Market Overview

The Global

Cloud Services Market size is expected to reach a

value of USD 644.5 billion in 2024, and it is further anticipated to reach a market

value of USD 2,466.1 billion by 2033 at a

CAGR of 16.1%.

The increased adoption of cloud computing in industries has spurred the growth in the cloud services market. Cloud computing is the operational efficiency of providing computing resources such as servers, storage, databases, and applications over the Internet on demand. This trend has resulted in the large-scale adoption of cloud solutions across different verticals, including healthcare, BFSI, and retail. It is due to the high growth in digital transformation that scalability, flexibility, and infrastructure costs have become so demanding.

Different types of services, such as IaaS, PaaS, and SaaS, are some of the examples where AWS, GCP, and Microsoft Azure have dominated the current market for cloud service providers. Also, increasing cloud security concerns and focus on data compliance initiatives force many organizations to adopt this solution.

By type, the market is segmented into public cloud, private cloud, and hybrid cloud environments. The segment of the public cloud dominates owing to its cost-effectiveness and scalability. Moreover, this boosts the market due to the higher adoption of cloud in SMEs and large enterprises. There is vast growth potential, as explained in the cloud services report, while businesses continue to adopt the cloud for competitive advantage amidst the dynamically changing digital landscape.

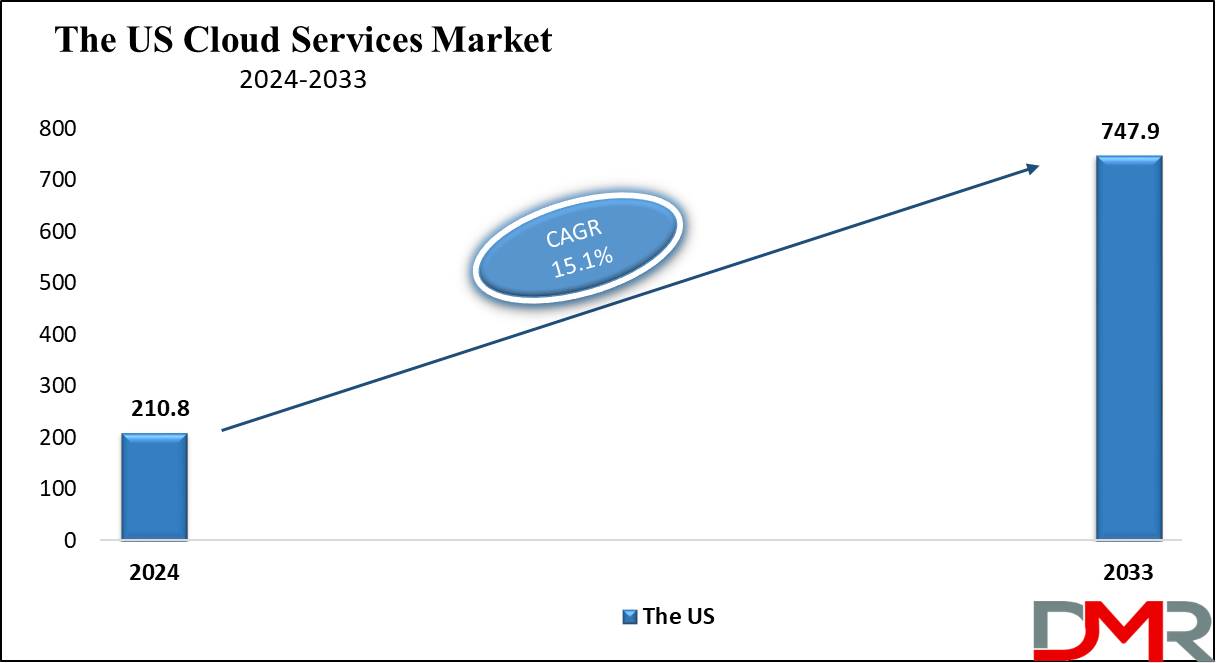

The US Cloud Services Market

The US Cloud Services Market is projected to be valued at USD 210.8 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 747.9 billion in 2033 at a CAGR of 15.1%.

The large-scale industrialization of cloud services has made the U.S. hold a leading position in the global market. Lately, cloud-based technologies have been increasing; thus, changing the size of the cloud services market in the region considerably within the past years. The technological advancements, robust digital infrastructure, and high demand for cloud computing services drive significant growth in this market.

Some of the key market trends involve the temporary shift of organizations toward general hybrid cloud environments. Organizations are using both public and private clouds to balance scalability and control over their data securely. Security in the cloud has become a big concern, and because of this, most U.S. companies are moving to more compliant and secure cloud platforms. Public cloud services are also growing very rapidly in the U.S. market, with leading companies like AWS, Microsoft Azure, and Google Cloud Platform providing the latest solutions.

These providers are preoccupied with innovation to make sure customers enjoy better security, scalability, and flexibility. Second, increasing attention to cloud platforms is boosting demand-especially for the healthcare, banking, and retail sectors. Other major developments in the United States cloud services market include the increasing adoption of IaaS due to the demand for scalable and efficient computing infrastructure. Overall growth in the market is supported by medium- and large-scale enterprises adopting the cloud to ease operations and cut overall costs.

Key Takeaways

- Global Market Value: The Global Cloud Services Market size is estimated to have a value of USD 644.5 billion in 2024 and is expected to reach USD 2,466.1 billion by the end of 2033.

- The US Market Value: The US Cloud Services Market is projected to be valued at USD 747.9 billion in 2033 from a base value of USD 210.8 billion in 2024 at a CAGR of 15.1%.

- By Service Segment Analysis: Infrastructure as a Service (IaaS) is anticipated to lead the global cloud services market with 44.9% of the market share in 2024.

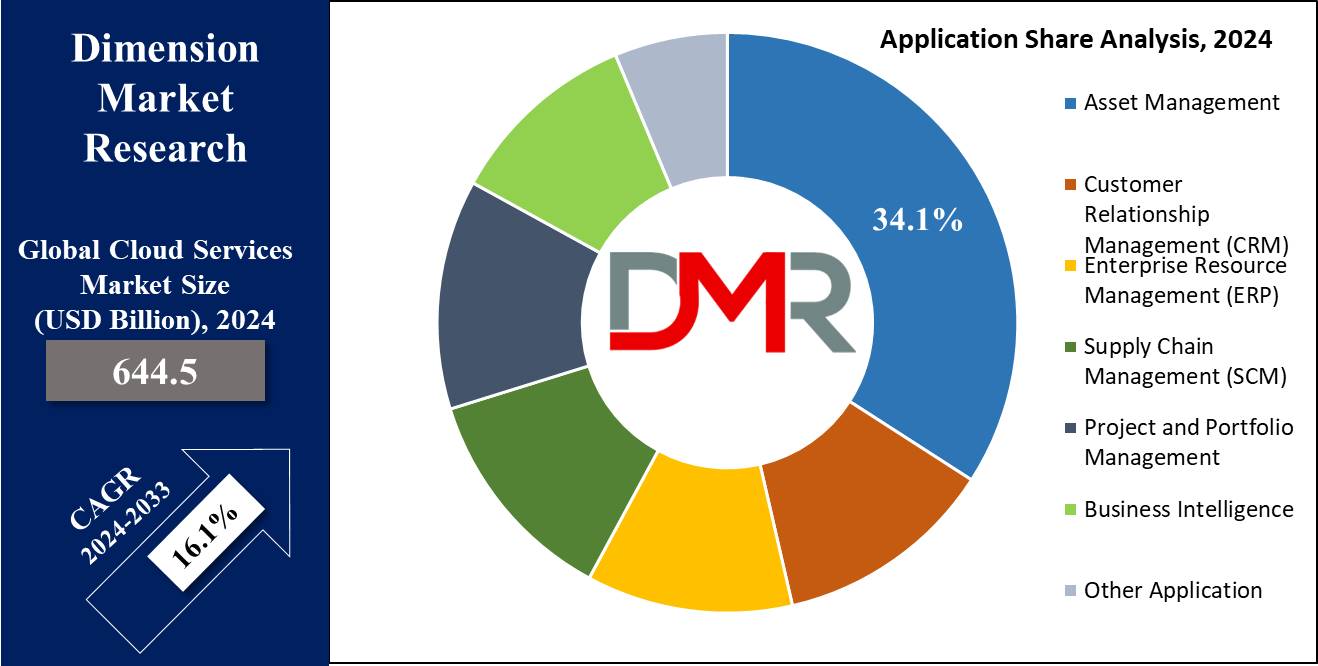

- By Application Segment Analysis: Asset management dominates this segment with 34.1% of the market share in 2024.

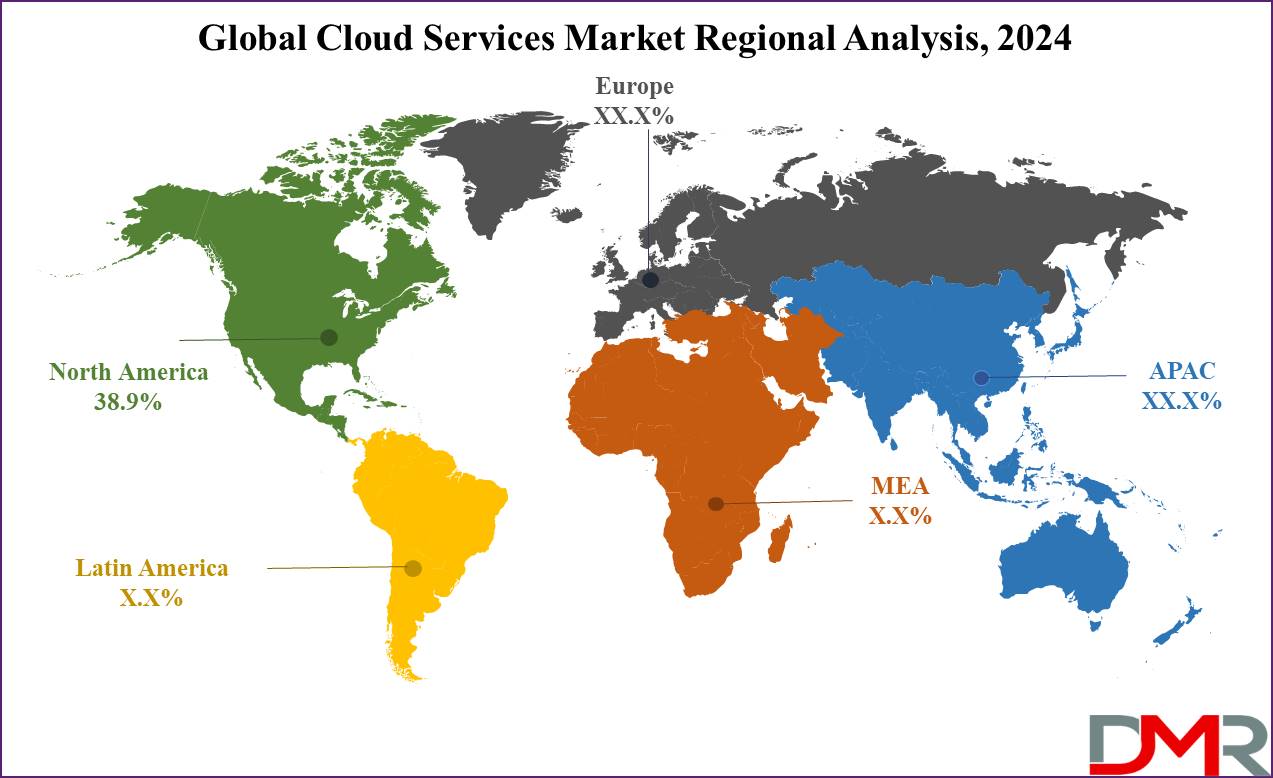

- Regional Analysis: North America is expected to have the largest market share in the Global Cloud Services Market with a share of about 38.9% in 2024.

- Key Players: Some of the major key players in the Global Cloud Services Market are Alibaba Group Holding Limited, Amazon Web Services Inc, Cisco Systems Inc, Dell Technologies Inc, Google Llc, and many others.

- Global Growth Rate: The market is growing at a CAGR of 16.1 percent over the forecasted period.

Use Cases

- Data Storage and Backup: Cloud platforms offer a variant in solutions to store large volumes of data in a secure, scalable, and cost-effective manner that is accessible from any part of the world, hence reducing on-premise infrastructure to the barest minimum.

- Enterprise Application Hosting: Applications like CRM, ERP, and HRM can now be cloud-deployed to enable firms to operate some of their most critical applications without investing in hardware or its maintenance.

- Disaster Recovery: Cloud services facilitate the replication and storage of data in various locations, enabling fast recoveries from disruptions for the continuity of businesses after the occurrence of such disasters.

- AI and Machine Learning: Companies have been able to exploit the huge opportunities in cloud infrastructure for training AI models, data analytics, and decision automation without investing massively in hardware.

Market Dynamic

Trends

Multi-Cloud AdoptionIt is one of the major trends that are still prevalent in the cloud services market around the world: adopting a multi-cloud strategy on the part of any organization. To avoid the vendor lock-in factor and to have operational flexibility, organizations are leveraging multiple cloud platforms such as AWS, Microsoft Azure, and Google Cloud.

By distributing the workloads in various cloud environments, companies can thus optimize costs, enhance performance, and strengthen data security. This multi-cloud approach lets every organization pick and choose appropriate cloud solutions for particular applications, which ensures that every need regarding performance, security, and compliance is met.

In addition, multi-cloud supports business continuity by eliminating the possibility of downtime since workloads can be seamlessly shifted between cloud providers in case of outages or performance issues.

Integration of Edge Computing

Another trend that has become very relevant in the cloud services market is the emergence of edge computing. This is because organizations have begun the adoption and deployment of IoT solutions, among other applications that require real-time processing, thus increasing demand for low-latency data processing.

Edge computing can enable data processing to be performed closer to the source of the data, thus enabling it to lower latency and make better real-time decisions. Edge computing is being considered and implemented by cloud service providers to offer enhanced network efficiency in light of the increasing demands for high-speed data processing.

Manufacturing, autonomous vehicles, and healthcare are where such concepts are very relevant, as the need for real-time processing of large volumes of data shows considerable prominence in operational success. Thus, edge computing combines with cloud computing to drive the overall growth in cloud services.

Growth Drivers

Increased Demand for Scalability

One of the key factors driving growth in the cloud services market is the increasing demand for scalable solutions. The cloud platform will allow any enterprise to scale its IT resources up or down, depending on real-time operational needs. This is very important for industries like e-commerce, where demand often varies and businesses must efficiently deal with peak loads without overprovisioning resources.

With cloud services, scaling in and out provides companies with an opportunity to bring down costs while ensuring a smooth performance. Due to this elasticity, especially in industries where demand is prone to variability, the adoption of cloud services has gained momentum.

Digital Transformation Initiatives

Documentation Cloud services have turned out to be the key enabler for most digital transformation initiatives of enterprises. Cloud-based solutions modernize the IT infrastructure of an organization, reduce operational costs, and improve overall efficiencies. Cloud services support the platform requirements for the integration of advanced technologies like AI, ML, and IoT in a business.

All these technologies require cloud platforms to process huge datasets and provide predictive analytics to drive automation. Thus, the help of cloud services is enabling various businesses to adopt this cutting-edge technology that, in turn, drives digital transformation in many industries, potentiating market growth.

Growth Opportunities

Cloud Adoption amongst Emerging Economies

The cloud services market is also seen to grow substantially in the emerging markets of Asia-Pacific, Africa, and Latin America. These regions are involved in the rapid modernization of their IT infrastructure. Such transformation is a scalable and cost-effective means to support cloud services. Cloud-based solutions for governance and business operations have been increasingly adopted by governments and businesses in these regions to attain efficiency, streamline operations, and cut down costs.

These geographical markets, with localized offerings from cloud service providers, present some lucrative growth opportunities. In general, as more organizations in emerging markets are realizing the effectiveness of cloud computing, the demand for cloud services is expected to surge during the forecast period in these regions.

Cloud-Native Application Development

Another growing area is around cloud-native applications. Enterprises increasingly leverage microservices architecture and containerization technologies to create agile, scalable applications that operate with better performance in the cloud.

This means native applications are offering benefits such as increased performance, faster times-to-deployment, and flexibility compared to traditional monolithic apps. With this, there is increased demand for PaaS solutions and other cloud development tools that will make it easy to create and manage cloud-native applications. This also opens up more revenue streams for cloud service providers as organizations try to remain competitive by making a shift toward cloud-native development.

Restraints

Security and Compliance Issues

Although cloud computing has many advantages, data security and issues of regulatory compliance are major concerns that act as a hindrance in the development of the market for cloud services. Due to the probability of breaches in data and compliance issues, organizations dealing in sensitive data, related mainly to sectors involving healthcare and finance, are very apprehensive about using the services of clouds.

Cloud service providers must ensure conformation of their offerings to strict data protection regulations with regards to GDPR, HIPAA, and PCI-DSS standards. Nevertheless, data privacy concerns, along with unprecedented security breaches and unauthorized access, hinder cloud adoption in various sectors and hence restrain market growth.

Legacy Infrastructure

Another major challenge that relates to the adoption of cloud services is the existence of legacy IT systems that are incompatible with cloud technology. The majority of organizations still depend on outdated infrastructure set up on location, and migrating to the cloud is often an extremely cumbersome and expensive task.

The migration of most of these legacy systems to the cloud requires great investment in time, resources, and technical expertise. This complex migration process, coupled with concerns over data loss or service disruption, has the effect of slowing the pace of the cloud particularly for larger-scale enterprises with entrenched legacy systems. Thus, it acts as a restraint on the overall growth of the Cloud Services market, especially for businesses with long-established IT infrastructure.

Research Scope and Analysis

By Service

Infrastructure as a Service (IaaS) is projected to dominate the global cloud services market with 44.9% of the market share in 2024. Because of such accessibility factors, scalability, and cost-effectiveness, IaaS is currently ruling the global cloud services market. In addition, IaaS provides organizations with virtualized computing resources, such as servers, storage, and networking, without any physical infrastructure.

This model has greater appeal for organizations to scale up their IT infrastructure based on demand without making huge upfront investments only. One of the main propellers of adopting IaaS will be its cost-effectiveness. It doesn't require any enterprise to buy out the expensive mechanism of physical servers or data centers; instead, it can leverage cloud infrastructure. This facilitates a pay-as-you-go pricing model, which enables companies to scale their resources as required to ensure they only pay for what they use.

This makes IaaS equally appealing to both tiny startups and major enterprises. Besides, IaaS provides great flexibility in that the business can easily set up its infrastructure, configure, and operate it with limited deep technological IT knowledge. Agility is the most important aspect that organizations should increasingly pursue because, through digital transformation or entry into new markets, infrastructures can be changed to meet ever-changing needs.

Further, IaaS suppliers such as AWS, Google Cloud, and Microsoft Azure offer a continuum of services from core computing and storage to advanced network-related services-including automation, security, and compliance. This wide gamut of offerings provided by the IaaS suppliers has made them the dominant force in the cloud service market because businesses increasingly rely on cloud infrastructure to support their operations.

By Deployment

The public cloud segment is anticipated to dominate the global cloud services market due to some advantages over other deployment models like private and hybrid clouds. Accordingly, public cloud services are business-scaled and cost-effective ways through which organizations of all sizes can get a wide array of resources and tasks using third-party providers such as Amazon Web Services, Google Cloud, and Microsoft Azure.

These services include, but are not limited to, IaaS, PaaS, and SaaS. The variety that the cloud service providers offer is the thing that makes the public cloud so alluring in the eyes of organizations seeking flexibility. Public cloud scaling does a better job of scaling resources up or down depending on the demand for those resources, which is why the public cloud cannot be surpassed in the leading race. Therefore, businesses can scale up or scale down their use of cloud resources at any time and only pay for what they use.

This pay-as-used model drastically cuts down the upfront infrastructure costs to a level that even SMEs can easily afford. Besides, with rapid deployment and access to advanced technology in place with the public cloud, it further eliminates the need for companies to maintain their data centers. This will surely attract companies that cherish agility and innovation due to its ease of deployment and management.

By Organization Size

Large corporations are projected to dominate the organization size segment in the global cloud services market on account of their large-scale needs for IT infrastructure, international operations, and multi-layered business processes. Large companies usually need a resilient and scalable cloud computing solution that will be obliged to manage vast volumes of data, ensure seamless communication, and provide state-of-the-art security features because of the demand for sensitive information.

The use of cloud services can give large enterprise businesses room to scale either up or down depending on the fluctuations in their business needs. Of particular note is scalability, which can handle fluctuations in demand during peak periods of business. It also provides large organizations with the much-needed ability to deploy hybrid and multi-cloud strategies using a mix of public, private, and on-premise cloud infrastructures. This also ensures that they can maintain control of critical operations while optimizing cost and performance across diverse business units.

Also, large enterprises usually have bigger budgets to invest in IT, which creates an avenue for them to exploit more sophisticated cloud computing offerings such as IaaS, PaaS, and SaaS. The same ability to invest in end-to-end cloud solutions makes large enterprises the leaders in the adoption of the cloud. Another factor that contributes to the leading role of large enterprises is their orientation toward digital transformation initiatives. Cloud services are all about modernizing legacy systems, enabling operational efficiency, and creating innovation with technologies such as AI and Machine Learning, which in turn drives further growth in the cloud service market.

By Application

Asset management is the leading application in the global cloud services market with 34.1% of the market share in 2024 as it is seen as a critical need to track, monitor, and optimize resources efficiently and tactically in real time. Thus, the role of cloud services is that they extend the ability of asset management platforms to cope with large volumes of data and provide actionable insights on how to handle circuitous asset portfolios-physical infrastructure to digital assets.

Cloud-based asset management software provides every organization with the flexibility to track assets moving on a global level, hence allowing the same centralized control as any other while lowering the operational complexities that come with managing resources across geographically dispersed locations. Real-time data processing in the cloud provides insight to businesses into the performance of their capital assets to detect anomalies and prevent downtime by allowing proactive maintenance of critical infrastructure.

Another important reason for asset management dominance in cloud applications is the integration of advanced technologies such as IoT and AI. Accordingly, these technologies enhance preciseness in tracking your assets, predictive maintenance, and allocation of resources. Cloud services make it easy for data to be collected from IoT devices and then analyzed using AI-driven algorithms to obtain insights that help in making more substantiated decisions.

In contrast, cloud-based asset management systems may guarantee scalability so that organizations can easily accommodate any increase in operational needs without increasing investments in infrastructure. Scalability is an advantage in industries requiring heavy asset management such as manufacturing, energy, and logistics, as these are comparable assets that help optimize performance toward cost minimization.

As a result of this, the cloud services market segment maintains dominance within this application, since organizations have tremendous demand to improve asset management with the help of cloud solutions.

By Industry Verticals

The BFSI (Banking, Financial Services, and Insurance) sector is anticipated to dominate the industry verticals segment in the global cloud services market. This may be because BFSI is expected to have a dire need for one of the most secure, highly scalable, and cost-effective solutions in the processing of large volumes of sensitive financial data and remains dominant in the industry verticals segment of the global cloud services market.

Most financial institutions deal with enormous transactional volume and processing of customer information every day; thus, the cloud infrastructure should enable processing, storing, and protecting this vital information in a secure environment with strict regulatory compliances.

This would enable BFSI organizations to scale their operations with much more ease and efficiency during busy seasons, such as the tax season or market volatility. Public, private, and hybrid cloud solutions offer banks and financial services companies a platform to handle customer data securely, reduce grounding operational costs, and enhance service delivery.

The real-time processing capability of cloud platforms helps in decision-making related to trading, risk management, and even fraud detection. In addition, there can be seen some major Cloud service adoptions in the BFSI sector to support digital transformation initiatives, including mobile banking application development, digital wallet, and AI-powered chatbot development for customer service cloud infrastructure.

It supports these innovations by providing scalability and security towards rapid deployments and seamless integrations with existing systems. Furthermore, BFSI organizations are facing challenges in terms of regulatory compliance, for which cloud service providers offer adequate solutions that are compliant with financial industry standards such as PCI-DSS, GDPR, and SOC 2.

The capability of ensuring data security, privacy, and compliance with these regulations has driven the mainstream adoption of cloud services among BFSI organizations and positioned the sector as the dominant vertical in the global cloud services market.

The Cloud Services Market Report is segmented on the basis of the following

By Service

- Infrastructure as a Service (IaaS)

- Primary Storage

- Disaster Recovery and Backup

- Archiving

- Compute

- Platform as a Service (PaaS)

- Application Development and Platforms

- Application Testing and Quality

- Analytics and Reporting

- Integration and Orchestration

- Data Management

- Software as a Service (SaaS)

- Customer Relationship Management (CRM)

- Enterprise Resource Management (ERM)

- Human Capital Management (HCM)

- Content Management

- Collaboration and Productive Suites

- Supply Chain Management (SCM)

- Others

By Deployment

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

By Application

- Asset Management

- Customer Relationship Management (CRM)

- Enterprise Resource Management (ERP)

- Supply Chain Management (SCM)

- Project and Portfolio Management

- Business Intelligence

- Other Application

By Industry Verticals

- BFSI

- Telecommunications

- IT and ITeS

- Government and Public Sector

- Retail and Consumer Goods

- Manufacturing

- Energy and Utilities

- Media and Entertainment

- Healthcare and Life Sciences

- Others

Regional Analysis

North America is projected to hold a dominant position in the global cloud services market as it commands over

38.9% of total revenue in 2024. The presence of key cloud service providers, such as Amazon Web Services, Inc. (AWS), Microsoft Azure, and Google Cloud, helps North America to lead in the said market.

Advanced IT infrastructure in the region, coupled with higher digital literacy, gave clear ways to industries such as BFSI, healthcare, manufacturing, and retail to adopt cloud computing solutions. The U.S. drives much of this dominance, impelled by a robust cloud computing ecosystem and increasing investment in cloud-based technologies.

One of the foremost reasons North America has dominance is that the region moved early in adopting advanced technologies like AI, machine learning, and IoT which need a cloud infrastructure for data storage and real-time analytics. Driven by a growing adoption of remote working and the increasing need for digital transformation, cloud services adoption continues to rise in North America, where companies are adopting hybrid and multi-cloud approaches as a means of driving greater operational efficiency and flexibility.

The region also boasts a very stringent regulatory framework, under which cloud service providers of the region are forced to adhere to data security and privacy standards. "This has precipitated confidence among enterprises to invest in cloud solutions, further bolstering the region's leadership in the market.

Another factor is that service providers of cloud solutions in North America continuously innovate to provide solutions for specific industry needs, whether that be healthcare data management or financial services. While cloud computing remains an integral part of IT strategies for organizations, North America is likely to maintain its dominance in the global cloud services market during the forecast period.

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Competitive in nature, the cloud services market is dominated by a few key players continuously through innovation, mergers and acquisitions, and partnerships. AWS remains the global leader in the market, holding a vital market share due to its extensive infrastructure, diverse offerings, and customer base. AWS would be a good choice for most enterprises of any scale since it has the broadest portfolio of services that range from cloud storage and computing to networking and even AI.

Another close competitor is Microsoft Azure, which specializes in an end-to-end cloud ecosystem for companies that need to work on or adopt hybrid cloud solutions. Its heavy investment in AI, machine learning, and enterprise applications has made Azure a favorite among big-scale companies. In addition, seamless integration with Microsoft's Office 365 suite further raises its desirability for enterprise customers in the quest for cloud-hosted productivity tools.

Google Cloud Platform has still been considered one of the serious contenders within the cloud services market, where most of its core strengths happen to be in data analytics and machine learning. With big data, AI, and real-time processing, it is most enterprises' go-to choice in technology sectors. Alibaba Cloud-which had its primary conventions in the Asia-Pacific region out to be a limelight for offering cloud infrastructure services in high demand for digital transformation in the emerging markets.

Some of the prominent players in the Global Cloud Services Market are:

- Alibaba Group Holding Limited

- Amazon Web Services, Inc

- Cisco Systems, Inc

- Dell, Technologies Inc

- Google Llc

- Hewlett Packard Enterprise Development Lp

- International Business Machines Corporation

- Microsoft Corporation

- Oracle Corporation

- Rackspace Hosting, Inc

- RyohinKeikaku Co. Ltd.

- Isagenix International LLC

- Other Key Players

Recent Developments

- September 2024: Amazon Web Services (AWS) announced the launch of a new AI-based security tool that enhances cloud data protection by identifying potential vulnerabilities and suggesting solutions in real time.

- August 2024: Microsoft Azure expanded its hybrid cloud capabilities by acquiring Nutanix, a leading provider of cloud infrastructure solutions, to strengthen its presence in the enterprise cloud space.

- July 2024: Google Cloud introduced advanced edge computing solutions to reduce latency and improve the real-time processing of IoT data, particularly for the manufacturing and healthcare industries.

- June 2024: Alibaba Cloud partnered with Huawei to enhance its cloud infrastructure across the Asia-Pacific region, aiming to offer more scalable and secure cloud solutions to SMEs.

- May 2024: IBM Cloud announced a collaboration with Red Hat to provide hybrid cloud solutions to enterprises looking to modernize their IT infrastructure and accelerate digital transformation.

- April 2024: Oracle Cloud introduced new data sovereignty features, ensuring that data storage and processing comply with local regulations in countries with strict data privacy laws.

- March 2024: Salesforce announced the acquisition of Tableau, further expanding its cloud-based analytics capabilities and enhancing its position in the cloud services market.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 644.5 Bn |

| Forecast Value (2033) |

USD 2,466.1 Bn |

| CAGR (2024-2033) |

16.1% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 210.8 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Deployment (Public, Private, and Hybrid), By Service (Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS)), By Organization Size (Small and Medium-sized Enterprises (SMEs), and Large Enterprise), By Application (Asset Management, Customer Relationship Management (CRM), Enterprise Resource Management (ERP), Supply Chain Management (SCM), Project and Portfolio Management, Business Intelligence, and Other Application), By Industry Verticals (BFSI, Telecommunications, IT and ITeS, Government and Public Sector, Retail and Consumer Goods, Manufacturing, Energy and Utilities, Media and Entertainment, Healthcare and Life Sciences, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Alibaba Group Holding Limited, Amazon Web Services Inc, Cisco Systems Inc, Dell Technologies Inc, Google Llc, Hewlett Packard Enterprise Development Lp, International Business Machines Corporation, Microsoft Corporation, Oracle Corporation, Rackspace Hosting Inc, RyohinKeikaku Co. Ltd., Isagenix International LLC, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Cloud Services Market size is estimated to have a value of USD 644.5 billion in 2024 and is expected to reach USD 2,466.1 billion by the end of 2033.

The US Cloud Services Market is projected to be valued at USD 210.8 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 747.9 billion in 2033 at a CAGR of 15.1%.

North America is expected to have the largest market share in the Global Cloud Services Market with a share of about 38.9% in 2024.

Some of the major key players in the Global Cloud Services Market are Alibaba Group Holding Limited, Amazon Web Services Inc, Cisco Systems Inc, Dell Technologies Inc, Google Llc, and many others.

The market is growing at a CAGR of 16.1 percent over the forecasted period.