Market Overview

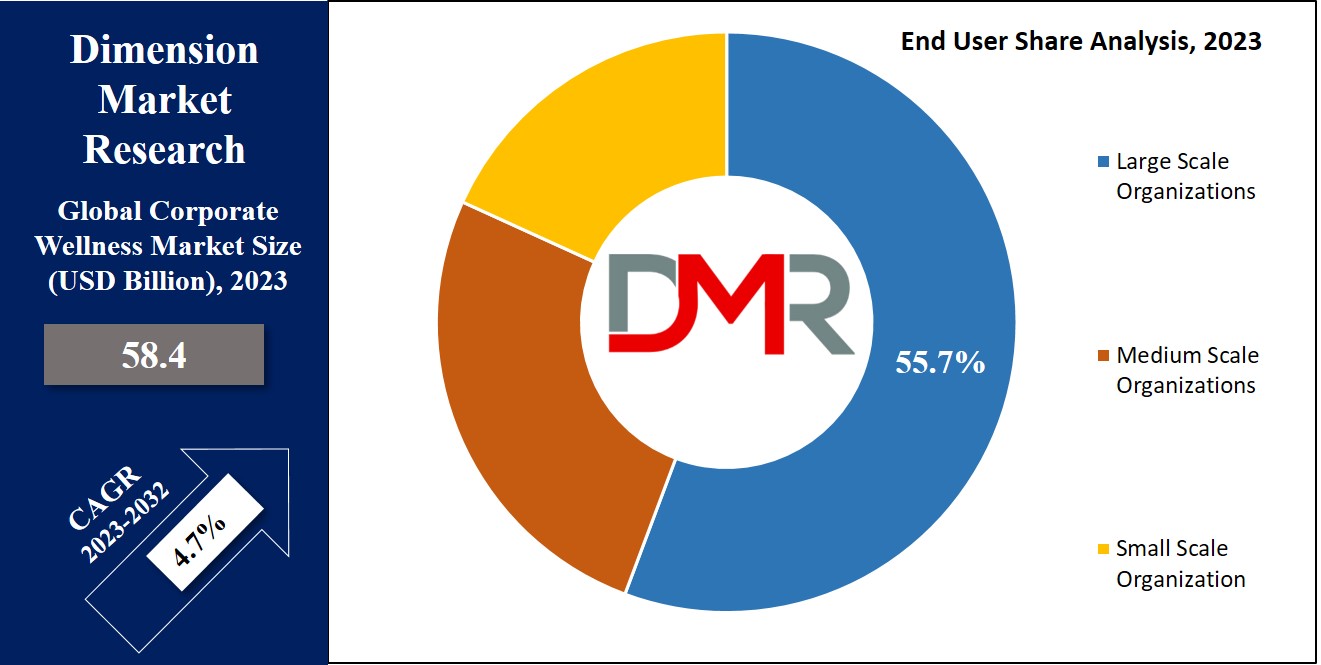

The Global Corporate Wellness Market is expected to reach a value of

USD 58.4 billion in 2023, and it is further anticipated to reach a market value of

USD 88.1 billion by 2032 at a

CAGR of 4.7%.

Workplace wellness programs look to enhance employee health & safety by implementing a coordinated set of health promotion measures directly on the job site. These initiatives include programs, policies, & community benefits, taking a specific approach to address laws & regulations related to diverse

health issues & risk factors, with a focus on creating a holistic & supportive environment that supports the well-being of employees in the workplace.

Key Takeaways

- By Category, Organizations/Employers segment takes the lead in 2023

- In addition, the Fitness & Nutrition Consultants segment is expected to have robust growth over the forecasted period.

- By End User, Large Scale Organizations take the lead & drive the market in 2023

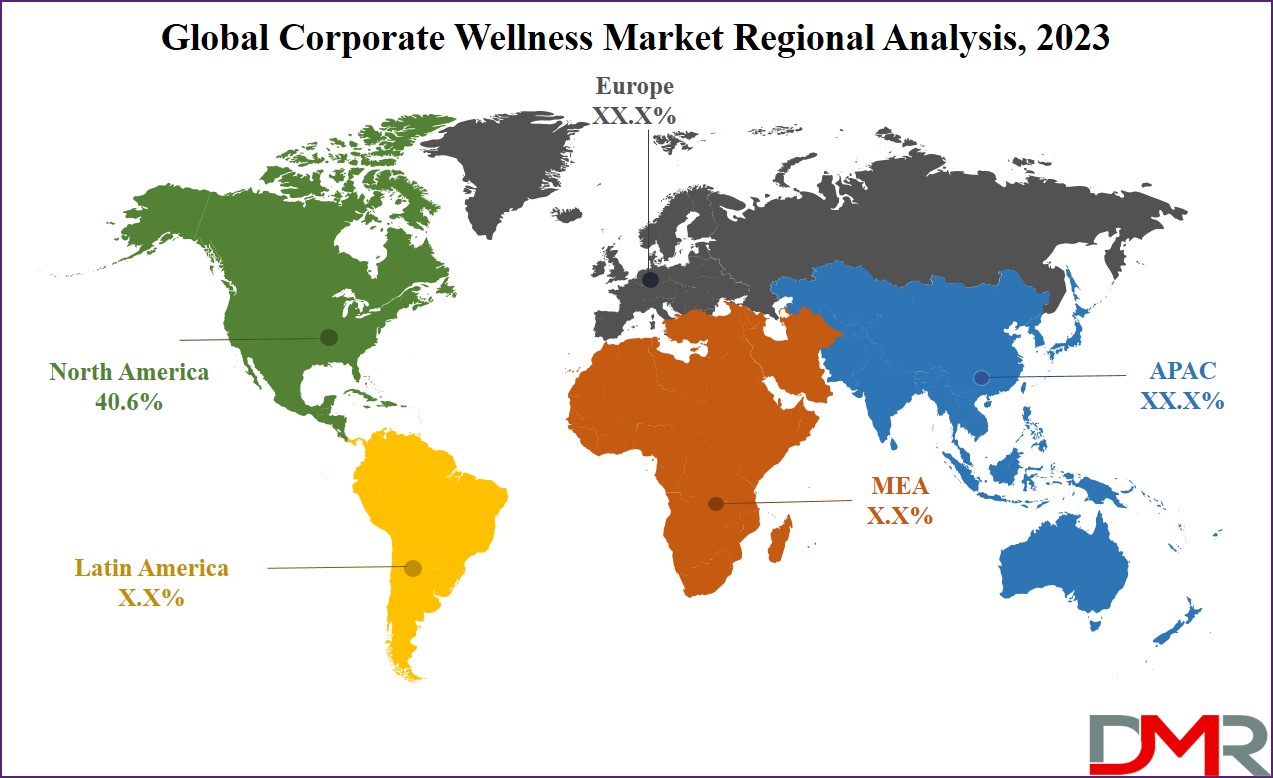

- North America has a 40.6% share of revenue in the global corporate wellness market in 2023

Market Dynamic

The workplace wellness market is being driven by factors like the growing adoption of sedentary lifestyles, increased awareness of the economic advantages provided by these programs, & the proactive installment of wellness initiatives by employers. In the coming future, untapped developing economies are expected to create new opportunities for the workplace wellness industry. Further, two primary growth drivers are the increase in the prevalence of chronic illnesses & raising public awareness of the various benefits associated with workplace wellness programs. Government initiatives aiming at both physical & mental health further contribute to this trend, with many corporations now allowing office gyms &

healthcare facilities staffed by trained fitness coaches, thereby encouraging the global workplace wellness market.

However, the growth of the workplace wellness market during the forecast period creates challenges like the unavailability of skilled professionals & the high cost of devices. Moreover, the growing financial burden on companies to adopt workplace wellness plans stands out as a major inhibiting factor, potentially restraining the market's growth in the specified forecast period.

Research Scope and Analysis

By Category

Based on category, the market is categorized into fitness & nutrition consultants, psychological therapists, and organizations/employers, where the corporate wellness market in 2023 witnessed the organizations/employers segment dominating, accounting for the largest market share, reflecting employers' significant investments in in-house & outsourced health management services, ranging from large corporations to small-scale businesses. Employers are constantly addressing the well-being of their workforce by delivering healthy catering options on-site, recognizing the link between employee health, productivity, & the financial impact of increased disease burdens.

Further, the fitness & nutrition consultants’ segment is expected for the fastest growth during the forecast period. As, employers are highly utilizing stress-relief initiatives like yoga, meditation, & art therapy into employee wellness programs. These initiatives not only contribute to stress minimization but also positively impact organizational dynamics by addressing issues related to employee anger & overall well-being. Further, the growing demand for psychological therapy services is concurrently driving growth in the fitness & nutrition consultant’s segment.

By Service

The health risk assessment segment leads & drives the global corporate wellness market, commanding the highest revenue share in 2023. Corporate wellness programs predominantly focus on screening efforts to identify health concerns and implement interventions that encourage healthier lifestyles among employees. More than half of companies offering corporate wellness services prioritize assessing their employees' health risks, with the health risk assessment sector dominating the market in terms of service offerings, which depends on its efficacy for early detection & reducing health risks, resulting in less absenteeism due to health issues & lower healthcare expenditures. Wellness programs under this segment include screenings to identify risks & implement interventions, acknowledging the impact of daily habits &environmental factors on employees' lives, and promoting a healthier lifestyle.

Moreover, the stress management segment is experiencing fast growth during the forecast period, driven by the rise in work-related & daily life stress among employees. These stress management programs play a vital role in assisting employees to effectively balance their professional & personal lives. Recognizing the intrinsic connection between a healthy mind & body, stress-relieving programs, and management skills are highly valued for encouraging optimal brain function & overall well-being.

By Delivery Mode

In the corporate wellness market, the delivery methods include both onsite & offsite programs, with onsite initiatives claiming the biggest share of the market in 2023. Onsite wellness programs take the lead by delivering employees with immediate & convenient access to wellness resources, supporting increased participation & engagement. Further, these programs contribute to growing productivity as they allow employees to quickly resume work post-wellness sessions. Beyond efficiency, onsite wellness initiatives provide a customized, hands-on approach personalized to meet the unique demands of employees, proving remarkably effective in addressing individual health risks & driving positive behavior changes.

Moreover, the noticeable benefits of onsite programs expand beyond individual well-being, including reductions in healthcare costs & absenteeism. The holistic impact on employee morale & retention has become a compelling reason for companies to increase their investments in these initiatives, highlighting the important role of onsite corporate wellness programs in strengthening a healthier & more engaged workforce.

By End User

In 2023, the corporate wellness market saw many large-scale organizations, capitalizing on well-documented studies indicating that properly executed programs can generate a return-on-investment exceeding double. Larger entities possess the infrastructure to smoothly integrate comprehensive wellness programs & services. Further, small-scale organizations allow corporate memberships & outsourced services to derive benefits. The implementation of corporate wellness initiatives proves instrumental in disease tracking, conducting regular health screenings, promoting preventive care, & reducing treatment costs, which not only reduces the disease burden but also contributes to minimizing overall healthcare premiums borne by employers.

Despite the switch to remote work due to lockdowns, maintaining employee access to health services at the workplace remains critical. The growing awareness of employee health programs, along with the rise in absenteeism &attrition, is expected to drive the growth of small & medium-scale organizations. These entities can enhance employee well-being by offering on-site services, like yoga & meditation classes, conducted bi-monthly or monthly.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Corporate Wellness Market Report is segmented on the basis of the following:

By Category

- Fitness & Nutrition Consultants

- Psychological Therapists

- Organizations/Employers

By Service

- Health Risk Assessment

- Fitness

- Smoking Cessation

- Health Screening

- Nutrition & Weight Management

- Stress Management

- Others

By Delivery Model

By End User

- Small Scale Organizations

- Medium Scale Organizations

- Large Scale Organizations

Regional Analysis

North America emerged as the leader in the corporate wellness market, capturing the largest

revenue share at 40.6%. According to the RAND employer survey, approximately half of the US employers integrate wellness programs, with larger companies often utilizing more sophisticated initiatives. The change in office culture significantly influences business owners in the region to prioritize such services, recognizing their impact on employee health.

Also, the Asia Pacific region is expected to have substantial growth in corporate wellness, as the rising working population & a growing awareness of employee health management drive the need for corporate health initiatives. Moreover, the aging workforce in the region provides a valuable market opportunity. Corporations are highly investing in healthcare infrastructure, addressing previously unnoticed demands & positioning the Asia Pacific to experience major advancements in corporate wellness during the forecast period.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global corporate wellness market is competitive & consists of many significant players, which hold a significant market share. The market is characterized by the growth in many corporations aiming to expand & include in-house employee wellness services. Some market players are expanding to accommodate & cater to a larger group of employees.

In January 2022, Headspace Inc. introduced Sayana, a mental health company leveraging artificial intelligence, which reflects the growing integration of technology to improve mental well-being services. Headspace's push into AI-driven mental health highlights the industry's commitment to innovative solutions, demonstrating a response to the changing needs of individuals looking for accessible & customized mental health support.

Some of the prominent players in the global Corporate Wellness Market are:

- ComPsych

- Fitbit Inc

- Vitality Group

- Wellsource Inc

- Marino Wellness

- EXOS

- Privia Health

- SOL Wellness

- Truworth Wellness

- Virgin Pulse

- Other Key Players

COVID-19 Pandemic & Recession: Impact on the Global Corporate Wellness Market:

The COVID-19 pandemic & following downturn have significantly impacted the global corporate wellness market. With remote work becoming normal companies switched their focus to

virtual wellness programs to support employees' mental & physical health. The pandemic highlighted the importance of employee well-being, leading businesses to invest in initiatives like stress management resources, virtual fitness classes, & mental health support. However, economic challenges enable cost-conscious organizations to reevaluate & sometimes reduce spending on wellness programs. As the business landscape expands, the corporate wellness market continues to adapt, balancing the demand for employee support with affordable solutions in the face of ongoing uncertainties.

Recent Developments

- In January 2022, Mindhouse underwent a rebranding, renaming itself as Shyft, which showcases the company's commitment to delivering a diverse range of wellness solutions catering to a broad array of health conditions & concerns. Shyft focuses on assisting customers in the reversal, remission, & management of their health conditions, reflecting a strategic switch towards comprehensive well-being offerings.

- In February 2022, GYMGUYZ, the global leader in onsite, in-home, & virtual personal training, expanded its corporate wellness services. Now, the company delivers wellness services not only on-site at corporate locations but also in the homes of remote workers, which is anticipated to contribute significantly to market growth, showcasing the industry's responsiveness to the changing work landscape & employee preferences.

- In February 2022, Quantum CorpHealth Pvt. Ltd, a health tech company, expanded its presence by inaugurating 3 new offices in India mainly in Pune, Bangalore, and Hyderabad, which focus on addressing the increasing demand for health & wellness services among corporate employees & their dependents in the country. The expansion reflects the company's commitment to meeting the evolving healthcare needs of the workforce.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 58.4 Bn |

| Forecast Value (2032) |

USD 88.1 Bn |

| CAGR (2023-2032) |

4.7% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Category (Fitness & Nutrition Consultants,

Psychological Therapists, and

Organizations/Employers), By Service (Health Risk

Assessment, Fitness, Smoking Cessation, Health

Screening, Nutrition & Weight Management, Stress

Management, and Others), By Delivery Model (On-

site and Off-site), By End User (Small Scale

Organizations, Medium Scale Organizations, and

Large Scale Organizations) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

ComPsych, Fitbit Inc., Vitality Group, Wellsource Inc.,

Marino Wellness, EXOS, Privia Health, SOL Wellness,

Truworth Wellness, Virgin Pulse, and Other Key

Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Corporate Wellness Market?

▾ The Global Corporate Wellness Market size is estimated to have a value of USD 58.4 billion in 2023 and

is expected to reach USD 88.1 billion by the end of 2032.

Which region accounted for the largest Global Corporate Wellness Market?

▾ North America has the largest market share for the Global Corporate Wellness Market with a share of

about 40.6% in 2023.

Who are the key players in the Global Corporate Wellness Market?

▾ Some of the major key players in the Global Corporate Wellness Market are ComPsych, Fitbit Inc, Vitality

Group, and many others.

What is the growth rate in the Global Corporate Wellness Market?

▾ The market is growing at a CAGR of 4.7 percent over the forecasted period.