Market Overview

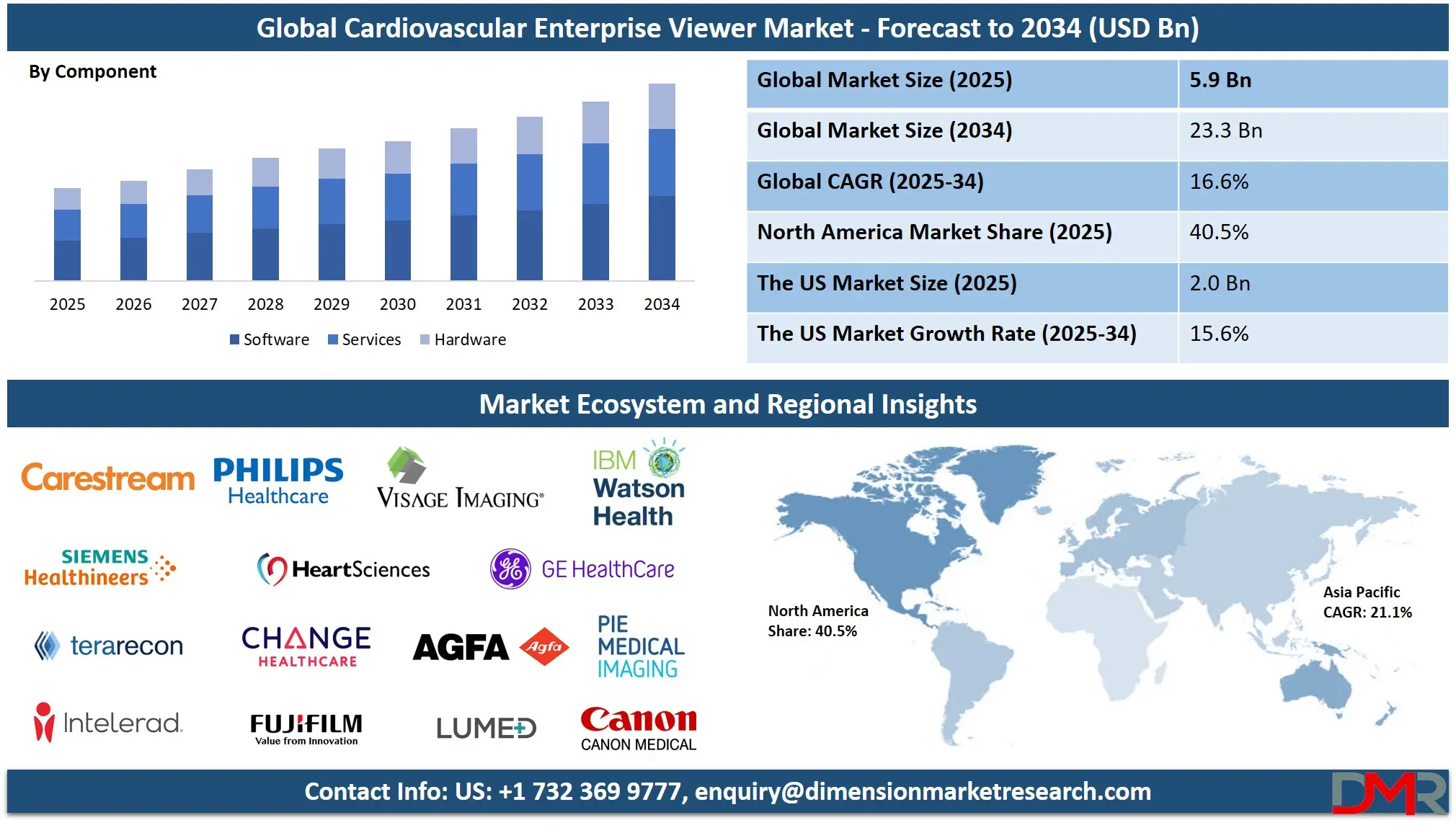

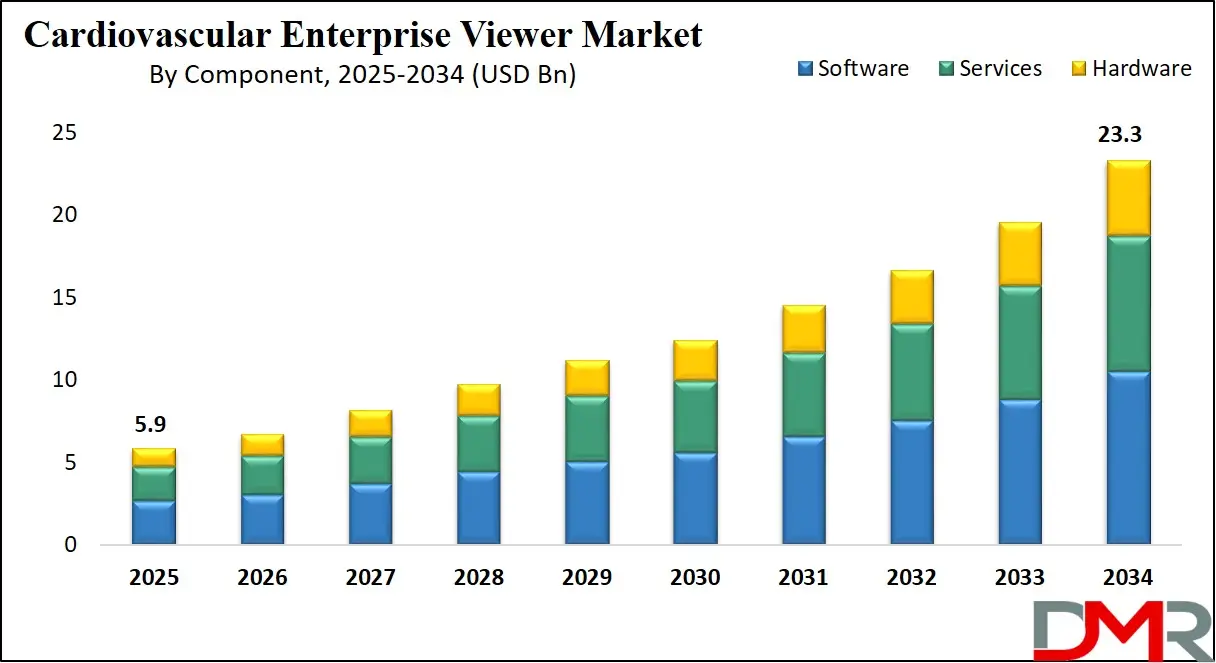

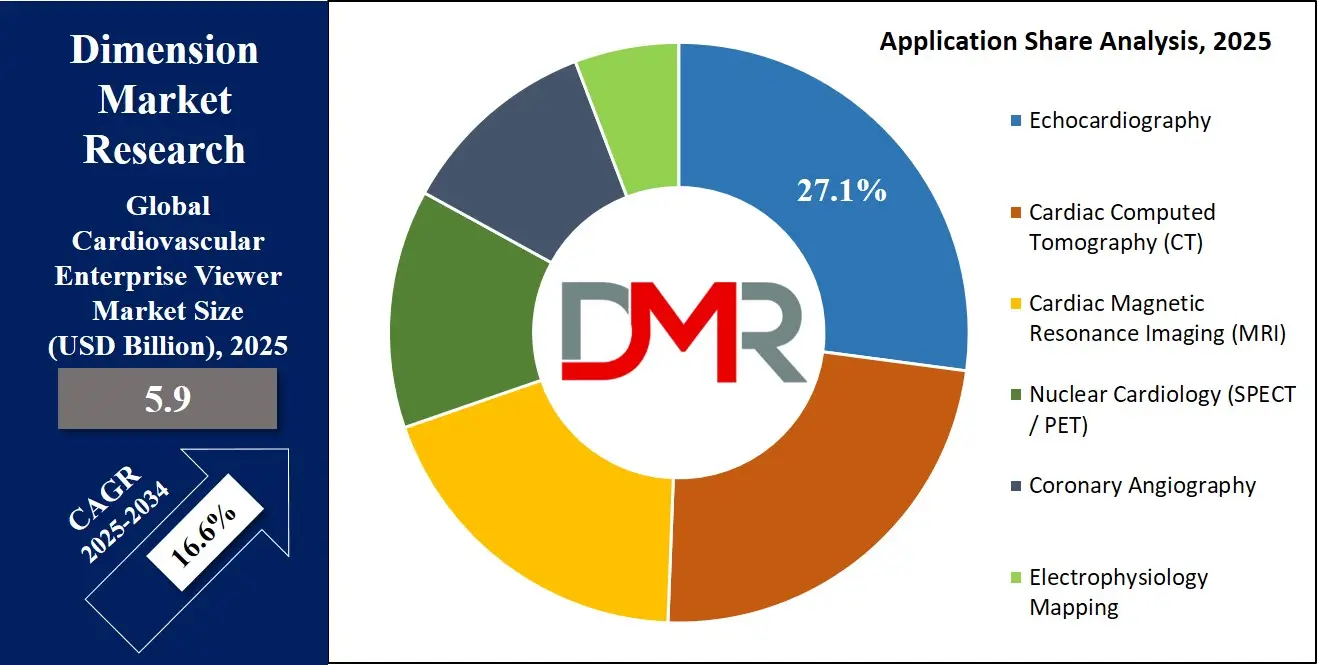

The Global Cardiovascular Enterprise Viewer Market is anticipated to reach USD 5.9 billion in 2025, driven by the escalating global burden of cardiovascular diseases (CVDs), which necessitates efficient diagnostic workflows. The market is expected to expand at a compound annual growth rate (CAGR) of 16.6% from 2025 to 2034, reaching a projected value of USD 23.3 billion by 2034.

Growth is primarily fueled by the critical shift from department-specific Picture Archiving and Communication Systems (PACS) to hospital-wide, vendor-neutral enterprise imaging strategies. This paradigm shift is essential for managing the deluge of complex data from multi-modality cardiac imaging, including echocardiography, cardiac CT, MRI, and nuclear studies.

The rising adoption of cloud-native platforms offers unprecedented scalability and facilitates telecardiology, while the integration of AI-driven diagnostic and reporting tools is transforming viewers from passive display systems into active diagnostic assistants. Furthermore, expanding applications in structural heart programs, electrophysiology, and heart failure clinics, coupled with stringent healthcare interoperability mandates, are creating a fertile ground for accelerated market expansion globally.

The global landscape for cardiovascular enterprise viewers is undergoing a profound evolution, moving beyond simple image retrieval into the core of collaborative, data-driven clinical decision support. A dominant trend is the consolidation of disparate imaging silos into unified, vendor-neutral archives (VNAs) that enable seamless access and fusion of multi-modality cardiac images from a single, intuitive interface.

This consolidation is crucial for comprehensive patient assessment, allowing a cardiologist to correlate wall motion on an echo with perfusion on a nuclear study and coronary anatomy on a CTA, thereby significantly enhancing diagnostic confidence.Concurrently, the technology is rapidly advancing into the realm of AI-powered analytics, where embedded algorithms provide automated chamber quantification, coronary plaque analysis, and myocardial strain mapping.

While some of these advanced AI applications remain in the validation and regulatory phase, they represent the future of precision diagnostics. The deep integration of cardiovascular viewers with Electronic Health Records (EHRs) and Hospital Information Systems (HIS) is another critical development, creating a unified clinical workspace that streamlines the entire patient care pathway from image acquisition to final report and treatment planning.

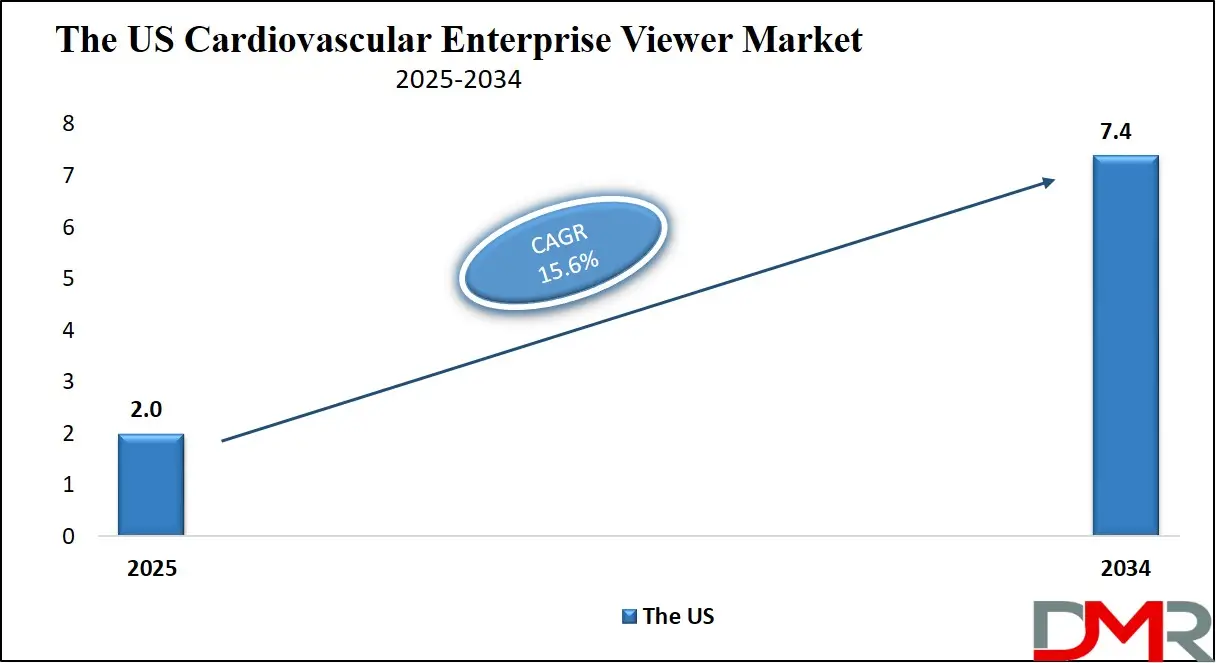

The US Cardiovascular Enterprise Viewer Market

The US Cardiovascular Enterprise Viewer Market is projected to reach USD 2.0 billion in 2025 at a compound annual growth rate of 15.6% over its forecast period.

The United States maintains a leadership position in the cardiovascular IT landscape, a status fortified by substantial federal investment and a robust regulatory framework. Agencies like the National Institutes of Health (NIH) actively foster innovation through initiatives that support the development of advanced imaging biomarkers and data standards for cardiovascular research.

The U.S. Food and Drug Administration has pioneered specific regulatory pathways for software as a medical device (SaMD), including AI-based image analysis tools, providing clarity for developers and having already cleared several such applications for cardiac imaging. This proactive stance from federal bodies creates a stable environment for technological advancement and commercial investment in the sector. The presence of world-leading academic and medical institutions, including the Cleveland Clinic and the Mayo Clinic, further drives clinical adoption through cutting-edge research and the implementation of enterprise-wide imaging platforms that directly improve diagnostic throughput and patient care.

A significant demographic advantage for the U.S. market is its large and aging population, a trend documented by the U.S. Census Bureau. This demographic shift predicts a substantial increase in the prevalence of cardiovascular conditions such as coronary artery disease, heart failure, and arrhythmias, which in turn drives demand for advanced diagnostic imaging and integrated review solutions. The need for consolidated platforms that can handle echocardiography, nuclear cardiology, and advanced cardiac CT/MRI is rising in direct correlation. Furthermore, the high healthcare expenditure per capita, as reported by the Centers for Medicare & Medicaid Services (CMS), indicates a system capable of adopting advanced IT solutions.

The Europe Cardiovascular Enterprise Viewer Market

The Europe Cardiovascular Enterprise Viewer Market is estimated to be valued at USD 980 million in 2025 and is further anticipated to reach USD 3.8 billion by 2034 at a CAGR of 14.2%.

The European cardiovascular enterprise viewer ecosystem is characterized by strong collaboration between public health systems and industry, guided by a comprehensive regulatory framework. The European Medicines Agency (EMA) and the new European Union Medical Device Regulation (MDR) provide a stringent set of requirements for the certification and clinical use of diagnostic software, ensuring high standards of safety and performance across member states.

This is supported by significant funding from Horizon Europe, the EU's key research and innovation program, which has allocated resources to projects focused on personalized medicine and integrated care for cardiovascular diseases. National health services, such as the NHS in the United Kingdom, are exploring the cost-benefit analysis of deploying enterprise viewers for regional image sharing, which is critical for guiding widespread adoption and reimbursement policies.

Europe's demographic structure, as analyzed by Eurostat, presents a clear driver for the cardiovascular IT sector. The region has one of the world's most rapidly aging populations, leading to a higher incidence of age-related cardiovascular diseases. This creates a pressing need for efficient, interoperable diagnostic platforms that can facilitate timely and accurate diagnosis across care settings.

The strong public healthcare systems prevalent across the continent are increasingly focused on value-based care, seeking technologies that can reduce duplicate testing and enable collaborative care pathways. The presence of a highly skilled IT workforce and a dense network of specialized cardiac centers facilitates the development and application of complex enterprise imaging solutions, from multi-modality review in Germany to regional telecardiology networks in France, positioning Europe as a critical and advanced market for cardiovascular IT innovation.

The Japan Cardiovascular Enterprise Viewer Market

The Japan Cardiovascular Enterprise Viewer Market is projected to be valued at USD 420 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 1.85 billion in 2034 at a CAGR of 16.0%.

Japan's foray into cardiovascular enterprise imaging is heavily influenced by its status as the world's most aged society, a demographic reality extensively documented by the Japanese Ministry of Health, Labour and Welfare. This has created an urgent and growing demand for efficient diagnostic solutions for heart disease, particularly in non-invasive imaging and remote monitoring. In response, the Japanese government has strategically prioritized digital health and telemedicine through national initiatives, with the Japan Agency for Medical Research and Development (AMED) funding projects that bridge the gap between academic research and clinical application. The Pharmaceuticals and Medical Devices Agency (PMDA), Japan's regulatory body, has been working to establish clear approval pathways for AI-based diagnostic software and integrated clinical viewing platforms, providing a structured, though rigorous, environment for developers to bring new products to market, ensuring they meet the highest safety standards.

The demographic advantage for Japan lies in its technologically proficient society and its urgent need to maintain the quality of life for its senior citizens. This drives innovation in creating seamless, user-friendly platforms that cater to the workflow needs of a busy cardiology practice. The National Institute of Advanced Industrial Science and Technology (AIST) is actively involved in research on data interoperability and secure health information exchange suitable for these applications. Furthermore, the high density of advanced medical institutions in urban centers like Tokyo and Osaka serves as an early adopter and testing ground for new enterprise viewer applications. This combination of demographic pressure, strong governmental support for digital health, and a culture of technological precision positions Japan as a unique and highly advanced market focused on leveraging enterprise viewers to address the challenges of a super-aged society.

Global Cardiovascular Enterprise Viewer Market: Key Takeaways

- Global Market Size Insights: The Global Cardiovascular Enterprise Viewer Market size is estimated to have a value of USD 5.9 billion in 2025 and is expected to reach USD 23.3 billion by the end of 2034, reflecting the critical need to manage complex cardiac data across expanding health networks.

- The Global Market Growth Rate: The market is growing at a CAGR of 16.6 percent over the forecasted period, significantly outpacing many other healthcare IT segments, driven by digitization and the value of integrated diagnostics.

- The US Market Size Insights: The US Cardiovascular Enterprise Viewer Market is projected to be valued at USD 2.0 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 7.4 billion in 2034 at a CAGR of 15.6%, maintaining its position as the single largest national market.

- Regional Insights: North America is expected to have the largest market share in the Global Cardiovascular Enterprise Viewer Market with a share of about 40.5% in 2025, attributed to its advanced healthcare IT infrastructure, high procurement capacity, and early adoption of AI.

- Key Players: Some of the major key players in the Global Medical 3D Printing Market are Philips Healthcare, GE Healthcare, Siemens Healthineers, Change Healthcare (now part of Oracle), Fujifilm Holdings Corporation, Agfa-Gevaert Group, IBM (Watson Health), Terarecon, Inc., Intelerad Medical Systems, and many others.

Global Cardiovascular Enterprise Viewer Market: Use Cases

- Multi-Modality Cardiac Image Review for Structural Heart Disease: In a multi-disciplinary team meeting, interventional cardiologists and cardiac surgeons use an enterprise viewer to fuse 3D transesophageal echo (TEE) data with cardiac CT angiography. This allows for precise pre-procedural planning for transcatheter aortic valve replacement (TAVR), including accurate annular sizing and assessment of access routes, directly impacting device selection and procedural strategy to minimize complications.

- Telecardiology for Regional STEMI Care Networks: A community hospital performing an emergency angiogram on a STEMI patient can instantly share the study via a cloud-based enterprise viewer with an on-call interventional cardiologist at a central tertiary center. The remote specialist can review the angiogram in real-time, assess lesion complexity, and guide the local team on whether to proceed with percutaneous coronary intervention (PCI) or immediately transfer the patient, optimizing time-to-reperfusion and resource allocation across a regional care network.

- Integrated Diagnostics for Heart Failure Management: A cardiologist evaluating a new heart failure patient accesses the enterprise viewer from within the EHR. The platform presents a unified patient folder containing the current echocardiogram (with AI-generated ejection fraction), prior cardiac MRIs for tissue characterization, and relevant chest X-rays. This holistic, integrated view enables a comprehensive assessment of etiology, severity, and previous changes, facilitating a more accurate diagnosis and personalized treatment plan without toggling between multiple disconnected systems.

- AI-Enabled Workflow Triage in a High-Volume Echo Lab: An enterprise viewer equipped with AI algorithms automatically analyzes all incoming echocardiograms. Studies flagged for severely reduced left ventricular function or significant valvular disease are prioritized at the top of the reading worklist. This ensures that patients with critical, time-sensitive findings receive rapid interpretation and intervention, improving patient outcomes and optimizing sonographer and cardiologist workflow by automating routine triage.

- Surgical Planning for Complex Congenital Heart Disease: Pediatric cardiothoracic surgeons use advanced 3D post-processing tools within an enterprise viewer to convert a cardiac CT dataset of an infant with complex congenital heart disease into a patient-specific, physical 3D model (or a detailed virtual model). This tactile or visual representation of the unique cardiac anatomy is invaluable for pre-surgical rehearsal, deciding on the optimal surgical approach, and communicating the procedure with the clinical team and the patient's family.

Global Cardiovascular Enterprise Viewer Market: Stats & Facts

American College of Cardiology (ACC) / National Cardiovascular Data Registry (NCDR)

- The ACC's NCDR, one of the largest clinical quality registries globally, captures data from over 2,500 hospitals, driving the need for standardized data extraction and reporting tools that are increasingly integrated with enterprise viewers for seamless data transfer and quality reporting.

U.S. Food and Drug Administration (FDA)

- The FDA's Digital Health Center of Excellence continues to refine the Pre-Cert (Pre-Certification) Program model, aiming to streamline the regulatory process for SaMD, including the AI components that are becoming integral to enterprise viewers.

- As of late 2023, the FDA had cleared over 50 AI/ML-enabled medical devices for cardiovascular applications, many of which are designed to function within or alongside enterprise viewing platforms.

Centers for Medicare & Medicaid Services (CMS)

- CMS's Merit-Based Incentive Payment System (MIPS) and Promoting Interoperability programs create financial incentives for providers to adopt certified EHR technology and engage in data exchange, indirectly supporting the adoption of interoperable enterprise viewers that can integrate with these systems.

European Society of Cardiology (ESC)

- The ESC's EuroHeart Projects aim to create large-scale, standardized registries across Europe, which will increase the demand for enterprise viewers with robust data mining and export capabilities to contribute to these multinational quality initiatives.

European Union Medical Device Regulation (MDR)

- The MDR's requirement for strict post-market clinical follow-up (PMCF) for medical devices, including diagnostic software, places a premium on enterprise viewers that can facilitate data collection for long-term performance and safety monitoring.

International Organization for Standardization (ISO)

- The adoption of ISO 21298:2023 (Health informatics Functional and structural roles) is gaining traction, providing a standardized framework for describing clinical workflows, which enterprise viewers can use to better model and support cardiology-specific diagnostic pathways.

World Health Organization (WHO)

- The WHO's Global Atlas of Medical Devices reports significant disparities in access to cardiac imaging equipment, highlighting the potential role of cloud-based enterprise viewers in extending the reach of specialist diagnostic expertise to low-resource settings via telecardiology.

Health Level Seven International (HL7) / FHIR

- The widespread adoption of FHIR Release 4 and the development of specific implementation guides for imaging (e.g., FHIR ImagingExchange) are dramatically lowering the barriers for enterprise viewers to achieve deep, standards-based integration with EHRs and population health tools.

Global Cardiovascular Enterprise Viewer Market: Market Dynamic

Driving Factors in the Global Cardiovascular Enterprise Viewer Market

Rising Global Burden of Cardiovascular Diseases and Imaging Volumes

The relentless increase in the global prevalence of CVDs, now the leading cause of death worldwide according to the WHO, is the most powerful driver for this market. This epidemic translates directly into a massive and growing volume of complex cardiac imaging studies. Managing this data deluge with legacy, siloed PACS is inefficient and prone to error. Enterprise viewers are uniquely positioned to address this challenge by providing a unified platform that streamlines the workflow for interpreting everything from routine echocardiograms to advanced cardiac CT and MRI. By enabling faster access, comparison with prior studies, and collaborative review, these platforms significantly improve diagnostic throughput, reduce reporting delays, and enhance overall patient management in the face of rising clinical demand.

Digital Transformation of Healthcare and Interoperability Mandates

The global healthcare industry is in the midst of a fundamental digital transformation, accelerated by government policies and consumer expectations. Legislation like the 21st Century Cures Act in the U.S. and the European Electronic Health Record Exchange Format mandate interoperability and prohibit information blocking. These regulations are compelling healthcare providers to dismantle data silos and adopt systems that can freely exchange information. Vendor-neutral, interoperable enterprise viewers are at the heart of this transformation. They act as the central hub for imaging data, capable of integrating with disparate PACS, VNAs, and EHRs from multiple vendors. This capability is no longer a luxury but a necessity for regulatory compliance, efficient care coordination across different providers, and participating in value-based care models that require a comprehensive view of the patient journey.

Restraints in the Global Cardiovascular Enterprise Viewer Market

High Implementation Costs and IT Infrastructure Integration Challenges

The total cost of ownership for an enterprise cardiovascular viewer can be prohibitive for many organizations, particularly smaller community hospitals and clinics in developing regions. Beyond the initial software licensing or subscription fees, significant investments are required for server hardware (for on-premise deployments), network upgrades to handle large image data transfers, and long-term storage solutions. The most formidable challenge and cost often lies in the complex systems integration work required to connect the new viewer with a hospital's existing patchwork of legacy PACS, EHRs, and hospital information systems. This integration can be technically challenging, time-consuming, and expensive, often requiring specialized IT consultants. This financial barrier forces healthcare administrators to conduct meticulous and protracted cost-benefit analyses, requiring vendors to provide clear evidence of a positive return on investment through demonstrable gains in radiologist productivity, reduced storage costs, or improved clinical outcomes.

Data Security, Privacy, and Cybersecurity Concerns

The very strength of an enterprise viewer the centralization of vast amounts of sensitive patient imaging data also represents its greatest vulnerability. A centralized system becomes a high-value target for cyberattacks, including ransomware and data breaches. The consequences of such an event can be catastrophic, leading to clinical downtime that jeopardizes patient care and significant reputational and financial damage. Furthermore, healthcare organizations must navigate a complex web of data protection regulations, such as HIPAA in the U.S. and the GDPR in Europe, which impose strict requirements on data storage, transmission, and access controls. Ensuring robust, end-to-end security for a platform accessible from various networks and devices is a massive undertaking. The perceived risk and the resource investment required for comprehensive cybersecurity measures can deter adoption, delay procurement processes, or push organizations toward more expensive, but perceivedly more secure, on-premise deployment models.

Opportunities in the Global Cardiovascular Enterprise Viewer Market

Expansion of Telehealth and Remote Reporting Services

The paradigm shift towards telehealth, cemented during the COVID-19 pandemic, has unlocked a massive and sustained opportunity for cloud-based enterprise viewers. These platforms are the technological backbone of modern telecardiology, enabling specialists to securely access, review, and interpret full-fidelity imaging studies from any location with an internet connection. This capability supports a wide range of services, including providing after-hours coverage for hospitals, offering subspecialty second opinions (e.g., in cardiac MRI), and enabling large teleradiology companies to service a distributed network of clients. For health systems, this expands the reach of their specialist expertise to underserved rural areas and allows for more flexible workforce models. For vendors, it creates a recurring revenue stream through SaaS subscriptions and opens new markets in regions with a shortage of on-site cardiologists.

Integration of Advanced AI and Predictive Analytics as a Standard Feature

The integration of sophisticated, FDA-cleared/CE-marked AI algorithms is transitioning from a competitive differentiator to a standard expectation for enterprise viewers. This represents a high-growth frontier. These AI tools are evolving from providing simple automated measurements (e.g., ejection fraction) to offering complex decision support, such as characterizing coronary plaque morphology, predicting the risk of major adverse cardiac events, and flagging rare findings like cardiac amyloidosis. By embedding these AI capabilities directly into the diagnostic workflow, the viewer transforms from a passive display tool into an active diagnostic partner that enhances diagnostic confidence, reduces variability between readers, and uncovers insights that may be missed by the human eye alone. This functionality creates a premium product tier, commands higher pricing, and opens up substantial new revenue streams for vendors through AI module licenses and partnerships with specialized AI developers.

Trends in the Global Cardiovascular Enterprise Viewer Market

Accelerated Shift Towards Cloud-Native and Vendor-Neutral Platforms

The dominant and most impactful trend is the rapid migration from on-premise, modality-specific workstations to cloud-native, vendor-neutral enterprise viewers. Cloud-native architecture, built from the ground up for the cloud, offers unparalleled advantages: it eliminates large upfront capital expenditure in favor of operational subscription fees, provides effortless scalability to handle fluctuating data volumes, and enables seamless, secure access for authorized users across multiple hospital sites or from home. Coupled with a vendor-neutral approach, which liberates imaging data from proprietary silos, this shift empowers health systems to consolidate their entire cardiovascular imaging archive into a single, unified platform. This provides a consistent, efficient viewing experience for all cardiologists and radiologists, regardless of their physical location or the manufacturer of the imaging equipment, fundamentally modernizing the imaging IT infrastructure.

Embedded Advanced Visualization and Quantitative Analysis Tools

There is a clear trend of embedding sophisticated advanced visualization and 3D post-processing capabilities directly into the core enterprise viewer, moving beyond the basic multiplanar reformation (MPR) of traditional PACS. Modern viewers now include features such as automated coronary artery tracking and analysis, myocardial perfusion quantification, 4D flow analysis for cardiac MRI, and volumetric rendering for structural heart planning. The key development is that these powerful tools are no longer separate applications requiring specialized training and manual data transfer. They are now an integral part of the primary diagnostic workflow. This integration allows a clinician to move seamlessly from reviewing a 2D ultrasound cine loop to generating a 3D model of the heart for surgical planning within the same application, drastically streamlining the path from image acquisition to final report and clinical decision.

Global Cardiovascular Enterprise Viewer Market: Research Scope and Analysis

By Component Analysis

The Software segment is projected to constitutes the brain of the solution and is projected to be the foundational and dominant component in terms of market revenue. This dominance is driven by the high value of the core application software, which includes the licensing or subscription fees for the viewer itself, advanced visualization modules, and integrated AI analytics. The software's capability to handle multi-modality data, provide a intuitive user interface, ensure diagnostic fidelity, and maintain seamless interoperability with EHRs and other hospital systems represents the primary value proposition for customers. The intense R&D invested in developing, updating, and securing this complex software is directly reflected in its cost and its central role in the market's financial structure.

However, the Services segment is not only the fastest-growing but is also critically important for long-term customer retention and market expansion. This segment encompasses a wide range of offerings, including initial implementation and systems integration, data migration from legacy PACS, comprehensive user training, ongoing application management and technical support, and managed services for cloud-based deployments. The critical need to ensure these complex platforms are correctly integrated into unique and often chaotic hospital IT environments, are adopted effectively by clinical staff, and remain operational and updated creates a robust and recurring revenue stream for vendors. The success, security, and regulatory compliance of the entire enterprise viewer deployment are intrinsically tied to the quality of these professional and managed services, making this segment both highly profitable and essential for achieving promised clinical and operational outcomes.

By Deployment Mode Analysis

Cloud-Based deployment is anticipated to exhibit the highest growth rate, revolutionizing how healthcare IT is consumed. Its explosive growth is fueled by a lower total cost of ownership (TCO) due to the conversion of large capital expenditures into predictable operational expenses, inherent and effortless scalability to accommodate data growth, and ubiquitous access that is ideal for supporting telecardiology, multi-site health systems, and remote workforces. Hospitals and diagnostic centers are increasingly drawn to the cloud to offload the significant burden and cost of maintaining on-premise server infrastructure, applying security patches, and ensuring high availability.

However, On-Premise deployment remains a significant and resilient model, particularly for large academic medical centers, government institutions, and organizations in regions with strict data sovereignty laws or limited internet bandwidth. These institutions often possess the required capital, extensive in-house IT expertise, and stringent data governance policies that mandate direct physical control over their servers and patient data, justifying the higher initial investment and ongoing maintenance overhead.

By Application Analysis

The Echocardiography application segment is expected to be a dominant segment in terms of volume and commercial adoption, given that ultrasound remains the most frequently performed, first-line cardiac imaging modality globally due to its portability, safety, and real-time capabilities. Enterprise viewers significantly streamline the review, comparison, and reporting of these high-volume studies, making them indispensable in both hospital and outpatient settings. The Advanced Cardiac CT/MRI segment, while lower in volume, is a major and critically important application area in terms of clinical value and revenue per study. The complex, multi-planar, and four-dimensional nature of these datasets demands powerful post-processing tools for accurate diagnosis.

The ability of modern enterprise viewers to provide integrated advanced 3D post-processing for tasks like coronary CTA analysis (e.g., for plaque burden and stenosis), myocardial tissue characterization with MRI, and planning for structural heart interventions directly within the diagnostic workflow demonstrates the highest value proposition. This capability enables deep clinical insights that are difficult, if not impossible, to achieve with traditional, basic PACS viewers, justifying significant investment from institutions performing advanced cardiac imaging.

By End-User Analysis

Hospitals & Cardiac Centers are projected to be the dominant end-users, as they represent the epicenters of cardiovascular care, generating the highest volume and most complex mix of imaging studies. These large institutions require robust, enterprise-scale solutions to manage workflow across numerous departments, including non-invasive cardiology, interventional cardiology, cardiothoracic surgery, radiology, and the emergency room. Their purchasing decisions are driven by the need for system-wide efficiency, interoperability, and support for multi-disciplinary team meetings.

Meanwhile, Ambulatory Care Centers & Clinics are the fastest-growing end-user segment. The global shift of healthcare delivery from inpatient to outpatient settings is powering this growth. These facilities are rapidly adopting cloud-based enterprise viewers to facilitate efficient internal image review, seamlessly share studies with referring physicians and hospital-based specialists for consultation, and offer comprehensive, one-stop cardiac care in a convenient community setting. This trend solidifies the role of enterprise viewers as critical enabling tools for distributed, value-based care models that prioritize patient convenience and coordinated care across the continuum.

The Global Cardiovascular Enterprise Viewer Market Report is segmented on the basis of the following:

By Component

- Software

- Cardiovascular Image Analysis Software

- Advanced Visualization & 3D/4D Rendering Tools

- PACS Integration Modules

- Workflow Optimization & Reporting Software

- AI-Enabled Image Interpretation Tools

- Services

- Implementation & Integration Services

- Training & Education Services

- Maintenance & Support Services

- Workflow Consulting & Optimization Services

- Hardware

- Workstations & Viewing Consoles

- Servers & Storage Systems

- Display Monitors

By Deployment Mode

- Cloud-Based

- On-Premise

- Hybrid

By Technology

- Web-Based Viewers

- HTML5-Based Universal Viewers

- Zero-Footprint Browsers

- Thin-Client Viewers

- Virtual Desktop Interface (VDI) Viewers

- Server-Rendered Visualization

- Thick-Client / Workstation-Based Viewers

- Dedicated High-Performance Client Software

- GPU-Accelerated Visualization Workstations

By Application

- Echocardiography

- 2D, 3D, and 4D Echo Viewing

- Strain Imaging & Quantification

- Cardiac Computed Tomography (CT)

- Coronary Calcium Scoring

- CT Angiography Visualization

- Cardiac Magnetic Resonance Imaging (MRI)

- Functional Assessment (LVEF, Wall Motion)

- T1/T2 Mapping Visualization

- Nuclear Cardiology (SPECT / PET)

- Perfusion Imaging Review

- Quantitative Analysis Modules

- Coronary Angiography

- Digital Subtraction Angiography (DSA) Review

- Real-Time Angio Image Comparison

- Electrophysiology Mapping

- 3D Cardiac Mapping Workflows

- Signal & Arrhythmia Visualization Tools

By End User

- Hospitals & Cardiac Centers

- Ambulatory Care Centers & Clinics

- Diagnostic Imaging Centers

- Research Institutes & Universities

Impact of Artificial Intelligence in the Global Cardiovascular Enterprise Viewer Market

- Automated Quantification and Analysis: AI algorithms are now capable of fully automated, highly reproducible quantification of key cardiac parameters. This includes left and right ventricular volumes and ejection fraction from both echo and MRI, myocardial strain from speckle tracking, coronary calcium scoring from non-contrast CT, and characterization of coronary plaque from CTA. This reduces inter-observer variability, frees up clinician time from tedious manual measurements, and ensures consistent, standardized reporting for clinical trials and registries.

- Intelligent Worklist Prioritization and Triage: AI-powered viewers can pre-analyze all incoming studies in the background. Based on the findings, they can automatically triage and prioritize the reading worklist. For example, studies indicating a severely reduced ejection fraction, a large pericardial effusion, or critical coronary stenosis can be flagged and moved to the top of the list. This ensures that patients with potentially life-threatening conditions receive immediate attention, improving outcomes and optimizing radiologist and cardiologist workflow in high-volume settings.

- Structured Reporting and Clinical Data Extraction: AI is revolutionizing reporting by automatically populating structured report templates with the measurements and observations it extracts from the images. It can pull data from the DICOM header, integrate its own quantitative results, and even use natural language processing to extract findings from prior free-text reports for comparison. This not only speeds up the reporting process dramatically but also creates structured, mineable data that can be used for population health, research, and quality improvement initiatives.

- Enhanced Diagnostic Confidence with Decision Support: Beyond quantification, AI serves as a powerful decision support tool. It can highlight areas of potential abnormality that might be overlooked, such as a subtle wall motion abnormality or an incidental pulmonary nodule. For complex cases, AI can provide differential diagnoses based on the imaging phenotype, acting as a second pair of eyes and enhancing the diagnostic confidence of the clinician, particularly for less experienced readers.

- Predictive Analytics and Risk Stratification: The most advanced AI applications are moving from diagnostics to prognostics. By analyzing imaging biomarkers in conjunction with clinical data from the EHR (e.g., age, lab values), AI models can help stratify a patient's risk for future cardiac events, such as myocardial infarction or heart failure hospitalization. This enables a shift towards more personalized, preventive care, allowing clinicians to intervene earlier with at-risk patients.

Global Cardiovascular Enterprise Viewer Market: Regional Analysis

Region with the Largest Revenue Share

North America, spearheaded by the United States, is projected to command the largest share of the global cardiovascular enterprise viewer market, estimated at 40.5% by the end of 2025. This dominance is rooted in a powerful and self-reinforcing ecosystem. The region is home to the world's leading healthcare IT and medical imaging corporations, which continuously drive innovation in viewer technology, cloud platforms, and AI integration. This technological vanguard is supported by a regulatory environment that, while rigorous, provides clear pathways for software approval through the FDA, and reimbursement policies from CMS and private payers that increasingly recognize the value of digital and AI-enabled diagnostics.

Furthermore, the presence of large, financially robust, and technologically sophisticated integrated delivery networks (IDNs) and academic medical centers creates a strong demand for enterprise-wide solutions that can streamline complex operations. These institutions not only have the high per-capita spending capacity to invest in such platforms but are also often the early clinical adopters and validation sites for new technologies. The synergy between pioneering vendors, a supportive policy and funding landscape, and advanced, demanding clinical end-users creates a virtuous cycle of innovation, adoption, and refinement that solidifies North America's leadership position.

Region with the Highest CAGR

The Asia Pacific region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) in the cardiovascular enterprise viewer market, representing the most dynamic and opportunistic growth frontier. This explosive growth is fueled by a confluence of powerful factors: massive, government-led healthcare infrastructure modernization, rising healthcare expenditures from a growing middle class, and a sharply increasing burden of cardiovascular diseases. National initiatives like "Healthy China 2030" and "Digital India" are explicitly prioritizing the digitization of healthcare and the adoption of advanced medical technologies, creating a powerful top-down push. This is coupled with a compelling demographic challenge, including rapidly aging populations in Japan, South Korea, and China, which directly drives demand for cardiac care and efficient diagnostic tools.

To serve their vast and diverse populations, there is an intense focus on developing cost-effective solutions. The growing presence of aggressive local IT vendors offering competitive, often cloud-first, platforms is making advanced technology more accessible and affordable than ever before. This potent combination of strong governmental support, urgent and unmet clinical needs, a rapidly expanding patient pool, and increasing market competition creates a perfect storm for growth, positioning the Asia Pacific as the epicenter of future market expansion.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Cardiovascular Enterprise Viewer Market: Competitive Landscape

The competitive landscape of the global cardiovascular enterprise viewer market is intensely fragmented and dynamic, characterized by a multi-layered competition between established imaging titans, specialized IT pure-plays, and agile startups. Dominant players like Philips Healthcare, GE Healthcare, and Siemens Healthineers leverage their immense strengths from being vertically integrated imaging companies. They compete by offering tightly bundled solutions that combine their own imaging hardware (CT, MRI, Ultrasound) with their proprietary enterprise viewers and VNAs, promising seamless integration and a single point of accountability. Their global sales, service, and clinical support networks provide a significant advantage. A major competitive trend is the formidable challenge posed by best-of-breed healthcare IT and PACS vendors, such as Change Healthcare (now part of Oracle) and Intelerad Medical Systems. These companies compete on the strength of their vendor-neutral architectures, deep interoperability with third-party systems, and highly optimized workflows tailored for high-volume reading, often at a more competitive price point.

Some of the prominent players in the Global Cardiovascular Enterprise Viewer Market are:

- Philips Healthcare

- GE Healthcare

- Siemens Healthineers

- Change Healthcare (Oracle)

- Fujifilm Holdings Corporation

- Agfa-Gevaert Group

- IBM (Watson Health)

- Terarecon, Inc.

- Intelerad Medical Systems Incorporated

- Canon Medical Systems Corporation

- HeartSciences

- Pie Medical Imaging

- Lumed

- Visage Imaging

- CARESTREAM Health

- Other Key Players

Recent Developments in the Global Cardiovascular Enterprise Viewer Market

- May 2024: The American College of Cardiology (ACC) announces a collaboration with major EHR and IT vendors to develop and promote a new FHIR-based implementation guide for seamless data exchange between cardiovascular enterprise viewers and national registries like the NCDR.

- April 2024: Philips Healthcare and a major U.S. non-profit health system announce a landmark 10-year strategic partnership to deploy a fully integrated, cloud-based enterprise imaging platform across all its 40+ hospitals, with a dedicated module for cardiovascular imaging designed to standardize care and enable system-wide telecardiology.

- March 2024: The FDA grants Breakthrough Device designation to a novel AI algorithm from a startup, developed for integration into enterprise viewers, which automatically identifies patients at high risk of developing atrial fibrillation from routine cardiac CT scans performed for other indications.

- February 2024: Siemens Healthineers finalizes the acquisition of a leading cloud-based imaging workflow and analytics company, explicitly stating the goal of enhancing its Teamplay digital health platform and embedding its capabilities into the Syngo.Via enterprise viewer for improved operational insights.

- January 2024: The European Society of Cardiology (ESC) Digital Health Summit features a live demonstration of a multi-center, multi-vendor enterprise viewer platform facilitating a real-time, multi-disciplinary team meeting with participants from five different countries, discussing a complex case of structural heart disease.

- November 2023: Intelerad announces a major new release of its flagship CloudPlus platform, featuring a redesigned, zero-footprint viewer with native AI orchestration capabilities, allowing radiologists to run multiple different AI algorithms from various vendors on a single study without leaving the application.

- October 2023: A leading European university hospital and a consortium of AI startups publicize the results of a federally-funded project using a federated learning infrastructure. This allowed them to train a robust AI model for cardiac MRI analysis across multiple institutions without sharing patient data, with the model now being deployed within their enterprise viewer.

- September 2023: At the RSNA annual meeting, several major vendors unveil new "Platform as a Service" (PaaS) offerings, allowing health systems and third-party developers to build and deploy custom clinical applications and AI tools directly on top of the vendor's enterprise viewer infrastructure.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 5.9 Bn |

| Forecast Value (2034) |

USD 23.3 Bn |

| CAGR (2025–2034) |

16.6% |

| The US Market Size (2025) |

USD 2.0 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Software, Services, Hardware), By Deployment Mode (Cloud-Based, On-Premise, Hybrid), By Technology (Web-Based Viewers, Thin-Client Viewers, Thick-Client/Workstation-Based Viewers), By Application (Echocardiography, Cardiac Computed Tomography (CT), Cardiac Magnetic Resonance Imaging (MRI), Nuclear Cardiology (SPECT/PET), Coronary Angiography, Electrophysiology Mapping), and By End-User (Hospitals & Cardiac Centers, Ambulatory Care Centers & Clinics, Diagnostic Imaging Centers, Research Institutes & Universities) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Philips Healthcare, GE Healthcare, Siemens Healthineers, Change Healthcare (now part of Oracle), Fujifilm Holdings Corporation, Agfa-Gevaert Group, IBM (Watson Health), Terarecon Inc., Intelerad Medical Systems, Canon Medical Systems Corporation, HeartSciences, Pie Medical Imaging, Lumed, Visage Imaging, CARESTREAM Health., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Cardiovascular Enterprise Viewer Market size is estimated to have a value of USD 5.9 billion in 2025 and is expected to reach USD 23.3 billion by the end of 2034.

The market is growing at a CAGR of 16.6 percent over the forecasted period of 2025 to 2034.

The US Cardiovascular Enterprise Viewer Market is projected to be valued at USD 2.0 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 7.4 billion in 2034 at a CAGR of 15.6%.

North America is expected to have the largest market share in the Global Cardiovascular Enterprise Viewer Market with a share of about 40.5% in 2025.

Some of the major key players in the Global Cardiovascular Enterprise Viewer Market are Philips Healthcare, GE Healthcare, Siemens Healthineers, Change Healthcare (now part of Oracle), Fujifilm Holdings Corporation, Agfa-Gevaert Group, IBM (Watson Health), Terarecon, Inc., Intelerad Medical Systems, and many others.