Central Venous Catheter Market Overview

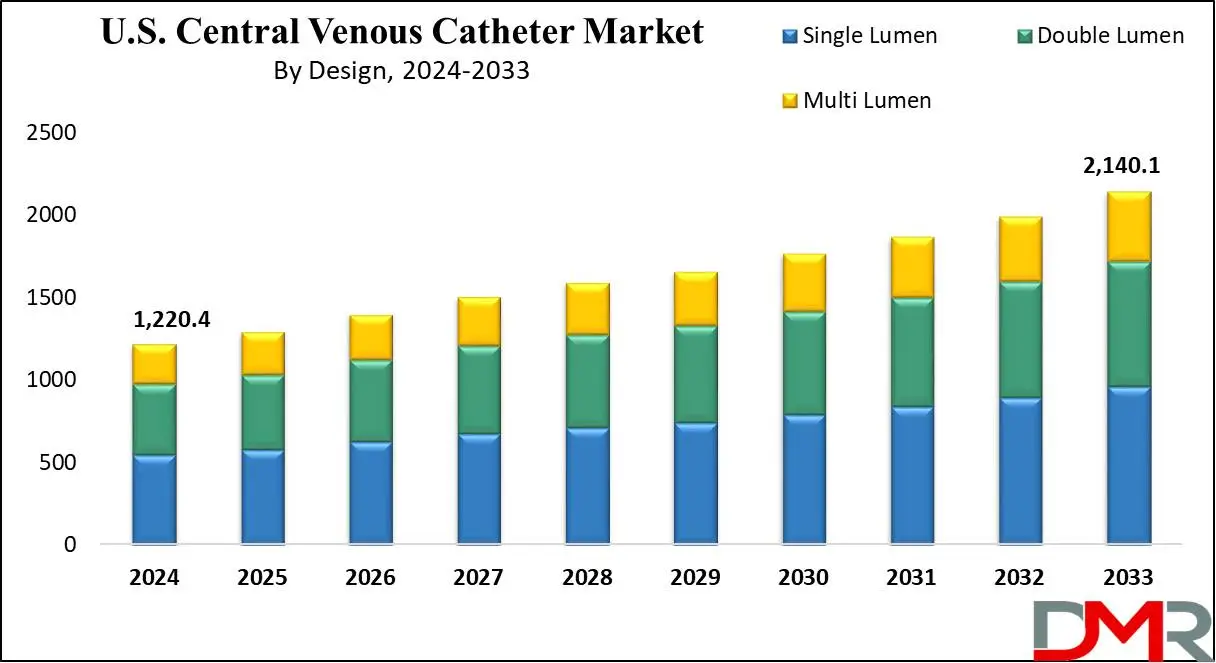

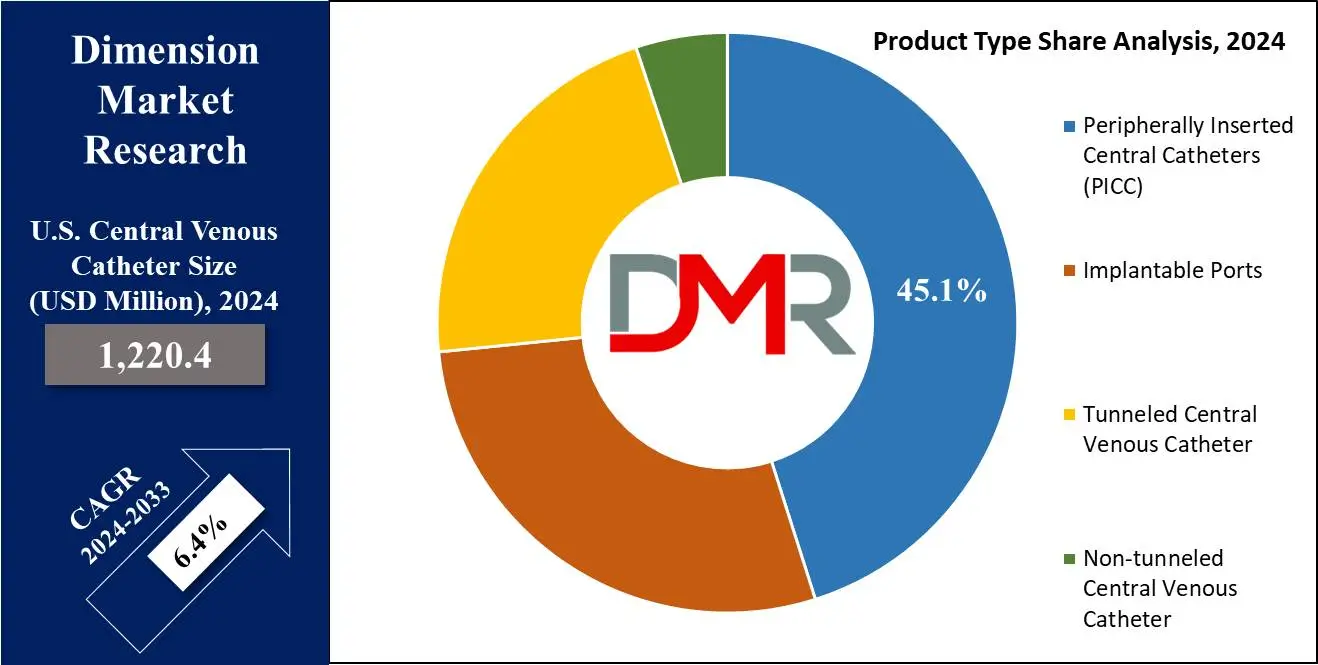

The U.S. Central Venous Catheter Market is projected to reach a market value of USD 1,220.4 million in 2024 and is further expected to attain a market value of USD 2,140.1 million by 2033 at a CAGR of 6.4%.

A Central Venous Catheter (CVC) is a Medical Device that is placed permanently into a large vein above the heart, usually in the neck, chest, or groin, to facilitate secure access to the central venous system. It is used in areas that may include the administration of medications, fluids, blood & blood products, and monitoring of hemodynamic processes.

Encompass different classes of catheters such as intravenous catheters for therapy infusions, hemodynamic monitoring, blood samples and medications, and fluid infusions. The market involves manufacturers, distributors, Healthcare Providers, and end-users like hospitals, outpatient surgical centers, and clinics as its entities.

Key Takeaways

- The U.S. Central Venous Catheter Market size is estimated to have a value of USD 1,220.4 million in 2024.

- The market is growing at a CAGR of 6.4 percent over the forecasted period.

- On the basis of the composition of the central venous catheter is projected to dominate this market as it holds 44.9% of the market share in 2024.

- The central venous catheter is projected to dominate this market based on composition with the highest market share in 2024.

- In the context of end users, hospitals are expected to dominate the United States central venous catheter market with the highest market share in 2024.

Use Cases

- Critical Care: Central venous catheters facilitate hemodynamic tracking and administration of medications in extensive care devices, making sure of precise affected person management.

- Chemotherapy: Used for long-time period chemotherapy administration, principal venous catheters offer dependable vascular get right of entry, lowering peripheral vein harm and lowering the chances of complications, a key application in the Oncology sector.

- Dialysis: Central venous catheters enable hemodialysis in sufferers with up-degree renal sickness, presenting temporary vascular get right of entry for fluid elimination and waste elimination.

- Parenteral Nutrition: Central venous catheters supply vital nutrients at once into the bloodstream, supporting sufferers unable to tolerate oral or enteral feeding.

Central Venous Catheter Market Dynamic

Continuous technology progress implies innovative vascular catheter designs and materials (including CVCs) where that focus on the patient's outcomes and ease of work for the doctors. Manufacturing regulations and approval processes are adjusted regularly per safety measures that are carried out by manufacturers. The greater competitiveness in the market encourages firms to offer new features, set up pricing strategies, and develop products with unique selling points more often.

Healthcare Reimbursement systems are the key factors influencing physicians' choice of a particular CVC product with remuneration rate having a direct impact on procurement decisions by the providers. Improving the clinical processes with infection prevention and minimally invasive methods stimulates the need for various types of CVC and accessories, which in turn indicates the shift of care from inpatient to outpatient, including growth in Home Infusion Therapy. These performance dynamics reshape the ground level of this market and play a significant role in CVC implementation thus fostering improvements that enhance safety, effectiveness, and patient experience.

Central Venous Catheter Market Research Scope and Analysis

By Product Type

In terms of product, peripherally inserted central catheters are anticipated to dominate the U.S. central venous catheter market with 45.1% of the market share by the end of 2024. Their dominance can be accredited to the easy application, low cost, and low probability of infection making it the first choice of healthcare professionals. Generally, the PICCs are peripherally inserted into the arm and threated centrally into the superior vena cava or right atrium which allows easy access to the central venous. The peripherally inserted central catheters do not require surgical implants which lessen the risk of complications and infection.

The wide adaptable nature of peripherally inserted central catheters made possible their use in various clinical settings like hospitals, ambulatory care centers, and home care settings. Moreover, PICCs are used preferably for prolonged intravenous therapy sessions, as well as, in the case of chemotherapy administration and antibiotic treatment because they reduce patient’s discomfort and improve their convenience. Simply, PICCs are the more adaptable, easier to use, and less risky CVC option for a wide variety of applications. This is what makes them a favorite in the market segment of central venous catheters.

By Composition

Based on the composition of the central venous catheter is projected to dominate this market as it holds 44.9% of the market share in 2024. The dominance of the single-lumen in this market is due to their simple structure, use in various tasks, and less complicated nature. The simple lumen catheter is used in normal routine procedures and surgeries which makes it a preferred choice by healthcare professionals.

In the comparison of the double and multi-lumen, the single lumen is easier to insert and has less probability of causing any type of infection. Also, they are cheaper compared to the double and multi-lumen which makes them the preferred choice for individuals who have a low budget and have momentary restrains. So, all these factors collectively play a vital role in the dominance of single lumen in the composition segment due to their budget-friendly nature and ease of use.

By Procedure

The central venous catheter is projected to dominate this market with the highest market share in 2024 due to the major role they play in cardiovascular condition-related operations & procedures. These catheters are used in a wide variety of cardiovascular procedures like hemodynamic monitoring, administering medications, and delivering fluids or blood products directly into the central bloodstream of the concerned patient.

These catheters are also proven to be effective in cases of surgeries like coronary artery bypass grafting, and valve replacement where the central artery is not working properly due to some obstruction or blockage which can lead to a major heart attack. Due to rising cases of d cardiovascular patients around the globe, the demand for the catheter has been significantly boosted.

By End User

In the context of end users, hospitals are expected to dominate the United States central venous catheter market with the highest market share in 2024. The rising number of patients in the United State is subsequently affecting the demand for central venous catheters. The hospital is a hub that is used for diagnosis, treatment as well as in case of emergency which makes it the most demanding place that uses central venous catheters.

The hospitals use the central venous catheter for performing various simple and complicated surgeries & operations in various departments ranging from neurosurgery to orthopedics. In some cases, hospitals use the central venous catheter in the imaging facilities and intensive care units. So collectively the wide capacities of hospitals which are equipped with various resources make them the primary end users of the central venous catheter.

The U.S. Central Venous Catheter Market Report is segmented on the basis of the following:

By Product Type

- Peripherally Inserted Central Catheters (PICC)

- Implantable Ports

- Tunneled Central Venous Catheter

- Non-tunneled Central Venous Catheter

By Composition

- Polyurethane

- Polyethylene

- Silicon

By Procedure

- Cardiovascular Procedure

- Chemotherapy Procedure

- Dialysis Procedure

By End User

- Hospital

- Ambulatory Surgical Centers

- Specialty Clinics

Central Venous Catheter Market Competitive Landscape

Key players that are playing a major role in the growth of the U.S. central venous catheter market a Cook Medical Inc., Argon Medical Devices Inc., ICU Medical Inc., Theragenics Corporation, Becton, Dickinson, and Company as they offer a variety of products to this market. These market players are competing with each other extensively by engaging in research and development activities which is aimed at expanding their product portfolio.

For example, tunneled and non-tunneled catheters offered by Becton, Dickinson, and Company (BD) are known for this product. While Cook Medical LLC and ICU Medical Inc. are known for their high-quality material which is used in cases of infusion therapy. This market is growing at a fast speed as it offers solutions to the specific clinical needs of healthcare professionals in case of hemodynamic monitoring in critical care settings.

Some of the prominent players in the U.S. Central Venous Catheter Market are

- Angio Dynamics Inc

- C.R. Bard Inc

- Teleflex Incorporated

- B. Braun Melsungen AG

- Medtronic Plc

- Cook Medical Inc.

- Argon Medical Devices Inc.

- ICU Medical Inc.

- Theragenics Corporation

- Becton, Dickinson and Company

- Polymedicure

- Lepu Medical Technology (Beijing) Co. Ltd.

- Gilead Sciences Inc

- Other Key Players

Recent Development

- In February 2024, BIOTRONIK launches the Micro Rx catheter, enhancing guidewire support during coronary interventions. Developed by IMDS, it prioritizes user-friendly intervention, aiding complex anatomies.

- In October 2023, Keysight Technologies plans to invest and expand in India, citing it as a top growth market, aligning with strategic growth vectors. Potential local hiring is anticipated.

- In June 2023, Merit Medical Systems, Inc. acquired the Surfacer Inside-Out access catheter system from Bluegrass Vascular, expanding its dialysis and biopsy device offerings.

- In April 2023, Perth's VeinTech secured $493,489 in funding to advance VeinWave technology, which aims to improve vein cannulation success rates, reduce costs, and enhance patient experience.

- In January 2022, The PowerLine Central Venous Catheter by BD is power injectable, durable, and allows for various medical procedures including contrast media injection and central venous pressure monitoring.

Central Venous Catheter Market Report Details

| Report Characteristics |

| Market Size (2024) |

USD 1,220.4 Mn |

| Forecast Value (2033) |

USD 2,140.1 Mn |

| CAGR (2023-2032) |

11.4% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product Type (Peripherally Inserted Central Catheters, Implantable Ports, Tunneled Central Venous Catheter, Non-tunneled Central Venous Catheter), By Composition (Polyurethane, Polyethylene, and Silicon), By Procedure (Cardiovascular Procedure, Chemotherapy Procedure, and Dialysis Procedure), By End User (Hospital, Ambulatory Surgical Centers, and Specialty Clinics) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Integra Life Sciences Corporation, AbbVie Inc., Johnson & Johnson, Hans BioMed, Becton, Dickinson and Company, Smith & Nephew Plc., Reprise Biomedical, Organogenesis Holdings Inc., Tissue Regenix, Zimmer Biomet Holdings Inc., Stryker Corporation, PolyNovo Limited, Fidia Pharma USA Inc., Baxter International Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The U.S. Central Venous Catheter Market size is estimated to have a value of USD 1,220.4 million in 2024 and is expected to reach USD 2,140.1 million by the end of 2033.

Some of the major key players in the U.S. Central Venous Catheter Market are Angio Dynamics Inc., C.R. Bard Inc., Teleflex Incorporated, B. Braun Melsungen, and many others.

The market is growing at a CAGR of 6.4 percent over the forecasted period.