Carbon dioxide is a colorless & odorless gas that plays a role in various natural processes, including volcanic activities, human respiration, & plant respiration. Even microbes utilize carbon dioxide for their energy needs. As a result, carbon dioxide is a fundamental element for sustaining life. It naturally exists in the atmosphere, but its concentration has been increasing due to processes like fossil fuel combustion & deforestation, which contributes significantly to greenhouse gas emissions.

The harmful effects of carbon dioxide, like climate change, global warming, & shifting weather patterns, can impact nearly everyone. To address these issues, several countries signed the Kyoto Protocol & introduced the concept of clean development mechanisms utilizing carbon credits. Despite its negative effects, the utility of carbon dioxide cannot be disregarded. Consequently, the concept of carbon capture & utilization has emerged, focusing on harnessing and utilizing the captured carbon for sustainable energy solutions.

In the coming years, the United States is expected to be one of the leading global markets for CO2, with a projected annual revenue growth rate of 5.1%. According to the U.S. Energy Information Administration, dry natural gas production in the country surpassed 1.29 trillion cubic feet in 2022, exceeding the previous year's levels.

This growth can be attributed to increased natural gas prices and a rising demand, particularly driven by exports. Additionally, the expanding

Energy Drinks also contributes to CO2 demand, as carbonation is a key component in beverage production, further supporting the need for industrial CO2 supplies. This increasing demand also strengthens its linkage to the broader industrial gases market, which includes oxygen, nitrogen, and other gases critical for multiple industries.

Market Dynamic

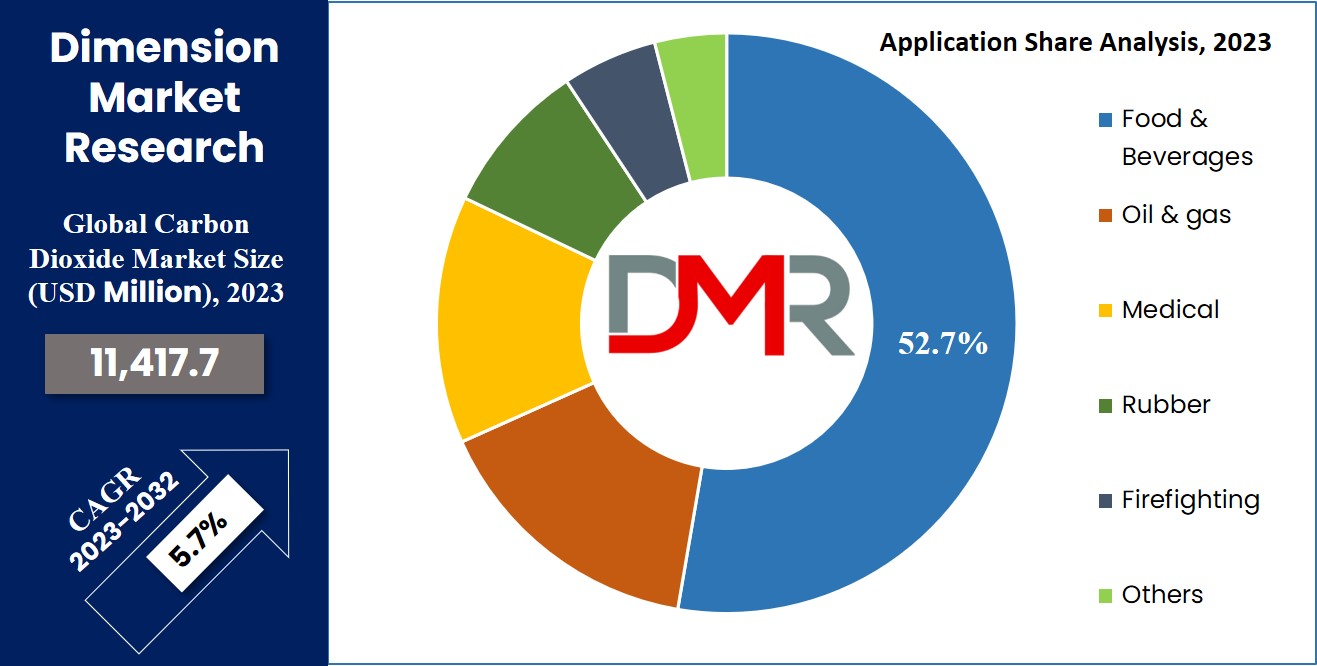

The global significance of CO2 utilization in the medical field is growing steadily. CO2 gas finds extensive application as an insufflation agent in various surgical procedures. It is used in various places such as in the food and beverages industries, oil and gas industries, medical, rubber, firefighting, etc. With the rising demand for Carbon dioxide in Enhanced Oil recovery, the market of carbon dioxide is expanding with the U.S. having the maximum share in the market.

Technology such as CCUS (Carbon capture utilization & storage) has the capacity to reduce emissions in diverse industries like power generation, iron manufacturing, refining, petrochemicals, steel production, & cement production. The technologies for carbon sequestration consist of capture, transport, storage, & utilization. And these technologies are further driving the market growth. However, the major concern related to the transportation of carbon dioxide has arisen as the pipelines used for it require more maintenance cost & fear of leakage is also something that hinders the market growth.

Research Scope and Analysis

By Source

Ethyl alcohol is the most used source as it’s easily available. Carbon dioxide is the byproduct of ethyl alcohol and in this way, it’s captured and utilized. Alcoholic fermentation of sugars using fungi produces ethyl alcohol and carbon dioxide.

Carbon dioxide production is also based on the process of reforming hydrocarbons such as natural ones that are produced by the oil and gas sector. And in this process, carbon dioxide is the main by-product. Combustion of carbon-based fuels such as methane, or natural gas, petroleum products such as gasoline, diesel, kerosene, etc. carbon dioxide is released during combustion and can be easily stored and utilized. Iron production from iron oxide also releases carbon dioxide as a major product.

By Application

By application, the Food & Beverage segment held the largest market share in 2023. Carbon dioxide is widely used as an acidity regulator in the food sector, playing a crucial role in producing carbonated soft drinks and soda water. It is also involved in bakery production and vacuum packaging to prevent food spoilage. Additionally, CO₂ finds application in the

Food Coating, where it is used in cryogenic freezing for coating processes, helping to preserve texture and quality in frozen snacks and ready-to-eat products. Beyond food applications, carbon dioxide is increasingly utilized in the Enhanced Oil Recovery (EOR) process.

After primary extraction, CO₂ is injected into reservoirs to create pressure and improve fuel recovery—often preferred over water for its efficiency. Additionally, the

Oil Spill Management benefits from CO₂ applications, as advanced technologies leverage carbon dioxide for environmental remediation and containment strategies in case of offshore spills, further diversifying its industrial demand.

carbon dioxide used as an insufflation gas for surgeries such as laparoscopy, endoscopy, & arthroscopy, to provide stability to body cavities for the ease of surgery is driving the market growth. The rubber sector utilizes SPE with carbon dioxide to get the benefit of a purity factor & a very short processing time. Whereas in the context of firefighting, carbon dioxide helps cover the fire & separates oxygen from fuel, and hence the fire gets controlled. Carbon dioxide is heavier than oxygen & therefore it plays an important role in fire extinguishers. Therefore, its usage has increased in the recent past.

The Global Carbon Dioxide Market Report is segmented on the basis of the following:

By Source

- Ethyl Alcohol

- Hydrogen

- Carbon Based fuels

- Iron production

- Others

By Application

- Food & Beverages

- Oil & Gas

- Medical

- Rubber

- Firefighting

- Others

Regional analysis

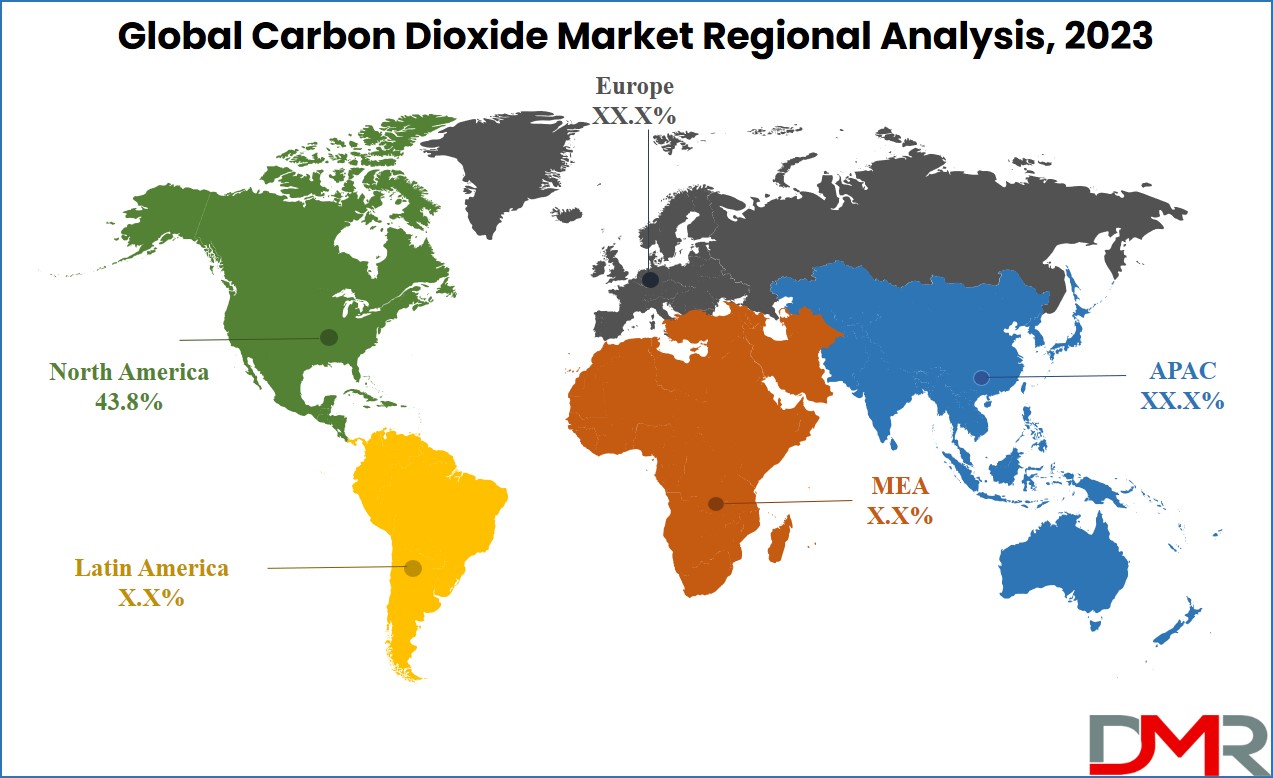

North America dominates the market with a maximum share of 43.8% in 2023. With rapid industrialization & healthcare infrastructure development, demand for carbon dioxide is also rising as it finds its usage in medical, industrial, & various places.

After North America, the second largest share goes to the Asia Pacific region. With a growing population & rising urbanization, many industries are flourishing and in return increasing the demand for carbon dioxide which further boosts this market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

There are various players involved in this market. Matheson Tri-Gas, Inc. and Linde plc, among other leading market players, have embraced sustainable sourcing strategies by taking into account the present regulatory landscape and future prospects. Additionally, prominent corporations are implementing expansion tactics to enhance their market share.

In February 2022, Dan-Unity CO2 and Aker Carbon Capture reached an agreement to explore the transportation of carbon dioxide through maritime channels. Aker Carbon Capture is actively working on a comprehensive value chain for carbon capture, utilization, and storage (CCUS), which includes the transportation of CO2 by sea.

Some of the prominent players in the global carbon dioxide market are:

- Gulf Cryo

- Messer Group

- India Glycols Limited

- SOL Spa

- Sicgil India Limited

- Air Liquide

- Acail gas

- Linda AG

- Taiyo Nippon Sanso Corporation

- Greco Gas Inc.

- Air Products and Chemicals, Inc.

- Other Key Players

Recent Devleopments