Market Overview

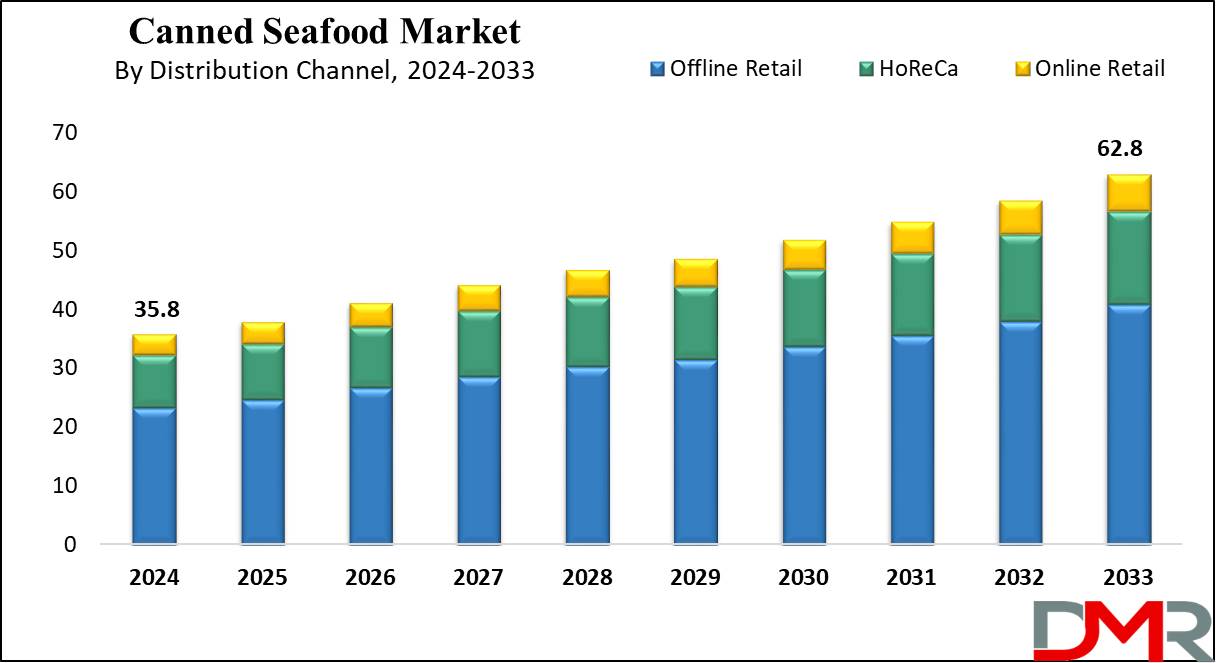

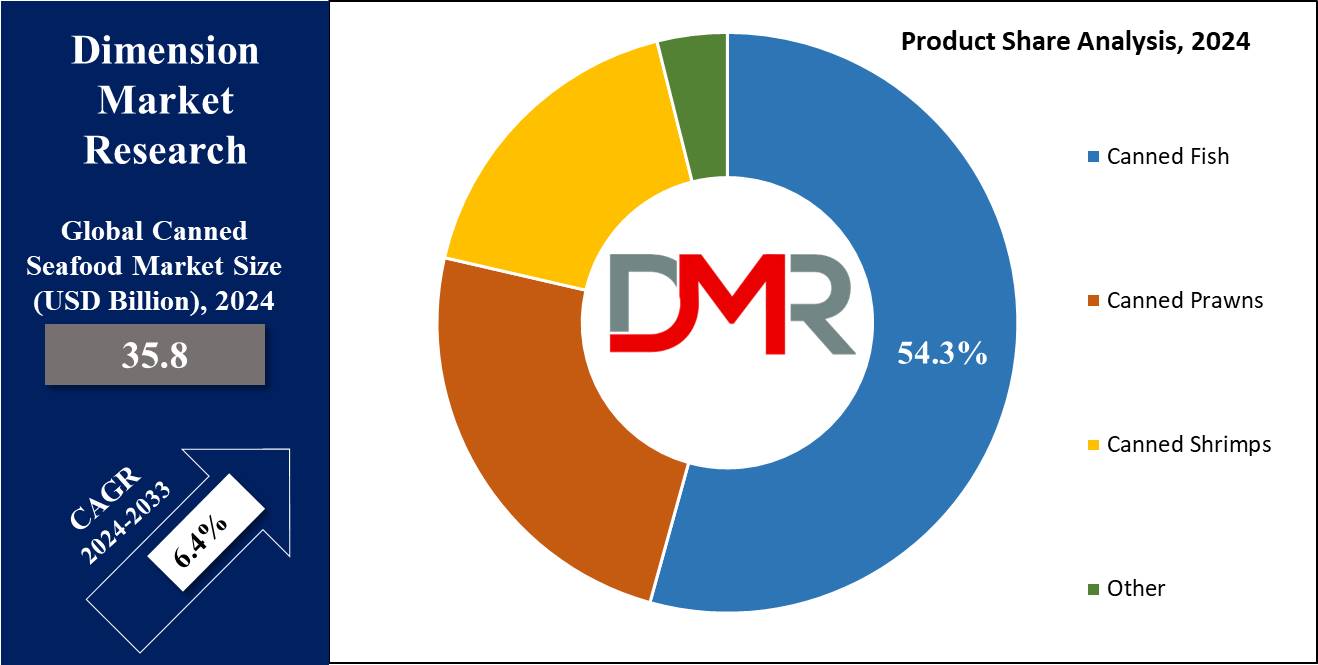

The Global Canned Seafood Market is expected to reach a market value of USD 35.8 billion in 2024 which is further projected to reach a value of USD 62.8 billion at a 6.4% CAGR for the forecasted period of 2024 to 2033.

The global canned seafood marketplace encompasses the manufacturing, distribution, and intake of numerous seafood products that might be preserved through canning strategies. This market is pushed through several elements, including increasing consumer need for convenient and long-lasting meal options, a trend also seen in the broader Frozen Food Market, developing cognizance of the fitness benefits related to seafood intake, and technological advancements in packaging and renovation techniques. Canned seafood gives clients a convenient way to incorporate seafood into their diets, providing a shelf-strong alternative that retains fresh seafood's dietary price and taste.

Geographically, the market is unfolding across regions with coastal is readily available for coastal access, in which seafood is simply available for processing and canning. Major players in the industry consist of massive multinational agencies and smaller, specialized manufacturers, each offering several canned seafood products together with tuna, salmon, sardines, and shellfish. This merchandise is disbursed through numerous channels consisting of supermarkets, hypermarkets, comfort stores, Online Retail, and food carrier outlets.

Additionally, there has been a trend towards sustainability and accountable sourcing within the canned seafood market, with customers showing a growing interest in products licensed as sustainable and ethically sourced. Additionally, innovation in product services, together with flavored and price-delivered canned seafood products, is similarly driving the growth of this market. Despite demanding situations together with fluctuating seafood costs and regulatory constraints, the global canned seafood market is predicted to see an increase in the client’s demand that are seeking handy, nutritious, and environmentally aware food alternatives.

Key Takeaways

- Market Value: The global canned seafood market is projected to reach a market value of USD 37.9 billion in 2025, in comparison to USD 62.8 billion in 2033 at a CAGR of 6.4%.

- Market Definition: Various kinds of living creatures that are obtained from the sea like fish, shellfish, and others are referred to as seafood and when they are preserved through the canning process offering a convenient and long-lasting food option for consumers is known as canned seafood.

- Product Segment Analysis: Canned Fish are expected to exert their dominance in this segment with the market value of 54.3% by the end of 2024.

- Distribution Channel Analysis: The offline retail distribution channel is projected to command this market with a 64.9% market share in 2024.

- Growth Factors: Rising need for easy-to-prepare Convenience Foods, coupled with rising awarness about health advantages and improvements in Food Packaging Market, drive the growth of the global canned seafood market.

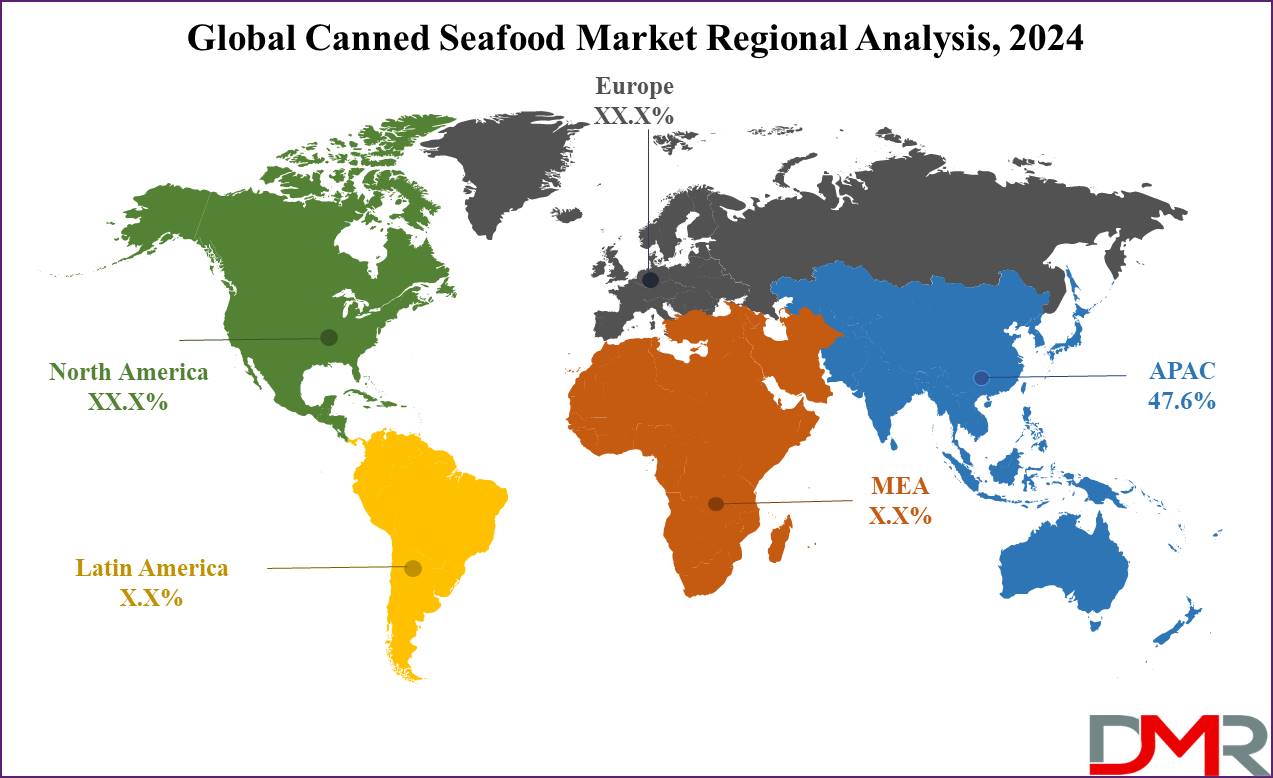

- Regional Analysis: Asia Pacific is predicted to dominate the global canned seafood market with 47.6% of market share in 2024.

Use Cases

- Emergency Circumstances: In an emergency like natural disasters or man-made conditions where the food is not easily accessible, canned food serves as a reliable source of sustenance during emergencies by offering non-perishable and reliable food options.

- Convenience: Canned food serves an ideal role in instant recipes as it provides a convenient option to consumers who don’t have much time for cooking and want a hassle-free source of protein.

- Versatility in Cooking: Canned seafood is extensively used in culinary cooking where it adds depth of flavor to various dishes, from pasta to salads.

- Long-Term Storage: Canned seafood can be stocked up in pantries, ensuring a readily available protein source for future meals as they have a long shelf life.

- Healthy Eating: Canned seafood rich in critical vitamins like omega-3 fatty acids, which promotes heart health and supports balanced diets, contributing to overall well-being.

Market Dynamic

The global canned seafood marketplace is encouraged with the aid of a large number of dynamic factors that shape its growth trajectory. To begin with, the rise in the number of customers who often buy ready-to-cook meals has consequently led to an increased demand for canned seafood amongst consumers. This trend is attracting particular attention in the urban centers where the hectic lifestyle and the time constraints of the people determine the demand for short-term solutions. Also, enhancing awareness of health benefits linked with seafood being high protein and omega-3 content material drives market growth faster.

Moreover, advancements in canning technology and packaging techniques have improved the shelf life of canned seafood products, attractive to a broader consumer base. However, the market isn't without its challenges. Fluctuations in raw material expenses, stringent regulations governing seafood harvesting and processing, and worries regarding sustainability and moral sourcing pose great restraints for the key market players.

In addition, there were innovations in canning technology and improved packaging techniques that have been increasing the shelf life of canned seafood products, good for broader consumer base. Yet, the market isn’t free of its drawbacks either. The challenges of variable raw materials prices, norms pertaining to seafood harvesting and processing that are being imposed forcefully, and also the doubts on longevity as well as moral sourcing are receiving the greatest impediment for key market players. The industry also relies on robust

Food Safety Testing Market protocols to ensure product quality and consumer trust.

Research Scope and Analysis

By Product

Canned fish like tuna, salmon and sardines are projected to dominate the global canned seafood market in term of products with 54.3% of market share in 2024. The canned fish dominate the product segment due to the wide variety of use and popularity of sea fishes like tuna and sardines. In the context of canned fish tuna hold around 40.3% of the total market share due to its meaty texture, mild flavor and wide application in various type of traditional and authentic cuisines globally which make it a one of common product in households and restaurants. Another reason that play a major role in the popularity of tuna in this segment is its extensive nutrient value as it is rich in protein and omega-3-fatty acid.

Sardines claim the second position in context the canned fish because of their specific taste, affordability, and dietary benefits. Sardines are preferred for their sturdy taste and oily texture, which pairs well with numerous dishes, from salads to pasta sauces. Additionally, sardines are valued for its high content of omega-three fatty acids, calcium, and nutrition D, making them a nutrient-dense choice for fitness-aware purchasers.

Furthermore, the global attraction of tuna and sardines contributes to their dominance within the canned fish segment. They are ate up throughout numerous areas and cultures, transcending culinary boundaries. As a end result, producers recognition on producing a extensive range of tuna and sardine products, inclusive of one-of-a-kind flavor profiles and packaging alternatives, to cater to diverse client choices. Overall, the long-lasting recognition and sizeable intake of tuna and sardines solidify their positions because the main alternatives inside the canned fish segment.

By Distribution Channel

Offline retail distribution channels are projected to dominate this segment in the global canned seafood market with 64.9% of market share in 2024. Offline retail distribution channel dominates the distribution of canned seafood due to several factors. Firstly, hypermarkets and supermarkets provide a one-stop purchasing enjoy, presenting a extensive variety of canned seafood products along different grocery products, attracting consumers looking for convenience and variety.

These stores also advantage from their ability to provide bulk purchases at cheap prices, attractive to value-conscious buyers. Convenience stores, independent grocery shops, and distinctiveness shops play niche roles, often catering to specific purchaser alternatives or imparting localized products, but they lack the considerable reach and sources of hypermarkets and supermarkets.

Additionally, offline outlets have established consider and credibility among consumers, assuring them of the exceptional and safety of canned seafood products. While online retail is developing, offline channels nevertheless dominate due to their bodily presence, high reputation, and capacity to offer a tactile shopping enjoy, factors that continue to resonate with many clients in spite of the convenience of online shopping.

The Canned Seafood Market Report is segmented on the basis of the following

By Product

- Canned Fish

- Tuna

- Salmon

- Sardines

- Mackerel

- Other

- Canned Prawns

- Canned Shrimps

- Other

By Distribution Channel

- Offline Retail

- Hypermarket/Supermarkets

- Convenience Stores

- Independent Grocery Stores

- Specialty Stores

- HoReCa

- Online Retail

Regional Analysis

Asia Pacific is expected to dominate the global canned seafood market with

47.6% of market share in 2024 and is further projected to show the subsequent growth in the upcoming period as well. Asia Pacific dominates the canned seafood market because of several key factors. Firstly, the vicinity boasts abundant marine assets, inclusive of diverse fish species and seafood, making it a first-rate hub for seafood production and processing. Countries like Thailand, China, and Indonesia are a number of the world's main manufacturers of canned seafood, profiting from their right of entry to rich fishing grounds and superior processing facilities.

Additionally, the cultural significance of seafood in many Asian cuisines drives excessive intake which further solidify their market position. Seafood, inclusive of canned types, is a staple in diets across Asia Pacific, contributing to sustained demand and market dominance. Furthermore, rapid urbanization and growing disposable incomes in international locations like China and India have caused extended patron spending on convenient meals options like canned seafood, further driving marketplace growth within the region.

On the opposite hand, the Middle East Africa region suggests the highest Compound Annual Growth Rate (CAGR) inside the canned seafood marketplace because of numerous emerging trends. Firstly, increasing cognizance of the health advantages related to seafood intake is driving demand for canned seafood products inside this region. As consumers are becoming extra health-conscious, they are seeking handy and nutritious meals alternatives, propelling the growth of the canned seafood market.

Additionally, enhancing economic situations and urbanization is major factors that are responsible for the expanding population which fuels the extra demand for processed and convenience foods like canned seafood. Moreover, developing tourism and worldwide delicacies traits in the Middle East Africa place also are contributing to expanded consumption of canned seafood, similarly fueling market increase and driving the growth of this market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global canned fish retailing market is very dynamic and globally competitive as it is comprised of various key players trying their best to widen their market share. The three big canned seafood producers such as the Thai Union Group, Bumble Bee Foods and Crown Prince Inc dominates the market due to their efficient product portfolios, brand recognition and distribution networks. Also, these businesses are continuously in pursuit of newer product offerings, where sustainable, practical, and taste are the main elements which shape consumers' changing preferences.

Moreover, mergers, acquisitions, and strategic partnerships are among the major strategic tools that market leaders and other players use to utilize the advantages of the market position they hold and increase their presence in the regions they are active in. With respect to regional players, they themselves are as big as the rest of the sellers, in the sense that they focus on the areas that are closer to them and to their customers. Beyond that, the production of the canned seafood thrives in the environment of excessive opposition force, as companies find themselves into the battle to rise above the competitors and acquire the bigger share of the market.

Some of the prominent players in the Global Canned Seafood Market are

- StarKist Co.

- Nippon Suisan Kaisha Ltd

- Maruha Nichiro Corporation

- Icicle Seafoods Inc.

- LDH (La Doria) Ltd

- Wild Planet Foods

- Thai Union Frozen Products

- American Tuna Inc.

- Universal Canning, Inc.

- Tri Marine Group

- Trident Seafoods Corporation

- Connors Bros. Ltd.

- Other Key Players

Recent Development

- In January 2024, Atalanta Corporation, a New Jersey-based grocery company, acquires J.A. Kirsch, a canned seafood importer, expanding its specialty food brand business in the U.S. seafood market.

- In January 2024, Sea Harvest, a South African whitefish company, acquires two seafood subsidiaries, enhancing its product range with fishmeal, fish oil, canned fish, and abalone.

- In November 2023, Baja Aqua-Farms, a Mexican Bluefin tuna company, received an undisclosed investment from a consortium including Continental Grain Company and others for expansion and sustainability.

- In September 2023, Bolton Group acquired Wild Planet Foods in the US, enhancing its position in sustainable seafood. Both share values and aim for growth.

- In September 2023, Brazil's Robinson Crusoe, Brazil's third largest seafood canner, aims to challenge market leaders Gomes da Costa and Camil by increasing production and launching new products.

- In June 2023, Bluu Seafood, a German start-up producing cultivated fish, secured USD 17.43 million in funding that plans to launch in Singapore by 2024, focusing on hybrid products. Regulatory approvals sought for US distribution.

- In October 2022, Scout, a canned seafood startup, secured USD 4.0 million in seed funding for their market expansion which is planned to be implemented after a major retail launch in 2023 after gaining B Corp certification.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 35.8 Bn |

| Forecast Value (2033) |

USD 62.8 Bn |

| CAGR (2023-2032) |

6.4% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Canned Fish, Canned Prawns, Canned Shrimps, and Other), By Distribution Channel (Offline Retail, HoReCa, and Online Retail) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

StarKist Co., Nippon Suisan Kaisha Ltd, Maruha Nichiro Corporation, Icicle Seafoods Inc., LDH (La Doria) Ltd, Wild Planet Foods, Thai Union Frozen Products, American Tuna Inc., Universal Canning Inc., Tri Marine Group, Trident Seafoods Corporation, Connors Bros. Ltd., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Canned Seafood Market size is estimated to have a value of USD 35.8 billion in 2024 and is expected to reach USD 62.8 billion by the end of 2033.

Asia Pacific is projected to be the largest market share for the Global Canned Seafood Market with a share of about 47.6% in 2024.

Some of the major key players in the Global Canned Seafood Market are StarKist Co., Nippon Suisan Kaisha Ltd, Maruha Nichiro Corporation, Icicle Seafoods Inc., and many others.

The market is growing at a CAGR of 6.4 percent over the forecasted period.