Clinical trials are essential research studies that assess the safety and effectiveness of medical interventions like drugs, biologics, and devices. They play a key role in advancing medical knowledge and improving patient care by providing critical data for regulatory approvals.

Recent data shows that 77% of registered clinical studies are interventional, with most focusing on drugs, biologics, and devices. Clinical trials account for 40% of the U.S. pharmaceutical research budget, valued at approximately $7 billion annually, highlighting their importance. Globally, non-U.S. regions lead in the number of registered studies, offering significant opportunities for expansion into untapped markets.

In 2024, the market is expected to grow with increased investments in

precision medicine and rare disease research. Emerging technologies like AI-driven analytics, remote patient monitoring tools, and decentralized trials are transforming the industry, making clinical research more efficient and accessible.

Trends such as remote trials using telemedicine and wearable devices are improving patient convenience and cutting costs. There is also a strong push toward including diverse populations in trials, supported by culturally sensitive recruitment methods.

The growing collaboration between tech companies and CROs is further driving innovation, while government support in developing regions opens doors for new business opportunities. With a focus on patient-centric approaches and technological advancements, businesses in this market can thrive in a competitive landscape.

Key Takeaways

- The market size is projected to reach a value of USD 174.3 billion in 2033, in comparison to USD 11.2 billion in 2024 at a CAGR of 36.5%.

- A clinical trial is a research study concerning human individuals to assess the safety and efficacy of medical interventions, like drugs and therapies, under controlled environments.

- Phase 3 is expected to exert its dominance in the phase segment with the highest market share by the end of 2024.

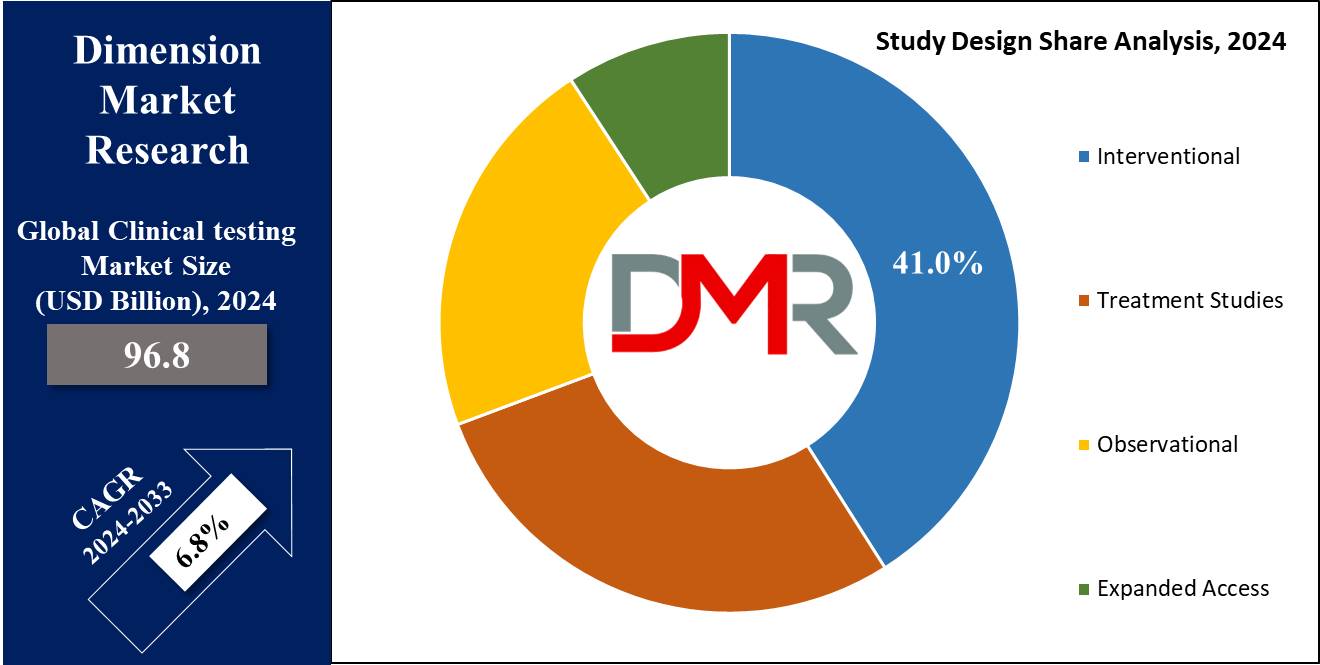

- Interventional are projected to exert prominence in this segment with 41.0% of market share in 2024.

- Oncology is projected to exert its dominance in the indication segment with the highest market share in 2024.

- Pharmaceutical & biopharmaceutical companies are expected to exert their dominance in the sponsor segment with the highest market share by the end of 2024.

- Vaccines are projected to exert prominence in this segment with 39.0% of the market share in 2024.

- The hospitals are projected to exert their dominance in the end-user segment with the highest market share in 2024.

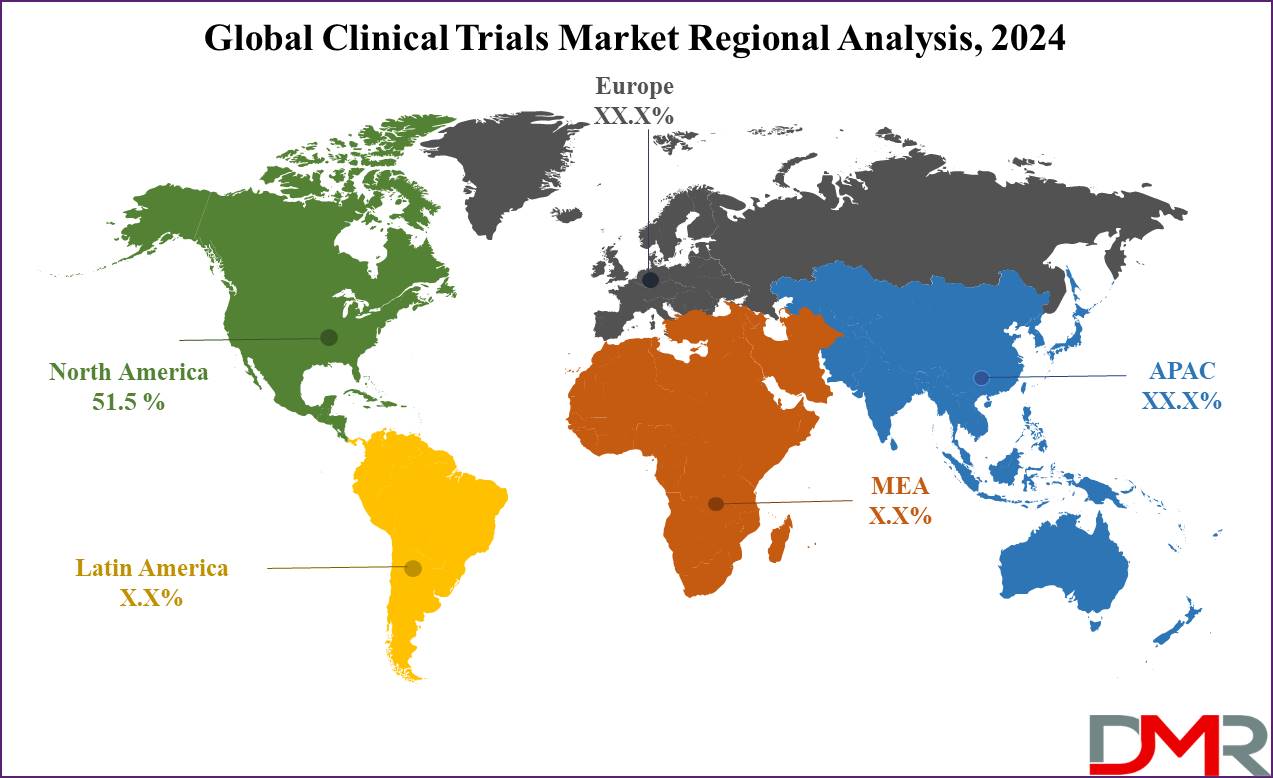

- North America is projected to dominate the global clinical trials market with 51.5% of the market share in 2024.

Use Cases

- Evaluating New Drug Efficacy: Clinical trials verify the effectiveness of novel pills in treating unique conditions, presenting essential data to determine their safety and efficacy for regulatory approval.

- Comparative Effectiveness Studies: These trials compare the effectiveness of various treatment options for a particular disease, guiding clinicians and patients in making knowledgeable choices about the most suitable treatment approach.

- Investigating Rare Diseases: Clinical trials focusing on rare diseases goal to recognize the underlying mechanisms, natural history, and treatment for these conditions.

- Precision Medicine Trials: These trials leverage genetic and molecular information to tailor treatment for individual patients, improving treatment outcomes with the aid of targeted therapies to patients who are most likely to benefit.

Market Dynamic

Trends

Virtual Clinical Trials Adoption

Virtual medical trials have become more and more famous because of improvements in digital health technologies. These trials permit far-flung monitoring and data collection, decreasing the need for physical website visits. This trend is pushed with the aid of the need to increase patient participation and reduce trial costs. Virtual trials also offer better access to diverse patient populations, improving the generalizability of clinical research outcomes and streamlining the clinical trial system.

Increased Focus on Oncology

The oncology segment continues to dominate the clinical trials market, driven by the high occurrence of cancer and the urgent need for new treatment procedures. Innovations in personalized treatment and immunotherapies are leading to more targeted and effective cancer treatments. This trend is supported through enormous investment and expedited regulatory pathways, making oncology trials an imperative recognition for pharmaceutical and biopharmaceutical corporations aiming to deliver new cancer treatments to the market.

Growth Drivers

Rising Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases, along with diabetes, cardiovascular illnesses, and most cancers is driving the need for clinical trials. As the worldwide population grows, the occurrence of these conditions rises, necessitating ongoing research and improvement of new treatments. This developing need directly contributes to the expansion of the scientific trials market, boosting the market.

Technological Advancements

Advancements in medical technology, inclusive of next-generation sequencing, AI, and machine learning, are revolutionizing clinical trials. These technologies enhance trial design, patient recruitment, and records analysis, making trials more efficient and cost-effective. Innovations including decentralized trials and real-time data monitoring also are enhancing trial outcomes and patient compliance, driving further growth in the clinical trials market.

Growth Opportunities

Expansion in Emerging Markets

Emerging markets, particularly in Asia-Pacific and Latin America, present extensive increase possibilities for the clinical trials marketplace. These areas provide huge, numerous affected person populations and lower operational expenses, making them appealing for engaging in medical trials. Increasing healthcare infrastructure and regulatory help in these areas also are facilitating the growth of clinical trials, presenting new opportunities for market growth.

Personalized Medicine

The rise of personalized medicine, which tailors treatments based on persons-specific genetic profiles, is opening new opportunities in the scientific trials market. The personalized medicinal drug requires extensive medical research to develop targeted therapies, especially in areas like oncology and rare sicknesses. This approach complements treatment efficacy and patient outcomes, driving the need for specialized medical trials and contributing to market growth.

Restraints

High Cost of Clinical Trials

The high cost of accomplishing clinical trials is a major restraint for this marketplace. These costs consist of charges related to patient recruitment, data management, and regulatory compliance. Small and medium-sized enterprises frequently struggle to bear those costs, restricting their potential to participate in clinical; research. This financial barrier can slow the general pace of innovation and market growth.

Stringent Regulatory Requirements

Stringent regulatory necessities and long approval processes can hinder the progress of scientific trials. Compliance with numerous regulations across different countries provides complexity and delays, impacting the efficiency of scientific research. These regulatory challenges can result in increasing costs and extended timelines for bringing new treatments to the marketplace, posing a giant restraint at the clinical trials market dynamics.

Research Scope and Analysis

By Phase

Phase 3 scientific trials dominate the medical trials market by segment due to their vital function within the drug development processes. These trials are pivotal as they involve large patient populations to confirm the efficacy and monitor the safety of recent treatments on a broader scale. The major objective of Phase 3 trials is to provide definitive proof of a drug’s effectiveness and accumulate comprehensive safety information. This segment normally includes several hundred to numerous thousand contributors, which enhances the statistical power of the results and ensures that the findings are sturdy and generalizable to the broader population.

Phase 3 trials are important for regulatory approval. Regulatory bodies, consisting of the FDA and EMA, rely closely on the data from Phase 3 trials to decide whether a new drug ought to be accepted for marketplace use. The data gathered on efficacy, side effects, and overall benefit-risk ratio is crucial for this decision-making process.

Moreover, the financial investment and resources allotted to Phase 3 trials are significant. Pharmaceutical and biopharmaceutical companies prioritize this section to make certain that their drugs meet the stringent necessities for market access, given the excessive prices associated with drug improvement and the capacity for tremendous economic returns once a drug is accepted.

Additionally, the fulfillment of a drug in Phase 3 can lead to accelerated symptoms and broader patient access, which is notably ideal for each organization and patient. This makes Phase 3 trials the point of interest of medical research efforts, similarly reinforcing their dominance in the medical trials marketplace.

By Study Design

Interventional research is projected to dominate the global clinical trials marketplace as it holds 41.0% of the market share in 2024 by taking a look at design due to its critical position in immediately assessing the efficacy and protection of the new treatments.

Interventional trials, mainly treatment research which includes randomized controlled trials (RCTs), are the gold standard for medical research. RCTs offer splendid proof by minimizing bias through randomization and control groups, ensuring reliable and robust results.

Adaptive medical trials, a subset of interventional research, provide flexibility by allowing adjustments based on interim results without compromising the integrity of the trial. This adaptability hastens the drug development process and improves resource allocation, making them more popular.

Non-randomized control trials also make a contribution to the dominance of interventional research, providing practical options when randomization isn't viable. These trials nevertheless provide treasured insights into treatment outcomes in real-world settings.

The emphasis on direct intervention to check new treatment, supported through rigorous methodologies and regulatory requirements, underscores the significance of interventional research. Their capacity to offer definitive proof of treatment efficacy and safety is crucial for regulatory approval and market access, using their prevalence in the clinical trials market.

By Indication

Oncology is expected to dominate the clinical trials market by using indication due to several key factors like cancer staying one of the leading reasons of death globally, driving an urgent need for new and powerful treatments. This high prevalence ensures huge funding in oncology research and development from pharmaceutical and biopharmaceutical groups, in addition to from governmental and non-governmental agencies.

The complexity and variety of most cancer types, consisting of blood cancers and solid tumors, necessitate a huge variety of scientific trials to increase focused treatment plans. Oncology trials regularly involve progressive strategies, together with immunotherapies, personalized medicine, and gene treatments, which require rigorous and tremendous clinical testing.

Furthermore, the regulatory framework and expedited pathways for cancer drugs, such as orphan drug designation and elevated approval processes, inspire more medical trials in oncology. These regulatory incentives help bring novel cancer treatments to market extra fast, enhancing the focus on this indication.

Additionally, the high potential for substantial financial returns on successful cancer drugs motivates ongoing funding and research in oncology. The combination of high disease burden, innovation in treatment modalities, supportive regulatory environments, and robust economic incentives ensures that oncology remains the dominant indication in the medical trials market.

By Service Type

Bioanalytical testing services are projected to dominate the clinical trials market section by service for several compelling reasons. Firstly, bioanalytical testing is important for evaluating the pharmacokinetics (PK), pharmacodynamics (PD), and overall efficacy of new drugs & treatments. These services provide crucial data on how a drug behaves within the frame, and its potential therapeutic benefits, which can be essential for regulatory approval.

Bioanalytical testing services embody an extensive variety of specialized assays and assessments, such as cell-based assays, virology testing, method development, optimization and validation, serology, immunogenicity, neutralizing antibodies, biomarker testing, and PK/PD testing services. This diversity of offerings ensures comprehensive evaluation and characterization of drug applicants, making them vital in the clinical trial procedure.

Moreover, improvements in

biotechnology and the growing complexity of the latest therapeutic modalities, inclusive of biologics and

gene therapy procedures, require state-of-the-art bioanalytical testing. These advancements have heightened the need for precise and reliable bioanalytical methods to support the improvement of innovative treatments.

Additionally, regulatory corporations have stringent requirements for bioanalytical records to ensure the safety and efficacy of recent drugs. This regulatory strain necessitates high-quality bioanalytical testing services, in addition to using their dominance within the clinical trials market.

By Sponsor

Pharmaceutical and biopharmaceutical organizations dominate the clinical trials market phase by the sponsor because of numerous vital factors. Firstly, these groups have extensive financial resources devoted to research and development (R&D). This significant investment enables them to conduct extensive and rigorous clinical trials necessary for developing new drugs and biologics.

Pharmaceutical and biopharmaceutical corporations are driven by the need to deliver advanced treatment therapies to market, specifically in response to unmet clinical needs. This force for innovation requires comprehensive clinical trials to ensure the safety, efficacy, and regulatory approval of recent treatments. Their commitment to advancing medical science translates into a wider variety of subsidized trials in comparison to different segments.

Furthermore, those businesses own specialized expertise and infrastructure for undertaking complex medical research, inclusive of access to advanced technology, skilled research teams, and robust data management systems. This infrastructure supports the efficient layout and execution of clinical trials throughout numerous stages.

Additionally, partnerships among pharmaceutical businesses, biopharmaceutical organizations, and academic establishments or clinical research organizations (CROs) improve their capacity to conduct massive-scale, multicenter trials. These collaborations are essential for accelerating the development process.

By Application

Vaccines are projected to dominate the clinical trials market segment with 39.0% of market share in 2024. The global demand for vaccines has surged, especially highlighted by the COVID-19 pandemic, which underscored the vital need for rapid vaccine improvement and deployment. This urgency has improved the wide variety of medical trials targeted at vaccines, riding a tremendous marketplace increase.

It also plays an essential function in public health by stopping the spread of infectious diseases. This importance ensures tremendous investment and help from governments, global health agencies, and personal entities, facilitating considerable scientific research and trials. The collaborative efforts among these stakeholders enhance the scope and scale of vaccine trials.

Additionally, advancements in biotechnology have caused modern vaccine development, consisting of mRNA vaccines, which require rigorous medical testing to ensure certain protection and efficacy. The improved timelines and priority assessment tactics for vaccine trials similarly contribute to their dominance.

Moreover, the success of high-profile vaccine trials, which include the ones for COVID-19, has validated the feasibility and importance of speedy vaccine development, encouraging ongoing investment and recognition in this area. Consequently, due to high demand, extensive investment, and technological improvements solidifies vaccines are solidified as the dominant application within the medical trials market.

By End User

Hospitals are expected to dominate the clinical trials market on the basis of end users as they hold the highest market share in 2024. Firstly, hospitals own the essential infrastructure and sources to conduct large-scale clinical trials, inclusive of advanced

medical equipment, specialized facilities, and comprehensive patient care capabilities. This extensive infrastructure helps the complexity and scale required for numerous levels of medical trials, specifically Phase III trials, which contain huge patient cohorts and rigorous monitoring.

Secondly, hospitals have access to a large patient population, improving the recruitment procedure for clinical trials. This range is essential for ensuring the robustness and generalizability of scientific research outcomes. Additionally, hospitals often have deep relationships with pharmaceutical companies & clinical research organizations (CROs), facilitating seamless collaboration and efficient trial management.

Moreover, hospitals provide an integrated environment for engaging in clinical studies, in which multidisciplinary teams of healthcare professionals, which include doctors, nurses, and researchers, can work together. This collaboration ensures comprehensive care and accurate data collection, vital for the success of clinical trials.

The Clinical Trials Market Report is segmented based on the following

By Phase

- Phase 1

- Phase 2

- Phase 3

- Phase 4

By Study Design

- Interventional

- Treatment Studies

- Randomized Control Trial

- Adaptive Clinical Trial

- Non-randomized Control Trial

- Observational

- Cohort Study

- Case-Control Study

- Cross-Sectional Study

- Ecological Study

- Expanded Access

By Indication

- Autoimmune/Inflammation

- Rheumatoid arthritis

- Multiple Sclerosis

- Osteoarthritis

- Irritable Bowel Syndrome (IBS)

- Others

- Pain Management

- Oncology

- Blood Cancer

- Solid Tumors

- Other

- CNS Condition

- Epilepsy

- Parkinson's Disease (PD)

- Huntington's Disease

- Stroke

- Traumatic Brain Injury (TBI)

- Amyotrophic Lateral Sclerosis (ALS)

- Muscle Regeneration

- Others

- Diabetes

- Interventional

- Observational

- Expanded Access

- Obesity

- Interventional

- Observational

- Expanded Access

- Cardiovascular

- Interventional

- Observational

- Expanded Access

- Others

By Service Type

- Protocol Designing

- Patient Recruitment

- Laboratory Services

- Site Identification

- Bioanalytical Testing Services

- Cell-based Assays

- Virology Testing

- Method Development, Optimization, & Validation

- Serology, Immunogenicity, & Neutralizing Antibodies

- Biomarker Testing Services

- PK/PD (Pharmacokinetics/Pharmacodynamics) Testing Services

- Other Bioanalytical Testing Services

- Analytical Testing Services

- Clinical Trial Supply & Logistic Services

- Clinical Trial Data Management Services

- Decentralized Clinical Services

- Medical Device Testing Services

- Others

By Sponsor

- Pharmaceutical & Biopharmaceutical Companies

- Medical Device Companies

- Others

By Application

- Vaccine

- Cell & Gene Therapy

- Small Molecules

- Others

By End User

- Hospital

- Laboratories

- Clinics

Regional Analysis

The global clinical trials market is expected to project significant growth as it is expected to

hold 51.5% of the market share in 2024. The North American marketplace, specifically the United States, dominates because of numerous key factors as this region has a high number of medical trials carried out yearly, supported by way of a properly established infrastructure for medical studies and a huge pool of participants willing to engage in medical studies. The presence of leading pharmaceutical companies and clinical research organizations (CROs) enhances the scope of the clinical trials in this region.

Additionally, North America advantages from huge funding in research and development, which drives the need for clinical trials. This funding is in addition reinforced by means of favorable regulatory frameworks that streamline the clinical trial process. The marketplace dynamics in North America are also stimulated by means of advancements in technology, inclusive of the adoption of virtual clinical trials, which increase efficiency and reduce prices.

Market analysis and market share analysis show that North America holds the largest market share due to these factors. The market segment of interventional trials and elevated access trials are mainly strong, contributing notably to market growth. During the forecast period, the clinical trials market in North America is expected to develop at a steady CAGR, pushed by the ongoing innovation and growing demand for clinical trial offerings.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The worldwide clinical trials market is surprisingly competitive, characterized by the presence of numerous key players striving to benefit marketplace proportion. Major corporations, along with IQVIA, Parexel, LabCorp, and Syneos Health, dominate the panorama, leveraging their full-size experience and superior technological abilities. These players continue to invest in Research and Development, pushing for advances in virtual and decentralized clinical trials which are fast becoming popular because of relevance and efficiency.

In terms of phase, clinical phase segmentation is studied, wherein the clinical phase III trials have a larger market share due to their significance in the drug approval process. North America takes the largest market share due to an upfront number of trials, developed healthcare systems in countries such as the US and Canada, and supportive legislation. Europe and the Asia-Pacific come next and are expected to grow at a higher rate as clinical trial activities and investment in healthcare rise in these areas.

New entrants are targeting micro-segments to avoid direct competition with established key players and adopting different strategies. Sometimes, companies might engage in partnerships, mergers, and acquisitions because of the need to collaborate and strengthen their ability to offer services or products as well as their presence globally, and thus the competitiveness of the environment is constantly shifting.

Some of the prominent players in the Global Clinical Trials Market are

- PAREXEL International Corporation

- IQVIA

- Charles River Laboratory

- Omnicare

- Kendle

- Chiltern

- Clinipace

- Laboratory Corporation of America

- Eli Lilly and Company

- ICON PLC

- Novo Nordisk AS

- Pfizer Inc.

- Other Key Players

Recent Developments

- In January 2024, Abbott announced the completion of the first trials for its Volt Pulsed Field Ablation (PFA) System, which is designed to treat heart rhythm disorders.

- In January 2024, Hoth Therapeutics, Inc. received approval from the FDA to expand its clinical trial for HT-001, a potential treatment for skin toxicities.

- In August 2023, LG Chem submitted an application to the Italian Medicines Agency for Phase 3 trials of its gout treatment, Tigulixostat. That same month, Parexel and Partex formed a strategic partnership to use AI-driven solutions to accelerate drug discovery and development for biopharmaceutical clients globally, aiming to reduce risks associated with their respective portfolios. I

- In August 2023, Novo Nordisk announced its acquisition of Inversago Pharma, as part of its strategy to develop new therapies for obesity, diabetes, and other significant metabolic diseases.

- In July 2022, the National Institute of Allergy and Infectious Diseases (NIAID), part of the NIH, began an early-stage clinical trial for an investigational vaccine to prevent Nipah virus infection.

- In May 2022, the International AIDS Vaccine Initiative (IAVI) and Moderna Inc. started a Phase I clinical trial of an mRNA vaccine antigen in Rwanda and South Africa.

- In April 2022, Charles River Laboratories International, Inc. acquired Explora BioLabs Holdings, Inc., a leading provider of contract vivarium research services.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 96.8 Bn |

| Forecast Value (2033) |

USD 174.3 Bn |

| CAGR (2024-2033) |

6.8% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Phase (Phase 1, Phase 2, Phase 3, and Phase 4), By Study Design (Interventional, Treatment Studies, Observational, and Expanded Access), By Indication (Autoimmune/Inflammation, Pain Management, Oncology, CNS Condition, Diabetes, Obesity, Cardiovascular, and Others), By Service Type (Protocol Designing, Patient Recruitment, Laboratory Services, Site Identification, Bioanalytical Testing Services, Analytical Testing Services, Clinical Trial Supply & Logistic Services, Clinical Trial Data Management Services, Decentralized Clinical Services, Medical Device Testing Services, and Others), By Sponsor (Pharmaceutical & Biopharmaceutical Companies, Medical Device Companies, and Others), By Application (Vaccine, Cell & Gene Therapy, Small Molecules, and Others), By End User (Hospital, Laboratories, and Clinics) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

PAREXEL International Corporation, IQVIA, Charles River Laboratory, Omnicare, Kendle, Chiltern, Laboratory Corporation of America, Eli Lilly and Company, ICON PLC, Novo Nordisk AS, Pfizer Inc., and Other Key Players |

| Purchase Options |

HVMN Inc., Thync Global Inc., Apple Inc., Fitbit Inc., TrackmyStack, OsteoStrong, The ODIN, Thriveport LLC, Muse, Moodmetric, and Other Key Players |