Market Overview

The

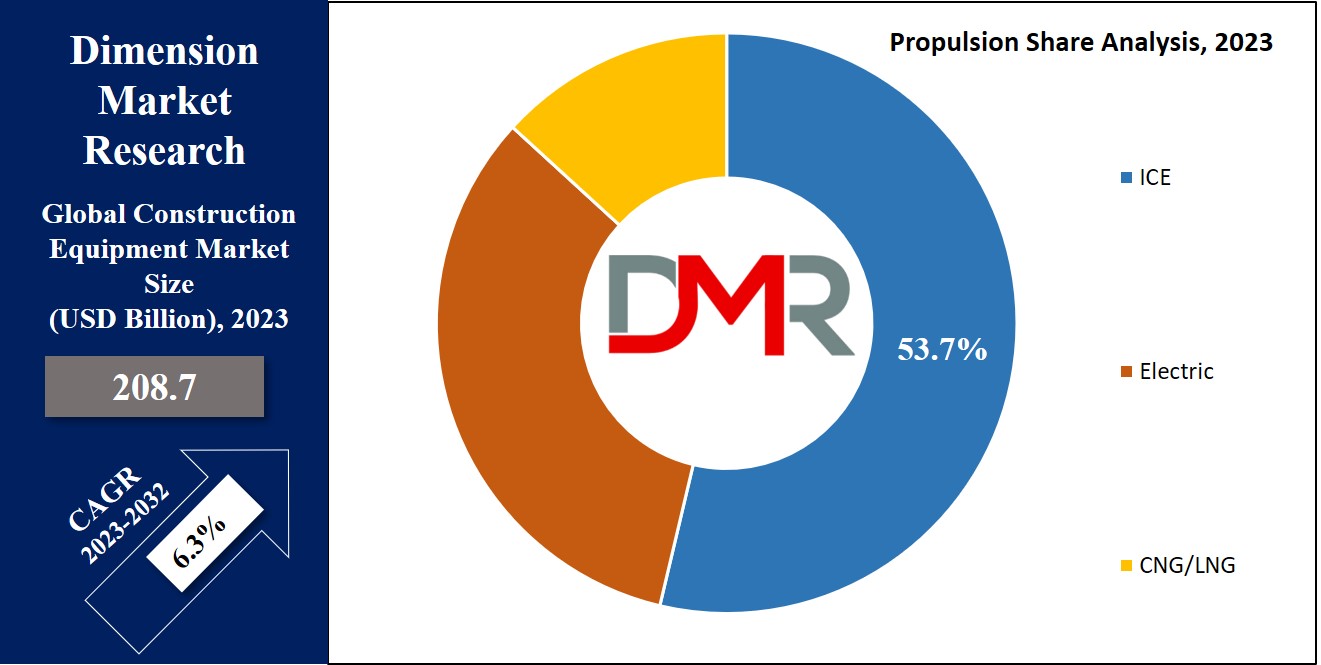

Global Construction Equipment Market is expected to reach a value of

USD 208.7 billion in 2023, and it is further anticipated to reach a market value of

USD 362.8 billion by 2032 at a

CAGR of 6.3%. The market has seen significant growth over the past few years and is predicted to grow significantly during the forecasted period as well.

Construction equipment is often known for its strong machinery customized for construction activities, including a range of heavy-duty vehicles & specialized tools. This category contains material handlers, graders, track-type excavators, skid-steers, track loaders, backhoes, hydromantic tools, pipelayers, compactors, loaders, & more.

Further, the growth in urbanization is anticipated to boost the need for construction equipment, with infrastructure development noticing significant investments from both the public & private sectors.

The construction equipment industry is buzzing with activity as the Association of Equipment Manufacturers (AEM) recently held its annual conference, unveiling its 2025 leadership and discussing strategies for industry challenges, including workforce development and sustainability.

Additionally, the Florida Asphalt Expo & Conference is set for December 17-19, 2024, in Orlando, focusing on innovations in asphalt and construction technology. On the merger front, consolidation trends are reshaping the sector, driven by the need for operational efficiencies and market expansion. These events underscore the industry's dynamic evolution, emphasizing innovation, collaboration, and future-ready strategies.

Market Dynamic

Market growth has been significantly influenced by a growing emphasis on infrastructure & development in automation for construction & manufacturing. The road construction machinery sector, mainly in the Asia-Pacific, has seen significant growth owing to a rise in government-driven road development initiatives. The changing landscape has forced construction equipment manufacturers to move towards

electric & hybrid vehicles to meet cost-effectiveness & emission standards. Moreover, the trend of renting or leasing construction equipment is growing due to cost efficiency & including professional operators, availing maintenance. This shift aligns with the industry's changing needs & challenges.

However, the market faces challenges arising from complex international trade policies & regulations. Tariffs, trade barriers, & shifting import/export regulations are presenting uncertainties in supply chains & impacting equipment costs. These constraints are impeding the smooth cross-border movement of machinery, leading to disruptions in manufacturing, distribution, & project timelines. The industry must handle this complex landscape, adapt to changing trade dynamics, & look into avenues for collaboration to reduce the adverse effects of these trade-related obstacles.

Research Scope and Analysis

By Product Category

In 2023, the material handling machinery category contributes significantly towards the overall revenue for the global construction equipment market. This growth is being driven by the development & expansion of the e-commerce industry, resulting in a major growth in the establishment of warehouses and an increased focus on optimizing supply chain procedures within these facilities. Moreover, owners of warehouses are giving preference to augmenting transparency, curtailing operational expenses, & overall efficiency improvement in both warehouse & operational plant scenarios. These dynamics are anticipated to prompt the demand for specialized forklifts, including stand-up riders & narrow-aisle variants, known for their exceptional operational accuracy & high navigational capabilities in confined spaces like corridors, multi-tiered levels, & mezzanines. All these factors are further anticipated to drive the market over the forecasted period as well.

By Product Type

The global construction equipment market is set to be driven by two major factors: cranes & construction machinery. Europe, in particular, is gearing up for significant construction projects, with countries like Germany, France, and Italy leading the way in terms of growth. These nations are witnessing a growth in construction activities, fueled by ambitious projects like expanding ports, building underwater tunnels that connect major European countries, & constructing extensive railway tunnel networks. To make these projects a reality, a diverse range of crane types will be employed, which in turn is expected to boost the crane market. This emphasizes the important role cranes play in shaping modern construction & contributes to the overall strength of the global construction equipment industry.

By Propulsion

In 2023, the Internal Combustion Engine (ICE) category has emerged as a significant driving factor in the global construction equipment market. ICE technology includes using combustion engines to generate power, which is then transferred to the wheels through a transmission system. These machines are provided with strong internal combustion engines that provide impressive torque & horsepower, allowing them to efficiently handle difficult tasks. The power derived from ICE machinery allows them to take on heavy loads, navigate challenging terrains, & successfully complete tasks requiring enough strength & durability.

Moreover, electric construction equipment is anticipated to notice a high growth over the forecasted period. Distinct from standard ICE machinery, electric models offer cost advantages with low maintenance & cheaper electricity than diesel or gasoline. This cost-effectiveness is further anticipated to drive market growth, supported by global government regulations & initiatives promoting electric equipment adoption.

By Power

In 2023, the <100 HP segment dominates the market share. This category includes equipment like mini-excavators, skid steer loaders, compact wheel loaders, & compact track loaders, known for their agility & adaptability. This growth is due to the increase in the use of compact construction equipment in emerging economies like Asia Pacific, Latin America, & Africa. The growth in urbanization, infrastructure projects, & small-scale construction has driven the need for versatile & economical compact machinery. Technological advancements, like improved powertrain efficiency, operator comfort, & automation, further boost this segment's progress.

Moreover, the 101-200 HP segment is also expected to experience high growth during the forecast period. This category includes essential heavy-duty equipment such as excavators, bulldozers, loaders, & graders.

Machines within the 101-200 HP range frequently include designs that focus on easy serviceability, facilitating convenient access to critical components for maintenance & repairs. Efficient maintenance practices along with easily accessible spare parts play a major role in reducing downtime & optimizing overall productivity.

The Global Construction Equipment Market Report is segmented on the basis of the following:

By Product Category

- Earth Moving Machinery

- Material Handling Machinery

- Heavy Construction Vehicles

- Others

By Product Type

- Telescopic Handler

- Loader and Backhoe

- Cranes

- Motor Grader

- Excavator

- Others

By Propulsion

By Power

- <100 HP

- 101-200 HP

- 201-400 HP

- >400 HP

Regional Analysis

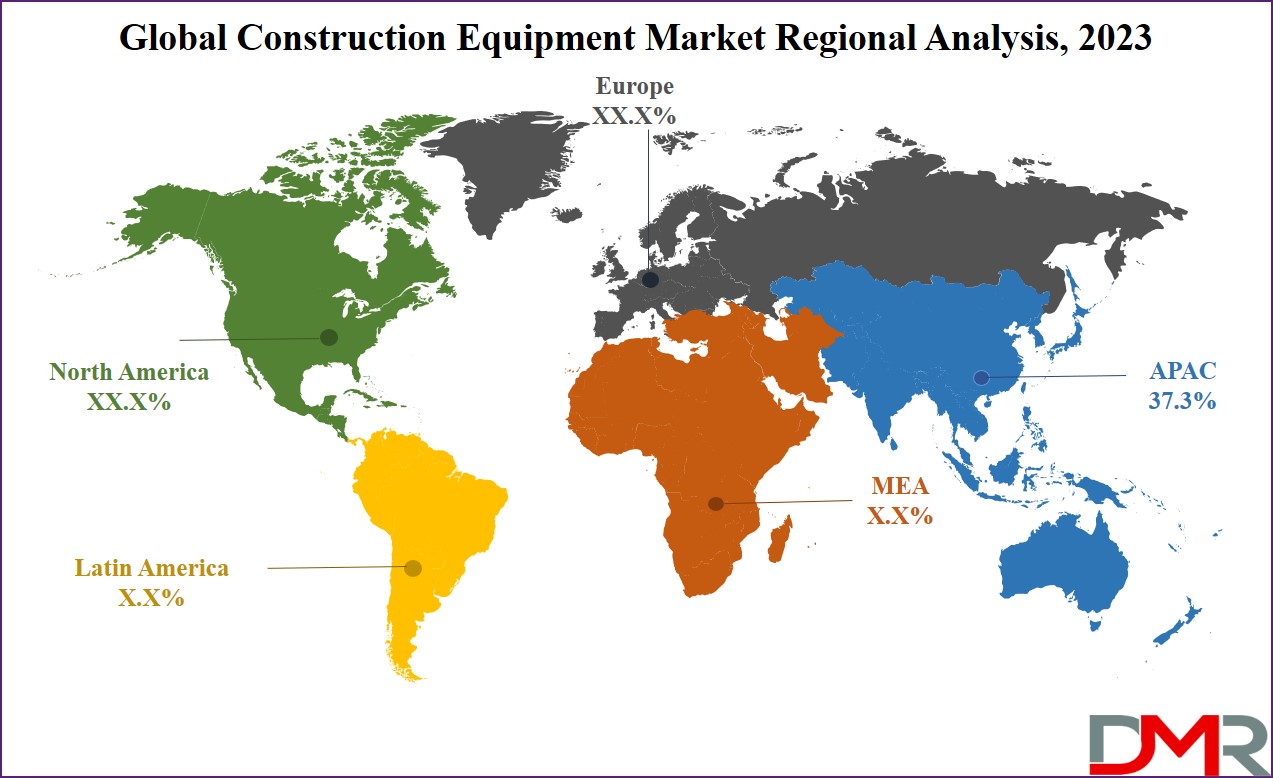

In 2023, Asia-Pacific leads the market by capturing a significant market

share of 37.3%, making it a leading region for the global construction equipment market. The expansion of the construction equipment market is said to be a favorable governmental initiative focused on supporting infrastructure projects in emerging economies such as India, China, & Southeast Asian nations. Moreover, China's latest Regional Comprehensive Economic Partnership (RCEP) free trade pact with Asia Pacific countries like Japan, South Korea, Australia, & smaller Southeast Asian counterparts is anticipated to stimulate the development of progressive transportation infrastructure ventures within the region, consequently driving market demand.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Many key players in the market have established dominance, by having a significant share of the market within the construction equipment sector. The market landscape is considered by a multitude of both international & regional players, encouraging an intensely competitive market setting. Beyond the major players, a major portion of the market is held by smaller-scale or local counterparts.

For instance, in May 2023, John Deere announced an expansion of its Performance Tiering, marking the shift from L-Series to P-Tier for its Compact Wheel Loader models, which are 244, 324, & 344. These future models will include the full spectrum of features found in the L-Series, while also introducing new productivity-boosting functionalities, which contain standard ride control integrated into the base models, along with additional factory-equipped options such as the inclusion of an auto-reversing fan.

Some of the prominent players in the Global Construction Equipment Market are:

- Caterpillar Inc

- Deere & Company

- CNH Industrial NV

- Komatsu Ltd

- Doosan Corp

- Volvo CE

- Terex Corp

- Hyundai Construction Equipment Co Ltd

- Hitachi Construction Machinery Co Ltd

- JCB

- Other Key Players

COVID-19 Pandemic & Recession: Impact on the Global Construction Equipment Market:

The COVID-19 pandemic & following economic recession significantly impacted the Global Construction Equipment Market. The outbreak at the start disrupted manufacturing & supply chains, causing production delays & shortages of critical components. Lockdowns & restrictions halted construction activities, causing project postponements & cancellations, and reducing the need for new equipment. Moreover, financial challenges caused many firms to reconsider capital expenditures, impacting equipment purchasing decisions. As the market depends on global collaboration & investment, the pandemic-induced recession further increased challenges, affecting both supply 7 demand sides. As economies recover, market players start adapting to changing construction trends, integrating digital solutions, and focusing on sustainability to handle the modified market successfully.

| Report Characteristics |

| Market Size (2023) |

USD 208.7 Bn |

| Forecast Value (2032) |

USD 362.8 Bn |

| CAGR (2023-2032) |

6.3% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product Category (Earth Moving Machinery,

Material Handling Machinery, Heavy Construction

Vehicles and Others), By Product Type (Telescopic

Handler, Loader and Backhoe, Cranes, Motor Grader,

Excavator and Others), By Propulsion (ICE, Electric

and CNG/LNG), By Power (<100 HP, 101-200 HP, 201-

400 HP and > 400 HP) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Caterpillar Inc, Deere & Company, CNH Industrial NV,

Komatsu Ltd, Doosan Corp, Volvo CE, Terex Corp,

Hyundai Construction Equipment Co Ltd, Hitachi

Construction Equipment Co Ltd, JCB, and Other Key

Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Construction Equipment Market size is estimated to have a value of USD 208.7 billion in 2023

and is expected to reach USD 362.8 billion by the end of 2032.

Asia Pacific has the largest market share for the Global Construction Equipment Market with a share of

about 37.3% in 2023.

Some of the major key players in the Global Construction Equipment Market are Volvo CE, JCB, Terex

Corp, and many others.

The market is growing at a CAGR of 6.3 percent over the forecasted period.