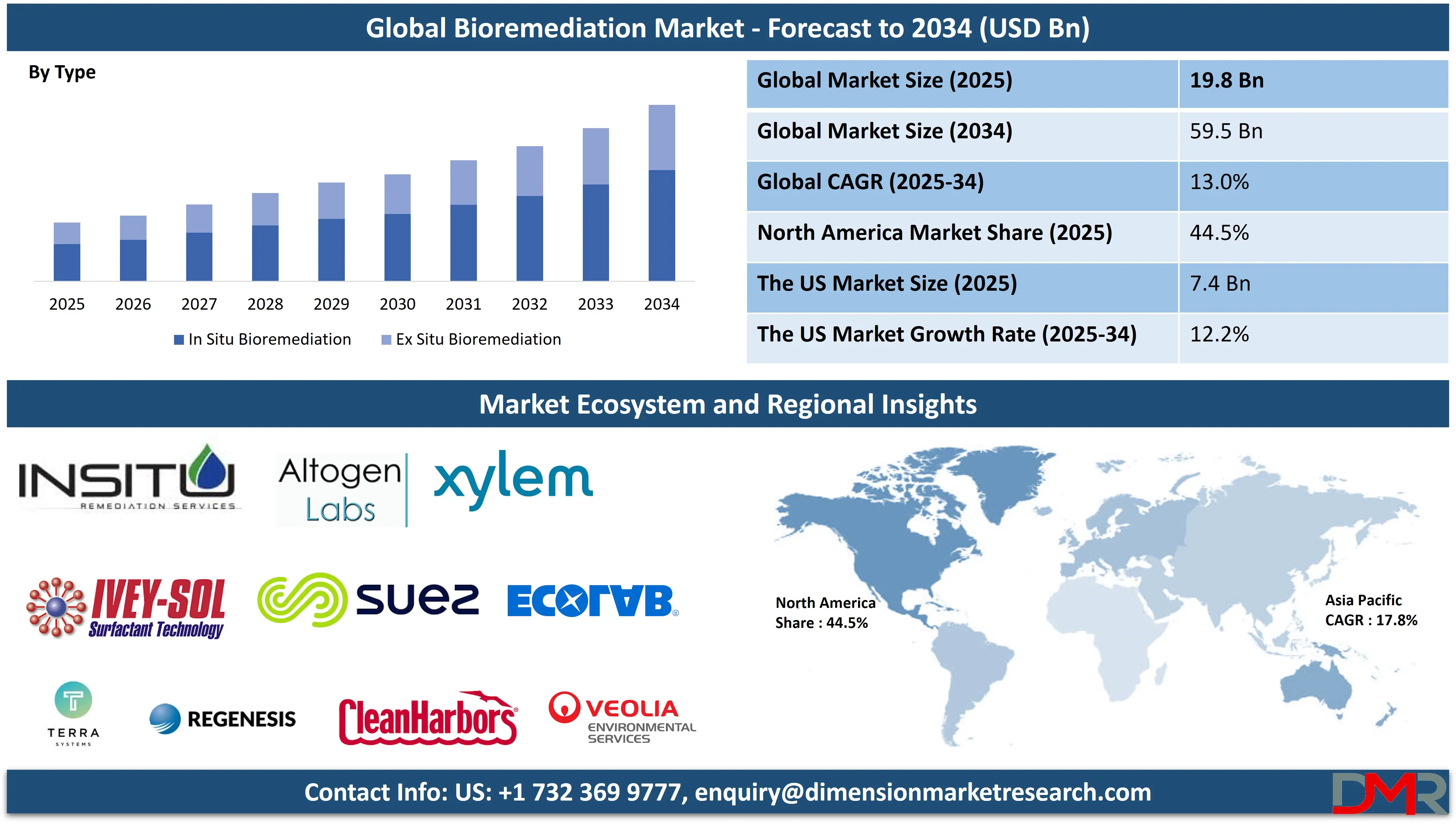

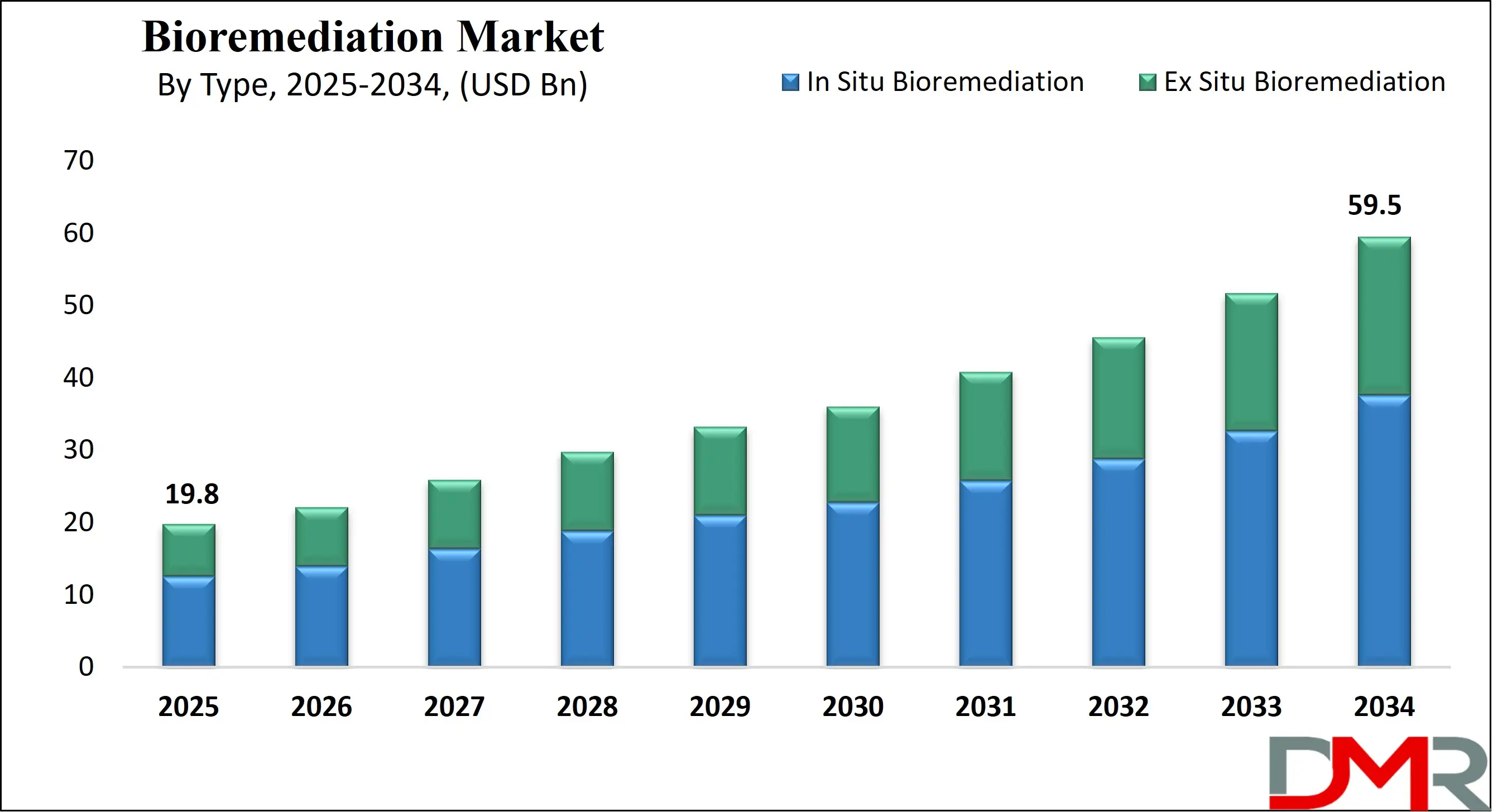

The Global Bioremediation Market is predicted to be valued at USD 19.8 billion in 2025 and is expected to grow to USD 59.5 billion by 2034, registering a compound annual growth rate (CAGR) of 13.0% from 2025 to 2034.

Bioremediation is a natural, eco-friendly process that utilizes living organisms, primarily microorganisms, such as bacteria, fungi, or plants, to break down or neutralize hazardous pollutants and contaminants in soil, water, and air. This method transforms harmful substances such as oil spills, heavy metals, pesticides, and industrial waste into less toxic or harmless compounds. It is commonly applied in areas affected by environmental pollution, including oil fields, landfills, and wastewater treatment sites.

Bioremediation can be in situ (at the contamination site) or ex-situ (removal of contaminants to treat elsewhere), offering a cost-effective and sustainable alternative to conventional chemical or mechanical cleanup methods. Emerging techniques, such as microbial consortia optimization and enzyme-assisted degradation, are also enhancing the Bioremediation Market’s effectiveness.

The global bioremediation market is witnessing significant growth driven by the rising demand for sustainable and environmentally friendly waste management solutions. As industrial activities and urbanization increase, so does the release of hazardous contaminants into the environment, boosting the need for efficient bioremediation technologies. This technique uses microbial metabolism to degrade harmful pollutants into non-toxic byproducts, offering a green alternative to conventional remediation methods. Companies are increasingly combining bioremediation with Soil Water Potential Sensor technologies to monitor soil health and optimize cleanup efficiency.

Growing awareness of environmental conservation and stringent government regulations aimed at controlling pollution levels have accelerated the adoption of bioremediation practices. Industries such as oil and gas, agriculture, chemical manufacturing, and mining are increasingly relying on this method for soil remediation, groundwater cleanup, and wastewater treatment to reduce ecological damage. Additionally, bioremediation is being complemented by environmentally conscious solutions like Eco-Friendly Straws in waste management initiatives, emphasizing a broader shift toward sustainable practices.

Technological advancements in bioaugmentation, biostimulation, and phytoremediation are further enhancing the efficacy and application scope of bioremediation. Innovations in genetic engineering and microbial strains have improved the degradation rate of complex hydrocarbons and persistent organic pollutants. As a result, the market is experiencing heightened demand across both in situ and ex situ treatment services. Integration with Chemical Injection Pumps is facilitating targeted delivery of nutrients and microbes to contaminated zones, enhancing process efficiency.

The integration of artificial intelligence and remote sensing technologies is streamlining the monitoring and execution of bioremediation projects. Additionally, the rise of partnerships between environmental engineering firms and biotechnology companies is contributing to the development of advanced solutions tailored to specific contaminants. With a growing focus on sustainable development and circular economy models, the global Bioremediation Market is poised for strong long-term expansion across diverse sectors seeking effective environmental restoration and contamination control.

The US Bioremediation Market

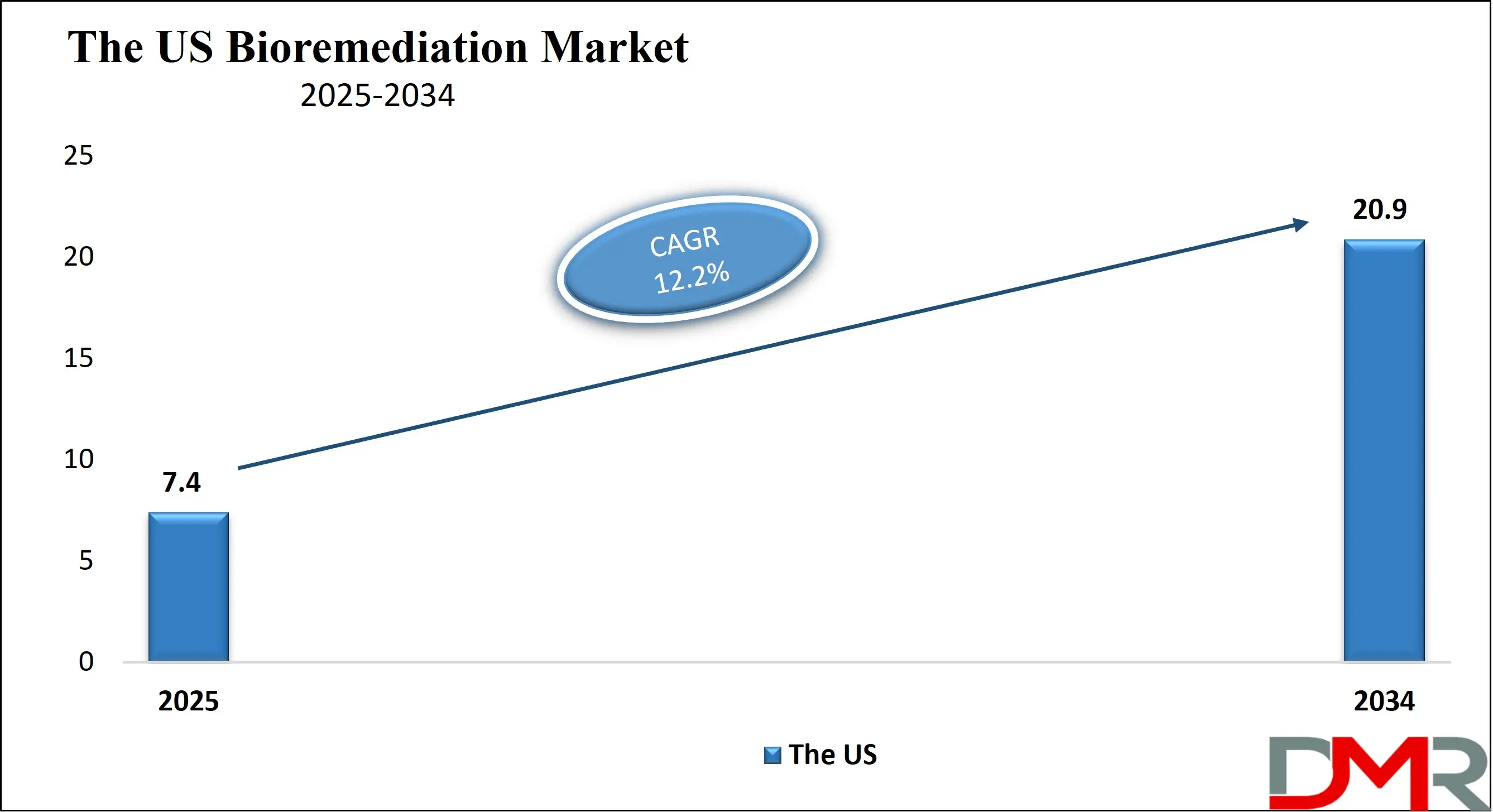

The US Bioremediation Market is projected to be valued at USD 7.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 20.9 billion in 2034 at a CAGR of 12.2%.

The US bioremediation market is driven by strict environmental regulations, increasing industrial waste generation, and growing public awareness about eco-friendly cleanup methods. The presence of advanced biotechnology research facilities and support for green technologies promotes the development of innovative microbial and enzymatic solutions. Federal and state-level initiatives for brownfield redevelopment and oil spill management also boost demand for in situ and ex situ bioremediation techniques. Moreover, rising contamination in soil and groundwater, particularly near industrial zones, pushes stakeholders to adopt sustainable remediation alternatives that align with regulatory compliance and environmental sustainability goals.

A major trend in the US bioremediation market is the rising adoption of bioaugmentation and phytoremediation for large-scale applications. Integration of Internet of Things (IoT) and AI in monitoring microbial activity and site conditions is gaining momentum. There's also a growing emphasis on using genetically modified microorganisms for faster and more targeted pollutant degradation. Public-private partnerships and increased funding for environmental biotechnology projects further support the market. Additionally, companies are shifting toward low-cost, scalable bioremediation solutions for rural and semi-urban areas, making the technology more accessible across different sectors including agriculture and municipal waste management.

The Japan Bioremediation Market

The Japan Bioremediation Market is projected to be valued at USD 1.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 3.4 billion in 2034 at a CAGR of 10.5%.

In Japan, the primary driver for the bioremediation market is the nation's vulnerability to natural disasters and the resulting need for rapid soil and water decontamination. Historical industrial pollution and the legacy of chemical spills in urban and coastal zones have necessitated the adoption of sustainable remediation practices. The government actively promotes bioremediation as part of its environmental restoration policies, especially in the context of revitalizing contaminated post-industrial sites. Additionally, Japan’s advanced biotech infrastructure and commitment to sustainable urban planning make bioremediation a favored solution in both public and private sector environmental initiatives.

Japan is experiencing growing interest in microbial remediation methods specifically designed for petroleum hydrocarbons and heavy metals. Universities and research institutions are increasingly collaborating with private companies to develop indigenous microbial strains adapted to local environmental conditions. The use of robotic and sensor-based technologies for real-time monitoring of bioremediation processes is expanding. There is also a shift toward community-led remediation projects, particularly in areas affected by industrial decline. Furthermore, Japan is exploring the potential of algae-based bioremediation in aquatic ecosystems, adding diversity to its biotechnological approaches in restoring natural habitats.

The Europe Bioremediation Market

The Europe Bioremediation Market is projected to be valued at USD 3.0 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 8.0 billion in 2034 at a CAGR of 11.5%.

Stringent EU environmental laws, such as the Water Framework Directive and Soil Thematic Strategy, drive the growth of the bioremediation market across Europe. Rising industrial activity, particularly in the manufacturing and chemical sectors, creates a pressing need for effective pollution control. Government-led brownfield restoration programs and funding for sustainable technologies enhance market demand. High awareness regarding environmental protection and preference for natural remediation over chemical methods among both industry players and regulatory bodies also fuel adoption. Additionally, increased focus on circular economy and ecological restoration encourages the integration of bioremediation practices in industrial and urban development plans.

Europe is witnessing a surge in the use of biostimulation techniques that involve the addition of nutrients to accelerate indigenous microbial degradation processes. Cross-border research collaborations and joint EU-funded environmental projects are enhancing technological innovations in bioremediation. There is growing utilization of bioreactors and hybrid remediation systems that combine biological and physical-chemical methods. Countries like Germany, the UK, and the Netherlands are leading in developing eco-industrial parks with integrated waste treatment through bioremediation. Furthermore, digital tools for site assessment, performance tracking, and predictive analytics are becoming a common feature in remediation planning and implementation.

Bioremediation Market: Key Takeaways

- Market Overview: The global bioremediation market is anticipated to reach a valuation of USD 19.8 billion in 2025 and is projected to grow significantly, hitting USD 59.5 billion by 2034. This expansion reflects a robust compound annual growth rate (CAGR) of 13.0% during the forecast period from 2025 to 2034.

- By Type Analysis: In Situ Bioremediation is expected to lead the market by the end of 2025, contributing approximately 63.5% of the overall market share.

- By Technology Analysis: Biostimulation is likely to emerge as the dominant technology in the bioremediation market by 2025, securing around 28.9% of the market share.

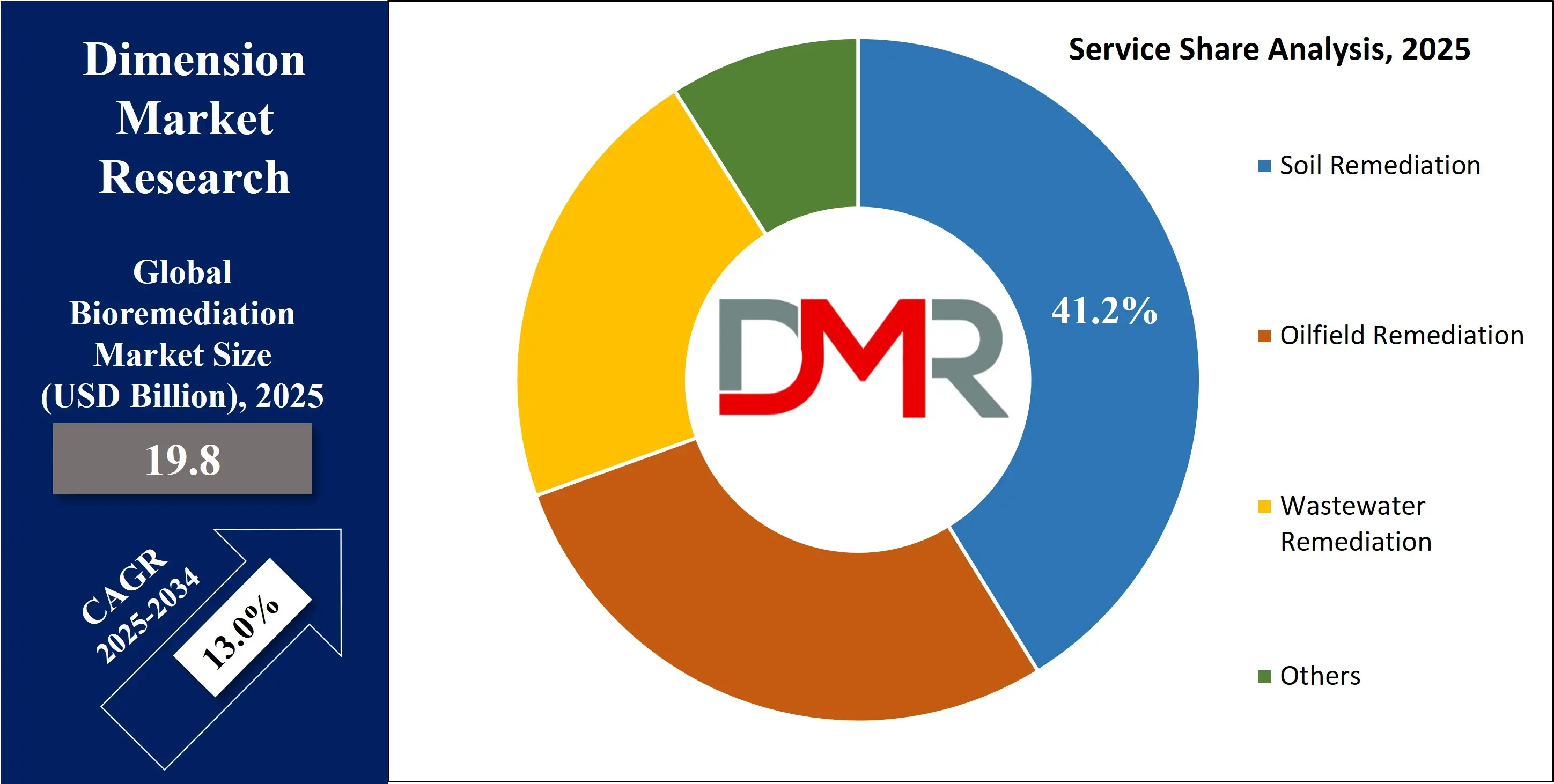

- By Service Analysis: Soil Remediation is projected to be the leading service segment, accounting for 41.2% of the global market by the end of 2025.

- Regional Insights: North America is forecasted to remain the top regional market for bioremediation, holding about 44.5% of the global share by 2025.

Bioremediation Market: Use Cases

- Oil Spill Cleanup: Bioremediation is widely used to treat oil spills in oceans and coastal areas by introducing hydrocarbon-degrading microbes. These microorganisms break down harmful petroleum compounds into non-toxic substances, offering an eco-friendly solution that minimizes damage to marine ecosystems and supports faster environmental recovery without the use of harsh chemicals.

- Industrial Waste Treatment: Industries discharge heavy metals, solvents, and other hazardous pollutants. Bioremediation uses specific bacteria or fungi to detoxify these wastes in soil and water, converting harmful substances into inert compounds. This helps reduce the ecological footprint of manufacturing operations while meeting environmental regulations more sustainably and cost-effectively.

- Landfill Leachate Management: Leachate from landfills contains high levels of organic and inorganic contaminants. Microbial bioremediation technologies help treat this runoff by metabolizing pollutants before they infiltrate groundwater. This sustainable technique is increasingly preferred over conventional treatments due to its low operational cost and minimal environmental disturbance.

- Agricultural Soil Remediation: Pesticide and fertilizer overuse degrade soil quality and pollute water bodies. Bioremediation introduces microbes that degrade residual agrochemicals and restore soil health. This promotes sustainable farming by improving nutrient cycling, increasing crop productivity, and reducing long-term environmental harm associated with chemical-intensive agriculture.

- Mining Site Restoration: Mining operations often leave behind toxic heavy metals in the surrounding environments. Bioremediation techniques, including phytoremediation and microbial metal transformation, are used to rehabilitate these areas. Plants and microbes absorb or neutralize contaminants, restoring ecosystems and enabling the safe reuse of degraded land.

Bioremediation Market: Stats & Facts

- U.S. Environmental Protection Agency (EPA): Bioremediation has been successfully applied at over 60% of Superfund sites with contaminated groundwater, demonstrating its broad adoption in environmental cleanups.

- National Research Council (NRC): According to their study, in situ bioremediation is capable of removing up to 90% of petroleum hydrocarbons in contaminated soils and groundwater under optimal conditions.

- Nature Reviews Microbiology: A review article states that specific microbial strains can degrade up to 80% of polycyclic aromatic hydrocarbons (PAHs) within 30 to 90 days depending on environmental conditions.

- Journal of Hazardous Materials: Biostimulation techniques were found to enhance the degradation rate of diesel-contaminated soil by more than 70% within 40 days.

- ScienceDirect (Elsevier): Research shows that bioaugmentation with Pseudomonas putida reduced BTEX (benzene, toluene, ethylbenzene, and xylene) concentrations by over 85% in less than 2 weeks in controlled environments.

- United Nations Environment Programme (UNEP): Bioremediation is considered a cost-effective solution for oil spill remediation, costing as little as USD 10–50 per cubic meter, which is significantly lower than traditional methods.

- International Journal of Environmental Science and Technology: In field trials, compost-assisted bioremediation reduced heavy metal bioavailability in soil by up to 60%, aiding in land restoration.

- Environmental Science & Technology (American Chemical Society): Anaerobic bioremediation techniques have demonstrated over 95% removal efficiency for chlorinated solvents like TCE (trichloroethylene) in contaminated aquifers.

Bioremediation Market: Market Dynamics

Driving Factors in the Bioremediation Market

Growing Environmental Pollution and Stringent Regulations

The rising levels of industrial pollution, oil spills, and hazardous waste accumulation are significantly boosting the demand for bioremediation solutions. Governments worldwide are imposing stringent environmental regulations and penalties for pollution, driving industries to adopt sustainable remediation techniques. Bioremediation, which utilizes microorganisms to degrade environmental contaminants, has emerged as a viable and eco-friendly option. Regulatory bodies like the EPA are actively promoting microbial remediation for soil and groundwater decontamination. The need for sustainable soil treatment and groundwater cleanup is intensifying, especially in urban and industrial zones. As awareness of environmental protection increases, the demand for biological wastewater treatment and eco-conscious remediation services is expected to surge across developed and emerging economies alike.

Increasing Adoption in Oil and Gas Industry

Bioremediation is gaining traction in the oil and gas industry due to its ability to treat hydrocarbon-contaminated sites effectively. With increasing incidents of oil spills and petroleum leaks, companies are shifting to bio-based oilfield remediation solutions. The natural degradation of hydrocarbons using bacteria and fungi is a cost-effective alternative to chemical methods. Moreover, bioaugmentation and biostimulation techniques are being used for large-scale remediation of oil-polluted environments. The integration of microbial remediation in oilfield operations enhances sustainability while minimizing long-term ecological risks. Growing demand for safer and environmentally compliant remediation techniques in upstream and downstream processes is reinforcing the role of bioremediation in petroleum site restoration and crude oil contamination mitigation.

Restraints in the Bioremediation Market

Limited Effectiveness in Extreme Environmental Conditions

One of the major limitations of bioremediation lies in its reduced efficacy under extreme environmental conditions. Microbial activity responsible for degrading pollutants is highly sensitive to factors like pH, temperature, salinity, and oxygen availability. In harsh or non-ideal conditions, the bioremediation process can slow down or fail altogether. For example, cold climates or arid environments can inhibit microbial metabolism, leading to prolonged remediation timelines. This variability restricts its application in certain geographies or heavily contaminated industrial sites. Unlike chemical or thermal remediation, bioremediation may not deliver consistent results under all conditions. This unpredictability continues to challenge its adoption for comprehensive soil remediation or groundwater restoration in difficult terrains.

Slow Remediation Rate and Longer Timeframes

While bioremediation is cost-effective and environmentally safe, one of its significant drawbacks is the slow pace of contaminant degradation. Biological cleanup of pollutants like heavy metals, chlorinated solvents, or complex hydrocarbons can take several months to years, depending on the concentration and environmental conditions. In emergency spill scenarios or time-sensitive cleanups, industries prefer faster alternatives such as excavation or chemical oxidation. Additionally, the need for continuous monitoring, nutrient amendments, and microbial support systems adds to the complexity and time cost. The extended duration required for complete site remediation makes it less attractive for large-scale commercial cleanup efforts or areas with immediate environmental risks, hindering broader market penetration.

Opportunities in the Bioremediation Market

Technological Advancements in Microbial Engineering

The growing integration of synthetic biology, genomics, and microbial engineering is opening new avenues in the bioremediation market. Genetically modified microorganisms (GMMs) are being developed to degrade specific contaminants with higher efficiency and adaptability to harsh conditions.

These engineered microbes can target pollutants like PCBs, heavy metals, and radioactive waste more effectively. Innovations in metagenomics and bioreactor design are also enabling faster pollutant breakdown and enhanced scalability of microbial remediation. This scientific progress is accelerating adoption across municipal wastewater treatment, industrial effluent remediation, and landfill leachate management. As biotechnological tools become more precise and affordable, they offer significant potential to transform environmental bioremediation into a high-performance, customized service.

Rising Demand from Developing Economies

Emerging economies in Asia, Latin America, and Africa are experiencing rapid industrialization, leading to increased pollution of soil and water bodies. Governments in these regions are initiating large-scale environmental restoration programs, creating significant demand for cost-effective and eco-friendly remediation solutions. Bioremediation fits this demand perfectly due to its lower infrastructure requirement and sustainable outcomes.

Rural and semi-urban areas lacking access to conventional remediation methods are turning to microbial solutions for local water and land clean-up. Furthermore, international funding and NGO participation in environmental health projects are fostering the adoption of bioremediation technologies in these regions. This represents a long-term opportunity for service providers to expand in underpenetrated markets.

Trends in the Bioremediation Market

Integration of Artificial Intelligence in Bioremediation Operations

A key trend shaping the bioremediation market is the integration of artificial intelligence and machine learning into remediation process management. AI-driven platforms are being used to monitor microbial activity, predict contaminant degradation rates, and optimize biostimulation conditions in real time. This allows for dynamic decision-making and reduces operational uncertainties. Smart bioreactors, sensors, and digital twins are further enhancing the efficiency of bioremediation in wastewater treatment and oilfield sites. Predictive analytics helps in site assessment and risk evaluation, reducing failure rates. As environmental biotechnology intersects with AI, this trend is expected to revolutionize the precision and scalability of bioremediation solutions across multiple verticals.

Growing Popularity of In-Situ Bioremediation Techniques

In-situ bioremediation is becoming increasingly popular due to its non-invasive nature and lower operational costs. Unlike ex-situ methods that require excavation and transportation of contaminated materials, in-situ techniques treat pollutants directly at the contamination site using bioaugmentation or bioventing. This not only reduces environmental disruption but also lowers logistics costs and carbon footprint. In-situ soil remediation is being widely used in brownfield redevelopment, agricultural land restoration, and groundwater decontamination. The rising preference for on-site microbial treatment aligns with global sustainability goals and environmental impact reduction. As more regions prioritize green remediation practices, this trend is gaining momentum within government and private sector cleanup initiatives.

Bioremediation Market: Research Scope and Analysis

By Type Analysis

In Situ Bioremediation is projected to dominate the global bioremediation market by the end of 2025, accounting for 63.5% of the total market share. Its strong market presence is driven by its cost-efficiency, minimal site disruption, and effectiveness in treating contaminated groundwater and soils directly at the site.

This method is increasingly favored in brownfield redevelopment and oil spill cleanups due to its eco-friendly characteristics and reduced need for excavation. The growing adoption of bioaugmentation, bioventing, and biosparging in petroleum hydrocarbon remediation supports its dominance. The increasing demand for sustainable environmental remediation technologies and stringent government regulations are further fueling the adoption of in situ solutions across industrial waste management and mining site restoration.

Ex Situ Bioremediation is anticipated to grow at the highest CAGR in the bioremediation market by the end of 2025, due to its ability to offer enhanced control over environmental conditions like pH, temperature, and oxygen levels. This segment is gaining momentum in treating heavy metal-contaminated soils and hazardous waste due to its reliability and predictability. Techniques such as land farming, biopiles, and composting are increasingly adopted in industrial zone cleanups and refinery sites.

The scalability and faster treatment cycles of ex-situ approaches are attracting investments in engineered remediation systems. Rapid urbanization, increasing environmental liabilities, and rising public pressure for industrial site restoration are boosting the growth prospects of this segment in developed and developing economies.

By Technology Analysis

Biostimulation is expected to dominate the global bioremediation market by the end of 2025, capturing 28.9% of the total share. This method enhances the activity of native microorganisms by injecting nutrients or oxygen into contaminated environments, making it a preferred choice for treating hydrocarbon-impacted soils and aquifers. Biostimulation is widely applied in the remediation of oil-contaminated shorelines and industrial spill zones, especially in petroleum and petrochemical sectors. The growing emphasis on low-impact and natural attenuation strategies, along with the increasing deployment in groundwater cleanup projects, contributes to its strong market lead. Regulatory frameworks mandating eco-safe pollution control solutions further accelerate the use of this technique in both developed and emerging regions.

Fungal Remediation is projected to register the highest CAGR in the bioremediation market by the end of 2025, fueled by its capability to degrade complex organic pollutants through enzymatic activity. The growing interest in mycoremediation for addressing persistent organic pollutants like pesticides, dyes, and petroleum-based chemicals is significantly enhancing this segment's traction. Fungal-based approaches are gaining adoption in sustainable waste treatment and are especially valuable for detoxifying contaminated agricultural land. Innovations in white-rot fungi and laccase enzyme application are opening new avenues for biologically treating hazardous substrates. Increased academic and industrial research, combined with a shift toward low-energy remediation methods, are propelling the use of fungal technologies in niche environmental applications across the globe.

By Service Analysis

Soil Remediation is forecasted to dominate the global bioremediation market by the end of 2025, accounting for 41.2% of the total market share. This dominance stems from the widespread contamination of agricultural lands, industrial zones, and urban sites with heavy metals, pesticides, and petroleum hydrocarbons.

Soil bioremediation services are in high demand due to increasing land reclamation efforts and strict environmental compliance mandates. Techniques such as composting, land farming, and bioventing are extensively employed for restoring soil health and reducing ecological risk. Government initiatives to rehabilitate brownfield sites and growing awareness of sustainable agriculture are driving investment in this service segment, making it the most utilized solution across various environmental and industrial cleanup projects.

Wastewater Remediation is expected to register the highest CAGR in the bioremediation market by the end of 2025, propelled by rising industrial discharge, urban wastewater generation, and tightening water pollution norms. This segment is gaining momentum as bioremediation technologies are being adopted in the treatment of sewage, pharmaceutical effluents, and food processing waste.

The application of microbial cultures and enzymatic processes in breaking down organic and inorganic pollutants is advancing rapidly in municipal and industrial setups. Increasing global water scarcity and the shift toward circular water reuse practices are further boosting the demand for biological treatment systems. Emerging economies are investing heavily in sustainable water infrastructure, reinforcing the long-term growth outlook of this segment.

The Bioremediation Market Report is segmented on the basis of the following:

By Type

- In Situ Bioremediation

- Ex Situ Bioremediation

By Technology

- Biostimulation

- Phytoremediation

- Bioreactors

- Fungal Remediation

- Bioaugmentation

- Land-based Treatment

By Service

- Soil Remediation

- Oilfield Remediation

- Wastewater Remediation

- Others

Regional Analysis

Region with the largest Share

North America is predicted to hold the largest share of the global bioremediation market by the end of 2025, accounting for 44.5%. The region’s dominance is driven by stringent environmental regulations enforced by agencies such as the EPA, along with substantial investments in advanced remediation technologies. High awareness regarding environmental restoration, widespread industrial contamination, and a well-established waste management infrastructure contribute to the market leadership.

The United States, in particular, leads in adopting microbial remediation techniques for soil and groundwater decontamination. Additionally, ongoing projects in oil spill cleanups, abandoned mine restorations, and brownfield redevelopment are fueling the demand. Strong collaboration between research institutions and government bodies further supports innovation and adoption of eco-friendly solutions in this region.

Region with Highest CAGR

Asia-Pacific is expected to witness the highest CAGR in the global bioremediation market by the end of 2025, driven by rapid industrialization, urban expansion, and increasing environmental degradation across major economies. Countries such as China, India, and Indonesia are experiencing growing concerns over soil, water, and air pollution, leading to increased government initiatives and environmental clean-up programs.

The region is seeing accelerated adoption of microbial and phytoremediation techniques, especially in agriculture-heavy and mining-intensive zones. Rising public-private partnerships and foreign investments in ecological restoration are supporting technological advancements. Moreover, the expanding manufacturing sector and increasing demand for sustainable waste treatment solutions position Asia-Pacific as a high-growth region in the coming years.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Impact of Artificial Intelligence in Bioremediation Market

- Enhanced Site Assessment and Monitoring: Artificial Intelligence (AI) significantly improves site assessment and contamination monitoring in bioremediation projects. By analyzing satellite imagery, sensor data, and historical environmental records, AI can precisely identify pollution hotspots and assess contamination levels. This allows for faster, more accurate evaluation of sites needing remediation, reducing time and cost associated with manual surveys. AI models also enable real-time monitoring of bioremediation progress, helping to adjust strategies as conditions evolve.

- Optimized Microbial Selection and Engineering: AI plays a vital role in identifying and engineering microbial strains capable of degrading specific contaminants. Machine learning algorithms analyze vast genomic datasets to predict which microorganisms are most effective for particular pollutants. Additionally, AI-driven bioinformatics tools accelerate the design of genetically modified microbes with enhanced degradation capabilities. This leads to more efficient and targeted bioremediation interventions.

- Predictive Modeling and Process Optimization: AI-powered predictive modeling helps simulate various bioremediation scenarios under changing environmental conditions. These models assist stakeholders in selecting the best remediation approach, forecasting performance, and preventing project failure. Furthermore, AI optimizes process parameters like temperature, pH, and nutrient supply, ensuring ideal conditions for microbial activity and pollutant breakdown.

- Cost Reduction and Decision Support: AI reduces operational costs by automating data analysis, reducing field visits, and minimizing trial-and-error. It also aids decision-making by integrating data from multiple sources, chemical, biological, and geological, and presenting actionable insights. This results in faster approvals, streamlined remediation workflows, and enhanced regulatory compliance in the bioremediation market.

Competitive Landscape

The competitive landscape of the global bioremediation market is characterized by the presence of several key players focusing on technological innovation, strategic partnerships, and regional expansion to gain market share. Major companies are investing in research and development to enhance the efficiency of microbial degradation, enzymatic breakdown, and eco-friendly remediation techniques. The market is witnessing increased collaboration between environmental service providers and industrial sectors such as oil & gas, mining, and agriculture to implement large-scale cleanup projects using sustainable remediation methods.

Emerging startups are entering the space with novel solutions such as genetically engineered microbes, bioaugmentation blends, and fungal-based remediation products. Established players are also offering integrated services that combine biostimulation, bioreactor design, and in situ soil treatment to provide cost-effective and site-specific solutions. With the growing adoption of green technologies and strict regulatory frameworks promoting pollution control, competition is intensifying in both developed and developing regions.

The market is further influenced by rising public awareness and government-funded initiatives aimed at groundwater purification, oilfield restoration, and hazardous waste remediation. As environmental liabilities grow, players are differentiating through proprietary biotechnologies, comprehensive service portfolios, and digital tools for monitoring bioremediation performance, setting the stage for robust industry growth.

Some of the prominent players in the Global Bioremediation Market are

- Regenesis

- Xylem Inc.

- Ecolab Inc.

- Suez SA

- Veolia Environnement S.A.

- Clean Harbors, Inc.

- Terra Systems, Inc.

- Ivey International Inc.

- InSitu Remediation Services Ltd.

- Bioremediation Consulting, Inc.

- Altogen Labs

- FMC Corporation

- Aquatech International LLC

- Drylet, Inc.

- REGENESIS Remediation Solutions

- OSEI Corporation

- Novozymes A/S

- Envirogen Technologies, Inc.

- Sevenson Environmental Services, Inc.

- AECOM

- Other Key Players

Recent Developments

- In February 2025, Veolia Environnement S.A. unveiled a new enzymatic treatment technology targeting industrial wastewater, enhancing degradation of pharmaceutical contaminants and boosting the company's advanced bioremediation capabilities globally.

- In January 2025, Terra Systems, Inc. collaborated with a U.S. municipality to implement bioaugmentation strategies, significantly accelerating the in-situ treatment of chlorinated solvents in aging urban groundwater systems.

- In November 2024, Novozymes A/S introduced a novel microbial blend for agricultural runoff remediation, designed to degrade excess nitrates and phosphates and reduce eutrophication risks in freshwater ecosystems.

- In August 2024, Xylem Inc. integrated AI-driven monitoring into its bioremediation units, enabling real-time microbial performance tracking in oil spill sites across Southeast Asia.

- In May 2024, Clean Harbors, Inc. expanded its bioremediation service fleet with mobile anaerobic digestion units, enhancing rapid deployment for emergency hazardous waste clean-up operations in industrial zones.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 19.8 Bn |

| Forecast Value (2034) |

USD 59.5 Bn |

| CAGR (2025–2034) |

13.0% |

| Historical Data |

2019 – 2023 |

| The US Market Size (2025) |

USD 7.4 Bn |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (In Situ Bioremediation, Ex Situ Bioremediation), By Technology (Biostimulation, Phytoremediation, Bioreactors, Fungal Remediation, Bioaugmentation, Land-based Treatment), By Service (Soil Remediation, Oilfield Remediation, Wastewater Remediation, Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Regenesis, Xylem Inc., Ecolab Inc., Suez SA, Veolia Environnement S.A., Clean Harbors, Inc., Terra Systems, Inc., Ivey International Inc., InSitu Remediation Services Ltd., Bioremediation Consulting, Inc., Altogen Labs, FMC Corporation, Aquatech International LLC, Drylet, Inc., REGENESIS Remediation Solutions, OSEI Corporation, Novozymes A/S, Envirogen Technologies, Inc., Sevenson Environmental Services, Inc., AECOM, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Bioremediation Market size is estimated to have a value of USD 19.8 billion in 2025 and is expected to reach USD 59.5 billion by the end of 2034.

North America is expected to be the largest market share for the Global Bioremediation Market with a share of about 44.5% in 2025.

Some of the major key players in the Global Bioremediation Market are Regenesis, Veolia Environnement S.A., Clean Harbors, Inc., and many others.

The market is growing at a CAGR of 13.0% over the forecasted period.

The US Bioremediation Market size is estimated to have a value of USD 7.4 billion in 2025 and is expected to reach USD 20.9 billion by the end of 2034.