Market Overview

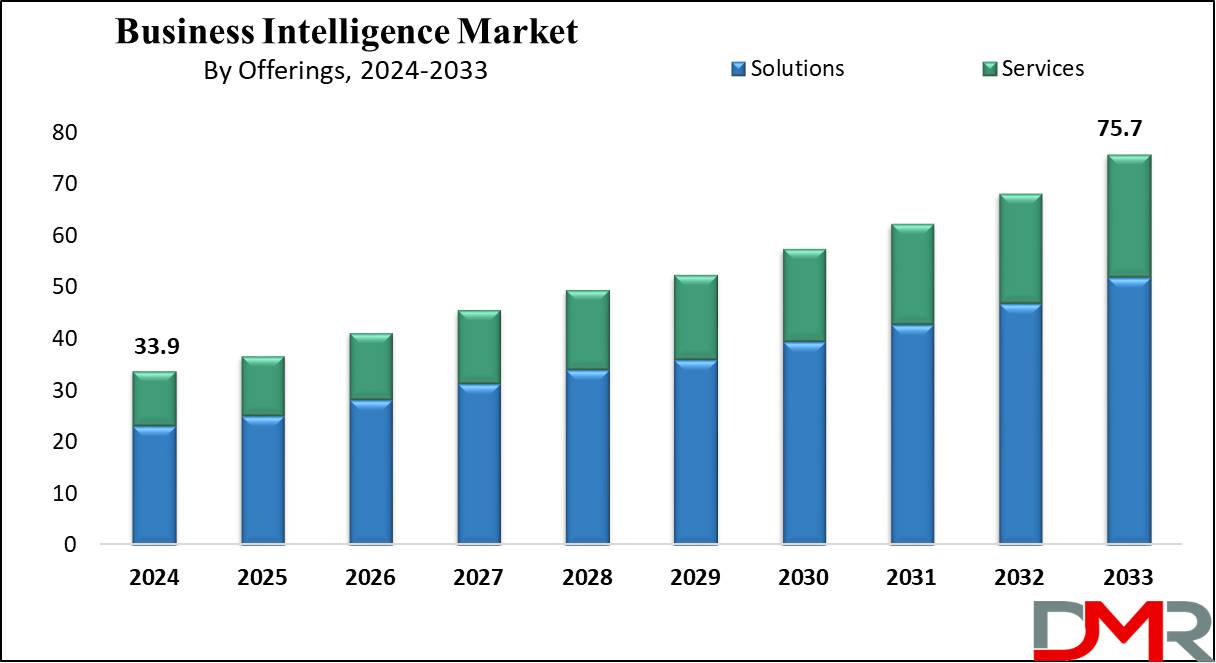

The Global Business Intelligence Market is projected to reach USD 33.9 billion in 2024 and grow at a compound annual growth rate of 9.3% from there until 2033 to reach a value of USD 75.7 billion.

Business intelligence (BI) is a procedural & technical framework for collecting, storing, and inspecting data produced by an organization's operations. Process analysis, descriptive analysis, data mining, and performance benchmarking are all included in it, forming an essential part of modern data analytics solutions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

With the help of business intelligence, an organization can base its choices on logical information about market trends and consumer spending habits. Like, a large organization's systems contain data because CRM and ERP are used to power those operations. As a result, listing all of the data that the company generates is the first step in using business intelligence, especially as enterprises increasingly adopt decision-support systems to enhance accuracy and speed.

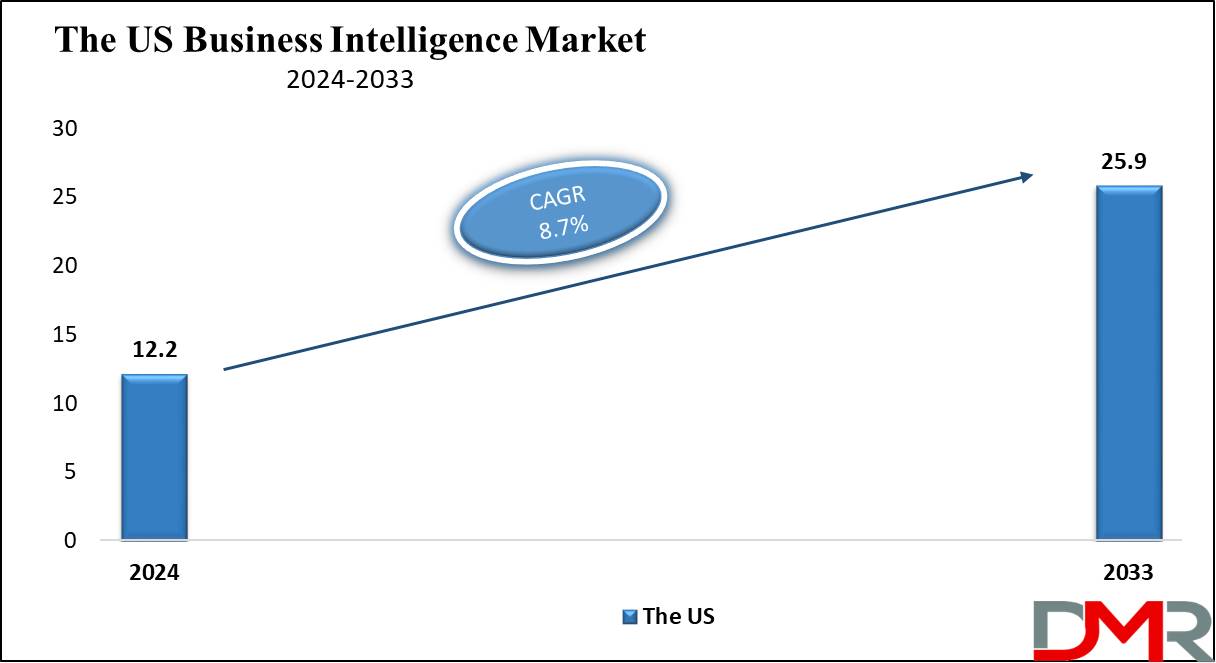

The US Business Intelligence Market

The US Business Intelligence Market is projected to reach USD 12.2 billion in 2024 at a compound annual growth rate of 8.7% over its forecast period.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The business intelligence market in the US provides various growth opportunities, driven mainly by the high dependency on data-driven decision-making across many sectors. Companies are adopting advanced analytics and BI tools to improve operational efficiency and enhance customer engagement. Moreover, investments in technologies like IoT & AI are boosting BI adoption, mainly among large enterprises that are focused on digitization and modernization efforts through robust enterprise analytics platforms.

Further, the market is driven by higher demand for data analytics, cloud adoption, and investments in AI and IoT technologies, which improve decision-making and operational efficiency. However, challenges like high implementation costs and the demand for specialized training may hinder growth, limiting accessibility for smaller enterprises.

Key Takeaways

- Market Growth: The Business Intelligence Market size is expected to grow by 39.0 billion, at a CAGR of 9.3% during the forecasted period of 2025 to 2033.

- By Offerings: The solutions segment is anticipated to get the majority share of the Business Intelligence Market in 2024.

- By Deployment: The cloud segment is expected to be leading the market in 2024

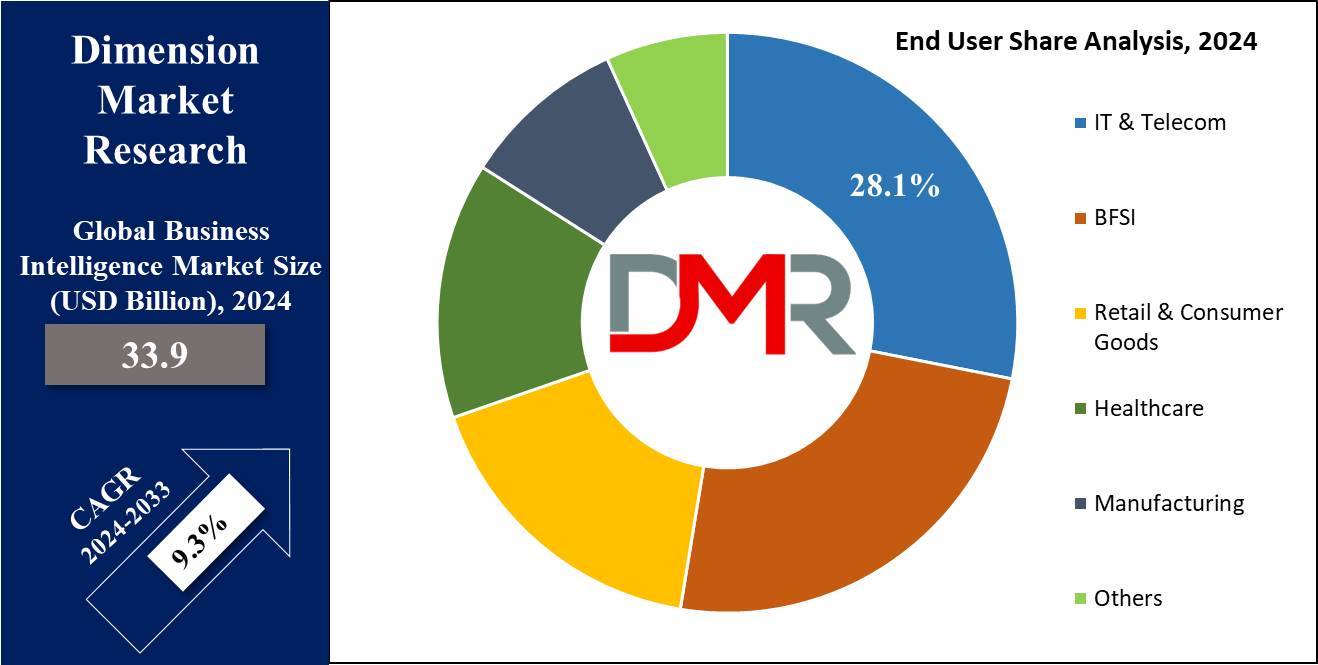

- By End User: The IT & Telecom segment is expected to get the largest revenue share in 2024 in the Business Intelligence Market.

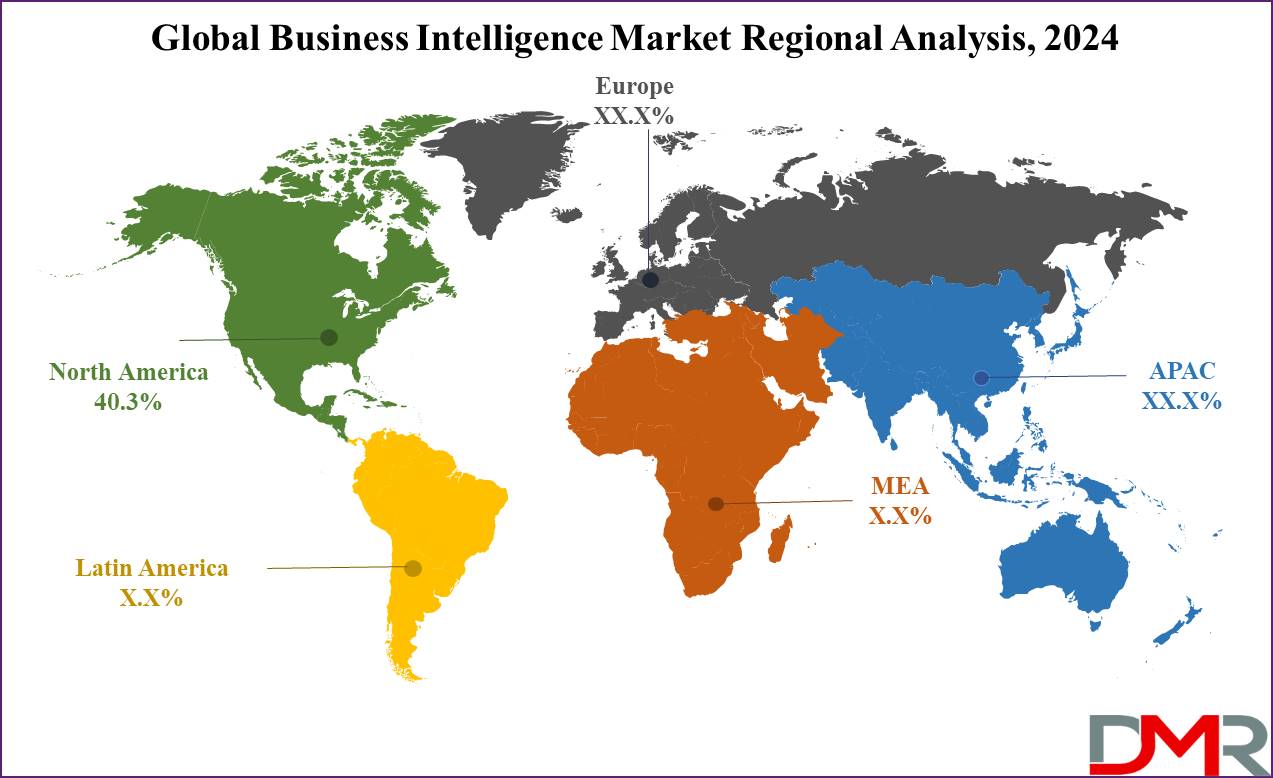

- Regional Insight: North America is expected to hold a 40.3% share of revenue in the Global Business Intelligence Market in 2024.

- Use Cases: Some of the use cases of Business Intelligence include sales performance analysis, operational efficiency tracking, and more.

Use Cases

- Sales Performance Analysis: BI tools support monitoring sales trends, identifying top-performing products, and forecasting future revenue, allowing data-driven strategies to optimize sales operations

- Customer Behavior Insights: BI gathers & analyzes customer data to understand purchasing patterns, segment audiences, and improve customer targeting and personalization efforts.

- Operational Efficiency Tracking: Organizations use BI dashboards to monitor KPIs like production costs, inventory levels, and supply chain performance for better resource management.

- Financial Forecasting and Budgeting: BI systems help in financial analysis by predicting cash flow, managing risks, and ensuring alignment between budgets & actual spending.

Market Dynamic

Driving Factors

Rising Demand for Data-Driven Decision Making

As businesses highly focus on staying competitive, the demand for real-time insights and actionable analytics drives BI adoption. Companies use BI tools to transform raw data into meaningful insights, supporting fast, strategic decisions in dynamic markets.

Integration of AI and Cloud Technologies

The transformation toward cloud-based BI solutions provides scalability, accessibility, and lower infrastructure costs, making BI more accessible to businesses of all sizes. In addition, AI-powered features like predictive analytics and natural language processing improve BI tools, automating insights and streamlining complex analyses.

Restraints

High Implementation Costs and Complexity

Installing BI solutions often demands higher investment in software, hardware, and skilled personnel. Small and medium enterprises (SMEs) may struggle with the financial and technical burden of integration, customization, and ongoing maintenance, limiting market penetration.

Data Privacy and Security Concerns

With the growing volumes of sensitive data flowing through BI platforms, making sure compliance with regulations like GDPR and data protection standards becomes challenging. Any breaches or vulnerabilities can result in financial losses & erode trust, making businesses cautious about adopting BI solutions.

Opportunities

Growing Adoption in Emerging Markets

Businesses in developing regions are highly adopting BI solutions to improve operational efficiency and competitiveness. As digital transformation expands in these markets, industries like retail, healthcare, and manufacturing provide significant opportunities for BI vendors to expand their customer base.

Expansion of Self-Service BI and Embedded Analytics

The growth of self-service BI tools empowers non-technical users to generate insights without IT support. In addition, embedding BI functionalities within existing applications provides simple analytics, opening new avenues for vendors to meet evolving business needs.

Trends

AI and Machine Learning Integration

A major trend in 2024 is the increasing use of AI & ML within business intelligence (BI). These technologies support automated data analysis, extracting insights rapidly, and identifying patterns without manual intervention. AI-powered analytics tools are allowing more precise predictive models, empowering businesses to make proactive decisions based on market trends & customer behavior.

Natural Language Processing (NLP) and Accessibility

BI platforms are highly adopting NLP to make data analytics more accessible. Users can interact with data utilizing conversational language, removing the need for complex query syntax, which standardizes the data analysis, allowing non-technical employees to generate insights through simple language inputs. NLP-powered tools also allow real-time report generation, improving decision-making efficiency across organizations.

Research Scope and Analysis

By Offerings

In the components segment of the business intelligence (BI) market is categorized into solutions, and services, among which the solutions segment is expected to lead throughout the forecast period, holding a significant share in 2024, which is anticipated to have promising growth as it includes various critical elements like dashboards and scorecards, data integration and ETL (extract, transform, load), reporting and visualization, along with query and analysis tools.

The growth in demand for these solutions is mainly driven by their ease of implementation and lower maintenance costs in comparison to other options. Organizations appreciate the user-friendly nature of these systems, which allow for rapid adoption and less disruption to existing processes. Furthermore, the ability to access live data insights through dashboards and reporting tools improves decision-making capabilities across many business functions.

As businesses recognize the value of data-driven insights, the solutions sub-segment is poised to continue its upward trajectory, meeting the diverse needs of organizations looking to optimize their performance and strategic planning.

By Deployment

In the deployment category of the business intelligence (BI) market, the cloud segment is anticipated to lead in 2024 and is expected to maintain a significant share during the forecast period, as it is growing into new regions, driven by several advantages. Cloud deployment provides secure and safe access to data, better storage solutions, and enhanced maintenance capabilities, making it a prominent option for many organizations. Businesses appreciate the flexibility and scalability that cloud solutions provide, allowing them to adapt quickly to changing needs and workloads.

Further, the on-premise segment is also gaining traction, mainly for organizations that prefer customized and personalized BI systems made for their specific requirements. While on-premise solutions may provide more control and customization, they often come with higher costs & maintenance responsibilities.

Yet, some companies continue to favor on-premise systems due to issues and challenges over data security or compliance issues. As both segments transforms, organizations are mostly assessing their deployment options to find the best fit for their operational and strategic goals.

By Organization Size

In the business intelligence (BI) market, solutions are highly utilized by both small and medium-sized enterprises (SMEs) and large corporations. However, large enterprises are expected to generate the highest revenue in 2024, as they are more focused on digitization & the integration of advanced technologies into their operations.

As a result, they are highly investing in advanced solutions, including the Internet of Things (IoT), artificial intelligence (AI), machine learning (ML), and cloud-based technologies, which leads to a higher adoption rate of BI solutions, enabling large enterprises to harness the power of data analytics for better decision-making and enhanced operational efficiency.

Further, as competition intensifies in various industries, large companies recognize the vitality of using data-driven insights to stay ahead. Overall, the increase in the trend toward advanced technology adoption among large enterprises highly contributes to the expansion of the BI market, highlighting their role as key players in driving innovation and efficiency.

By Application

In the business intelligence (BI) market, solutions are mostly utilized across various applications, like supply chain analytics, financial performance management, customer relationship management (CRM), and production planning. Among these, the financial performance and strategy management segment is expected to capture the largest market share in 2024 and also show the highest growth rate in the future, which allows organizations to effectively monitor their financial health & performance metrics, make better decisions, and focus on key areas like revenue generation, return on investment (ROI), and managing operational costs.

As companies look for better profitability and efficiency, the need for these financial BI tools has grown. Many enterprises are adopting them as important components of their BI strategies, recognizing their potential to improve overall performance and simplify financial operations, which reflects the rising importance of data-driven insights in navigating complex financial landscapes and achieving strategic objectives.

By End User

Business intelligence (BI) is gaining popularity across industries like banking, retail, healthcare, and telecommunications. Among these, IT and telecommunications are expected to hold the largest share of BI revenue in 2024. Telecom companies utilize BI to enhance pricing strategies, customize marketing campaigns, and refine products based on customer data.

BI also helps in operational efficiency by optimizing networks and enhancing customer satisfaction. As the need for data-driven decisions grows, telecom businesses increasingly depend on BI tools to enhance service delivery and maintain a competitive edge. Further, the banking, financial services, and insurance (BFSI) sector is anticipated to experience the fastest growth in BI adoption during the forecast period. BI tools support financial institutions to streamline workflows, boost profitability, and manage risks more effectively.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

With real-time reporting and customer insights, BFSI companies can provide better services, enhance retention rates, and ensure smoother data handling. As the financial industry experiences rising challenges in risk management and customer engagement, the role of BI becomes even more critical for driving strategic growth and efficiency.

The Business Intelligence Market Report is segmented on the basis of the following

By Offerings

- Solutions

- Dashboards & Scorecards

- Data Integration & ETL

- Reporting & Visualization

- Query & Analysis

- Services

- Consulting

- Deployment & Integration

- Support & Maintenance

By Deployment

By Organization Size

By Application

- Supply Chain Analytic Applications

- CRM Analytics Operations

- Financial Performance & Strategy Management

- Production Planning Analytic Operations

- Others

By End User

- BFSI

- IT & Telecom

- Retail & Consumer Goods

- Manufacturing

- Healthcare

- Others

Regional Analysis

The North American business intelligence (BI) market is set to lead the market throughout the projected period while having a share of 40.3% in 2024. Several factors contribute to this dominance, like a major focus on data development, an increase in competition, and the broad adoption of cloud computing. In addition, the growing use of BI solutions and digitalization across many sectors will enhance business management insights, ultimately driving sales, production, and innovation.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

These trends show the region's commitment to using technology for better decision-making, further solidifying its position as a market leader. Further, in Europe, the BI market holds a significant share, largely due to the rising adoption of cloud-based solutions, which have expanded the implementation of business intelligence across organizations. Within Europe, Germany is set to lead the market, while the UK is also expected to see major growth during the forecast period.

In addition, the Asia-Pacific region is anticipated to experience rapid growth, driven by the industrialization of the Internet of Things (IoT) and the large adoption of advanced technologies, which is particularly evident in China, which is set to have a significant market share. In addition, the Indian BI market is anticipated to expand steadily, contributing to the overall growth of the sector in the Asia-Pacific region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The business intelligence market is highly competitive, with vendors looking to innovate through AI, cloud integration, & data visualization tools. Companies are competing to provide user-friendly platforms that integrate self-service analytics, predictive insights, and simple integration with existing business systems. As businesses demand faster, real-time decision-making capabilities, BI providers compete by improving data accessibility and reducing complexity.

Market players are also prioritizing security features & compliance to address privacy concerns. With the quick transformation of technology, differentiation depends in offering agile, scalable solutions that empower businesses of all sizes to derive actionable insights efficiently.

Some of the prominent players in the Global Business Intelligence are

- IBM Corp

- Salesforce

- Microsoft Corp

- SAP SE

- Oracle Corp

- Infor

- AWS

- TIBCO

- Zoho

- Sisense

- Other Key Players

Recent Developments

- In October 2024, Cloverleaf Analytics released Version 4.0 of its Cloverleaf Insurance Intelligence platform, where the version's shows improved capabilities, like its elimination of the operational data store (ODS) and establishment of a data warehouse, allowing carriers to more easily and rapidly upload and store policies, claims, and legacy raw data.

- In September 2024, Oracle unveiled new AI-powered capabilities for Oracle Fusion Data Intelligence that support organizations to extract maximum value from their data assets and have a competitive edge in a highly analytics-driven business landscape, which consists of new intelligent applications for Oracle Fusion Cloud Human Capital Management (HCM) and Oracle Fusion Cloud Supply Chain & Manufacturing (SCM) that go beyond traditional analytics & recommend actions to users in critical day-to-day workstreams.

- In June 2024, Databricks launched Databricks AI/BI, a new type of business intelligence (BI) product that focuses on democratizing analytics and insights for anyone in an organization, which features a pair of complementary experiences like an AI-powered, low-code interface for developing and distributing fast, interactive dashboards; and Genie, a conversational interface for showcasing ad-hoc and follow-up questions through natural language.

- In April 2024, Tech Mahindra announced its plans to collaborate with Microsoft to launch a unified workbench on Microsoft Fabric, an analytics platform for businesses & data professionals. Further, the workbench "will help organizations boost the adoption of Microsoft Fabric and allow them to create complex data workflows with a simple-to-use interface, which uses Microsoft Fabric, an all-in-one analytics solution for enterprises like data movement, data science, real-time analytics, and business intelligence.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 33.9 Bn |

| Forecast Value (2033) |

USD 75.7 Bn |

| CAGR (2024-2033) |

9.3% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 12.2 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Offerings (Solutions and Services), By Deployment (Cloud and On-premises), By Organization Size (SMEs and Large Enterprises), By Application (Supply Chain Analytic Applications, CRM Analytics Operations, Financial Performance & Strategy Management, Production Planning Analytic Operations, and Others), By End User (BFSI, IT & Telecom, Retail & Consumer Goods, Manufacturing, Healthcare, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

IBM Corp, Salesforce, Microsoft Corp, SAP SE, Oracle Corp, Infor, AWS, TIBCO, Zoho, Sisense, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Business Intelligence Market?

▾ The Global Business Intelligence Market size is expected to reach a value of USD 33.9 billion in 2024 and is expected to reach USD 75.7 billion by the end of 2033.

Which region accounted for the largest Global Business Intelligence Market?

▾ North America is expected to have the largest market share in the Global Business Intelligence Market with a share of about 40.3% in 2024.

How big is the Business Intelligence Market in the US?

▾ The Business Intelligence Market in the US is expected to reach USD 12.2 billion in 2024.

Who are the key players in the Global Business Intelligence Market?

▾ Some of the major key players in the Global Business Intelligence Market are IBM Corp, Salesforce, Microsoft Corp, and others.

What is the growth rate in the Global Business Intelligence Market?

▾ The market is growing at a CAGR of 9.3 percent over the forecasted period.