Overview

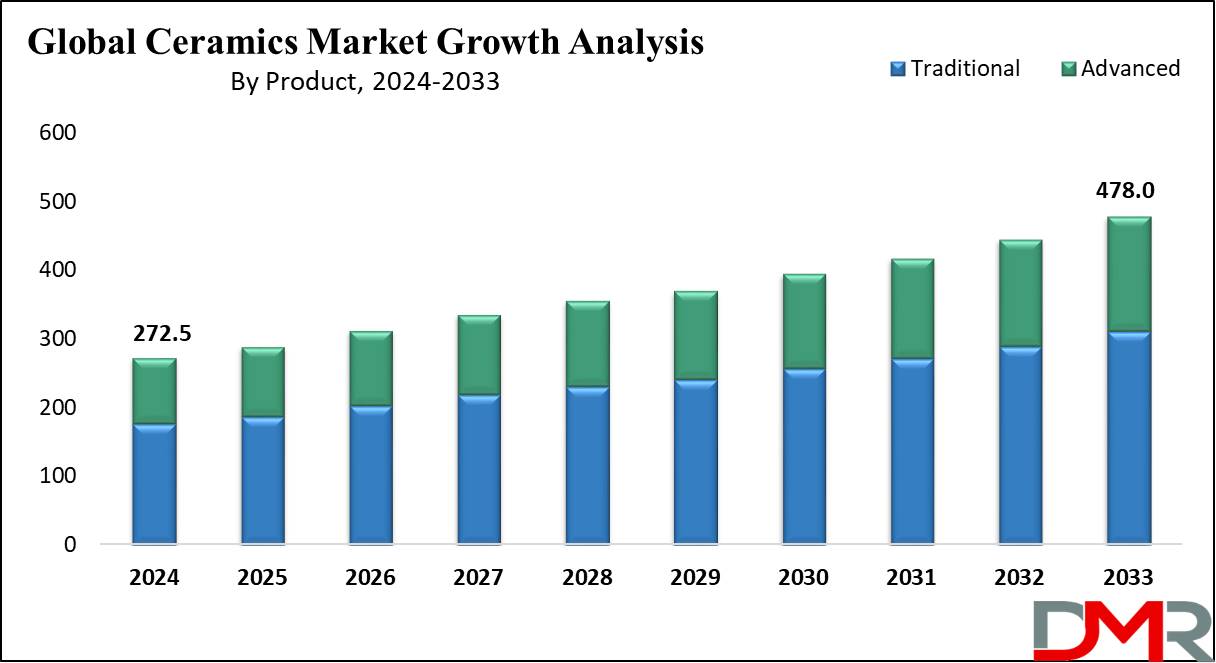

The Global Ceramics Market size is estimated to reach USD 255.6 Billion in 2024 and is further anticipated to value USD 435.9 Billion by 2033, at a CAGR of 6.2%.

The ceramics market encompasses a range of products manufactured from carbides, oxides, and nitrides, with conventional items such as whiteware, porcelain, stoneware, and chinaware widely used in residential and non-residential construction. The demand for ceramics is bolstered by global growth in construction and renovation activities, where these materials are favored for durability and aesthetic appeal.

Ceramics are solid materials defined by metal and non-metal bonds, showcasing properties like chemical inertness, high melting points, hardness, and low conductivity making them suitable for varied applications. These properties stem from their unique crystalline structure and chemical composition, allowing for applications ranging from decorative and household items to advanced uses such as nuclear fuel pellets.

The manufacturing of traditional ceramics typically involves silica, clay, and feldspar, while advanced ceramics leverage materials like alumina, tungsten carbide, and silicon carbide, enhancing attributes such as abrasion and electrical resistance.

The ceramics market is further driven by technological innovations, expanding demand in construction, and advances in medical applications. Smart ceramics, now incorporated in electronics, enhance product functionality and performance. Additionally, the shift towards sustainable materials and processes reflects industry responsiveness to environmental regulations and consumer preferences.

The growing demand for ceramic tiles and sanitary ware, particularly in the Asia-Pacific region, is a key driver, driven by urbanization and higher living standards in emerging economies. As the market evolves, these trends underscore the adaptability and expanding relevance of ceramics across multiple sectors.

Key Takeaways

- Market Size & Share: Global Ceramics Market size is estimated to reach USD 255.6 Billion in 2024 and is further anticipated to value USD 435.9 Billion by 2033, at a CAGR of 6.2%.

- Product Analysis: In the ceramics market, the traditional ceramics segment is the dominant category, holding approximately 65% of the market share in 2023..

- Application Analysis: Ceramic tiles hold the largest share in the global ceramics market at 35% in 2023, accounting for roughly one third of market revenues.

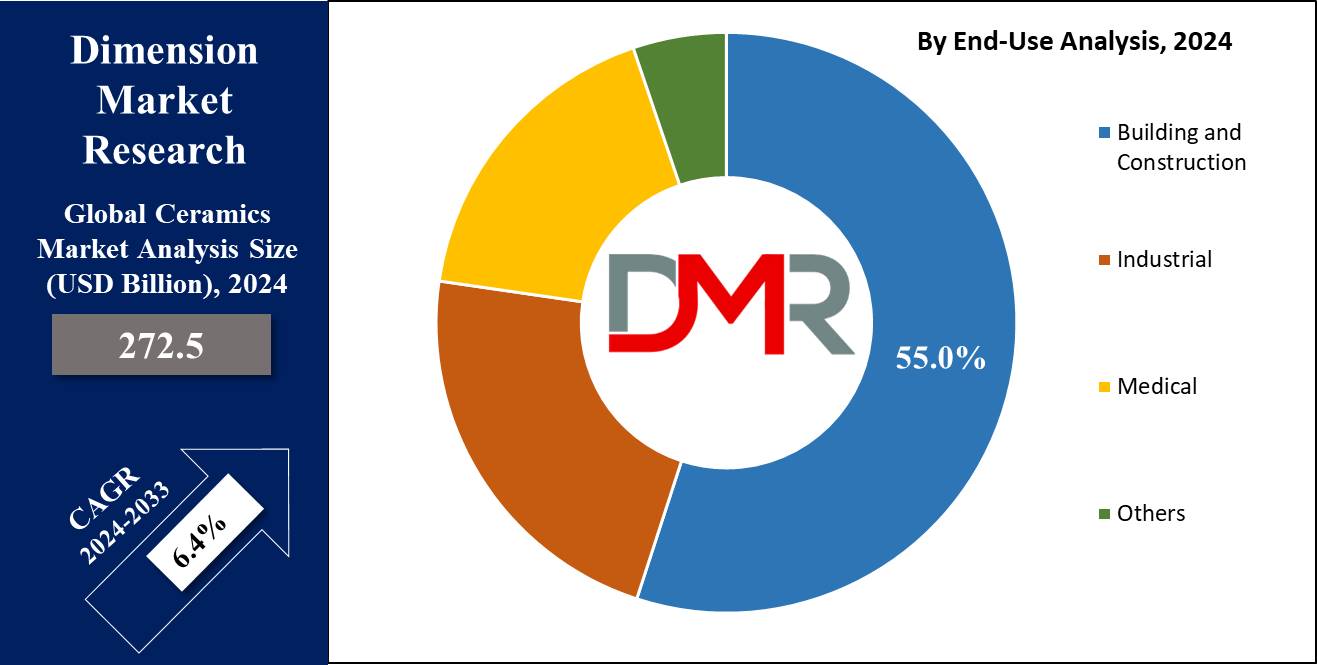

- End-Use Analysis: Building and construction represented approximately 55% of the ceramics market by end use segment in 2023.

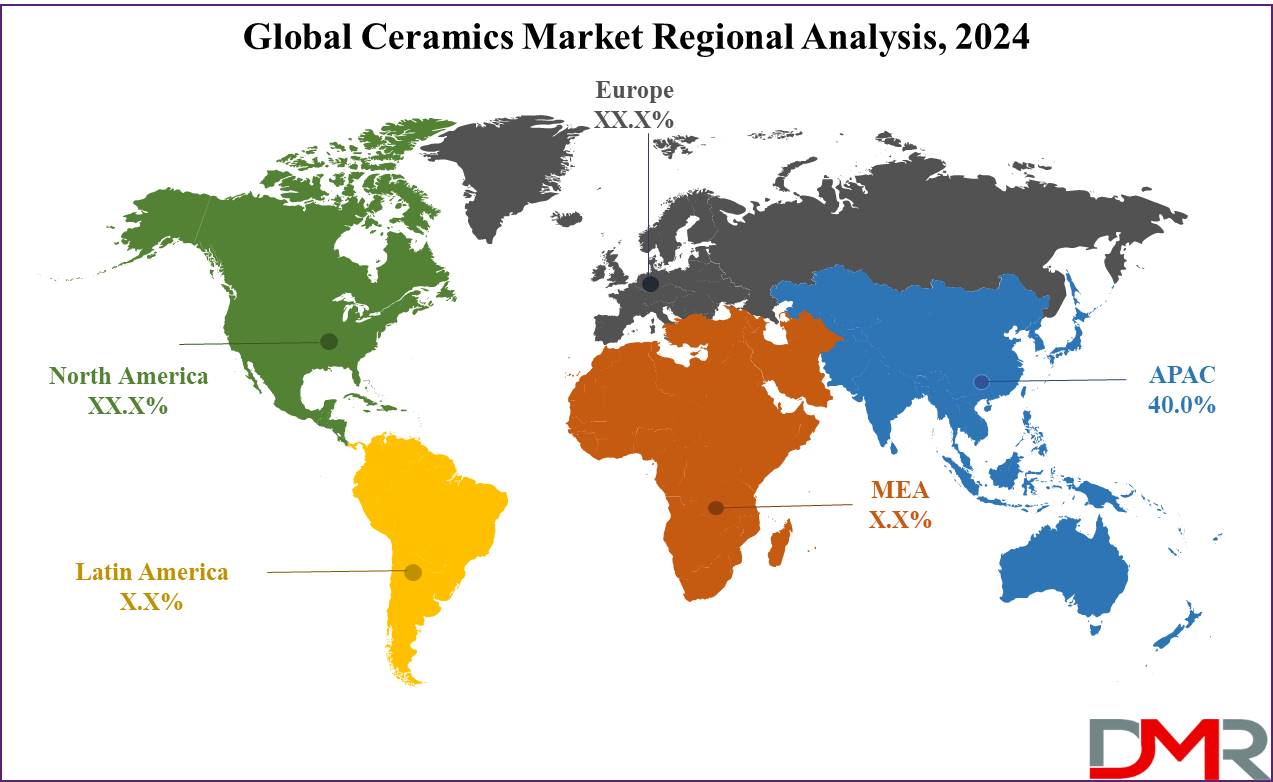

- Regional Analysis: Asia-Pacific ceramics market accounts for approximately 40% of global sales due to rapidly urbanizing populations and increasing construction activities.

- Sustainability Trends: There is a growing focus on eco-friendly and sustainable ceramics, with companies incorporating recycled materials and innovative manufacturing processes to meet consumer demand and regulatory requirements.

Use Cases

- Construction and Infrastructure: Ceramics play an essential part in construction, with applications in tiles, bricks and sanitary ware. Their durable nature, weather resistance and low maintenance costs make them suitable for both residential and commercial structures alike. Ceramic tiles in particular are widely utilized on floors and walls due to their aesthetic versatility, water resistance and long lifespan in high traffic areas.

- Medical and Dental Applications: Ceramics have long been utilized in medical implants, prosthetics, and dental restorations due to their biocompatibility, wear resistance, and strength properties. Ceramics have proven particularly helpful when replacing joint replacements or dental crowns due to long-term performance without increased risks from immune reactions. Furthermore, ceramics are used in devices like ultrasonic surgical tools as their inertness and hardness provide advantages.

- Ceramics in Electronics and Semiconductors: Ceramics play an indispensable role in electronics for their insulating, heat resistant, dielectric properties. Ceramic capacitors, insulators, resistors and substrates for semiconductors all rely heavily on ceramic materials as key building blocks. Recently however, smart ceramics with piezoelectric and thermoelectric responses are increasingly being utilized as sensors, actuators, energy storage solutions to meet demand for miniaturized yet efficient electronic components.

- Aerospace and Defense: Both aerospace and defense sectors rely heavily on ceramic components that must withstand extreme conditions. Ceramic composites are increasingly being utilized in turbine blades, engine components, heat shields, corrosion-resistant heat shields, turbine blades, heat shields and heat shields due to their superior heat resistance, light weight design and corrosion-resistance qualities. Advanced ceramics also extend durability in protective gear like armor or helmets by offering both lightweight and impact resistance properties.

- Automotive Industry: Ceramics play an essential role in automotive safety and efficiency, particularly within brake systems and engine components. Ceramic brake pads feature superior wear resistance and heat tolerance, reducing maintenance needs while increasing performance. Furthermore, catalytic converters containing ceramic materials reduce emissions for improved environmental compliance as well as air quality improvement.

Report Dynamics

Driver

Growing Demand in Construction and Infrastructure

Rising Demand in Construction and Infrastructure The ceramics market is being propelled forward by rising demand in global construction and infrastructure markets, especially those situated in developing regions. Ceramic materials are ideal for construction because of their durability, heat resistance and aesthetic versatility, making them essential in applications such as tiles, sanitary ware and cladding.

As urbanization and housing development expand across Asia-Pacific regions, demand for reliable and sustainable materials - such as ceramics - increases. Ceramics have also become more commonly utilized in both new construction projects as well as renovation projects due to their enhanced performance capabilities and durability while meeting aesthetic and environmental standards.

Trend

Integrating Advanced Ceramics in Electronics

The ceramics industry is witnessing an increase in the use of advanced ceramics in electronics and semiconductor applications. Advanced ceramics are highly sought-after due to their exceptional properties, including electrical insulation, heat resistance, and piezoelectric capabilities - making them the go-to material for electronic components like capacitors, sensors and insulators.

Smart ceramics offer multifunctional capabilities, including energy storage and environmental sensing, supporting IoT technologies. Furthermore, as electronic devices become smaller and more energy-efficient, ceramic component demand continues to increase and drive innovation within this sector.

Restraint

High Production Costs and Energy Requirements

A key challenge facing the ceramics market is its high costs associated with production and energy usage. Manufacturing ceramics requires energy-intensive processes and high temperature kilns that increase production costs significantly. As well, the expense and difficulty involved with using specialty raw materials and advanced production techniques hinder the accessibility of high-performance ceramics.

Environment regulations and energy costs present manufacturers with additional obstacles, as they seek to lower emissions while meeting sustainable standards. Such constraints can reduce profitability and scalability in ceramic production in areas with strict environmental policies or fluctuating energy costs.

Opportunity

Rise of Eco-Friendly and Sustainable Ceramics

Sustainable Ceramics Provide an Anomalous Market Opportunity Eco-friendly ceramics represent an emerging opportunity for market expansion as industries and consumers prioritize environmentally responsible practices. Manufacturers are taking steps to reduce waste, energy use and emissions by employing energy-efficient production techniques with recycled materials and energy saving production methods.

Demand for sustainable building materials also supports this trend, with ceramics providing durable, low maintenance and recyclable solutions that contribute to sustainable building projects. Current research into biodegradable and reusable ceramics could greatly expand applications across packaging, construction and healthcare. With increasing emphasis on eco-conscious products and their impact on sustainability-minded industries and consumers, ceramics market could experience growth through catering to this niche.

Research Scope and Analysis

Product Analysis

In the ceramics market, the traditional ceramics segment is the dominant category, holding approximately 65% of the market share in 2023. This includes products such as ceramic tiles, sanitary ware, tableware, and bricks, which are widely used in the construction, home decor, and infrastructure sectors.

The demand for traditional ceramics is driven by urbanization, rising living standards, and ongoing residential and commercial construction activities, particularly in emerging economies. Their cost-effectiveness, aesthetic appeal, and durability make them ideal for a wide range of applications, from flooring and roofing to decorative items.

Advanced ceramics, although a smaller segment with a 35% market share, are gaining rapid traction in industries such as electronics, healthcare, and automotive. These ceramics offer superior properties such as high thermal and electrical resistance, wear resistance, and biocompatibility, making them essential for manufacturing high-performance components like semiconductors, medical implants, and automotive parts. As industries require more specialized materials, advanced ceramics are expected to drive future market growth.

Application Analysis

Ceramic tiles hold the largest share in the global ceramics market at 35% in 2023, accounting for roughly one third of market revenues. Ceramic tile sales are driven primarily by residential and commercial building construction industries as demand surges; ceramic tiles are revered for their durability, ease of maintenance and aesthetic value making them an excellent choice for flooring, walls and roofing applications both new and renovations alike.

Sanitary ware is another significant segment, representing approximately 25% of market share. Ceramic materials are commonly used for bathroom products like sinks, toilets and bathtubs due to their durability, water resistance and aesthetic quality - factors which have driven up its demand. An increase in residential construction as well as home renovation projects is contributing to its demand.

Other applications for ceramics - such as abrasives, bricks and pipes, pottery and others - account for the remaining market share. Ceramics' versatility extends into numerous fields thanks to heat resistance, strength and low porosity properties which increase adoption across different industries.

End-Use Analysis

Building and construction represented approximately 55% of the ceramics market by end use segment in 2023. This was driven primarily by high demand for tiles, sanitary ware, and other building materials used in residential and commercial properties as a result of urbanization, infrastructure development, home renovation projects in emerging markets, which continue to boost demand for ceramics in this segment.

Industrial applications account for about 25% of market share. Ceramics have numerous manufacturing uses in industries like automobile and electronics manufacturing; as insulation, abrasives and components. Their superior thermal stability, wear resistance and electrical insulation properties make advanced ceramics indispensable tools in these sectors.

Medical ceramics continue to increase their market share, accounting for about 10%. Bioceramics are widely used in implants, prosthetics, and dental materials due to their biocompatibility and durability; remaining market share accounts for other industries like pottery or consumer goods.

The Global Ceramics Market Report is segmented based on the following

By Product

By Application

- Sanitary Ware

- Abrasives

- Bricks and Pipes

- Tiles

- Pottery

- Others

By End-Use

- Building and Construction

- Industrial

- Medical

- Others

Regional Analysis

Asia-Pacific ceramics market accounts for approximately 40% of global sales due to rapidly urbanizing populations and increasing construction activities. Countries like China, India and Japan play key roles in this market with high demands for ceramic tiles, sanitary ware, and advanced ceramics used in electronics.

Infrastructure projects and rising residential and commercial developments drive demand for long-lasting ceramic products in Southeast Asia, further driven by advanced manufacturing technologies and favorable government policies in these economies. North America and Europe both play key roles, with significant demand for advanced and sustainable ceramic applications.

By Region and Countries

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Key players in the ceramics market prioritize innovation and product diversification to meet growing demands from various sectors - such as construction, electronics, and healthcare. Leading manufacturers prioritize advanced ceramics for use in electronics and industrial applications, drawing upon their extensive knowledge to produce materials with exceptional durability, thermal stability, and chemical resistance.

Many companies are expanding their sustainable offerings, adopting eco-friendly processes and recycling materials in order to address environmental concerns while comply with stringent regulations. Strategic partnerships, research investments and regional expansions are common practices which enable these players to seize emerging market opportunities - especially those emerging markets such as Asia-Pacific.

Some of the prominent players in the global Ceramics market are

Recent Development

- 3M – New Product Launch (March 2023): 3M introduced a line of advanced ceramic materials tailored for electronics and industrial applications. These high-performance ceramics offer enhanced thermal stability and durability, ideal for high-stress environments. This launch aligns with 3M’s focus on innovative solutions for demanding applications, particularly in semiconductor and renewable energy sectors.

- AGC Ceramics Co., Ltd. (January 2023): AGC Ceramics acquired a specialty ceramics manufacturing firm in January 2023, expanding its production capacity and enhancing its portfolio for electronics and automotive markets. The acquisition allows AGC to meet growing demand for ceramics in high-tech applications, further strengthening its position in Asia and boosting its advanced material offerings.

- CeramTec GmbH (April 2023): CeramTec GmbH launched a series of biocompatible ceramics for medical implants in April 2023. These products feature improved wear resistance and are tailored for orthopedic and dental applications. The launch underscores CeramTec’s commitment to advancing healthcare solutions, meeting the needs of an aging population and growing demand for durable implant materials.

- CoorsTek Inc.(February 2023): In February 2023, CoorsTek entered a strategic partnership with a European tech company to develop ceramic components for electric vehicle batteries. This collaboration leverages CoorsTek’s expertise in ceramics with cutting-edge battery technology, aiming to improve energy efficiency and extend battery life in EVs, addressing the growing market for sustainable transportation.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 255.6 Bn |

| Forecast Value (2033) |

USD 435.9 Bn |

| CAGR (2024-2033) |

6.2% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Traditional, Advanced) By Application (Sanitary Ware, Abrasives, Bricks and Pipes, Tiles, Pottery, Others) By End-Use (Building and Construction, Industrial, Medical, Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

3M, AGC Ceramics Co., Ltd., CeramTec GmbH,, CoorsTek Inc., Du-Co Ceramics Company, Kajaria Ceramics, MOHAWK INDUSTRIES, INC., Morgan Advanced Materials, RAK CERAMICS, Saint Gobain |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |