Market Overview

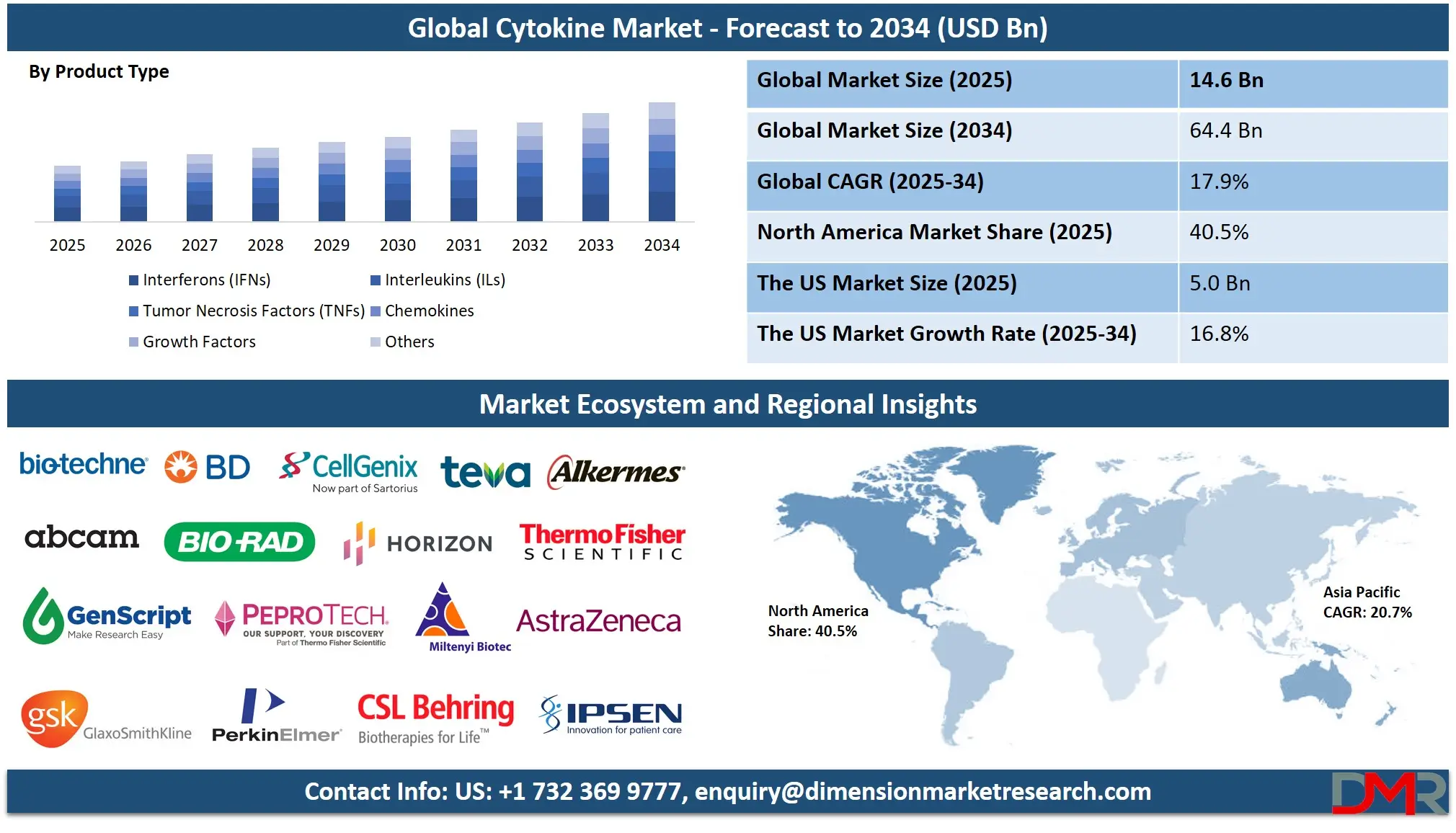

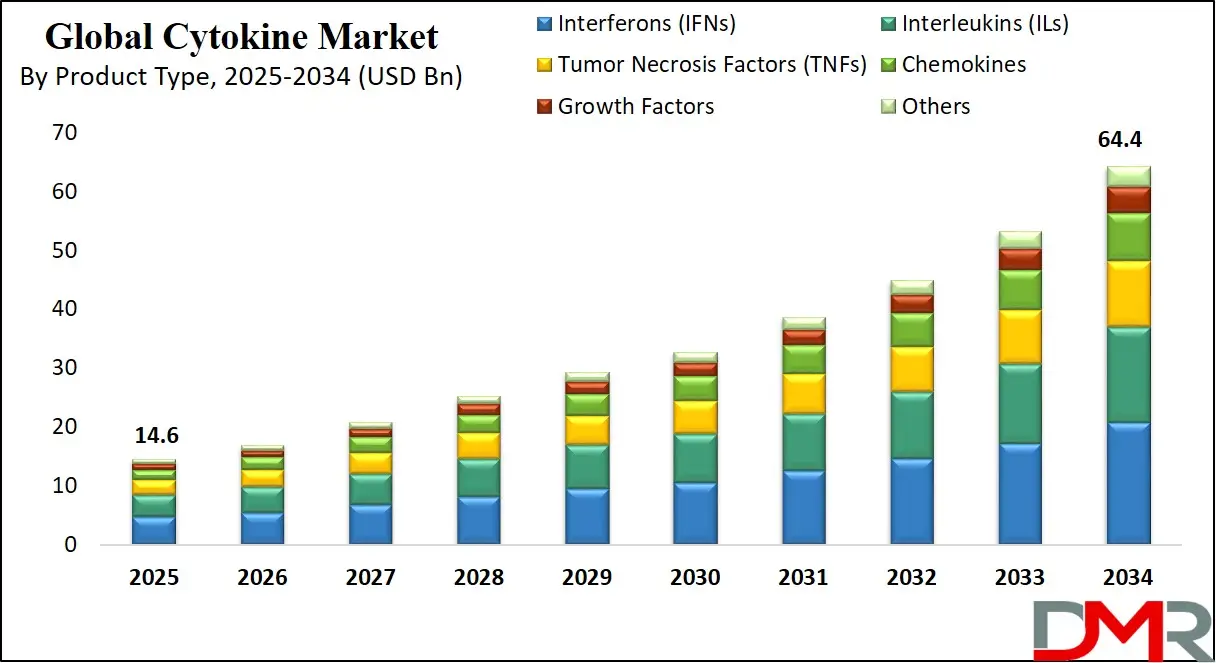

The Global Cytokine Market is anticipated to reach USD 14.6 billion in 2025, driven by advancements in immunotherapy, targeted drug development, and the rising prevalence of chronic inflammatory and autoimmune diseases. The market is expected to expand at a robust compound annual growth rate (CAGR) of 17.9% from 2025 to 2034, reaching a projected value of USD 64.4 billion by 2034.

The growth of this market is fueled by the increasing adoption of biologics and biosimilars, rising demand for personalized medicine in oncology, and the integration of cytokine-based therapies in regenerative medicine. Additionally, expanding applications in oncology, immunology, and infectious diseases, coupled with the growing availability of recombinant cytokines and advanced detection assays, are expected to further accelerate market expansion globally.

The global landscape for cytokine therapeutics and diagnostics is experiencing a profound transformation, moving beyond basic research into the core of clinical therapeutics and companion diagnostics. A significant trend is the shift towards combination therapies, where cytokines are used alongside checkpoint inhibitors and other immunomodulators to enhance anti-tumor efficacy. This synergistic approach is revolutionizing cancer treatment protocols and improving patient response rates.

Concurrently, the technology is advancing into next-generation cytokine engineering, where research focuses on creating mutant and fusion proteins with improved half-lives and reduced toxicity, though many of these remain in late-stage clinical development. The integration of artificial intelligence with cytokine profiling is also emerging, identifying novel biomarkers for disease stratification and automating the analysis of complex cytokine signaling networks from patient data.

The market's expansion is fueled by substantial opportunities in precision medicine, particularly in tailoring immunotherapies that offer targeted action compared to broad-spectrum anti-inflammatory drugs. The oncology segment has become a major adopter, leveraging cytokine therapies like interleukin-2 (IL-2) and interferon-alpha (IFN-α) in the treatment of melanoma and renal cell carcinoma, which has refined treatment paradigms.

Furthermore, the ongoing development of novel, long-acting pegylated cytokines and receptor antagonists opens new avenues for creating treatments that modulate the immune system with greater control. These innovations are poised to address complex clinical challenges in autoimmune diseases like rheumatoid arthritis and psoriasis, providing solutions that were previously limited by side effects.

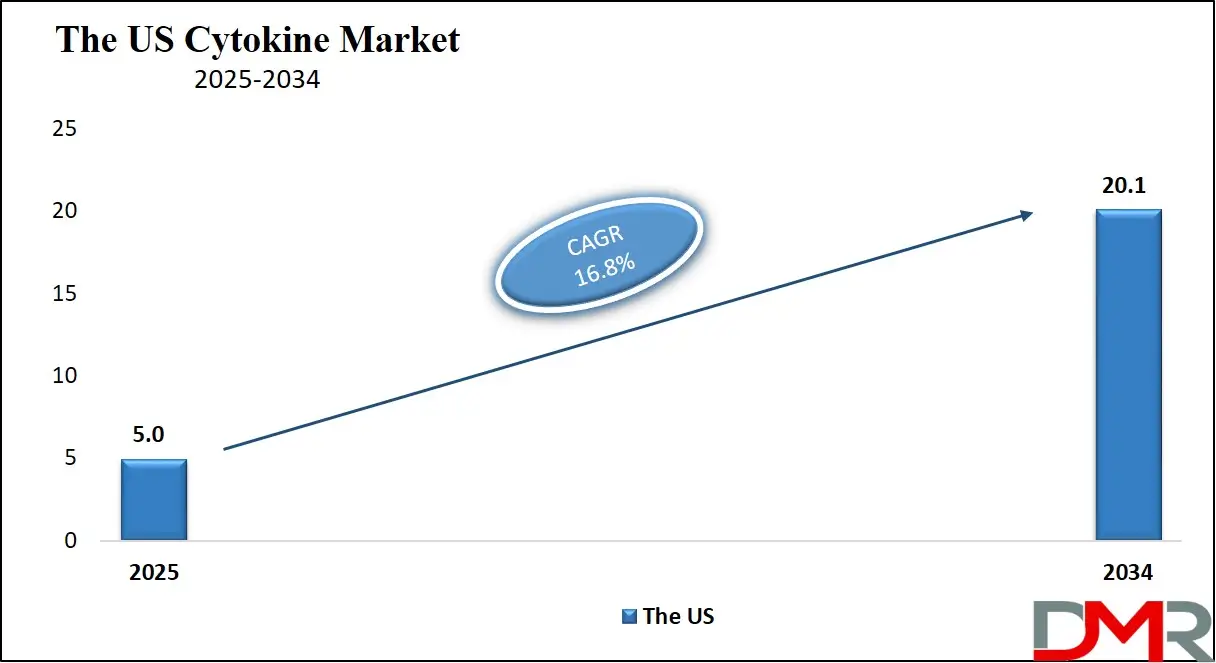

The US Cytokine Market

The US Cytokine Market is projected to reach USD 5.0 billion in 2025 at a compound annual growth rate of 16.8% over its forecast period.

The United States maintains a leadership position in the cytokine therapeutics landscape, a status fortified by substantial federal investment and a robust regulatory framework. Agencies like the National Institutes of Health (NIH) actively foster innovation through initiatives funding immunology research, which accelerates the understanding of cytokine pathways and their therapeutic potential.

The U.S. Food and Drug Administration has pioneered specific regulatory pathways for biologic drugs, including cytokines, providing clarity for manufacturers and having already approved several cytokine-based therapies and associated diagnostic assays. This proactive stance from federal bodies creates a stable environment for technological advancement and commercial investment in the sector. The presence of world-leading academic and medical institutions, including the Mayo Clinic and the Cleveland Clinic, further drives clinical adoption through cutting-edge research and the establishment of specialized centers for immunotherapy that directly improve patient care.

A significant demographic advantage for the U.S. market is its high prevalence of cancer and autoimmune diseases, trends documented by the CDC and National Cancer Institute. This epidemiological reality predicts a substantial and sustained demand for advanced immunotherapies, which in turn drives the cytokine market. The need for effective treatments for conditions like melanoma, hepatitis, and multiple sclerosis is rising in direct correlation. Furthermore, the high healthcare expenditure per capita, as reported by the Centers for Medicare & Medicaid Services (CMS), indicates a system capable of adopting advanced, albeit sometimes costly, biologic therapies. This financial capacity, combined with a growing body of clinical evidence demonstrating the value of cytokine therapies in improving survival outcomes and quality of life, is encouraging their integration into treatment guidelines, ensuring continued market growth.

The Europe Cytokine Market

The Europe Cytokine Market is estimated to be valued at USD 2.2 billion in 2025 and is further anticipated to reach USD 8.9 billion by 2034 at a CAGR of 14.5%.

The European cytokine ecosystem is characterized by strong collaboration between public research institutions and the pharmaceutical industry, guided by a comprehensive regulatory framework. The European Medicines Agency (EMA) and the new European Union Medical Device Regulation (MDR) provide a stringent set of requirements for the approval and clinical use of cytokine-based therapies and companion diagnostics, ensuring high standards of safety and performance across member states.

This is supported by significant funding from Horizon Europe, the EU's key research and innovation program, which has allocated resources to projects focused on immunology and personalized medicine, including the development of novel cytokine antagonists and agonists. National health services, such as the NHS in the United Kingdom, are exploring the cost-benefit analysis of deploying cytokine inhibitors for chronic diseases, which is critical for guiding widespread adoption and reimbursement policies.

Europe's demographic and epidemiological structure, as analyzed by Eurostat, presents a clear driver for the cytokine sector. The region has a high and growing burden of autoimmune and inflammatory diseases, creating a pressing need for innovative, targeted treatments that can improve the quality of life. The strong public healthcare systems prevalent across the continent are increasingly focused on value-based care, seeking therapies that can reduce long-term disability and healthcare costs. The presence of a highly skilled biopharmaceutical workforce and a dense network of specialized clinical research organizations facilitates the development and application of complex biologic drugs, from interleukin inhibitors in Germany to TNF-α blockers across the continent, positioning Europe as a critical and advanced market for cytokine innovation.

The Japan Cytokine Market

The Japan Cytokine Market is projected to be valued at USD 1.1 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 4.8 billion in 2034 at a CAGR of 16.1%.

Japan's foray into cytokine-based medicine is heavily influenced by its aging population and the associated rise in age-related cancers and chronic diseases, a demographic reality extensively documented by the Japanese Ministry of Health, Labour and Welfare. This has created an urgent and growing demand for advanced immunotherapies and regenerative medicine. In response, the Japanese government has strategically prioritized biopharmaceuticals and regenerative medicine through national initiatives, with the Japan Agency for Medical Research and Development (AMED) funding projects that bridge the gap between academic research and clinical application. The Pharmaceuticals and Medical Devices Agency (PMDA), Japan's regulatory body, has been working to establish clear approval pathways for advanced therapy medicinal products (ATMPs), including cytokine-based cell therapies, providing a structured, though rigorous, environment for manufacturers to bring new products to market, ensuring they meet the highest safety standards.

The demographic and technological advantage for Japan lies in its high life expectancy and its urgent need to maintain the healthspan of its senior citizens. This drives innovation in creating well-tolerated, effective therapies for an older patient cohort. Research institutions like the RIKEN Center are actively involved in research on cytokine signaling and engineering. Furthermore, the high density of advanced medical institutions in urban centers like Tokyo and Osaka serves as an early adopter and testing ground for new biologic treatments. This combination of demographic pressure, strong governmental support for biotechnology, and a culture of high-quality manufacturing positions Japan as a unique and highly advanced market focused on leveraging cytokine science to address the challenges of a super-aged society.

Global Cytokine Market: Key Takeaways

- Global Market Size Insights: The Global Cytokine Market size is estimated to have a value of USD 14.6 billion in 2025 and is expected to reach USD 64.4 billion by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 17.9 percent over the forecasted period.

- The US Market Size Insights: The US Cytokine Market is projected to be valued at USD 5.0 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 20.1 billion in 2034 at a CAGR of 16.8%.

- Regional Insights: North America is expected to have the largest market share in the Global Cytokine Market with a share of about 40.5% in 2025.

- Key Players: Some of the major key players in the Global Cytokine Market are Roche AG, Novartis AG, Johnson & Johnson, Pfizer Inc., AbbVie Inc., Sanofi S.A., Merck & Co., Inc., Bristol-Myers Squibb, Eli Lilly and Company, and many others.

Global Cytokine Market: Use Cases

- Cancer Immunotherapy: cytokines like interleukin-2 (IL-2) and interferon-alpha (IFN-α) are used to activate the patient's immune system to attack cancer cells in malignancies such as melanoma and renal cell carcinoma.

- Autoimmune Disease Management: Monoclonal antibodies that target specific cytokines, such as TNF-α inhibitors (e.g., adalimumab), are used to suppress pathological inflammation in rheumatoid arthritis, psoriasis, and inflammatory bowel disease.

- Infectious Disease Response: Cytokines like interferons are part of the body's natural defense and are used therapeutically to treat viral infections such as hepatitis B and C.

- Regenerative Medicine: Growth factors, which are a class of cytokines, are used in tissue engineering and wound healing to stimulate cell proliferation and differentiation.

- Companion Diagnostics: Multiplex cytokine assays are used to profile patient immune status, predict response to therapy, and monitor for cytokine release syndrome (CRS) in patients receiving CAR-T cell therapy.

Global Cytokine Market: Stats & Facts

National Institutes of Health (NIH)

- The NIH Clinical Trials database lists over 5,000 active or recruiting clinical trials involving cytokines as of 2024.

U.S. Food and Drug Administration (FDA)

- FDA published "Guidance for Industry: Clinical Pharmacology Data for Cytokine and Cognate Receptor Modulators"

- FDA content on cytokine storm and CAR-T cell therapy toxicity was last updated as of 22 September 2023.

- During the COVID-19 response, the FDA issued an Emergency Use Authorization (EUA) for tocilizumab, an IL-6 receptor antagonist, for the treatment of severe COVID-19 in hospitalized patients (EUA issued June 2021).

- The FDA has approved over 20 distinct cytokine-targeting biologics for various indications.

World Health Organization (WHO)

- WHO published the "Model List of Essential Medicines" which includes several cytokine-based therapies, such as interferon alfa-2b (latest update 2023).

- WHO COVID-response reporting noted the critical role of cytokine storm in severe COVID-19 outcomes, leading to global research into immunomodulators.

European Medicines Agency (EMA)

- The EMA's Committee for Medicinal Products for Human Use (CHMP) has granted marketing authorization for numerous cytokine-targeting therapies under the centralized procedure.

- The EU's Advanced Therapy Medicinal Product (ATMP) regulation provides a pathway for cell therapies genetically modified to express cytokines.

International Organization for Standardization (ISO)

- ISO standards, such as those from ISO/TC 276 (Biotechnology), provide frameworks for the quality control and characterization of biologic products, including cytokines.

Global Cytokine Market: Market Dynamic

Driving Factors in the Global Cytokine Market

Rising Prevalence of Chronic Diseases

The global increase in cancer, autoimmune disorders, and chronic inflammatory diseases is a primary driver for the cytokine market. These conditions often involve dysregulated cytokine pathways, creating a direct demand for therapies that can modulate these signals. Cytokine-based treatments offer targeted mechanisms of action for conditions like rheumatoid arthritis, psoriasis, and various cancers, improving patient outcomes compared to traditional non-specific immunosuppressants.

Advancements in Biotechnology and Drug Development

The establishment of clearer regulatory pathways for biologics and biosimilars by major agencies like the U.S. FDA and the EMA has provided the necessary clarity for manufacturers. Furthermore, substantial investment in biotech R&D has led to the engineering of next-generation cytokines with improved pharmacokinetics and safety profiles, such as pegylated interferons and mutant IL-2 variants designed to preferentially activate anti-tumor T cells.

Restraints in the Global Cytokine Market

High Cost of Development and Therapy

The significant investment required for the research, development, and clinical trials of biologic drugs, including cytokines, presents a major barrier. The complex manufacturing processes and stringent quality control requirements contribute to high production costs, which are passed on to healthcare systems and patients. This can limit access and slow down widespread adoption, especially in cost-sensitive markets.

Complex Safety Profile and Toxicity

Cytokines are potent immunomodulators, and their use can be associated with significant adverse effects, including cytokine release syndrome (CRS), neurotoxicity, and flu-like symptoms. Managing these toxicities requires specialized clinical oversight and can limit the therapeutic window, restraining their broader use.

Opportunities in the Global Cytokine Market

Expansion in Biosimilars

The patent expiration of several blockbuster cytokine-targeting biologics (e.g., adalimumab, etanercept) represents one of the largest and most rapidly expanding opportunities. The development and approval of biosimilars are increasing market competition, improving patient access, and driving volume growth in the treatment of autoimmune diseases.

Personalized Medicine and Companion Diagnostics

A high-potential growth frontier lies in pairing cytokine therapies with companion diagnostics. Profiling a patient's cytokine milieu can help identify responders, non-responders, and those at risk for severe side effects. This approach to precision medicine in immunology could revolutionize treatment selection and efficacy, opening a new and substantial market segment for diagnostic assays and tailored therapeutic regimens.

Trends in the Global Cytokine Market

Combination Immunotherapies

A dominant trend is the use of cytokines in combination with other immunotherapies, such as checkpoint inhibitors (e.g., anti-PD-1). This approach seeks to overcome resistance to single-agent therapies by creating a more robust and synergistic anti-tumor immune response, driving innovation in clinical trial design and therapeutic strategies.

Cytokine Engineering

The industry is witnessing rapid innovation in the engineering of novel cytokine molecules. This includes creating fusion proteins, mutating cytokines to alter receptor binding affinity, and developing conditional activation strategies. These "designer cytokines" aim to maximize therapeutic efficacy while minimizing systemic toxicity, pushing the boundaries of targeted immunotherapy.

Global Cytokine Market: Research Scope and Analysis

By Product Type Analysis

The Interferons (IFNs) segments are projected to represent the foundational and dominant categories in the global cytokine market in terms of therapeutic use, established revenue, and clinical validation. This dominance is primarily driven by their critical and well-elucidated roles in modulating the immune system. Interferons, particularly IFN-α and IFN-β, have long been cornerstone therapies in virology and oncology. They are approved for treating conditions such as hepatitis B and C, multiple sclerosis, and malignancies like melanoma and hairy cell leukemia. Their mechanism of action, which involves activating antiviral states and inhibiting cell proliferation, remains a vital tool in the therapeutic arsenal. Concurrently, the Interleukins segment, encompassing agents like IL-2 (aldesleukin), holds a central position in immunomodulation. IL-2 is an FDA-approved therapy for metastatic renal cell carcinoma and melanoma, functioning by stimulating T-cell proliferation and activity. The deep scientific understanding of interleukin signaling pathways has also made them prime targets for inhibition in autoimmune diseases, with drugs targeting IL-17, IL-12, and IL-23 achieving blockbuster status for psoriasis and other inflammatory conditions.

While Interleukins and Interferons represent the mature core of the market, the Growth Factors segment is demonstrably the fastest-growing category. This accelerated growth is fueled by an expanding spectrum of applications beyond traditional uses. Growth factors such as Granulocyte Colony-Stimulating Factor (G-CSF) are indispensable in oncology support care for managing chemotherapy-induced neutropenia, reducing infection rates and enabling dose-intensive regimens. The segment's dynamism, however, stems from its pivotal role in cutting-edge medical fields. In regenerative medicine and wound care, growth factors like Platelet-Derived Growth Factor (PDGF) and Epidermal Growth Factor (EGF) are used to accelerate tissue repair in diabetic foot ulcers and burns.

By Application Analysis

The Oncology application segment is the undisputed leader in the global cytokine market, commanding the largest share of commercial revenue and attracting the most significant research and development focus. Cytokines are integral to the foundation and evolution of cancer immunotherapy. Established therapies, including high-dose Interleukin-2 (IL-2) for metastatic melanoma and renal cell carcinoma, and Interferon-alpha for certain leukemias and lymphomas, have paved the way.

The modern immuno-oncology landscape continues to heavily rely on cytokine biology, not just as direct therapeutics but as critical components of the tumor microenvironment that influence patient response to other modalities like checkpoint inhibitors. The high incidence and mortality rates of cancer globally, coupled with the relentless pursuit of more effective immunotherapies, ensure that oncology remains the primary driver of the cytokine market. Massive R&D investments are channeled into developing next-generation cytokine-based therapies, such as engineered IL-2 variants with improved safety profiles and IL-15 superagonists, designed to enhance anti-tumor immunity without triggering severe side effects, solidifying this segment's dominance.

Following oncology, the Autoimmune and Inflammatory Diseases segment represents a major and critically important application area. This segment's substantial market share is directly driven by the blockbuster commercial success of cytokine-targeting biologics. The most prominent example is the class of Tumor Necrosis Factor-alpha (TNF-α) inhibitors, including adalimumab, etanercept, and infliximab, which have revolutionized the treatment of rheumatoid arthritis, inflammatory bowel disease, psoriasis, and ankylosing spondylitis. Beyond TNF-α, the therapeutic landscape has expanded to include highly effective agents targeting interleukins. Monoclonal antibodies against IL-17 (e.g., secukinumab), IL-12/23 (e.g., ustekinumab), and IL-23 (e.g., guselkumab) have set new benchmarks for efficacy in psoriatic disease.

By End-User Analysis

Pharmaceutical & Biotechnology Companies are projected to be the dominant commercial end-users, driving the production, innovation, and R&D side of the global cytokine market. These entities are responsible for the entire lifecycle of cytokine-based therapies, from initial discovery and preclinical research through complex clinical trials, regulatory approval, and large-scale commercial manufacturing. They invest billions in researching novel cytokine targets, engineering next-generation molecules with improved properties, and developing robust biologic manufacturing processes. Their dominance is reflected in their control over extensive intellectual property portfolios and blockbuster drugs. This segment also includes companies focused on developing biosimilars for off-patent cytokine inhibitors, which represents a major growth vector. The strategic activities of these companies—including mergers and acquisitions of biotech firms with promising cytokine platforms—directly shape the competitive landscape and dictate the pace of innovation in the market, making them the primary engines of the industry.

In contrast, Hospitals & Clinics serve as the primary end-users for the administration of cytokine therapies and are thus critical for market revenue realization. These healthcare settings are where approved cytokine drugs, such as intravenous IL-2 for cancer or subcutaneous TNF-α inhibitors for rheumatoid arthritis, are delivered to patients. Their purchasing decisions, influenced by formularies, treatment guidelines, and reimbursement policies, directly impact commercial sales. Furthermore, large hospital networks often participate in late-stage clinical trials for new cytokine therapies.

The Global Cytokine Market Report is segmented on the basis of the following:

By Product Type

- Interferons (IFNs)

- Interleukins (ILs)

- Tumor Necrosis Factors (TNFs)

- Chemokines

- Growth Factors

- Epidermal Growth Factor

- Fibroblast Growth Factor

- Vascular Endothelial Growth Factor

- Platelet-Derived Growth Factor

- Others

By Application

- Oncology

- Cancer Immunotherapy

- Targeted Cytokine Therapy

- Autoimmune & Inflammatory Diseases

- RA

- Psoriasis

- Crohn’s Disease

- Infectious Diseases

- Viral

- Bacterial

- Pathogen-Related Therapies

- Hematological Disorders

- Anemia

- Neutropenia

- Stem Cell Mobilization

- Regenerative Medicine

- Tissue Repair

- Cell Proliferation

- Wound Healing

- Others

By End-User

- Pharmaceutical & Biotechnology Companies

- Hospitals & Clinics

- Research Institutes & Academic Centers

- Contract Research Organizations (CROs)

- Diagnostic Laboratories

Impact of Artificial Intelligence in the Global Cytokine Market

- Biomarker Discovery & Patient Stratification: AI algorithms analyze complex multi-omics data to identify cytokine signatures predictive of disease progression, treatment response, and toxicity, enabling precision medicine.

- Drug Design & Development: AI-driven platforms accelerate the design of novel cytokine analogs and fusion proteins by predicting structure-function relationships and optimizing binding properties.

- Clinical Trial Optimization: AI analyzes real-world data and historical trial information to improve patient recruitment, predict clinical outcomes, and identify optimal combination therapy regimens.

- Toxicity Prediction: Machine learning models are being trained to predict adverse events like cytokine release syndrome (CRS) based on early patient data, allowing for proactive management.

- Supply Chain & Manufacturing: AI optimizes the complex biomanufacturing processes for biologics, predicting yields and ensuring quality control for cytokine production.

Global Cytokine Market: Regional Analysis

Region with the Largest Revenue Share

North America, led by the United States, is projected to command the largest share of the global cytokine market, holding 40.5% of the market share by the end of 2025. This dominance is due to a powerful confluence of factors, including a high and well-diagnosed prevalence of chronic diseases such as cancer and autoimmune disorders that drive demand for advanced therapies. The region benefits from a sophisticated healthcare infrastructure with high per-capita spending, enabling rapid adoption of innovative, albeit costly, biologic treatments.

A robust regulatory framework, spearheaded by the U.S. FDA, provides clear and predictable pathways for the approval of biologics and biosimilars, de-risking investment for manufacturers. Furthermore, the presence of the world's leading pharmaceutical and biotechnology companies, coupled with substantial public and private R&D funding from entities like the NIH, creates a virtuous cycle of innovation and commercialization, solidifying North America's position as the revenue leader.

Region with the Highest CAGR

The Asia Pacific region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) in the global cytokine market. This explosive growth is fueled by massive healthcare modernization and rising per-capita expenditure, making advanced treatments more accessible to a vast and growing patient pool for cancer and autoimmune diseases. Governments across the region, particularly in China and India, are actively promoting biotechnology through national initiatives, creating a favorable investment climate. The expanding presence of contract research and manufacturing organizations (CROs/CMOs) is lowering development costs and accelerating local production. Concurrently, regulatory frameworks are maturing, improving the approval process for new drugs and, critically, for biosimilars. The increasing affordability and availability of these biosimilar versions of blockbuster cytokine inhibitors are a key driver, unlocking immense treatment potential and positioning Asia Pacific as the world's fastest-growing cytokine market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Cytokine Market: Competitive Landscape

The competitive landscape of the global cytokine market is dynamic and features a mix of large multinational pharmaceutical corporations, pure-play biotechnology firms, and a vibrant ecosystem of research-driven startups. Dominant players like Roche AG (Genentech), Novartis AG, and Johnson & Johnson leverage their extensive R&D capabilities, large-scale biologics manufacturing expertise, and global commercial networks to maintain a stronghold, particularly in the realms of oncology and autoimmune diseases. A significant trend is the strategic acquisition of biotech companies with promising cytokine platforms by larger pharma companies to bolster their immunotherapy pipelines. Simultaneously, the market sees intense competition from specialized players like AbbVie Inc. with its blockbuster TNF inhibitors and emerging companies focused on novel cytokine targets and engineered molecules, ensuring continuous innovation and intensifying competition.

Some of the prominent players in the Global Cytokine Market are:

- Thermo Fisher Scientific Inc.

- BD (Becton, Dickinson and Company)

- Bio-Rad Laboratories, Inc.

- Lonza Group AG

- PerkinElmer, Inc.

- CSL Behring

- Teva Pharmaceutical Industries Ltd.

- AstraZeneca plc

- GlaxoSmithKline plc (GSK)

- Horizon Therapeutics plc

- Ipsen Biopharmaceuticals

- Alkermes plc

- CellGenix GmbH (a Sartorius Company)

- PeproTech Inc. (part of Thermo Fisher Scientific)

- Miltenyi Biotec

- GenScript Biotech Corporation

- Abcam plc

- Bio-Techne Corporation

- Sarepta Therapeutics, Inc.

- Cytune Pharma SAS

- Other Key Players

Recent Developments in the Global Cytokine Market

- May 2024: The American Association for Cancer Research (AACR) annual meeting features multiple presentations on next-generation engineered IL-2 variants showing improved efficacy and safety profiles in Phase I/II trials.

- April 2024: Novartis AG announces positive top-line results from a Phase III clinical trial evaluating its novel IL-1β inhibitor in cardiovascular disease.

- March 2024: The FDA grants Breakthrough Therapy Designation to a new IL-15 receptor agonist for the treatment of advanced solid tumors.

- February 2024: A major collaboration is announced between Pfizer Inc. and a biotech startup to develop conditionally active cytokine therapies for oncology.

- January 2024: The "J.P. Morgan Healthcare Conference" features keynotes from biotech CEOs highlighting their cytokine engineering platforms as core assets.

- November 2023: The first biosimilar for a key interleukin inhibitor (ustekinumab) receives regulatory approval in Europe.

- October 2023: A leading research university publishes a landmark study in Nature identifying a new cytokine network involved in fibrosis, opening a new potential therapeutic avenue.

- September 2023: The European Society for Medical Oncology (ESMO) Congress features a symposium on managing cytokine-related adverse events in the era of combination immunotherapy.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 14.6 Bn |

| Forecast Value (2034) |

USD 64.4 Bn |

| CAGR (2025–2034) |

17.9% |

| The US Market Size (2025) |

USD 5.0 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product Type (Interferons (IFNs), Interleukins (ILs), Tumor Necrosis Factors (TNFs), Chemokines, Growth Factors, Others), By Application (Oncology, Autoimmune/Inflammatory Diseases, Infectious Diseases, Hematological Disorders, Regenerative Medicine, Others), By End-User (Pharmaceutical & Biotechnology Companies, Hospitals & Clinics, Research Institutes & Academic Centers, Contract Research Organizations (CROs), Diagnostic Laboratories) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Thermo Fisher Scientific Inc., BD (Becton, Dickinson and Company), Bio-Rad Laboratories Inc., Lonza Group AG, PerkinElmer Inc., CSL Behring, Teva Pharmaceutical Industries Ltd., AstraZeneca plc, GlaxoSmithKline plc (GSK), Horizon Therapeutics plc, Ipsen Biopharmaceuticals, Alkermes plc, CellGenix GmbH (Sartorius), PeproTech Inc. (Thermo Fisher), Miltenyi Biotec, GenScript Biotech Corporation, Abcam plc, Bio-Techne Corporation, Sarepta Therapeutics Inc., Cytune Pharma SAS, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Cytokine Market size is estimated to have a value of USD 14.6 billion in 2025 and is expected to reach USD 64.4 billion by the end of 2034.

The market is growing at a CAGR of 17.9 percent over the forecasted period from 2025 to 2034.

The US Cytokine Market is projected to be valued at USD 5.0 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 20.1 billion in 2034 at a CAGR of 16.8%.

North America is expected to have the largest market share in the Global Cytokine Market with a share of about 40.5% in 2025.

Some of the major key players in the Global Cytokine Market are Roche AG, Novartis AG, Johnson & Johnson, Pfizer Inc., AbbVie Inc., Sanofi S.A., Merck & Co., Inc., Bristol-Myers Squibb, Eli Lilly and Company, and many others.