A content delivery network or CDN is comprised of interconnected servers that deliver content securely. To improve the speed and connectivity, CDNs strategically position servers at network exchange points. The content delivery network is defined based on the revenues generated from the solutions and services used at various ends globally.

The US Content Delivery Network Market

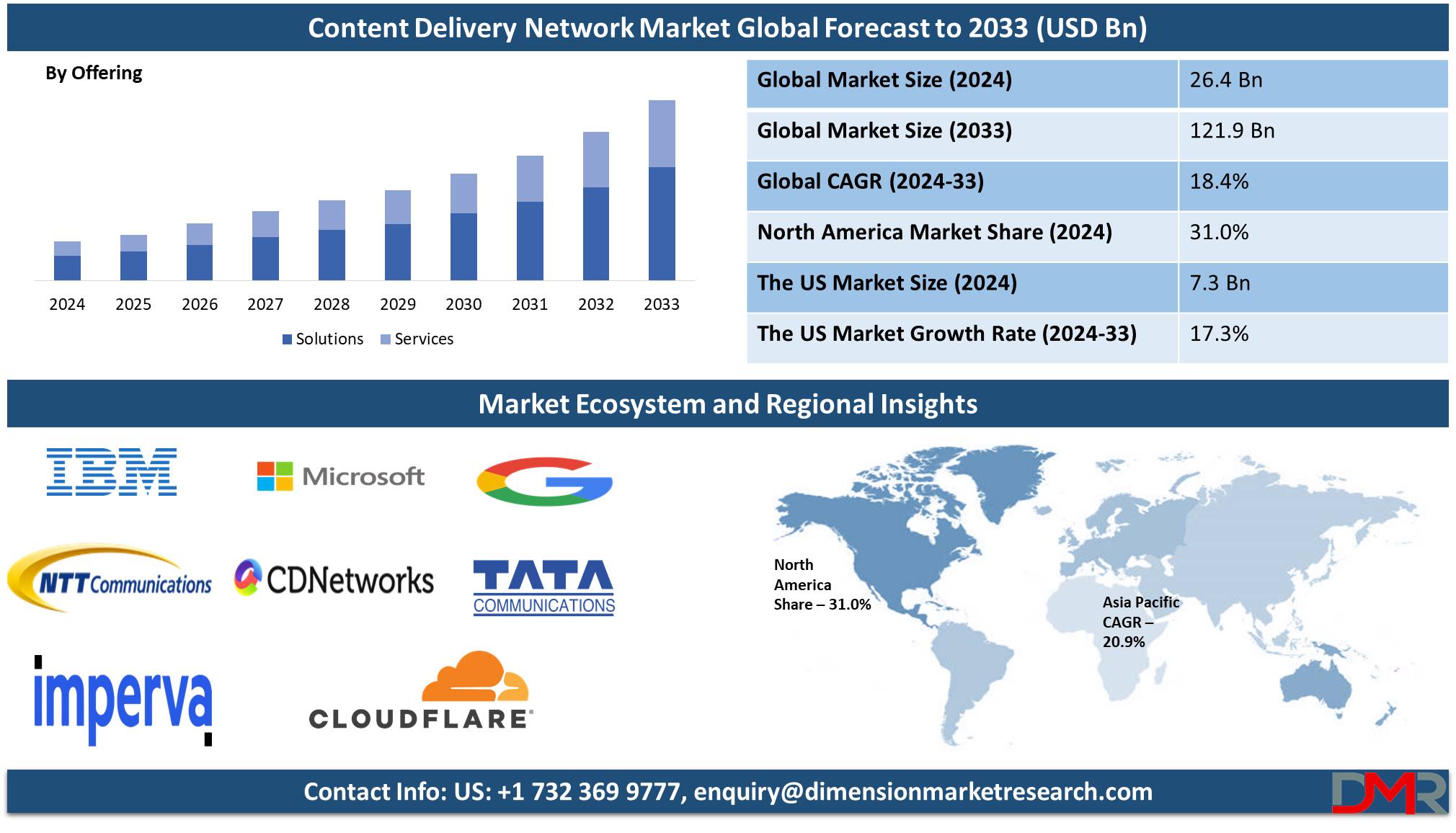

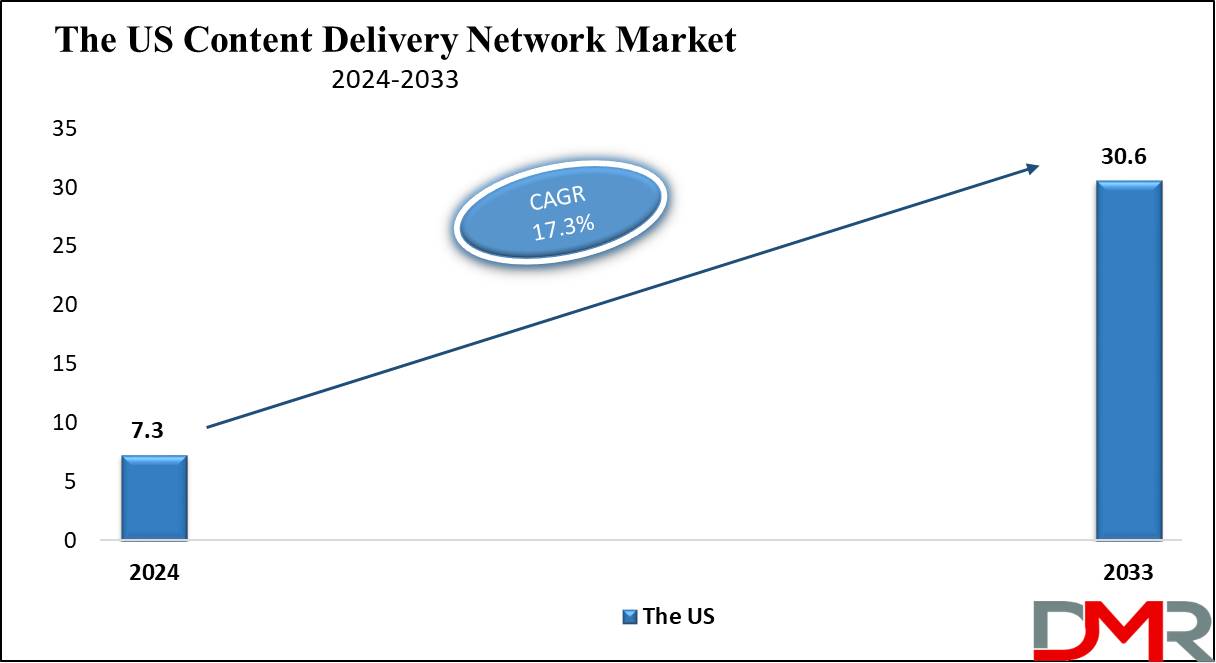

The US Content Delivery Network Market is projected to reach USD 7.3 billion in 2024 at a compound annual growth rate of 17.3% over its forecast period.

The US offers many growth opportunities for the CDN market due to the rise in the adoption of cloud-based services, edge computing, and 5G networks. An increase in demand for high-quality video streaming, online gaming, and real-time applications is further driving market expansion. In addition, with growing cybersecurity concerns, there is strong potential for CDN solutions integrated with advanced

Network Security features to thrive in the market.

Further, the demand for seamless streaming, online gaming, and real-time applications is supported by advancements in cloud computing, 5G networks, and edge infrastructure. However, a key challenge to growth is the high cost of building and maintaining large-scale CDN networks, along with challenges in managing increasing cyber threats and meeting stringent data privacy regulations.

Key Takeaways

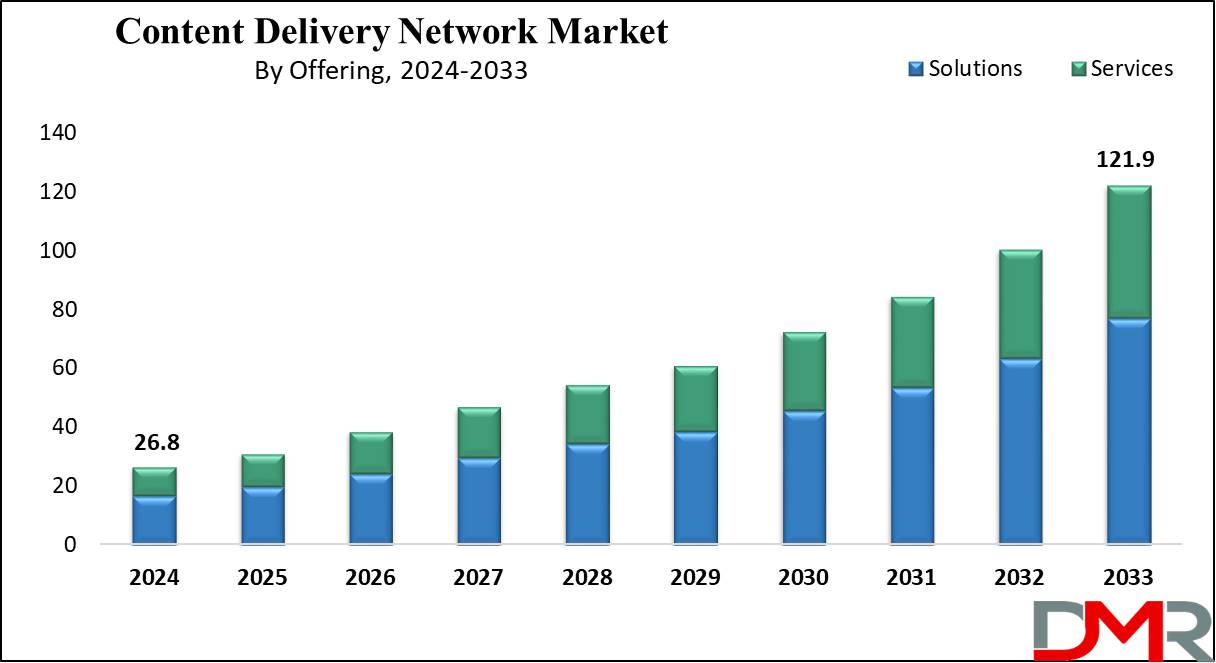

- Market Growth: The Content Delivery Network Market size is expected to grow by 90.7 billion, at a CAGR of 18.4% during the forecasted period of 2025 to 2033.

- By Offering: The solutions segment is anticipated to get the majority share of the Content Delivery Network Market in 2024.

- By Provider Type: The Traditional CDN segment is expected to be leading the market in 2024

- By End User: The media & entertainment segment is expected to get the largest revenue share in 2024 in the Content Delivery Network Market.

- Regional Insight: North America is expected to hold a 31.0% share of revenue in the Global Content Delivery Network Market in 2024.

- Use Cases: Some of the use cases of Smart Parking systems include enhanced security, improved website performance, and more.

Use Cases

- Improved Website Performance: CDNs minimize latency by caching content closer to end users across multiple locations, which leads to faster loading times of the website, improving the user experience, and potentially boosting search engine rankings.

- Scalability for High Traffic Events: During peak traffic events, CDNs can handle higher demand by distributing traffic across their network, which prevents server overload and ensures content remains accessible.

- Enhanced Security: CDNs provide security characteristics like DDoS protection, Web Application Firewalls (WAF), and secure token authentication, supporting to protection of websites from various cyber threats while ensuring safe data transmission.

- Content Delivery for Global Audiences: CDNs allow businesses to deliver content efficiently to a global audience by caching static assets like images, videos, and scripts at various nodes across the world, ensuring a consistent experience regardless of the user's location. This also supports digital ecosystems such as Content Services Platforms, which rely on timely and secure content distribution.

Market Dynamic

Driving Factors

Increasing Demand for Online Streaming and Cloud Services

With the growth in video streaming platforms, gaming services, and remote work tools, there is an increase in demand for simplified content delivery. CDNs help reduce latency, enhance user experience, and ensure uninterrupted streaming, driving their adoption across industries.

Surge in Cybersecurity Threats and DDoS Attacks

As websites and applications experience growth in cyber threats, businesses look for better CDN solutions with built-in security features like DDoS reduction and Web Application Firewalls (WAF), which focuses on security and boosts the demand for CDNs in both the enterprise and consumer markets.

Restraints

High Deployment and Operational Costs

Setting up a CDN infrastructure requires high investment in servers, data centers, and network maintenance. For smaller businesses, the high costs linked with premium CDN services may act as a barrier, limiting adoption to large enterprises or those with substantial budgets.

Complex Integration and Management Challenge

Incorporating CDN services with existing IT infrastructures, mainly in multi-cloud environments, can be complex. In addition, maintaining easy performance, managing configurations, and ensuring compatibility with transformation technologies may deter organizations without specialized technical expertise.

Opportunities

Expansion in Emerging Markets

As internet penetration and digital adoption rise in emerging economies, there is an increase in demand for faster and more reliable content delivery. CDNs have an opportunity to expand into these regions, delivering optimized web performance and local caching to meet the increase in consumer expectations. They also play a pivotal role in industries like digital health, where smart monitoring of

Insulin Delivery Devices and other wearables depends on real-time connectivity.

Growth of Edge Computing and IoT

The growth of edge computing and the Internet of Things (IoT) develops new opportunities for CDNs to provide low-latency solutions by processing data closer to end users. By integrating with edge nodes, CDNs can power real-time applications like autonomous vehicles, smart cities, and AR/VR experiences.

Trends

Integration with Edge Computing and AI

CDNs have deepened their integration with edge computing, which brings processing closer to end-users, which reduces latency, and boosts real-time capabilities for applications like IoT and streaming. In addition, AI-powered tools are optimizing CDN operations by predicting traffic and managing resources dynamically, making sure uninterrupted performance during peak demands.

Industry Consolidation and Sustainability Initiatives

The market has seen major consolidations as key players like Verizon and StackPath exited the CDN space, aiming at other priorities. Further, many providers are adopting sustainable practices like energy-efficient data centers and renewable energy solutions, addressing environmental concerns while staying competitive.

Research Scope and Analysis

By Offering

The CDN market is divided into two main offerings: solutions and services. The solutions segment, which includes media delivery, web and app performance optimization, and cloud security, is anticipated to hold the largest market share in 2024, which is driven by the growth in the utilization of CDNs to improve media streaming and enhance website performance. As businesses depend more on easy media delivery and optimized web applications, CDN solutions play a major role in ensuring smooth user experiences with minimal delays, further boosting their demand.

Further, the services segment is expected to grow at the fastest rate, with the highest growth rate in the coming years, as the rising need for professional services, like consulting, deployment, and maintenance, to support the businesses manage and optimize their CDN infrastructure effectively. Many companies are turning to these services to incorporate advanced CDN solutions and maintain peak performance, mainly as the complexity of digital ecosystems grows. The need for ongoing support & consulting services also reflects the transformation towards managed solutions, where companies prefer to depend on external expertise for operational efficiency and troubleshooting.

By Content Type

In terms of content type, the content delivery network (CDN) market is divided into static and dynamic content types. Dynamic content, which includes real-time interactions such as live streaming, online gaming, and video conferencing, is expected to have the largest market share in 2024. These applications depend heavily on CDNs to maintain low latency and high performance, ensuring smooth and uninterrupted user experiences. The growth in the popularity of these real-time services constantly drives the demand for dynamic content delivery solutions, as they play a critical role in minimizing delays and improving responsiveness.

Further, the static content segment is expected to see the highest growth rate, as it focuses on providing pre-stored content, including images, HTML files, CSS, and JavaScript, which remain unchanged across sessions. CDNs help optimize the delivery of this content by getting it closer to users, which reduces website loading times and enhances performance. As businesses highly prioritize fast, seamless digital experiences, the demand for efficient static content delivery is growing, contributing to the rapid expansion of this segment.

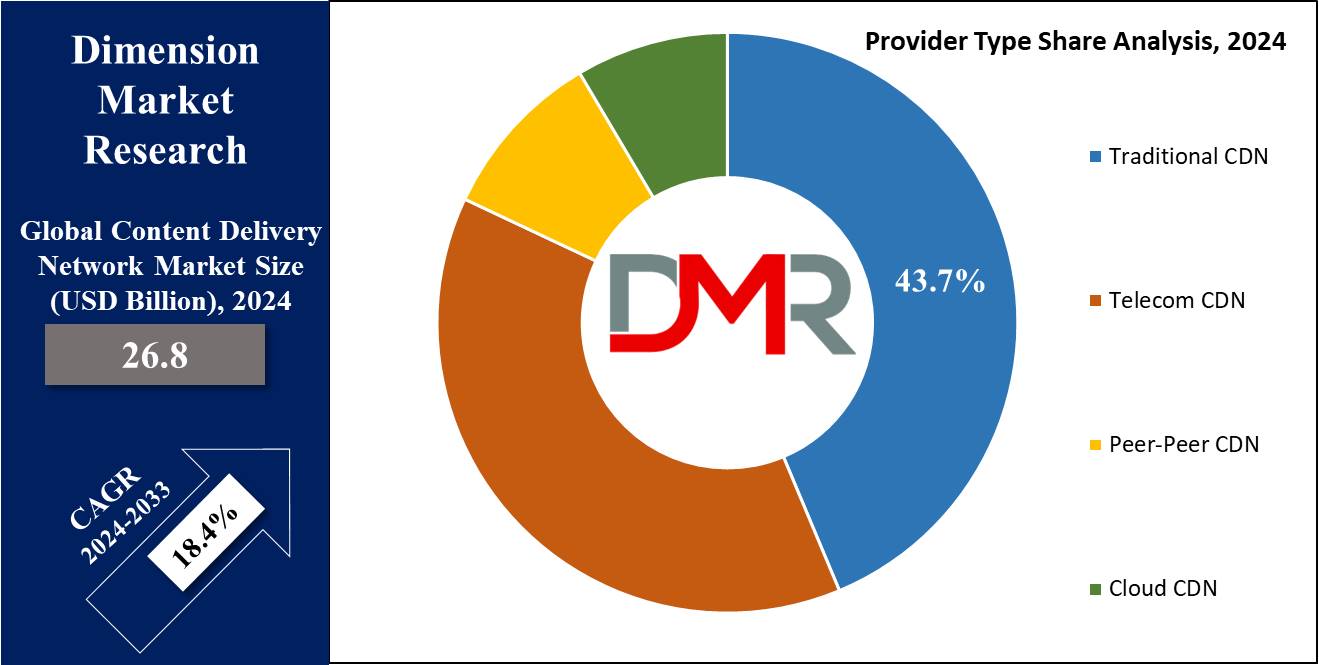

By Provider Type

The traditional commercial CDN segment is set to lead the CDN market in 2024, driven by solutions that accelerate content delivery, improve

network performance, and support media streaming. The increase in global data consumption is making providers focus on optimizing content delivery and network efficiency. However, challenges grow as older CDN solutions struggle to meet the demands of new technologies. In addition, mobile users highly need content from distant servers, which may not be well optimized for their devices, creating limitations for this segment's growth.

Further, cloud-based CDN services are anticipated to grow significantly, helping enhance the delivery of web content, applications, and media through globally distributed servers. These services reduce the delays by caching content at edge locations closer to users, improving the speed and reliability. Also, current developments like dynamic content caching and intelligent prefetching predict and store frequently accessed data to improve efficiency. As cloud CDNs evolve, they are becoming vital for modern digital experiences, addressing many of the challenges faced by traditional CDNs.

By End User

The global content delivery network (CDN) market is segmented by end-users, into e-commerce, media and entertainment, healthcare, advertising, financial services, and education, where the media and entertainment sector is expected to lead in revenue in 2024 due to the growing demand for innovative digital experiences, as media companies must rapidly release high-quality content to meet user expectations. To simplify this process, media-focused CDNs incorporate automation and monitoring tools that improve content management and delivery workflows.

Developers use advanced APIs and automation platforms, like Terraform, to allow simple integration, efficient provisioning, and faster deployment of content. These automation tools also provide live monitoring and observability, helping media companies maintain a smooth, uninterrupted delivery experience across various platforms. As digital consumption grows, the ability of CDNs to optimize performance and handle large-scale content efficiently is becoming important for media organizations to stay competitive and meet the growing demand for high-speed content delivery.

The Content Delivery Network Market Report is segmented on the basis of the following:

By Offering

- Solutions

- Media Delivery

- Web Performance Optimization

- Cloud Security

- Services

- Design & Consulting Services

- Storage Services

- Analytics & Performance Monitoring

- Website & API Management

- Network Optimization Services

- Digital Rights Management

- Others

By Content Type

- Static Content

- Dynamic Content

By Provider Type

- Traditional CDN

- Telecom CDN

- Peer-to-Peer CDN

- Cloud CDN

By End User

- Media & Entertainment

- E-commerce

- Advertising

- Healthcare

- Financial Services

- Research & Education

- Others

Regional Analysis

North America is expected to hold over

31% of the global CDN market share in 2024, driven by key factors like the large popularity of 4K resolution displays and the region’s high internet penetration. These elements help a strong CDN infrastructure capable of effectively delivering large volumes of data.

In addition, the rapid growth of cloud-based services, the rollout of high-speed data networks, and the growth in the use of smartphones further drive the demand for CDN solutions. Leisure spending in the region is also growing, allowing various investments in streaming, gaming, and media services that depend on CDN technology to improve performance and user experience.

Moreover, the CDN market in Europe is forecast to steadily grow, with rising demand across sectors like e-commerce, media and entertainment, gaming, and enterprise services, which is driven by the growing popularity of online streaming platforms, the expansion of e-commerce, and the demand for reliable digital tools in business operations. In addition, the Asia-Pacific region is also expected to witness solid growth, driven by emerging economies like India and China, which are expanding rapidly as consumer markets.

The rise in population, along with the expansion in online gaming and media consumption, has increased the need for improved networking infrastructure. Government initiatives like Digital India are also promoting the use of CDN solutions by enabling faster and more secure data delivery.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The content delivery network (CDN) market is highly competitive, with many players providing various solutions across media delivery, web performance, and cloud security. Companies compete by enhancing network efficiency, reducing latency, and expanding global server coverage to attract customers.

Innovation plays a major role, with providers integrating advanced technologies like edge computing, AI, and automation to enhance content delivery. In addition, partnerships with telecom operators, cloud providers, and media platforms help extend market reach. The increase in demand for real-time applications like gaming and streaming drives competition further and and promotes providers to deliver high-speed, scalable solutions with robust security features.

Some of the prominent players in the Global Content Delivery Network are:

- Microsoft

- IBM

- Google

- NTT Communications

- Tata Communications

- CDNetworks

- Imperva

- Lumen Technologies

- Cloudflare

- CacheNetworks

- Other Key Players

Recent Developments

- In August 2024, Trump Media & Technology Group launched its custom-built content delivery network (“CDN”), and linear TV streaming is now available to all Truth Social users on the Web version of Truth Social, truthsocial.com.

- In August 2024, BT Group unveiled the attainment of its Multicast-Assisted Unicast Delivery (MAUD) technology from proof of concept to real-world application in its first live content delivery network (CDN) deployment with Edgio, as the constant demand for live content and the growth of on-demand services, MAUD aims to better the efficiency of the complex network journey that content takes to reach viewers and improve their viewing experience.

- In April 2024, Trump Media & Technology Group Corp. unveiled that after six months of testing on its Web and iOS platforms, the company has finished the research and development phase of its new live TV streaming platform and will begin scaling up its content delivery network (“CDN”).

- In February 2024, Vultr launched Vultr CDN, which is a next-generation content delivery service that pushes content closer to the edge without compromising security. Building atop Vultr’s global infrastructure spanning six continents allows the company with global content and media caching, empowering Vultr’s worldwide community of over 225K developers with turnkey services for scaling their websites and web applications

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 26.8 Bn |

| Forecast Value (2033) |

USD 121.9 Bn |

| CAGR (2024-2033) |

18.4% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 7.3 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Offering (Solutions and Services) By Content Type (Static Content and Dynamic Content), By Provider Type (Traditional CDN, Telecom CDN, Peer-to-Peer CDN, and Cloud CDN), By End User (Media & Entertainment, E-commerce, Advertising, Gaming, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Microsoft, IBM, Google, NTT Communications, Tata Communications, CDNetworks, Imperva, Lumen Technologies, Cloudflare, CacheNetworks, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |