Smart lighting refers to lighting systems that can be controlled remotely, often through a smartphone app, voice assistants, or other connected technologies. These systems are powered by internet connectivity and can adjust based on the user's preferences, time of day, or environmental conditions.

The Smart Lighting market is expanding rapidly, driven by increasing demand for energy-efficient, sustainable, and connected lighting solutions. This market includes products like smart bulbs, smart switches, sensors, and complete smart lighting systems.

The integration of Internet of Things (IoT) technology and advancements in automation has made it easier for consumers and businesses to adopt these systems, creating a highly dynamic and competitive market landscape. Not only are established players investing heavily in smart lighting solutions, but there is also an increasing number of startups and emerging businesses entering the space, providing innovative, cost-effective solutions to meet the growing demand.

In 2024, the growth opportunities in the smart lighting market are abundant, and both established players and new businesses stand to benefit from these prospects. For large companies, the focus will likely be on expanding their product portfolios, improving system interoperability, and enhancing energy-saving capabilities to stay competitive.

Smart lighting companies can integrate features like carbon monoxide detectors and nightlights, which surveys indicate consumers are keen on—58% of individuals are interested in smart lighting, and 56% want these additional safety features. For newer and entry-level businesses, offering affordable, plug-and-play smart lighting solutions targeted toward cost-conscious consumers can capture significant market share.

By developing easy-to-use apps, ensuring seamless integration with popular home automation systems, and focusing on sustainability, these companies can address growing consumer preferences for convenience and energy savings. Leveraging partnerships with energy providers or homebuilders can also be a key growth strategy to tap into the burgeoning market.

Several key trends are shaping the smart lighting market, creating exciting growth opportunities. One such trend is the rising emphasis on energy efficiency and sustainability. According to reports from companies like GDS Lighting, smart lighting systems can reduce lighting costs by 35% to 70%, offering substantial energy savings. This has been a significant driver in both residential and commercial markets, where businesses and homeowners are increasingly adopting solutions that contribute to lowering energy consumption.

Additionally, smart bulbs, which use LEDs, are also a key part of this movement. These bulbs are at least 15 times more durable than traditional incandescent options and use 70% to 90% less energy, offering a compelling case for both cost savings and environmental impact reduction.

Another key trend is the growing importance of voice-activated and app-based control for smart lighting systems. With the widespread use of smart home devices and the increasing popularity of platforms like Amazon Alexa, Google Assistant, and Apple HomeKit, consumers now expect their lighting to be as easily controllable as any other smart device.

Smart Lighting Market Key Takeaways

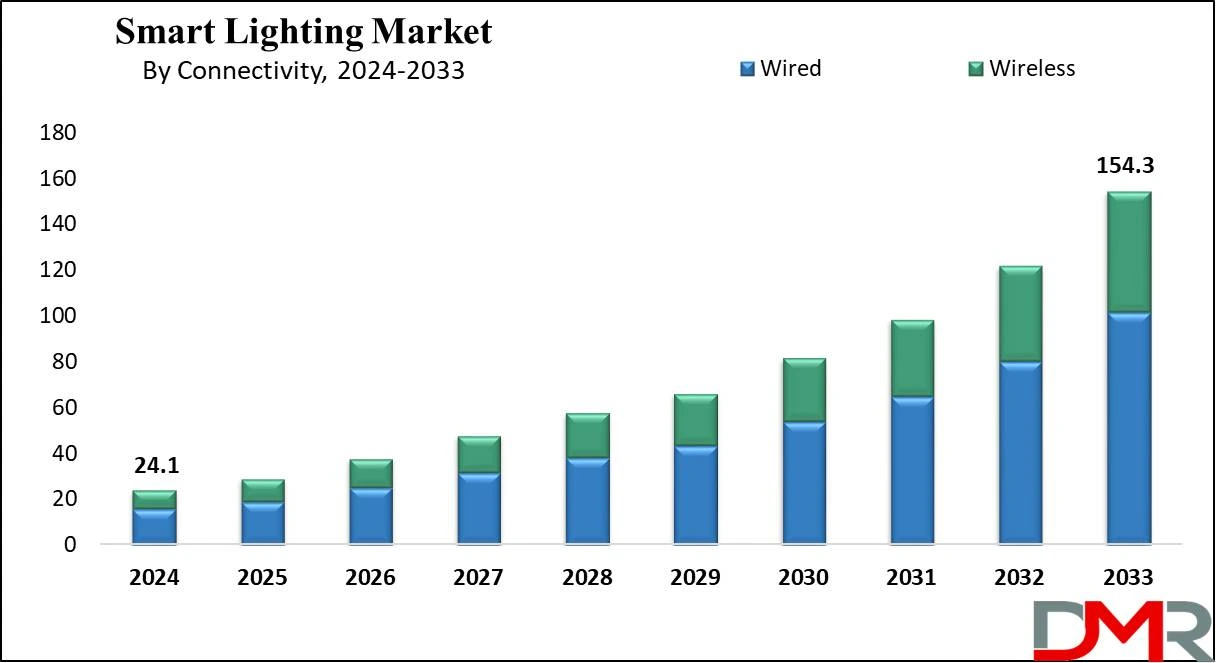

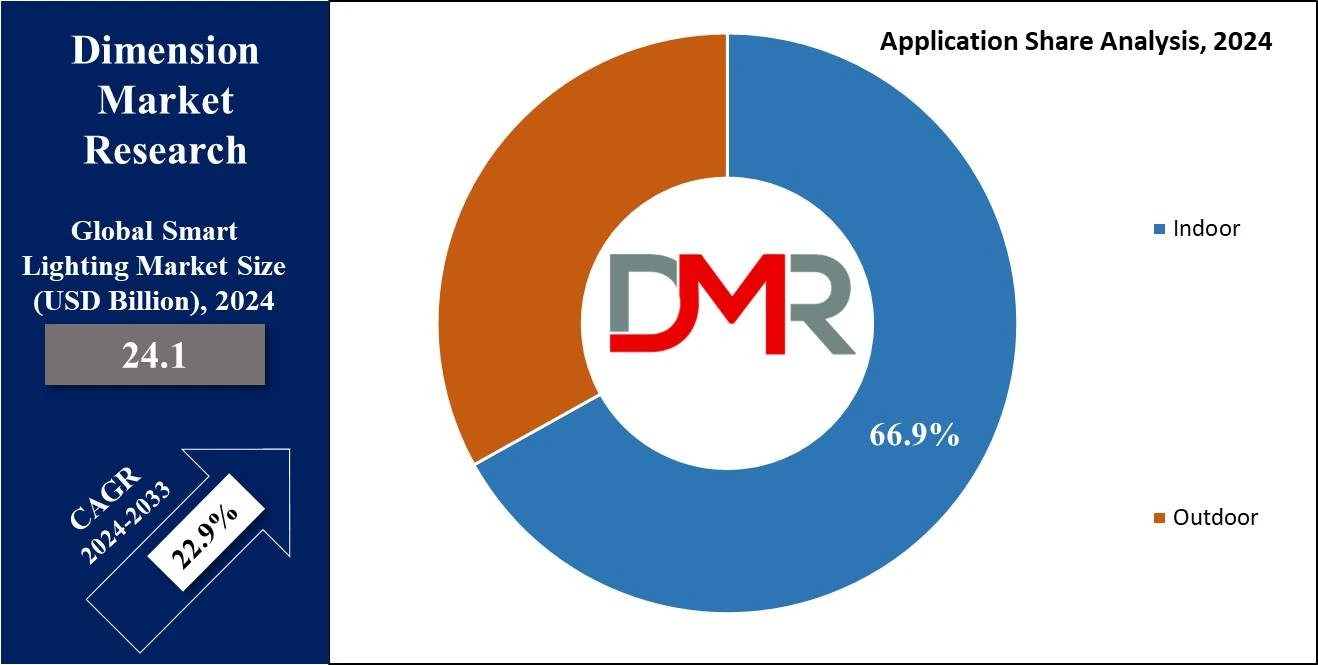

- The Global Smart Lighting Market is expected to grow by 130.2 billion, at a CAGR of 22.9% during the forecasted period.

- By Connectivity, the wired segment is expected to lead in 2024 & is anticipated to dominate throughout the forecasted period.

- By Component, the hardware segment is expected to have a lead throughout the forecasted period.

- By End Use, the indoor segment is expected to be the dominant driver of the growth of the market in forecasted years.

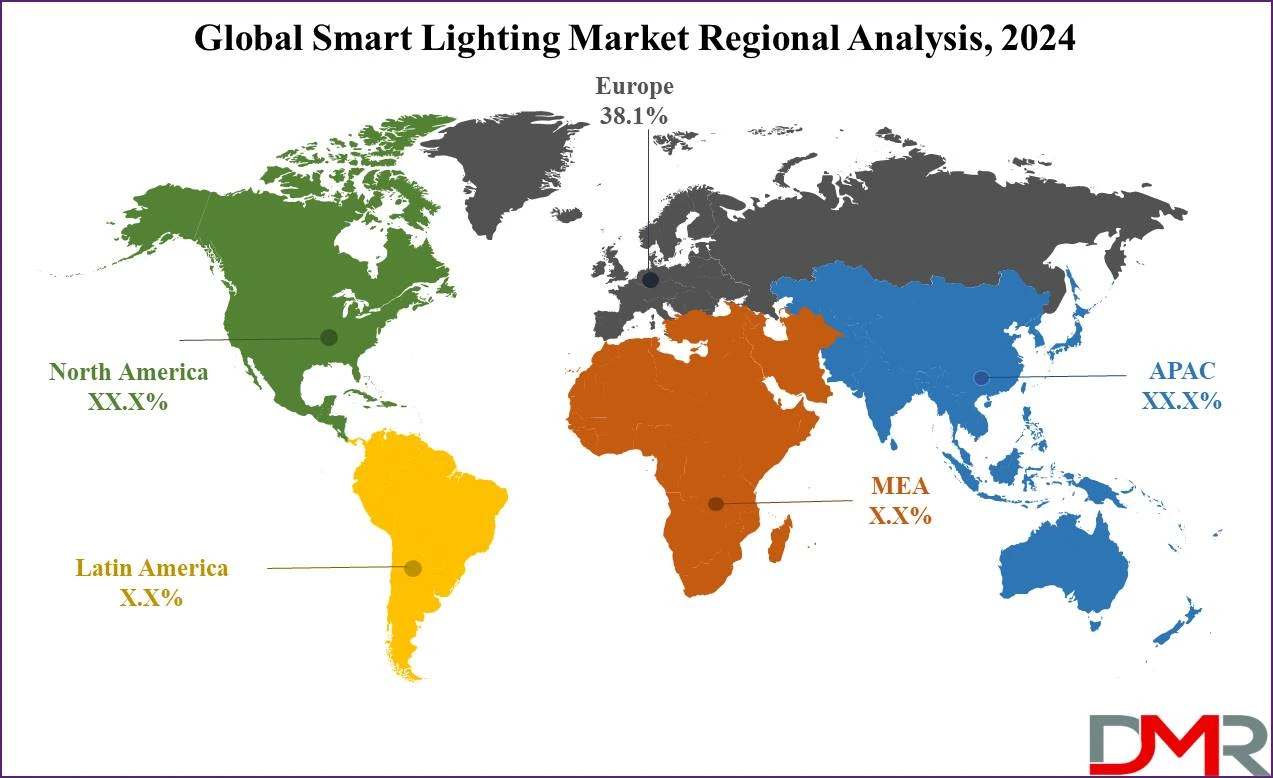

- Europe is expected to hold a 38.1% share of revenue in the Global Smart Lighting Market in 2024.

- Some of the use cases of Smart Lighting include home automation, smart cities, and more.

Smart Lighting Market Use Cases

- Home Automation: Smart lighting systems provide convenience &energy efficiency in homes by allowing users to remotely control lights through smartphone apps or voice commands. Users can set lighting based on their preferences or occupancy sensors, improving security & reducing energy wastage.

- Retail Environments: In retail settings, smart lighting can improve the shopping experience by dynamically adjusting lighting levels & colors to highlight products or create specific atmospheres. Motion sensors can activate lighting in certain areas, improving visibility & reducing operational costs by optimizing energy use.

- Smart Cities: Smart lighting plays a major role in urban environments by enhancing safety & efficiency. Streetlights provide sensors that can detect motion or ambient light levels, adjusting brightness accordingly. In addition, smart street lighting can support data collection for traffic management, environmental monitoring, & public safety initiatives.

- Healthcare Facilities: In healthcare settings, smart lighting systems can contribute to patient comfort, well-being, & recovery. Tunable LED lighting can mimic natural daylight patterns, promoting better sleep cycles & reducing patient stress. In addition, motion-sensing capabilities can improve staff efficiency by automatically illuminating areas as needed, improving complete operational efficiency.

Smart Lighting Market Dynamic

The global smart lighting market is experiencing many trends, with the higher urban population emerging as a major driver expected to support market growth. As urbanization continues to rise globally, concerns regarding reliable & sustainable energy sources, along with environmental issues like climate change &

greenhouse gas emissions, are growing, which led to a growth in the adoption of energy-efficient lighting solutions in both residential & commercial settings, a trend expected to stay and drive growth in the smart lighting market.

In addition, developments in technologies like IoT,

Cloud computing, & Bluetooth are contributing to the growth of smart homes, where many features are smoothly integrated, which has grown the demand for smart LED lighting systems that provide remote control capabilities & integration with other devices, further driving market expansion.

However, factors like the high cost of smart lighting create challenges to smart lighting market growth. The overall cost of smart lighting includes various expenses throughout its lifecycle, like equipment, installation, operation, & maintenance, making it a higher investment in comparison to traditional lighting solutions, which often leads budget-conscious consumers & residential owners to opt for conventional energy-saving lighting instead.

Compatibility issues also restrain market growth, as smart lighting may not always be compatible with current infrastructure & fittings, having replacements & potentially limiting usage scenarios. These challenges highlight the need for addressing cost concerns & improving compatibility to unlock the full potential of the smart lighting market.

Research Scope and Analysis

By Component

The smart lighting market is categorized into three key components: hardware, software, and services. Among these, the hardware segment is expected to take the dominant revenue share by 2024. Within hardware, lamps & luminaires are the main categories, with lamps showing major growth potential during the forecast period, which is fueled by the higher demand for connected lighting solutions that provide features like color adjustment, dimming capabilities, & remote operation through devices like smartphones or tablets.

Also, the software segment is anticipated to witness the fastest growth during the forecast period, as the growth is driven by the higher adoption of smart lighting for data-driven applications in critical areas. In addition, software applications are important for allowing control of lights through mobile devices & for integration with popular smart platforms like Cortana, Alexa, and Siri, supporting voice-controlled operation. The rising preference for creating ambient environments & facilitating data collection in smart city initiatives is expected to further drive the growth of this segment in the coming years.

By Connectivity

The wired segment is expected to dominate the global smart lighting market in 2024, with expectations of the fastest growth throughout the forecast period. Wired connections are important for longer ranges, above 30 feet. Further, technologies like Ethernet, DALI, DSI, and DLVP provide connectivity over extended distances, surpassing 100 meters up to 1000 feet. The growth in smart lighting adoption within commercial & industrial sectors is driving the need for wired connectivity solutions to ensure reliable & strong connections in larger spaces.

Further, the wireless segment is expected to experience high growth during the forecast period. Wireless connectivity is mainly favored by consumers looking for connections within shorter ranges. Technologies like Bluetooth, Wi-Fi, Z-Wave, SmartThings, and ZigBee allow smoother integration between lighting fixtures & smartphone applications for convenient control of lighting functions. In the residential sector, wireless technology is majorly used for its ability to adjust luminaire hues and colors, looking at aesthetic preferences within confined spaces.

By Application

The indoor segment is set to dominate the global smart lighting market in 2024, with residential, commercial, and industrial applications being key drivers. The residential sector is expected to significant growth due to the higher popularity of user-controlled smart lighting solutions, providing customizable lighting atmospheres. Further, the need in commercial & industrial spaces is driven by the importance of managing lighting consumption efficiently, mainly in facilities operating around the clock. Using smart lighting with integrated sensors makes optimized use based on occupancy, with automatic dimming capabilities responding to ambient lighting conditions.

Also, the outdoor segment is anticipated to experience quick growth during the forecast period, divided into highways & roadways, architecture, and other applications. In addition, outdoor architectural lighting, covering areas like gardens & building exteriors, is experiencing higher demand driven by the imperative for energy-efficient solutions & better surveillance, which is mainly evident in smart street lighting initiatives, where LED-based systems equipped with cameras & sensors are being installed by governments to monitor outdoor activities & share relevant data.

The Smart Lighting Market Report is segmented on the basis of the following

By Component

- Hardware

- Software

- Services

By Connectivity

By Application

- Indoor

- Outdoor

- Highway & Roadways

- Architecture

- Others

Regional Analysis

Europe is expected to lead the global smart lighting market in 2024, with an

estimated 38.1% share, driven by its major efforts in establishing safety & performance standards for indoor commercial smart lighting. Notably, LED luminaires & replacement smart lamps are new key growth areas, backed by current developments in LED technology. While existing smart lighting manufacturers constantly update their products, others are expanding their portfolios to enter the market. There's a major rush of dedicated smart luminaire vendors, mainly for applications like down lighting, task lighting, and outdoor illumination.

In addition, in the Asia Pacific, high growth is expected, driven by rising demand in commercial & residential sectors. Also, China is expected to dominate the market, followed by Japan, India, & South Korea, all investing largely in smart city projects. Also, North America is growing, driven by higher consumer acceptance & energy-efficient solutions provided by leading companies promoting greater adoption of smart lighting solutions.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global smart lighting market is highly competitive, characterized by numerous players ranging from established lighting manufacturers to technology giants & startups. Key strategies like product innovation, strategic partnerships, and mergers & acquisitions to expand market presence & offer complete solutions. In addition, companies aim to enhance interoperability & compatibility with various smart home ecosystems to meet changing consumer needs for smoother integration & ease of use, which fosters innovation and drives advancements in smart lighting technologies.

Some of the prominent players in the global Smart Lighting Market are

- Itron Inc

- Signify Holding

- YEELIGHT

- Verizon

- Schneider Electric

- Wipro Lighting

- Honeywell International Inc

- Acuity Brand Lighting

- Ideal Industries Inc

- Hafele America Co

- Other Key Players

Recent Developments

- In February 2024, Signify launched the Philips Smart Light Hub (SLH) in New Delhi, which was developed on the concept of an experience center, providing a holistic shopping experience to customers. Spanning over 2000 square feet, the Philips Smart Light Hub has a wide range of over 300 SKUs, making it a destination for all lighting requirements. Further, the store's architecture is created to provide an immersive & interactive environment, enabling customers to explore & experience the latest innovations in smart lighting technology.

- In February 2024, Aqara launched its latest addition to the smart lighting lineup, named the Ceiling Light T1M, which combines radiant white lighting with a colorful gradient ring, available in Aqara's Amazon stores & select retailers globally, which can create various atmospheres. The independently addressable RGB ring allows integration into holistic smart home experiences, delivering visual notifications for status changes, & improving safety and convenience.

- In October 2023, Halonix Technologies launched India's first 'UP-DOWN GLOW' LED Bulb, showcasing its commitment to enriching lives through leading technology. Both the upper part (Dome) & the lower part (stem) glow in different colors, providing consumers with different options for creating some magic with the lighting in their room through 3 different switch-enabled modes.

- In June 2023, Utah announced Vivint Smart Lighting, an elegant lighting solution developed to make homes safer, smarter, & more sustainable. Vivint Smart Lighting allows one to place switches anywhere, doesn’t need electrical work, makes sure the dependable connectivity, and expands the smart home capabilities in one’s home.

- In January 2023, GE Lighting announced the expansion of its smart lighting brand Cync’s Dynamic Effects line, which positions Cync even more squarely as an affordable Philips Hue & Nanoleaf competitor. New hexagon wall panels, neon-style rope lights that can be shaped how you like, and A19 & BR30 bulbs join the complete-color gradient indoor & outdoor light strips and are around USD 40 cheaper than comparable Hue versions.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 24.1 Bn |

| Forecast Value (2033) |

USD 154.3 Bn |

| CAGR (2023-2032) |

22.9% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Connectivity (Wired and Wireless), By Component (Hardware, Software, and Services), By Application (Indoor and Outdoor) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Itron Inc, Signify Holding, YEELIGHT, Verizon, Schneider Electric, Wipro Lighting, Honeywell International Inc, Acuity Brand Lighting, Ideal Industries Inc, Hafele America Co, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |