Market Overview

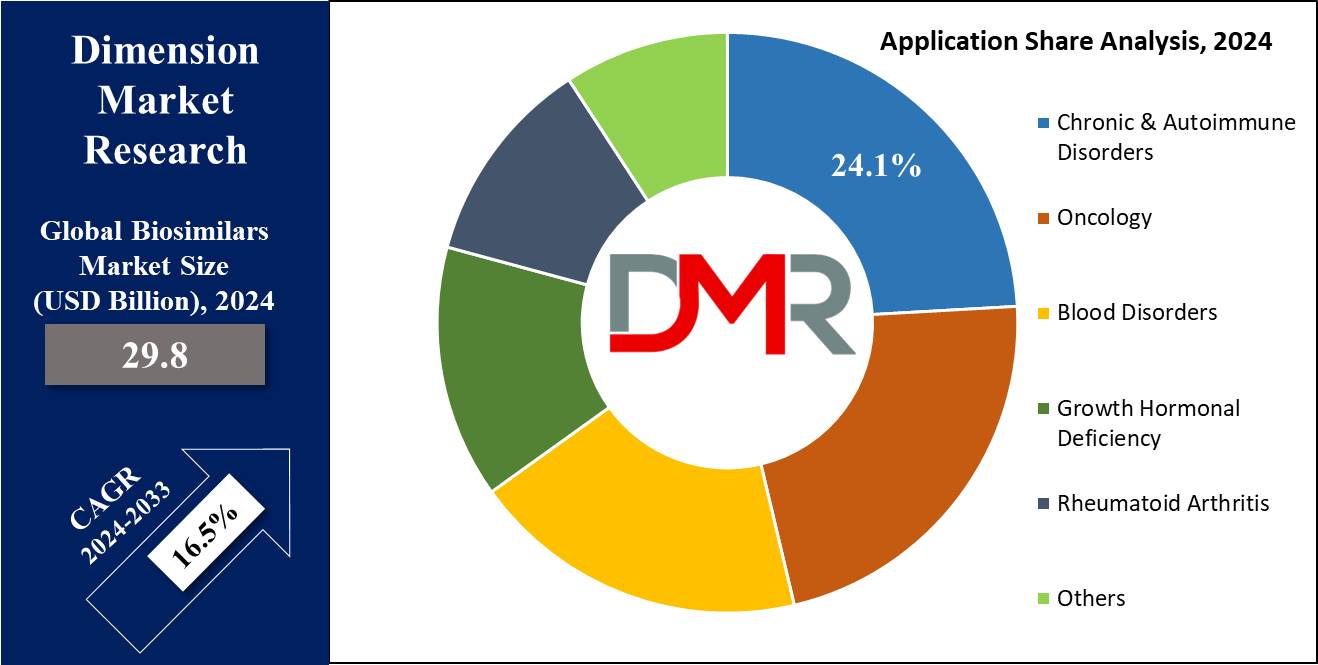

The Global Biosimilars Market was valued at USD 25.5 billion in 2023, and it is further anticipated to reach a market value of USD 117.9 billion by 2033 at a CAGR of 16.5%. The market has seen significant growth over the past few years and is predicted to grow significantly during the forecasted period as well.

Biosimilars, also known as follow-on biologics, are nearly identical replicas of an original product, developed by different companies. These are critical medical products and are used in the treatment of a large spectrum of chronic & acute illnesses, and are not related to recording electrical brain activity, as their primary role depends on providing treatments for several diseases & disorders.

The biosimilars market is rapidly expanding due to increased demand for affordable treatment options, especially in oncology, immunology, and chronic diseases. Biosimilars, which are highly similar to biologic drugs but cost less, have gained regulatory approvals worldwide, spurring growth in North America, Europe, and emerging markets.

The global market is projected to grow significantly, driven by patent expirations of major

biologics and a push for healthcare cost savings.

Recent industry events like the Biosimilars and Biologics Summit and the Biosimilars Europe Congress have focused on regulatory updates, patient access, and innovative biosimilar development. Conferences spotlight opportunities in emerging regions like Asia-Pacific, where demand is strong due to increased disease prevalence and supportive regulations.

Key players, including Pfizer, Amgen, and Biocon, are investing heavily in R&D to improve market share. The demand for biosimilars is expected to drive both healthcare savings and expanded access to essential biologic treatments.

A survey on U.S. pharmacist biosimilars revealed that 46% of respondents had used either a biologic or biosimilar for 1-5 years. Regarding knowledge, 50% reported knowing a little about these treatments, while 36% were unaware of their lower cost and 55% did not know about pharmacy-level interchangeability.

Confidence was high 85% supported biosimilars' benefits to healthcare, 95% trusted biologics, and 91% trusted biosimilars. Among users, 66% had taken a biosimilar, with 84% switching from a biologic, driven 43% by clinician recommendation. Notably, 49% of respondents said they’d consider switching if it reduced costs.

Key Takeaways

- Market Growth: The Biosimilars Market size is expected to grow by 83.6 billion, at a CAGR of 16.5% during the forecasted period of 2025 to 2033.

- By Product: The recombinant non-glycosylated proteins segment as an application is expected to lead in 2024 with a major & is anticipated to dominate throughout the forecasted period.

- By Application: Chronic & autoimmune disorders are expected to get the largest revenue share in 2024 in the Biosimilars market.

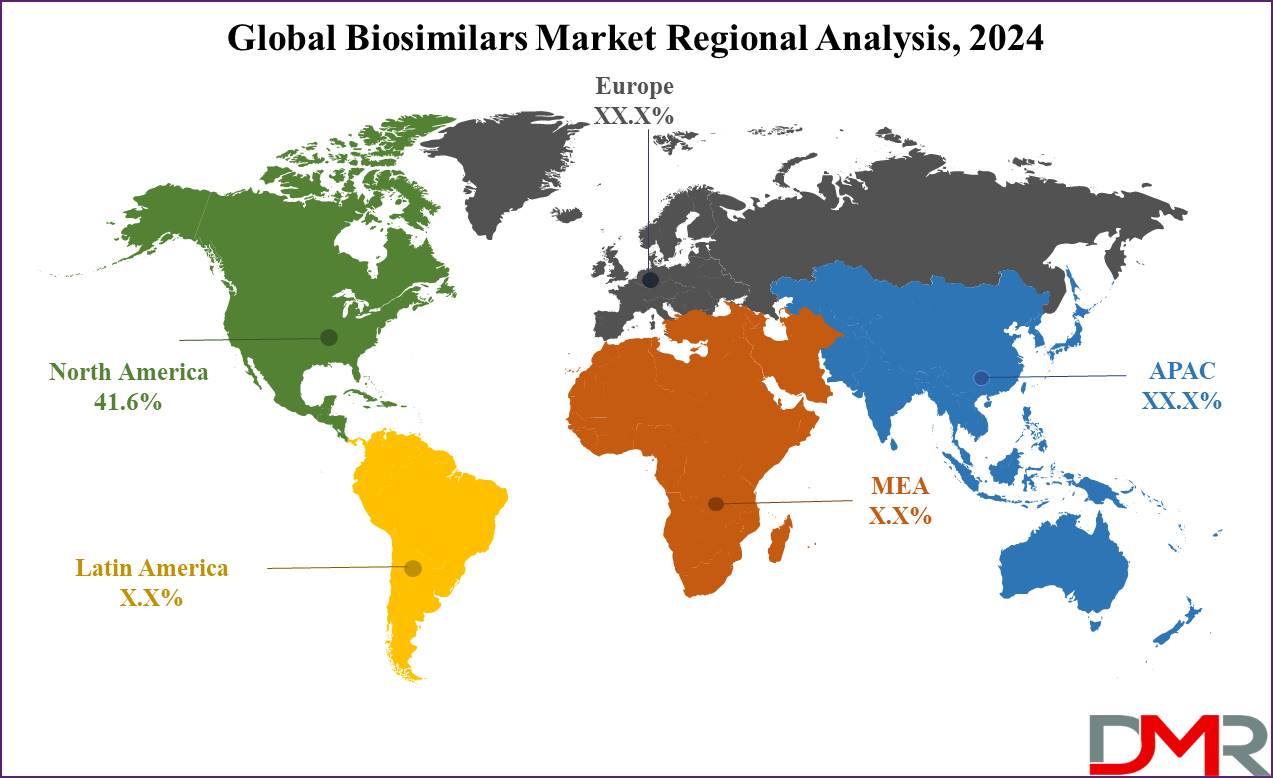

- Regional Insight: North America is expected to hold a 41.6% share of revenue in the Global Biosimilars Market in 2024.

- Use Cases: Some of the use cases of Biosimilars include treatment of chronic diseases, cost reduction & healthcare savings, and more.

Use Cases

- Cost Reduction and Healthcare Savings: Biosimilars provide a more affordable alternative to expensive biologics, potentially minimizing healthcare costs significantly, which is mainly beneficial for healthcare systems and patients who struggle with the high costs of biologic therapies.

- Increased Patient Access to Treatment: The availability of biosimilars growth in patient access to critical biologic treatments, which is particularly important in regions with limited healthcare budgets or where the high cost of original biologics limits patient access.

- Treatment for Chronic Diseases: Biosimilars are used in the treatment of chronic conditions like rheumatoid arthritis, psoriasis, and inflammatory bowel diseases. They provide comparable therapeutic benefits as their reference biologics, providing effective management of these long-term diseases.

- Expansion of Therapeutic Options: By launching biosimilars, the range of available therapeutic options is expanded. Physicians have more choices in prescribing treatments, which can be customized to individual patient needs and preferences, causing better-personalized care.

Market Dynamic

Driving Factors

Patent Expirations of Biologic Drugs

As patents for many blockbuster biologic drugs expire, the market opens up for biosimilars. These expirations create opportunities for biosimilar manufacturers to develop and launch their products, leading to higher competition and market growth. The influx of biosimilars post-patent expiry helps drive down costs and expand access, further growing market demand.

Supportive Regulatory Frameworks and Policies

Regulatory agencies across the world, like the FDA in the United States and the EMA in Europe, have built clear pathways for the approval of biosimilars. These supportive regulatory frameworks ensure that biosimilars meet strict standards for safety, efficacy, and quality. In addition, policies promoting the use of biosimilars, like incentives for healthcare providers and payers, contribute to the market's expansion by supporting greater acceptance and usage of biosimilar products.

Opportunities

Expansion into Emerging Markets

Emerging markets provide major growth potential for biosimilars due to the higher demand for affordable healthcare solutions. Countries with rising healthcare expenditures and a growing prevalence of chronic diseases can greatly benefit from the affordable nature of biosimilars. By strategically entering these markets, biosimilar manufacturers can tap into a large and underserved patient population, driving market growth.

Development of Biosimilars for Complex and Specialty Biologics

There is a major opportunity to design biosimilars for complex and specialty biologics, like those used in oncology, autoimmune diseases, and rare conditions. As the original biologics in these categories are mostly extremely expensive, biosimilars can provide a more accessible and affordable alternative. Success in this area requires advanced manufacturing capabilities and robust clinical trials, but the potential market impact is significant, given the high demand for these specialized treatments.

Restraints

Regulatory and Approval Challenges

The strict regulations needed for biosimilars, focused on ensuring safety, efficacy, and quality, can create lengthy and costly approval processes. Meeting these rigorous standards including large clinical trials and complete comparative studies with reference biologics, can delay market entry and high development costs, creating a significant barrier for manufacturers.

Market Acceptance and Physician Skepticism

Despite regulatory approvals, there can be skepticism among healthcare providers and patients regarding the efficiency and safety of biosimilars in comparison to original biologics, which can be driven by a lack of familiarity or confidence in biosimilar products. Overcoming this needs high educational efforts and real-world evidence to build trust and encourage large adoption, which can be a slow and challenging process.

Trends

Increased Collaboration and Partnerships

There has been a major growth in collaborations and partnerships between pharmaceutical companies,

biotechnology firms, and contract research organizations (CROs). These collaborations are focused on sharing expertise, minimizing development costs, and increasing the time to market for biosimilars. By using each other's strengths, companies can more effectively navigate regulatory needs and improve their competitive positioning in the market.

Technological Advancements in Biomanufacturing

Developments in biomanufacturing technologies are playing a vital role in the development of biosimilars. Innovations like improved cell line development, better purification processes, and advanced analytical techniques are causing higher efficiency, better product quality, and lower production costs. These technological advancements are enabling more companies to enter the biosimilar market and are contributing to the production of more complex biosimilars, expanding the range of available treatments.

Research Scope and Analysis

By Product

The Biosimilars market based on product type includes recombinant non-glycosylated proteins & glycosylated proteins. In 2024, the recombinant non-glycosylated proteins segment is set to have the largest share of revenue, mainly due to the increase in regulatory approvals for biosimilars, a testament to governments' growing assistance for these products. In addition, the rising number of critical diseases like diabetes is contributing to the growth of this segment.

Further, the recombinant glycosylated proteins segment is expected to show the fastest growth in the forecasted period. As patents for biologics, like Humira, Erythropoietin (EPO), & Neulasta, expire, many players are ready to enter the biosimilars market, providing significant growth opportunities. Furthermore, advancements in technology within the recombinant glycosylated proteins segment have given growth to numerous therapies, like modified proteins & soluble receptors, which can further drive the expansion of this segment by improving treatment options.

By Application

In terms of applications, the biosimilars market is categorized into several segments, like chronic & autoimmune disorders, oncology, growth hormonal deficiency, rheumatoid arthritis, blood disorders, & others, where in 2024, chronic & autoimmune disorders are set to drive and lead in terms of revenue, mainly due to the growth in the number of autoimmune conditions & better awareness surrounding these diseases. Like, data from the National Institute of Environmental Health Sciences shows that about 24 million people in the United States suffer from autoimmune diseases, showcasing the demand for treatments in this category.

Further,

oncology as an application is anticipated to show rapid growth in the biosimilar market, which can be due to the growth in the global occurrence of cancer cases, a major driving force behind the market growth. As per the World Cancer Research Fund International, over 18 million individuals have been suffering from cancer in the recent past.

The development of biosimilars for cancer treatment holds promise for affordable options, mainly in low- & middle-income nations with largely cancer-related mortality rates. Improving access to affordable cancer treatment is which is also anticipated to further boost the market growth.

The Biosimilars Market Report is segmented on the basis of the following

By Product

- Recombinant Glycosylated Proteins

- Recombinant Non-glycosylated Proteins

By Application

- Chronic & Autoimmune Disorders

- Oncology

- Blood Disorders

- Growth Hormonal Deficiency

- Rheumatoid Arthritis

- Others

Regional Analysis

North America is expected to come out as a dominant force in the biosimilars market in 2024, accounting for the largest

revenue share at 41.6%, which is due to the region's strong regulatory framework for biosimilars & the presence of key industry players. Furthermore, North America benefits from relatively easy access to biosimilars.

As per the US Generic Biosimilars Saving Report in the recent past, the US has taken major steps in biosimilar adoption, with 31 biosimilars approved & 20 launched, resulting in about 10 million additional days of therapy. These 20 biosimilars were valued at 30% lower than their biologic counterparts, driving down costs for both biosimilars & biologics and promising further growth in the region.

Also, Asia Pacific is expected to rapid growth in the biosimilars market, which is driven by the active involvement of major players like Biocon, Dr. Reddy’s Laboratories, Pfizer Inc., & more, who have played major roles in developing & commercializing biosimilars in the region. China, in particular, has seen a growth in health expenditure highlighting the region's growing commitment to healthcare and setting the stage for major biosimilar market expansion.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Biosimilars market experiences intense competition, featuring several global & local companies competing for market share. The appeal of biosimilars lies in their cost-saving potential, which draws interest among new entrants eager to boost their profits, as many of these players are dedicated to attaining regulatory nods, investing more in R&D, introducing fresh products, & expanding their geographic reach, all in an attempt to secure their position within the market.

Some of the prominent players in the Global Biosimilars Market are

- Novartis AG

- Amgen Inc

- Pfizer Inc

- Biocon

- AbbVie Inc

- Samsung Biopis

- Viatris Inc

- Biocad

- Dr. Reddy’s Laboratories

- LG Life Sciences

- Other Key Players

Recent Developments

- In April 2024, Alvotech and Teva Pharmaceuticals, a U.S. affiliate of Teva Pharmaceutical Industries Ltd. unveiled that the U.S. Food and Drug Administration (FDA) has approved SELARSDI injection for subcutaneous use, as a biosimilar to Stelara, for the treatment of moderate to act plaque psoriasis and for active psoriatic arthritis in adults & pediatric patients 6 years and older. As the strategic partnership between Teva and Alvotech, Teva is responsible for the exclusive commercialization of SELARSDI in the US.

- In April 2024, Accord BioPharma, announced that the U.S. FDA has approved HERCESSI, a biosimilar to Herceptin, to treat HER2-overexpressing breast & gastric or gastroesophageal junction adenocarcinoma.

- In October 2023, Pfizer Inc. announced that the U.S. Food and Drug Administration (FDA) has designated ABRILADA as an interchangeable biosimilar to Humira. The interchangeable designation applies to all approved indications of ABRILADA, including certain patients with juvenile idiopathic arthritis, rheumatoid arthritis (RA), ankylosing spondylitis, psoriatic arthritis, Crohn's disease, plaque psoriasis, hidradenitis suppurativa, ulcerative colitis, and uveitis.

- In September 2023, Biogen Inc. unveiled that the U.S. Food and Drug Administration (FDA) has approved TOFIDENCE intravenous formulation, a biosimilar monoclonal antibody referencing ACTEMRA. The CONFIDENCE intravenous formulation is approved for curing moderately to severely active rheumatoid arthritis, polyarticular juvenile idiopathic arthritis, and systemic juvenile idiopathic arthritis.

- In February 2023, Fresenius Kabi, launched its pegfilgrastim biosimilar, Stimufendin the United States for use in patients with non-myeloid malignancies receiving myelosuppressive anti-cancer drugs linked with a clinically significant incidence of febrile neutropenia.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 29.8 Bn |

| Forecast Value (2033) |

USD 117.9 Bn |

| CAGR (2024–2033) |

16.5% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Recombinant Glycosylated Proteins and Recombinant Non-glycosylated Proteins), By Application (Chronic & Autoimmune Disorders, Oncology, Blood Disorders, Growth Hormonal Deficiency, Rheumatoid Arthritis, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Novartis AG, Amgen Inc, Pfizer Inc, Biocon, AbbVie Inc, Samsung Biopis, Viatris Inc, Biocad, Dr. Reddy’s Laboratories, LG Life Sciences, and Other Key Players |

| Purchase Options |

HVMN Inc., Thync Global Inc., Apple Inc., Fitbit Inc., TrackmyStack, OsteoStrong, The ODIN, Thriveport LLC, Muse, Moodmetric, and Other Key Players |

Frequently Asked Questions

The Global Biosimilars Market size reached a value of USD 25.5 billion in 2023 and is expected to reach USD 117.9 billion by the end of 2033.

North America is expected to have the largest market share for the Global Biosimilars Market with a share of about 41.6% in 2024.

Some of the major key players in the Global Biosimilars Market are Novartis AG, Pfizer Inc, Biocon, and many others.

The market is growing at a CAGR of 16.5 percent over the forecasted period.