Cyber insurance also known as third-party cyber liability insurance protects businesses that are unable to prevent a cyberattack or data breach affecting their clients, which handles the legal costs associated with cyber liability lawsuits, including any fines or settlements that may come from such incidents.

As cyber threats such as data breaches, ransomware attacks, and system vulnerabilities increase, companies face greater financial risks from such incidents; consequently, the demand for cyber insurance solutions has skyrocketed across industries - serving to protect them against rising costs associated with attacks.

Technological developments and digital services expansion have opened new paths for cyber insurance products. Businesses are taking advantage of AI/ML algorithms to custom-tailor policies based on risk assessments, providing more accurate coverage. Furthermore, insurers are working on integrating cybersecurity best practices into their offerings, creating opportunities for preventative measures alongside risk mitigation.

According to Security, the Cyber Insurance Market reflects evolving consumer awareness and purchasing patterns. Sixty-six percent of U.S. adults are familiar with cyber insurance, with familiarity increasing to 59% among those who have experienced cybercrime, compared to just 35% among those who haven’t.

Among those without coverage, 40% cite the need for further research as the primary barrier, followed by perceived high costs at 34%. Interestingly, 43% believe premiums for policies covering up to $25,000 cost under $100 annually, while only 7% estimate premiums above $200. These insights highlight a growing need for market education and accessible pricing strategies.

As data protection regulations tighten, cyber insurance demand has steadily grown. Enterprises increasingly seek comprehensive protection to comply with regulations like GDPR and CCPA; insurers can seize this changing regulatory landscape as an opportunity to meet growing customer demands for policy flexibility, cybersecurity integration solutions, and risk management solutions. Furthermore, their market stands to expand with hybrid work environments and digital transformation strategies. The integration of

Generative AI in Cyber Security further enhances threat detection and response capabilities, positioning insurers to offer more advanced, AI-driven risk mitigation services.

Ransomware attacks have become one of the costliest threats, with claims related to these attacks increasing by 35% year-on-year. Insurance providers have responded by emphasizing coverage against such attacks; premiums for comprehensive cyber insurance policies increased 15-20% year-on-year during 2023; small and medium-sized enterprises (SMEs) showed great enthusiasm in this area with 25% more inquiries coming from this sector alone.

Key Takeaways

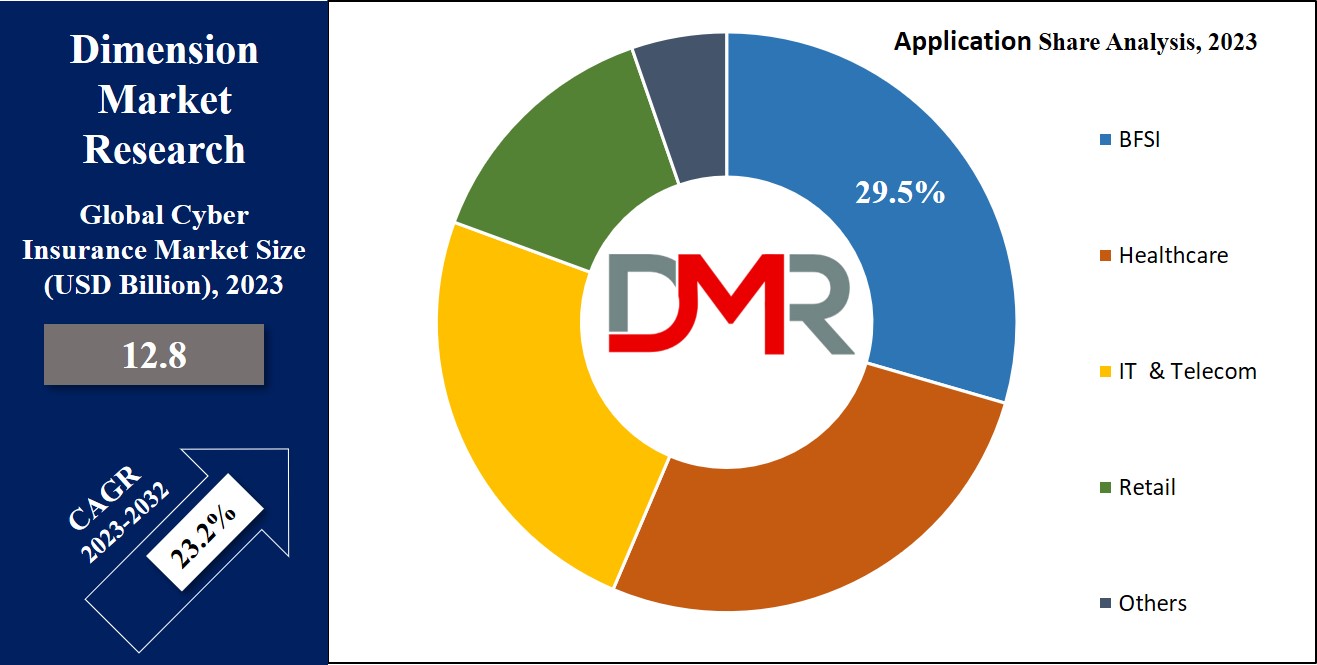

- Market Growth: The global cyber insurance market is projected to grow from USD 12.8 billion in 2023 to USD 83.6 billion by 2032, at a CAGR of 23.2%.

- Key Drivers: Rising cyber threats, digitalization, and tightened data regulations—such as GDPR and CCPA—are fueling demand for comprehensive cyber insurance across industries.

- Policy Innovations: Insurers are leveraging AI and machine learning to customize policies and offer proactive cybersecurity services alongside traditional risk mitigation.

- SME Adoption: Small and medium-sized enterprises are increasingly seeking cyber insurance, with a 25% rise in inquiries, highlighting growing awareness and risk exposure in this segment.

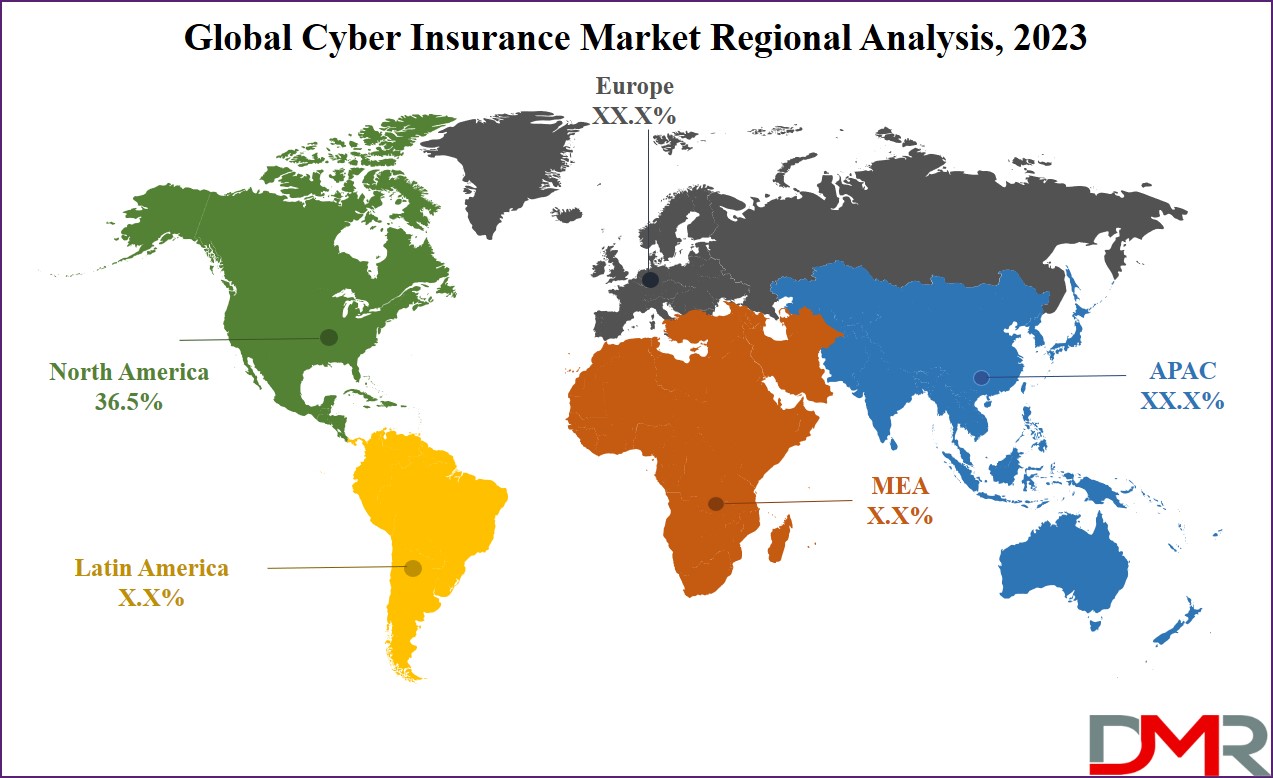

- Regional Leaders: North America dominates with 36.5% revenue share, driven by awareness and presence of major insurers; Asia Pacific is expected to witness significant growth due to rising cybercrime.

- Sector Trends: BFSI (Banking, Financial Services, and Insurance) leads in adoption, while healthcare shows high future growth potential due to increasing digitalization and data vulnerability.

- Ransomware Impact: Claims related to ransomware attacks rose 35% year-over-year, and insurance premiums for broad cyber policies increased 15-20% in 2023.

Use Cases

- Data Breach Mitigation: Insurance helps companies recover from data breaches by covering legal costs, customer notifications, and financial losses due to compromised digital assets and data.

- Ransomware Response: Firms use cyber insurance to offset rising costs from ransomware attacks, including extortion payouts, incident response, and system restorations.

- Healthcare Protection: Hospitals and clinics apply cyber insurance to safeguard sensitive patient records and ensure compliance with health data regulations in case of cyberattacks.

- SME Safeguarding: Small and medium businesses utilize cyber policies to protect against business interruptions, third-party liabilities, and recovery from targeted cyber incidents.

- Regulation Compliance: Organizations use cyber insurance to navigate changing data privacy laws such as GDPR, covering costs and penalties resulting from regulatory breaches.

- Financial Sector Security: Banks and insurers employ cyber coverage to mitigate risks from fraudulent transactions, theft, and large-scale breaches targeting financial infrastructure.

Market Dynamic

The easy availability of personal data online & the growth in the use of social media have encouraged cybercriminals to engage in illegal activities, like selling medical records, personal information like identities, & credit card details on the dark web. Further, the demand for cyber insurance is on the rise. With a major portion of the global population spending a large time on online platforms, the number of cyber threats is a key driver of this growing demand.

In addition, government & regulatory organizations have taken steps to increase cybersecurity defenses, further driving the demand for cyber insurance, mainly due to data privacy laws like the European General Data Protection Regulation & the

Healthcare Insurance Portability and Accountability Act.

However, the market faces challenges in terms of a lack of expertise & technical knowledge, along with rising concerns about cybersecurity & data privacy. The absence of a vast historical record of cyber incidents & a general lack of understanding poses a significant challenge to the market's growth.

Research Scope and Analysis

By Organization Size

The large enterprise segment dominates the market in 2023 & is projected to retain its domination over the forecast period. These organizations have a high spending capability to execute strong cybersecurity solutions. In addition, large organizations are highly funded in cyber insurance policies to reduce risks related to a cyberattack. In addition, cyber insurance can highly contribute to enhancing computer security risk management in an organization, which is anticipated to further enhance the segment’s growth over the forecasted period.

Further, Small & medium enterprises (SMEs) are more at risk of cyberattacks as they don’t possess the essential security infrastructure. They are constantly looking to assess, identify, & respond to evolving threats. Cyber insurance has the potential to economize businesses by providing first-party & third-party protection coverage, as it includes business interruption, loss or damage to digital assets, online extortion, & theft of money along with computer forensics investigation, customer notification costs, loss of third-party data, multi-media liability, & third-party contractual indemnification.

By Application

The BFSI (Banking, Financial Services, and Insurance) segment remains the dominant force in the cyber insurance market in 2023, as it has gained prominence due to the growth in monetary transactions it handles, making it a prime target for cybersecurity incidents, including extensive breaches, fraud, & heists. Given the important role of banking & financial services in the economy, protecting their security is of paramount importance. In addition, financial institutions & government agencies are highly adapting cyber insurance solutions to reduce increasing losses & enhance their overall risk management strategies.

Also, the healthcare segment is expected to exhibit a high growth rate in the coming years, as the digital transformation in this sector has made patient data more accessible, but it has also raised concerns about online vulnerabilities. Sensitive healthcare information is highly exposed to both external & internal threats, making the sector an attractive end for hackers. To address these changing cyber threats, healthcare organizations are predicted to adopt cyber insurance as a practical measure to offset potential losses & strengthen their cybersecurity defenses.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Cyber Insurance Market Report is segmented on the basis of the following:

By Organization Size

By Application

- BFSI

- Healthcare

- IT & Telecom

- Retail

- Others

Regional Analysis

In 2023, the North American market leads the market with the major revenue

share at 36.5%. This can be said owing to the presence of major players like The Chubb Corporation and American International Group, Inc. The region's growth is further driven by increasing awareness of cyber insurance in small and medium-sized enterprises (SMEs), which is anticipated to boost demand in the coming years.

Also, the Asia Pacific region is expected to have significant growth during the forecasted period, primarily due to the growth in the occurrence of cybercrimes in developing countries like Australia, India, & China. The rise in prominence of Asian countries in the global economy has allowed governments to prioritize cybersecurity, leading to a growth in demand for cyber insurance.

Insurers are looking for the opportunity to provide policies that cover cyber risks & underwrite cyber products, thus contributing to the expansion of cybersecurity strategies across various industries in the region.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The cyber insurance market experiences moderate concentration, where major companies include advanced technology & expand their reach through established distribution networks. These tech-savvy leaders are committed to staying competitive by investing in new ideas, engaging in mergers & acquisitions, and forming partnerships to make sure they remain the leaders of the market.

For instance, in September 2022, The Coalition, a cyber insurance company based in San Francisco, expanded its services to assist small & medium-sized businesses in the USA to effectively handle cyber threats, by integrating cybersecurity tools, digital forensics access, monitoring, incident response, & comprehensive insurance coverage. As a result, the company expanded its customer base & ventured into the United Kingdom market, providing its expertise in managing & reducing cyber risks to a large audience.

Some of the prominent players in the global Cyber Insurance Market are:

- AON Plc

- American International Group Inc

- Berkshire Hathaway Inc

- AXA XL

- Munich Re Group

- Zurich Insurance Co Ltd.

- Allianz Global Corporate & Speciality

- XL Group

- The Chubb Corp

- Insureon

- Other Key Players

Recent Developments

- In March 2025, CFC launched the Cyber Proactive Response product, offering broader coverage, new benefits, and fewer exclusions for businesses with revenues up to $250 million.

- In March 2025, Canopius expanded its bespoke cyber insurance product for the energy and utility sectors, adding enhanced coverage and proactive support for critical infrastructure clients.

- In July 2025, Zurich Insurance Group acquired BOXX Insurance, enabling Zurich to offer retail and SME cyber insurance and services globally.

- In July 2025, Vanta raised $150 million in funding at a $4.15 billion valuation to boost capabilities in automated risk management and vendor security for cyber insurance clients.

- In September 2025, Debeka launched a new cyber insurance product for private households, expanding its reach to individual customers in Germany.