Market Overview

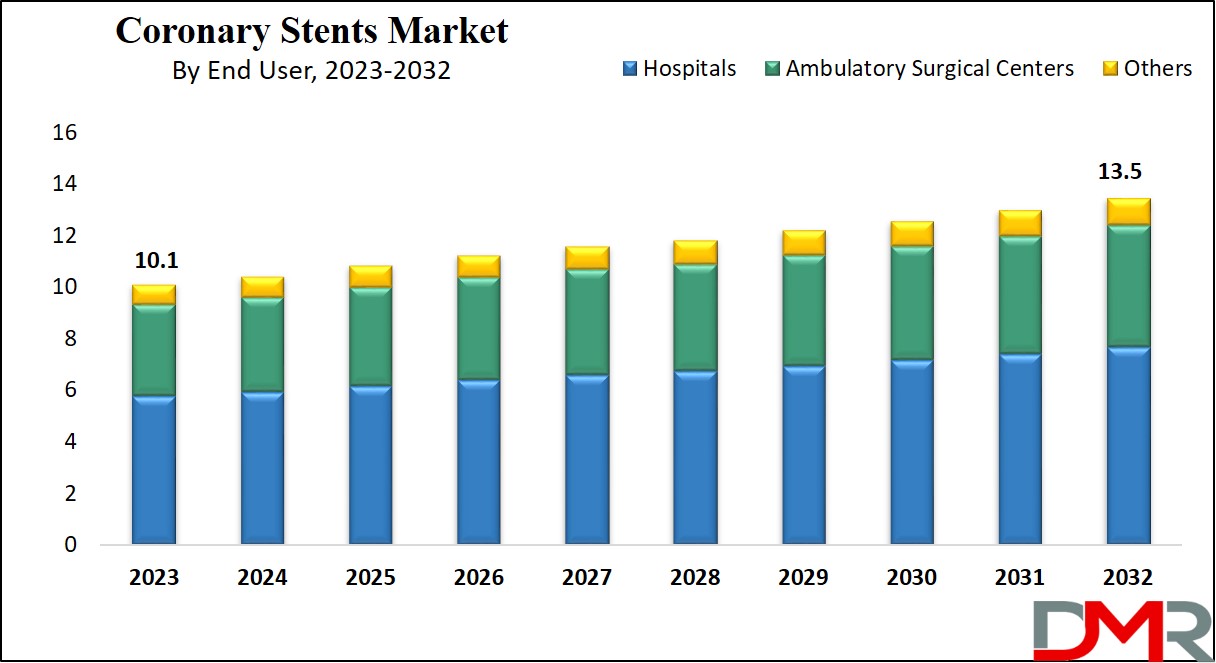

The Global Coronary Stents Market is expected to reach a value of USD 10.1 billion in 2023, and it is further anticipated to reach a market value of USD 13.5 billion by 2032 at a CAGR of 3.2%.

The global coronary stents market refers to the industry that involves the production, distribution, and sale of coronary stents on an international level. These clinical medical devices include bare-steel stents, drug-eluting stents, and bioresorbable stents. All market contributors such as producers, suppliers, and distributors play an important part in designing and delivering these cardiovascular devices worldwide.

Marketplace dynamics are molded through such factors as supply, demand, and product innovation, along with regulatory aspects and economic considerations across different territories. The market’s influence includes the use of coronary stents in various clinical procedures, particularly within interventional cardiology, including percutaneous coronary intervention.

Research published by the National Library of Medicine in June 2021 highlights that coronary artery disease (CAD), a leading cardiovascular condition, accounts for approximately 610,000 deaths annually in the U.S., equating to 1 in 4 fatalities.

As CAD remains the primary cause of mortality in the country, the rising prevalence of this condition is anticipated to drive demand for effective coronary stent devices. These stents play a crucial role in most Percutaneous Coronary Intervention (PCI) procedures, which are widely used to treat CAD. Consequently, this trend is expected to significantly boost market growth throughout the forecast period.

Key Takeaways

- Based on type, drug-eluting stents dominate this segment as they hold 67.7% of the market share in 2023.

- Based on biomaterials, metallic biomaterials dominate this segment as they hold the highest market share in 2023.

- Hospitals emerge as the primary end users in the coronary stents market as they hold 34.1% of the market share in 2023.

- North America dominates this market as it holds 34.1% of the market share in 2023.

Use Cases

- Percutaneous Coronary Intervention (PCI): Coronary stents are widely used in PCI procedures to restore normal blood flow in blocked or narrowed coronary arteries, reducing the risk of heart attacks and improving long-term patient survival rates.

- Treatment of Coronary Artery Disease (CAD): Stents are a frontline therapy for patients suffering from CAD, particularly those with recurring chest pain (angina) or those at high risk of myocardial infarction, offering a minimally invasive alternative to open-heart surgery.

- Drug-Eluting Stents (DES) for Reduced Restenosis: Advanced DES release medication at the site of implantation to prevent scar tissue growth, significantly lowering restenosis rates compared to bare-metal stents and reducing the need for repeat procedures.

- Emergency Use in Acute Coronary Syndrome (ACS): In cases of sudden cardiac events such as heart attacks, stents play a lifesaving role by quickly reopening arteries and stabilizing patients during critical interventions.

- Bioresorbable Stents for Younger Patients: Biodegradable stents are increasingly adopted for younger and active patients, as they dissolve naturally after restoring artery function, reducing long-term complications and allowing arteries to return to natural flexibility.

Market Dynamic

The growth of the global coronary stents market may be attributed to various factors along with the growing prevalence of cardiovascular diseases globally, pushed through growing old populations, dangerous existence, and increased incidences of heart-associated situations. The improvement of technology, especially heart stents’ design and materials has made DESs extraordinary outcomes with fewer complications.

The marketplace is very competitive where the key vendors are performing product development, strategic partnerships, and mergers & acquisitions to enhance their position in the market. The regulatory environment performs a critical position, with adjustments impacting the advent of the latest stent products.

Emerging markets are witnessing multiplied demand due to growing healthcare consciousness, improving infrastructure, and a rising center-elegance populace with higher disposable earnings. There is an extraordinary shift in the direction of minimally invasive methods, along with percutaneous coronary intervention (PCI) with stent implantation, driven by the preference for reduced recuperation time and complications.

The ongoing rise in cardiovascular diseases globally underscores the non-stop call for coronary stents, whilst healthcare reimbursement regulations and consciousness campaigns in addition impact adoption, particularly in developed economies.

Driver

Coronary stents market growth is driven by rising rates of cardiovascular diseases globally, particularly due to lifestyle factors and diet choices that increase their prevalence. Lifestyle choices that contribute to CVDs such as poor dietary habits, obesity and diabetes increase risk, leading to an escalation in coronary artery disease cases that require minimally invasive solutions like coronary stents for treatment.

Technological innovations like drug-eluting stents (DES) and bioresorbable stents have enhanced patient outcomes by reducing restenosis/thrombosis risks. Additionally, an aging global population more vulnerable to CVDs further spurs demand for coronary stents within healthcare settings. Advances in

Medical Imaging also support precise diagnosis and treatment planning in these procedures.

Trend

A notable trend in the Coronary Stents Market is the surge in adoption of biodegradable or bioresorbable stents, which disintegrate after they restore normal blood flow, eliminating long term complications and repeat procedures.

Continuous innovations in material science and engineering are further improving these bioresorbable options while regulatory approvals and increased physician awareness are driving their widespread usage all contributing towards having an unprecedented effect on coronary intervention practices globally.

Restraint

The high cost of advanced coronary stents, including drug eluting and bioresorbable options, poses a substantial barrier to market expansion. Affordability issues for low and middle income countries is especially troublesome.

Furthermore, limited healthcare infrastructure and inadequate insurance coverage severely impede access to such procedures in resource limited regions. Furthermore, stringent regulatory processes and research and development costs impede market entry for new technologies; although manufacturers are exploring cost reduction strategies, affordability and accessibility barriers continue to inhibit broader adoption worldwide.

Opportunity

Emerging markets present significant opportunities for the Coronary Stents Market, due to improved healthcare infrastructure and greater awareness about cardiovascular health. As CVD rates surge across Asia Pacific, Middle East, and Africa regions, interventional cardiology solutions become even more necessary. Governments and private stakeholders are investing heavily in healthcare, increasing access to treatments such as coronary angioplasty and stent placement.

Partnerships between manufacturers and local distributors can facilitate the introduction of affordable stents tailored specifically to regional economic conditions. Moreover, with the rising global focus on

Neurological Disorder Drugs and cardiovascular innovations together driving investments in healthcare R&D, providers of coronary stents are likely to benefit from this interconnected growth.

Research Scope and Analysis

By Type

Based on type, drug-eluting stents dominate this segment as

they hold 67.7% of the market share in 2023 and are projected to show subsequent growth in the upcoming period of 2023 to 2032. Drug-eluting stents (DES) have emerged because the important preference for coronary stents within the international marketplace because of their compelling advantages.

These stents drastically reduce restenosis charges by releasing drugs that inhibit clean muscle cell growth, offering stepped forward lengthy-time period results compared to bare-metallic stents.

Their focused drug delivery minimizes effect on surrounding tissues, and improvements in biodegradable DES, gradually dissolving over the years, showcase the potential for lowering lengthy-term complications.

The customizable drug launch profiles of DES generation permit for tailor-made kinetics, optimizing the balance among restenosis prevention and recuperation promotion. Extensive clinical evidence supports their safety and efficacy, main to good sized adoption among healthcare specialists.

The versatility of biodegradable and non-biodegradable options, coupled with ongoing technological improvements, contributes to the continuous development of DES performance and safety. Notably, DES's capability to lessen the want for repeat interventions enhances patient effects and healthcare price-effectiveness.

While DES dominates the market, ongoing research aims to cope with associated demanding situations, and rising technology like bioabsorbable stents may also shape the future panorama of coronary stent options.

By Biomaterials

Based on biomaterials, metallic biomaterials dominate this segment as they hold the highest market share in 2023. Metallic biomaterials, notably stainless steel, cobalt-chromium, and platinum-chromium alloys, have established dominance in the coronary stent segment due to various key factors. Their high biocompatibility ensures minimal adverse reactions, facilitating successful integration within the human body.

Renowned for their strength and durability, metallic biomaterials meet the mechanical demands of coronary stents, providing essential structural support to blood vessels. The excellent radial strength of alloys like cobalt-chromium contributes to effective vessel support, preventing restenosis.

Additionally, their inherent radiopacity allows for clear visualization during medical imaging procedures, ensuring precise monitoring post-implantation. Advances in metallurgy enable the production of stents with thin struts, enhancing flexibility and ease of deployment.

Furthermore, the drug-eluting capabilities of metallic stents, coupled with corrosion resistance and a proven clinical track record, underscore their efficacy in preventing tissue overgrowth and ensuring long-term stability. Regulatory approvals and standardization contribute to the widespread use of metallic coronary stents, though ongoing research in biomaterial science may introduce new materials or hybrid designs to address evolving clinical needs and challenges.

By End User

Hospitals emerge as the primary end users in the coronary stents market as they hold 34.1% of the market share in 2023 and are expected is show significant growth in the forecasted period as well. The dominance of healthcare facilities can be attributed to their seamless continuum of care, equipped with specialized cardiac units and advanced technology for cardiovascular interventions, including coronary stent implantation.

With the capability to handle emergency cases and provide inpatient procedures, hospitals align with the nature of coronary stent interventions, ensuring immediate attention and necessary accommodations.

Their infrastructure, including path labs and operating rooms, supports complex interventional procedures, while multi-disciplinary teams of healthcare professionals collaborate to manage cardiovascular diseases effectively. Hospitals additionally excel in presenting post-process care, monitoring patients intently, and supplying rehabilitation offerings when wanted.

Integrated into healthcare systems, hospitals facilitate coordinated care across specialties, making sure a holistic approach to affected person restoration. Additionally, coverage and repayment guidelines often desire clinic-based methods, making coronary stent implantation economically possible within this place.

The Coronary Stents Market Report is segmented based on the following

By Type

- Drug-eluting Stents

- Biodegradable

- Non-Biodegradable

- Bare-metal Coronary Stents

- Bioabsorbable Stents

By Biomaterial

- Metallic Biomaterials

- Polymer Biomaterials

- Natural Biomaterials

By End User

- Hospitals

- Ambulatory Surgical Centers

- Others

Regional Analysis

North America dominates this market as it

holds 34.1% of the market share in 2023 and is expected to show subsequent growth in the forthcoming year of 2023 to 2032. North America's dominance within the international coronary stents marketplace is multifaceted and rooted in various factors.

This place, mainly the USA and Canada, boasts a well-developed healthcare infrastructure and good-sized technological adoption, offering admission to ultra-modern medical centers.

The high incidence of cardiovascular diseases, notably coronary artery ailment, fuels the growth of this market. North America's management in technological improvements and medical studies results in revolutionary products like drug-eluting stents and bioresorbable stents, presenting an aggressive area globally.

Strong funding in studies and development through leading scientific device producers and pharmaceutical businesses in addition propels the continuous improvement of coronary stent technologies. Favorable reimbursement rules inside the vicinity facilitate affected patients right of entry to advanced medical approaches, encouraging the adoption of coronary stents.

The vast aging populace in North America, extra liable to cardiovascular illnesses, guarantees a steady call for interventions, which includes coronary stents. Rigorous regulatory requirements set by businesses like the U.S. FDA and Health Canada contribute to market trust and safety.

Additionally, the awareness of key enterprise players in North America solidifies its dominance inside the coronary stents marketplace, although the evolving dynamics of other areas, such as Europe and the Asia-Pacific, can also affect the destiny of this marketplace.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global coronary stents market is characterized by the presence of key industry players with significant market influence. Companies such as Abbott Laboratories, known for its Xience line of drug-eluting stents, Medtronic plc with products such as Resolute Integrity and Resolute Onyx, and Boston Scientific Corporation, which offers Promus and Synergy stents, are other players mainly in the project Notable sponsors include Terumo Company, B. Braun Melsungen AG, Biotronik SE and Companies; KG, Cordis Corporation (a Healthcare Corporation), and Cook Medical Inc. (Department of Health Services).

These companies present diverse and innovative products, emphasizing a commitment to research and development. Their global or regional reach, contracting, financial health, and regulatory compliance further contribute to their competitive position.

Market dynamics influenced by trends, consumer preferences, and technological developments emphasize the importance of constantly monitoring industry developments Mergers, acquisitions, and continuous improvements contribute to, and reflect, an evolving competitive environment in the future of the coronary stents market.

Some of the prominent players in the Global Coronary Stents Market are

- Abbott

- Medtronic

- Boston Scientific Corporation

- Terumo Corporation

- B Braun Melsungen AG

- Biotronik

- Stentys SA

- MicroPort Scientific Corporation

- C. R. Bard Inc.

- Cook Medical

- Other Key Players

Recent Developments

- In April 2023, Terumo Europe initiated a new clinical study, NAGOMI COMPLEX PMCF, to investigate the Ultimaster Nagom sirolimus-eluting coronary stent system in complex PCI patients. The Ultimaster Nagomi™ received MDR certification and CE marks approval in

- November 2022. The study aims to enroll 3000 patients across 60 centers in Europe and will focus on complex PCI patients with specific vessel and lesion characteristics. Ultimaster Nagomi™ integrates features like an optimized delivery system, expanded size range, and increased overexpansion capability to address the challenges of treating complex lesions in daily practice.

- In August 2022, Medtronic introduced the Onyx Frontier drug-eluting stent in Europe after obtaining the CE Mark approval.

- In May 2022, Medtronic plc gained FDA approval for the Onyx Frontier drug-eluting stent, featuring a delivery system specifically engineered to improve stent deliverability and enhance acute performance.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 10.1 Bn |

| Forecast Value (2032) |

USD 13.5 Bn |

| CAGR (2023-2032) |

3.2% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Drug-eluting Stents, Bare-metal Coronary Stents, and Bioabsorbable Stents), By Biomaterial (Metallic Biomaterials, Polymer Biomaterials, and Natural Biomaterials), By End User (Hospitals, Ambulatory Surgical Centers and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Abbott, Medtronic, Boston Scientific Corporation, Terumo Corporation, B Braun Melsungen AG, Biotronik, Stentys SA, MicroPort Scientific Corporation, C. R. Bard Inc., Cook Medical, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Coronary Stents Market size is estimated to have a value of USD 10.1 billion in 2023 and is

expected to reach USD 13.5 billion by the end of 2032.

North America has the largest market share for the Global Coronary Stents Market with a share of about

34.1% in 2023.

Some of the major key players in the Global Coronary Stents Market are Abbott, Medtronic, Boston

Scientific Corporation, Terumo Corporation, and many others.

The market is growing at a CAGR of 3.2 percent over the forecasted period.