Market Overview

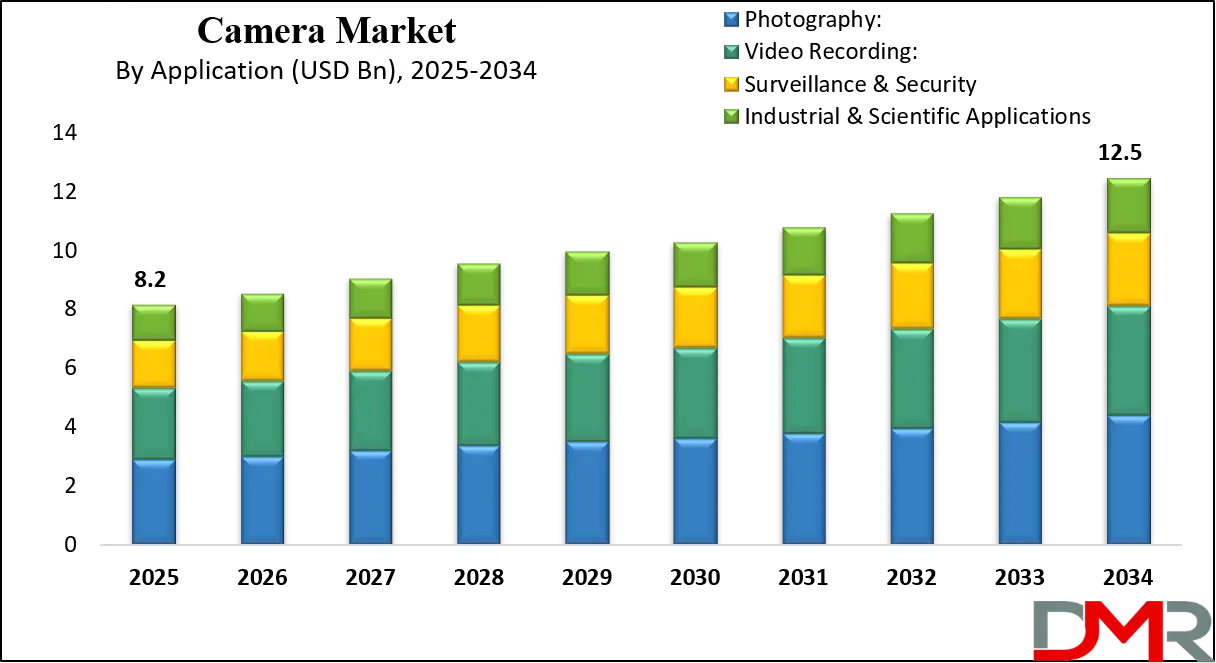

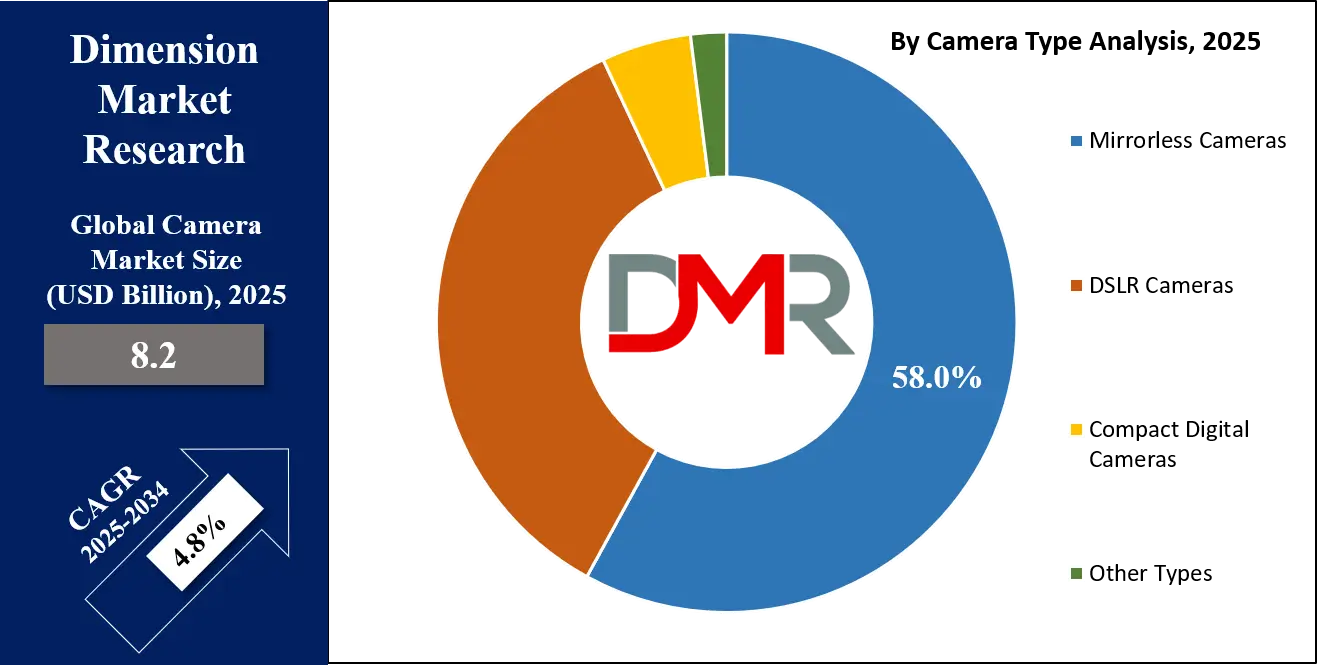

The global camera market is projected to reach USD 8.2 billion in 2025 and is expected to grow to USD 12.5 billion by 2034, expanding at a CAGR of 4.8%.

Rising demand for high-resolution imaging, mirrorless and DSLR cameras, content creation, and professional photography applications are driving market growth across consumer and industrial segments. Advances in optical technology, computational photography, and connectivity features continue to support adoption in videography, surveillance, and industrial imaging sectors.

.webp)

A camera is an optical instrument designed to capture and record images, either as still photographs or as moving pictures, through the controlled exposure of a photosensitive medium or digital sensor. It operates by focusing light through a lens system onto a

sensor or film, enabling the precise reproduction of color, detail, and depth. Modern cameras integrate sophisticated technologies such as autofocus systems, image stabilization, high-resolution sensors, and advanced processing algorithms, allowing users to capture high-quality visuals under diverse lighting and environmental conditions.

Cameras serve not only as tools for artistic expression and personal documentation but also play crucial roles in professional photography, cinematography, scientific research, and surveillance. The evolution from analog film cameras to digital and mirrorless systems has expanded the possibilities for creative and industrial applications, making cameras essential instruments across multiple sectors.

The global camera market encompasses the production, distribution, and sale of a wide range of photographic and imaging devices, including digital single-lens reflex cameras, mirrorless cameras, compact point-and-shoot cameras, and specialized professional equipment for filmmaking and industrial use. Driven by technological advancements, growing consumer demand for high-resolution imaging, and the proliferation of content creation platforms, the market has witnessed significant growth across both consumer and professional segments.

Additionally, the market is influenced by trends in social media engagement, vlogging, live streaming, and photography-based e-commerce, which are fueling the adoption of advanced camera systems with superior sensor performance, lens versatility, and connectivity features.

Industry players in the global camera market operate through strategic collaborations, innovation in optical and digital imaging technology, and expanding distribution channels in emerging regions. The market's dynamics are shaped by the growing integration of artificial intelligence, computational photography, and cloud-based storage solutions, which enhance image processing and user experience.

Growth is also supported by rising investment in cinematic productions, surveillance infrastructure, and scientific imaging applications. The combination of innovation, consumer trends, and industrial demand is driving continuous evolution, positioning the camera market as a critical component of the global imaging and optics ecosystem.

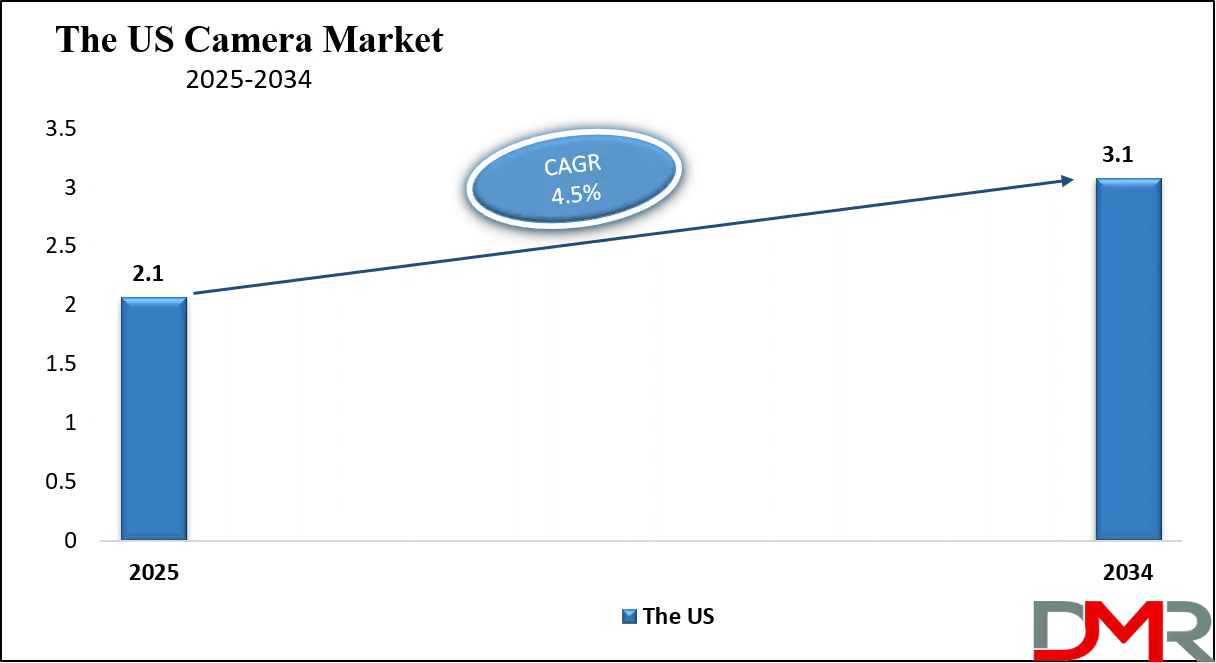

The US Camera Market

The U.S. Camera market size is projected to be valued at USD 2.1 billion by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 3.1 billion in 2034 at a CAGR of 4.5%.

The US camera market represents one of the most mature and technologically advanced segments within the global imaging industry. It encompasses a wide range of devices, including digital single-lens reflex (DSLR) cameras, mirrorless systems, compact point-and-shoot cameras, action cameras, and professional cinematography equipment. Consumer demand in the US is largely driven by photography enthusiasts, social media content creators, vloggers, and professional photographers who seek high-resolution imaging, superior lens performance, and advanced features such as image stabilization, autofocus, and 4K video recording.

The market also benefits from strong retail and e-commerce channels, allowing both consumers and professionals easy access to the latest camera technologies. In addition, the growing trend of live streaming, video blogging, and short-form video content has amplified the need for versatile cameras capable of delivering high-quality visuals across digital platforms.

Industrial and commercial applications play a significant role in shaping the US camera market. Surveillance and security systems, scientific imaging, automotive imaging, and industrial inspection rely heavily on advanced imaging solutions with high precision and durability. Market growth is further supported by continuous technological innovations, including computational photography, artificial intelligence-powered image processing, and connectivity with cloud storage and mobile devices.

Leading market players in the US invest heavily in research and development to introduce features such as enhanced low-light performance, ultra-high-resolution sensors, and modular camera systems for professional cinematography. Overall, the US camera market is characterized by rapid innovation, strong consumer adoption, and a diverse range of applications spanning professional, industrial, and entertainment sectors.

Europe Camera Market

The European camera market is projected to reach approximately USD 2.5 billion in 2025, reflecting a steady demand for digital imaging devices across the region. This growth is driven by a combination of consumer enthusiasm for photography, widespread adoption of mirrorless and DSLR cameras, and a mature content creation ecosystem. Enthusiasts and professional photographers in Europe increasingly seek high-resolution sensors, advanced lens systems, and features such as image stabilization and low-light performance. Social media influence, online content sharing, and travel photography are also significant contributors to the demand for compact and professional-grade cameras, ensuring steady market expansion.

From an industrial perspective, the European camera market is supported by the use of imaging technologies in surveillance, industrial inspection, and scientific research. AI-enabled cameras, networked IP systems, and high-precision optical devices are being increasingly deployed in sectors such as security, healthcare, and manufacturing, creating additional growth opportunities. The market is expected to expand at a compound annual growth rate (CAGR) of around 3.0% over the coming years, driven by continuous technological innovation, rising consumer spending on high-quality imaging devices, and the integration of computational photography and connectivity features that enhance both the overall user experience and professional utility.

Japan Camera Market

The Japanese camera market is expected to reach approximately USD 180 million in 2025, reflecting strong growth driven by technological innovation and a highly engaged consumer base. Japan has long been a hub for advanced imaging technology, with domestic manufacturers like Canon, Sony, Nikon, and Fujifilm leading the development of high-resolution sensors, mirrorless systems, and professional-grade cameras. Consumer interest in photography, content creation, and videography continues to support the demand for compact digital cameras, DSLR, and mirrorless systems, while the rise of social media platforms and digital content sharing further accelerates market adoption.

From an industrial and commercial perspective, Japan’s camera market benefits from applications in surveillance, industrial inspection, and scientific research. High-performance imaging solutions with AI-powered features, advanced optics, and connectivity capabilities are increasingly deployed across security systems, manufacturing, and laboratory environments. The market is projected to grow at a robust CAGR of 10.0% through the coming years, reflecting the combined effect of innovation-driven product development, rising consumer demand for advanced imaging devices, and the adoption of AI and computational photography technologies that enhance functionality across both professional and industrial applications.

Global Camera Market: Key Takeaways

- Market Value: The global Camera market size is expected to reach a value of USD 12.5 billion by 2034 from a base value of USD 8.2 billion in 2025 at a CAGR of 4.8%.

- By Camera Type Analysis: Mirrorless Cameras are anticipated to dominate the camera type segment, capturing 60.0% of the total market share in 2025.

- By Application Segment Analysis: Photography will dominate the application segment, capturing 35.0% of the market share in 2025.

- Regional Analysis: Asia Pacific is anticipated to lead the global Camera market landscape with 40.0% of total global market revenue in 2025.

- Key Players: Some key players in the global Camera market are Canon Inc., Sony Group Corporation, Nikon Corporation, Fujifilm Holdings Corporation, Panasonic Holdings Corporation, OM SYSTEM / Olympus Corporation, Leica Camera AG, Hasselblad, Ricoh Imaging Company, Ltd., Sigma Corporation, Zeiss Group, DJI Innovations, GoPro, Inc., Blackmagic Design, Arri AG, Hikvision Digital Technology Co., Ltd., Dahua Technology Co., and Others.

Global Camera Market: Use Cases

- Professional Photography and Videography: Cameras are extensively used by professional photographers and videographers to capture high-resolution images and videos for commercial, editorial, and artistic purposes. DSLR and mirrorless cameras dominate this segment due to superior sensor quality, interchangeable lenses, and advanced autofocus systems. This use case also includes wedding, fashion, wildlife, and event photography, as well as filmmaking and content production for digital media platforms. The demand is driven by social media, advertising campaigns, and online content creation, requiring cameras that deliver precise color reproduction, image clarity, and cinematic-quality video.

- Consumer and Social Media Content Creation: The rise of social media influencers, vloggers, and content creators has significantly fueled the adoption of compact digital cameras, mirrorless systems, and action cameras. Consumers seek portable, user-friendly cameras with high-resolution imaging, 4K video recording, and connectivity features for instant sharing on platforms like Instagram, YouTube, and TikTok. Features such as image stabilization, fast autofocus, and AI-powered shooting modes enhance usability, enabling creators to produce professional-looking content without extensive technical expertise. This segment also benefits from the growing trend of travel and lifestyle photography.

- Surveillance and Security Applications: Security and surveillance represent a critical industrial use of cameras, including network IP cameras, CCTV systems, and smart monitoring solutions. Organizations, government agencies, and commercial establishments rely on these cameras for real-time monitoring, threat detection, and data recording. Features such as night vision, motion detection, AI-based analytics, and remote access have become standard requirements. This use case also extends to traffic monitoring, smart city projects, and facility management, where advanced cameras provide operational efficiency, safety, and regulatory compliance.

- Industrial and Scientific Imaging: Cameras are increasingly deployed in industrial inspection, scientific research, and medical imaging applications. High-resolution cameras with precision optics and specialized sensors are used for quality control, laboratory analysis, microscopy, and automated manufacturing processes. In scientific research, cameras assist in imaging experiments, wildlife studies, and astronomy. Industrial imaging solutions often integrate with machine vision systems, AI-based defect detection, and robotic automation to improve accuracy, reduce errors, and enhance productivity. This use case highlights the critical role of cameras beyond consumer and entertainment purposes.

Impact of Artificial Intelligence on Camera Market

Artificial intelligence is transforming the global camera market by enhancing imaging capabilities, automation, and user experience across both consumer and industrial applications. AI-powered features such as intelligent autofocus, scene recognition, facial detection, and real-time image processing enable cameras to capture sharper, more accurate, and professional-quality visuals with minimal user intervention. In surveillance and security, AI algorithms support motion detection, anomaly recognition, and predictive analytics, improving safety and operational efficiency.

Additionally, computational photography, AI-assisted post-processing, and integration with cloud-based platforms are driving adoption in content creation, social media, and industrial imaging, making AI a key growth driver for the camera market.

Global Camera Market: Stats & Facts

U.S. Bureau of Labor Statistics (BLS)

- Employment Growth in Media and Communication Occupations: Overall employment in media and communication occupations is projected to grow slower than the average for all occupations from 2024 to 2034. Despite limited employment growth, about 104,800 openings are projected each year, on average, in these occupations largely due to the need to replace workers who leave the occupations permanently.

- Employment of Film and Video Editors and Camera Operators: Overall employment of film and video editors and camera operators is projected to grow 3 percent from 2024 to 2034, about as fast as the average for all occupations. About 6,400 openings for film and video editors and camera operators are projected each year, on average, over the decade. Many of those openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire.

Federal Communications Commission (FCC)

- Prohibition on Authorization of “Covered” Equipment: As of February 6, 2023, no new authorizations of “covered” equipment will be permitted, including certain video surveillance equipment, due to national security concerns.

- Prohibition on Contracting for Certain Telecommunications and Video Surveillance Services or Equipment: The Federal Acquisition Regulation (FAR) 52.204-25 prohibits contracting for certain telecommunications and video surveillance services or equipment, impacting the procurement of such technologies by federal agencies.

U.S. Department of Homeland Security (DHS)

- Science and Technology Directorate Budget Overview: The FY 2025 Budget includes USD 836.1 million for the Science and Technology Directorate, supporting research, development, test, and evaluation efforts critical to maintaining threat awareness and delivering mitigation strategies, including those related to surveillance technologies.

- Securing the Information and Communications Technology and Services Supply Chain: The Department of Commerce's Bureau of Industry and Security published regulations and procedures to address undue or unacceptable risks to national security and U.S. foreign policy interests arising from the use of information and communications technology and services, including those related to surveillance equipment.

Government Accountability Office (GAO)

- Smart Cities Report: The GAO report on Smart Cities highlights the use of smart technologies, including surveillance cameras, in transportation and law enforcement services across various cities, emphasizing the need for effective implementation and oversight.

- Immersive Technologies in Federal Agencies: A GAO survey found that 17 of the 23 civilian federal agencies reported activities involving immersive technologies, including virtual reality and augmented reality, for training and public outreach, indicating a trend towards advanced technologies in federal operations.

Global Camera Market: Market Dynamics

Global Camera Market: Driving Factors

Rising Demand for High-Resolution Imaging

The growing consumer and professional preference for high-resolution imaging and advanced optical performance is fueling camera market growth. Mirrorless cameras, DSLRs, and action cameras with superior sensors, image stabilization, and enhanced low-light capabilities are increasingly adopted for professional photography, content creation, and videography. Social media platforms and video streaming channels are further driving demand for high-quality visuals, prompting manufacturers to innovate in lens technology, sensor resolution, and computational photography.

Expansion of Content Creation and Social Media Influence

The proliferation of digital content creation, including vlogging, live streaming, and influencer-driven marketing, is a major driver for the global camera market. Compact and portable cameras with AI-powered autofocus, 4K video recording, and connectivity features are increasingly preferred by creators for seamless content production and sharing. Rising engagement on platforms like YouTube, TikTok, and Instagram encourages adoption of cameras that offer professional-grade features in consumer-friendly formats, boosting overall market growth.

Global Camera Market: Restraints

Competition from Smartphone Cameras

The rapid improvement of smartphone camera technology, including multi-lens setups, AI-enhanced imaging, and computational photography, poses a significant restraint to the standalone camera market. Consumers increasingly rely on smartphones for casual photography and social media content, reducing demand for compact and entry-level digital cameras. This trend pressures manufacturers to innovate constantly and differentiate cameras through advanced features, professional optics, and specialized applications.

High Cost of Advanced Camera Systems

Professional-grade cameras, including DSLRs, mirrorless, and cinema cameras, often involve substantial investment in lenses, accessories, and maintenance. The high purchase cost can limit adoption, particularly in emerging markets and among casual consumers. This financial barrier, combined with the availability of affordable alternatives like smartphones, constrains market growth despite technological advancements.

Global Camera Market: Opportunities

Growth in Surveillance and Security Applications

Industrial and commercial adoption of cameras for surveillance, smart monitoring, and security solutions presents significant growth potential. AI-enabled IP cameras, CCTV systems, and motion detection solutions are increasingly used in smart cities, transportation, and corporate facilities. Integration with cloud storage, facial recognition, and analytics enhances operational efficiency and safety, creating lucrative opportunities for camera manufacturers in the professional and enterprise segments.

Emerging Industrial and Scientific Imaging Applications

The expansion of cameras in industrial inspection, machine vision, medical imaging, and scientific research offers new avenues for growth. High-resolution sensors, precision optics, and AI-based image processing are critical for quality control, laboratory experiments, and automated manufacturing. Demand for specialized imaging solutions in sectors like healthcare, aerospace, and robotics allows companies to diversify product portfolios and capture niche market segments.

Global Camera Market: Trends

Integration of Artificial Intelligence and Computational Photography

AI and computational photography are reshaping camera functionality, enabling features like scene detection, automated image correction, and real-time post-processing. These technologies enhance the user experience and expand applications in content creation, professional photography, and industrial imaging. AI-driven cameras also support predictive analytics in surveillance, reducing manual intervention and improving image accuracy.

Increasing Adoption of Mirrorless and Hybrid Camera Systems

Immersive content creation is rapidly gaining traction due to the rise of mirrorless cameras, which offer compact size, interchangeable lenses, high-resolution sensors, and powerful video capabilities. Hybrid systems that seamlessly combine photography and videography are addressing the evolving needs of professionals and content creators. The ongoing shift from traditional DSLRs to mirrorless and hybrid cameras reflects a broader trend toward portability, advanced imaging technology, and multifunctional devices all essential for delivering immersive and engaging visual content in the global market.

Global Camera Market: Research Scope and Analysis

By Camera Type Analysis

Mirrorless cameras are expected to lead the camera type segment, capturing around 60% of the total market share in 2025 due to their compact design, lightweight construction, and advanced imaging capabilities. These cameras offer high-resolution sensors, fast autofocus, and excellent low-light performance, making them ideal for both professional photographers and content creators who prioritize portability without compromising image quality.

The growing popularity of mirrorless systems is further driven by their versatility in video recording, support for interchangeable lenses, and integration with modern connectivity features, which allow seamless transfer of images and videos to social media and cloud platforms.

DSLR cameras continue to hold a significant portion of the market due to their robust build, superior optical performance, and reliability in professional photography. Despite the growing adoption of mirrorless systems, DSLRs remain preferred by many professionals and enthusiasts for specialized applications such as sports, wildlife, and studio photography, where optical viewfinders, extended battery life, and a wide range of compatible lenses provide practical advantages.

The combination of established user trust and consistent image quality ensures that DSLRs maintain a strong presence in the global camera market alongside emerging mirrorless technologies.

By Application Analysis

Photography is expected to dominate the application segment of the global camera market, capturing approximately 35% of the market share in 2025. This dominance is driven by the widespread adoption of cameras for personal, professional, and commercial purposes. Consumers and professionals increasingly demand high-resolution imaging for capturing portraits, events, travel experiences, and artistic projects.

Social media platforms, blogging, and content-sharing websites further fuel the need for superior photographic quality, encouraging the adoption of advanced mirrorless and DSLR cameras with features like fast autofocus, image stabilization, and high dynamic range. Additionally, professional photographers rely on cameras with versatile lens options and precise control over exposure and composition to meet industry standards in fashion, wildlife, and commercial photography.

Video recording represents another key application in the camera market, gaining traction with the rise of digital content creation, vlogging, and streaming platforms. Mirrorless cameras and DSLRs equipped with 4K or higher resolution video capabilities are increasingly preferred by both amateur and professional videographers.

Features such as continuous autofocus, image stabilization, and slow-motion capture enhance the quality of video content, making these cameras essential tools for filmmakers, online influencers, and media production companies. The growing demand for professional-grade video content in marketing, entertainment, and educational sectors continues to drive the adoption of cameras optimized for high-quality video recording, complementing the photography segment in the overall market.

The Camera Market Report is segmented on the basis of the following:

By Camera Type

- Mirrorless Cameras

- DSLR Cameras

- Compact Digital Cameras

- Other Types

By Application

- Photography

- Video Recording

- Surveillance & Security

- Industrial & Scientific Applications

Global Camera Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is expected to lead the global camera market in 2025, accounting for approximately 40% of total market revenue, driven by a combination of high consumer demand, rapid technological adoption, and strong manufacturing capabilities in the region. Countries such as China, Japan, and South Korea serve as both major production hubs and key consumption markets, supporting the growth of mirrorless, DSLR, and compact cameras.

Rising interest in photography, social media content creation, and professional videography, along with expanding e-commerce and retail networks, further fuel market expansion. Additionally, the growing use of cameras in surveillance, industrial applications, and scientific research across the region reinforces Asia Pacific’s dominant position in the global market landscape.

Region with significant growth

The Middle East and Africa (MEA) region is emerging as a high-growth market for cameras, driven by growing adoption of digital imaging technologies in both consumer and professional segments. Rising interest in social media content creation, travel photography, and videography among younger populations is boosting demand for mirrorless and DSLR cameras.

Additionally, investments in surveillance infrastructure, smart city projects, and industrial imaging applications are contributing to market expansion. Growing disposable incomes, improving e-commerce penetration, and the gradual rise of professional photography and media production industries are expected to position MEA as a region with significant growth potential in the global camera market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Camera Market: Competitive Landscape

The global camera market is highly competitive, dominated by established players such as Canon, Sony, Nikon, and Fujifilm, alongside specialized brands like DJI, GoPro, and Blackmagic Design. Companies compete through continuous innovation in sensor technology, lens performance, image stabilization, and connectivity features to cater to both professional photographers and consumer content creators.

Strategic partnerships, product launches, and expansion into emerging markets are common strategies to enhance market presence. Additionally, the rise of mirrorless and hybrid camera systems has intensified competition, pushing manufacturers to differentiate through AI-enabled features, video capabilities, and integration with social media and cloud platforms, creating a dynamic and rapidly evolving market landscape.

Some of the prominent players in the global camera market are:

- Canon Inc.

- Sony Group Corporation

- Nikon Corporation

- Fujifilm Holdings Corporation

- Panasonic Holdings Corporation

- OM SYSTEM / Olympus Corporation

- Leica Camera AG

- Hasselblad

- Ricoh Imaging Company, Ltd.

- Sigma Corporation

- Zeiss Group

- DJI Innovations

- GoPro, Inc.

- Blackmagic Design

- Arri AG

- Hikvision Digital Technology Co., Ltd.

- Dahua Technology Co., Ltd.

- Axis Communications AB

- Bosch Security Systems

- Honeywell International Inc.

- Other Key Players

Global Camera Market: Recent Developments

- May 2025: Glass Imaging raised USD 20 million in a funding round to advance AI-powered camera technologies. The investment aims to accelerate the development of their imaging solutions, enhancing capabilities in various applications.

- May 2025: Spot AI introduced its first Video AI Agents for the physical world, marking a significant milestone in bringing agentic AI capabilities from the digital to the physical world. The company also announced nearing USD 100 million in funding to date, supporting its expansion and innovation in AI camera systems.

- May 2025: Axelera AI secured €61.6 million ($66.7 million) in funding to support its AI hardware acceleration technology. The investment will aid in the development of purpose-built AI chiplets, enhancing performance in imaging and other applications.

- September 2024: Canon unveiled the EOS C50, a compact cinema camera featuring a 32MP full-frame sensor and Open Gate recording capability. Weighing under 700g, it positions itself as a lightweight alternative to the Sony FX3, catering to content creators and filmmakers seeking portability without compromising on image quality.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 8.2 Bn |

| Forecast Value (2034) |

USD 12.5 Bn |

| CAGR (2025–2034) |

4.8% |

| The US Market Size (2025) |

USD 2.1 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Camera Type (Mirrorless Cameras, DSLR Cameras, Compact Digital Cameras, Other Types), and By Application (Photography, Video Recording, Surveillance & Security, Industrial & Scientific Applications) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Canon Inc., Sony Group Corporation, Nikon Corporation, Fujifilm Holdings Corporation, Panasonic Holdings Corporation, OM SYSTEM / Olympus Corporation, Leica Camera AG, Hasselblad, Ricoh Imaging Company, Ltd., Sigma Corporation, Zeiss Group, DJI Innovations, GoPro, Inc., Blackmagic Design, Arri AG, Hikvision Digital Technology Co., Ltd., Dahua Technology Co., and Others |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The global Camera market size is estimated to be worth USD 8.2 billion in 2025 and is expected to reach USD 12.5 billion by the end of 2034.

The US Camera market is projected to be valued at USD 2.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 3.1 billion in 2034 at a CAGR of 4.5%.

Asia Pacific is expected to have the largest market share in the global Camera market, with a share of about 40.0% in 2025.

Some of the major key players in the global Camera market are Canon Inc., Sony Group Corporation, Nikon Corporation, Fujifilm Holdings Corporation, Panasonic Holdings Corporation, OM SYSTEM / Olympus Corporation, Leica Camera AG, Hasselblad, Ricoh Imaging Company, Ltd., Sigma Corporation, Zeiss Group, DJI Innovations, GoPro, Inc., Blackmagic Design, Arri AG, Hikvision Digital Technology Co., Ltd., Dahua Technology Co., and Others.

What is the growth rate of the global Camera market?