Market Overview

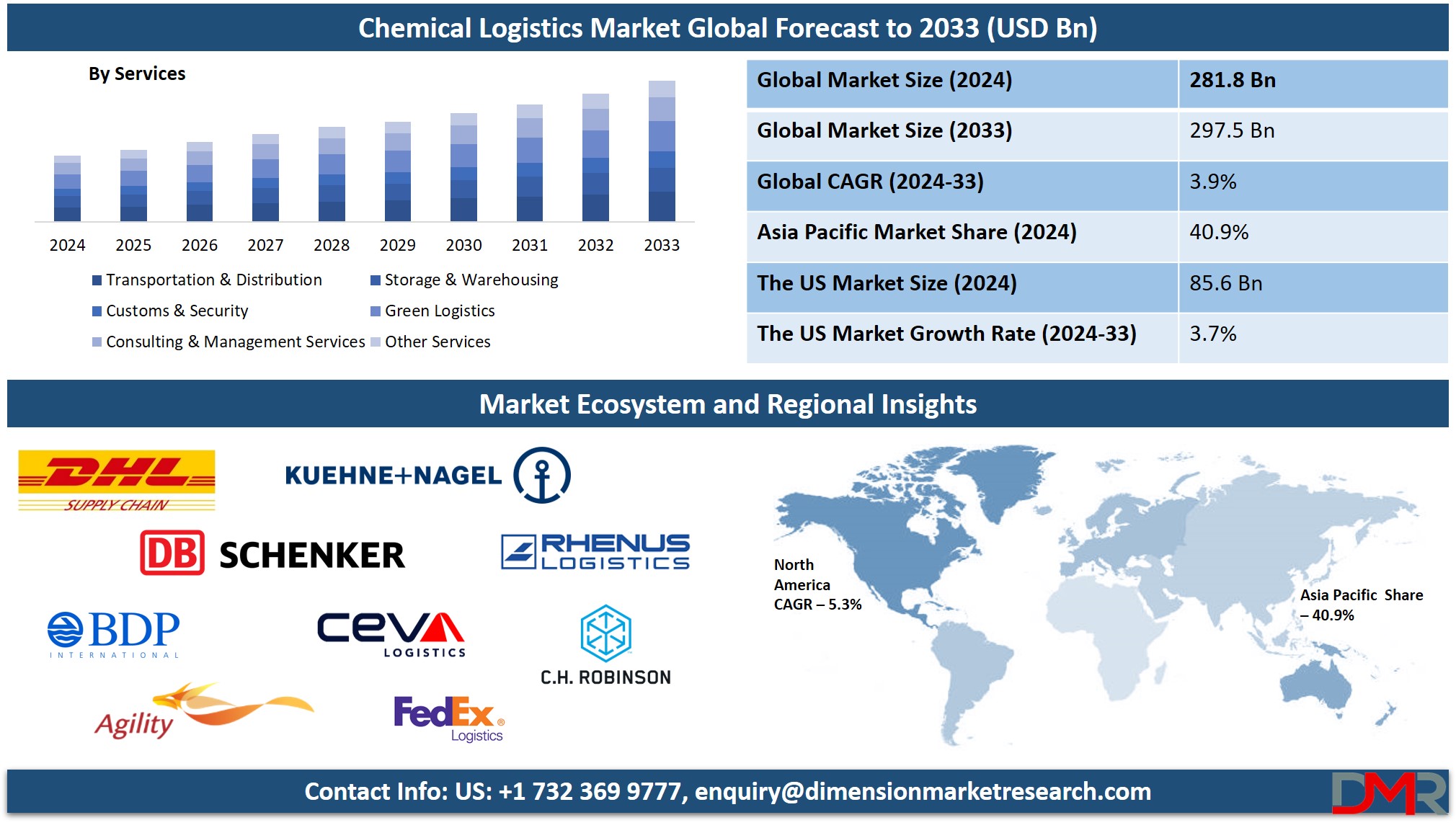

The Global

Chemical Logistics Market is expected to reach a

value of USD 281.8 billion in 2024 and which further forecasted to reach

USD 297.5 billion by 2033, at a

CAGR of 3.9%.

Chemical logistics plays a crucial role in the supply chain of chemical products in the most effective manner using transportation, storage, and distribution. Given the rapid growth in the chemical sector, the demand for value-added logistics services has surged. The global chemical logistics market size is expected to expand significantly during the forecast period, driven by innovations in green logistics and an increase in the adoption of reliable logistics practices by major industries such as the pharmaceutical industry, cosmetic industry, gas industry, and specialty chemicals industry. Furthermore, increasing global chemical production and ever-growing demand for

supply chain management have amplified the prominence of this market.

Chemical logistics demand has become a major growth contributor to the chemical logistics market. Now, the companies involved in the business of the chemical logistics market are focusing on the development of different types of technologies, through which the processes regarding chemical logistics would be eased, which in turn, ensures appropriate handling of hazardous chemicals without affecting the environment or life forms around. The increasing usage of

chemical injection pumps in the oil & gas and petrochemical sectors has also created specialized logistics demands for transporting and maintaining these precision instruments.

For instance, Rhenus Logistics has introduced high-class solutions to extend the range of its services in chemical logistics. It shows consistency with the growth of the green warehouse's trend in the chemical sector, as it reduces the carbon footprint yet still maintains efficient operation levels. The ability to manage all other different types of chemical needs with efficient logistics boosting gives the prominent players a high market share in the chemical logistics arena.

Growing demand for logistics in the specialty chemicals industry and the cross-border flow of chemicals point toward a strong logistics infrastructure. With the changing dynamics of the global chemical logistics market, the focus has shifted towards market expansion, leading to significant investments in logistics companies. Technologies like

Generative AI in logistics are transforming how companies plan and optimize distribution routes, forecast inventory requirements, and simulate supply chain disruptions for better risk management.

Growth in the demand for chemicals and the dependence of chemical manufacturers on highly specialized logistics providers for maintaining their products are driving this growth in the chemical logistics market. There is, however growing interest in green logistics, in which a big trend toward more sustainable development can be seen. This is in tune with the need for the entire world to implement greener solutions to whatever problems are at hand, particularly seen through the pharmaceutical industry or cosmetic industries.

The market is segmented based on various services and applications that are designed to serve diversified industry needs requiring the shipment and transportation of chemical products. Safety and efficiency are considered paramount in this marketplace, where demand for value-added logistics solutions is increasing steadily. The growth of the chemical manufacturing industry is, therefore, a critical driver in the growth of the chemical logistics sector.

In light of the efforts of chemical companies to meet demand on a worldwide scale, the need for effective and efficient logistics has been felt, and specialized services have become quite necessary. According to the market research review, strategic partnerships by logistics companies with chemical manufacturers remain key to their seamless operations. It can particularly be seen in those areas of the gas industry and specialty chemicals' presence where chemical logistics come into the market with all types of services for various industries.

The forecast for the chemical logistics market is a growth rate that is quite strong, with an increased level of activities in the distribution of chemicals and innovations in the solutions for logistics. In the chemical logistics sector, digital technologies like real-time tracking and automation are being integrated. Market players are investing in these technologies to enhance efficiency and maintain their competitive edge.

The valuation of the size of the logistics market was quite significant, hence expected to see a moderate CAGR, supported by primary drivers such as an upsurge in the expanding chemical supply chain and rising chemicals industries across the globe. The implementation of

Artificial Intelligence (AI) in logistics systems has further improved operational forecasting, asset management, and route planning, resulting in lower costs and faster delivery cycles.

The US Chemical Logistics Market

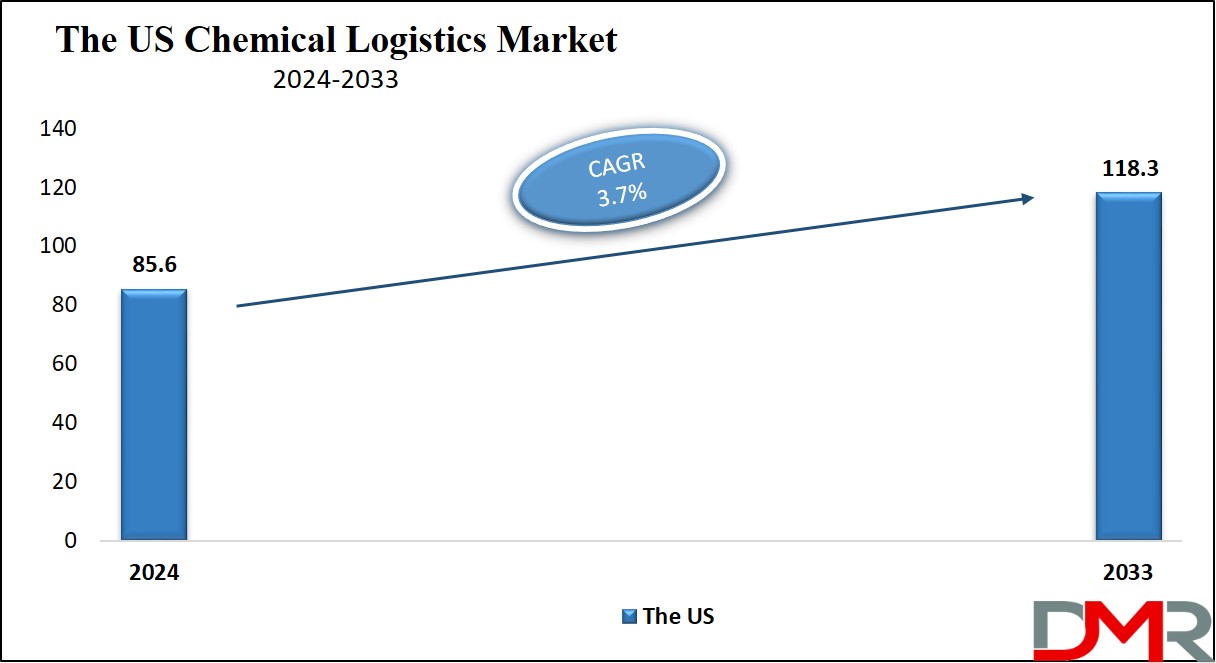

The

US Chemical Logistics Market is projected to be

valued at USD 85.6 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds

USD 118.3 billion in 2033 at a

CAGR of 3.7%.

The U.S. leads with regard to the operation of chemical logistics due to its pretty well-established base of manufacturing chemicals. The United States also has a high demand for appropriate logistics infrastructure that would manage complex supply chains related to the industry since it is one of the world's largest producers of chemicals.

- The market benefits from developed roadways, rail networks, and ports that enable the transportation of chemicals both domestically and internationally. With growing environmental sustainability concerns, logistics providers have started using green practices, such as transitioning to electric fleet vehicles, optimizing supply chains for energy efficiency, and implementing renewable energy solutions in warehouses. In addition, many U.S.-based companies are deploying logistics robotics to automate warehouse operations and reduce dependency on manual labor.

- Transportation and distribution services dominate the market, with road transport being at the forefront due to its flexibility and efficiency in carrying short- to medium-haul shipments. Multimodal solutions using rail and sea transport are increasingly sought after; these offer cost-effective options for long-distance logistics.

- Companies such as XPO Logistics and A&R Logistics, are expanding in the U.S. by investing in digital solutions and infrastructure upgrades. The companies apply technologies like predictive analytics and blockchain to improve the supply chain visibility and ensure compliance with strict safety regulations.

Key Takeaways

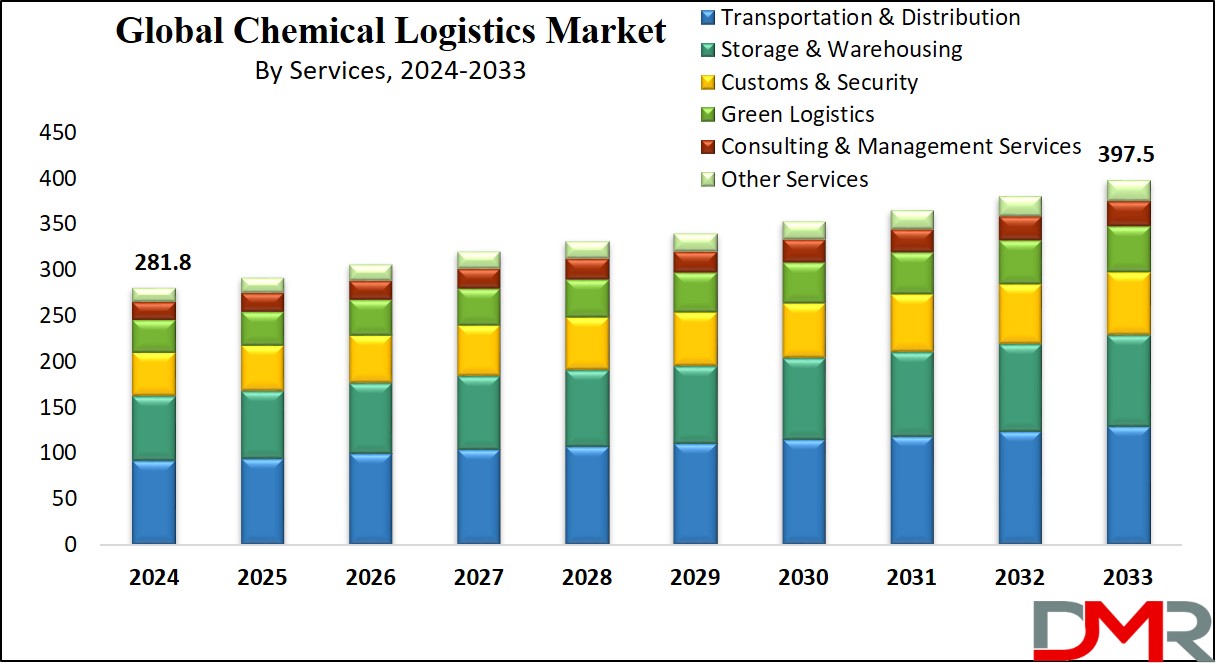

- Global Market Value: The Global Chemical Logistics Market size is estimated to have a value of USD 281.8 billion in 2024 and is expected to reach USD 297.5 billion by the end of 2033.

- The US Market Value: The US Chemical Logistics Market is projected to be valued at USD 85.6 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 118.3 billion in 2033 at a CAGR of 3.7%.

- By Services Segment Analysis: Transportation services, especially in the chemical logistics market are projected to dominate the service seg, ent with 32.2% of the market share in 2024.

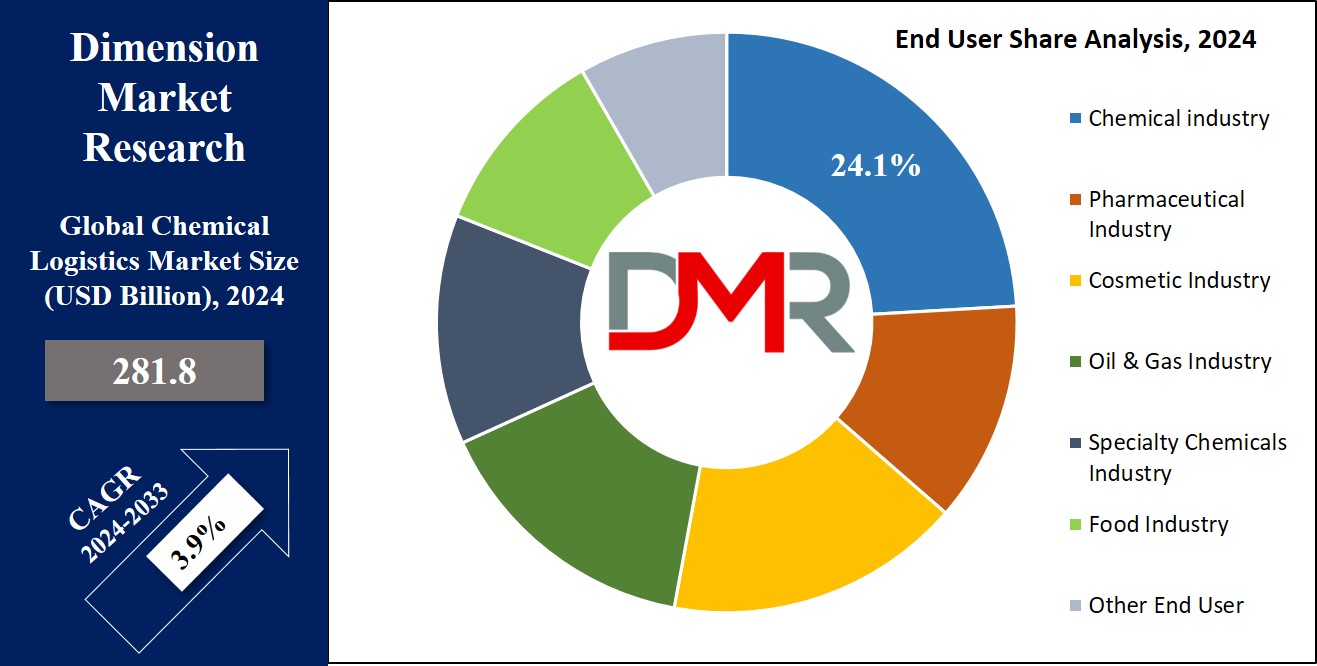

- By End User Segment Analysis: The chemical industry is projected to dominate the chemical logistics market as it holds 24.1% of the market share in 2024,

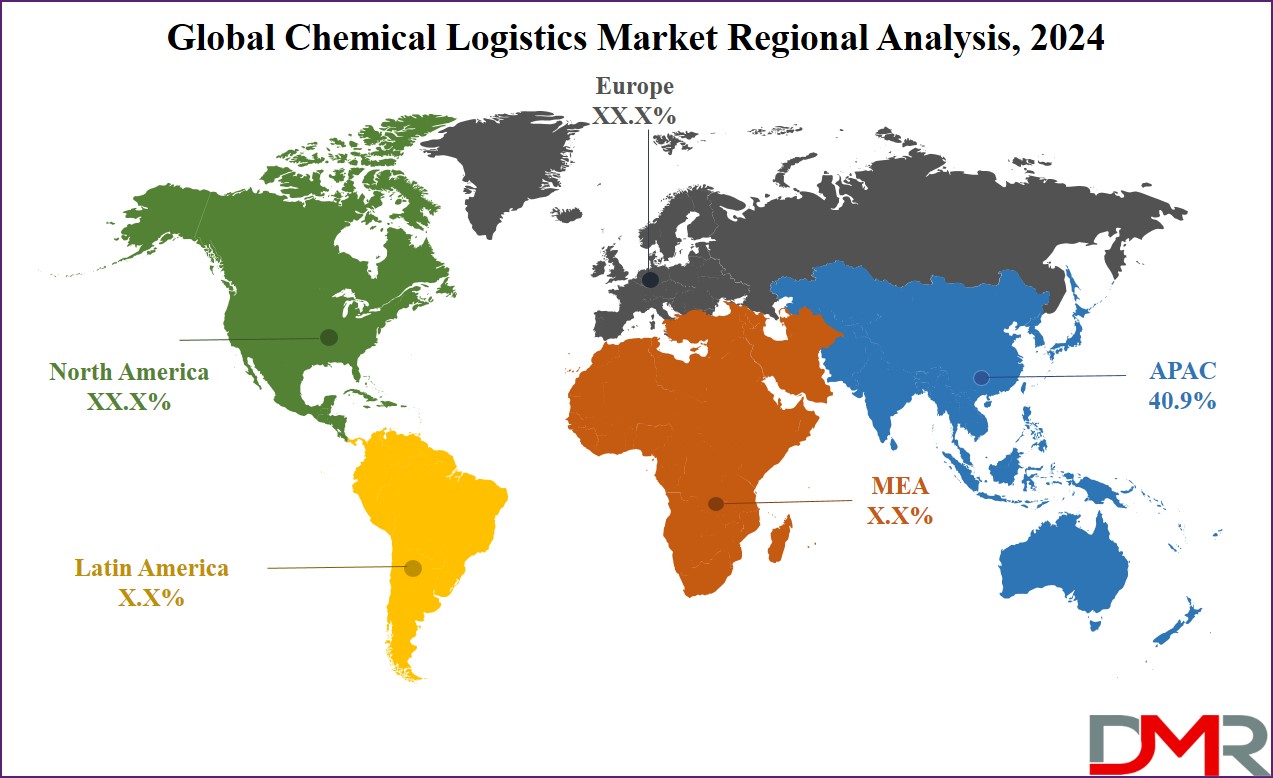

- Regional Analysis: Asia Pacific is expected to have the largest market share in the Global Chemical Logistics Market, about 40.9% in 2024.

- Key Players: The major key players in the Global Chemical Logistics Market are DHL Supply Chain & Global Forwarding, DB Schenker, Agility Logistics, Rhenus Logistics, C.H. Robinson, A&R Logistics, and many others.

- Global Growth Rate: The market is growing at a CAGR of 3.9 percent over the forecasted period.

Use Cases

- Pharmaceutical Industry: Logistics providers play important roles in ensuring the secure transportation of temperature-sensitive pharmaceutics through refrigerated containers and IoT-enabled real-time monitoring systems that ensure compliance in transit and product integrity.

- Cosmetic Industry: Efficient supply chains will play a major role in the management of raw material and cosmetic products' distribution to ensure timely market availability for the satisfaction of consumer demands coupled with strict regulatory standards concerning their safety and quality.

- Gas Industry: Special logistics services in cryogenic transportation are an important aspect of the safe handling of liquefied and pressurized gases. This ensures that such gases are transported in special containers that retain safety and prevent leaks or accidents.

- Specialty Chemicals Industry: Specialty chemical manufacturing, therefore, largely relates to bulk storage, precision in delivery, and regulatory compliances requiring specialized logistical solutions. Furthermore, these services guarantee the safe handling and timely distribution of such valuable chemicals, meeting particular industrial standards.

Market Dynamic

Trends in the Global Chemical Logistics Market

Green Logistics PracticesThis can also involve the implementation of greener practices within their sustainability strategies by chemical logistics service providers. It includes electric and hybrid transporters, inroads of renewable energy sources in the operation of warehouses, and optimized route planning to minimize fuel consumption and increase the efficiency of operations. Green logistics are driven by regulatory pressure, such as the Paris Agreement, and by the growing market demand from environmentally conscious consumers and industries desiring greener operations.

For example, the transportation of hazardous chemicals is becoming greener, with firms looking toward cleaner alternatives that align with both environmental goals and compliance regulations. Not only is it good for the planet, but these practices also ensure costs are reduced in the long run, making it a win-win situation for the company and the environment because of green logistics.

Digitalization in LogisticsIn addition, there have been digitalizations in logistics with the help of various emerging technologies, such as blockchain, IoT, and AI.

Blockchain technology brings in the element of transparency within the supply chain since it develops indelible marks on every transaction, which in turn can be used to maintain the integrity of data. IoT is also changing the face of the industry by facilitating real-time monitoring, especially for those shipments that require sensitive temperature or humidity control. For example, IoT sensors guarantee the proper conditions under which pharmaceutical products or some perishable chemicals are being transported, to keep standards of quality and safety.

On top of that, some AI-based tools optimize operational processes by predictive maintenance, route optimization, and demand forecasting and, hence, make it possible to conduct logistics activities more effectively and at a lesser cost. Increased adoption of such digital technologies has improved the overall supply chain resilience and transparency while lessening human error and operational costs.

Growth Drivers in the Global Chemical Logistics Market

Rising Chemical Production

The global demand for chemicals has surged, with industries like automotive, electronics, pharmaceuticals, and agriculture driving the pace. With these industries growing continuously, the demand for efficient chemical logistics is also taking shape. Emerging economies of Asia and Latin America are greatly contributing to this growth.

While countries like China and India hold large amounts of production, industrialization across Southeast Asia and Africa has promoted chemical consumption. Given the rapid urbanization and industrious growth across these geographies, the logistics industry is increasingly required to bear the load of transportation and distribution across a wide range of chemicals. This is a demand that creates both challenges and opportunities at the same time for all chemical logistics providers since they try to optimize their networks and infrastructures to meet the arising needs of these industries in the best possible way.

Infrastructure Development

Infrastructure development is one of the main factors that contribute to growth in the chemical logistics market. Investments in port expansions, improved highway networks, and state-of-the-art logistics hubs create an efficient way of transportation, helping to reduce lead times while lowering costs for companies. Good logistics infrastructure also ensures better access to key markets, reducing congestion and improving connectivity between suppliers and consumers.

For example, the creation of new multimodal transport systems, such as integrated rail, road, and maritime hubs, makes chemical transportation easier, as well as quicker and cheaper regarding supply chains. Infrastructure development, particularly in developing regions, is important to enable global expansion of production and distribution networks of chemicals.

Growth Opportunities in the Global Chemical Logistics Market

Specialized Logistics Services

Value-added logistics services demand has grown significantly for the chemical industry. Hazardous chemicals, for example, must be relocated by special transporters such as tankers and ISO-containerized transporters to maintain safety from any hazardous situations and keep up with regulatory standards. With the growth in production quantity in the global arena, companies are seeking logistics service providers that would be able to provide them with customized solutions regarding the transport of flammable, corrosive, or toxic material.

Increasing demand for such niche logistic services offers tremendous opportunities for more tailored and safe solutions from companies, taking maximum advantage of the high level of expertise required to handle chemicals with a very high potential for danger. Specialty needs will be consumed by temperature-sensitive chemicals too, which would have the requirement of refrigerated transport or storage, again an extended scope of the said opportunity.

Emerging Markets

The markets of Southeast Asia, Africa, and parts of Latin America have become new grounds for the supply of chemical logistics services. The rapid industrialization, urbanization, and growth in the import of chemicals in these regions spur the demand for effective and dependable logistics solutions.

With these markets continuing to develop, demand for chemicals grows in industries such as agriculture, automotive, and consumer goods very areas that increase the need for logistics providers. It's here that companies could gain traction by offering cost-effective, reliable services for growth in chemical production and consumption within developing markets.

Restraints in the Global Chemical Logistics Market

High Costs

The chemical logistics industry has high-cost pressure due to strict safety regulations, special equipment investment, and environmental standards. For instance, hazardous chemicals are normally transported in specialized vehicles, such as pressurized containers or refrigerated trucks, which all have higher operational costs. Besides, logistics players have to invest in enhanced safety-related measures like personal protection devices, safe warehousing, and necessary certificates of compliance with regulatory regimes, all of which add to the aggregate cost factor.

It is also quite beyond the reach of most SMEs to afford such high costs, which severely limits their competitive positioning vis-à-vis larger players in the same industry. This cost barrier can further inhibit innovation, with companies being more reluctant to invest in new technologies or upgrades to infrastructure in a world of rising operational expenses.

Geopolitical Risks

Major geopolitical risks involving trade restrictions, tariffs, and regional conflicts act as heavy hindrances to the development and growth of the global chemical logistics market. Chemicals mostly originating from different countries in global flow may lead to delays and increased costs or even supply chain disruption. Besides that, political instability in some producing or transit regions-for instance, the Middle East or Eastern Europe further elevates these risks, making transport more expensive and eventually leading to bottlenecks within the supply chain.

Additionally, tariffs or changes in trade policies may alter the flow of chemicals between countries, which might affect logistics providers' capabilities to sustain efficient and cost-effective operations. It follows, therefore, that such geopolitical challenges place the chemical logistics players in constant observance of international relations globally, thereby diversifying their supply network to minimize the risks of acute trade disruption.

Research Scope and Analysis

By Services

Transportation services, especially in the chemical logistics market are projected to dominate the service segment with 32.2% of the market share in 2024. Transportation services form the most important aspect of the chemical logistics market, where different chemicals have to be delivered from their production facilities to customers or end-users in a timely and efficient manner. This section of the logistics market is quite crucial, as the nature of commodities transported involves safety aspects, regulatory issues, and speed of delivery.

Chemicals usually require particular transport conditions, such as maintaining temperature, handling hazardous materials, and following strict international regulations. This would be achieved through transportation services, which cater to such needs by offering dedicated fleets, temperature-controlled vehicles, and specialized routes. The transportation and distribution segments lead the way in chemical logistics, owing to enhanced tenets of complexity and volume about burgeoning chemical products in the supply chains.

For example, raw chemicals are important feedstock contributors in industries such as the pharmaceuticals, agriculture sector, and manufacturing plants relying largely on regular, precise procurement of both raw and finished supplies. Additionally, transfers services need to be flexible regarding issues on variability in destination, type of chemical involved, or urgency.

Thus, e-commerce and generally intercontinental trade contributed even further in strengthening the relevance of the subject logistics services by triggering increased demand and, of course, innovation.

High-volume real-time tracking, together with other innovative technologies that demand timely deliveries in non-damaged, safe-from-theft, contamination-free cargoes, are paramount with chemicals.

By Mode of Transportation

Among all transportation modes, roadways have emerged as the leading mode of transport in the chemical logistics market because of their unparalleled flexibility and reliability in offering short-haul deliveries. The main reason for the importance of road transport is that it provides direct access to various industrial locations; thus, it has become an integrated part of the supply chain for chemicals. Roadways also have their relative advantages such as door-to-door delivery, thereby reducing transit times and the intricacy of handling shipments-especially small lots of chemicals, which may not justify bulk transport.

It can also handle anything from hazardous materials to rather benign types of chemicals due to the versatility of road transport, with dedicated vehicles such as tankers, bulk carriers, and temperature-controlled trucks. Besides, road transport will be able to navigate through both urban and rural routes, thus making it more appealing for chemical logistics. Quite unlike rail or sea transportation, which has fixed routes and schedules, road transport is highly adaptable to changing conditions and urgent delivery requirements.

In all, this makes the road the preferred means for last-mile delivery, which is so essential for areas such as agriculture, manufacturing industries, and healthcare. Thus, with the rise in global demand for chemicals, the future promises to keep the present status quo in freight transport: pretty fast, functional, and rather accessible routes will outperform pressing sustainability concerns and emerging demands from the side of regulation.

By End User

The chemical industry forms the largest end-user segment in the logistics market as it holds 24.1% of the market share in 2024, which is driving demand for transportation and distribution services. Thus, this industry requires complex logistical solutions for the supply of raw materials, intermediates, and finished products. Apart from that, it finds applications in numerous downstream industries such as automotive, pharmaceutical, agriculture, and consumer goods these industries are completely dependent upon the timely delivery of the respective chemicals for the manufacturing and distributing of their goods.

This demand has given birth to a highly specialized way of transportation, especially because of the growing demand for specialty chemicals, petrochemicals, and agricultural chemicals across the globe. For instance, hazardous chemicals, like flammable liquids or toxic substances, have to be treated with extreme caution, are subject to highly specialized packaging, and must follow rigid safety standards.

The need for just-in-time delivery in the chemical industry, together with its demand for high-value-added services, drives the growth in the chemical logistics market. Besides, the constant changes in the chemical formulation and manufacturing processes require flexibility in the logistics services, as many of the new chemicals and materials have their specific issues related to storage and transportation.

In itself, the chemical industry's turn toward sustainability raises the bar in terms of the complexity of its logistics, from eco-friendly chemicals to eco-friendly packaging. This move has further increased demand for new logistics solutions, including temperature-sensitive transportation, reverse logistics, and recycling among more efficient supply chain management practices. Overall, with the centrality of the chemical industry to the global economy, the dominance of chemicals as a product within the logistics sector remains clear, accounting for the majority of cargo tonnage and volume of transportation.

The Chemical Logistics Market Report is segmented on the basis of the following

By Services

- Transportation & Distribution

- Storage & Warehousing

- Customs & Security

- Green Logistics

- Consulting & Management Services

- Others

By Mode of Transportation

- Roadways

- Railways

- Airways

- Waterways

- Pipelines

By End User

- Chemical industry

- Pharmaceutical Industry

- Cosmetic Industry

- Oil & Gas Industry

- Specialty Chemicals Industry

- Food Industry

- Other End User

Regional Analysis

The Asia-Pacific region is projected to hold a dominant position in the chemical logistics market with

40.9% of the market share in 2024. The Asia-Pacific region accounts for the largest share of the chemical logistics market, largely because of rapid industrialization and growing chemical production, especially in countries like China and India. The Asia-Pacific region hosts a number of the world's largest manufacturing hubs and has the maximum share in the production and consumption of chemicals in the chemical sector.

Apart from that, the development of industries like automotive, electronics, and pharmaceuticals in countries such as China, Japan, and South Korea has created a demand for chemicals and thereby boosted chemical logistics services. The region's dominance could be attributed to China, the world's largest producer of chemicals. Huge infrastructure development in the country-particularly transportation systems like ports, highways, and railways-has ultimately paved the way for the comfortable and swift transportation of chemical products both within the country and to other countries as well.

In addition, the budding economy of India and the rapid growth in its manufacturing base is also one of the reasons for the upsurge in recent times regarding the production and consumption of chemicals in that region. As these countries prepare for increased production to cater to both domestic and international demand, the chemical logistics market is continuously growing. Besides this, the establishment of new chemical plants and facilities, combined with increasing demand for more sophisticated and efficient logistics solutions, propels Asia-Pacific to the fore in chemical logistics.

The fact that environmental regulations have stiffened worldwide has ensured significant adoption of advanced logistics technologies like AI-driven supply chain management, temperature-controlled transport, and real-time tracking across the Asia-Pacific, so as to meet both regulatory requirements and the growing consumer expectations for speed and safety. Competitive advantages of the region, such as low labor costs, extensive transport infrastructure, and an increasing pool of skilled logistics professionals, further maintain the status of the Asia-Pacific region as the most sought-after place for the production and distribution of chemicals.

The rise in the middle class in most countries of the Asia-Pacific region has also contributed to the growth of consumer goods industries reliant on chemical products, thus driving further the need for efficient logistics services. It would finally be said that, in the face of the rapid industrialization of the two rising China and India, improving logistics infrastructure, and increasing regional demand for chemicals, the Asia-Pacific will undoubtedly emerge as the undisputed global leader in the growing market of chemical logistics.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive scenario of the global chemical logistics market includes key logistics providers like DHL Supply Chain, XPO Logistics, and Rhenus Logistics. These companies are focused on finding innovative technologies and expanding their service portfolios to sustain leadership in the market. For reduction in carbon footprint, DHL Supply Chain has significantly invested in green solutions for logistics and also striving for operational efficiency.

Moreover, sustainability has become entrenched within the company's strategies since chemical markets demand greener logistic alternatives on growing demand. XPO Logistics extends its presence all over the world through acquisitions of shareholdings, ensuring delivery of value-added chemicals logistics services across different geographies.

Rhenus Logistics is highly present in terms of infrastructure. Real-time tracking for digital transformation and other issues related to customer service improvement and reduction in lead times are being heavily invested in. Besides this, companies are increasingly investing in technologies such as IoT, automation, and AI-driven solutions to meet the increasing demand for safe, efficient, and reliable chemical logistics services.

Moreover, they extend their service portfolios with value-added chemical products like dangerous goods, pharmaceuticals, and gases to remain competitive in the dynamic environment of chemical logistics.

Some of the prominent players in the Global Chemical Logistics Market are

- DHL Supply Chain & Global Forwarding

- Kuehne + Nagel International AG

- DB Schenker

- Agility Logistics

- Rhenus Logistics

- C.H. Robinson

- A&R Logistics

- BDP International

- Ceva Logistics

- Al-Futtaim Logistics

- Montreal Chemical Logistics

- Petrochem Middle East

- FedEx Logistics

- Other Key Players

Recent Developments

- May 2024: C.H. Robinson introduced advanced tracking and safety technologies to improve hazardous chemical transportation, enhancing real-time visibility and monitoring capabilities throughout the supply chain for better safety and efficiency.

- April 2024: Sinotrans launched a digital platform to enhance the management and tracking of chemical logistics, integrating order management, transportation planning, warehouse management, and shipment tracking for improved efficiency and transparency.

- April 2024: Quantix SCS, a Wind Point Partners portfolio company, acquired CLX Logistics, strengthening its position as a leading supply chain services provider for the chemical industry in North America.

- March 2024: Leschaco opened a chemical logistics center in the Netherlands, strategically located near major seaports and waterways like the Rhine and Meuse, optimizing multimodal transportation for chemical goods.

- December 2023: DHL acquired Agility Integrated Logistics, boosting its chemical logistics capabilities and enhancing its presence in emerging markets through expanded integrated logistics services.

- November 2023: BASF and DB Cargo formed a partnership to implement sustainable logistics solutions for the chemical industry, focusing on reducing the environmental impact through innovative rail and intermodal transport options.

- October 2023: XPO Logistics acquired Kuehne+Nagel’s contract logistics business, including chemical logistics operations, strengthening its network and expanding expertise in handling hazardous materials.

- September 2023: Dow and Ryder collaborated to enhance the efficiency and visibility of Dow's chemical transportation network, using Ryder's logistics expertise and technology for optimized planning and execution.

- March 2023: Brenntag acquired Univar Solutions, consolidating its position as a leading chemical distributor and expanding its reach in the chemical logistics market.