Chemical injection pumps play a vital role in ensuring precise chemical management across various handling processes. These pumps are instrumental in the precise delivery of chemicals, contributing to the efficiency & effectiveness of diverse industrial applications. It enhances the control & reliability of chemical dosing, addressing the need for accuracy in managing chemicals in different industrial processes.

The chemical injection pumps market is experiencing significant growth across various sectors, particularly in oil & gas and

pharmaceuticals, which is propelling the market growth. The increasing awareness of the benefits of chemical pumps is a key contributor to this accelerated growth. Additionally, the push for automation to minimize waste, and enhance safety is the major market driver. The establishment of desalination facilities in GCC nations and other developed and emerging countries to combat water shortages is also aiding in market expansion.

France is heavily dependent on imported petroleum products from the United States, Middle Eastern countries and other regions. About 60% the country's total energy consumption is derived from fossil fuels. These include coal, natural gas and petroleum.

France imports crude oils from Saudi Arabia and Russia. also imports natural gas from Norway, Nigeria and the Netherlands. Over 95% the oil used in France is imported. Russia is a major supplier.

In the aftermath of the Russia - Ukraine war the European Union is actively working to decrease dependence on Russian oil. France, as one of the EU's largest oil importers, has intensified discussions with the United Arab Emirates in order to replace Russian imports and secure alternative oil supplies.

Chemical Injection Pumps Market Key Takeaways

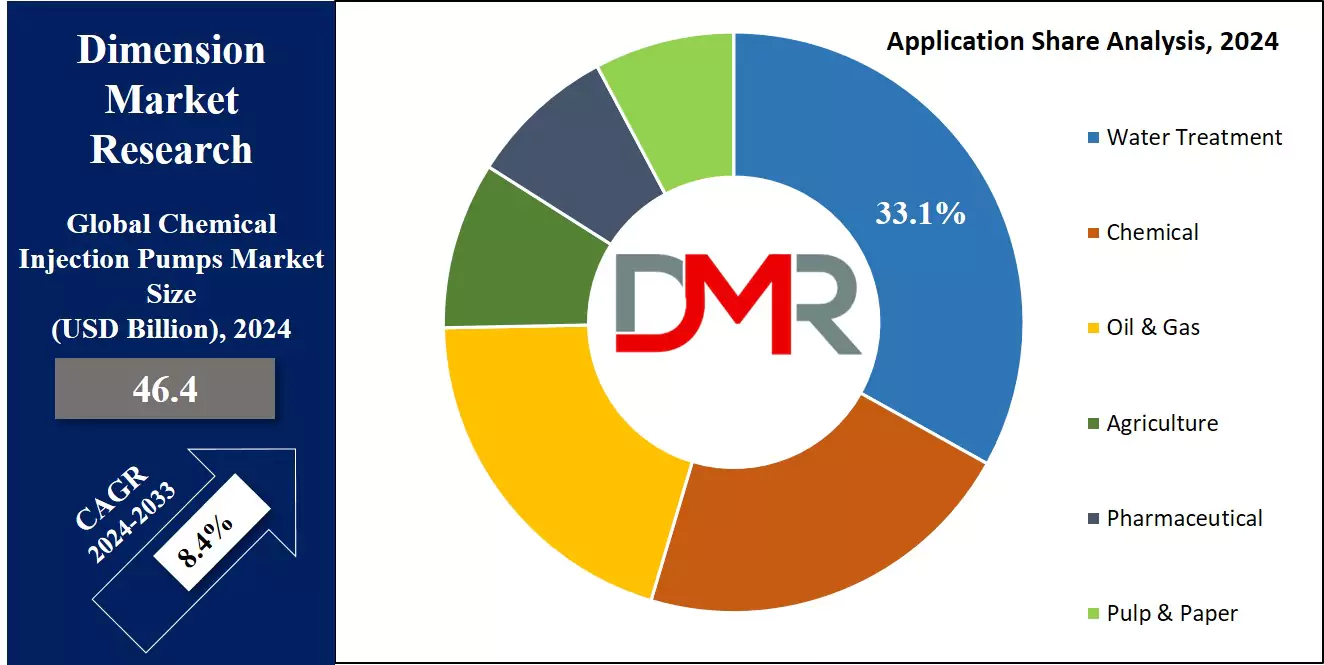

- Market Size: Global Chemical Injection Market is projected to grow by 46.1 billion, at a CAGR of 8.4 % during the forecasted period.

- Market Definition: Chemical Injection pump is a device to efficiently deliver chemicals into a system or process. They are commonly used in industries such as oil and gas, water treatment, agriculture, and manufacturing.

- Analysis of Product: By Product, the Diaphragm Pump is predicted to lead in 2024 & is anticipated to dominate throughout the forecasted period. In addition, Pistons/Plungers is expected to have significant growth over the forecasted period.

- Application Preview: The global chemical injection pumps market is segmented into water treatment, oil & gas, agricultural, chemical, pharmaceutical, and pulp & paper. By Application, Water treatment is expected to take the lead & drive the market in 2024.

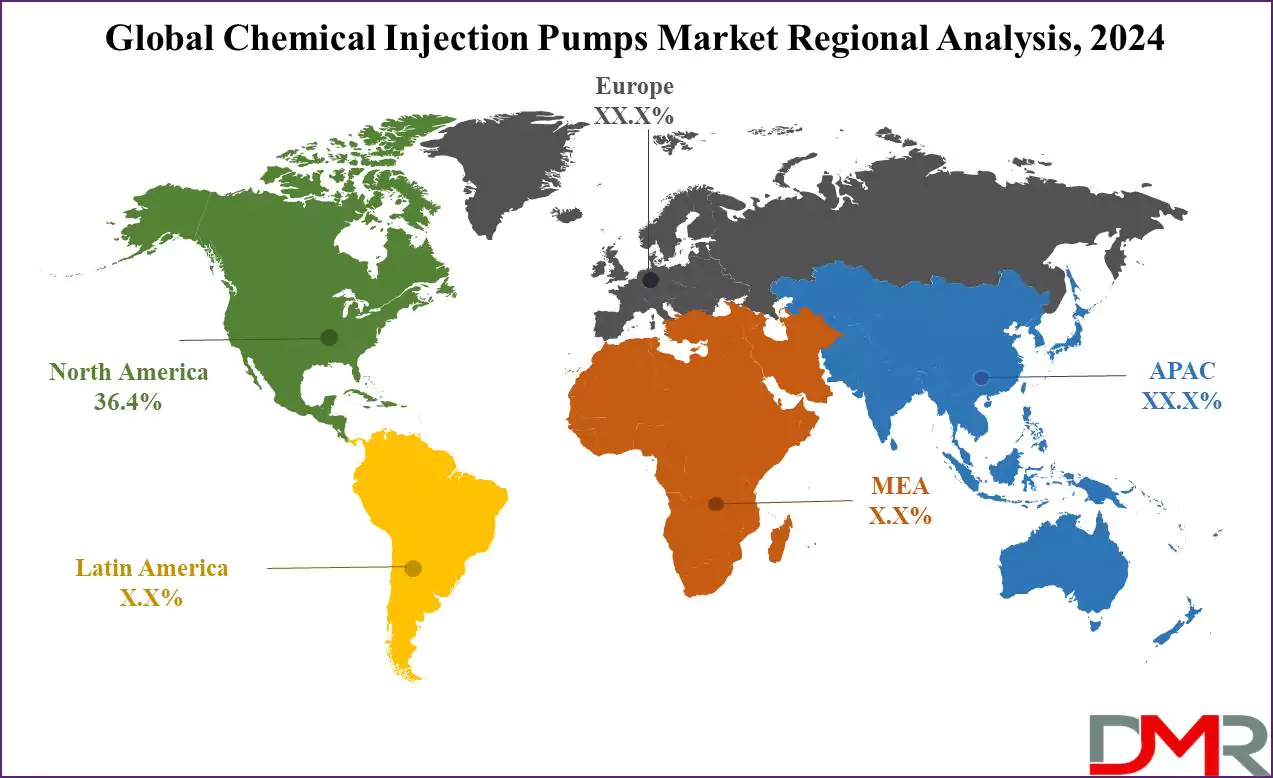

- Regional Analysis: North America has a 36.4% share of revenue in the Global Chemical Injection Pumps Market in 2024.

Chemical Injection Pumps Market Use Cases

- Oil & Gas Industry: Used for injecting corrosion inhibitors, scale inhibitors, and demulsifiers to protect pipelines and enhance extraction processes.

- Water Treatment: Helps in dosing disinfectants like chlorine and pH adjusters to maintain safe and clean water supplies.

- Chemical Processing: Accurately injects acids, alkalis, and other chemicals in industrial chemical manufacturing.

- Food & Beverage Industry: Used for precise dosing of additives, preservatives, and sanitizing agents to ensure product quality.

- Pharmaceutical Manufacturing: Delivers precise quantities of chemicals for drug formulation and sterilization.

- Agriculture & Fertigation: Injects fertilizers, pesticides, and nutrients into irrigation systems for improved crop yield.

Chemical Injection Pumps Market Dynamic

Drivers

Demand for Efficient Chemical Injection PumpsThe chemical injection market is growing due to rising demand for efficient and accurate pumps. These pumps are useful for optimizing processes by ensuring precise chemical addition at the appropriate times, enhancing overall operational efficiency, and reducing costs. These chemical pumps are extensively used in the water treatment industry due to increasing concerns about water quality and scarcity, necessitating high-quality control solutions.

Technological Advancements and Industrial Expansion

The demand for these pumps is growing due to technological advancement in these industries as they utilize data-driven insights and predictive maintenance, leading to more selective and controlled chemical delivery. Adoption of new technology is leveraging industries focused on enhanced process control and efficiency. There is also an increasing focus on optimizing operations to improve efficiency, productivity, and yield.

Restraints

Sector-Specific Requirement

The chemical pump market is facing challenges due to growing sector-specific requirements, with dosage, flow rate, & discharge pressure adjustments necessary. Local manufacturers face limitations in creating customized items due to a lack of technology & abilities, providing restrains to market expansion, as overcoming these challenges will be crucial for sustained growth in the chemical pumps market.

Risks of Improper Chemical Dosing and Compliance Issues

Pump failure is one of the major issues faced by this market, as it can result in improper chemical dosing, compromising safety measures, and regulatory compliance, and potentially causing accidents and environmental problems. Maintenance or downtime for these pumps can cause operational disruptions, impacting production schedules, reducing output, and potentially leading to revenue losses, which obstruct the growth of the chemical injection market.

Opportunities

Growth in the oil and gas sector

Oil and gas production holds a great opportunity in this market as these pumps allow precise chemical injection into wells to enhance oil recovery, control scale, and prevent corrosion. Increased chemical uses in these industries also present a great opportunity for the expansion of the chemical injection pump market. Chemical injection pump manufacturers focus on advanced technologies and robust engineering to produce pumps.

Sustainable environment practiceThese pumps allow accurate chemical dosing, reducing waste and minimizing environmental impact which fulfill the sustainable goal of industry for responsible and efficient operations. It is helpful to adhere to stringent regulatory standards by precisely controlling the number of chemicals injected.

Trend

Growing use in water treatmentIncreasing awareness about clean water and stringent environmental regulations are fueling the demand for chemical injection pumps. They are important for optimizing water usage and ensuring regulatory compliance in industrial processes. These pumps are designed to handle a variety of chemicals such as chlorine, fluoride, coagulants, and pH adjusters, which are used in the purification of water.

Chemical Injection Pumps Market Research Scope and Analysis

By Type

The diaphragm pump segment accounts

58% market share in chemical injection pumps market in 2024 and is expected to maintain its lead throughout the forecast period, as these pumps stand out for their exceptional operational efficiency, safety features, and precision, making them widely favored, which is experiencing substantial growth, driven by the rising need in pharmaceutical,

water treatment, & medical industries.

Further, the pharmaceutical sector, in particular, depends heavily on diaphragm pumps for their accurate dosing of chemicals, playing a vital role in chemical manufacturing & research processes. With their multifaceted applications & reliability, diaphragm pumps are anticipated to continue their strong growth trajectory, solidifying their status as a major player in the market.

By Application

Oil & Gas stands as the dominant industry segment in 2024 when it comes to chemical injection pumps market share, accounting for roughly 41.2%. This can be attributed to their need for reliable chemical dosing systems that maintain infrastructure integrity, improve oil recovery rates, and control corrosion; chemical injection pumps play a vital role in upstream, midstream, and downstream operations; thus their wide usage across processes.

Water Treatment pumps have become an invaluable component of modern life. Used for dosing disinfectants, coagulants, and other treatment chemicals accurately to maintain safe and compliant water quality, Water Treatment pumps play a crucial role. Meanwhile, agriculture also sees regular demand for chemical injection pumps due to precise fertilizer and pesticide injection into irrigation systems for improved crop yield.

Chemical, Pharmaceutical, and Pulp & Paper industries further contribute market growth by using chemical injection pumps safely handling hazardous substances that are potentially corrosive, reactive, or sensitive materials safely.

The Chemical Injection Pumps Market Report is segmented based on the following

By Type

- Diaphragm Pump

- Pistons/Plungers

By Application

- Water Treatment

- Oil & Gas

- Agricultural

- Chemical

- Pharmaceutical

- Pulp & Paper

How Does Artificial Intelligence Contribute To Improve Chemical Injection Pumps Market ?

- Predictive Maintenance: AI-powered analytics detect wear and tear in pumps, preventing failures and reducing downtime.

- Real-time Monitoring: Smart sensors with AI monitor pressure, flow rates, and chemical levels, ensuring optimal injection.

- Process Automation: AI automates pump operations, adjusting injection rates based on real-time conditions, reducing manual intervention.

- Energy Efficiency: AI optimizes pump performance, minimizing energy consumption and operational costs.

- Leak Detection & Safety: AI-driven systems identify leaks and anomalies early, preventing hazardous chemical spills.

- Data-driven Optimization: AI analyzes operational data to enhance pump lifespan, chemical dosing accuracy, and overall efficiency.

Chemical Injection Pumps Market Regional Analysis

North America is predicted to claim

the largest market share at 36.4%, in 2024, a dominance expected to persist throughout the forecasted period, as the region, which contains the US & Canada, has consistently held a substantial portion of the global metering pump market, which can be attributed to a strong & advanced industrial & manufacturing sector, stringent water treatment regulations, and a growing emphasis on precision & efficiency in chemical dosing processes.

Further, the Asia-Pacific region is expected to have the fastest market growth in the coming years, as rapid industrialization & the expansion of water treatment infrastructure are driving significant expansion in the metering pumps market. Moreover China & India, with growing investments in water & wastewater treatment, contribute to the growing demand for metering pumps. Furthermore, the region's expanding textile, pulp paper, & water treatment industries are additional catalysts for market growth.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Chemical Injection Pumps Market Competitive Landscape

The global chemical injection pumps market notices a competitive landscape marked by diverse companies competing for market share, as major players are distinguished by their diverse product offerings, technological development, and strategic collaborations.

Further constant innovations, emphasis on R&D, and a focus on meeting industry-specific needs contribute to the dynamic & competitive nature of the market. Chemical injection pump companies are continuously innovating to deliver high-performance, reliable solutions. These activities have paved the way for the expansion of business and the customer base of market players.

The key players in the chemical injection pump market are anticipated to have lucrative growth opportunities in the future with the rising demand for chemical injection pumps in the global market. Chemical injection pump suppliers play a crucial role in providing a diverse range of pumps tailored to meet specific industry needs.

Some of the prominent players in the Global Chemical Injection Pumps Market are

Chemical Injection Pumps Market Recent Development

- In February 2023, Cummins Inc. introduced 2 new dewatering pump solutions, the QSF4X4 & QSF6X6, designed for construction, oil & gas, agricultural, mining, water, and wastewater applications, as these offer customers a reliable & fully finished solution. The pumps feature heavy-duty cast-iron construction, are carried for easy transportation, & can self-prime and re-prime automatically. The QSF6X6 handles flow rates up to 2,600 GPM, while the QSF4X4 supports up to 1,350 GPM.

- In May 2023, Movement Industries Corporation unveiled the expansion of its Custom Skid Deployment, featuring proprietary chemical injection with IoT technology, as it successfully introduced a 2,000-gallon tank designed for remote use & plans to continue production. Monitored & controlled by Movement's proprietary IoT technology, the custom tank skid highlights a significant milestone, showcasing the company's commitment to marketing & selling its innovative design, manufacturing, and IoT technologies.

- In April 2023, Perma-Pipe International Holdings, Inc. announced the acquisition of two contracts totaling over USD 8 million, which includes supplying insulated piping, specifically Perma-Pipe’s XTRU-THERM thermally insulated piping system, for a thermal distribution system on Fanshawe College's campus in London, Ontario, Canada, and highlights Perma-Pipe's role in providing innovative solutions for thermal applications.

- In December 2022, PPM Ltd announced the full operation of its Brunei-based entity, PPM (BN) SDN BHD, catering to the local & Asia Pacific regions for chemical injection needs. Now, by overcoming challenges, PPM (BN) SDN BHD has become a major supplier in the local market, as it specializes in delivering pump skids, transfer pumps, flow meters, & pneumatic chemical injection pumps to the oil &gas industry.