Cold Form Blister Packaging Market continues to gain ground, due to increasing demand from pharmaceuticals and healthcare sectors. Manufacturers are increasingly opting for cold form blister packaging solutions due to enhanced product protection features like tamper-evident seals.

Demand for childproof and protective packaging has dramatically transformed the pharmaceutical market, particularly cold form blister packs used to store sensitive medicines. Cold form blister packs provide valuable protection from moisture, light exposure, and contamination - essential factors in maintaining product efficacy.

Emerging markets, particularly Asia-Pacific, are seeing increased interest from companies. Here, expanding healthcare infrastructure and pharmaceutical production are spurring demand, prompting companies to customize packaging solutions according to regional requirements and meet specific consumer requirements.

Technological advances are driving innovation in cold form blister packaging. Eco-friendly materials, smart packaging technologies, and enhanced automation have become key trends - not only enhancing product safety and convenience but also helping lower environmental impact - creating a sustainable future in packaging.

Regulatory measures are key drivers for the cold-form blister packaging market. For instance, in the U.S., the CPSC (Consumer Product Safety Commission) has provided regulatory frameworks for child-resistant packaging under the PPPA (Poison Prevention Packaging Act). Therefore, OTC drugs & prescription drugs need to be packaged in special packaging like cold-form blister packaging solutions, making it difficult for children to open.

Moreover, this form of packaging has gained traction among

healthcare professionals due to its capability to secure products. United States-based healthcare packaging player Aptar provides the Active-Blister healthcare packaging. The Food and Drug Administration allowed for its usage in the prevention of HIV capsules, enhancing the rising acceptance of cold-form blister packaging in the pharmaceutical sector.

Key Takeaways

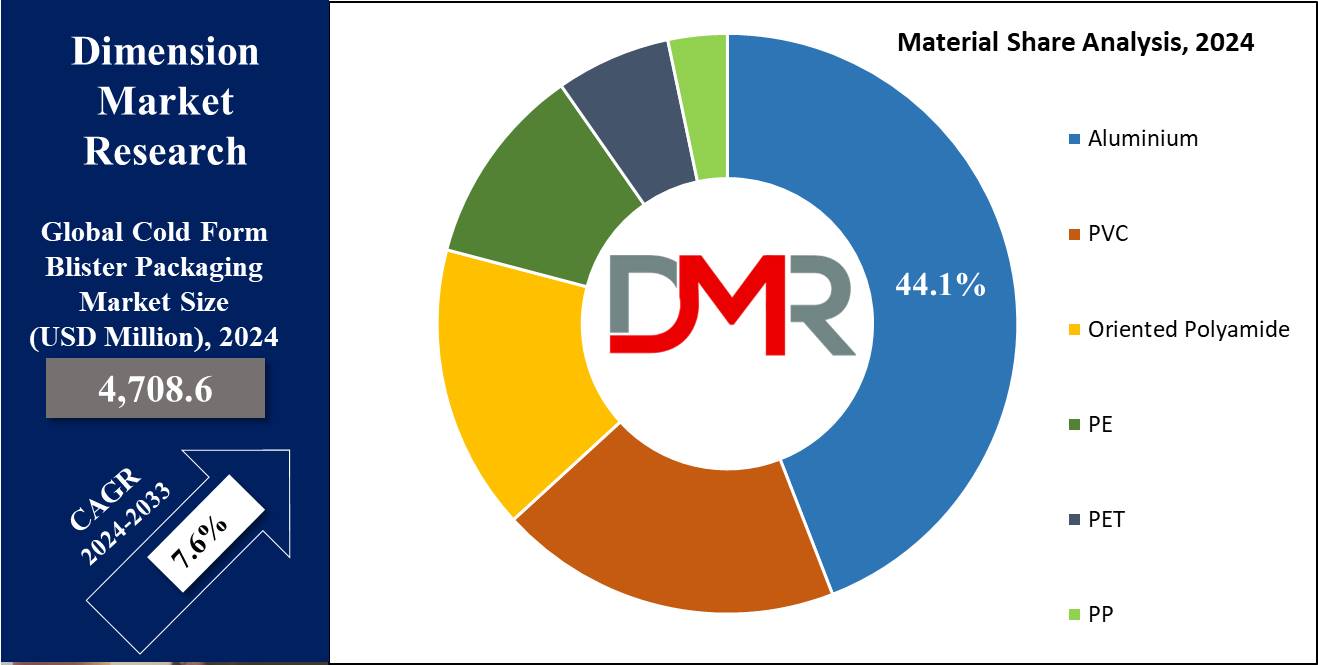

- Market Size: The global cold form blister market is projected to grow by USD 1,060.6 million, at a CAGR of 7.6 % from 2025 to 2033, i.e. forecast period.

- Market Definition: Cold-form blister packaging is a type of packaging that is used primarily for products that require high barrier protection from moisture, light, and oxygen.

- Material Analysis: Aluminum is predicted to dominate the global cold form blister market based on material as it holds the highest market share of 44.1% in 2024.

- Application Analysis: Healthcare as the application is predicted to dominate with maximum revenue share in the global market in 2024.

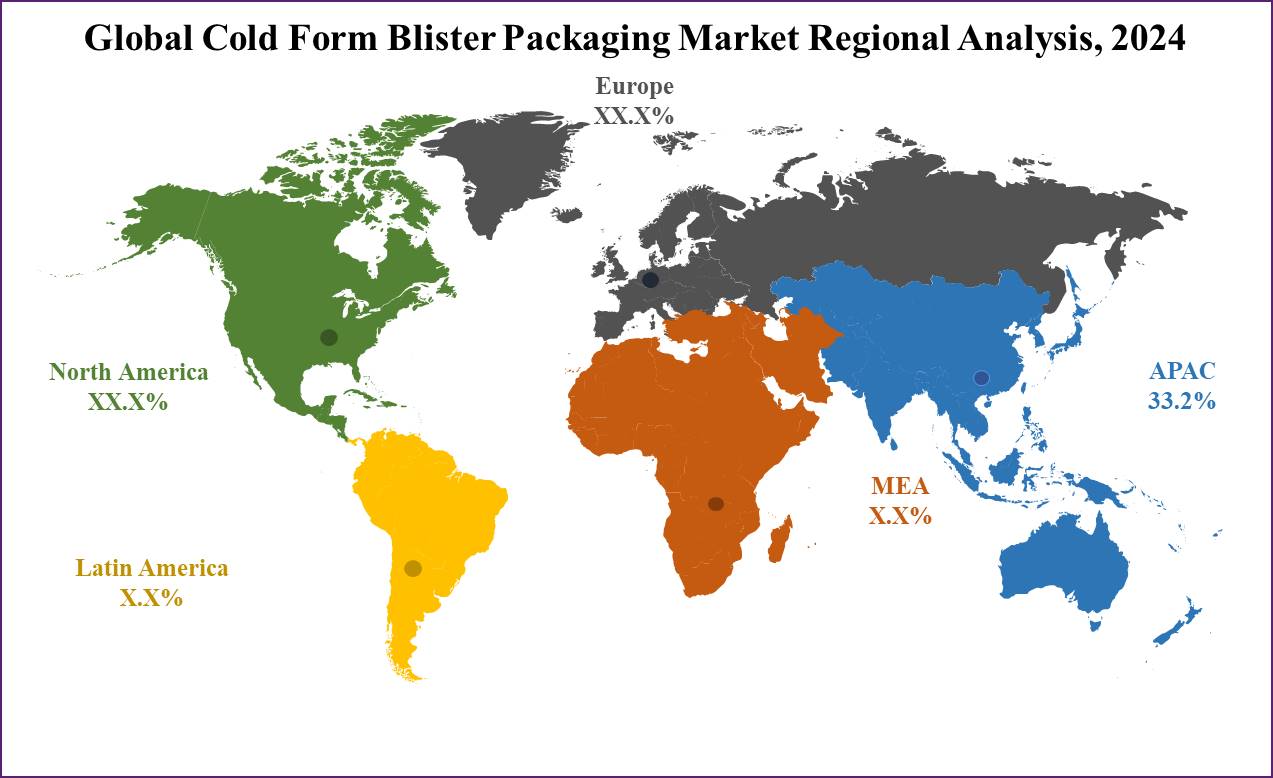

- Regional Analysis: Asia-Pacific is expected to dominate the global cold form packaging market as it holds 33.2 % of the market share in 2024.

Use Cases

- Pharmaceuticals: Cold-form blister packaging is used for transparent packaging tablets, capsules, and other solid-dose pharmaceuticals as they provide excellent protection against environmental factors which ensures the stability and efficiency of the medication.

- Nutraceuticals: These kinds of packaging are used in the nutraceutical industry as Vitamins, minerals, and herbal supplements are packaged using cold-form blisters to preserve their potency and extend shelf life by protecting them from moisture, light, and air.

- Clinical Trial Supplies: Blister packaging is also used for packaging clinical trial medications to ensure that the integrity of the drug is maintained throughout the trial period and it also prevents the quality of the drug due to exposure to external elements.

- Cosmetics and Personal Care: This packaging is used for skincare products, foundations, and other cosmetics as it ensures product integrity and hygiene by preventing contamination and degradation.

Market Dynamic

Drivers

Consumer Preference for Convenient Packaging and Rapid Demand Across Many Sectors

The cold-form blister packaging market is fueled by its property of being a convenient and easy-to-use packaging solution as it is favored by many customers globally. This type of packaging is cost-effective compared to rigid packaging because it uses fewer materials, occupies less shelf space, and provides an excellent hang-hook display. It is becoming popular in many sectors due to its tamper-proof and user-friendly packaging, which drives the growth of this market.

Regulatory Compliance and Safety

The enforcement of stringent regulations for pharmaceutical packaging, particularly those requiring tamper-evident features, is expected to drive the future adoption of cold-form blister packaging. Companies need to opt for these solutions to ensure compliance with strict government safety mandates. According to a recent study, this kind of packaging is proven to be highly efficient in protecting drugs from contamination, moisture, and light, which could alter the effect of the medicine and expand the growth of this market.

Restraint

High Production Cost

Cold blister packaging is normally more costly compared to other packaging solutions. The high cost associated with manufacturing and materials makes this packaging option expensive, thereby limiting the growth of this market. Intricate manufacturing processes and superior-quality materials often increase the cost of expense.

Environmental Concerns

There is extensive use of aluminum in cold-form blister packaging raises significant environmental concerns. The production of aluminum contributes to the higher energy consumption and greenhouse gas emissions. Also, the recycling process for aluminum is complex and less efficient, which further accelerates its environmental impact, which obstructs the growth of this market.

Opportunities

Demand in the food industry

Cold blister packaging is useful for packaging a wide range of fresh goods, such as meat, fruits, bakery products, candy, and ice cream. It protects food from damage and effectively displays containing items during handling and transportation. It offers superior product protection as it is lighter than materials like glass or metal, which provides numerous opportunities for the growth of the cold-form blister packaging market.

Trends

Sustainable Packaging

The cold-form packaging market is experiencing significant transformations as there are focus on sustainability. Manufacturers are increasingly incorporating eco-friendly packaging and sustainable materials to reduce their ecological footprint and minimize waste generation. There is a growing effort to minimize material usage without compromising the integrity & functionality of the packaging by using recyclable materials, biodegradable options, and innovative designs.

Customization and Personalization

There is a huge popularity of customized & personalized packaging solutions to fulfill the evolving demands of consumers & brands. The recent adoption of digital printing technology has transformed the industry which allows for more visually appealing packaging that aligns perfectly with branding strategies and consumer preferences. These packaging can produce small batches with unique designs, personalized messaging, and branding elements that improve the consumer experience and brand loyalty.

Research Scope and Analysis

By Material

Aluminum is predicted to dominate the cold-form blister packaging market with a maximum share of 44.1% in 2024. This dominance is due to aluminum's unique features, such as barrier effectiveness, avoiding contamination, & enhancing the life of items by impeding oxygen & moisture ingress. Moreover, aluminum plays a vital role in providing the stability & efficacy of medical products, including capsules, & over-the-counter drugs making sure that they are viable for longer duration, thereby propelling market growth for this segment.

Furthermore, the segment of PVC is expected to see further expansion in upcoming years. Polyvinyl Chloride is economical & has high visibility characteristics making it a perfect choice for cold-form blister packaging, especially for items with lower prices. Additionally, PET finds widespread utilization in cold-form blister packaging because of its durable, lightweight, & recyclable characteristics.

By Application

Healthcare as an application is expected to dominate the cold-form blister packaging maximum revenue share in 2024. This market is further segmented into various applications such as consumer products, food & confectionery, healthcare industries, electronics & semiconductors, & others. This dominance is due to the composite plastic & aluminum film materials utilized in this kind of packaging, providing product protection at a higher level as compared to thermoformed plastics. The tight seal made around the product by cold-forming blister packaging gives increased protection against contamination, physical damage, & tampering, providing efficacy & safety to the packaged items.

Consumer Product is anticipated to show growth because of the increasing popularity of several items like lipsticks, bar soaps, toothbrushes, shower gels, and more. It is important for customers to go through the packaging & see the product & its information for cosmetic and skin care products. Cold-form blister packing with transparent plastic film materials enhances the product’s appearance, making customers look for the inside contents, contributing to market growth in the consumer goods segment.

The Global Cold Form Blister Packaging Market Report is segmented on the basis of the following:

By Material

- Aluminum

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Polyethylene (PE)

- Polyethylene Terephthalate (PET)

- Oriented Polyamide

By Application

- Consumer Products

- Food & Confectionary

- Healthcare

- Electronics & Semiconductors

- Others

Regional Analysis

The Asia Pacific region is predicted to dominate the cold-form blister packaging market, accounting for a

maximum share of 33.2% in 2024. The dominance is anticipated to be driven by the rising healthcare and medical sectors in the area. The increase in the rising trend of online platforms further enhances the demand for cold form blister packaging in the market. Community pharmacies adopt these blister packs because of their ease of handling, efficiency in space, & capability to show the product & its information via transparent kind of packaging. Moreover, online platforms for selling products such as Amazon give priority to the use of such kind of packaging for medical items as it gives compact & safe solutions for transporting and therefore fostering the market’s growth.

North America acts as a key hub for computer hardware & accessories, containing peripherals, components, & networking technologies, thanks to the existence of well-developed electronic players such as Microsoft, Apple Inc., etc. The acceptance of this kind of packaging in this sector is propelled by its ability to protect sensitive & fragile components of electronic items during warehousing & transportation. This type of packaging gives a cushioning effect, protects against moisture, & effectively decreases the chances of damage during handling & transportation.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global market for cold-form blister packaging is highly competitive, with key market players such as Amcor plc, Bemis Company Inc. (now part of Amcor), Constantia Flexibles Group, Uflex Ltd., and Tekni-Plex leading the industry. Healthcare companies and packaging manufacturers are focused on meeting the industry's needs for packaging solid unit dose medications, such as tablets, pills, and capsules.

To capture market share in specific regions, these leading companies are employing various strategies, including numerous mergers and acquisitions. Furthermore, key market players are engaging in technological collaborations to develop advanced products with superior performance features, all aimed at boosting their revenue.

Some of the prominent players in the Global Cold Form Blister Packaging Market are

- Bemis Company Inc.

- Constantia Flexibles

- Amcor plc

- WINPAK Ltd.

- Uflex Limited

- Sonoco Products Company

- Bilcare Research

- Tekni-Plex

- Essentra plc

- ACG

- Wasdell Group

- Other Key Players

Recent Development

- In October 2023, Aluflexpack AG, a prominent European producer of high-quality circular flexible packaging and barrier solutions, signed an agreement to acquire 68% of Helioflex by enhancing its presence in the lucrative pharmaceutical sector and rapidly growing geographic markets.

- In July 2023, Constantia Flexibles introduced its latest pharmaceutical packaging product, the cold-form foil REGULA CIRC as it replaces traditional PVC with a polyethylene (PE) sealing layer, reducing plastic content while increasing the aluminum proportion, thereby embracing circular economy principles through a higher aluminum percentage.

- In June 2023, TekniPlex Healthcare expanded its presence in North America and its global capacity by opening a new 200,000-square-foot manufacturing facility in Madison, Wisconsin, USA, which significantly enhanced the company’s lamination capacity for a variety of materials, including PET, nylon, paper, foil, PE, EAA, and ionomer, available in both peelable and non-peelable structures.

- In April 2023, Amcor plc announced a partnership with Tyson Foods, Inc., a global food company, to jointly develop cost-effective cold-form blister packaging solutions for food products, which allows both companies to leverage their expertise and resources to create innovative packaging solutions, enhancing their competitive edge in the market.

- In November 2022, UK-Shawpak, a manufacturer of medical packaging equipment, launched its latest Shawpak Rigid Blister Machine, which made it possible for businesses to quickly create their trays, and enabled the company to provide a full range of packaging solutions to its clients in the medical and pharmaceutical industries.