Market Overview

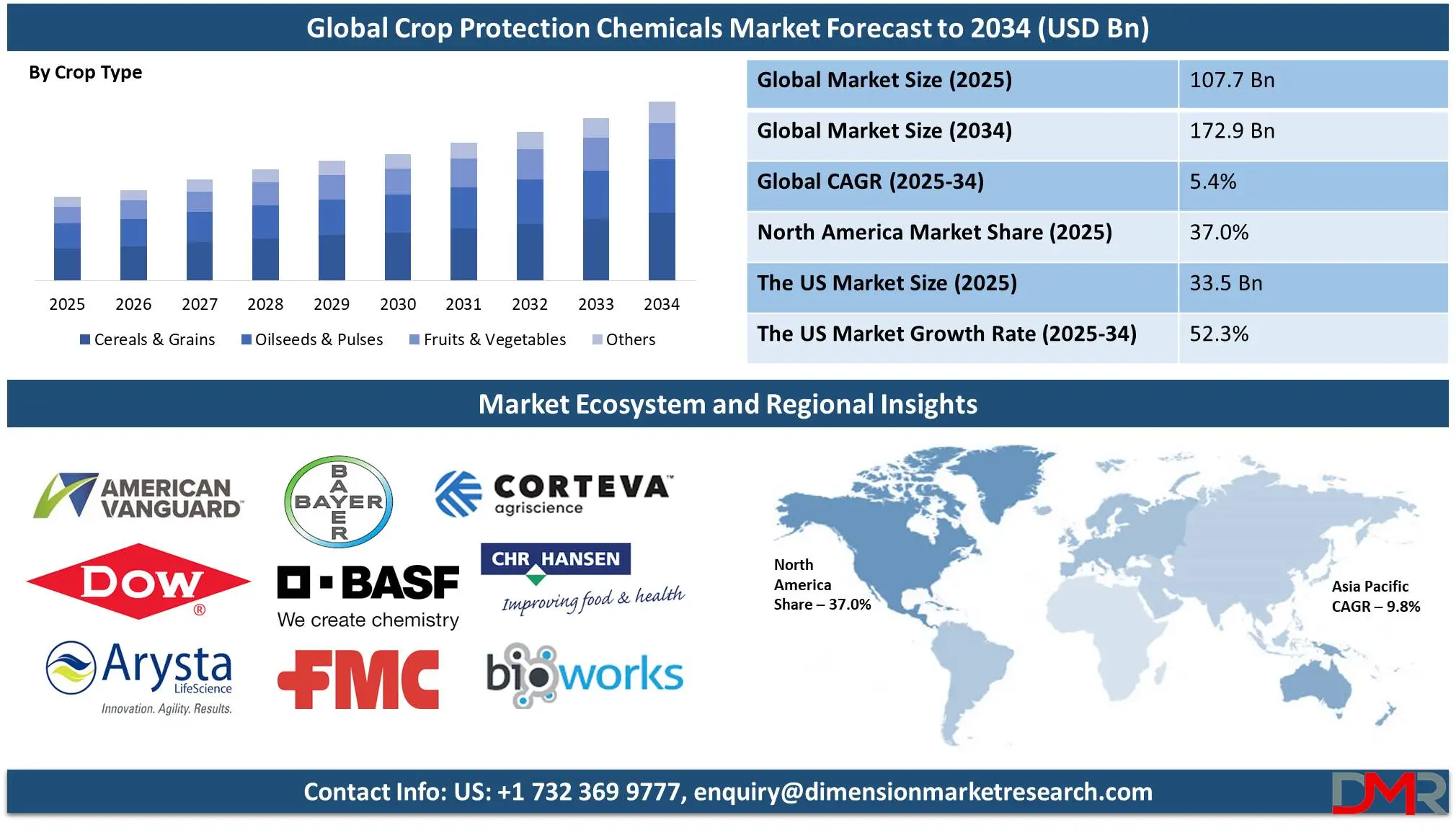

The Global Crop Protection Chemicals Market is expected to be valued at

USD 107.7 billion in 2025, and it is further anticipated to reach a market value of

USD 172.9 billion by 2034 at a

CAGR of 5.4%.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global crop protection chemicals market encompasses an expansive selection of agrochemicals designed to protect crops against pests, diseases, weeds, and biological threats that compromise agricultural productivity and food security. These include herbicides, insecticides, fungicides, and bactericides each serving an individual purpose in mitigating biological threats that threaten crop loss.

Demand for these products has grown with population. Advances in formulation technologies and precision farming have enhanced both the effectiveness and sustainability of crop protection products. In last few decades, the market for agricultural chemicals has experienced remarkable expansion due to high farming practices and expansion of agricultural lands in developing economies.

Asia Pacific, Latin America, and Africa have all contributed substantially to market expansion with their agrarian economies heavily reliant on chemical crop protection products to maximize yields. Furthermore, factors like climate change, soil degradation, and resistant pests have raised awareness for alternative and eco-friendly solutions. Hence the reason that more agrochemical companies are investing heavily in research and development for eco-friendly biopesticides that reduce environmental impact while maintaining crop safety. These developments often intersect with the

specialty chemicals sector, which contributes innovative active ingredients and delivery mechanisms tailored for modern agriculture.

Government policies and regulations play a pivotal role in shaping the crop protection chemicals market. Stringent environmental and health-related guidelines have led to safer and more targeted pesticides with reduced residues being developed for regions like North America and Europe. Government policies and regulations play a pivotal role in shaping the crop protection chemicals market. Stringent environmental and health-related guidelines have led to safer and more targeted pesticides with reduced residues being developed for regions like North America and Europe.

Emerging economies take a different approach to agricultural productivity enhancement by carefully balancing regulatory measures with agricultural productivity goals. Approval processes for new chemical formulations may be lengthy and complex, necessitating companies to meet stringent safety standards before commercialization. Nonetheless, market trends continue to advance with sustainable, and residue-free solutions derived from biological sources entering the marketplace.

Artificial Intelligence, data analytics, and drone-based applications are revolutionizing how farmers apply crop protection chemicals, guaranteeing optimal dosage with reduced environmental impact.

Crop monitoring using satellite imaging and drone-based analytics allows farmers to apply chemicals only where needed, optimizing resource use. While the industry faces obstacles such as regulatory restrictions and growing concerns over chemical resistance, continual innovations in agricultural biotechnology and alternative pest management strategies will create long-term growth and resilience within its market.

The US Crop Protection Chemicals Market

The US Crop Protection Chemicals Market is projected to be valued at

USD 33.5 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 52.3 billion in 2034 at a

CAGR of 5.1%.

The US crop protection chemicals market represents an integral part of the global agricultural industry, driven by vast farmlands, advanced farming techniques, and a rising need for effective crop management solutions. The market offers an assortment of agrochemicals such as herbicides, insecticides, fungicides, and bactericides that all help protect crops from weeds, pests, and diseases. The US is one of the leading consumers of crop protection chemicals due to its extensive production of key crops such as corn, soybeans, wheat, and cotton that require extensive pesticide use for maximum yield efficiency. Pressure to increase agricultural output while mitigating environmental impacts has led to innovation in chemical formulations for targeted and sustainable solutions being adopted into mainstream agriculture practices.

US crop protection chemicals market growth can be attributed to its advanced agricultural infrastructure, including precision farming technologies, genetically modified crops, and high-efficiency irrigation systems. American farmers have increasingly adopted integrated pest management (IPM) strategies, which combine chemical applications with biological and mechanical pest control methods to maximize efficiency and minimize adverse impacts. Digital agriculture technologies such as AI-driven pest detection, automated spraying, and satellite-based monitoring have enhanced precision in pesticide application, not only increasing crop yields but also contributing to reduced wastage.

Global Crop Protection Chemicals Market: Key Takeaways

- Market Value: The global crop protection chemicals market size is expected to reach a value of USD 172.9 billion by 2034 from a base value of USD 107.7 billion in 2025 at a CAGR of 5.4%.

- By Type Segment Analysis: Herbicides are anticipated to lead in the type segment, capturing 42.0% of the market share in 2025.

- By Origin Type Segment Analysis: Synthetic pesticides are poised to consolidate their market position in the origin type segment capturing 92.0% of the total market share in 2025.

- By Form Type Segment Analysis: Liquid Formulations is expected to maintain their dominance in the form type segment capturing 70.0% of the total market share in 2025.

- By Mode of Application Type Segment Analysis: The foliar spray method is expected to lead in the mode of application type segment, capturing 58.0% of the market share in 2025.

- By Crop Type Segment Analysis: Cereals & Grains are poised to lead in the crop type segment, capturing 46.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global crop protection chemicals market landscape with 37.0% of total global market revenue in 2025.

- Key Players: Some key players in the global crop protection chemicals market are American Vanguard Corp, Dow Chemical Company, Arysta LifeSciences Corporation, Bayer AG, BASF SE, FMC Corporation, Corteva, and Other Key Players.

Global Crop Protection Chemicals Market: Use Cases

- Weed Management in Large-Scale Farming: Large agricultural operations, particularly in crops like corn, wheat, and soybeans, rely heavily on herbicides to control weed infestations. Weeds compete with crops for nutrients, sunlight, and water, significantly reducing yield potential. By using selective and non-selective herbicides, farmers can efficiently eliminate weeds while ensuring healthy crop growth, leading to improved productivity and cost savings. Herbicide-resistant weeds have emerged as a challenge, pushing the industry to develop more advanced formulations.

- Pest Control in Fruit and Vegetable Cultivation: In fruit and vegetable farming, insecticides and fungicides play a crucial role in protecting crops from harmful insects, fungi, and bacterial diseases. For example, apple orchards require regular application of fungicides to prevent scab disease, while vegetable crops like tomatoes and potatoes depend on insecticides to control pests like aphids and caterpillars. This ensures high-quality produce, minimizing losses caused by infestations.

- Seed Treatment for Enhanced Crop Protection: Seed treatment chemicals are widely used in crops such as rice, soybeans, and cotton to provide early-stage protection against soil-borne pathogens, fungi, and insects. By coating seeds with protective chemicals before planting, farmers ensure better germination rates and healthier seedlings. This approach reduces the need for excessive pesticide application later in the crop cycle and improves overall farm efficiency. With the rising cost of crop production, seed treatment is seen as a cost-effective way to enhance yields and reduce losses.

- Soil Treatment for Sustainable Agriculture: Soil health is a growing concern due to factors like nutrient depletion and pest buildup. Soil treatment chemicals, including fumigants and biological agents, help manage soil-borne diseases and pests, improving soil fertility. This practice is commonly used in high-value crops like strawberries and potatoes, where soil-borne pathogens can cause significant yield losses. It also supports sustainable farming by reducing the long-term dependency on synthetic pesticides and by promoting construction chemicals that enhance agricultural infrastructure like greenhouses and irrigation systems.

Global Crop Protection Chemicals Market: Stats & Facts

- According to the Food and Agriculture Organization (FAO), global pesticide use in agriculture reached 3.70 million tonnes of active ingredients in 2022, marking a 4.0% increase from 2021. The US and Asia remain the largest consumers of pesticides, with herbicides being the most widely used category.

- According to the US Environmental Protection Agency (EPA), the US accounts for approximately 20.0% of global pesticide usage, with an annual consumption of around 400,000 to 500,000 metric tons. Herbicides make up the majority of pesticide use in the US, particularly in soybean, corn, and wheat production.

- According to the European Food Safety Authority (EFSA), the European Union has implemented stringent regulations on pesticide residues, with over 96.0% of food samples in compliance with legal residue limits in 2021. The EU is also increasing efforts to reduce synthetic pesticide use and promote biopesticides as part of the Farm to Fork Strategy, aiming to cut chemical pesticide use by 50.0% by 2030.

- According to the Indian Ministry of Agriculture and Farmers Welfare, India’s pesticide market was valued at USD 5.7 billion in 2022, with exports accounting for more than 50.0% of total production. The country has been actively promoting biopesticides, which currently represent about 10.0% of the domestic market, with rapid growth driven by sustainable farming initiatives.

- According to the China Ministry of Agriculture and Rural Affairs (MARA), China remains the largest producer and exporter of pesticides globally, supplying over 40.0% of the world's total pesticide demand. The country is focusing on reducing pesticide overuse and shifting towards more eco-friendly formulations. China’s domestic pesticide consumption is expected to stabilize as precision farming technologies gain adoption.

- According to the Brazilian National Health Surveillance Agency (ANVISA), Brazil is among the world's top pesticide consumers, with over 600,000 tons of pesticides used annually. The agency is working on stricter regulations to control pesticide residues in food, especially for crops like soybeans, coffee, and sugarcane.

- According to the World Health Organization (WHO), excessive pesticide use poses risks to human health, with approximately 385.0 million cases of unintentional pesticide poisoning occurring annually, leading to around 11,000 deaths worldwide. WHO emphasizes the need for stricter safety regulations and the promotion of non-chemical alternatives for pest control.

- According to the Australian Pesticides and Veterinary Medicines Authority (APVMA), Australia has a highly regulated pesticide market, ensuring that all crop protection products undergo rigorous scientific assessments before approval. In recent years, the Australian government has focused on encouraging low-toxicity and environmentally friendly pesticides, leading to a 15.0% increase in biopesticide approvals between 2020 and 2023. The country is also working towards reducing chemical pesticide reliance in favor of precision agriculture and sustainable pest control techniques.

Global Crop Protection Chemicals Market: Market Dynamic

Global Crop Protection Chemicals Market: Driving Factors

Growing Global Food Demand and the Need for Higher Agricultural ProductivityAs global population growth continues, food production must also increase to meet growing needs, making agricultural efficiency even more essential. Unfortunately, shrinking arable land, climate change, and pest infestations present numerous obstacles that must be met using advanced farming solutions including crop protection chemicals which is an invaluable way to safeguard plants against diseases, weeds, and pests while maintaining maximum yields in agricultural production.

By 2050, global population projections estimate that it will have increased to 9.7 billion according to the UN. With such an anticipated population rise comes the demand for staple crops such as wheat, rice, maize, and soybeans, thus necessitating production to increase by 50.0-70.0% globally to meet the rising population's needs. Pests and plant diseases present a threat to food security, destroying nearly 40.0% of global crop production each year according to FAO figures, and costing global economies over USD 220.0 billion annually, impacting both large-scale farms as well as smaller farmers.

Rising Incidences of Crop Diseases and Pest Infestations

Farmers face growing challenges in protecting their crops from emerging pathogens, invasive pests, and rapidly mutating diseases that threaten agricultural yields, these outbreaks may reduce productivity, raise food prices, and cause supply chain disruptions that reduce yields in agriculture. Therefore, the crop protection chemicals industry has evolved into creating more targeted solutions with long-term effectiveness to combat threats. Agrochemical companies have responded by investing in innovative active ingredients and bio-based solutions that offer better pest management while simultaneously minimizing environmental impact.

Unpredictable weather patterns and harsh climate conditions have contributed to numerous outbreaks of plant disease in recent years. Increased humidity levels and temperature variations provide ideal conditions for fungal and bacterial infections to thrive, leading to crop losses of unprecedented proportions. Global trade and migration patterns have allowed invasive species to reach globally where they had not existed before, including pests like Tuta absoluta (tomato leaf miner) and brown marmorated stink bugs that previously did not exist.

Global Crop Protection Chemicals Market: Restraints

Stringent Regulatory Framework and Environmental Concerns

The crop protection chemicals market is significantly constrained by strict regulatory policies and increasing environmental concerns surrounding pesticide usage. Governments globally are adopting stringent regulations to monitor and restrict synthetic pesticide usage due to potential detrimental effects on human health, biodiversity, and soil quality. Such regulations lead to bans, restrictions, or lengthy approval processes that make the introduction of new products difficult for agrochemical firms.

Environmental Protection Agency (EPA), European Food Safety Authority (EFSA), and India's Central Insecticides Board & Registration Committee (CIBRC) all apply strict regulations on pesticide registration, residue limits, and environmental impact assessments for new and existing products. EU's Farm to Fork Strategy seeks to reduce chemical pesticide usage by 50.0% by 2030 while driving the industry toward solutions such as biopesticides and precision farming.

High Development Costs and Limited Accessibility for Small-Scale Farmers

Crop protection chemicals represent a formidable obstacle to market expansion, particularly among small-scale farmers. The research and development (R&D) process for new pesticides, herbicides, and fungicides is highly complex, time-consuming, and expensive. It often requires regulatory approvals, safety testing, field trials, and innovation investment as companies strive to comply with environmental regulations, leading to higher product costs for consumers.

As a result, small and marginal farmers in developing regions often struggle to afford premium crop protection solutions. Limited financial resources, subsidies, or distribution networks all impede them from purchasing modern agrochemicals. Additionally, organic farming trends and stringent chemical residue regulations could further restrict them from purchasing cost-effective solutions. Addressing this challenge requires affordable alternatives, government support programs, and increased awareness regarding safe pesticide usage.

Global Crop Protection Chemicals Market: Opportunities

Rising Demand for Bio-Based and Sustainable Crop Protection Solutions

Amid concerns over chemical residues, soil degradation, and environmental impacts of traditional chemical-based crop protection methods, governments and agricultural stakeholders have promoted biopesticides, bioherbicides, and other sustainable options such as advances in biotechnology or microbe-based solutions that offer effective pest and disease management with minimal ecological footprint. Eco-friendly crop protection solutions have gained momentum due to regulatory support and government incentives for sustainable farming practices. Businesses investing in biological formulations, precision agriculture, and integrated pest management (IPM) strategies may find success tapping into this emerging market by offering products suitable for large farms as well as smallholder farmers seeking cost-effective, and safe solutions.

Expansion of Precision Agriculture and Digital Farming Technologies

Precision agriculture and digital farming technologies are providing the crop protection chemicals market with new growth opportunities. Due to AI, IoT, drones, and satellite imaging innovations, farmers can now monitor crop health more closely, detect early pest infestations early, and apply crop protection chemicals more precisely, leading to improved yields while decreasing wasteful usage, environmental impact and costs while optimizing pesticide and herbicide usage.

Integrating smart spraying systems, automated machinery, and variable rate application (VRA) technologies has revolutionized how crop protection products are utilized in modern farming. As governments and agribusinesses push towards adopting smart farming methods, crop protection chemicals companies can collaborate with agri-tech firms to create precision formulations and digital advisory services compatible with precision farming.

Global Crop Protection Chemicals Market: Trends

Increasing Focus on Regulatory Compliance and Eco-Friendly Formulations

Governments and regulatory bodies globally are tightening restrictions on pesticide residues, environmental toxicity, and human health impact, leading to companies investing heavily in creating low-toxicity, biodegradable, and residue-free crop protection products to comply with evolving regulations. This trend is spurring innovation in next-generation chemical formulations, including nanotechnology-based pesticides, pheromone-based pest control solutions, and plant extract-derived biochemicals.

Agrochemical companies are restructuring existing products to meet sustainability standards and gain regulatory approvals in key agricultural markets such as the U.S., EU, and Asia-Pacific regions. Also, an increased demand for "green label" or certified organic crop protection products is prompting companies to develop more environmentally friendly options in their portfolios.

Growing Adoption of Integrated Pest Management (IPM) Strategies

Farmers are turning more frequently to Integrated Pest Management (IPM) due to rising awareness of pesticide resistance, soil health concerns, and the desire for long-term agricultural sustainability. Governments and agricultural organizations are also supporting IPM through training programs, incentives, and regulatory support, encouraging balanced use of both chemical and nonchemical pest control methods.

AI-powered pest monitoring systems, drone-based surveillance, and decision support tools are making IPM strategies even more efficient by providing real-time detection and optimized chemical usage. As a result, agrochemical companies are diversifying their portfolios with IPM-compliant products such as targeted pesticides, biocontrol agents, and advisory services to meet modern agriculture's evolving demands.

Global Crop Protection Chemicals Market: Research Scope and Analysis

By Type

Herbicides are expected to dominate the crop protection chemicals market, capturing 42.0% of the total market share by 2025. Their dominance can be explained by rising weed infestation rates that decrease crop yields by competing for nutrients, water, and sunlight with plants. Furthermore, no-till farming techniques require effective solutions to weed control while simultaneously minimizing soil disruption which is not found in herbicides.

As herbicide-tolerant genetically modified (GM) crops have proliferated across major agricultural economies such as the U.S., Brazil, and Argentina, their use has led to an increased demand for selective herbicides. Farmers increasingly turn to broad-spectrum and pre-emergent herbicides to maximize productivity while cutting labor costs associated with manual or mechanical weed removal. Innovations of low-toxicity bio-based herbicides are also gaining ground due to regulatory pressure for eco-friendly alternatives.

While herbicides remain the dominant force in the market, insecticides have seen a rise in demand due to climate change and rising temperatures driving pest infestations and shifting agricultural practices. Many regions are also seeing an upsurge in insect-borne crop diseases leading to greater demand for targeted and systemic insecticides to protect staple crops such as rice, wheat, and corn from damage caused by insects.

The rapid expansion of high-value horticultural crops such as fruits and vegetables is driving insecticide use. Furthermore, with new pesticide-resistant insect species emerging every year companies must develop advanced formulations like RNA-based insecticides and new chemical compounds for effective pest control. Integrative Pest Management (IPM) programs have fostered responsible use of insecticides alongside biological controls, leading to precision-targeted and residue-free insecticides for both large-scale commercial farms and smallholder farmers.

By Origin

Synthetic pesticides are set to maintain their dominant position in the crop protection chemicals market, capturing 92.0% of the total market share by 2025. This dominance can be attributed to their high efficacy, broad-spectrum activity, and long shelf life qualities which make them especially appealing for large-scale commercial farming operations. Synthetics provide immediate pest control measures that contribute to higher crop yields while guarding against widespread infestations. As synthetic pesticides are cost-effective alternatives, their adoption has increased.

Their cost effectiveness makes them attractive in high-production crops such as cereals, oilseeds, cotton, and sugarcane, many farmers rely on systemic and contact-based synthetic pesticides that offer long-lasting residual effects against pests, weeds, and fungal infections. Technological advancements such as nanoencapsulation and controlled-release crop protection chemicals help improve efficiency while safeguarding environmental safety.

The biologicals segment is experiencing significant growth, driven by increasing consumer preference for organic produce, stricter regulatory frameworks on chemical residue limits, and heightened awareness of environmental sustainability. The rising emphasis on eco-friendly agricultural practices and sustainable crop protection solutions has further accelerated the adoption of biopesticides as a viable alternative to conventional chemical pesticides.

One key driver for biopesticide adoption is an increase in resistance of pests and pathogens to traditional synthetic pesticides, prompting industry players to explore biological control solutions. Furthermore, government support, subsidies, and regulatory approvals make biopesticide formulations more readily accessible to farmers, particularly in regions with stringent environmental laws such as Europe or North America.

By Form

Liquid formulations are projected to dominate the form-type segment in the crop protection chemicals market, capturing 70.0% of the total market share by 2025. Their ease of application, uniform coverage, and higher absorption efficiency make them the top choice among farmers globally. Liquid pesticides, including emulsifiable concentrates (ECs), suspension concentrates (SCs), and soluble liquids (SLs) offer great mixability with water as well as compatibility with modern spraying technologies for precise application that delivers improved pest control results.

Liquid formulations have become even more in demand with the proliferation of precision agriculture, as their liquid form allows drone spraying, automated irrigation systems, and ultra-low volume (ULV) applications, optimizing pesticide distribution across large agricultural areas, protecting farmworkers against dust dispersion or inhalation exposure risks, and optimizing pesticide distribution across large agricultural areas and improving crop protection efficiency.

Solid pesticide formulations have experienced steadily rising demand due to their extended shelf life, ease of storage, and reduced risk of chemical degradation. Their stability under varying environmental conditions makes them a practical and cost-effective choice for farmers seeking reliable and long-lasting crop protection solutions. Wettable powders (WP), granules (GR), and water-dispersible granules (WDG) are preferred due to their stability under extreme temperature and moisture conditions, making them suitable for regions with fluctuating climatic conditions.

The use of solid formulations can also be attributed to their cost-effectiveness and reduced packaging waste, aligning with the industry shift toward sustainable farming practices and eco-friendliness. Many solid formulations use slow-release mechanisms for extended protection against pests and diseases while decreasing the frequency of reapplications.

By Mode of Application

The foliar spray method is projected to maintain its leading position in the mode of application type segment, capturing 58.0% of the total market share by 2025. This dominance can be attributed to its efficacy in providing immediate protection, uniform coverage, and minimal chemical wastage. This method is particularly beneficial for fast-acting pest and disease control, as it allows for direct absorption through the plant’s stomata. One key driver of foliar spraying demand is the increasing use of water-soluble formulations and micronutrient-enriched pesticides, which help plant metabolism and stress resistance. Furthermore, commercial farmers' adoption of automated spraying systems offers improved precision applications while decreasing labor costs, making foliar spraying an appealing choice for high-value crops such as fruits, vegetables, and oilseeds.

At the same time, the demand for soil treatment applications is on the rise, fueled by concerns over soil degradation, nutrient depletion, and the spread of soil-borne diseases. This method is increasingly recognized for its role in enhancing root development, improving water retention, and boosting overall crop resilience. Biological soil amendments and chemical fumigation techniques are driving innovation in this space, enabling effective control of nematodes, fungi, and weed seeds before planting.

Furthermore, as sustainable farming practices such as cover cropping and regenerative agriculture expand they encourage soil-applied microbial pesticides and organic conditioners as key elements for long-term agricultural productivity. Precision soil treatment technologies are improving both their efficacy and adoption rates, such as variable rate application (VRA), deep soil injection, seed treatment with soil-enhancing microbes, and seed treatment. Bio-based soil treatments such as beneficial fungi, bacteria, or enzyme-based formulations offer farmers eco-friendly alternatives to conventional chemical treatments.

By Crop Type

Cereals and grains are expected to dominate the crop type segment, accounting for 46.0% of the total market share by 2025. Their dominance can be explained by high global consumption, extensive cultivation area, and their critical role in food security. Staple crops such as wheat, rice, corn, and barley provide vital nutritional components to billions of people globally, driving demand for crop protection chemicals that enhance productivity while protecting against pests, weeds, and fungal infections. Rising global populations and shifting diets have also put pressure on farmers to maximize cereal and grain yields, leading to an upsurge in demand for herbicides, insecticides, and fungicides.

Furthermore, expanding high-yield hybrid and genetically modified (GM) cereal crops, particularly in Asia-Pacific, North America, and Latin America, has further necessitated advanced crop protection solutions capable of offering greater resistance against environmental stresses and pest attacks.

Oilseeds and pulses have seen steady increases in cultivation due to rising demand for plant-based proteins, edible oils, and biodiesel production.

Crops like soybeans, canola, sunflower, lentils, and chickpeas are more widely grown due to their nutritional benefits, versatility in food processing applications, and industrial uses. Vegan and vegetarian diets, combined with an increase in consumption of protein-rich foods, have led to a rise in the cultivation of pulses and legumes for protein production, creating greater demand for effective pest and disease control solutions. Oilseeds such as soybean and rapeseed play an integral role in biofuel production, necessitating increased crop protection measures to ensure optimal yields.

The Crop Protection Chemicals Market Report is segmented on the basis of the following

By Type

- Herbicides

- Insecticides

- Fungicides & Bactericides

- Others

By Origin

By Form

By Mode of Application

- Foliar Spray

- Soil Treatment

- Seed Treatment

- Others

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

Global Crop Protection Chemicals Market: Regional Analysis

The region with the largest Revenue Share

North America is set to dominate the global crop protection chemicals market, capturing

37.0% of total market revenue in 2025. This dominance reflects its highly developed agricultural sector, extensive adoption of advanced farming technologies, and strong regulatory frameworks regulating crop protection solutions. Countries like the US and Canada play pivotal roles in global agricultural production with vast cultivation areas for cereals, oilseeds, pulses, and specialty crops that require effective pest, weed, and disease control solutions.

Genetically Modified (GM) crops such as corn, soybean, and cotton have created a rise in demand for herbicide-tolerant and pest-resistant crop protection strategies. North America's strong research and development ecosystem has fostered innovative bio-based pesticides, precision application methods, and sustainable agrochemical formulations strengthening North American dominance in this market.

The region with the highest CAGR

The Asia-Pacific region is expected to witness the highest compound annual growth rate (CAGR) in the global crop protection chemicals market, driven by expanding agricultural activities, rising food demand, and increasing adoption of modern farming techniques. Countries such as China, India, Japan, and Southeast Asian nations are experiencing rapid agricultural transformation, fueled by population growth, shrinking arable land, and the urgent need to improve crop productivity.

Governments and farmers across this region are actively investing in advanced crop protection solutions to increase yields and minimize postharvest losses while commercial farming, high-value crop cultivation expansion, and government subsidies for agrochemicals are fuelling the adoption of pesticides, herbicides, and fungicides. Climate-induced pest and disease outbreaks have caused a surge in demand for both synthetic and biological crop protection solutions. Countries like India and China are significantly increasing pesticide usage while also advocating sustainable alternatives like biopesticides or Integrated Pest Management (IPM) programs.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Crop Protection Chemicals Market: Competitive Landscape

The global crop protection chemicals market is highly competitive, featuring multinational corporations, regional players, and emerging companies all striving for innovative yet eco-friendly solutions. The industry is defined by ongoing product innovation, regulatory changes, and bio-based alternatives. These companies strive to strengthen their market positions through research & development, strategic acquisitions, or expansion into high-growth regions.

Leaders like BASF SE, Bayer AG, Syngenta AG, Corteva Agriscience, FMC Corporation, UPL Limited, Sumitomo Chemical Co. Ltd, and Nufarm Limited dominate the market with extensive product portfolios and robust global distribution networks. These firms invest heavily in research to develop more efficient, residue-free crop protection solutions with reduced environmental impacts that feature biological pesticides, precision farming technologies, and artificial intelligence-driven pest detection systems for improved efficiency and reduced ecological impact of chemical usage.

Mergers and acquisitions have played an instrumental role in reshaping the competitive landscape, enabling companies to strengthen their foothold in key markets. Furthermore, partnerships between agrochemical firms and technology companies are helping create smart crop protection strategies by combining traditional chemicals with data-driven insights for the optimal application of protection strategies. Asia-Pacific, Latin America, and Africa have seen substantial expansion into emerging markets over recent years due to rising food demand and agricultural activity boosting demand for crop protection products. Companies are entering these regions via joint ventures, acquisitions, or the establishment of localized manufacturing units to cater to this increasing farmer base.

Some of the prominent players in the global crop protection chemicals market are:

- American Vanguard Corp

- Dow Chemical Company

- Arysta LifeSciences Corporation

- Bayer AG

- BASF SE

- FMC Corporation

- Corteva

- Syngenta AG

- UPL Limited

- Sumitomo Chemical Co. Ltd

- Nufarm Limited

- Other Key Players

Global Crop Protection Chemicals Market: Recent Developments

- December 2024: UPL Corporation announced the US Environmental Protection Agency's registration of NIMAXXA bionematicide. This seed treatment, containing a unique combination of three biological strains, provides season-long protection against nematodes in soybeans and corn, targeting pests such as soybean cyst nematode, root-knot nematode, and reniform nematode.

- November 2024: Australian agribusiness company Elders acquired Delta Agribusiness for USD 475.0 million. Delta operates through a network of 68 sites and 40 independent wholesale customers across various Australian states.

- October 2024: Helm AG acquired Plantix, a company that had evolved from a crop disease diagnosis app into an e-commerce platform for pesticide purchases. This transformation highlights the broader challenges faced by mission-driven agritech startups in balancing sustainability objectives with financial viability.

- May 2024: BASF introduced Efficon Insecticide to the Indian market. This product is part of BASF's strategy to expand its portfolio of crop protection solutions in the region, addressing local agricultural challenges.

- March 2023: Corteva Agriscience announced the commercial launch of Adavelt™ active, a novel fungicide with a new mode of action designed to protect against a wide range of crop diseases. The product received registrations in Australia, Canada, and South Korea, with commercial sales beginning in the same year.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 107.7 Bn |

| Forecast Value (2034) |

USD 172.9 Bn |

| CAGR (2025-2034) |

5.4% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 33.5 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Herbicides, Insecticides, Fungicides & Bactericides, and Others), By Origin (Synthetic, and Biologicals), By Form (Liquid, and Solid), By Mode of Application (Foliar Spray, Soil Treatment, Seed Treatment, and Others), and By Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

American Vanguard Corp, Dow Chemical Company, Arysta LifeSciences Corporation, Bayer AG, BASF SE, FMC Corporation, Corteva, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global crop protection chemicals market?

▾ The global crop protection chemicals market size is estimated to have a value of USD 107.7 billion in 2025 and is expected to reach USD 172.9 billion by the end of 2034.

What is the size of the US crop protection chemicals market?

▾ The US crop protection chemicals market is projected to be valued at USD 33.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 52.3 billion in 2034 at a CAGR of 5.1%.

Which region accounted for the largest global crop protection chemicals market?

▾ North America is expected to have the largest market share in the global crop protection chemicals market with a share of about 37.0% in 2025.

Who are the key players in the global crop protection chemicals market?

▾ Some of the major key players in the global crop protection chemicals market are American Vanguard Corp, Dow Chemical Company, Arysta LifeSciences Corporation, Bayer AG, BASF SE, FMC Corporation, Corteva, and many others.

What is the growth rate in the global crop protection chemicals market?

▾ The market is growing at a CAGR of 5.4 percent over the forecasted period.