Market Overview

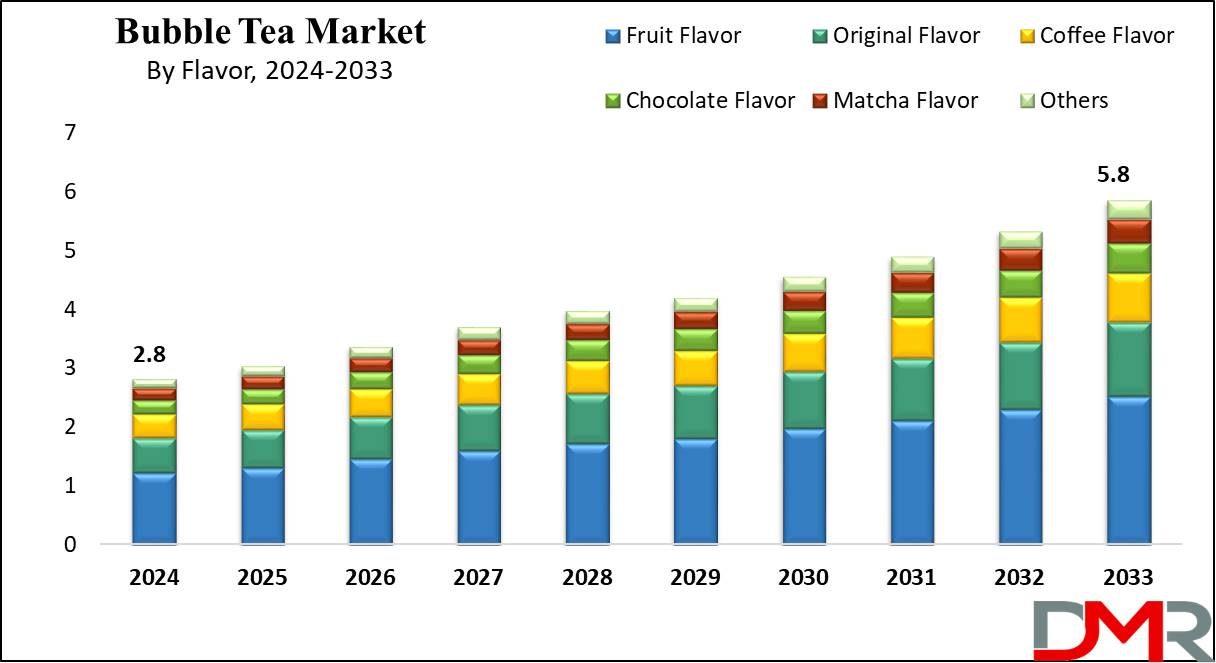

The Global Bubble Tea Market size is expected to reach a market value of USD 2.8 billion in 2024 which will further grow to USD 5.8 billion by 2033 at a CAGR of 8.4%.

This fast-growing market is driven by various factors, including the rising consumer preference for unique and novel

non-alcoholic beverages, as well as increased disposable income. The bubble tea trend is expanding globally beyond its Asian origins, with a growing presence in regions such as North America and Europe.

Flavored bubble tea, including fruit-flavored bubble tea, is a dominant section of the market due to the wide variety of flavors catering to diverse customer tastes. Fruit-flavored options like mango, strawberry, and lychee have garnered significant popularity, partly due to their perceived health benefits, which align with the global demand for healthy snacks and nutraceuticals.

Additionally, black tea remains a popular base ingredient for bubble tea, thanks to its robust flavor profile and caffeine content that appeals to health-conscious consumers seeking a refreshing beverage or energy drinks.

The market's expansion is also fueled by a competitive environment between established brands and startups, leading to continuous product innovation in both flavors and packaging solutions, including biodegradable packaging.

Asia Pacific leads the bubble tea market, particularly in Taiwan, China, and Japan, where the bubble tea culture has deep roots. However, significant growth opportunities lie in markets with increasing urbanization and demand for trendy beverages like bubble tea.

Key Takeaways

- Market Value: The market size is projected to reach a market value of USD 5.8 billion in 2033, in comparison to USD 2.8 billion in 2024 at a CAGR of 8.4%.

- Market Definition: The bubble tea market encompasses a wide range of establishments and products globally, featuring several tea-based beverages combined with tapioca pearls and other flavorful toppings, catering to diverse client preferences.

- By Type Segment Analysis: Flavored bubble tea is expected to exert its dominance in the type segment with a 29.0% market share by the end of 2024.

- By Base Ingredients Segment Analysis: Black tea is projected to exert its prominence in the base ingredient segment with the highest market share in 2024.

- By flavor Segment Analysis: Fruit-flavored bubble tea is projected to exert their dominance in the flavor segment with 43.2% of market value by the end of 2024.

- Regional Analysis: Asia Pacific is predicted to dominate the global bubble tea market with 39.2% of the market share in 2024, with a strong presence of bubble tea outlets across urban areas and retail automation in major cities.

Use Cases

- Refreshing Beverage: Bubble tea offers a satisfying, thirst-quenching experience with its combination of tea, milk, and chewy tapioca pearls, perfect for warm summer days.

- Social Gathering: Bubble tea serves as a contemporary, interactive drink for gatherings, fostering camaraderie as friends enjoy a customizable mix of flavors and toppings.

- Study Aid: With its caffeine boost and comforting sweetness, bubble tea aids in maintaining focus during late-night study sessions.

- Afternoon Pick-Me-Up: Ideal for combating the afternoon slump, bubble tea provides energy, making it a favored preference among professionals seeking a midday refreshment.

- Dessert Alternative: Acting as a lighter guilt-free dessert, bubble tea satisfies sweet cravings, providing an alternative to traditional sugary treats.

Market Dynamic

Trends

Flavor Innovation & Customization

The bubble tea marketplace is witnessing widespread innovation in flavors, with a growing form of options consisting of taro, matcha, chocolate, and an extensive variety of fruit flavors. This trend caters to various customer tastes and alternatives, improving the attraction of bubble tea.

Customization alternatives, allowing purchasers to customize their drinks with different flavorings, toppings, and sweetness levels, further consumer engagement and satisfaction.

Health-Conscious Choices

There is a growing trend in the direction of healthier bubble tea alternatives. Consumers are more and more seeking liquids that provide nutritional benefits, consisting of the rich in antioxidants and nutrients.

Fruit-flavored bubble teas, which are perceived as healthier options due to their herbal components, are in particular famous. Additionally, innovations like low-calorie and sugar-free bubble tea options are emerging to cater to health-conscious customers.

Growth Drivers

Cultural Popularity & Global Expansion

Bubble tea's cultural importance, specifically in its origin regions like Taiwan and throughout Asia, drives its continuous growth. This popularity is spreading globally, with installed manufacturers like Gong Cha and Chatime expanding their global presence. The increasing number of bubble tea outlets in North America, Europe, and different regions underscores its growing international appeal.

Rising Disposable Incomes & Urbanization

Increasing disposable incomes and urbanization, especially in growing global locations, are key drivers of the bubble tea marketplace. As more consumer moves to urban regions and their disposable income increase, the demand for trendy and novel beverages like bubble tea rises. This demographic shift helps the expansion of bubble tea shops and the proliferation of diverse flavor services.

Growth Opportunities

Expansion into New Markets

There are substantial growth opportunities the growth by expanding into developing markets. Regions like Africa and South America, in which bubble tea remains especially new, present vast potential for market entry and growth. Establishing a presence in these regions can assist brands capture new consumer bases and increase global market share.

Product Diversification

Diversifying product lines to encompass health-orientated alternatives, which include low-calorie, sugar-free, and natural bubble tea, offers wide growth opportunities. Additionally, expanding the variety of flavors and innovative ingredients can entice a broader audience. The introduction of ready-to-drink (RTD) bubble tea products, like BUBLUV’s healthier boba substitutes, can cater to the convenience-driven segment of consumers.

Restraints

Health Concerns

Despite the popularity of bubble tea, health concerns associated with excessive sugar content and calorie intake pose a huge restraint. Traditional bubble tea recipes frequently incorporate high levels of sugar and synthetic ingredients, that can deter health-conscious consumers. Addressing these concerns through healthier formulations is essential for sustained market increase.

Supply Chain Challenges

The bubble tea market faces challenges with sourcing high-quality ingredients and maintaining consistency in the availability of tapioca pearls. These issues could potentially increase costs and affect the quality of bubble tea packaging and

supply chain management.

Research Scope and Analysis

By Type

Flavored bubble tea is projected to dominate the type segment in the bubble tea market, accounting for

over 29.0% of the overall revenue in 2024, and is expected to maintain its lead during the forecast period because of its wide range of offerings and versatility.

The primary reason for its dominance is the extensive sort of flavors to be had, catering to diverse consumer preferences. From fruity options like mango, strawberry, and lychee to extra specific choices such as taro, matcha, and chocolate, flavored bubble tea offers something for everyone.

The innovation in flavor combos additionally maintains the market dynamic and exciting, continuously attracting new customers and retaining existing ones. Consumers experience the novelty and customization that flavored bubble tea provides, letting them try one-of-a-kind tastes and mix-ins with each visit to a bubble tea shop. This customization trend aligns with the increasing demand for personalized food and beverage experiences.

Additionally, flavored bubble tea appeals to health-conscious consumers who are looking for both indulgence and nutritional benefits. Many fruit-flavored bubble teas are rich in nutrients and antioxidants, making them a healthier option than conventional sugary beverages. This health appeal, combined with the satisfaction of unique and delicious flavors, drives its recognition.

The advertising and promotion of flavored bubble tea additionally play a critical role in its dominance. Brands often introduce limited-time flavors and seasonal specials, creating a sense of urgency and exhilaration that boosts sales. Social media campaigns and collaborations with influencers similarly enhance the visibility and desirability of flavored bubble tea, ensuring its continued prominence within the market.

By Base Ingredients

Black tea is expected to dominate the bubble tea marketplace as a base ingredient due to several compelling factors that contribute to its wide popularity and preference. Black tea is projected to account for the biggest share of the market in 2024 and is further anticipated to continue its dominance during the upcoming period as well.

Black tea offers a robust and wealthy taste profile that serves as an excellent base for the diverse toppings and flavorings used in bubble tea. Its robust flavor can stand up to the sweetness of syrups, the creaminess of milk, and the chewiness of tapioca pearls, creating a well-balanced and gratifying beverage. This versatility makes black tea a favorite choice amongst both customers and bubble tea makers.

Additionally, black tea is extensively recognized and customary globally, making it a familiar and accessible option for lots consumers. Its deep-rooted cultural importance, particularly in Asia where bubble tea originated, in addition, boosts its enchantment. Traditional tea-drinking cultures in countries like Taiwan, China, and Japan have extended records of black tea intake, imparting a strong basis for its persevered reputation in bubble tea formulations.

Moreover, black tea consists of higher caffeine content material in comparison to other teas, supplying an energy increase that many consumers are seeking from their drinks. This makes black tea-based bubble tea a famous choice for those seeking out each refreshment and a mild stimulant effect. The health benefits associated with black tea, inclusive of its antioxidant homes and capability to enhance coronary heart health, also a contribute to its dominance.

By Flavor

The fruit-flavored bubble tea is projected to dominate the global bubble tea market, accounting for over 43.2% of the market share in 2024. This dominance is expected to maintain its leading position throughout the forecast period.

This dominance is driven by the using the wide availability of various fruit flavors, together with popular alternatives like strawberry, mango, ardor fruit, watermelon, pineapple, cantaloupe, avocado, peach, coconut, lychee, grape, honeydew, kiwi, and banana. These flavors cater to a wide variety of consumer choices, contributing to their widespread appeal.

Fruit-flavored bubble tea is specifically famous among health-conscious consumers and vegetarians due to its rich content of antioxidants and nutrients, which assist cleanse toxins from the body. This fitness gain complements its elegance, mainly as more purchasers grow to be more and more aware of their nutritional choices.

Additionally, the natural and clean flavor of fruit flavors aligns well with the developing trend towards healthier beverage options. The wide range of fruit flavors maintains to attract a larger consumer base, which includes those looking for range and people with specific dietary preferences. This sustained demand ensures that the fruit flavor section remains the most important and fastest developing in the bubble tea market.

The Bubble Tea Market Report is segmented based on the following

By Type

- Flavored Bubble Tea

- Creamer Bubble Tea

- Sweetener Bubble Tea

- Jelly Bubble Tea

- Tapioca Pearls Bubble Tea

- Others

By Base Ingredients

- Black Tea

- Green Tea

- Oolong Tea

- White Tea

By Flavor

- Fruit Flavor

- Mango

- Strawberry

- Lychee

- Peach

- Others

- Original Flavor

- Coffee Flavor

- Chocolate Flavor

- Matcha Flavor

- Others

Regional Analysis

Asia Pacific is projected to dominate the global bubble tea market

with 39.2% of market share in 2024. The Asia Pacific region dominates the bubble tea market because of numerous key factors rooted in cultural, financial, and demographic advantages.

Bubble tea, originating from Taiwan in the 1980s, has robust cultural significance and widespread acceptance throughout Asia. This cultural affinity ensures a steady and high demand for bubble tea within the region.

The region's large and young population, especially in regions like China, Japan, South Korea, and Taiwan, drives the market's growth.

Younger consumers, who are extra adventurous with their food and beverage alternatives, form the major consumer base for bubble tea. The rising disposable incomes and urbanization in these countries also contribute to the increasing consumption of trendy and novel beverages like bubble tea.

Additionally, the Asia Pacific region benefits from a well-developed network of bubble tea stores and cafes, that have proliferated unexpectedly in urban centers. The presence of leading bubble tea brands along with Gong Cha, Chatime, and CoCo Fresh Tea further consolidates regional market dominance by launching various products and significantly expanding its operations within Asia.

Furthermore, the inclusion of order technology along with innovative marketing strategies has increased consumer accessibility and convenience, solidifying the leading position of the Asia Pacific region in the global bubble tea market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The bubble tea market is characterized by intense competition and rapid growth, driven by each established international brand and rising startups. Key gamers like Gong Cha, Chatime, and CoCo Fresh Tea & Juice have extensive global footprints and strong franchise models. Gong Cha, for example, keeps its competitive expansion throughout the U.S. And Europe, capitalizing on its robust brand popularity and wide menu services.

Startups like BUBLUV are disrupting the marketplace with innovative products, including low-calorie, Ready-To-Drink (RTD) bubble tea, catering to health-conscious consumers. Major food and beverage groups like Del Monte Foods and Baskin Robbins are also entering the space, leveraging their established market presence to introduce bubble tea products.

The market sees continuous innovation in flavors and ingredients, with a growing trend toward more healthy options. Online retailing and strategic partnerships further accentuate competition as brands attempt to attain a broader audience and differentiate their services in a crowded marketplace.

Some of the prominent players in the Global Bubble Market are

- Chatime Group

- Gong Cha

- Yummy Towns Holdings Corporation

- K.O.I The Co. Ltd

- Bobabox Ltd.

- T Bun International

- Troika J C

- Fokus Inc

- Lollicup USA Inc.

- The Bubble Tea Company

- Ten Ren’s Tea Time

- Bubble Tea House Company

- Cuppotee

- Other Key Players

Recent Developments

- In August 2023, Frazy, an emerging café-quality custom beverage start-up, announced the launch of Frazy Boba Tea. This new addition to their popular Frazy Bottles line includes six new boba flavors.

- In June 2023, JOYBA launched the ‘Real Tea, Real Milk’ campaign, partnering with Netflix's Ginny & Georgia star. This campaign aims to raise awareness and provide individuals with the knowledge, skills, and confidence to enjoy real tea with real milk.

- January 2023, Gong Cha, originally from Taiwan and a leading global bubble tea brand, marked a new milestone by opening its first store in Portugal. This expansion follows the brand's European debut in 2019. The Portugal store will be managed by franchisee Amelle Morisot.

- September 2022, Gong Cha opened its first outlet at the Merrion Centre in Yorkshire. This international operator, with 1,500 outlets worldwide, aims to enhance the Chinese food and beverage offerings at the Merrion Centre. The new Yorkshire outlet is expected to create at least 20 jobs.

- In April 2022, BUBLUV, Inc., a New York-based start-up, unveiled BUBLUV Bubble Tea, the first Ready-To-Drink (RTD) healthier boba substitute. This innovative product boasts less than 50 calories per bottle, with no added sugar or chemical components.

- In May 2022, Baskin Robbins, renowned for its ice cream, launched its first bubble tea offering, ‘Tiger Milk Bubble Tea’. Unlike traditional boba, this drink features tapioca pearls made with brown sugar. The new item will be available for a limited time during the spring and summer seasons.

- In April 2022, Chatime, the world's largest tea house franchise, opened its first outlet in Blanchardstown, Dublin. This new Irish outlet offers authentic Taiwanese beverages, including a variety of bubble tea flavors. Chatime plans to open a second Irish outlet by June 2022 in Cork City.

- March 2022, Gong's, a prominent bubble tea brand with over 1,670 outlets, announced its plans to accelerate its US expansion. The brand signed three new master franchisees (MFs), granting territory rights for Louisiana, Colorado, and Michigan. These deals are projected to add 60 new outlets to Gong Cha's US presence over the next five years. Currently, the brand operates over 150 restaurants in states including New York, New Jersey, Texas, California, and others, across 11 additional states and Washington, DC. New Orleans is set to welcome its first store in spring 2022.

- In April 2022, Del Monte Foods launched a new bubbly beverage brand called ‘Joyba’. In collaboration with New York-based brand design agency CBX, Del Monte introduced multiple flavors of bubble tea, including coffee, strawberry, cherry, and lemonade.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 2.8 Bn |

| Forecast Value (2033) |

USD 5.8 Bn |

| CAGR (2024-2033) |

8.4% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Flavored Bubble Tea, Creamer Bubble Tea, Sweetener Bubble Tea, Jelly Bubble Tea, Tapioca Pearls Bubble Tea, Others), By Base Ingredient (Black Tea, Green Tea, Oolong Tea, White Tea), and By Flavor (Fruit Flavor, Original Flavor, Coffee Flavor, Chocolate Flavor, Matcha Flavor, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Chatime Group, Gong Cha, Yummy Towns Holdings Corporation, K.O.I The Co. Ltd, Bobabox Ltd., T Bun International, Troika J C, Fokus Inc, Lollicup USA Inc., The Bubble Tea Company, Ten Ren’s Tea Time, Bubble Tea House Company, Cuppotee, and Other Key Players |

| Purchase Options |

HVMN Inc., Thync Global Inc., Apple Inc., Fitbit Inc., TrackmyStack, OsteoStrong, The ODIN, Thriveport LLC, Muse, Moodmetric, and Other Key Players |

Frequently Asked Questions

The Global Bubble Tea Market is estimated to reach USD 2.8 billion in 2024, which is further expected to reach USD 5.8 billion by 2033.

Asia Pacific is projected to dominate the Global Bubble Tea Market with a share of 39.2% in 2023.

Some of the major key players in the Global Bubble Tea Market are Chatime Group, Gong Cha, Yummy Towns Holdings Corporation, and K.O.I The Co. Ltd, and many others.

The market is growing at a CAGR of 8.4 percent over the forecasted period.