Market Overview

The Global Cybersecurity Consulting Services Market is projected to reach USD 21.8 billion in 2025 and grow at a compound annual growth rate of 20.7% from there until 2034 to reach a value of USD 119.1 billion.

The global cybersecurity consulting services market is experiencing exponential growth as enterprises across sectors confront escalating digital risks. As cyberattacks become more advanced, organizations are increasingly dependent on specialized consulting firms for services such as threat intelligence, compliance auditing, penetration testing, and incident response. Companies are transitioning from traditional in-house security teams to outsourced advisory models to reduce costs, bridge talent shortages, and ensure access to cutting-edge methodologies.

The demand surge is strongly driven by the rapid adoption of cloud computing, remote workforces, growing digital transformation across industries, and stricter regulatory environments. Governments worldwide are enforcing mandates such as GDPR, HIPAA, and CCPA, compelling organizations to adopt proactive risk management strategies. Furthermore, emerging threats from ransomware, supply chain breaches, and nation-state actors are creating an urgency to overhaul legacy security postures through expert consulting.

Opportunities lie in sectors such as healthcare, manufacturing, and critical infrastructure, which are undergoing digital transformation but face operational security gaps. Consulting providers are leveraging artificial intelligence, Zero Trust architecture, threat hunting, and real-time monitoring as differentiated service offerings. Additionally, environmental, social, and governance (ESG) criteria are emerging as a new front where cybersecurity plays a critical role in reporting and compliance.

However, the market also faces restraints. Budget constraints among SMEs, lack of skilled cybersecurity professionals, fragmented regulatory standards, and a high dependency on third-party tools can inhibit full-scale deployment. Moreover, evolving threat landscapes demand continuous skill upgradation, which can stretch both providers and clients.

The US Cybersecurity Consulting Services Market

The US Cybersecurity Consulting Services Market is projected to reach USD 7.0 billion in 2025 at a compound annual growth rate of 19.4% over its forecast period.

The United States cybersecurity consulting services market remains the global leader, underpinned by advanced digital infrastructure, high cloud adoption, and a dynamic threat environment. According to the Cybersecurity and Infrastructure Security Agency (CISA), the country faces over 300,000 cybersecurity-related incidents annually, prompting government and private sector collaboration to build more resilient systems. The Department of Homeland Security (DHS) emphasizes the importance of cybersecurity advisory partnerships for critical infrastructure sectors.

A unique demographic advantage lies in the U.S.’s access to top-tier talent from institutions like MIT, Stanford, and Carnegie Mellon. The National Initiative for Cybersecurity Education (NICE), under the U.S. Department of Commerce, supports national cybersecurity workforce development, boosting the capacity of consulting firms. Moreover, agencies like the Federal Trade Commission (FTC) and National Institute of Standards and Technology (NIST) issue cybersecurity frameworks that form the compliance bedrock for many organizations, which consulting services help to implement and manage.

Cloud migration, remote workforce enablement, and increasing frequency of ransomware attacks are pushing organizations to adopt third-party cybersecurity consulting services. The U.S. also benefits from major tech hubs in Silicon Valley, Austin, and Boston, making it an incubator for next-gen cybersecurity consulting tools and talent. Additionally, defense contracts and public-private initiatives, such as the Joint Cyber Defense Collaborative (JCDC), are generating sustained demand for expert services.

The combination of a digitally mature economy, government-driven regulatory enforcement, and demographic access to skilled professionals places the U.S. cybersecurity consulting services market on a strong growth trajectory through 2034.

The Europe Cybersecurity Consulting Services Market

The Europe Cybersecurity Consulting Services Market is estimated to be valued at USD 3.2 billion in 2025 and is further anticipated to reach USD 14.5 billion by 2034 at a CAGR of 18.0%.

The European cybersecurity consulting services market is expanding steadily, driven by regulatory obligations, increasing digital maturity, and rising cyber risk awareness. The European Union Agency for Cybersecurity (ENISA) reports that ransomware and supply chain attacks remain persistent threats, especially in sectors like energy, healthcare, and public administration. Consulting services are vital for implementing the Network and Information Systems Directive (NIS2) and ensuring GDPR compliance.

A significant demographic advantage in Europe stems from multilingual talent pools and government-supported training initiatives. Programs under the European Digital Strategy are fostering digital skills and security awareness across member states. Countries such as Germany, France, and the Netherlands are developing national cybersecurity strategies that encourage public-private partnerships, including consulting engagements. Additionally, European research hubs like the CyberSec4Europe pilot support the development of innovative consulting models and shared cybersecurity resources.

The rise of Smart Cities and industrial IoT across the EU also fuels demand for consulting services focused on risk management, cloud security, and secure architecture design. Europe's diverse regulatory landscape makes it essential for organizations to leverage consulting firms that can offer tailored compliance strategies across multiple jurisdictions.

Challenges include fragmented digital ecosystems across member states and lower investment capabilities in certain Eastern European regions. The increasing focus on cyber-resilience, digital sovereignty, and secure AI development will further enhance the region’s demand for specialized cybersecurity advisory services.

The Japan Cybersecurity Consulting Services Market

The Japan Cybersecurity Consulting Services Market is projected to be valued at USD 1.3 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 5.6 billion in 2034 at a CAGR of 17.6%.

Japan’s cybersecurity consulting services market is witnessing rapid evolution as the country embraces digital transformation across key sectors such as manufacturing, finance, and public services. The National Center of Incident Readiness and Strategy for Cybersecurity (NISC) underscores Japan’s cybersecurity risk posture amid rising cross-border cyber threats. As part of the “Cybersecurity Strategy 2021,” Japan aims to bolster its resilience through capacity building and professional consulting frameworks.

Japan has a demographic advantage rooted in its strong engineering education system and government investment in IT infrastructure. Agencies like the Ministry of Economy, Trade and Industry (METI) and the Japan Information Technology Services Industry Association (JISA) are developing standards and human capital for cybersecurity excellence. Additionally, collaborations between academia and industry under initiatives like “Cybersecurity for Society 5.0” ensure a pipeline of consultants equipped with modern skill sets.

Japanese enterprises traditionally rely on in-house IT teams, but the growing complexity of digital ecosystems has pushed demand toward external cybersecurity consulting firms. The Tokyo Stock Exchange and financial institutions are particularly active in onboarding third-party consultants for risk assessments, cyber-insurance guidance, and incident response planning. Moreover, Japan’s push toward cloud-native environments ahead of the Osaka Expo 2025 and global sporting events has led to a surge in consulting engagement.

Despite cultural conservatism in outsourcing, the need to comply with international standards such as ISO 27001 and global supply chain security norms is encouraging companies to seek specialized advisory support.

Global Cybersecurity Consulting Services Market: Key Takeaways

- Global Market Size Insights: The Global Cybersecurity Consulting Services Market size is estimated to have a value of USD 21.8 billion in 2025 and is expected to reach USD 119.1 billion by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 20.7 percent over the forecasted period of 2025.

- The US Market Size Insights: The US Cybersecurity Consulting Services Market is projected to be valued at USD 7.0 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 34.4 billion in 2034 at a CAGR of 19.4%.

- Regional Insights: North America is expected to have the largest market share in the Global Cybersecurity Consulting Services Market with a share of about 38.0% in 2025.

- Key Players: Some of the major key players in the Global Cybersecurity Consulting Services Market are Accenture, IBM, Deloitte, PwC (PricewaterhouseCoopers), EY (Ernst & Young), KPMG, Booz Allen Hamilton, BAE Systems, and many others.

Global Cybersecurity Consulting Services Market: Use Cases

- Critical Infrastructure Risk Audits: Consulting firms help utilities and transportation agencies identify vulnerabilities in operational technology systems. This includes ICS/SCADA assessments, segmentation design, and compliance with NIST and ISO standards to avoid service disruptions and regulatory penalties.

- Cloud Migration Security: Advisors support enterprises transitioning to cloud environments by designing secure architectures, conducting posture assessments, and ensuring governance frameworks like CIS benchmarks and shared responsibility models are implemented correctly.

- Incident Response Retainers: Organizations subscribe to incident response services to ensure rapid containment, forensics, and recovery during a breach. Consulting teams provide playbooks, simulations, and 24/7 support to mitigate damage and legal exposure.

- Cyber Insurance Readiness: Consultants help businesses meet the prerequisites for cyber insurance coverage. They conduct risk evaluations, document controls, and optimize policies to align with underwriter expectations, thereby reducing premium costs and enhancing claim validity.

- ESG and Cyber Resilience Reporting: As cybersecurity becomes integral to ESG strategies, consulting services are used to align digital risk management with corporate sustainability goals. Reports are structured for investor transparency, regulatory filings, and board-level accountability.

Global Cybersecurity Consulting Services Market: Stats & Facts

U.S. Cybersecurity & Infrastructure Security Agency (CISA)

- CISA handles over 320,000 cybersecurity-related incidents annually, reflecting the immense scale of cyber threats across U.S. government and private sector organizations. This high volume necessitates a broad deployment of cybersecurity consultants, who help organizations manage alerts, breaches, and threat containment activities across all sectors, including healthcare, finance, and energy.

- CISA collaborates with over 90% of critical infrastructure operators in the United States, including energy grids, transportation, and public utilities. This collaboration frequently involves external cybersecurity consultants to assess, secure, and maintain these systems by federal cybersecurity requirements.

- The Cyber Hygiene Program, operated by CISA, has helped more than 10,000 organizations adopt best practices in vulnerability scanning and risk mitigation. Consulting firms assist in deploying these measures by translating technical guidance into actionable strategies for small and large enterprises.

National Institute of Standards and Technology (NIST)

- Over 60% of U.S. federal agencies have implemented the NIST Cybersecurity Framework, often facilitated by consulting firms. These firms provide essential services such as framework mapping, gap assessments, and strategy development to ensure agencies meet federal cybersecurity standards.

- Through the NICE program, NIST has supported the education and training of thousands of cybersecurity consultants. These professionals are crucial to public- and private-sector clients in applying NIST standards for secure systems, particularly in areas like critical infrastructure, federal compliance, and threat response.

European Union Agency for Cybersecurity (ENISA)

- Approximately 24% of EU-based organizations have engaged external cybersecurity consultants for incident response planning. This includes pre-breach preparation, simulation testing, and defining escalation processes to comply with EU-level mandates like the Cybersecurity Act.

- ENISA reported a 37% increase in ransomware attacks across Europe in 2023. This trend has prompted more companies to onboard consulting firms for threat intelligence and ransomware mitigation planning, especially in sectors like healthcare and government.

- Only 46% of critical infrastructure organizations in the EU are compliant with the updated NIS2 Directive. Cybersecurity consultants are now being increasingly hired to assist with policy interpretation, control implementation, and gap closure to achieve regulatory compliance.

Japan’s National Center of Incident Readiness and Strategy for Cybersecurity (NISC)

- As part of Japan’s national cybersecurity strategy, 30,000 professionals, including consultants, have been upskilled through government-funded programs. This initiative ensures that organizations have access to trained advisors for digital risk governance, especially in preparation for major events like Expo 2025.

- Over 40% of Japanese businesses rely on third-party consultants to meet regulatory and technical readiness. Consultants are instrumental in assisting with ISO certification, cloud security, and digital risk audits, particularly for finance and industrial sectors.

- In a single quarter of 2023, Japan detected over 17 million cyberattack attempts against its networks. This persistent threat environment has fueled the need for expert-led consulting services in proactive defense, attack surface reduction, and cyber incident response.

U.S. Department of Homeland Security (DHS)

- DHS designates 16 critical infrastructure sectors, each advised to maintain formal cybersecurity consulting partnerships. These include finance, energy, communications, and transportation sectors heavily reliant on consulting firms for cybersecurity audits, simulations, and training.

- The Cyber Resilience Review (CRR) program, under DHS, has been adopted by over 1,500 organizations to benchmark their cyber maturity. Consultants are key in executing this review, interpreting findings, and building tailored resilience strategies.

UK National Cyber Security Centre (NCSC)

- More than 2,000 UK companies have implemented the Cyber Essentials scheme with the help of cybersecurity consultants. These services help in meeting government-backed security baseline certifications essential for public contracts.

- In 2023, 79% of medium and large UK businesses employed consulting services to meet cybersecurity obligations under GDPR and the UK’s national cyber strategy. Consultants have proven essential in bridging in-house talent gaps and aligning with complex compliance structures.

German Federal Office for Information Security (BSI)

- About 68% of large German enterprises conducted penetration testing and audits using third-party consultants in 2023. This is in response to growing cyber risks in industrial sectors and the rising importance of ISO 27001 readiness.

- The “IT-Grundschutz” security framework, developed by BSI, is implemented in over 8,000 German organizations with assistance from cybersecurity advisors. Consulting services help tailor these guidelines to each organization's unique IT environment.

Australian Cyber Security Centre (ACSC)

- One-third of Australian businesses use cybersecurity consultants to meet compliance requirements under the Security of Critical Infrastructure Act. This includes risk assessments, asset classification, and access control audits.

- The Essential Eight Maturity Model, a government-recommended baseline, is implemented by over 40% of SMEs in Australia through cybersecurity advisors. Consulting engagements include endpoint hardening, privilege restriction, and patch management strategies.

Canada Centre for Cyber Security

- About 42% of Canadian companies engage cybersecurity consultants to manage advanced threat detection, conduct response drills, and develop risk mitigation playbooks. The Canadian government actively encourages such engagements under its cyber strategy.

- Consultants promote adoption of CyberSecure Canada, the government’s certification program, now rolled out across 5,000+ businesses. Advisory services help firms meet all 13 control areas required by the framework.

International Telecommunication Union (ITU)

- Over 60% of ITU member countries now operate national cybersecurity strategies that rely heavily on third-party consulting firms for implementation and training support.

- ITU’s global training initiatives have helped train nearly 100,000 cybersecurity professionals, many of whom operate as consultants supporting capacity-building in developing nations across Africa, Asia, and Latin America.

INTERPOL Cybercrime Directorate

- INTERPOL has coordinated consulting workshops across more than 50 nations, helping local law enforcement and enterprises implement modern cybersecurity controls and incident response strategies.

- Due to increased ransomware-as-a-service activity, INTERPOL reported a 200% rise in cybersecurity consulting requests from developing nations, particularly for sectors like education, finance, and local governance.

World Economic Forum (WEF)

- In its 2024 cybersecurity outlook, 91% of global business leaders acknowledged the need for third-party consulting expertise to manage growing digital risks, highlighting consultants as critical to operational resilience.

- Just 27% of surveyed organizations rated themselves as cyber-resilient, indicating a massive global gap that cybersecurity consultants are expected to help close by implementing risk frameworks and recovery strategies.

OECD

- OECD projects a cybersecurity talent gap exceeding 3.5 million by 2026. This void is increasingly being filled through consultancy models that allow organizations to tap into external expertise instead of building full internal teams.

- OECD research reveals that SMEs are three times more likely to hire external cybersecurity consultants than develop in-house teams, due to cost, skill limitations, and evolving compliance landscapes.

United Nations Institute for Disarmament Research (UNIDIR)

- UNIDIR works with over 80 developing nations, offering cybersecurity policy consulting and risk analysis as part of its digital peace and cyber norms programs, enabling these countries to craft sovereign and secure cyber strategies.

Global Cybersecurity Consulting Services Market: Market Dynamic

Driving Factors in the Global Cybersecurity Consulting Services Market

Rising Regulatory Mandates and Cross-Border Compliance Requirements

The global surge in data protection laws and industry-specific cybersecurity mandates is a major growth driver for consulting services. Regulations such as the General Data Protection Regulation (GDPR), California Consumer Privacy Act (CCPA), and the Network and Information Systems Directive (NIS2) impose stringent cybersecurity obligations on organizations, requiring expert interpretation, gap assessment, and remediation planning.

Consulting firms play a pivotal role in translating these complex requirements into operational and technical controls, often across multi-jurisdictional landscapes. The growing adoption of privacy-enhancing technologies and the need to demonstrate compliance through continuous monitoring and third-party audits further drive demand for cybersecurity advisors. In sectors like BFSI, healthcare, and telecom, failure to meet regulatory benchmarks results in significant financial and reputational penalties, reinforcing the need for expert-led strategies.

Additionally, with supply chain security now under scrutiny, organizations must ensure their partners and vendors are also compliant, which adds another layer of complexity and drives reliance on third-party consultants for risk vetting and policy enforcement. Governments are increasingly promoting cybersecurity through initiatives such as NIST’s CSF, ISO 27001, and Cyber Essentials, which indirectly boost consulting engagement.

As compliance becomes an ongoing rather than a one-time activity, the market for advisory services focused on audits, training, and framework implementation is expected to expand exponentially, especially in emerging economies adopting global data standards.

Escalating Threat Landscape and Cyberattack Sophistication

The increasing volume and complexity of cyber threats globally serve as a key growth driver for cybersecurity consulting services. Advanced Persistent Threats (APTs), ransomware-as-a-service (RaaS), and state-sponsored attacks are targeting not just major corporations but also SMEs, critical infrastructure, and public institutions. As threat vectors evolve, ranging from cloud misconfigurations to insider threats and AI-driven malware, organizations are compelled to seek expert guidance on how to build a multi-layered defense posture.

Cybersecurity consultants are being hired to conduct red teaming, penetration testing, threat modeling, and zero-trust architecture assessments that internal teams often lack the bandwidth or expertise to perform. Additionally, with the rise of hybrid work environments and widespread cloud adoption, traditional perimeter defenses are becoming obsolete, making strategic consulting critical.

Companies increasingly require help with secure access management, data encryption policies, and endpoint hardening tasks that are highly technical and demand tailored advice. Consulting firms also enable faster response to incidents by preparing organizations with well-documented playbooks, conducting breach readiness simulations, and offering 24/7 incident response retainers.

As organizations realize that being "cyber-resilient" is no longer optional, consulting firms are positioned as strategic partners in mitigating reputational, legal, and operational risks. The dynamic nature of the threat landscape ensures continuous demand for cybersecurity expertise, positioning consultants as critical agents in defense modernization.

Restraints in the Global Cybersecurity Consulting Services Market

Shortage of Skilled Cybersecurity Professionals and High Attrition Rates

One of the biggest restraints affecting the cybersecurity consulting services market is the global shortage of skilled professionals. According to organizations like ISC² and OECD, the cybersecurity workforce gap exceeds 3.5 million roles, with consulting firms competing against end-user organizations, tech vendors, and government agencies for the same talent pool.

This shortage drives up salaries, increases onboarding and training costs, and limits the capacity of consulting firms to scale their services, particularly in emerging markets. Moreover, high attrition rates within the consulting sector exacerbate the problem, as skilled employees often leave for in-house roles with better work-life balance or higher compensation.

This churn disrupts client engagements and erodes institutional knowledge. For smaller consulting firms, talent retention is especially challenging due to the inability to match benefits offered by multinational competitors. Additionally, constant updates in threat landscapes, tools, and compliance standards demand ongoing certification and upskilling, which puts further pressure on already strained teams.

The shortage also limits the ability of consulting firms to diversify into emerging domains such as quantum-resilient security or secure AI governance. Without significant investment in talent pipelines, workforce development, and employee wellness, consulting firms may find themselves unable to meet growing client demands, thereby capping their revenue potential and market penetration.

Budget Constraints and Perceived Cost of Consulting Engagements

Despite the growing need for cybersecurity preparedness, many organizations, especially SMEs and entities in cost-sensitive industries, view consulting services as a discretionary or non-critical expense. The perceived high cost of engaging cybersecurity consultants, particularly for long-term or complex engagements, serves as a major market restraint.

Organizations often lack the internal budgetary frameworks or executive buy-in to justify external advisory fees, especially when cybersecurity outcomes are intangible or preventive rather than profit-generating. This mindset persists even as the cost of data breaches and regulatory fines escalates. Additionally, in developing countries and underserved regions, access to high-quality cybersecurity consulting is limited due to affordability challenges.

Even in mature markets, CFOs and procurement teams may resist retainer models or ongoing advisory fees, preferring reactive services post-incident. This cost aversion restricts proactive risk management and leaves many organizations vulnerable. Furthermore, misalignment between the technical complexity of services offered and the client's understanding or valuation of those services leads to underutilization or rejection of full-scale consulting proposals. While some firms are experimenting with flexible pricing models and pay-as-you-go options, widespread skepticism about ROI remains a barrier to growth. To overcome this, consulting firms must enhance transparency, quantify risk-reduction benefits, and articulate the business value of cybersecurity in financial and operational terms.

Opportunities in the Global Cybersecurity Consulting Services Market

Expansion into SME and Mid-Market Segments Through Modular Offerings

While large enterprises have historically dominated the client base for cybersecurity consulting services, there is a significant untapped opportunity within the small and medium-sized enterprise (SME) segment. SMEs often lack in-house security talent and dedicated CISOs, yet they face the same regulatory and operational risks as larger corporations.

Recognizing this, many consulting firms are developing modular, scalable, and cost-effective solutions specifically tailored for the mid-market. Offerings include fixed-price cybersecurity assessments, subscription-based incident response services, and cloud security onboarding packages that address the most critical vulnerabilities within budget constraints. These services are further enabled through automation and remote delivery models, lowering overhead and increasing accessibility.

In regions like Southeast Asia, Latin America, and Eastern Europe, government initiatives supporting SME digitization are further encouraging demand for advisory services. Consulting firms can capitalize on this growth opportunity by designing industry-specific packages, for instance, secure payment systems for retail SMEs or compliance toolkits for healthcare startups.

Bundled training, compliance templates, and integration with popular platforms like Microsoft 365 or AWS are also becoming popular features in SME-centric consulting portfolios. The push toward cyber insurance among SMEs is another trigger for consulting engagement, as firms seek to meet the eligibility criteria for coverage. This segment offers long-term growth potential for consultancies willing to innovate, adapt pricing models, and scale personalized service delivery.

Advisory for ESG-Linked Cybersecurity and Cyber Insurance Readiness

A major emerging opportunity in the cybersecurity consulting services market is the rising demand for ESG-aligned cybersecurity strategies and cyber insurance readiness assessments. As investors, regulators, and customers demand greater accountability on environmental, social, and governance (ESG) criteria, cybersecurity is now viewed as an essential governance pillar.

Consultants are increasingly called upon to help organizations develop cyber risk reporting frameworks that align with ESG disclosures, such as those required by the Task Force on Climate-Related Financial Disclosures (TCFD) or the upcoming European Sustainability Reporting Standards (ESRS). These services include advising boards on cyber risk as part of enterprise governance, integrating cybersecurity into sustainability KPIs, and drafting sections of ESG reports that cover digital integrity and data stewardship.

Simultaneously, businesses seeking cyber insurance coverage must demonstrate a robust security posture to secure favorable premiums. Consulting firms help organizations prepare by conducting gap assessments, defining incident response plans, and collecting audit-ready documentation. They also support negotiations with insurers by translating technical controls into insurable risk language. As more insurance companies refine their underwriting criteria, the role of consultants in bridging technical and financial risk will expand. These dual mandates, ESG and insurance readiness, are creating a new domain of consulting that intersects compliance, strategy, and cyber defense, offering a high-growth frontier for firms that understand both cyber risk and enterprise governance.

Trends in the Global Cybersecurity Consulting Services Market

Integration of AI-Driven Security Solutions into Consulting Frameworks

A growing trend in the cybersecurity consulting services market is the incorporation of artificial intelligence and machine learning into consulting deliverables. Cybersecurity consultants are now offering AI-driven threat intelligence, behavioral analytics, and predictive risk modeling as part of their value proposition. These tools assist in detecting anomalies faster and responding to threats in real time, reducing dwell time significantly.

Consultants help organizations adopt AI-powered security orchestration, automation, and response (SOAR) platforms that streamline incident handling and accelerate decision-making. Furthermore, consultants are developing proprietary algorithms or integrating with platforms like IBM QRadar and Splunk to deliver advanced, adaptive cyber defenses.

As AI capabilities grow, consultancies are not only deploying tools but also guiding clients through the regulatory, ethical, and security implications of AI-based cyber solutions. The demand for this trend is highest among financial institutions, healthcare providers, and critical infrastructure entities facing complex cyber threats.

The use of

generative AI for simulating phishing campaigns, writing playbooks, and generating threat intelligence reports has further transformed the role of consultants from traditional advisors to proactive cyber risk strategists. This trend ensures consulting services remain aligned with emerging threat landscapes and the need for autonomous defense capabilities. The deep integration of AI into cybersecurity services will likely become a baseline requirement for competitiveness and effectiveness in the consulting space by 2030.

Shift Toward Outcome-Based and Shared-Risk Consulting Engagements

Traditional time-and-material or project-based consulting models are gradually being replaced by outcome-based and shared-risk frameworks. Clients are now demanding accountability not just for effort but for cybersecurity outcomes such as reduced incident frequency, regulatory compliance, or improved cyber maturity scores.

In this model, cybersecurity consultants and firms share liability or reward depending on defined performance indicators. This trend is gaining popularity in sectors like healthcare and manufacturing, where organizations face high penalties for breaches and need long-term assurance of results. Shared-risk models are compelling because they align the consultant’s incentive structure with the client’s risk profile, creating a more collaborative and enduring relationship.

Additionally, these models push consultants to invest in tools, platforms, and continuous training to meet performance benchmarks, resulting in higher-quality service delivery. It also helps clients justify the cybersecurity investment internally, as payment is tied to measurable outcomes. This shift has been especially prominent in Europe and North America, where data protection regulations like GDPR and HIPAA necessitate demonstrable risk mitigation.

As cybersecurity becomes a board-level concern, this trend reflects a broader industry shift toward transparency, performance metrics, and value delivery. Consulting firms that offer flexible engagement models with performance guarantees are likely to gain a competitive edge and become preferred partners for long-term security transformation.

Global Cybersecurity Consulting Services Market: Research Scope and Analysis

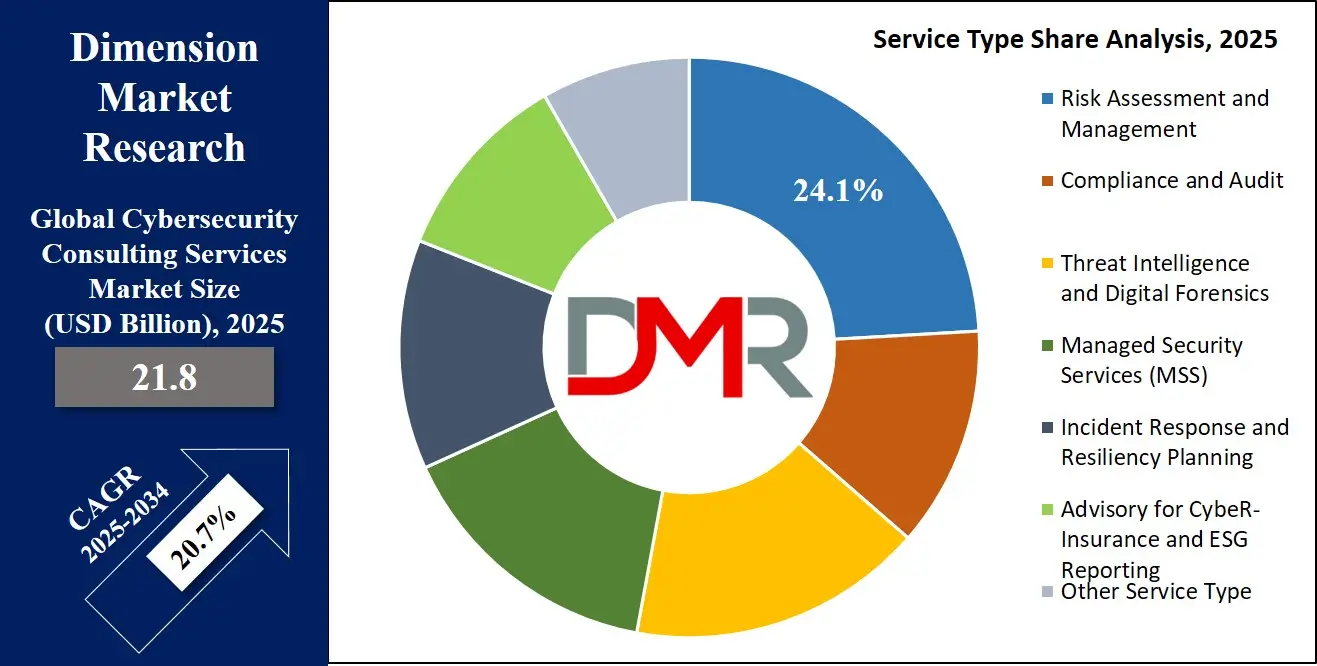

By Service Type Analysis

Risk Assessment and Management is projected to be the most dominant service type within the global cybersecurity consulting services market. This segment plays a critical role across every industry, as it enables organizations to understand the potential vulnerabilities, threat vectors, and impact of cyberattacks on their digital infrastructure. It forms the starting point of any cybersecurity strategy, helping businesses prioritize resource allocation and tailor their security investments. Regulatory frameworks such as GDPR, HIPAA, and ISO 27001 mandate periodic risk assessments, making this service essential in both compliance and operational contexts.

Consulting firms are hired to assess risks related to network access, cloud workloads, identity management, application security, and physical IT assets. These services also include vendor risk assessments, particularly important in supply chain-heavy sectors. The growing reliance on third-party SaaS and infrastructure providers has led to a spike in demand for continuous monitoring and risk scoring solutions, all underpinned by expert consulting.

In addition, the increasing requirement for cyber insurance coverage compels organizations to conduct thorough risk assessments to qualify for favorable premiums. With the rise of hybrid work and complex multi-cloud environments, businesses lack the in-house expertise to identify blind spots, further fueling demand. Consulting providers also offer scenario-based simulations and risk modeling aligned to business objectives.

As cyber risks continue to evolve rapidly, enterprises seek agile, dynamic risk management strategies that go beyond static assessments. This growing need to integrate risk intelligence into broader security and business strategies ensures that Risk Assessment and Management remains the most sought-after and revenue-generating segment among consulting services.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Organization Size Analysis

Large enterprises are anticipated to represent the dominant user base in the cybersecurity consulting services market, accounting for a substantial share of total revenue and engagement volume. These organizations manage expansive digital footprints that include on-premise data centers, multi-cloud deployments, global user bases, and complex supply chains, all of which significantly increase their cybersecurity exposure. Large enterprises face constant threats from nation-state actors, ransomware syndicates, and insider threats, and are under pressure to demonstrate cyber resilience to stakeholders, regulators, and customers.

In addition, the compliance landscape for large enterprises is highly rigorous. Organizations in sectors like banking, telecommunications, and pharmaceuticals are required to meet stringent data protection mandates such as GDPR, SOX, HIPAA, and CCPA. These entities cannot typically manage all security aspects in-house, especially for cross-border regulations. As a result, they routinely engage cybersecurity consulting firms for risk assessments, incident response planning, compliance audits, and red teaming operations.

Large enterprises also have the financial strength and long-term strategic vision to invest in comprehensive cybersecurity roadmaps. They are more likely to enter into multi-year partnerships with consultants that include MSSP services, threat hunting programs, and ESG-related cyber governance. Another contributing factor is the high cost of data breaches at this scale IBM reports average breach costs for large firms exceeding $4 million, reinforcing the need for advisory services.

Furthermore, large enterprises are early adopters of next-gen solutions like Zero Trust, AI-driven threat detection, and quantum readiness, requiring specialized consulting knowledge. These dynamics collectively position large enterprises as the most dominant consumer segment in this market.

By Deployment Mode Analysis

Cloud-based deployment is expected to be the dominant model in the cybersecurity consulting services market due to the widespread adoption of cloud computing technologies and the growing shift toward hybrid and remote work environments. As organizations migrate mission-critical applications and data to public, private, and hybrid cloud platforms, their cybersecurity posture must also evolve to accommodate the new risk surface. Misconfigurations, identity mismanagement, and a lack of visibility in multi-cloud environments make cloud deployments particularly vulnerable to sophisticated attacks, including lateral movement and privilege escalation.

Consulting firms specializing in cloud security help clients conduct secure cloud onboarding, design cloud-native security architectures, enforce identity and access policies, and implement continuous compliance monitoring. With enterprises increasingly adopting Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and Software-as-a-Service (SaaS) models, cybersecurity consultants guide clients on meeting shared responsibility frameworks mandated by providers such as AWS, Microsoft Azure, and Google Cloud.

Cloud-based security consulting also supports integration of tools like CASBs (Cloud Access Security Brokers), SIEM platforms, and microsegmentation controls. Consultants help organizations achieve compliance with frameworks such as FedRAMP, ISO 27017, and SOC 2, all essential in cloud-first operating models. Additionally, consulting services are often bundled with DevSecOps, allowing security to be embedded into cloud application development from the start.

The cost-effectiveness and scalability of cloud deployments make them attractive for both large enterprises and SMEs. As such, consulting firms offering modular, cloud-native security advisory services are in high demand. The accelerating pace of digital transformation ensures that cloud-based consulting will continue to dominate deployment preferences in the foreseeable future.

By Industry Vertical Analysis

The Banking, Financial Services, and Insurance (BFSI) sector is poised to be the dominant vertical in the cybersecurity consulting services market, driven by its high vulnerability to cyber threats and strict regulatory scrutiny. Financial institutions are prime targets for cybercriminals due to the valuable data they handle, ranging from account credentials to transaction histories and personally identifiable information (PII). This necessitates constant surveillance, advanced threat protection, and robust compliance frameworks, all of which are implemented with the aid of expert consultants.

Cybersecurity consulting in BFSI typically includes services such as penetration testing, security audits, data encryption advisory, anti-fraud consulting, and insider threat detection. These services help financial institutions adhere to regulatory requirements such as the Payment Card Industry Data Security Standard (PCI-DSS), SOX, Basel III, and GDPR. Consulting firms also play a key role in preparing financial firms for audits and cyber insurance, while guiding their digital transformation journeys without compromising risk exposure.

As digital banking, mobile payments, and fintech innovations rapidly scale, BFSI firms are adopting new architectures that require constant reassessment of security postures. Consulting services are also crucial in supporting zero-trust architecture, AI-powered fraud detection, and secure customer onboarding in this vertical. Furthermore, geopolitical tensions and financial cyber warfare threats have prompted banks and insurance companies to invest in advanced scenario planning and threat intelligence, much of which is developed in collaboration with cybersecurity consulting firms.

Due to the critical nature of financial operations, the reputational impact of a breach is immense. Thus, BFSI remains the most consultant-dependent industry, accounting for a leading share in both spending and long-term security engagements.

The Global Cybersecurity Consulting Services Market Report is segmented on the basis of the following:

By Service Type

- Risk Assessment and Management

- Compliance and Audit

- Threat Intelligence and Digital Forensics

- Managed Security Services (MSS)

- Incident Response and Resiliency Planning

- Advisory for CybeR-Insurance and ESG Reporting

- Other Service Type

By Organization Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By Deployment Mode

By Industry Vertical

- Banking, Financial Services & Insurance (BFSI)

- Healthcare

- Government & Defense

- IT & Telecommunications

- Retail & E-commerce

- Manufacturing

- Energy & Utilities

- Other Industry Vertical

Impact of Artificial Intelligence in the Global Cybersecurity Consulting Services Market

- Enhanced Threat Detection: AI enables cybersecurity consultants to detect anomalies and threats faster by using machine learning algorithms that analyze vast datasets in real time, improving proactive defense capabilities across endpoints, networks, and cloud infrastructures for enterprise clients.

- Automation of Repetitive Tasks: AI automates routine cybersecurity operations such as log analysis, alert triage, and compliance checks, allowing consultants to focus on strategic risk management and advisory roles while enhancing response times and reducing operational fatigue.

- Predictive Risk Assessment: AI-driven analytics empower consultants to conduct predictive modeling of cyber risks, enabling organizations to identify vulnerabilities and simulate breach scenarios with greater precision, helping clients prioritize security investments and improve incident preparedness.

- AI-Powered Incident Response: Cybersecurity consultants use AI in Security Orchestration, Automation, and Response (SOAR) platforms to accelerate incident containment, automate playbooks, and reduce mean time to detect (MTTD) and respond (MTTR) to cyber incidents.

- Customized Security Recommendations: AI helps consultants provide personalized security strategies by analyzing client-specific behaviors, industry threat landscapes, and regulatory needs, enabling more accurate and adaptive cybersecurity consulting solutions tailored to each organization’s unique risk profile.

- Support for Cyber Insurance Readiness: Consultants use AI tools to generate data-driven cyber maturity reports and risk scores, assisting clients in qualifying for cyber insurance policies while supporting insurers with accurate underwriting based on real-time risk insights.

Global Cybersecurity Consulting Services Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to hold the dominant position in the global cybersecurity consulting services market with

38.0% of the total revenue by the end of 2025, driven by its technologically advanced digital infrastructure, high regulatory enforcement, and early adoption of emerging cybersecurity frameworks. The U.S., in particular, accounts for a substantial market share due to its concentration of Fortune 500 companies, large-scale financial institutions, and critical infrastructure operators, all of which require continuous cybersecurity advice.

Agencies like the Cybersecurity and Infrastructure Security Agency (CISA) and the National Institute of Standards and Technology (NIST) have introduced rigorous standards and programs such as the NIST Cybersecurity Framework and FedRAMP, encouraging enterprises to seek specialized consulting support for implementation and compliance.

The region’s strong investment in cloud adoption, AI, and digital transformation further accelerates demand for consulting services related to cloud security, zero trust architecture, and identity management. High-profile cyberattacks, including ransomware campaigns and supply chain breaches, have also heightened board-level interest in proactive cyber governance.

Moreover, the mature presence of global consulting giants such as Deloitte, PwC, Booz Allen Hamilton, and Accenture, headquartered or heavily invested in North America, reinforces the region’s dominance through innovation and service expansion. Additionally, the region leads in cyber insurance adoption, ESG-linked cybersecurity frameworks, and third-party risk management, all areas where consultants play a strategic role. With well-established cybersecurity laws, a skilled workforce, and strong federal-industry collaboration, North America remains the most lucrative and advanced market for cybersecurity consulting services globally, both in terms of service maturity and client sophistication.

Region with the Highest CAGR

Asia Pacific is poised to experience the highest compound annual growth rate (CAGR) in the global cybersecurity consulting services market, fueled by rapid digital transformation, expanding cloud adoption, and increasing regulatory enforcement across emerging and developed economies. Nations such as India, China, Japan, South Korea, Singapore, and Australia are investing heavily in cybersecurity modernization programs, driving the need for third-party consulting expertise. The widespread adoption of digital banking, e-governance, smart city initiatives, and 5G connectivity across the region introduces new threat vectors, pushing public and private entities to engage cybersecurity consultants for threat modeling, incident response planning, and regulatory alignment.

Governments across Asia Pacific are tightening cyber regulations; examples include Singapore’s Cybersecurity Act, India’s CERT-In directives, and Japan’s national cybersecurity strategy, leading organizations to seek advisory services to ensure compliance. Furthermore, the region suffers from a pronounced cybersecurity talent gap, especially in developing economies, which makes outsourcing to consultants more viable than building internal teams. Local consulting firms, global players, and regional specialists are all expanding their footprints to meet this surging demand.

Additionally, many multinational companies are expanding operations in APAC due to cost advantages, which raises the need for uniform cybersecurity controls across global facilities. The increase in ransomware, phishing, and supply chain attacks in Southeast Asia has also prompted more proactive risk assessments and security audits. As SMEs in Asia Pacific become more digitized, modular and scalable consulting offerings are witnessing high adoption. These converging factors make Asia Pacific the fastest-growing region for cybersecurity consulting, poised to significantly increase its global market contribution over the next decade.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Cybersecurity Consulting Services Market: Competitive Landscape

The global cybersecurity consulting services market is highly competitive and characterized by the presence of both multinational consulting giants and specialized cybersecurity firms. Leading players such as Accenture, Deloitte, PwC, EY, and KPMG dominate the high-end consulting segment, offering comprehensive cybersecurity advisory services integrated with digital transformation, compliance, and risk management strategies. These firms leverage global delivery centers, industry partnerships, and in-house threat intelligence units to provide tailored, scalable, and end-to-end cybersecurity solutions across diverse sectors.

In parallel, niche players like Booz Allen Hamilton, NCC Group, Mandiant (now part of Google Cloud), and Trustwave offer specialized services in threat hunting, incident response, digital forensics, and defense strategy for critical infrastructure and government clients. These firms often win mandates requiring deep technical expertise and domain-specific knowledge.

Cloud service providers such as Microsoft, AWS, and Google Cloud have also entered the consulting landscape, partnering with cybersecurity firms or launching their own advisory arms. Meanwhile, regional firms in Asia Pacific and Latin America are gaining traction by offering localized services tailored to regulatory and language-specific requirements.

The competitive dynamics are further shaped by strategic partnerships, mergers and acquisitions, and talent acquisition. For example, IBM Consulting and Capgemini are expanding their cybersecurity capabilities through partnerships and acquisitions of boutique firms. The need for consultants with AI, cloud security, zero trust, and regulatory alignment expertise continues to shape competition. The market also sees innovation in service models, with outcome-based and subscription-based engagements gaining popularity, offering flexibility and measurable value to enterprise clients.

Some of the prominent players in the Global Cybersecurity Consulting Services Market are:

- Accenture

- IBM

- Deloitte

- PwC (PricewaterhouseCoopers)

- EY (Ernst & Young)

- KPMG

- Booz Allen Hamilton

- BAE Systems

- Capgemini

- Wipro

- Atos

- Tata Consultancy Services (TCS)

- DXC Technology

- Leidos

- McKinsey & Company

- Cognizant

- HCLTech

- NCC Group

- Infosys

- Optiv Security

- Other Key Players

Recent Developments in the Global Cybersecurity Consulting Services Market

June 2025

- F5’s Acquisition of Fletch: In June 2025, F5 announced its acquisition of Fletch, a startup specializing in AI-driven cybersecurity insights. Fletch’s agentic AI platform offered real-time intelligence on emerging cyber threats by scanning open-source intelligence sources and industry alerts. F5 plans to integrate Fletch’s capabilities into its application delivery and security stack, strengthening its consulting and threat mitigation services. This deal reflects the growing importance of AI-enhanced consulting and automation in cybersecurity decision-making.

- Netgear Acquires Exium: Netgear finalized its acquisition of Bengaluru-based cybersecurity firm Exium to enter the Secure Access Service Edge (SASE) space. Exium’s capabilities in secure networking and zero-trust access bolster Netgear’s consulting services for managed service providers (MSPs) and small-to-mid-sized enterprises (SMEs). This move aligns with growing client demand for advisory services that integrate networking and security under one architecture.

May 2025

- Sensiba and AssuranceLab Merger: U.S.-based consultancy Sensiba acquired Australian cybersecurity and compliance firm AssuranceLab. The acquisition expands Sensiba’s reach into the Asia-Pacific region and enhances its capabilities in ESG reporting, privacy compliance, and ISO certification consulting. This merger reflects rising global demand for cybersecurity consulting aligned with governance and sustainability frameworks.

- Infosys Acquires The Missing Link: Infosys completed the acquisition of The Missing Link, a full-stack cybersecurity consulting firm headquartered in Australia. This strategic move strengthens Infosys’ cybersecurity consulting presence in the Asia-Pacific market, allowing the company to offer services such as penetration testing, cloud security, and managed detection and response. The acquisition also supports Infosys’ broader digital transformation offerings in regulated industries.

April 2025

- Palo Alto Networks Acquires Protect AI: At the RSA Conference 2025, Palo Alto Networks announced the acquisition of Protect AI, a company specializing in machine learning model security. Estimated between $650 million $700 million, this deal enhances Palo Alto’s consulting and AI governance capabilities. The acquisition allows Palo Alto to offer advisory services around securing AI pipelines, which is becoming increasingly relevant as clients integrate generative AI into their operations.

- RSA Conference 2025: Held from April 28 to May 1, the RSA Conference 2025 gathered over 45,000 cybersecurity professionals in San Francisco. Key themes included the security of agentic AI, the expansion of zero-trust frameworks, and emerging models for foundation model security. Many consulting firms launched new services or showcased updated platforms during the event, underscoring RSA's significance as a consulting-led innovation hub.

March 2025

- InCyber Forum USA Announcement: Local government and European cybersecurity agencies jointly announced the launch of the first InCyber Forum USA, scheduled for June 2025 in San Antonio, Texas. The event is set to facilitate collaboration between North American and European cyber consultants, regulators, and technology firms. It emphasizes policy convergence, international risk mitigation strategies, and consulting opportunities in transatlantic digital security.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 21.8 Bn |

| Forecast Value (2034) |

USD 119.1 Bn |

| CAGR (2025–2034) |

20.7% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 7.0 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Service Type (Risk Assessment and Management, Compliance and Audit, Threat Intelligence and Digital Forensics, Managed Security Services (MSS), Incident Response and Resiliency Planning, Advisory for CybeR-Insurance and ESG Reporting, and Other Service Type), By Organization Size (Large Enterprises, and Small & Medium Enterprises (SMEs)), By Deployment Mode (Cloud-Based, and On-Premises), By Industry Vertical (Banking, Financial Services & Insurance (BFSI), Healthcare, Government & Defense, IT & Telecommunications, Retail & E-commerce, Manufacturing, Energy & Utilities, and Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Accenture, IBM, Deloitte, PwC (PricewaterhouseCoopers), EY (Ernst & Young), KPMG, Booz Allen Hamilton, BAE Systems, Capgemini, Wipro, Atos, Tata Consultancy Services (TCS), DXC Technology, Leidos, McKinsey & Company, Cognizant, HCLTech, NCC Group, Infosys, Optiv Security, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Cybersecurity Consulting Services Market?

▾ The Global Cybersecurity Consulting Services Market size is estimated to have a value of USD 21.8 billion in 2025 and is expected to reach USD 119.1 billion by the end of 2034.

What is the growth rate in the Global Cybersecurity Consulting Services Market in 2025?

▾ The market is growing at a CAGR of 20.7 percent over the forecasted period of 2025

What is the size of the US Cybersecurity Consulting Services Market?

▾ The US Cybersecurity Consulting Services Market is projected to be valued at USD 7.0 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 34.4 billion in 2034 at a CAGR of 19.4%.

Which region accounted for the largest Global Cybersecurity Consulting Services Market?

▾ North America is expected to have the largest market share in the Global Cybersecurity Consulting Services Market with a share of about 38.0% in 2025.

Who are the key players in the Global Cybersecurity Consulting Services Market?

▾ Some of the major key players in the Global Cybersecurity Consulting Services Market are Accenture, IBM, Deloitte, PwC (PricewaterhouseCoopers), EY (Ernst & Young), KPMG, Booz Allen Hamilton, BAE Systems, and many others.