Market Overview

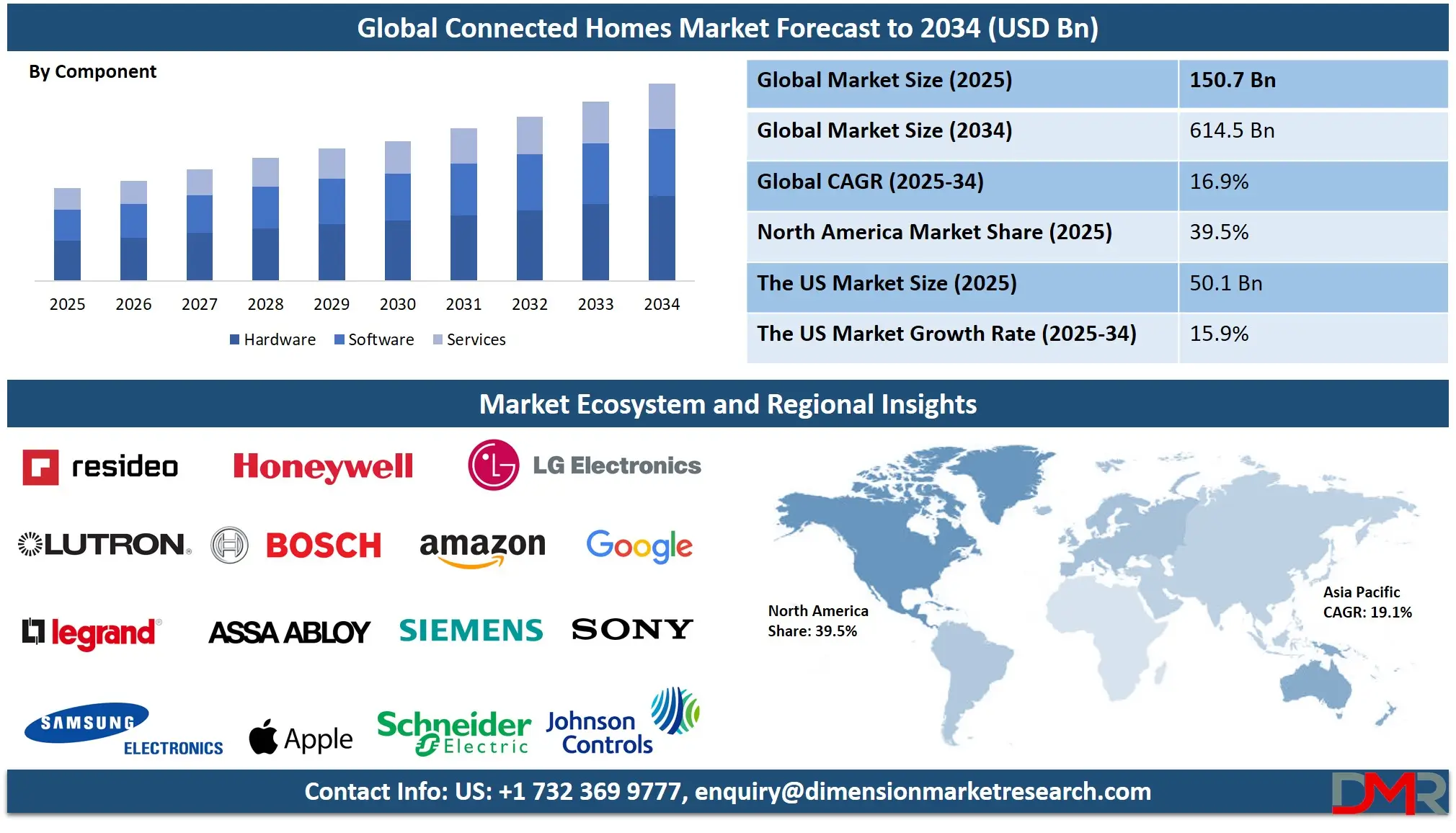

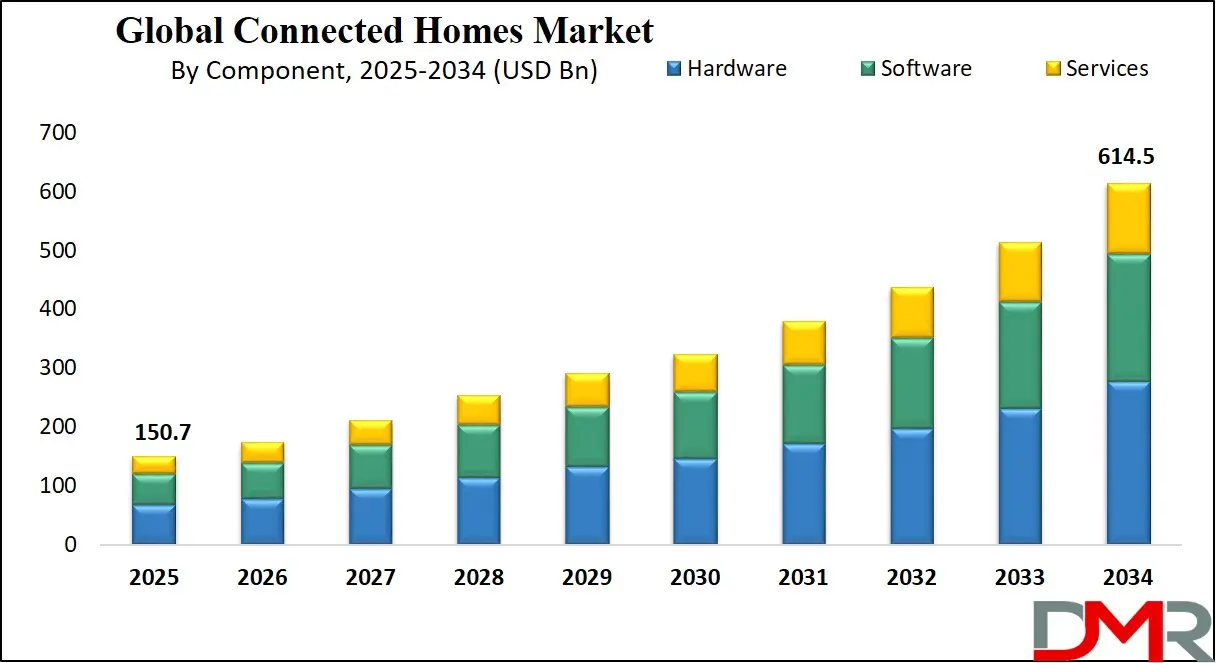

The Global Connected Homes Market is anticipated to reach USD 150.7 billion in 2025, driven by advancements in smart home hubs, security systems, and energy management technologies. The market is expected to expand at a robust compound annual growth rate (CAGR) of 16.9% from 2025 to 2034, reaching a projected value of USD 614.5 billion by 2034.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global landscape for connected homes is experiencing a profound transformation, moving beyond standalone devices into integrated ecosystems of intelligent, automated living. A significant trend is the shift towards centralized smart home hubs, where homeowners are adopting integrated platforms to manage security, energy, and entertainment systems from a single interface.

This centralization of control enhances user convenience and improves energy efficiency by providing unified, data-driven management of home environments. Concurrently, the technology is advancing into predictive automation, where AI focuses on learning user behaviors to adjust settings proactively for lighting, heating, and security, though fully autonomous homes remain in the growth phase. The integration of 5G and Wi-Fi 6 with smart home ecosystems is also emerging, optimizing device connectivity and automating routine tasks through enhanced data transfer speeds and reliability.

The market's expansion is fueled by substantial opportunities in personalized living experiences, particularly in crafting custom automation scenarios that offer unparalleled comfort and efficiency compared to standard manual controls. The home security segment has become a major adopter, leveraging the technology for the precise and real-time monitoring of properties through smart cameras, doorbells, and locks, which has revolutionized residential safety.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Furthermore, the ongoing development of novel, energy-efficient smart devices, including advanced thermostats and solar-integrated systems, opens new avenues for creating homes that optimize power consumption. These innovations are poised to address complex consumer needs in multi-device interoperability and sustainable living, providing solutions that were previously unimaginable.

The US Connected Homes Market

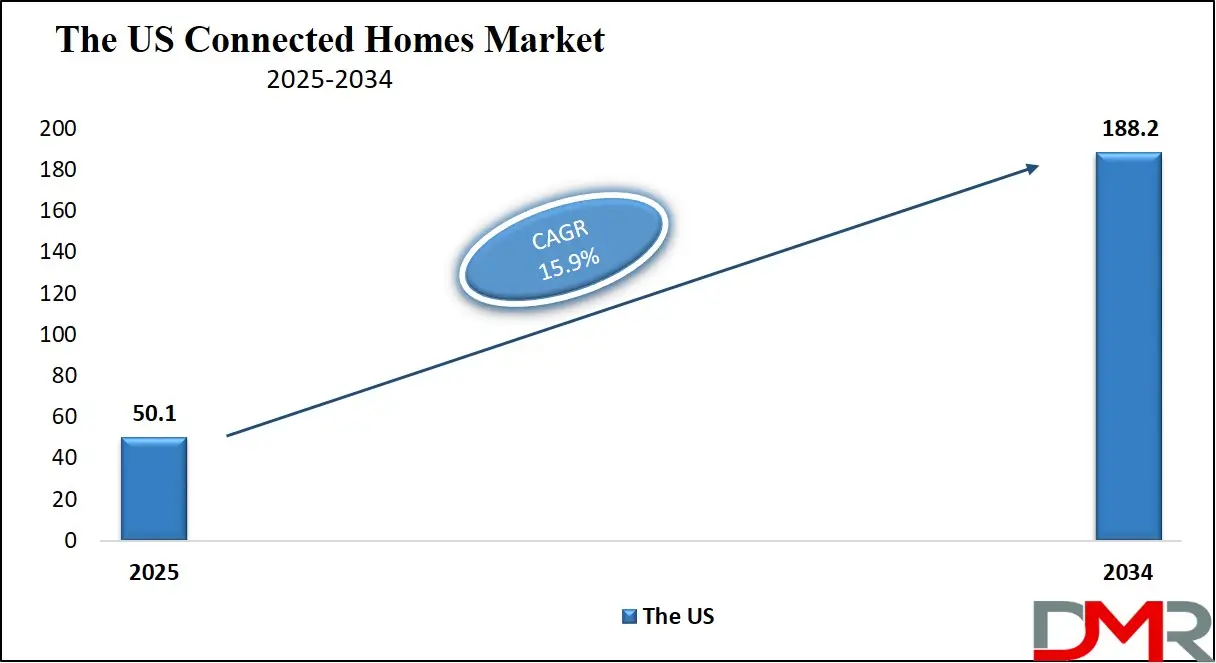

The US Connected Homes Market is projected to reach USD 50.1 billion in 2025 at a compound annual growth rate of 15.9% over its forecast period.

The United States maintains a leadership position in the connected home landscape, a status fortified by substantial technology investment and a robust ecosystem of innovators. Agencies like the National Institute of Standards and Technology (NIST) actively foster innovation through initiatives such as the Cybersecurity for IoT program, which provides a framework for secure and interoperable devices to accelerate market growth.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Federal Communications Commission (FCC) has pioneered specific regulatory pathways for connected device spectrum allocation, providing clarity for manufacturers and having already certified over a thousand such devices for use in recent years. This proactive stance from federal bodies creates a stable environment for technological advancement and commercial investment in the sector. The presence of world-leading technology companies and service providers, including Amazon, Google, and Comcast, further drives consumer adoption through cutting-edge products and the establishment of comprehensive smart home platforms that directly enhance daily living.

A significant demographic advantage for the U.S. market is its high disposable income and tech-savvy population, a trend documented by the U.S. Census Bureau. This demographic reality predicts a substantial increase in the adoption of smart home technologies for convenience, security, and energy savings, which in turn drives demand for integrated home solutions. The need for whole-home automation systems, security monitoring services, and energy management devices is rising in direct correlation.

Furthermore, the high penetration of broadband and smartphone usage, as reported by the Pew Research Center, indicates a population ready to adopt advanced, connected technologies. This technological readiness, combined with a growing body of evidence demonstrating the value of connected solutions in improving home efficiency and security, is encouraging more households to integrate this technology into their standard of living, ensuring continued market growth.

The Europe Connected Homes Market

The Europe Connected Homes Market is estimated to be valued at USD 28.7 billion in 2025 and is further anticipated to reach USD 102.4 billion by 2034 at a CAGR of 14.1%.

The European connected home ecosystem is characterized by strong collaboration between public research institutions and industry, guided by a comprehensive regulatory framework. The European Telecommunications Standards Institute (ETSI) and the new Radio Equipment Directive (RED) provide a stringent set of requirements for the certification and operation of connected home devices, ensuring high standards of security and interoperability across member states.

This is supported by significant funding from Horizon Europe, the EU's key research and innovation program, which has allocated resources to projects focused on IoT for smart living, including the development of energy-efficient home automation and secure communication protocols. National initiatives, such as those in Germany's "Smart Home 2.0" program, are exploring the standardization and data privacy aspects of deploying connected technologies, which is critical for guiding widespread adoption and consumer trust.

Europe's demographic structure, as analyzed by Eurostat, presents a clear driver for the connected home sector. The region has one of the world's most rapidly aging populations, leading to a higher demand for assisted living technologies and energy-saving solutions. This creates a pressing need for innovative, user-friendly systems that can improve the quality of life for elderly citizens and reduce household costs. The strong focus on sustainability and energy efficiency prevalent across the continent is increasingly aligned with smart home technologies that can reduce carbon footprints and lower utility bills. The presence of a highly skilled technology workforce and a dense network of specialized installers facilitates the development and application of complex connected solutions, from smart heating systems in the UK to automated security in France, positioning Europe as a critical and advanced market for connected home innovation.

The Japan Connected Homes Market

The Japan Connected Homes Market is projected to be valued at USD 9.8 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 38.2 billion in 2034 at a CAGR of 15.5%.

Japan's foray into connected homes is heavily influenced by its status as a technologically advanced society with a rapidly aging population, a demographic reality extensively documented by the Japanese Ministry of Internal Affairs and Communications. This has created an urgent and growing demand for remote health monitoring, safety sensors, and automated living solutions, particularly for senior citizens living alone.

In response, the Japanese government has strategically prioritized IoT and smart home technologies through national initiatives, with the Ministry of Economy, Trade and Industry (METI) funding projects that bridge the gap between technology development and residential application. The Association of Radio Industries and Businesses (ARIB), Japan's standards body, has been working to establish clear technical standards for connected home devices, providing a structured, though rigorous, environment for manufacturers to bring new products to market, ensuring they meet the highest performance and security standards.

The demographic advantage for Japan lies in its technologically proficient society and its urgent need to create sustainable, supportive living environments for its senior citizens. This drives innovation in creating intuitive, reliable automation systems that cater to the specific needs of an older demographic. The National Institute of Information and Communications Technology (NICT) is actively involved in research on secure and robust communication protocols suitable for these applications. Furthermore, the high density of technology companies and electronics manufacturers in urban centers like Tokyo and Osaka serves as an early adopter and testing ground for new connected home applications. This combination of demographic pressure, strong governmental support for technology, and a culture of innovation positions Japan as a unique and highly advanced market focused on leveraging connected home technologies to address the challenges of an aging society and urban living.

Global Connected Homes Market: Key Takeaways

- Global Market Size Insights: The Global Connected Homes Market size is estimated to have a value of USD 150.7 billion in 2025 and is expected to reach USD 614.5 billion by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 16.9 percent over the forecasted period of 2025.

- The US Market Size Insights: The US Connected Homes Market is projected to be valued at USD 50.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 188.2 billion in 2034 at a CAGR of 15.9%.

- Regional Insights: North America is expected to have the largest market share in the Global Connected Homes Market with a share of about 39.5% in 2025.

- Key Players: Some of the major key players in the Global Connected Homes Market are Amazon.com, Inc., Google LLC, Apple Inc., Samsung Electronics Co., Ltd., Siemens AG, Schneider Electric SE, LG Electronics Inc., Robert Bosch GmbH, and many others.

Global Connected Homes Market: Use Cases

- Home Security & Monitoring: Homeowners use integrated systems of smart cameras, motion sensors, and automated door locks to remotely monitor and secure their properties, providing real-time alerts and peace of mind.

- Energy Management: Smart thermostats and connected lighting systems learn user habits and adjust heating, cooling, and lighting automatically to optimize energy consumption and reduce utility bills.

- Voice-Controlled Entertainment: Whole-home audio systems and smart TVs are integrated with voice assistants like Alexa and Google Assistant, allowing for seamless control of entertainment and media across different rooms.

- Automated Appliances: Smart refrigerators, ovens, and washing machines can be controlled remotely, receive maintenance alerts, and optimize their operation cycles for convenience and efficiency.

- Elderly & Assisted Living: Connected home systems incorporate emergency response buttons, fall detection sensors, and remote health monitoring devices to support independent living for senior citizens.

Global Connected Homes Market: Stats & Facts

National Institute of Standards and Technology (NIST)

- NIST Cybersecurity for IoT program lists 12 core published guidelines for securing connected devices in its repository.

Federal Communications Commission (FCC)

- FCC published "Equipment Authorization for IoT Devices" guidance (initial final guidance date: 14 March 2018).

- FCC connected device page content was last marked "content current as of 18 September 2023."

- During the smart home adoption surge, the FCC reported over 2,000 new device certifications for smart home products (as of 2022).

- The same FCC update reported 15 million+ new connected device registrations in the smart home category (significant increase vs. prior period).

- FCC reported 8.5 million unique queries to its equipment authorization database for smart home devices (2022 reporting period).

- FCC reported the allocation of additional spectrum in the 6 GHz band for Wi-Fi 6E, benefiting high-bandwidth smart home applications (finalized 2020).

- FCC reported 320+ manufacturers submitted device capability information for smart home interoperability testing (as of June 2023).

- FCC records confirm the first FCC-certified smart home hub was approved in 2014 (approval documents dated late 2014).

Consumer Technology Association (CTA)

- CTA evaluated interoperability standards for simultaneous operation of up to 50 connected devices in typical home environments.

- CTA published an advisory/report "State of Smart Home Interoperability" (summary guidance published Jan 15, 2024).

- CTA has highlighted cybersecurity and data privacy risks associated with some connected home devices and recommended best practices for consumers.

Organisation for Economic Co-operation and Development (OECD)

- OECD analysis reported that an increase of ~USD 20,000 in imports of smart home components is associated (on average) with an increase of about USD 4.5 million in exports of smart home compatible goods.

- OECD found that a 1% increase in the value of imports of connectivity modules corresponds to approximately a +0.03% increase in exports of smart home systems.

International Telecommunication Union (ITU)

- ITU is composed of 193 member states (formal ITU membership structure).

- ITU published the "Global Standards for IoT and Smart Cities" (ITU-T Y.4000) series as a final document (published 21 November 2022, Edition 3).

- ITU's 2020–2024 strategic work program recorded the release of several smart home connectivity guidance documents in 2023 to address interoperability and security.

European Telecommunications Standards Institute (ETSI) / European Commission (EC)

- A EU-wide survey-based study reported 42% of households in key markets were using at least one smart home device (mainly for security and energy saving).

- The EU regulator (EC) issued explicit guidance on cybersecurity requirements for connected devices under the Radio Equipment Directive (published 12 January 2022).

World Economic Forum (WEF)

- WEF published "The Future of Connected Homes" (publication date 10 March 2024) addressing economic implications, data governance, and sustainability for smart homes.

- WEF IoT reporting noted that in a global innovation snapshot ~35% of listed proptech innovations in a regional sample were based on connected home technologies (reported in WEF country/summary reporting).

International Organization for Standardization (ISO) / IEC (standards bodies)

- ISO's membership comprises 167 national member bodies (context for ISO standardization activities).

- ISO's catalog shows tens of thousands of standards globally (ISO often reports ~24,800 total published standards across all domains.

- Recent literature/standards reviews reported ~28 smart home/interoperability standards under development across ISO/IEC working groups (IoT standardization pipeline).

- IEC Smart Home systems committee surpassed the 800-member mark (membership of working group reported over 800 members in mid-2023), reflecting standards activity including security and interoperability subcommittees.

Australian Communications and Media Authority (ACMA)

- ACMA guidance pages for connected device compliance and labeling were published and last updated in 2024 (guidance maintained and updated; example update Aug 22, 2024).

- An Australian regulatory impact assessment estimated ~15%–40% market penetration for households that might utilise connected home systems (range estimate used in policy analysis).

Global Connected Homes Market: Market Dynamic

Driving Factors in the Global Connected Homes Market

Demographic Shift towards Urbanization and Digital Lifestyles

The global demographic trend of increasing urbanization and the rise of digital-native populations is a primary driver for the connected homes market. Urban residents and younger demographics have a higher propensity for technology adoption, seeking convenience, security, and energy efficiency through smart home solutions. Connected home technology is uniquely positioned to address these needs through integrated systems for lighting, climate control, security, and entertainment that can be managed remotely via smartphones, offering superior control and functionality compared to traditional home systems and improving the quality of urban living.

Supportive Regulatory Frameworks and Industry Standards

The establishment of clearer cybersecurity and interoperability standards by major bodies like the EU's RED and industry consortia like the Connectivity Standards Alliance (e.g., Matter protocol) has provided the necessary clarity and confidence for manufacturers to invest heavily in the sector. These frameworks validate the security and compatibility of connected devices, accelerating their market acceptance. Furthermore, substantial government and institutional funding, such as from Horizon Europe for IoT research and various national broadband initiatives, directly fuels infrastructure development and innovation in smart home applications. This financial and regulatory support de-risks innovation and catalyzes the transition of connected homes from a luxury to a mainstream consumer offering.

Restraints in the Global Connected Homes Market

High Initial Setup and Integration Costs

The significant initial investment required for comprehensive smart home systems, along with the ongoing costs for compatible devices, professional installation, and subscription services, presents a major barrier to entry, particularly for middle-income households. Beyond the hardware, the total cost of ownership includes potential home network upgrades, system integration fees, and ongoing cloud service subscriptions. This financial hurdle can slow down widespread adoption, as consumers must justify the investment, often requiring demonstrable proof of energy savings, security benefits, or convenience to achieve a perceived positive return on investment.

Cybersecurity Concerns and Data Privacy Issues

The effective implementation of connected homes introduces significant risks related to data breaches, unauthorized access, and privacy invasion. There is a pronounced concern among consumers about the security of their personal data and the potential for smart devices to be hacked. The lack of universally implemented, robust security protocols across all devices and the complexity of managing digital security for non-technical users further exacerbates this challenge. Without stronger security guarantees, transparent data policies, and user-friendly security management, consumer trust and the pace of mass-market adoption are critically hampered.

Opportunities in the Global Connected Homes Market

Expansion in Energy Management and Sustainability

The home energy management segment represents one of the largest and most rapidly expanding opportunities for connected home adoption. The technology is ideal for optimizing energy consumption through smart thermostats, lighting controls, and energy monitoring systems. The shift from traditional utility management to smart, data-driven workflows, driven by real-time analytics and automation, offers homeowners significant gains in cost reduction and environmental sustainability. This alignment with global sustainability goals positions connected home technology as a cornerstone for the future of energy-efficient living.

Integration with Health and Wellness Monitoring

A nascent but high-potential growth frontier lies in the health and wellness sector, where connected home technology is being explored for ambient assisted living and proactive health monitoring. This technology enables the creation of systems that can track daily activity patterns, monitor sleep quality, and even detect emergencies like falls for elderly residents. It allows for the integration of non-invasive health sensors into the home environment, providing insights for preventative care. This capability for proactive wellness management could revolutionize home-based care, opening a completely new and substantial market segment for connected home technologies beyond convenience and security.

Trends in the Global Connected Homes Market

Interoperability and Unified Ecosystems

A dominant trend is the move towards universal standards and protocols that ensure seamless interoperability between devices from different manufacturers. Initiatives like the Matter standard aim to break down proprietary silos, allowing smart devices to communicate effortlessly regardless of brand. The benefits are profound, leading to simplified setup for consumers, enhanced system reliability, and a more vibrant competitive market. This trend fosters a more collaborative industry environment, transforming the smart home from a collection of isolated gadgets into a truly integrated and intelligent living space.

AI-Powered Predictive Automation

The industry is witnessing rapid innovation in the application of artificial intelligence to create truly intelligent homes. This includes the development of systems that learn resident behaviors and preferences over time to automatically adjust lighting, temperature, and entertainment settings. Concurrently, significant research is focused on predictive maintenance, where systems can alert homeowners to potential device failures before they occur. These advancements are expanding the application horizon from reactive control to proactive, context-aware automation that anticipates needs and enhances daily life, pushing the boundaries of convenience and personalization.

Global Connected Homes Market: Research Scope and Analysis

By Component Analysis

The Hardware segment is projected to remains the backbone of the Global Connected Homes Market, primarily because it represents the physical interface through which consumers experience digital home automation. Smart speakers, security cameras, thermostats, smart locks, smoke detectors, smart lighting systems, and connected appliances form the visible, tangible layer of the connected ecosystem. These devices integrate advanced sensors, embedded chips, machine learning capabilities, and wireless connectivity modules, all of which drive their relatively higher price points. As homeowners seek convenience, safety, and energy efficiency, hardware continues to be their first point of investment. Additionally, property developers, builders, and large residential projects increasingly incorporate advanced hardware solutions into base designs, contributing to consistent demand.

However, the Services segment is transitioning into a powerhouse of growth and long-term profitability. Services include installation, integration, configuration, ongoing maintenance, and cloud-based software subscriptions that enable enhanced analytics, video storage, device health monitoring, and remote access features. As the installed base of hardware expands, recurring revenue opportunities multiply. Consumers increasingly rely on specialized technicians and service providers for seamless interoperability across complex multi-device ecosystems. Subscription services for security monitoring, energy analytics, predictive maintenance, and AI-enabled automation are becoming essential components of modern connected homes. The overall customer experience, long-term system performance, and cybersecurity resilience are heavily dependent on the quality and continuity of these services. As connected homes evolve from gadget-based setups to full ecosystem-driven environments, the services segment is expected to surpass hardware in cumulative value, making it fundamental to the future structure of the market.

By Technology Analysis

Wi-Fi is expected to remain the dominant technology in connected homes due to its universal presence, high data transfer rate, and straightforward setup. The majority of data-heavy devices—such as video doorbells, security cameras, streaming hubs, and smart speakers—depend on Wi-Fi to ensure seamless communication and real-time functionality. Nearly every household possesses a Wi-Fi router, eliminating the need for additional hubs for mainstream products. This ubiquity ensures widespread adoption and makes Wi-Fi the default backbone for smart home connectivity. Its ongoing advancements—including Wi-Fi 6 and Wi-Fi 7—further enhance network reliability, reduce congestion, and support large numbers of simultaneously connected devices.

For low-power, battery-operated devices, Zigbee and Z-Wave dominate. These protocols were specifically engineered for smart home environments, enabling mesh networks that extend coverage throughout large homes, improve signal stability, and consume minimal energy. They are preferred in applications such as smart locks, IoT sensors, leak detectors, and temperature modules—devices that require reliability and efficiency over bandwidth.

Bluetooth Low Energy (BLE) excels in short-range connectivity and proximity-based interactions. Users often rely on BLE for quick pairing, smartphone-triggered automation, and wearable-device integration. It supports frictionless device onboarding and remains vital for personal devices and DIY installations.

The future lies in Matter over Thread, a transformative standard designed to unify the fragmented smart home market. Backed by major global players, Matter aims to enable fluid interoperability between brands, robust security, simplified installation, and improved user experience—paving the way for a universal connected home standard.

By Communication Protocol Analysis

Proprietary and Brand-Specific Ecosystems is projected to remain foundational to the connected home market due to their early-market influence and integrated user experience. Platforms such as Amazon Alexa, Google Assistant, and Apple HomeKit established themselves as dominant gateways to smart home adoption by offering easy setup, intuitive interfaces, and voice-driven controls. These ecosystems created consumer trust and familiarity, enabling users to expand their smart home capabilities seamlessly. Brand-specific ecosystems ensure optimized performance for products within their networks, making them particularly attractive for novice users who prioritize convenience. Their cohesive environments continue to be a major driver for unit sales, especially in the early stages of consumer adoption.

However, as homes become more complex and consumers look for cross-brand compatibility, Open Standard Protocols like Zigbee and Z-Wave increasingly dominate the structural foundation of large-scale home automation networks. These open systems enable multi-device interoperability, efficient energy consumption, and stable mesh networking—critical for creating a truly connected home with dozens of devices. Their strong security frameworks and device certification programs ensure reliability across different brands and product categories.

Meanwhile, Matter-over-Thread represents the most rapidly advancing frontier, driven by unprecedented industry collaboration. Although currently in early stages of deployment, it promises to standardize communication across devices, solving long-standing fragmentation issues. Matter reduces consumer confusion, eliminates brand lock-in, and simplifies the installation process. The result is a more open, secure, and interoperable ecosystem that is expected to significantly shape the future of the connected home industry.

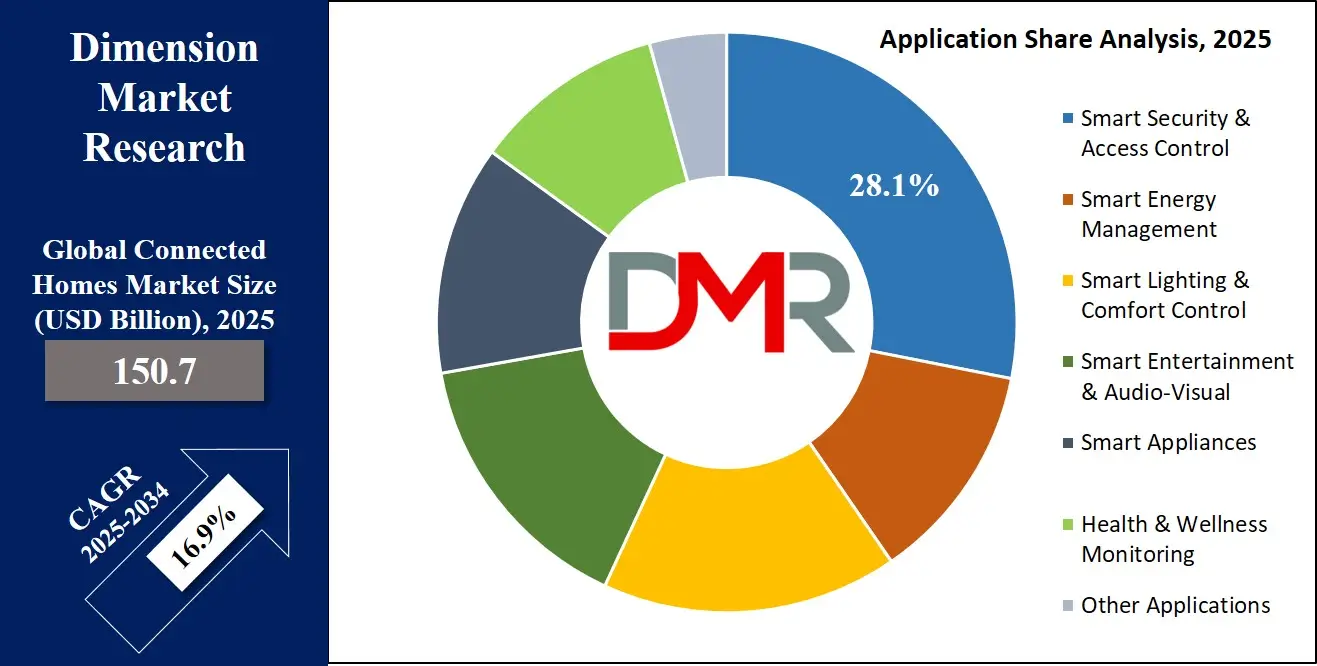

By Application Analysis

The Smart Security & Access Control segment is poised to stands at the forefront of the connected homes market, driven by growing consumer demand for safety, real-time monitoring, and remote access. Products like smart locks, video doorbells, Wi-Fi cameras, motion sensors, and AI-powered surveillance systems have become essential components of modern homes.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Their ability to provide instant alerts, high-definition video feeds, package theft prevention, and integration with emergency services offers measurable and immediate value to homeowners. The psychological sense of safety—combined with convenience features such as keyless entry and automated door locking—reinforces security as the first-choice application for consumers entering the smart home ecosystem. Continuous innovation, declining hardware prices, and subscription-based monitoring services further bolster this segment.

The Smart Energy Management segment, however, has rapidly evolved into a core growth engine due to rising environmental awareness and the increasing cost of electricity. Smart thermostats, smart plugs, connected meters, and adaptive lighting systems empower households to optimize energy usage and reduce unnecessary consumption. Real-time analytics, AI-driven scheduling, and remote control allow homeowners to achieve substantial reductions in utility expenses. Governments worldwide are promoting energy-efficient homes through regulations and incentives, fueling adoption. This segment also aligns strongly with global sustainability priorities, making it attractive not only to individual consumers but also to builders and developers aiming to meet green-building certification standards. Together, security and energy management form the foundational pillars driving the market’s long-term expansion and mainstream appeal.

By End-User Analysis

Residential Homeowners and Tech-Savvy Renters are projected to currently the dominant end-user base, contributing to the highest unit sales and widespread adoption of connected home technologies. Individual consumers typically begin their smart home journey with one or two devices—often smart speakers or smart security solutions—and gradually expand into more comprehensive ecosystems. Their purchasing decisions are influenced by convenience, comfort, security, and the desire for modern living experiences. Improvements in affordability, increased retail availability, and intuitive mobile apps further accelerate adoption among this group. Tech-savvy renters, particularly in urban areas, often install portable smart devices that enhance their living environment without requiring structural modifications, reinforcing this segment’s strength.

In contrast, Real Estate Developers and Builders represent the fastest-growing and most transformative end-user segment. Developers are increasingly incorporating smart home features—such as integrated thermostats, lighting systems, connected smoke detectors, and structured wiring—into new construction projects. This shift is driven by rising consumer expectations for “smart-ready” homes, competitive differentiation in the property market, and government incentives promoting smart and energy-efficient housing. Builders view connected technologies as a value-add that enhances property appeal and marketability while offering long-term sustainability benefits. As connected homes move from optional upgrades to standard amenities in mid- and high-end residential developments, this segment will significantly reshape market penetration patterns.

The proactive integration of smart systems at the construction stage ensures seamless device interoperability, reduces retrofit costs, and accelerates mainstream adoption—marking a critical evolution in the connected home ecosystem.

The Global Connected Homes Market Report is segmented on the basis of the following:

By Component

- Hardware

- Smart Home Hubs & Controllers

- Security & Monitoring Devices

- Smart Cameras

- Smart Doorbells

- Smart Locks

- Sensors (Motion, Contact, Leak)

- Smart Appliances

- Smart Refrigerators

- Smart Ovens & Cooktops

- Smart Washing Machines

- Comfort & Lighting Control

- Smart Thermostats

- Smart Lighting Systems

- Smart Blinds & Shades

- Entertainment Systems

- Smart TVs & Displays

- Smart Speakers & Soundbars

- Media Streamers

- Software

- Device Management & Control Platforms

- Mobile Applications

- Web Portals

- Analytics & Insights Software

- Energy Usage Monitoring

- Behavioral Pattern Analysis

- Predictive Maintenance Alerts

- AI & Automation Engines

- Voice Assistant Integration

- Routine & Scene Automation

- Predictive Behavior Learning

- Services

- Professional Services

- System Design & Consultation

- Installation & Integration

- Maintenance & Support

- Managed Services

- Remote Monitoring & Management

- Security Management

- Software Updates & Patches

By Technology

- Wi-Fi

- Bluetooth/BLE

- Zigbee

- Z-Wave

- Thread

- Cellular (4G/5G)

- Other

By Communication Protocol

- Proprietary Ecosystems

- Open Standard Protocols

- Matter-over-Thread

- Hybrid/Multi-Protocol Hubs

By Application

- Smart Security & Access Control

- Smart Energy Management

- Smart Lighting & Comfort Control

- Smart Entertainment & Audio-Visual

- Smart Appliances

- Health & Wellness Monitoring

- Other applications

By End-User

- Residential Homeowners

- Tech-Savvy Renters

- Real Estate Developers & Builders

- Hospitality Sector

- Property Management Companies

- Senior Living Facilities

Impact of Artificial Intelligence in the Global Connected Homes Market

- Enhanced Personalization & Automation: AI algorithms analyze user behavior, preferences, and environmental data to create highly personalized automations for lighting, temperature, and entertainment, improving comfort and efficiency.

- Predictive Maintenance & Diagnostics: AI-driven systems monitor device health, predict potential failures in appliances or systems, and proactively alert users or service providers, reducing downtime and repair costs.

- Intelligent Energy Optimization: AI optimizes heating, cooling, and appliance operation based on real-time energy pricing, weather forecasts, and occupancy patterns, maximizing cost savings and sustainability.

- Advanced Security & Threat Detection: AI-powered video analytics distinguish between routine activity and potential security threats (e.g., package theft, unfamiliar persons), reducing false alarms and providing more intelligent alerts.

- Voice-First Natural Interaction: AI enhances natural language processing in voice assistants, enabling more complex, context-aware commands and conversational control over the smart home environment.

Global Connected Homes Market: Regional Analysis

Region with the Largest Revenue Share

North America, led by the United States, is projected to command the largest share of the global connected homes market with 39.5% of market share by the end of 2025, due to a powerful confluence of technological leadership, high disposable income, and early adopter culture. The region is home to many of the world's leading technology companies, such as Amazon, Google, and Apple, which continuously drive innovation in both hardware and AI-powered platforms.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

This technological edge is complemented by high broadband and smartphone penetration, creating a ripe environment for adoption. The presence of a robust retail and e-commerce infrastructure enables easy access to a wide variety of smart home products. Furthermore, high consumer awareness and a willingness to invest in convenience and security drive demand. This synergy between leading tech giants, a supportive digital infrastructure, and receptive consumers creates a virtuous cycle that solidifies North America's dominant market position.

Region with the Highest CAGR

The Asia Pacific region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) in the connected homes market, fueled by massive urbanization, rising disposable incomes, and government-led digitalization initiatives. Countries like China, Japan, and South Korea are home to leading electronics manufacturers and are making substantial investments in 5G and smart city infrastructure, which directly benefits the connected home ecosystem. The region's vast and growing middle class is increasingly tech-savvy and seeking modern living solutions. Furthermore, specific demographic challenges, such as the rapidly aging population in Japan and South Korea, are driving demand for assisted living technologies that can be integrated into connected homes. The growing presence of local manufacturers offering cost-competitive hardware is making the technology more accessible than ever. This combination of strong infrastructural development, urgent demographic needs, a growing consumer base, and increasing affordability creates an explosive growth environment, positioning the Asia Pacific as the fastest-growing market globally.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Connected Homes Market: Competitive Landscape

The competitive landscape of the global connected homes market is fragmented and highly dynamic, characterized by a mix of technology giants, established electronics firms, and a vibrant ecosystem of specialized startups. Dominant players like Amazon.com, Inc., Google LLC, and Apple Inc. leverage their extensive ecosystems of voice assistants, platforms, and partner devices to maintain a stronghold, particularly in the realms of entertainment, voice control, and core hub functionality. These companies compete not only on technology but also on the strength of their brand ecosystems and user data networks. A significant trend is the deep foray of traditional home appliance conglomerates, such as Samsung Electronics Co., Ltd. and LG Electronics Inc., which are aggressively integrating smart connectivity and AI into their refrigerators, washing machines, and televisions.

This vertical integration allows them to offer comprehensive smart home suites. Simultaneously, the market sees intense competition from specialized security-focused players, including Ring (owned by Amazon) and Arlo Technologies, Inc., in video monitoring, and home automation specialists like Lutron Electronics Co., Inc. in lighting control. The landscape is further energized by startups focusing on disruptive applications like AI-powered energy management and privacy-focused security systems, ensuring continuous innovation and intensifying competition across all segments.

Some of the prominent players in the Global Connected Homes Market are:

- Amazon.com, Inc.

- Google LLC

- Apple Inc.

- Samsung Electronics Co., Ltd.

- Siemens AG

- Schneider Electric SE

- LG Electronics Inc.

- Robert Bosch GmbH

- Sony Group Corporation

- Honeywell International Inc.

- Assa Abloy AB

- Johnson Controls International plc

- Legrand SA

- Lutron Electronics Co., Inc.

- Resideo Technologies, Inc.

- Alarm.com Holdings, Inc.

- Vivint Smart Home, Inc.

- Control4 Corporation (Snap One)

- Arlo Technologies, Inc.

- Aqara (Lumi United)

- Other Key Players

Recent Developments in the Global Connected Homes Market

- May 2024: The Connectivity Standards Alliance announces the launch of the Matter 1.2 specification, adding support for new device types including robotic vacuums, refrigerators, and energy management systems.

- April 2024: Amazon and Siemens AG announce a strategic collaboration to integrate Amazon's Sidewalk network with Siemens' building automation systems for enhanced neighborhood-scale IoT applications.

- March 2024: The U.S. National Institute of Standards and Technology (NIST) releases a new draft framework for "Labeling of IoT Device Security" aimed at helping consumers make informed purchases.

- February 2024: Google LLC completes its acquisition of Nest Renew, a developer of energy management software, enhancing its portfolio in sustainable home automation.

- January 2024: The "Consumer Electronics Show (CES) 2024" is held in Las Vegas, USA, featuring keynotes on the future of AI-powered predictive smart homes.

- November 2023: Samsung launches the "SmartThings Station," a new multi-protocol hub with built-in wireless charging, aimed at simplifying the setup of complex smart home ecosystems.

- October 2023: Apple and a consortium of major U.S. homebuilders announce a partnership to pre-wire new homes with Thread and Matter support for seamless Apple HomeKit integration.

- September 2023: The IFA consumer electronics fair in Berlin features a dedicated "Smart Home of the Future" pavilion, highlighting new interoperable devices from Signify (Philips Hue) and Bosch.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 150.7 Bn |

| Forecast Value (2034) |

USD 614.5 Bn |

| CAGR (2025–2034) |

16.9% |

| The US Market Size (2025) |

USD 50.1 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Hardware, Software, Services), By Technology (Wi-Fi, Bluetooth/BLE, Zigbee, Z-Wave, Thread, Cellular 4G/5G, Other), By Communication Protocol (Proprietary Ecosystems, Open Standard Protocols, Matter-over-Thread, Hybrid/Multi-Protocol Hubs), By Application (Smart Security & Access Control, Smart Energy Management, Smart Lighting & Comfort Control, Smart Entertainment & Audio-Visual, Smart Appliances, Health & Wellness Monitoring, Other Applications), By End-User (Residential Homeowners, Tech-Savvy Renters, Real Estate Developers & Builders, Hospitality Sector, Property Management Companies, Senior Living Facilities) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Amazon.com, Inc., Google LLC, Apple Inc., Samsung Electronics Co., Ltd., Siemens AG, Schneider Electric SE, LG Electronics Inc., Robert Bosch GmbH, Sony Group Corporation, Honeywell International Inc., Assa Abloy AB, Johnson Controls International plc, Legrand SA, Lutron Electronics Co., Inc., Resideo Technologies, Inc., Alarm.com Holdings, Inc., Vivint Smart Home, Inc., Control4 Corporation (Snap One), Arlo Technologies, Inc., Aqara (Lumi United), and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Connected Homes Market?

▾ The Global Connected Homes Market size is estimated to have a value of USD 150.7 billion in 2025 and is expected to reach USD 614.5 billion by the end of 2034.

What is the growth rate in the Global Connected Homes Market in the forecast period?

▾ The market is growing at a CAGR of 16.9 percent over the forecasted period of 2025 to 2034.

What is the size of the US Connected Homes Market?

▾ The US Connected Homes Market is projected to be valued at USD 50.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 188.2 billion in 2034 at a CAGR of 15.9%.

Which region accounted for the largest Global Connected Homes Market?

▾ North America is expected to have the largest market share in the Global Connected Homes Market with a share of about 39.5% in 2025.

Who are the key players in the Global Connected Homes Market?

▾ Some of the major key players in the Global Connected Homes Market are Amazon.com, Inc., Google LLC, Apple Inc., Samsung Electronics Co., Ltd., Siemens AG, Schneider Electric SE, LG Electronics Inc., Robert Bosch GmbH, and many others.